Global Automotive Light Vehicle Sensors Market

Market Size in USD Billion

CAGR :

%

USD

11.48 Billion

USD

22.36 Billion

2024

2032

USD

11.48 Billion

USD

22.36 Billion

2024

2032

| 2025 –2032 | |

| USD 11.48 Billion | |

| USD 22.36 Billion | |

|

|

|

|

Automotive Light-Vehicle Sensors Market Size

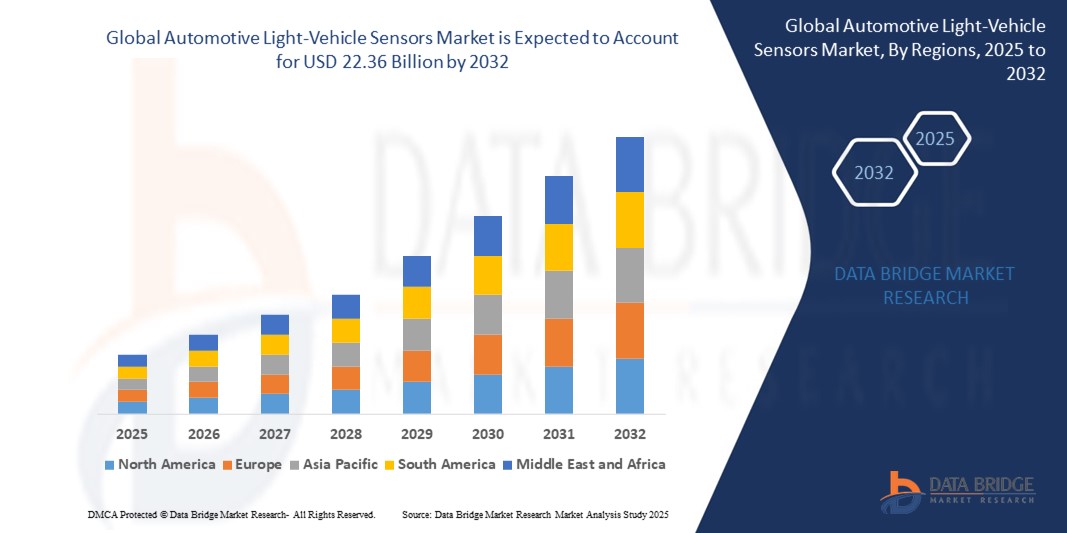

- The Global Automotive Light-Vehicle Sensors Market was valued at USD 11.48 billion in 2025 and is projected to reach USD 22.36 billion by 2032, growing at a CAGR of 10.0% during the forecast period.

- This market growth is driven by the increased integration of advanced driver-assistance systems (ADAS), the shift toward electrification and emission regulations, and the rising demand for real-time monitoring and diagnostics in light vehicles. Innovations in sensor miniaturization, reliability, and vehicle automation continue to accelerate adoption globally

Automotive Light-Vehicle Sensors Market Analysis

- Automotive light-vehicle sensors are critical electronic components that provide real-time data to enhance vehicle safety, performance, fuel efficiency, and emissions control, forming the backbone of modern automotive electronics, including powertrain, safety, and ADAS systems.

- The growing adoption of electric vehicles (EVs), connected cars, and advanced driver-assistance systems (ADAS) is significantly driving demand for precision sensors, especially in light vehicles where fuel efficiency and safety are top priorities.

- Asia-Pacific leads the light-vehicle sensors market with the largest market share in 2025, driven by its dominant position in global automobile production, the expansion of EV manufacturing hubs in China, India, Japan, and South Korea, and increasing government mandates for vehicle safety and emission standards. The region benefits from both large-scale domestic demand and export-oriented automotive strategies.

- North America is a significant market with a projected share of 36.7% in 2025, attributed to its advanced automotive manufacturing infrastructure, stringent emission and safety regulations, and a strong focus on connected mobility. The U.S., in particular, is witnessing rapid sensor integration in both hybrid and electric vehicle models.

- The Speed and Position Sensor segment is expected to dominate the market with a 32.4% share in 2025, due to their critical role in engine management, transmission systems, and ADAS modules, making them indispensable in modern vehicle architectures.

Report Scope and Automotive Light-Vehicle Sensors Market Segmentation

|

Attributes |

Automotive Light-Vehicle Sensors Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

The global shift toward electric vehicles (EVs), hybrid electric vehicles (HEVs), and autonomous driving is significantly increasing the demand for high-precision sensors in light vehicles. Sensors such as battery temperature monitors, LiDAR, radar, and camera-based systems are critical to power management, range optimization, and ADAS functionalities—creating robust opportunities for sensor manufacturers to innovate and scale.

Automotive OEMs and Tier 1 suppliers are actively pursuing partnerships and R&D initiatives to integrate AI-driven analytics, edge computing, and V2X communication into sensor systems. This enables predictive maintenance, real-time vehicle diagnostics, and enhanced safety. Strategic collaborations with semiconductor and tech firms are helping expand the global footprint and improve performance standards across smart mobility ecosystems. |

|

Value Added Data Infosets |

In addition to insights on market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated for the Global Automotive Light-Vehicle Sensors Market also include import-export analysis, manufacturing and production capacity overview, production-consumption analysis, price trend analysis, impact of climate change on automotive supply chains, supply chain and value chain analysis, raw material and semiconductor sourcing overview, vendor selection and benchmarking criteria, as well as in-depth strategic tools such as PESTLE Analysis, Porter's Five Forces Analysis, and global regulatory and compliance frameworks, especially related to vehicle safety, emissions, and electronic component standards. |

Automotive Light-Vehicle Sensors Market Trends

“Advancements in AI-Enabled and Connected Sensor Technologies”

- A key accelerating trend in the global automotive light-vehicle sensors market is the integration of artificial intelligence (AI) and vehicle connectivity technologies such as V2X (vehicle-to-everything) communication, enabling smarter, real-time data processing and predictive analytics for enhanced safety and efficiency.

- For example, AI-powered sensor fusion systems combine data from multiple sensors (radar, lidar, cameras) to provide precise environmental perception for advanced driver-assistance systems (ADAS) and autonomous driving features. Companies like Bosch and Continental are pioneering these integrated sensor platforms.

- AI-enabled sensors can learn driving patterns and environmental conditions to improve accuracy and reduce false positives in critical applications such as collision avoidance, adaptive cruise control, and lane-keeping assistance.

- Connectivity integration allows vehicles to share sensor data with other vehicles and infrastructure, facilitating real-time traffic management and hazard warnings, contributing to safer and more efficient roadways.

- The move towards sensor miniaturization and low-power consumption technologies supports the integration of multiple sensor types within compact automotive modules, meeting the demands of electric and hybrid vehicles for energy-efficient solutions.

- Major OEMs and suppliers, including Denso and Infineon Technologies, are investing heavily in the development of AI-based sensors with enhanced diagnostics, self-calibration, and over-the-air update capabilities to support future mobility trends.

- The rising adoption of AI and connectivity in automotive sensors is reshaping vehicle design and user expectations, driving the demand for more reliable, intelligent, and integrated sensing solutions across all vehicle segments.

Automotive Light-Vehicle Sensors Market Dynamics

Driver

“Increasing Demand Driven by Vehicle Safety Regulations and Electrification Trends”

- The growing implementation of stringent vehicle safety and emission regulations worldwide is a major driver boosting demand for advanced automotive light-vehicle sensors. Governments and regulatory bodies are mandating enhanced safety features such as ADAS, collision avoidance systems, and emission monitoring, which rely heavily on sensor technologies.

- For example, in early 2025, Bosch announced new sensor modules designed to meet evolving Euro 7 emissions standards and U.S. NHTSA safety regulations, highlighting the industry's response to regulatory pressures driving innovation.

- As consumers prioritize vehicle safety, fuel efficiency, and low emissions, automakers are increasingly equipping light vehicles with sophisticated sensor arrays, including oxygen, temperature, pressure, and position sensors, to optimize engine performance and support hybrid and electric drivetrains.

- The rise in electric vehicle (EV) adoption is fuelling demand for specialized sensors used in battery management systems, thermal monitoring, and powertrain control, accelerating market growth.

- Furthermore, the increasing complexity of in-vehicle electronic systems and the expansion of connected and autonomous vehicle technologies require high-precision sensors capable of real-time data acquisition and processing, encouraging OEMs and Tier 1 suppliers to invest in advanced sensor development.

- The convenience of integrated sensor networks providing continuous diagnostics and predictive maintenance is pushing sensor adoption not only in new vehicles but also in the aftermarket, supporting growing consumer interest in vehicle safety and reliability.

Restraint/Challenge

“Concerns Over Cybersecurity Risks and High Initial Investment Costs”

- Increasing connectivity of automotive sensors, especially those integrated into ADAS and autonomous driving systems, raises significant cybersecurity concerns. Vulnerabilities in sensor networks can expose vehicles to hacking, data breaches, and unauthorized control, creating apprehension among manufacturers and consumers alike.

- For instance, reports of potential hacking incidents targeting vehicle communication systems have heightened industry focus on securing sensor data transmissions and ensuring system integrity.

- Addressing these cybersecurity challenges requires implementation of robust encryption, secure authentication protocols, and continuous over-the-air (OTA) software updates. Leading sensor manufacturers like Bosch and Continental emphasize their cybersecurity frameworks to build trust and compliance with stringent automotive security standards such as ISO/SAE 21434.

- Another major challenge is the high initial cost of advanced sensor technologies, including 3D imaging sensors and LiDAR, which can increase vehicle production costs. This price premium may slow adoption, particularly in emerging markets or budget vehicle segments.

- Although costs are gradually declining due to economies of scale and technological advancements, the perceived expense of integrating complex sensor arrays remains a restraint, especially among cost-sensitive consumers and manufacturers balancing affordability with innovation.

- Overcoming these obstacles through enhanced cybersecurity solutions, cost optimization, and consumer education on the benefits of sensor technologies will be critical for accelerating widespread adoption and sustained market growth.

Automotive Light-Vehicle Sensors Market Scope

The market is segmented on the basis of sensor type, vehicle type, application, and sales channel.

- By Sensor Type

The automotive light-vehicle sensors market is segmented into temperature sensors, pressure sensors, speed sensors, oxygen sensors, position sensors, image sensors, and others. The pressure sensor segment is expected to hold the largest market share in 2025, driven by its essential role in engine management, tire pressure monitoring systems (TPMS), and braking systems. Pressure sensors ensure optimal fuel efficiency and safety, making them a critical component in both conventional and electric vehicles. Meanwhile, image sensors are anticipated to witness the fastest growth rate from 2025 to 2032, fuelled by increasing adoption of camera-based ADAS and autonomous driving technologies that require high-resolution environmental sensing.

- By Vehicle Type

The market is segmented into passenger cars and light commercial vehicles (LCVs). The passenger cars segment dominates the market in terms of revenue share due to higher production volumes and growing consumer demand for safety and comfort features equipped with sensor technology. The LCVs segment is projected to experience steady growth, driven by expanding logistics and delivery services requiring enhanced vehicle safety and fleet management solutions.

- By Application

Sensor applications include powertrain, chassis, safety & control, telematics, body electronics, and others. The powertrain segment accounts for the largest market share in 2025, as sensors play a vital role in optimizing engine performance, emission control, and fuel efficiency. The safety & control segment is expected to grow rapidly, driven by the widespread adoption of ADAS features such as collision avoidance, lane departure warning, and adaptive cruise control, all reliant on accurate sensor data.

- By Sales Channel

The market is segmented into original equipment manufacturers (OEM) and aftermarket. The OEM segment dominates the market, supported by the integration of sensors in new vehicle production with advanced safety and performance systems. The aftermarket segment is growing steadily due to increasing demand for sensor replacements, retrofits, and upgrades in existing vehicles, particularly in emerging markets.

Automotive Light-Vehicle Sensors Market Regional Analysis

- North America dominates the automotive light-vehicle sensors market with the largest revenue share of driver-assistance systems (ADAS), and a strong presence of leading 37.5% in 2025, driven by stringent safety and emission regulations, widespread adoption of advanced automotive manufacturers and suppliers.

- Consumers and OEMs in the region highly prioritize vehicle safety, fuel efficiency, and connected car technologies, resulting in accelerated integration of sensors across light vehicles. The U.S. market particularly benefits from substantial investments in electric vehicle production and autonomous driving research.

- This robust adoption is further supported by high disposable incomes, advanced manufacturing infrastructure, and government incentives promoting clean mobility and smart transportation solutions, establishing North America as a critical market for sensor innovation and deployment.

U.S. Automotive Light-Vehicle Sensors Market Insight

The U.S. automotive light-vehicle sensors market captured the largest revenue share of 82% within North America in 2025, driven by rapid adoption of advanced driver-assistance systems (ADAS), increasing electric vehicle production, and growing consumer demand for enhanced vehicle safety and connectivity.

Consumers and OEMs are prioritizing sophisticated sensor technologies for features such as collision avoidance, lane departure warning, and real-time diagnostics, fueling market growth. The U.S. government's focus on stringent safety regulations and incentives for electric vehicle adoption further accelerates sensor integration.

Additionally, increasing investments in connected and autonomous vehicle research, alongside collaborations between automotive manufacturers and technology firms, significantly contribute to expanding the sensor market in the country.

Europe Automotive Light-Vehicle Sensors Market Insight

The European automotive light-vehicle sensors market is projected to expand at a significant CAGR throughout the forecast period, driven by stringent safety and emission regulations enforced by the European Union and rising consumer demand for advanced vehicle safety features.

Increasing urbanization and the shift toward electric and hybrid vehicles are fostering widespread sensor adoption across passenger and light commercial vehicles. European consumers and manufacturers are prioritizing connected car technologies, energy efficiency, and compliance with environmental standards.

The market growth is supported by substantial investments in research and development, government incentives for clean mobility, and the integration of sensors in both new vehicle production and retrofit solutions in commercial fleets and passenger cars.

U.K. Automotive Light-Vehicle Sensors Market Insight

The U.K. automotive light-vehicle sensors market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing adoption of advanced safety technologies and the country’s strong regulatory focus on vehicle emissions and road safety.

Concerns regarding vehicle safety and environmental impact are driving both manufacturers and consumers to prioritize sensor-equipped vehicles with enhanced ADAS features and fuel efficiency. The U.K.’s expanding electric vehicle market and growing investments in connected and autonomous vehicle technologies further stimulate market demand.

Additionally, the well-developed automotive industry infrastructure and increasing consumer awareness about smart vehicle technologies contribute to the continued growth of the sensors market in the region.

Germany Automotive Light-Vehicle Sensors Market Insight

The German automotive light-vehicle sensors market is expected to grow at a considerable CAGR during the forecast period, driven by the country’s strong emphasis on automotive innovation, environmental sustainability, and strict regulatory frameworks targeting emissions and vehicle safety.

Germany’s advanced automotive manufacturing infrastructure, home to leading OEMs such as Volkswagen, BMW, and Mercedes-Benz, supports rapid adoption of cutting-edge sensor technologies. Increasing integration of sensors in electric and autonomous vehicles, along with a focus on data privacy and system security, aligns with local consumer and regulatory expectations.

Asia-Pacific Automotive Light-Vehicle Sensors Market Insight

The Asia-Pacific automotive light-vehicle sensors market is poised to grow at the fastest CAGR over the forecast period, fueled by rapid urbanization, rising disposable incomes, and expansive automotive production hubs in countries like China, India, Japan, and South Korea.

Government initiatives supporting electric vehicle adoption, smart mobility, and connected car technologies are accelerating sensor integration across passenger and light commercial vehicles. Asia-Pacific’s growing middle-class consumer base and increasing demand for advanced safety and emissions-compliant vehicles further drive market expansion.

Japan Automotive Light-Vehicle Sensors Market Insight

The Japan automotive light-vehicle sensors market is gaining momentum due to the country’s leadership in automotive technology, urbanization, and strong consumer preference for high safety and convenience standards.

Increasing adoption of connected and autonomous vehicle features, along with a rising elderly population demanding intuitive and reliable vehicle safety technologies, fuels sensor demand. Integration of sensors with IoT and telematics platforms enhances real-time vehicle diagnostics and predictive maintenance.

China Automotive Light-Vehicle Sensors Market Insight

China’s automotive light-vehicle sensors market accounted for the largest revenue share in Asia-Pacific in 2025, propelled by rapid urbanization, a booming middle class, and aggressive government policies promoting electric vehicles and smart mobility.

China stands as a global automotive manufacturing powerhouse, with domestic companies and multinational OEMs driving sensor adoption to meet regulatory requirements and consumer demand for advanced safety, connectivity, and emissions control. The push toward smart cities and affordable sensor technologies further accelerates market growth across passenger and commercial vehicles.

Automotive Light-Vehicle Sensors Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are specifically related to each company’s focus on the automotive light-vehicle sensors market.

The Major Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Sensata Technologies (United States)

- Infineon Technologies AG (Germany)

- NXP Semiconductors N.V. (Netherlands)

- Delphi Technologies (United Kingdom)

- Texas Instruments Incorporated (United States)

- Valeo SA (France)

- Analog Devices, Inc. (United States)

- ZF Friedrichshafen AG (Germany)

- TE Connectivity Ltd. (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Autoliv Inc. (Sweden)

- Hitachi Astemo Ltd. (Japan)

- HELLA GmbH & Co. KGaA (Germany)

- Stoneridge, Inc. (United States)

- Murata Manufacturing Co., Ltd. (Japan)

- Allegro MicroSystems, Inc. (United States)

- Amphenol Advanced Sensors (United States)

Latest Developments in Global Automotive Light-Vehicle Sensors Market

- In April 2025, Bosch announced the launch of its next-generation MEMS-based pressure and temperature sensors for electric vehicles, aimed at enhancing thermal management and battery efficiency. These sensors support real-time diagnostics and are optimized for high-voltage applications, reinforcing Bosch’s leadership in EV sensor technology.

- In March 2025, Denso Corporation unveiled its AI-enabled LiDAR perception system designed for Level 3 and Level 4 autonomous vehicles. The system integrates seamlessly with existing sensor platforms to provide advanced object detection and environmental mapping, improving autonomous navigation and safety.

- In February 2025, Continental AG introduced its Intelligent Speed Sensor Suite for next-gen ADAS applications, capable of supporting advanced functions such as predictive cruise control and adaptive steering. This innovation is aimed at addressing the growing demand for semi-autonomous capabilities in passenger and light commercial vehicles.

- In January 2025, Infineon Technologies AG expanded its portfolio of automotive-grade magnetic position sensors by launching the XENSIV™ TLE4999 family. These sensors offer high accuracy and redundancy for safety-critical systems like steering angle detection and electric motor control, essential in electric and hybrid vehicles.

- In December 2024, Sensata Technologies announced a strategic partnership with a major North American EV manufacturer to supply custom-built sensor modules for battery management and thermal control. The collaboration aims to boost EV performance and safety, highlighting Sensata’s growing influence in the electrification domain.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.