Global Automotive Load Floor Market

Market Size in USD Billion

CAGR :

%

USD

2.18 Billion

USD

3.15 Billion

2024

2032

USD

2.18 Billion

USD

3.15 Billion

2024

2032

| 2025 –2032 | |

| USD 2.18 Billion | |

| USD 3.15 Billion | |

|

|

|

|

Automotive Load Floor Market Size

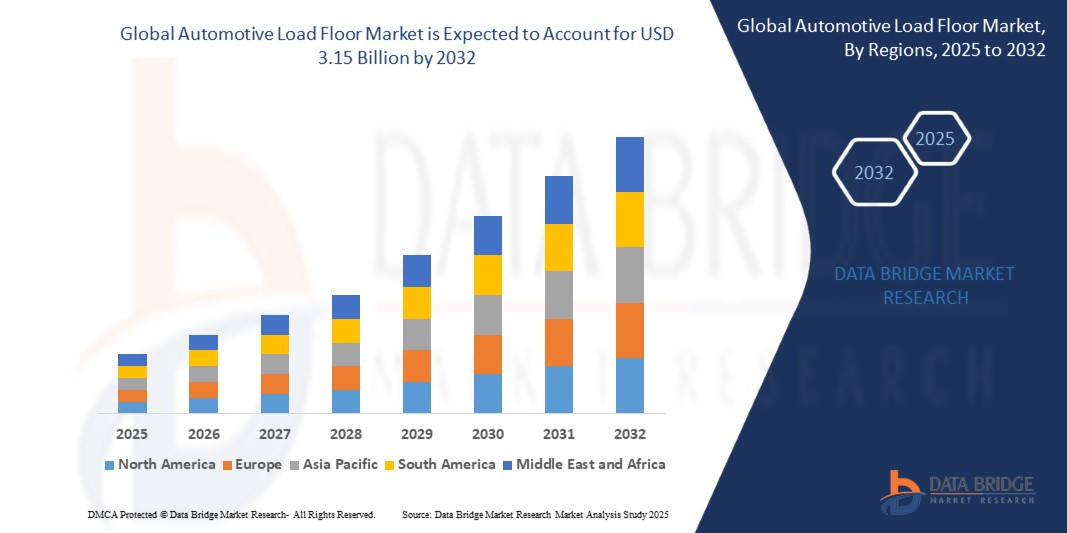

- The global automotive load floor market size was valued at USD 2.18 billion in 2024 and is expected to reach USD 3.15 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced interior components, growing vehicle production, and rising consumer preference for enhanced cargo space utility

- In addition, the integration of smart storage features and modular load floor designs in modern vehicles is boosting product innovation and adoption across passenger and commercial vehicle segments

Automotive Load Floor Market Analysis

- The rising trend of vehicle customization and demand for lightweight, durable materials are driving innovations in automotive load floor design

- Automakers are increasingly adopting composite materials and recyclable thermoplastics to reduce vehicle weight while maintaining structural integrity

- North America led the automotive load floor market with the largest revenue share of 36.4% in 2024, supported by high vehicle production volumes and strong demand for cargo optimization in SUVs and light commercial vehicles

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive load floor market, driven by expanding automotive manufacturing hubs in China, India, and Southeast Asia, coupled with growing consumer interest in smart and modular vehicle interiors

- The hardboard segment accounted for the largest market revenue share in 2024, attributed to its cost-efficiency and high strength-to-weight ratio. Hardboards are widely adopted by manufacturers for their ease of cutting and forming, offering effective load-bearing properties while maintaining affordability. In addition, their availability across a wide range of vehicle categories supports steady demand

Report Scope and Automotive Load Floor Market Segmentation

|

Attributes |

Automotive Load Floor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Load Floor Market Trends

“Increased Adoption Of Lightweight And Recyclable Materials In Load Floor Manufacturing”

- Automakers are replacing traditional materials with lightweight alternatives such as thermoplastics and polymer composites to improve fuel efficiency

- Environmental regulations are pushing manufacturers to use recyclable materials that reduce carbon emissions and support sustainability

- Honeycomb and foam-based load floors offer structural integrity while significantly reducing the overall vehicle weight

- Consumers are showing greater interest in eco-friendly vehicle components, encouraging adoption of sustainable materials

- For instance, Ford’s use of honeycomb polypropylene load floors in SUVs helps achieve weight reduction and better fuel economy

Automotive Load Floor Market Dynamics

Driver

“Rising Demand For SUVs And Hatchbacks Driving Load Floor Innovation”

- The growing popularity of SUVs and hatchbacks has increased the need for functional, spacious, and modular cargo areas

- Automakers are integrating load floors with adjustable height and underfloor compartments to enhance usability and storage

- Modern load floors are now being designed with carpeted and laminated finishes to match interior aesthetics in premium models

- Urban buyers seek versatile vehicle interiors, pushing OEMs to invest in multi-functional and durable load floor systems

- For instance, Hyundai’s Tucson features a dual-level load floor that allows users to switch between flat loading and deeper storage space

Restraint/Challenge

“High Material Costs And Complex Manufacturing Processes”

- Advanced load floor materials such as carbon fiber and thermoplastic composites are costly and raise production expenses

- Sophisticated molding and assembly techniques are required to build multi-layered and integrated load floor systems

- Smaller suppliers often lack the infrastructure or capital investment to adopt lightweight material manufacturing

- Meeting safety regulations and trunk design compatibility adds complexity to load floor engineering

- For instance, creating foldable load floors with integrated storage in electric vehicles demands high tooling costs and precision fabrication, raising barriers for new entrants

Automotive Load Floor Market Scope

The market is segmented on the basis of material type, operation, sales channel, application, and vehicle type.

• By Material Type

On the basis of material type, the automotive load floor market is segmented into hardboard, fluted polypropylene, honeycomb polypropylene, composites, twin sheet, natural fiber, wooden, and others. The hardboard segment accounted for the largest market revenue share in 2024, attributed to its cost-efficiency and high strength-to-weight ratio. Hardboards are widely adopted by manufacturers for their ease of cutting and forming, offering effective load-bearing properties while maintaining affordability. In addition, their availability across a wide range of vehicle categories supports steady demand.

The honeycomb polypropylene segment is expected to witness the fastest growth rate from 2025 to 2032, owing to increasing demand for lightweight automotive materials that improve fuel efficiency and lower emissions. This material is gaining traction among OEMs for its high durability, recyclability, and insulation properties. Its usage is particularly rising in SUVs and electric vehicles, where weight reduction is a key performance factor.

• By Operation

Based on operation, the market is categorized into fixed and sliding. The fixed segment held the largest revenue share in 2024, supported by its long-standing use in traditional vehicle layouts and simplicity in manufacturing. Fixed load floors are preferred in compact and mid-sized vehicles due to lower production costs and reduced assembly complexity.

The sliding segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by consumer demand for modular and adjustable cargo space. Sliding load floors are gaining popularity in luxury vehicles and SUVs, offering improved access, flexible storage, and premium functionality.

• By Sales Channel

The automotive load floor market is segmented into original equipment manufacturer (OEM) and aftermarket based on sales channel. The OEM segment dominated the market with a significant revenue share in 2024, owing to strong partnerships between automakers and material suppliers for pre-installed load floors. OEM-installed systems are built to match precise vehicle designs and safety standards, providing high customer value.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing customization and replacement demand in aging vehicle fleets. As consumers seek to enhance cargo organization and durability, aftermarket load floor products present an accessible and diverse option across price points.

• By Application

On the basis of application, the market is segmented into interior systems, cargo systems, and load floor systems. The cargo systems segment emerged as the largest in 2024, owing to heightened demand for spacious and configurable storage in utility vehicles. Automakers are optimizing trunk and cargo areas with foldable and multi-layered load floors to increase usability.

The load floor systems segment is expected to witness the fastest growth rate from 2025 to 2032, bolstered by innovative multi-functional designs and increasing use in electric and autonomous vehicle interiors. These advanced systems enhance utility while maintaining lightweight construction.

• By Vehicle Type

By vehicle type, the market is segmented into compact, mid-sized, luxury, SUV, and LCV. The SUV segment led the market with the largest revenue share in 2024, supported by the segment’s dominance in global automotive sales. SUVs benefit from dual-level and sliding load floor systems, meeting consumer expectations for convenience and space.

The luxury vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased adoption of high-end materials, noise reduction features, and smart cargo solutions. Manufacturers are integrating premium-grade load floors to match luxury design standards and enhance user experience.

Automotive Load Floor Market Regional Analysis

- North America led the automotive load floor market with the largest revenue share of 36.4% in 2024, supported by high vehicle production volumes and strong demand for cargo optimization in SUVs and light commercial vehicles

- The region benefits from widespread adoption of composite load floors for enhanced durability, lighter weight, and noise reduction across both luxury and mainstream vehicle segments

- Consumer preference for spacious interiors and multifunctional cargo systems continues to drive the incorporation of innovative load floor designs across OEM production lines

U.S. Automotive Load Floor Market Insight

The U.S. automotive load floor market accounted for a dominant revenue share in North America in 2024, driven by a high penetration of sport utility vehicles (SUVs), pickups, and mid-sized cars. Growing consumer focus on utility, cargo space, and vehicle customization is encouraging manufacturers to adopt hardboard, fluted polypropylene, and composite materials in trunk and cabin floor solutions. OEMs are prioritizing lighter and more durable load floor systems to meet fuel efficiency regulations while enhancing user experience.

Europe Automotive Load Floor Market Insight

The Europe automotive load floor market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the region’s strong emphasis on sustainable automotive solutions and electric vehicle (EV) manufacturing. Regulatory requirements for environmental compliance and lightweight components are boosting the use of natural fiber and twin sheet materials in cargo and interior systems. The growth of the EV segment is also creating opportunities for load floor design innovation to accommodate new platform layouts.

Germany Automotive Load Floor Market Insight

Germany holds a leading position in the Europe market due to its large automotive manufacturing base, high R&D investments, and focus on premium vehicles. German OEMs are integrating sliding and modular load floors to enhance cargo flexibility and storage access in luxury sedans and crossovers. In addition, the country’s emphasis on reducing carbon emissions and developing eco-friendly materials is pushing demand for recyclable and composite-based load floor systems.

U.K. Automotive Load Floor Market Insight

The U.K. automotive load floor market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for utility vehicles and advancements in interior system design. The market is seeing rising adoption of portable and sliding load floor solutions in SUVs and estate cars, offering enhanced cargo flexibility. In addition, the U.K.'s growing electric vehicle (EV) adoption is encouraging OEMs to innovate load floor architectures to accommodate new battery layouts and storage configurations, particularly in compact and mid-sized vehicles.

Asia-Pacific Automotive Load Floor Market Insight

The Asia-Pacific automotive load floor market is expected to witness the fastest growth rate from 2025 to 2032, propelled by rising vehicle production, infrastructure development, and increasing demand for compact and mid-sized cars. Countries such as China, India, and Japan are experiencing growing demand for load floor systems in both internal combustion engine (ICE) vehicles and emerging EV models. Local suppliers are also supporting cost-effective solutions, making advanced load floors more accessible to mass-market manufacturers.

China Automotive Load Floor Market Insight

China dominated the Asia-Pacific market in 2024, owing to its robust automotive production and expansion of electric vehicles. The country’s strong domestic component manufacturing ecosystem and rapid urbanization are fostering the adoption of lightweight and multifunctional load floors across a wide range of vehicles. Rising customer expectations for advanced storage configurations and increased trunk utility in SUVs are further contributing to market growth in China.

Japan Automotive Load Floor Market Insight

Japan’s automotive load floor market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong focus on fuel efficiency, compact vehicle design, and advanced materials. Japanese manufacturers are increasingly using lightweight materials such as honeycomb polypropylene and composites to reduce vehicle weight and improve fuel economy. The market also benefits from rising integration of modular load floor systems in hybrid and electric vehicles, aligned with Japan's national push toward sustainability and green mobility initiatives.

Automotive Load Floor Market Share

The Automotive Load Floor industry is primarily led by well-established companies, including:

- Gemini Stearates (India)

- Woodbridge (Canada)

- CIE Automotive (Spain)

- ASG Group (Australia)

- SA Automotive (U.S.)

- DS Smith (U.K.)

- Applied Component Technology (U.K.)

- Nagase America LLC. (U.S.)

- IDEAL Automotive GmbH (Germany)

- UFP Technologies Inc. (U.S.)

- Huntsman International LLC (U.S.)

- Tricel Honeycomb Corporation (U.S.)

- Borgers SE & Co. KGaA (Germany)

- ABC Technologies (Canada)

- KRAIBURG TPE GMBH & CO. KG (Germany)

- Sonoco Products Company (U.S.)

- Recticel (Belgium)

- BASF SE (Germany)

Latest Developments in Global Automotive Load Floor Market

- In June 2023, Greatoo Intelligent launched a new energy-efficient tire curing press technology aimed at reducing environmental impact and operational costs. This development is expected to enhance production efficiency while aligning with growing sustainability standards in the tire manufacturing industry, potentially strengthening Greatoo’s market position

- In May 2023, Guilin Rubber Machinery Co., Ltd. unveiled a comprehensive new line of rubber processing machinery, including equipment for vulcanizing, calendering, mixing, and extruding. This product expansion is intended to meet the evolving demands of rubber manufacturers, offering advanced capabilities and boosting overall production flexibility in the sector

- In July 2021, JK Tyre entered into an agreement with Ki Mobility Solutions Private Ltd. (KMS) to provide 24/7 customer support services. This partnership is designed to improve service responsiveness and customer satisfaction, thereby enhancing JK Tyre’s brand loyalty and service-driven market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.