Global Automotive Metals Market

Market Size in USD Billion

CAGR :

%

USD

176.16 Billion

USD

264.26 Billion

2024

2032

USD

176.16 Billion

USD

264.26 Billion

2024

2032

| 2025 –2032 | |

| USD 176.16 Billion | |

| USD 264.26 Billion | |

|

|

|

|

Automotive Metals Market Size

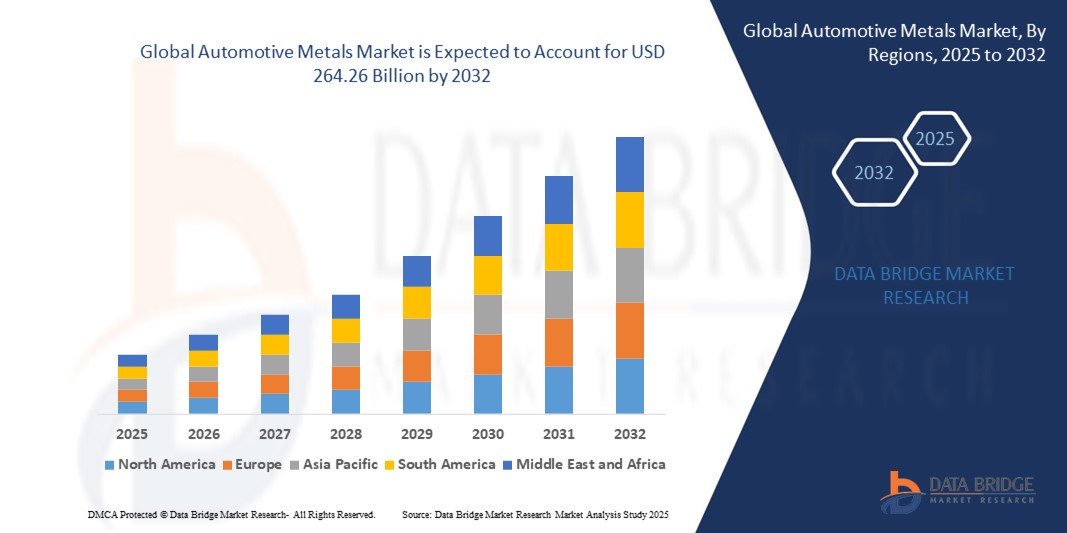

- The global automotive metals market size was valued at USD 176.16 billion in 2024 and is expected to reach USD 264.26 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight and fuel-efficient vehicles, increasing adoption of electric vehicles (EVs), and advancements in high-strength alloys to improve safety and performance

- In addition, drivers include stringent emission regulations, rapid urbanization, and growing investments in automotive manufacturing infrastructure across emerging economies

Automotive Metals Market Analysis

- Automakers are increasingly focusing on lightweight materials such as aluminum, magnesium, and advanced high-strength steel (AHSS) to enhance fuel efficiency and meet stringent emission norms

- The shift toward EVs is driving demand for specialized metals that offer high conductivity, durability, and corrosion resistance, particularly in battery enclosures and structural components

- Asia-Pacific dominated the automotive metals market with the largest revenue share of 47.5% in 2024, driven by robust automotive production in countries such as China, Japan, India, and South Korea, alongside increasing adoption of lightweight metals to meet stringent emission standards and improve fuel efficiency

- North America region is expected to witness the highest growth rate in the global automotive metals market, driven by technological innovation, supportive government policies, and the expansion of electric and hybrid vehicle manufacturing

- The mild steel segment dominated the market with the largest revenue share in 2024, driven by its cost-effectiveness, ease of manufacturing, and widespread use in structural automotive components. Its durability and high recyclability make it a preferred choice for mass-market vehicles, especially in regions with cost-sensitive consumers

Report Scope and Automotive Metals Market Segmentation

|

Attributes |

Automotive Metals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Metals Market Trends

Shift Toward Lightweight and High-Strength Alloys in Automotive Manufacturing

- The increasing focus on vehicle lightweighting to meet stringent emission standards and improve fuel efficiency is driving a shift toward the use of aluminum, magnesium, and advanced high-strength steel (AHSS) in automotive manufacturing. These metals significantly reduce vehicle mass without compromising crash safety or structural performance. As global fuel economy regulations tighten, lightweighting has become a critical design priority for both conventional and electric vehicles

- Rising adoption of electric vehicles (EVs) is accelerating demand for metals that offer high strength-to-weight ratios and superior corrosion resistance, essential for battery enclosures, chassis components, and structural reinforcements. By optimizing weight while ensuring safety, these metals help improve battery efficiency, extend driving range, and enhance overall performance. EV manufacturers are increasingly integrating advanced alloys to meet these technical requirements

- The affordability and recyclability of certain automotive metals, such as aluminum and steel, are making them attractive for mass production, enabling manufacturers to balance cost efficiency with sustainability goals. Recycled metals also reduce environmental impact and support circular economy initiatives. This cost-sustainability balance is becoming an important competitive advantage for automakers in global markets

- For instance, in 2023, several global automakers announced plans to increase aluminum content in next-generation EV platforms by over 25%, aiming to enhance driving range and reduce carbon footprint while improving crash performance. This shift reflects a broader industry trend toward material substitution and design optimization to meet evolving regulatory and consumer demands

- While the use of lightweight metals offers performance and efficiency gains, long-term market growth depends on advancements in alloy development, cost reduction in production processes, and supply chain stability to meet rising demand across global automotive hubs. Collaboration between automakers, material scientists, and suppliers will be essential to ensure scalable, affordable, and sustainable solutions

Automotive Metals Market Dynamics

Driver

Rising Demand for Fuel-Efficient and Electric Vehicles

- Growing Growing consumer preference for fuel-efficient and environmentally friendly vehicles is encouraging automakers to replace heavier conventional materials with lightweight metals. This material shift helps manufacturers meet stringent fuel economy standards while appealing to eco-conscious buyers. The trend also aligns with global sustainability goals, making lightweight metals a strategic choice for long-term competitiveness

- The rapid growth of EV production worldwide is boosting demand for high-performance metals that can withstand structural stresses while accommodating battery weight and thermal management requirements. Lightweight alloys play a key role in offsetting heavy battery packs, ensuring optimal driving range and performance. Automakers are increasingly investing in material innovation to enhance safety, durability, and energy efficiency in electric vehicle

- Governments across major automotive markets are implementing policies and incentives that encourage the use of eco-friendly materials, further accelerating the adoption of advanced alloys in vehicle production. These initiatives include tax benefits, emission-based vehicle regulations, and R&D grants for sustainable manufacturing. Compliance with such regulations not only avoids penalties but also enhances brand reputation among environmentally conscious consumers

- For instance, in 2024, the European Union tightened CO₂ emission targets for passenger vehicles, prompting manufacturers to increase the use of lightweight metals to comply with regulations and avoid penalties. This regulatory pressure has led to significant investments in material substitution and advanced manufacturing technologies. Companies are also partnering with metal producers to secure a steady supply of compliant, high-quality alloys

- While demand for fuel-efficient and electric vehicles drives material innovation, consistent metal availability, global trade stability, and cost competitiveness remain critical to sustaining adoption at scale. Manufacturers must balance environmental objectives with financial feasibility to maintain profitability. Strategic sourcing, recycling integration, and long-term supplier partnerships will be essential to support the continued growth of lightweight metal usage in the automotive industry

Restraint/Challenge

High Production Costs and Supply Chain Vulnerabilities

- The production of advanced lightweight alloys often involves complex processes and high energy requirements, leading to elevated manufacturing costs compared to conventional steel. This cost gap can make it challenging for automakers to integrate these materials in mass-market or entry-level models without affecting profit margins. In many cases, the additional costs are only justified in premium or performance vehicle segments, slowing overall adoption in the broader industry

- Dependence on specific mining regions for raw materials such as aluminum, magnesium, and specialty steels exposes the market to geopolitical risks, trade restrictions, and price volatility. Any political instability, export ban, or supply bottleneck in these regions can disrupt the availability of critical inputs, creating uncertainty for automotive producers. This dependency also forces manufacturers to maintain costly inventory buffers or seek alternative sources, which may not match quality standards

- Supply chain disruptions, including fluctuations in raw material availability and shipping delays, can hinder timely production and delivery of automotive components, affecting overall industry output. Such delays can cause production line stoppages, missed delivery deadlines, and increased operational costs for automakers. The global nature of the automotive metals supply chain makes it highly sensitive to port congestion, freight rate spikes, and transportation bottlenecks

- For instance, in 2023, global aluminum prices surged due to supply restrictions in key producing countries, impacting automotive manufacturers’ cost structures and delaying production schedules. This price spike forced several automakers to adjust sourcing strategies, reduce production volumes, or temporarily halt specific vehicle lines. The ripple effect was felt across OEMs and tier-1 suppliers, intensifying pressure on already stretched profit margins

- While technological advancements are gradually reducing production costs, developing diversified sourcing strategies and investing in recycling infrastructure are essential to overcome these challenges and ensure steady market growth. Expanding the use of secondary (recycled) metals can lower dependence on volatile primary sources while supporting sustainability goals. Long-term investments in closed-loop supply chains and localized metal processing facilities can also enhance market resilience

Automotive Metals Market Scope

The market is segmented on the basis of type, product, end user, vehicle type, and application.

- By Type

On the basis of type, the automotive metals market is segmented into mild steel, alloy steel, high strength steel, and advanced high strength steel (AHSS). The mild steel segment dominated the market with the largest revenue share in 2024, driven by its cost-effectiveness, ease of manufacturing, and widespread use in structural automotive components. Its durability and high recyclability make it a preferred choice for mass-market vehicles, especially in regions with cost-sensitive consumers.

The advanced high strength steel (AHSS) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for lightweight yet strong materials to meet stringent emission norms and safety standards. AHSS offers superior crash performance and enables automakers to reduce vehicle weight without compromising structural integrity, making it a critical material in next-generation vehicle design.

- By Product

On the basis of product, the automotive metals market is segmented into aluminum, steel, magnesium, and others. The steel segment held the largest market revenue share in 2024 due to its dominant role in body-in-white manufacturing and its ability to balance cost, strength, and ease of fabrication. Its established global supply chain further supports its continued leadership in the market.

The aluminum segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight properties, corrosion resistance, and recyclability. Increasing adoption of aluminum in electric vehicles (EVs) for battery enclosures, chassis, and body panels is further boosting demand, as manufacturers aim to improve range and efficiency.

- By End User

On the basis of end user, the market is segmented into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). The passenger cars segment accounted for the largest revenue share in 2024, supported by high production volumes, rising consumer demand for fuel efficiency, and ongoing material innovations in mass-market and premium vehicle segments.

The light commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the surge in e-commerce and urban logistics, which is prompting manufacturers to adopt lightweight metals to enhance payload capacity and fuel efficiency.

- By Vehicle Type

On the basis of vehicle type, the automotive metals market is segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. Passenger vehicles led the market in 2024 due to their dominant share in global vehicle production and increasing incorporation of advanced alloys to meet safety and efficiency targets.

The heavy commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, with manufacturers increasingly adopting stronger and lighter metals to improve load capacity, durability, and operational cost efficiency.

- By Application

On the basis of application, the market is segmented into body structure, power train, suspension, and others. The body structure segment dominated the market in 2024, as structural components account for the largest share of metal usage in vehicles, with manufacturers prioritizing lightweight materials to enhance fuel economy and comply with regulatory requirements.

The suspension segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of high-strength metals that enhance ride comfort, stability, and durability in both passenger and commercial vehicles.

Automotive Metals Market Regional Analysis

• Asia-Pacific dominated the automotive metals market with the largest revenue share of 47.5% in 2024, driven by robust automotive production in countries such as China, Japan, India, and South Korea, alongside increasing adoption of lightweight metals to meet stringent emission standards and improve fuel efficiency

• The region benefits from a strong manufacturing base, cost-effective labor, and easy access to raw materials, enabling large-scale production and export of automotive components. Rapid urbanization, rising disposable incomes, and growing demand for passenger and commercial vehicles are further accelerating market expansion

• Government policies promoting electric vehicle (EV) adoption and sustainable manufacturing are also boosting the consumption of advanced high-strength steel (AHSS), aluminum, and magnesium alloys in the region’s automotive sector

China Automotive Metals Market Insight

The China automotive metals market captured the largest revenue share of 56% in 2024 within Asia-Pacific, driven by its position as the world’s largest automotive producer and consumer. The country’s rapid EV production growth, coupled with government incentives for lightweight materials, is fostering demand for advanced alloys and high-strength steels. A strong domestic supply chain, combined with technological advancements in metallurgy, supports large-scale adoption. In addition, China’s ongoing investment in smart manufacturing and recycling infrastructure is helping meet both domestic and export demands for automotive metals.

Japan Automotive Metals Market Insight

The Japan automotive metals market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s advanced automotive manufacturing capabilities, focus on innovation, and strong presence of leading automakers. The adoption of lightweight metals such as aluminum and AHSS is increasing to enhance fuel efficiency, meet stringent environmental regulations, and support the country’s growing EV sector. Japan’s emphasis on precision engineering and integration of sustainable materials is fostering demand for high-quality automotive metals, with exports playing a key role in market growth.

Europe Automotive Metals Market Insight

The Europe automotive metals market is expected to witness the fastest growth rate from 2025 to 2032, fueled by strict EU emission regulations and a strong push toward lightweighting to improve fuel efficiency and reduce CO₂ emissions. The presence of premium automakers, extensive R&D in alloy development, and high adoption of electric and hybrid vehicles are supporting market growth. European manufacturers are increasingly utilizing AHSS, aluminum, and magnesium in both passenger and commercial vehicle production, with a focus on sustainability and circular economy principles.

Germany Automotive Metals Market Insight

The Germany automotive metals market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country’s leadership in automotive engineering and innovation. The demand for high-strength, lightweight metals is rising to meet the needs of luxury, performance, and electric vehicle segments. Strong industrial infrastructure, coupled with advanced metallurgical research and government support for green mobility, continues to position Germany as a key consumer and exporter of automotive metals in Europe.

U.K. Automotive Metals Market Insight

The U.K. automotive metals market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s expanding electric vehicle production and its commitment to achieving net-zero emissions by 2050. Lightweight metals, including aluminum and magnesium alloys, are being increasingly used to improve vehicle efficiency and performance. The presence of specialized manufacturing facilities, combined with R&D initiatives in next-generation alloys, is supporting the market, while trade partnerships and the adoption of sustainable manufacturing practices continue to enhance the U.K.’s position in the global automotive metals industry.

North America Automotive Metals Market Insight

The North America automotive metals market is expected to witness the fastest growth rate from 2025 to 2032, supported by high vehicle ownership rates, technological innovation, and increasing EV manufacturing investments, particularly in the U.S. and Canada. The region’s automakers are actively shifting toward lightweight alloys and AHSS to comply with federal fuel economy standards and improve vehicle performance. A mature aftermarket sector, combined with expanding infrastructure for EV production, is also driving demand for advanced automotive metals.

U.S. Automotive Metals Market Insight

The U.S. automotive metals market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s strong automotive production base, growing consumer preference for fuel-efficient vehicles, and rapid EV adoption. Federal and state-level policies encouraging sustainable mobility, alongside significant investments in domestic metal processing facilities, are boosting the use of aluminum, AHSS, and magnesium alloys. The presence of major automakers and Tier 1 suppliers further supports steady market demand.

Automotive Metals Market Share

The automotive metals industry is primarily led by well-established companies, including:

- Alcoa Corporation (U.S.)

- ATI (U.S.)

- ArcelorMittal (Luxembourg)

- ChinaSteel (Taiwan)

- Essar (India)

- HYUNDAI STEEL (Sout Korea)

- Kaiser Aluminum (U.S.)

- Nippon Steel Corporation (Japan)

- Novelis (U.S.)

- POSCO (South Korea)

- Tata Steel (India)

- thyssenkrupp AG (Germany)

- United States Steel Corporation (U.S.)

- voestalpine AG. (Austria)

Latest Developments in Global Automotive Metals Market

- In July 2023, ArcelorMittal announced a USD 5 million investment in CHAR Technologies through its inaugural XCarb Accelerator Program, under the XCarb Innovation Fund. This initiative seeks out top companies and breakthrough technologies capable of accelerating the decarbonization of the steel industry. The investment is expected to support the development and commercialization of sustainable steelmaking solutions, reducing carbon emissions and enhancing environmental performance, thereby driving innovation and competitiveness in the global automotive metals market

- In September 2022, Magna introduced its latest innovation, rear thermoplastic swing doors, debuting with the all-electric Volkswagen ID series. This development aims to improve vehicle accessibility while aligning with the automotive industry’s shift toward lightweight materials and electric mobility. The use of thermoplastic components not only reduces vehicle weight but also enhances design flexibility and durability, contributing to improved efficiency, sustainability, and performance in the automotive metals market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.