Global Automotive Night Vision Systems Market

Market Size in USD Billion

CAGR :

%

USD

4.63 Billion

USD

11.08 Billion

2024

2032

USD

4.63 Billion

USD

11.08 Billion

2024

2032

| 2025 –2032 | |

| USD 4.63 Billion | |

| USD 11.08 Billion | |

|

|

|

|

Automotive Night Vision Systems Market Size

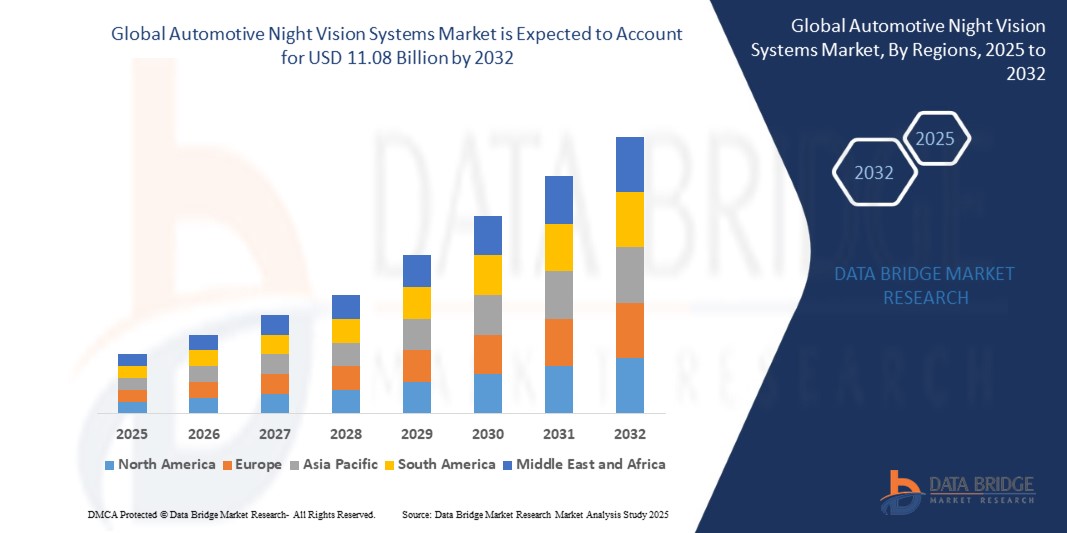

- The global automotive night vision systems market size was valued at USD 4.63 billion in 2024 and is expected to reach USD 11.08 billion by 2032, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by the increasing integration of advanced driver assistance systems (ADAS) and rising emphasis on road safety, particularly during low-visibility conditions such as nighttime or inclement weather

- Furthermore, advancements in thermal imaging and infrared sensor technologies are enabling automakers to incorporate night vision systems into a broader range of vehicles, including luxury, electric, and autonomous models. These converging factors are accelerating the deployment of night vision systems, thereby significantly boosting the industry's growth

Automotive Night Vision Systems Market Analysis

- Automotive night vision systems enhance driver visibility during nighttime or poor weather conditions by detecting pedestrians, animals, and objects beyond the range of standard headlights using thermal or infrared imaging

- The market demand is being driven by growing safety concerns, tightening vehicle safety regulations, and increased adoption of premium and autonomous vehicles. As consumers prioritize advanced safety features, night vision systems are emerging as a critical component of modern driver assistance technologies

- North America dominated the automotive night vision systems market with a share of 34.36% in 2024, due to the rising adoption of advanced driver assistance systems (ADAS) and increasing consumer demand for enhanced nighttime safety

- Asia-Pacific is expected to be the fastest growing region in the automotive night vision systems market during the forecast period due to rapid urbanization, rising disposable incomes, and growing demand for technologically advanced and safer vehicles

- Far Infrared (FIR) segment dominated the market with a market share of 60.95% in 2024, due to its superior performance in detecting thermal radiation and identifying pedestrians, animals, and other heat-emitting objects in complete darkness or poor weather conditions. FIR technology is widely favored for enhancing driver visibility beyond the range of headlights, improving nighttime safety, especially in luxury vehicles. Its ability to function without requiring external illumination makes it reliable for diverse driving environments

Report Scope and Automotive Night Vision Systems Market Segmentation

|

Attributes |

Automotive Night Vision Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Night Vision Systems Market Trends

Increasing Development of Smart Cities and Infrastructure

- The automotive night vision systems market is growing in tandem with the global push for smart city initiatives and intelligent transportation systems that prioritize safer and more efficient traffic management

- For instance, companies such as Bosch and Continental are developing night vision technologies integrated with smart city infrastructure, enabling vehicles to communicate with street lighting, traffic signals, and pedestrian monitoring systems to enhance night-time visibility and road safety

- The advancement of sensor fusion technologies, combining infrared cameras with other ADAS (Advanced Driver-Assistance Systems) sensors, facilitates improved detection of pedestrians, animals, and obstacles beyond vehicle headlights in urban environments

- Growing investments in smart roads, connected vehicle networks, and V2X (vehicle-to-everything) communications support the deployment and utility of night vision systems as part of comprehensive infrastructure modernization

- Increasing urbanization and expansion of road networks in emerging markets also drive demand for automotive safety features aligned with intelligent infrastructure development

- Continuous government and private sector initiatives to improve nighttime driving safety through infrastructure enhancements and vehicle technology integration are accelerating market adoption of night vision systems

Automotive Night Vision Systems Market Dynamics

Driver

Growing Focus on Road Safety

- Heightened global focus on road safety, driven by regulatory mandates, rising nighttime accident rates, and consumer demand, is a key growth driver for automotive night vision systems

- For instance, automakers such as Denso and Valeo incorporate advanced night vision solutions in premium and mid-range vehicles to address challenges of low visibility and pedestrian detection during night driving, thereby enhancing driver awareness and reducing accidents

- Increasing legislative requirements for ADAS technologies including night vision in several countries boost adoption rates, especially in safety-conscious markets such as Europe and North America

- Rising vehicle production of SUVs and luxury vehicles, which traditionally feature more advanced safety systems, also contributes to growing penetration of night vision technology. Public awareness campaigns and insurance incentives promoting vehicles equipped with enhanced night-time safety features further encourage market growth

- The push toward autonomous and semi-autonomous vehicles increases reliance on sophisticated sensor suites, including night vision, to operate safely in low-light and complex driving conditions

Restraint/Challenge

High Cost of Night Vision Systems

- One of the main barriers limiting widespread adoption of automotive night vision systems is their relatively high cost of development, production, and integration into vehicles, which impacts consumer affordability

- For instance, premium system providers such as Bosch and FLIR Systems face challenges in reducing costs sufficiently for mid-range and economy vehicle segments, restricting current use mostly to luxury and high-end models

- The cost intensity arises from expensive infrared sensors, high-resolution cameras, and complex processing units necessary to deliver accurate and reliable night vision imaging

- Additional expenses for integration with other vehicle systems and ensuring compliance with automotive standards further increase total installation costs. Price-sensitive markets and regions with lower vehicle affordability exhibit slower adoption due to upfront costs, despite the safety benefits

- Although technological advancements and higher production volumes are gradually pushing prices down, current costs remain a restraint for mass-market penetration

Automotive Night Vision Systems Market Scope

The market is segmented on the basis of technology, display, component, vehicle type, and system type.

• By Technology

On the basis of technology, the automotive night vision systems market is segmented into Far Infrared (FIR) and Near Infrared (NIR). The Far Infrared (FIR) segment accounted for the largest market revenue share of 60.95% in 2024, primarily due to its superior performance in detecting thermal radiation and identifying pedestrians, animals, and other heat-emitting objects in complete darkness or poor weather conditions. FIR technology is widely favored for enhancing driver visibility beyond the range of headlights, improving nighttime safety, especially in luxury vehicles. Its ability to function without requiring external illumination makes it reliable for diverse driving environments.

The NIR segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and ability to provide sharper image quality under low-light conditions. NIR-based systems use active illumination and reflectivity-based imaging, allowing for better object recognition, particularly in urban settings. The increasing integration of NIR systems in mid-range vehicles and the growing push for advanced driver assistance systems (ADAS) are accelerating its adoption.

• By Display

On the basis of display, the market is segmented into Navigation System, Instrument Cluster, and Head-Up Display (HUD). The Navigation System segment held the largest market share in 2024, owing to its established presence in vehicles and ability to centralize information for the driver. Night vision data integrated into the navigation interface allows for intuitive visual representation of hazards, enhancing situational awareness without overwhelming the driver.

The HUD segment is anticipated to experience the highest growth from 2025 to 2032, attributed to its capability to project critical information directly onto the windshield. This minimizes driver distraction and improves reaction time during nighttime driving. The increasing adoption of HUDs in premium and electric vehicles, driven by the focus on immersive and safe driving experiences, is propelling the demand for HUD-based night vision system displays.

• By Component

On the basis of component, the market is categorized into Night Vision Camera, Controlling Unit, Display Unit, Sensor, and Other Components. The Night Vision Camera segment dominated the largest revenue share in 2024, as it forms the core component enabling the system to capture thermal or infrared images. Advances in imaging sensors and rising demand for real-time threat detection have further strengthened the market for high-resolution, automotive-grade night vision cameras.

The Sensor segment is projected to record the fastest CAGR from 2025 to 2032, driven by innovations in infrared and thermal sensing technologies. These sensors enhance detection accuracy in complex driving conditions, ensuring early identification of road hazards. As automotive OEMs focus on improving autonomous and semi-autonomous functionalities, the role of advanced sensors in night vision systems continues to grow rapidly.

• By Vehicle Type

On the basis of vehicle type, the market is bifurcated into Passenger Cars and Commercial Vehicles. The Passenger Cars segment held the dominant market share in 2024, fueled by rising consumer awareness of safety technologies and growing incorporation of ADAS features in premium and mid-range cars. Increasing concerns over night-time collisions and pedestrian safety have prompted automakers to integrate NVS into high-end passenger vehicles.

The Commercial Vehicle segment is expected to grow at the fastest pace from 2025 to 2032, supported by heightened emphasis on driver safety, especially during long-haul nighttime travel. Fleet operators are increasingly adopting night vision systems to reduce accident rates and ensure compliance with safety regulations. The shift toward advanced safety features in commercial transportation is driving system installation in buses, trucks, and utility vehicles.

• By System Type

On the basis of system type, the market is segmented into Passive NVS and Active NVS. The Passive NVS segment captured the largest revenue share in 2024, as it utilizes thermal imaging to detect heat signatures without emitting any infrared light. This makes it more suitable for unobtrusive surveillance and reliable detection in total darkness, favored by premium vehicle manufacturers for its effectiveness and discreet performance.

The Active NVS segment is projected to register the highest growth during the forecast period, due to its ability to deliver higher image clarity by using infrared light sources. Active systems are gaining popularity for their enhanced object recognition capabilities and adaptability in varying lighting conditions. The rising integration of such systems in smart mobility solutions and increasing investment in advanced ADAS functionalities are accelerating the growth of active NVS.

Automotive Night Vision Systems Market Regional Analysis

- North America dominated the automotive night vision systems market with the largest revenue share of 34.36% in 2024, driven by the rising adoption of advanced driver assistance systems (ADAS) and increasing consumer demand for enhanced nighttime safety

- The region benefits from strong automotive innovation, high consumer awareness of safety technologies, and regulatory support for accident reduction technologies

- Luxury and premium vehicle manufacturers in the U.S. and Canada are increasingly integrating night vision systems, particularly in models aimed at safety-conscious consumers

U.S. Automotive Night Vision Systems Market Insight

The U.S. automotive night vision systems market captured the largest revenue share in 2024 within North America, fueled by strong demand for high-end driver safety technologies and the increasing adoption of autonomous and semi-autonomous vehicles. Major automakers are integrating thermal imaging and infrared night vision cameras into premium models to improve driver response times and reduce nighttime collisions. Rising concerns over road safety, coupled with growing investment in connected vehicle ecosystems, are further accelerating market growth across both passenger and commercial vehicle segments.

Europe Automotive Night Vision Systems Market Insight

The Europe automotive night vision systems market is projected to grow at a substantial CAGR during the forecast period, primarily driven by stringent safety regulations and growing consumer preference for high-performance, safety-oriented vehicles. Increasing urbanization, a rising number of nighttime road accidents, and the European New Car Assessment Programme (Euro NCAP) standards are prompting OEMs to adopt night vision systems across more models. The integration of ADAS features into electric and hybrid vehicles is also driving adoption across key European economies.

U.K. Automotive Night Vision Systems Market Insight

The U.K. automotive night vision systems market is expected to grow at a noteworthy CAGR during the forecast period, supported by the country’s emphasis on road safety and growing interest in connected vehicle technologies. Consumer demand for smart, convenience-oriented features in vehicles is encouraging automakers to deploy infrared night vision as part of broader safety packages. The trend toward electrification and increasing integration of smart mobility solutions across urban centers are also bolstering market expansion.

Germany Automotive Night Vision Systems Market Insight

The Germany automotive night vision systems market is projected to expand at a considerable CAGR during the forecast period, driven by the country’s strong automotive manufacturing base and continuous focus on innovation. Leading German luxury automakers are incorporating night vision technologies into their flagship models, targeting tech-savvy and safety-conscious consumers. Increasing investment in vehicle automation and emphasis on pedestrian safety are major factors supporting the widespread integration of FIR and NIR systems across both domestic and export vehicles.

Asia-Pacific Automotive Night Vision Systems Market Insight

The Asia-Pacific automotive night vision systems market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapid urbanization, rising disposable incomes, and growing demand for technologically advanced and safer vehicles. Countries in the region are actively supporting smart mobility and infrastructure development, leading to increased adoption of ADAS technologies, including night vision systems. Expanding automotive production capacity and the availability of cost-effective sensors and cameras are also making these solutions more accessible across mid-range vehicles.

Japan Automotive Night Vision Systems Market Insight

The Japan automotive night vision systems market is gaining momentum due to the country’s advanced automotive ecosystem, strong focus on innovation, and growing interest in smart and safe driving technologies. The increasing prevalence of connected vehicles, rising urban density, and aging population are driving demand for night vision systems that enhance nighttime visibility and overall driving assistance. Integration with other smart features such as collision avoidance and driver monitoring is further supporting market expansion.

China Automotive Night Vision Systems Market Insight

The China automotive night vision systems market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increasing consumer awareness, and the nation’s push toward smart and autonomous vehicle adoption. The Chinese automotive market is highly receptive to in-vehicle technology upgrades, particularly in the electric vehicle segment. Strong government support, local innovation in sensor technology, and the presence of major domestic OEMs are driving extensive deployment of night vision systems across a broad spectrum of vehicle types.

Automotive Night Vision Systems Market Share

The automotive night vision systems industry is primarily led by well-established companies, including:

- AISIN CORPORATION (Japan)

- Valeo (France)

- Veoneer US Safety Systems, LLC. (Sweden)

- OMRON Corporation (Japan)

- Magna International Inc. (Canada)

- DENSO CORPORATION (Japan)

- ZF Friedrichshafen AG (Germany)

- Aptiv (Ireland)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Autoliv Inc. (Sweden)

- Visteon Corporation (U.S.)

Latest Developments in Global Automotive Night Vision Systems Market

- In January 2024, Valeo partnered with Teledyne FLIR to introduce Automotive Safety Integrity Level (ASIL) B-rated thermal imaging technology into night vision systems for ADAS. This collaboration is expected to significantly enhance road safety by improving the detection of pedestrians, animals, and other obstacles in low-visibility conditions. By integrating thermal imaging into Valeo’s sensor suite and ADAS software stack, the partnership aims to bolster the performance of automatic emergency braking (AEB) systems during nighttime driving. This development strengthens Valeo’s position in the ADAS market and is anticipated to accelerate the adoption of night vision technologies across both commercial and passenger vehicle segments, including autonomous vehicles

- In October 2023, Koito Manufacturing Co., Ltd. and Denso Corporation announced a strategic collaboration aimed at advancing the object recognition capabilities of automotive image sensors, with a strong focus on enhancing nighttime driving safety. By leveraging Koito’s expertise in automotive lighting and Denso’s innovations in sensor technologies, the companies are working to integrate advanced lamps and image sensors to improve visibility in dark driving conditions. This joint initiative aligns with industry efforts toward reducing traffic fatalities and is expected to drive increased adoption of night vision systems as OEMs seek integrated solutions to meet evolving safety regulations and consumer expectations

- In January 2022, Opel unveiled its Grandland SUV, the first model in its lineup to feature a Night Vision system. This system uses an infrared camera discreetly housed behind the Opel Vizor and works in conjunction with the adaptive IntelliLux LED Pixel Light to detect pedestrians and animals in low-light or dark conditions. The launch of this vehicle marks Opel’s entry into the growing market for factory-installed night vision technologies and demonstrates a shift among mainstream automakers to make such safety features more accessible, beyond the luxury vehicle segment. This move is expected to influence other manufacturers to follow suit, expanding the market base

- In September 2021, Hanwha Systems Co., Ltd. and Truwin Co., Ltd. formed a joint venture to develop and manufacture infrared sensors tailored for automotive night vision systems, especially in autonomous vehicles. This partnership aims to strengthen the supply chain and technology base for IR components critical to night vision performance. By localizing sensor production and focusing on autonomous driving applications, the joint venture enhances South Korea’s competitiveness in the global night vision systems market and supports the growing demand for advanced safety technologies in next-generation vehicles

- In May 2020, FLIR Systems Inc. launched the first European Thermal Imaging Dataset for Automotive Driver Assistance Development. This dataset includes thousands of annotated thermal images captured under various lighting and weather conditions across six European cities. Designed to support machine vision testing, the dataset is a valuable resource for automakers developing and training AI models for ADAS, AEB, and autonomous vehicle night vision applications. By offering realistic, high-quality thermal data, FLIR’s initiative plays a pivotal role in accelerating the development of more accurate and robust night vision technologies, contributing to faster commercialization and broader adoption across the European market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.