Global Automotive Metal Casting Market

Market Size in USD Billion

CAGR :

%

USD

31.30 Billion

USD

58.37 Billion

2025

2033

USD

31.30 Billion

USD

58.37 Billion

2025

2033

| 2026 –2033 | |

| USD 31.30 Billion | |

| USD 58.37 Billion | |

|

|

|

|

Automotive Metal Casting Market Size

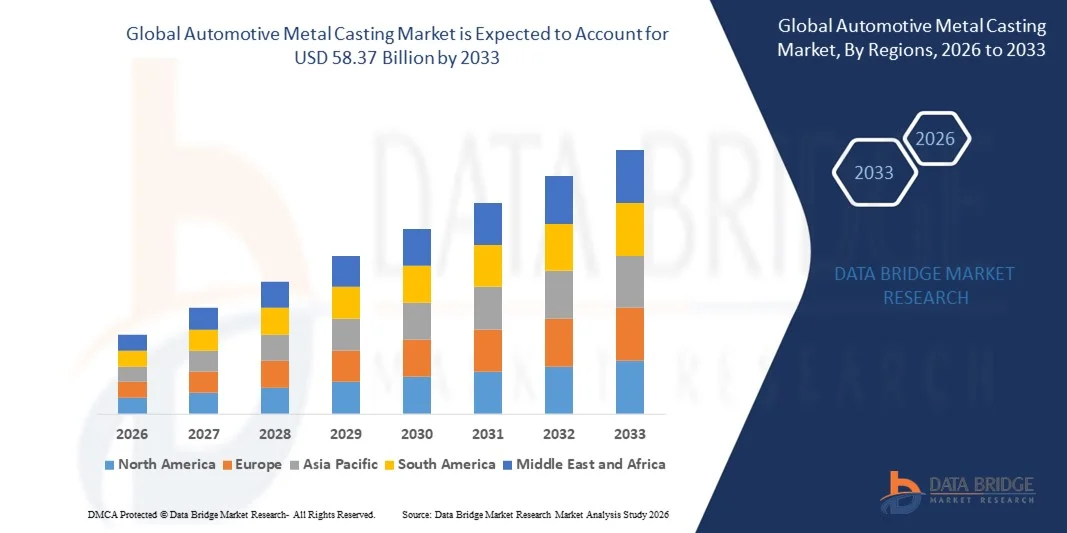

- The global automotive metal casting market size was valued at USD 31.30 billion in 2025 and is expected to reach USD 58.37 billion by 2033, at a CAGR of 8.10% during the forecast period

- The market growth of the automotive metal casting industry is largely fueled by the increasing demand for lightweight, high-strength components in vehicles, driven by stringent fuel efficiency and emission regulations across global markets

- Furthermore, the rising adoption of electric and hybrid vehicles is accelerating the need for aluminum, magnesium, and advanced alloy castings, as these materials help reduce vehicle weight without compromising structural integrity. These converging trends are boosting investments in advanced casting technologies, thereby significantly enhancing the industry’s growth

Automotive Metal Casting Market Analysis

- Automotive metal castings, including components for engines, transmissions, and body assemblies, are becoming increasingly essential in modern vehicles due to their ability to combine durability, precision, and weight reduction, which are critical for performance, safety, and efficiency

- The escalating demand for metal cast components is primarily driven by the shift toward electric mobility, increasing production of lightweight vehicles, and technological advancements in high-pressure die casting, sand casting, and other precision casting processes, which enable manufacturers to produce complex, high-quality parts at scale

- North America dominated the automotive metal casting market with a share of 39% in 2025, due to the strong presence of leading automakers, advancements in casting technologies, and the growing demand for lightweight vehicle components

- Asia-Pacific is expected to be the fastest growing region in the automotive metal casting market during the forecast period due to rising automobile production, expanding EV manufacturing, and rapid industrialization in emerging economies

- Aluminium segment dominated the market with a market share of 48.1% in 2025, due to its lightweight nature, high strength-to-weight ratio, and superior corrosion resistance. Automakers increasingly adopt aluminum castings to reduce vehicle weight, improve fuel efficiency, and comply with stringent emission regulations. The material’s flexibility for intricate component design and recyclability further strengthen its adoption in both internal combustion engine (ICE) and electric vehicles. The widespread use of aluminum in critical components such as engine blocks, transmission housings, and structural parts continues to fuel its dominance across the market

Report Scope and Automotive Metal Casting Market Segmentation

|

Attributes |

Automotive Metal Casting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Metal Casting Market Trends

Increasing Adoption of Lightweight Materials in Vehicle Manufacturing

- The automotive metal casting market is witnessing increased growth driven by the demand for lightweight materials that enhance fuel efficiency and reduce vehicle emissions. The shift toward aluminum and magnesium alloys in casting processes supports vehicle manufacturers in meeting stringent regulatory standards and consumer expectations for greener vehicles

- For instance, companies such as Nemak and Georg Fischer are producing advanced aluminum casting components used in electric and hybrid vehicles to reduce overall vehicle weight without compromising structural integrity. These innovations contribute to improved performance and extended driving ranges for electrified vehicles

- Lightweight metal casting is also enabling design flexibility, allowing manufacturers to create complex, high-strength parts with reduced manufacturing costs and shorter lead times. This capability supports the broader trend toward vehicle modularity and customization in the automotive industry

- In addition, the integration of computer-aided design (CAD) and simulation technologies optimizes casting processes, reducing defects and material waste. The adoption of these digital tools accelerates production cycles and enhances quality control across the supply chain

- The growing focus on sustainability is encouraging the use of recycled metals and energy-efficient casting methods, which further drive market growth. Automakers’ commitment to a circular economy is pushing suppliers to develop innovative casting solutions that minimize environmental impact

- Overall, the rising adoption of lightweight metal casting represents a fundamental transformation in automotive manufacturing. This evolution aligns closely with the industry’s ambitions to develop more efficient, environmentally friendly, and high-performance vehicles

Automotive Metal Casting Market Dynamics

Driver

Rising Demand for Electric and Hybrid Vehicles

- The accelerating global demand for electric and hybrid vehicles (EVs and HEVs) is a key market driver for automotive metal casting. These vehicles require specialized cast components such as battery housings, electric motor parts, and lightweight structural elements to meet performance and safety standards.

- For instance, Mahindra Castings has increased its production capacity for aluminum casting parts to supply leading EV manufacturers. This move underscores the growing requirement for precision metal castings tailored to electric powertrain components

- Government incentives and regulations promoting zero-emission vehicles are encouraging automakers to shift toward electrification, thus increasing the demand for cast components compatible with EV designs. The trend is motivating suppliers to innovate and scale their casting operations accordingly

- In addition, the expansion of charging infrastructure and consumer acceptance of EVs is fueling vehicle sales, which further drives the need for reliable and lightweight cast metal parts. This growth is accelerating investments in casting technology development focused on EV requirements

- The combined effect of environmental policies, technological advancements, and shifting consumer preferences ensures sustained demand for automotive metal castings in the electric and hybrid vehicle segment. This ongoing transition is reshaping supplier strategies and market growth trajectories

Restraint/Challenge

High Production Costs and Material Price Volatility

- High production costs associated with advanced metal casting techniques present a significant challenge that may limit market expansion. The expenses related to raw materials, energy consumption, and precision tooling raise manufacturing costs, especially for lightweight alloys such as aluminum and magnesium

- For instance, fluctuations in global aluminum prices due to supply chain disruptions and geopolitical factors directly affect the cost structure of casting suppliers. This volatility impacts pricing strategies and profit margins, creating uncertainty for both manufacturers and buyers

- In addition, the complexity of maintaining tight tolerances and quality standards in automotive castings requires skilled labor and high-end machinery, further increasing operational expenses. These factors can limit the ability of smaller players to compete effectively in the market

- In addition, economic downturns or shifts in automotive production volumes can magnify the impact of fixed casting plant costs, reducing overall profitability. Cost-sensitive automakers may prioritize alternative manufacturing methods or materials during such periods, affecting casting demand

- Addressing these cost and price volatility challenges through supply chain optimization, investment in energy-efficient technologies, and material innovation will be crucial. Solutions that balance cost control with consistent quality will enable long-term competitiveness in the automotive metal casting market

Automotive Metal Casting Market Scope

The market is segmented on the basis of material, process, and application.

- By Material

On the basis of material, the automotive metal casting market is segmented into iron, aluminum, magnesium, zinc, and others. The aluminum segment dominated the market with the largest revenue share of 48.1% in 2025, driven by its lightweight nature, high strength-to-weight ratio, and superior corrosion resistance. Automakers increasingly adopt aluminum castings to reduce vehicle weight, improve fuel efficiency, and comply with stringent emission regulations. The material’s flexibility for intricate component design and recyclability further strengthen its adoption in both internal combustion engine (ICE) and electric vehicles. The widespread use of aluminum in critical components such as engine blocks, transmission housings, and structural parts continues to fuel its dominance across the market.

The magnesium segment is anticipated to witness the fastest growth rate from 2026 to 2033 due to the growing emphasis on ultra-lightweight materials in next-generation vehicles. Magnesium’s exceptional strength and 75% lighter weight than steel make it ideal for electric vehicle (EV) applications, where weight reduction directly influences battery performance and driving range. Its increased use in steering wheels, seat frames, and gearbox casings reflects the automotive industry’s shift toward high-performance materials. The ongoing research to enhance magnesium’s durability and cost-efficiency further supports its rapid market expansion.

- By Process

On the basis of process, the automotive metal casting market is segmented into gravity, high & low pressure, and sand casting. The high & low pressure casting segment dominated the market in 2025 due to its ability to produce complex and high-precision components with superior surface finishes. This process is widely preferred for manufacturing engine blocks, wheels, and suspension parts where accuracy and strength are crucial. Automakers rely on high and low pressure casting for consistent quality, minimal porosity, and efficient metal utilization, contributing to its broad acceptance across both luxury and mass-market vehicle production.

The sand casting segment is projected to witness the fastest growth rate during 2026–2033, supported by its flexibility, cost-effectiveness, and suitability for low-volume production. Sand casting allows the creation of large, intricate parts such as engine manifolds and housings at lower tooling costs, making it attractive for prototype development and specialized vehicle components. The process’s adaptability to various metals and ability to accommodate rapid design changes also encourage its use among electric and hybrid vehicle manufacturers. Continuous innovation in sand mold materials and automation technologies further accelerates its market growth.

- By Application

On the basis of application, the automotive metal casting market is segmented into body assembly, engine, and transmission. The engine segment held the largest revenue share in 2025, driven by the ongoing demand for durable, heat-resistant cast components in both ICE and hybrid vehicles. Cast metals provide the necessary mechanical strength and thermal stability for parts such as cylinder heads, pistons, and engine blocks. The use of aluminum and iron alloys in engine systems helps manufacturers achieve performance efficiency while maintaining reliability under high operating conditions, reinforcing the segment’s dominance.

The body assembly segment is expected to record the fastest CAGR from 2026 to 2033, attributed to the rising production of lightweight and modular vehicle structures. Automakers are increasingly using cast aluminum and magnesium components for body panels, chassis parts, and structural reinforcements to enhance fuel efficiency and crash safety. The shift toward electric vehicles has further boosted demand for lightweight cast structures to offset heavy battery packs. The body assembly segment’s growth is also supported by advancements in high-pressure die casting technologies enabling large single-piece body structures, often referred to as “gigacasting,” adopted by leading EV manufacturers.

Automotive Metal Casting Market Regional Analysis

- North America dominated the automotive metal casting market with the largest revenue share of 39% in 2025, driven by the strong presence of leading automakers, advancements in casting technologies, and the growing demand for lightweight vehicle components

- The region’s focus on improving fuel efficiency and meeting stringent emission standards is accelerating the adoption of aluminum and magnesium castings across vehicle platforms

- The presence of established automotive manufacturing hubs and technological innovation in foundry processes continues to strengthen North America’s position in the global market

U.S. Automotive Metal Casting Market Insight

The U.S. automotive metal casting market captured the largest revenue share in 2025 within North America, supported by robust vehicle production and the growing transition toward electric vehicles (EVs). Automakers in the U.S. are increasingly utilizing high-pressure die casting and precision sand casting methods to develop lightweight, high-performance parts. The demand for aluminum and magnesium components in engines, transmissions, and body assemblies is further fueled by stringent CAFÉ standards. In addition, the rapid adoption of automation and additive manufacturing in foundries enhances production efficiency and component quality across the U.S. market.

Europe Automotive Metal Casting Market Insight

The Europe automotive metal casting market is projected to grow at a significant CAGR throughout the forecast period, driven by the region’s strong automotive manufacturing base and strict CO₂ emission regulations. European automakers are rapidly adopting advanced casting materials to achieve lightweight construction without compromising strength or safety. The increasing demand for electric and hybrid vehicles further stimulates the adoption of aluminum and magnesium castings. The region’s ongoing shift toward sustainability and circular manufacturing also promotes the use of recycled metals and energy-efficient casting techniques.

U.K. Automotive Metal Casting Market Insight

The U.K. automotive metal casting market is anticipated to expand at a steady CAGR during the forecast period, supported by the growth of the domestic EV industry and the government’s commitment to carbon neutrality. Local foundries are investing in lightweight alloys and digital casting technologies to meet automaker requirements for high-precision, durable components. The presence of global automotive brands and their R&D centers enhances innovation and adoption of advanced metal casting solutions, particularly in electric drivetrains and structural applications.

Germany Automotive Metal Casting Market Insight

The Germany automotive metal casting market is expected to witness substantial growth during the forecast period, driven by its strong engineering capabilities and leading position in premium vehicle production. German automakers are increasingly utilizing aluminum and magnesium castings for engine, transmission, and chassis parts to achieve lightweight and performance efficiency. The country’s focus on Industry 4.0 integration within foundries, coupled with innovations in high-pressure die casting, strengthens production efficiency. Moreover, sustainability-driven manufacturing practices and recycling initiatives align with the country’s environmental policies, fueling continued adoption.

Asia-Pacific Automotive Metal Casting Market Insight

The Asia-Pacific automotive metal casting market is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising automobile production, expanding EV manufacturing, and rapid industrialization in emerging economies. Increasing investments from global automakers and the availability of cost-efficient labor and raw materials enhance regional competitiveness. The growing demand for lightweight materials and government incentives promoting domestic vehicle production further accelerate market expansion across China, India, and Japan.

China Automotive Metal Casting Market Insight

The China automotive metal casting market accounted for the largest market share in Asia-Pacific in 2025, supported by its vast vehicle manufacturing base and strong domestic demand. The country’s focus on electric mobility, along with extensive R&D investments in lightweight casting technologies, drives large-scale adoption of aluminum and magnesium alloys. Moreover, the presence of numerous casting facilities and favorable government initiatives promoting local production strengthen China’s leadership in the regional market.

India Automotive Metal Casting Market Insight

India is projected to be the fastest-growing country in the Asia-Pacific automotive metal casting market during the forecast period, fueled by rapid vehicle production growth and government initiatives under the “Make in India” program. The increasing adoption of fuel-efficient and lightweight vehicle components, coupled with rising foreign investments in foundry infrastructure, supports the market’s expansion. Domestic manufacturers are increasingly embracing automated casting systems and advanced materials to meet global quality standards and cater to both export and domestic demands.

Automotive Metal Casting Market Share

The automotive metal casting industry is primarily led by well-established companies, including:

- Nemak S.A.B. de C.V. (Mexico)

- Ryobi Limited (Japan)

- Georg Fischer Ltd. (Switzerland)

- Rheinmetall Automotive AG (Germany)

- Ahresty Corporation (Japan)

- Dynacast (U.S.)

- Endurance Technologies Limited (India)

- MINO Industry USA, Inc. (U.S.)

- Acast AB (Sweden)

- Aluminum Castings Company LLC (U.S.)

- Alcoa Corporation (U.S.)

- Bühler AG (Switzerland)

- Form Technologies (U.S.)

- TOSHIBA MACHINE CO., LTD. (Japan)

Latest Developments in Global Automotive Metal Casting Market

- In August 2025, Nemak completed the acquisition of GF Casting Solutions’ lightweight components business in Romania, which includes two advanced production facilities in Pitești and Scornicești. This expansion strengthens Nemak’s manufacturing presence in Europe and enhances its ability to supply high-performance aluminum and magnesium castings for electric and hybrid vehicles. The development underscores the company’s strategy to meet growing global demand for lightweight, energy-efficient automotive components, reinforcing its leadership in sustainable casting technologies

- In July 2025, Georg Fischer AG (GF) entered into an agreement to divest its automotive casting division, GF Casting Solutions, to Nemak S.A.B. de C.V. for approximately USD 336 million. This move allows GF to realign its business strategy toward industrial applications while enabling Nemak to expand its technological expertise and customer base in lightweight casting. The transaction highlights the ongoing consolidation within the automotive metal casting industry as major players strengthen their positions in electric mobility and advanced material solutions

- In May 2025, Alcoa Corporation introduced a new series of automotive-grade aluminum alloys specifically designed for high-pressure die casting. These alloys provide superior weight reduction, enhanced strength, and improved recyclability, aligning with the automotive industry’s transition toward sustainable and lightweight vehicle construction. This innovation is expected to boost the adoption of aluminum casting in electric and hybrid vehicles, positioning Alcoa as a key innovator in advanced casting materials

- In April 2025, Thyssenkrupp announced a strategic partnership with JFE Holdings to jointly develop advanced aluminum casting solutions for next-generation electric vehicles. The collaboration focuses on optimizing material strength, improving thermal performance, and reducing overall vehicle weight. This initiative reflects the increasing emphasis on research-driven innovation to enhance efficiency in EV production, contributing to the growth and modernization of the global automotive metal casting market

- In March 2025, Pace Industries secured a USD 150 million multi-year contract with a leading global automaker to supply precision aluminum die-cast components for new electric vehicle platforms. The agreement reinforces the growing role of die casting in EV manufacturing and strengthens Pace Industries’ position as a key supplier of lightweight structural components. This development is set to drive technological advancement and increase production efficiency within the automotive metal casting sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.