Global Automotive Natural Gas Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

34.10 Billion

USD

41.87 Billion

2024

2032

USD

34.10 Billion

USD

41.87 Billion

2024

2032

| 2025 –2032 | |

| USD 34.10 Billion | |

| USD 41.87 Billion | |

|

|

|

|

Automotive Natural Gas Vehicle Market Size

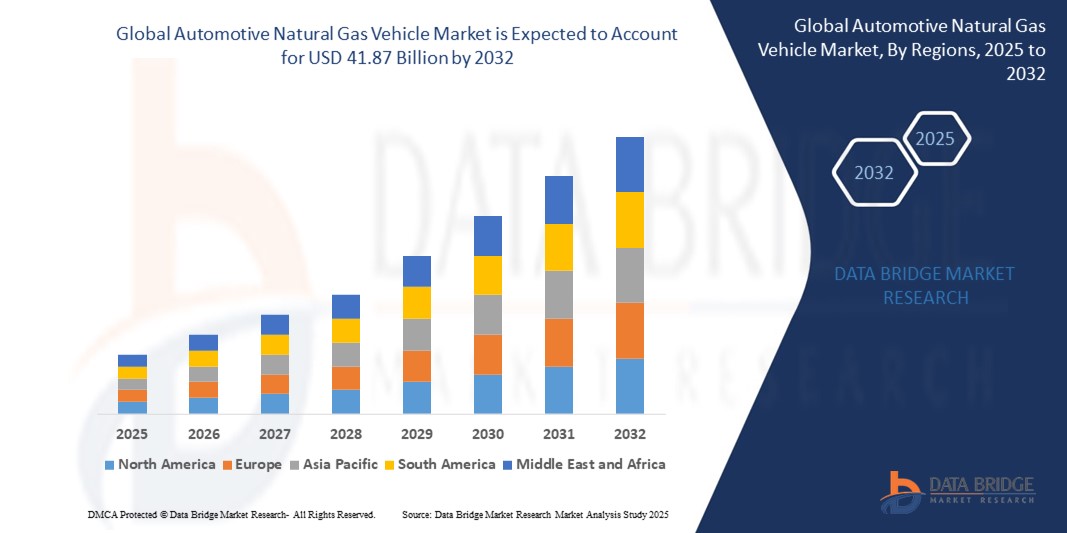

- The global Automotive Natural Gas Vehicle market size was valued at USD 34.1 billion in 2024 and is expected to reach USD 41.87 billion by 2032, at a CAGR of 2.6% during the forecast period

- The market growth is largely fuelled by the growing as more people and companies look for cleaner and more affordable transportation options. Natural gas vehicles produce fewer emissions than traditional gas or diesel cars, making them better for the environment

- Furthermore, Governments are supporting this shift by offering tax breaks and investing in natural gas fuelling stations. The cost of natural gas is also generally lower, helping drivers save money in the long run. Advances in technology are making NGVs more efficient and reliable. Together, these factors are encouraging more drivers to choose natural gas vehicles

Automotive Natural Gas Vehicle Market Analysis

- From the name itself, it is clear that automotive natural gas vehicles are those vehicles that run on natural gas. The automotive natural gas vehicles use natural liquefied gas or compressed natural gas as a substitute to petrol, diesel or any other fuel. The automotive natural gas vehicles don’t generate environmental pollution and are cheaper in cost.

- The power in automotive natural gas vehicles is generated by the combustion of methane and oxygen into water and carbon dioxide. The automotive natural gas vehicles offer high mileage and centrally fuelled fleets offers similar fuel range for long routes. Further, the automotive natural gas vehicles offer reduced transportation costs and better fuel economy.

- Asia-Pacific dominates the Automotive Natural Gas Vehicle market with the largest revenue share of 45.2% in 2025, characterized by rising demand for passenger vehicles owing to rising personal disposable income. On-going development of natural gas infrastructure is also driving the market growth rate

- North America is expected to be the fastest growing region in the Automotive Natural Gas Vehicle market during the forecast period due to because of the growing automobile production and stringent regulations on carbon emissions

- Compressed Natural Gas segment is expected to dominate the Automotive Natural Gas Vehicle market with a market share of 49.5% in 2025, driven by its Rising awareness about the environmental impact of petrol and diesel vehicles emissions coupled

Report Scope and Automotive Natural Gas Vehicle Market Segmentation

|

Attributes |

Automotive Natural Gas Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Natural Gas Vehicle Market Trends

“Integration of Renewable Natural Gas (RNG) in NGVs”

- A growing trend in the natural gas vehicle (NGV) market is the use of Renewable Natural Gas (RNG), which is a cleaner and more eco-friendly version of traditional natural gas. RNG is made from organic waste like food scraps, farm waste, and even sewage, turning everyday trash into usable fuel. Because it's made from renewable sources, it's considered carbon-neutral, meaning it doesn't add extra carbon to the atmosphere. This makes RNG a great option for reducing harmful emissions from vehicles, especially in cities with air pollution problems.

- Many companies and governments are supporting this shift to RNG as part of their climate goals. It helps reduce reliance on fossil fuels and promotes a circular economy by reusing waste.

- For businesses, it also offers a greener image and may qualify for tax benefits or government incentives. As refueling stations for RNG expand, more vehicle fleets are making the switch. It's especially popular among transit and delivery vehicles that operate daily. Overall, RNG is helping reshape the NGV market into a cleaner and more sustainable transportation solution.

- For Instance, In March 2025, Clean Energy Fuels Corp. announced the launch of a new RNG fueling station in California, aimed at supporting the growing fleet of NGVs in the region. The station is designed to provide high-quality RNG to commercial fleets, including waste management and transit companies, facilitating a transition to low-emission transportation. This initiative is part of Clean Energy's broader strategy to expand RNG infrastructure across North America, aligning with California's stringent emission reduction targets.

Automotive Natural Gas Vehicle Market Dynamics

Driver

“Technological Advancements in NGV Efficiency”

- Technology is making natural gas vehicles (NGVs) better and more efficient than ever before. New engine designs help these vehicles run smoother and use fuel more wisely, which means they waste less gas. Improvements in how fuel is stored make NGVs safer and allow them to travel longer distances without refueling.

- Advanced emission control systems also reduce harmful pollution, helping NGVs meet tougher environmental rules. Because of these upgrades, NGVs are becoming just as reliable and powerful as regular gasoline or diesel vehicles. This means businesses and drivers can save money on fuel and maintenance over time. As a result, more companies are choosing NGVs for their fleets, especially in delivery and public transport.

- These technological leaps make NGVs a smart choice for cleaner, cost-effective transportation. They are helping push the whole industry toward greener solutions. Overall, technology is key to making natural gas vehicles more popular worldwide.

- For Instance, In March 2025, Tata Motors launched a new line of CNG-powered trucks equipped with advanced engine technologies aimed at reducing emissions and improving fuel efficiency. The trucks feature enhanced fuel injection systems and optimized combustion processes, resulting in lower greenhouse gas emissions and improved mileage. This move aligns with India's commitment to reducing vehicular pollution and supports the growing demand for cleaner transportation solutions.

Restraint/Challenge

“Competition from Electric Vehicles (EVs)”

- The rapid growth and adoption of electric vehicles present a significant challenge to the natural gas vehicle market. Governments worldwide are implementing policies and incentives to promote EVs, such as tax rebates, subsidies, and stricter emissions regulations for internal combustion engine vehicles. These measures make EVs more appealing to consumers and fleet operators.

- Furthermore, advancements in battery technology have led to improvements in EV range, charging speed, and overall performance, narrowing the gap between EVs and traditional vehicles. As EV infrastructure continues to expand and battery costs decrease, EVs are becoming more accessible and practical, diverting attention and investment away from NGVs.

- This shift in focus poses a challenge for the NGV market, which must find ways to differentiate itself and demonstrate its unique benefits to remain competitive.

- For Instance, In May 2025 to block California's regulation that would have banned the sale of new gas-powered vehicles by 2035. This decision reflects the ongoing debate and resistance to transitioning away from traditional internal combustion engine vehicles. While this move may provide temporary relief for the NGV market, it also underscores the challenges faced by alternative fuel vehicles in competing with the growing popularity and support for electric vehicles. The NGV sector must navigate these competitive dynamics and find strategies to coexist with and complement the rise of EVs in the automotive industry.

Automotive Natural Gas Vehicle Market Scope

The market is segmented on the basis fuel type, vehicle type and distribution channel.

- By Fuel Type

Automotive natural gas vehicle market, on the basis of fuel type has been segmented into compressed natural gas and liquefied natural gas. Compressed Natural Gas segment is expected to dominate the Automotive Natural Gas Vehicle market with a market share of 49.5% in 2025, driven by its Rising awareness about the environmental impact of petrol and diesel vehicles emissions coupled

The liquefied natural gas segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, fueled by higher energy density, making it ideal for long-haul and heavy-duty transport. Rising infrastructure investments and lower emissions further drive its increasing adoption.

- By Vehicle Type

Based on vehicle type, the automotive natural gas vehicle market has been segmented into passenger, commercial, light-duty and heavy-duty buses and trucks, three-wheelers, motorcycles and others. The passenger held the largest market revenue share in 2025 of, driven by the rising demand for cost-effective, low-emission commuting options among urban consumers. Increased government support for cleaner mobility solutions also played a key role in boosting adoption.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its rising adoption of natural gas trucks and buses in logistics and public transport. Cost savings and stricter emission norms are pushing fleet operators toward cleaner alternatives.

- By Distribution Channel

On the basis of distribution channel, the automotive natural gas vehicle market is segmented into OEM and aftermarket. The OEM held the largest market revenue share in 2025, driven by the increasing factory-fitted natural gas vehicle offerings from major automakers. This trend reflects growing consumer preference for ready-to-use, eco-friendly transport solutions.

The aftermarket segment held a significant market share in 2025, favored for its cost-effective vehicle conversion solutions and accessibility in regions lacking OEM options. It also supports older vehicles transitioning to cleaner fuel alternatives.

Automotive Natural Gas Vehicle Market Regional Analysis

- Asia-Pacific dominates the Automotive Natural Gas Vehicle market with the largest revenue share of 45.2% in 2025, characterized by rising demand for passenger vehicles owing to rising personal disposable income. On-going development of natural gas infrastructure is also driving the market growth rate

- strong government support and vast natural gas reserves. Countries like China and India are actively promoting CNG and LNG vehicles to reduce air pollution and cut fuel imports. Growing urban populations and rising fuel costs have pushed demand for cleaner, more affordable transport options.

- The region is also investing heavily in natural gas infrastructure, including refueling stations and conversion centers. Local automakers are introducing a variety of NGVs to meet diverse consumer and commercial needs. This combination of policy, demand, and infrastructure is solidifying Asia-Pacific’s dominance in the market.

India Automotive Natural Gas Vehicle Market Insight

The India Automotive Natural Gas Vehicle market is gaining momentum due to the rising fuel prices and the need for cleaner transportation. With government support and a growing number of CNG stations, more people are turning to natural gas vehicles as a cost-effective and eco-friendly choice. Automakers are also stepping up by offering a wider range of CNG models to meet this growing demand.

China Automotive Natural Gas Vehicle Market Insight

The China Automotive Natural Gas Vehicle market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the strong government policies aimed at cutting emissions and reducing oil dependence. The country’s massive investments in natural gas infrastructure, especially in urban areas, made NGVs more accessible. Domestic automakers also played a big role by launching a variety of affordable and efficient NGV models.

North America Automotive Natural Gas Vehicle Market Insight

The North America Automotive Natural Gas Vehicle market is poised to grow at the fastest CAGR of over 21% in 2025, driven by increasing environmental regulations and a push for cleaner fuel alternatives. Growing investments in LNG and CNG infrastructure are making natural gas vehicles more practical for both commercial and passenger use. Additionally, fleet operators are adopting NGVs to reduce fuel costs and lower emissions.

U.S. Automotive Natural Gas Vehicle Market Insight

The U.S. Automotive Natural Gas Vehicle market captured the largest revenue share of 53% within North America in 2025, fueled by the strong government incentives and growing demand for cleaner transportation. Expanding CNG and LNG fueling networks made natural gas vehicles more convenient for users. Additionally, commercial fleets embraced NGVs to save on fuel costs and meet stricter emission standards.

Europe Automotive Natural Gas Vehicle Market Insight

The European Automotive Natural Gas Vehicle market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict environmental regulations pushing for lower emissions. Governments are supporting cleaner fuel adoption through incentives and infrastructure development. Growing awareness of sustainability is encouraging both consumers and businesses to choose natural gas vehicles.

U.K. Automotive Natural Gas Vehicle Market Insight

The U.K. Automotive Natural Gas Vehicle market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the government incentives and a shift towards cleaner transportation. The U.K. accounted for 5.8% of the European NGV market share in 2024, reflecting its commitment to sustainable mobility. Policies such as tax exemptions for NGVs and funding for refueling infrastructure support this transition. Additionally, fleet operators benefit from discounts and special leasing terms, making NGVs more attractive. The U.K.'s regulatory environment positions natural gas as a transitional fuel, aiding businesses and individuals in replacing traditional fuels with cleaner options.

Germany Automotive Natural Gas Vehicle Market Insight

The German Automotive Natural Gas Vehicle market is expected to expand at a considerable CAGR during the forecast period, fueled by strong government support and incentives encouraging cleaner transportation. Expanding CNG and LNG refueling infrastructure is making natural gas vehicles more accessible. Additionally, many companies are switching their fleets to natural gas to reduce emissions and fuel costs.

Automotive Natural Gas Vehicle Market Share

The Automotive Natural Gas Vehicle industry is primarily led by well-established companies, including:

- TOYOTA MOTOR CORPORATION.,

- Hexagon Agility,

- General Motors,

- Volkswagen,

- Caterpillar.,

- ISUZU MOTORS LIMITED,

- Westport Fuel Systems Inc.,

- Landi Renzo S.p.a.,

- Daimler AG.,

- Quantum Fuel Systems LLC.,

- Navistar, Inc.,

- PACCAR Inc.,

- Cummins Inc.,,

- Clean Energy Fuels.,

- CNH Industrial N.V.,

- Foton Motor Inc.,

- AB Volvo,

- Suzuki Motor Corporation,

- Honda Motorcycle & Scooter India Pvt. Ltd.

- HYUNDAI MOTOR GROUP

Latest Developments in Global Automotive Natural Gas Vehicle Market

-

In April 2025, Toyota unveiled a prototype of its hydrogen combustion engine, aiming to demonstrate the viability of hydrogen as a carbon-neutral fuel for internal combustion engines. This initiative aligns with Toyota's strategy to diversify its approach to achieving carbon neutrality, complementing its electric vehicle offerings. The engine is designed to operate on synthetic fuels, including hydrogen, and is being tested in various vehicle models to assess performance and emissions. Toyota's commitment to this technology reflects its belief in the continued relevance of internal combustion engines in a sustainable future.

- In June 2025, Honda introduced a hydrogen-powered motorcycle, marking a significant step in its commitment to sustainable transportation. The motorcycle features a compact hydrogen fuel cell system, offering an alternative to traditional internal combustion engines. Honda plans to distribute the motorcycle in select markets, focusing on regions with the necessary hydrogen refueling infrastructure. The launch demonstrates Honda's dedication to expanding its portfolio of environmentally friendly vehicles. The company aims to increase production capacity in the coming years to meet anticipated demand

- In May 2025, Toyota launched a hydrogen-powered pickup truck as part of its efforts to promote sustainable transportation solutions. This vehicle utilizes the company's hydrogen combustion engine technology, offering a practical application of the new powertrain. The pickup truck is designed for both urban and rural environments, providing a zero-emission alternative to traditional gasoline-powered models. Toyota plans to distribute this model in select markets, with an initial focus on regions with established hydrogen refueling infrastructure. The launch underscores Toyota's commitment to advancing hydrogen technology in the automotive sector.

- In October 2024, Hexagon Agility received orders valued at USD 4.3 million for renewable natural gas (RNG) fuel system installations in Class 8 trucks powered by Cummins' X15N natural gas engine. These systems are designed to support the growing adoption of RNG in heavy-duty transportation, offering a sustainable alternative to diesel. Hexagon Agility is expanding its production capacity to meet the increasing demand for RNG fuel systems, with plans to ramp up operations in the second half of 2025. The company's efforts align with the industry's shift towards cleaner fuels and emissions reduction. Hexagon Agility's advancements in RNG technology contribute to the broader adoption of sustainable transportation solutions

- In January 2025, Hexagon Agility launched a new line of advanced RNG fuel storage solutions for heavy-duty trucks. These storage systems are designed to enhance the efficiency and safety of RNG-powered vehicles, supporting the transition to cleaner fuels in the commercial transportation sector. The launch includes a range of products tailored to meet the specific needs of various truck models and operational requirements. Hexagon Agility's new fuel storage solutions are expected to play a crucial role in the widespread adoption of RNG in the industry. The company plans to showcase these products at upcoming industry events and through partnerships with OEMs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.