Global Automotive Magnet Wire Market

Market Size in USD Billion

CAGR :

%

USD

5.14 Billion

USD

7.21 Billion

2024

2032

USD

5.14 Billion

USD

7.21 Billion

2024

2032

| 2025 –2032 | |

| USD 5.14 Billion | |

| USD 7.21 Billion | |

|

|

|

|

Automotive Magnet Wire Market Analysis

The automotive magnet wire market is poised for substantial expansion due to the ongoing transition towards electrification in the automotive industry. The rapid growth of electric vehicles (EVs) and hybrid electric vehicles (HEVs) has created a heightened demand for high-performance magnet wires, which are critical in electric motors, powertrain systems, and battery components. Increasing investments in research and development have led to innovations in heat-resistant insulation materials and improved conductivity, enhancing the efficiency and longevity of magnet wires in harsh automotive environments. Furthermore, stringent environmental regulations aimed at reducing carbon emissions, coupled with consumer preference for sustainable and energy-efficient vehicles, are key drivers propelling the market forward.

Automotive Magnet Wire Market Size

Global automotive magnet wire market size was valued at USD 5.14 billion in 2024 and is projected to reach USD 7.21 billion by 2032, with a CAGR of 4.31% during the forecast period of 2025 to 2032.

Automotive Magnet Wire Market Trend

“Growing Emphasis on Sustainable Materials”

The automotive magnet wire market is increasingly focusing on sustainable materials to reduce environmental impact and meet regulatory demands. Manufacturers are exploring eco-friendly alternatives, such as biodegradable insulation and recyclable copper, to minimize waste. This shift not only aligns with global sustainability goals but also appeals to environmentally conscious consumers. Additionally, utilizing sustainable materials can enhance the overall trends of automotive components, improving energy efficiency and reducing emissions. As a result, companies investing in sustainable practices are likely to gain a competitive edge in a rapidly evolving market.

Report Scope and Market Segmentation

|

Attributes |

Automotive Magnet Wire Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K. , France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, New Zealand, Indonesia, Thailand, Malaysia, Singapore, Philippines, Taiwan, Vietnam, Rest of Asia Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Oman, Bahrain, Kuwait, Qatar, Rest of Middle East and Africa |

|

Key Market Players |

ACEBSA (Spain), Cividale S.p.A. (Italy), Craig Wire Products LLC (USA), Device Technologies, Inc. (USA), Ederfil Becker (Germany), ELEKTRISOLA (Germany), Fujikura Ltd. (Japan), Furukawa Electric Co., Ltd. (Japan), Hitachi Metals, Ltd. (Japan), LS Cable & System Ltd. (South Korea), Ewwa (Germany), MWS Wire Industries, Inc. (USA), Ningbo Jintian Copper (Group) Co., Ltd. (China), Rea (Italy), Sam Dong (South Korea), Sumitomo Electric Industries, Ltd. (Japan), Superior Essex Inc. (USA), Synflex Elektro GmbH (Germany), TaYa Electric Wire & Cable Co., Ltd. (Taiwan), Tongling Jingda Special Magnet Wire Co., Ltd. (China), and Wenzhou Jogo Imp & Exp Co., Ltd. (China) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Automotive Magnet Wire Market Definition

Automotive magnet wire is a specialized type of insulated copper or aluminum wire used to create

electro magnet fields in automotive applications. It is designed to withstand high temperatures, vibrations, and harsh conditions commonly found in vehicle environments. Magnet wire is essential in the production of motors, transformers, solenoids, and other components in electric vehicles (EVs), alternators, ignition coils, and various other systems that rely on electro magnet mechanisms to function efficiently.

Automotive Magnet Wire Market Dynamics

Driver

- Increased Demand for Electric and Hybrid Vehicles

The increased demand for electric and hybrid vehicles has led to a surge in the need for high-quality automotive magnet wire. This wire is crucial for efficient motor and transformer operations, as it enhances electrical conductivity and minimizes energy losses. As electric and hybrid vehicles rely heavily on advanced electrical systems and components, automotive magnet wire plays a vital role in improving performance and reliability, driving the need for innovations in wire technology to meet the growing market demands. The surge in electric and hybrid vehicle production is reshaping the global automotive magnet wire market. As manufacturers focus on developing advanced electric motors and high-density batteries, the demand for high quality magnet wire intensifies. This trend drives innovation in wire insulation technologies, such as the development of specialized PEEK compounds and neodymium magnets, to meet the performance and efficiency needs of modern EVs.

For instance,

In 2023, global electric car sales remained concentrated in a few major markets: China, Europe, and the United States. China led with 8.1 million new registrations, a 35% increase from 2022, and became the largest exporter of electric vehicles (EVs). The U.S. saw 1.4 million new EV registrations, driven by tax credits and price reductions, while Europe registered nearly 3.2 million new electric cars, with high adoption rates in Germany, France, the UK, and Sweden. This growing demand for electric and hybrid vehicles underscores the increased need for high-quality automotive magnet wire, which is essential for the efficient operation of electric motors and transformers. As the electric vehicle market expands, innovations in magnet wire technology become crucial for enhancing performance and meeting the rising global demand

- Rising Demand for Automotive Electronic Components

The rising demand for automotive electronic components is significantly influencing the automotive magnet wire market. As vehicles become increasingly equipped with sophisticated electronic systems, including advanced driver assistance and infotainment features, the need for high-performance magnet wire grows. This wire is essential for ensuring reliable and efficient operation of electronic motors, sensors, and connectors. Consequently, the market for automotive magnet wire is expanding, driven by the necessity for materials that can meet the rigorous demands of modern automotive electronics, including higher durability, better thermal management, and enhanced conductivity.

For instance,

- In May 2024, Superior Essex completed its acquisition of the remaining minority interest in Essex Furukawa Magnet Wire from Furukawa Electric Co., Ltd., becoming the sole owner of the brand and its global operations. The company plans to relaunch the magnet wire business under a new name later in 2024 while continuing to operate existing facilities worldwide. This strategic move positions Superior Essex to strengthen its market presence and address the rising demand for automotive electronic components. The focus on the automotive industry, power, and electrification underscores the growing importance of advanced magnet wire technologies in meeting the increasing needs of electric vehicles and other high-performance applications

Opportunity

- Increasing Partnerships With Tech Firms for Advanced Automotive Components

The increasing partnerships with tech firms for advanced automotive components present a significant opportunity for the automotive magnet wire market. As electric vehicles (EVs) and hybrid electric vehicles (HEVs) become more technologically advanced, the demand for high-performance magnet wire in critical components such as motors, inverters, and transformers is expected to rise. Collaborations with tech companies allow manufacturers to integrate cutting-edge innovations like improved heat resistance, enhanced electrical conductivity, and miniaturization of components, which are essential for the efficiency and reliability of modern EV powertrains. This opens the door for magnet wire manufacturers to create tailored solutions that meet the stringent requirements of next-generation automotive applications.

For instance,

In April 2022, Enedym Inc. has teamed up with Sona Comstar to develop and manufacture magnet less switched reluctance motors (SRMs) for electric vehicles in India. This partnership leverages Enedym’s SRM technology, which does not rely on rare earth metals, to create high-performance and cost-effective drivetrains. This collaboration highlights the increasing trend of tech firms working together to advance automotive components, particularly in the electric vehicle sector. As the industry shifts away from traditional rare earth materials, there will be growing demand for advanced magnet wire solutions to support these new technologies, presenting significant opportunities for innovation in the automotive magnet wire market

- Advancements in Durable, Heat-Resistant Insulation Materials

Advancements in durable, heat-resistant insulation materials present a significant opportunity for the automotive magnet wire market. As automotive technology evolves, particularly with the rise of electric vehicles (EVs) and hybrid vehicles, there is an increasing need for magnet wires that can withstand higher temperatures and harsh conditions. New insulation materials that offer enhanced heat resistance and durability can improve the performance and longevity of magnet wires used in these advanced automotive applications. This evolution supports the development of more efficient and reliable electric drivetrains, contributing to the overall advancement of automotive technology.

For instance,

- In August 2021, Essex Furukawa Magnet Wire has been awarded a significant contract to supply 33,000 tons of High Voltage Winding Wire (HVWW) for a premium automaker's electric vehicles, focusing on 800V applications at their Arolsen, Germany plant. This contract underscores the company's commitment to advancing EV technology with HVWW's superior heat resistance and high performance. This development represents a major opportunity for the automotive magnet wire market, as it aligns with the growing need for durable, heat-resistant insulation materials. The HVWW wire's ability to handle high voltages and temperatures highlights the rising demand for advanced insulation solutions, which will drive growth and technological advancements in the automotive magnet wire sector.

Restraint/ Challenge

- Stringent Standards Increase Compliance and Production Cost

Stringent standards in the automotive industry significantly raise compliance and production costs for manufacturers of magnet wire. As regulations tighten around energy efficiency, emissions, and safety, manufacturers must invest heavily in research, development, and advanced materials to meet these demands. This leads to increased production costs, as companies are forced to adopt more expensive processes and raw materials to ensure their products meet the required specifications. These added expenses can negatively impact profit margins and make it harder for smaller manufacturers to compete in the market, creating challenges in the overall supply chain.

For instance,

According to the document published by Schwering & Hasse Elektrodraht GmbH, magnet wire must undergo rigorous testing to ensure it can withstand the challenges of winding, assembly, and harsh operating conditions, such as exposure to coolants, oils, or overloads. These tests, outlined in the IEC 60851 standard, assess the wire's electrical, mechanical, chemical, and thermal properties, including partial discharge resistance, elongation, flexibility, and heat shock. Meeting these stringent standards increases compliance and production costs, as manufacturers must invest in advanced testing processes and materials.

- Disruptions in Copper Supply Chain Pose Risks

Disruptions in the copper supply chain present significant challenges for the automotive magnet wire market. Copper is a critical material for manufacturing high-performance magnet wires used in automotive applications, including those for electric vehicles and advanced driver assistance systems. Any interruptions in copper supply can lead to increased costs, delays in production, and potential shortages of essential components. This instability not only affects manufacturers' ability to meet demand but can also disrupt the entire supply chain, from raw material suppliers to end users in the automotive industry. Moreover, fluctuations in copper availability and prices can impact the overall cost structure of automotive magnet wires. Manufacturers may face difficulties in maintaining consistent quality and performance while navigating the economic pressures of volatile copper prices. This challenge is particularly acute as the automotive industry increasingly relies on advanced magnet wires for new technologies and features, amplifying the potential impact of supply chain disruptions on innovation and production timelines.

For instance,

- In April 2024, according to the article published by Mining.com.au, the copper market is rallying due to supply disruptions and record-low inventories, with prices reaching new highs. Major supply issues,including mine shutdowns and reduced production forecasts, have tightened the market and increased prices, further driven by rising demand from electrification and artificial intelligence. Disruptions in the copper supply chain pose a significant risk to the automotive magnet wire market.As copper prices rise, the cost of magnet wires, which rely on copper, is likely to increase, leading to higher production costs and potential shortages of essential components for automotive applications.

Automotive Magnet Wire Market Scope

The global automotive magnet wire market is segmented into nine notable segments, which are segmented on the basis of type, product type, shape, insulation type, technology focus type, integration framework type, application, distribution channel and end user.

By Type

- Copper Wire

- Product Type

- Enamelled Wire

- Covered Conductor Wire

- Shape

- Round Magnet Wire

- Round Bondable Magnet Wire

- Rectangle Magnet Wire

- Square Magnet Wire

- Product Type

- Aluminium Wire

- Product Type

- Enamelled Wire

- Covered conductor Wire

- Shape

- Round Magnet Wire

- Round Bondable Magnet Wire

- Rectangle Magnet Wire

- Square Magnet Wire

- Product Type

By Product Type

- Enamelled Wire

- Covered Conductor Wire

By Shape

- Round Magnet Wire

- Round Bondable Magnet Wire

- Rectangle Magnet Wire

- Square Magnet Wire

By Insulation Material

- Polyamide-Imide (PAI)

- Polyimides (PI)

- Polyetherimide (PEI)

- Polyether Ether Ketone (PEEK)

- Others

By Technology Focus Type

- Neodymium Technology

- Samarium Cobalt Technology

- Ferrite Technology

- Others Magnet Technology

By Integration Framework Type

- Soft Magnet

- Hard Magnet

- Semi-Hard Magnet

By Application

- Motors

- Transformers

- Inductors

- Braking

- Battery Harness

- Starter/ Alternator Harness

- EDS Power Supply

- Battery Cables

- HV Power Cables

- LVDS/HDS

- COAX

- Windows

- Door Locking

- Seating

- Stability

- Other Electrical Devices

By Distribution Channel

- Direct Sales

- Type

- B2B/Third Party Distributions

- Speciality Stores

- E-Commerce

- Supermarket/Hypermarket

- Type

- Indirect Sales

By End User

- Motor Industry

- Sensor Industry

- Actuators Industry

- Lightning Industry

- Passenger

- Vehicles

- Type

- Passenger Vehicles

- Electrical Vehicles

- Commercial Vehicles

- Type

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Industry Vehicles

- Military Vehicles

- Type

- Energy

- Home Appliances

- Transformer

- Signalling and Supply

- Data

- Others

Automotive Magnet Wire Market Regional Analysis

Global automotive magnet wire market is segmented into nine notable segments which are segmented on the basis of type, product type, shape, insulation type, technology focus type, integration framework type, application, distribution channel and end user.

The countries covered in the global automotive magnet wire market report are U.S., Canada, Mexico, Germany, U.K. , France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, rest of Europe, China, Japan, India, South Korea, Australia, New Zealand, Indonesia, Thailand, Malaysia, Singapore, Philippines, Taiwan, Vietnam, rest of Asia Pacific, Brazil, Argentina, rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Oman, Bahrain, Kuwait, Qatar, and rest of Middle East and Africa.

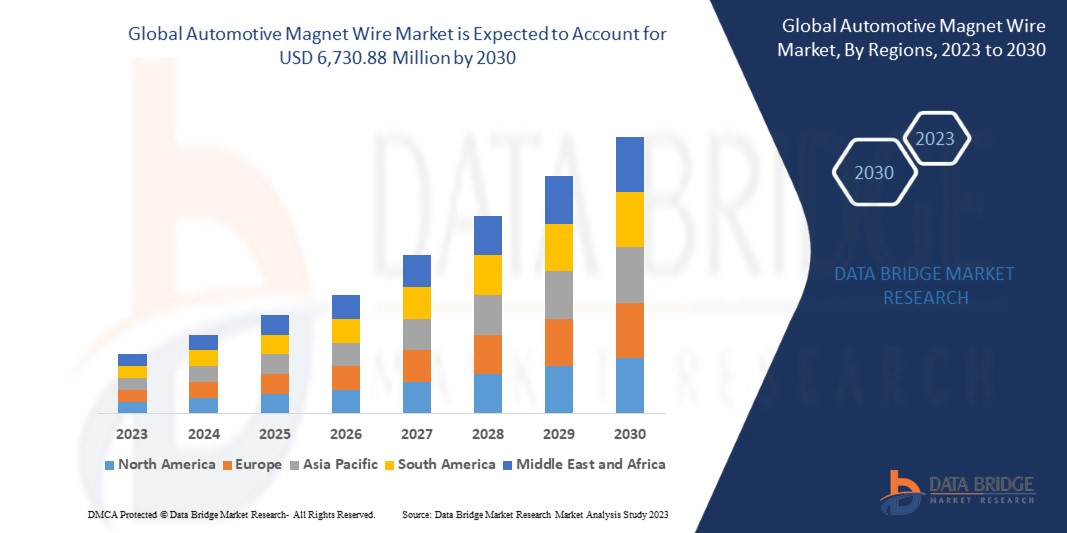

Asia Pacific is expected to dominate the automotive magnet wire market due to its extensive manufacturing capabilities, cost-effective production, and strong supply chain infrastructure. Additionally, the region's rapid growth in automotive production and technological advancements further solidify its market leadership over North America, Europe, and other regions.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and global brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Automotive Magnet Wire Market Share

Global automotive magnet wire market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on automotive magnet wire the market.

Automotive Magnet Wire Market Players Operating in the Market are:

- ACEBSA (Spain)

- Cividale S.p.A. (Italy)

- Craig Wire Products LLC (USA)

- Device Technologies, Inc. (USA)

- Ederfil Becker (Germany)

- ELEKTRISOLA (Germany)

- Fujikura Ltd. (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- Hitachi Metals, Ltd. (Japan)

- LS Cable & System Ltd. (South Korea)

- Ewwa (Germany)

- MWS Wire Industries, Inc. (USA)

- Ningbo Jintian Copper (Group) Co., Ltd. (China)

- Rea (Italy)

- Sam Dong (South Korea)

- Sumitomo Electric Industries, Ltd. (Japan)

- Superior Essex Inc. (USA)

- Synflex Elektro GmbH (Germany)

- TaYa Electric Wire & Cable Co., Ltd. (Taiwan)

- Tongling Jingda Special Magnet Wire Co., Ltd. (China)

- Wenzhou Jogo Imp & Exp Co., Ltd. (China)

Latest development Automotive Magnet Wire

- In June 2024, Sumitomo Electric acquired a majority stake in German cable manufacturer Südkabelto support two major HVDC projects with Amprion, advancing Germany's energy transition. This acquisition boosts Sumitomo Electric’s European presence and production capabilities, particularly in high-voltage cables. By leveraging this expertise, the company can indirectly strengthen its automotive magnet wire production, which plays a crucial role in electric vehicle systems, aligning with the growing demand for sustainable energy and automotive solutions

- In January 2024, Hitachi Metals has rebranded as Proterial, Ltd. following its acquisition by Bain Capital, and is proposing its NMF 15 ferrite magnets as a potential alternative to neodymium magnets in electric vehicle (EV) traction motors, aiming to reduce reliance on rare earth elements. This development positions Proterial to offer more sustainable solutions for EV motors by integrating their ferrite magnets, potentially reducing resource risks and costs while expanding their product offerings in the automotive magnet wire market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.