Global Automotive Parts Packaging Market

Market Size in USD Million

CAGR :

%

USD

8.88 Million

USD

12.16 Million

2024

2032

USD

8.88 Million

USD

12.16 Million

2024

2032

| 2025 –2032 | |

| USD 8.88 Million | |

| USD 12.16 Million | |

|

|

|

Automotive Parts Packaging Market Size

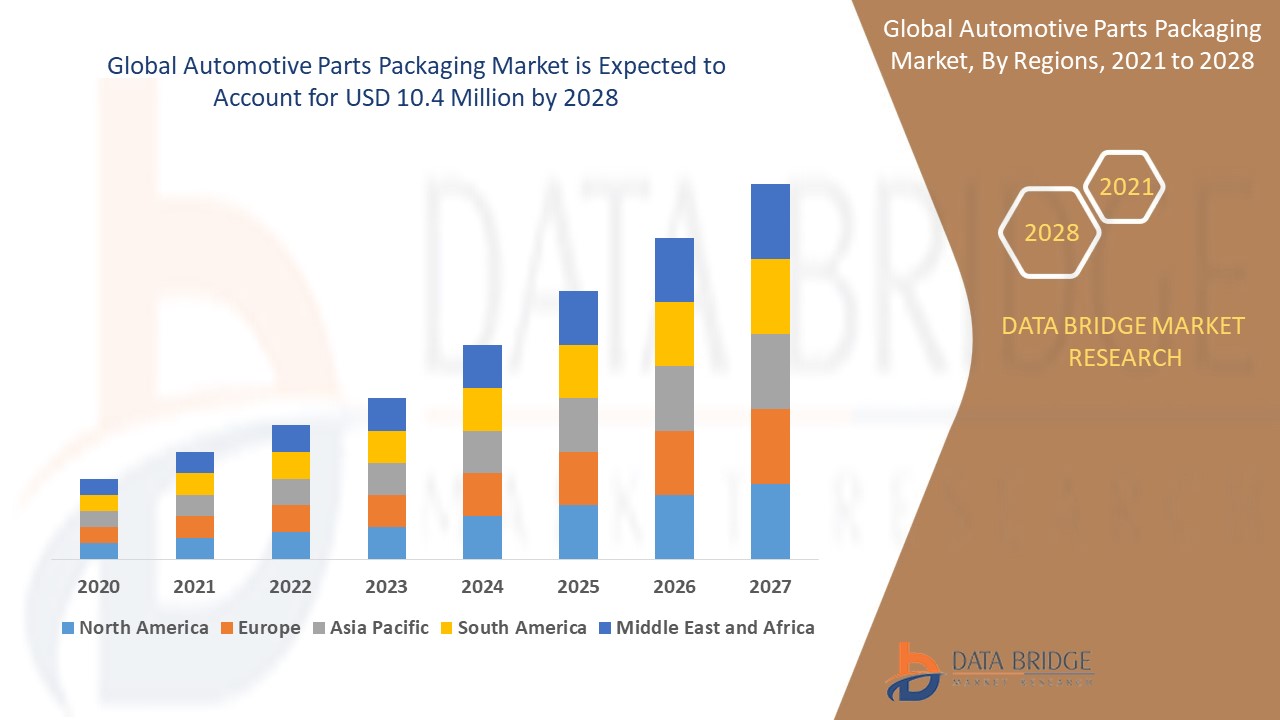

- The global automotive parts packaging market was valued at USD 8.88 million in 2024 and is expected to reach USD 12.16 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.00%, primarily driven by the increasing demand for durable and eco-friendly packaging solutions.

- Asia-Pacific leads in market growth, while North America and Europe hold significant shares due to advanced automotive industries

Automotive Parts Packaging Market Analysis

- Automotive parts packaging refers to the materials and processes used to package components and spare parts for vehicles to ensure their protection, safe transportation, and easy storage. This packaging is designed to prevent damage during handling, shipping, and storage while also facilitating efficient inventory management. It includes various types of packaging such as crates, boxes, bubble wrap, shrink films, and custom-designed containers, often with a focus on durability, security, and sustainability to meet the specific needs of automotive parts

- The automotive parts packaging market is expanding due to the rising demand for vehicle components, increased vehicle production, and the growing trend of online automotive part sales, which requires efficient and secure packaging solutions

- There is a significant shift towards eco-friendly packaging options, including recyclable materials, biodegradable plastics, and reusable containers, as automakers and suppliers focus on reducing their environmental

- For instance, major automotive manufacturers like Toyota and Ford are incorporating recyclable and sustainable materials in their packaging to meet both regulatory requirements and consumer demand for eco-conscious products.

- Globally, the automotive parts packaging market is poised for continued growth, driven by technological innovation, sustainability initiatives, and the evolving needs of the automotive industry, making it crucial for companies to adopt adaptive and efficient packaging solutions

Report Scope and Automotive Parts Packaging Market Segmentation

|

Attributes |

Automotive Parts Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Parts Packaging Market Trends

“Growth in E-commerce and Direct-to-Consumer Deliveries”

- The rise in online shopping for automotive components has led to a greater demand for packaging solutions that can accommodate direct-to-consumer shipments. As consumers increasingly prefer the convenience of purchasing auto parts online, packaging needs to ensure safe and cost-effective delivery

- With the growth in e-commerce, automotive parts packaging must be more protective and easier to handle. Packaging solutions are being optimized to minimize damage during transit and reduce the complexity of returns, which is crucial for maintaining customer satisfaction

- For instance, Amazon and eBay have seen significant growth in automotive parts sales, requiring manufacturers to develop specialized packaging like padded boxes and custom foam inserts to ensure parts arrive in perfect condition

- E-commerce platforms are pushing for highly customized, branded packaging solutions that enhance the unboxing experience and provide clear instructions for consumers. This customization not only promotes the brand but also protects parts in various shipping conditions

- The rise in e-commerce and direct-to-consumer deliveries is significantly shaping the automotive parts packaging market, pushing for more secure, cost-effective, and customized packaging solutions. Companies must adapt by embracing innovation and improving packaging designs to meet growing consumer expectations and maintain supply chain efficiency

Automotive Parts Packaging Market Dynamics

Driver

“Rising Vehicle Production and Aftermarket Demand”

- The global rise in vehicle production is a primary driver of automotive parts packaging demand. As manufacturers produce more vehicles, the need for replacement parts (such as engines, brake components, and electronics) increases, driving a parallel demand for packaging solutions

- The expanding global fleet of cars and trucks leads to a higher volume of vehicles requiring parts over their lifecycle. As more vehicles hit the road, the need for aftermarket parts and accessories grows, fueling packaging requirements

- The automotive aftermarket industry, including parts and accessories sales, repairs, and maintenance, is expanding. This growth leads to a rising need for efficient, safe, and cost-effective packaging solutions to ship parts to service centers and customers

- With the automotive industry increasingly moving toward electric vehicles (EVs) and hybrid models, new parts and components (such as batteries, specialized motors, and advanced electronic systems) require specific, innovative packaging solutions to protect sensitive technologies

For instance,

- Global vehicle production in 2023 was projected to reach over 80 million units, contributing to a significant demand for automotive parts. The higher production numbers drive the need for increased automotive parts packaging, especially for replacement components in the aftermarket

- With the rise in electric vehicles, companies such as Tesla are creating new types of parts that require innovative packaging solutions to protect complex, high-tech components like EV batteries. For instance, Tesla’s battery modules and associated components require specialized packaging for safe handling and shipping

- The increasing production of vehicles and the expanding aftermarket demand are driving the need for automotive parts packaging. As the global vehicle fleet grows, along with the shift toward electric vehicles, packaging solutions must evolve to meet the demand for efficient, secure, and sustainable packaging to transport these parts.

Opportunity

“Technological Advancements in Packaging”

- Smart packaging incorporates technologies such as sensors, RFID, and QR codes, enabling real-time tracking, monitoring of product conditions (e.g., temperature, humidity), and enhanced customer engagement

- The growing emphasis on sustainability has led to advancements in biodegradable, recyclable, and reusable packaging materials, reducing environmental impact and meeting consumer demand for eco-friendly options

- New materials, such as edible films, active packaging, and antimicrobial coatings, are being developed to improve the shelf life, safety, and quality of products, especially in the food and healthcare industries

- Automation in packaging lines, powered by artificial intelligence (AI) and robotics, is making packaging faster, more efficient, and less prone to human error, significantly reducing costs and increasing throughput

For instance,

- In 2020, companies such as Avery Dennison began implementing RFID tags in packaging for tracking purposes, enabling supply chain transparency and enhancing the user experience with real-time product

- In 2021, Unilever started rolling out packaging made from biodegradable materials in their food and beverage products to reduce plastic waste and meet sustainability targets

- Technological advancements in packaging, such as smart packaging, sustainability efforts, and automation, are transforming industries by improving product quality, reducing environmental impact, and enhancing operational efficiency. These innovations not only meet consumer demands for convenience and sustainability but also offer significant opportunities for companies to innovate and stay competitive in the marketplace

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- Advanced packaging solutions, such as automated systems and smart packaging technologies (like RFID tags), require significant upfront investment. This high initial cost can be a barrier for smaller manufacturers or those with limited budgets

- The growing demand for eco-friendly packaging materials (for instance, biodegradable plastics, recyclable composites) often comes at a higher cost compared to traditional packaging options, making it more expensive for manufacturers to adopt sustainable solutions

- The need for customized packaging solutions to protect various automotive parts adds to the cost. Tailored designs that fit specific components require more materials and labor, raising overall packaging costs

- Advanced packaging solutions that use technologies like temperature-controlled packaging, shock absorption, or protection for sensitive parts can result in higher logistics costs due to the additional care needed during handling and transportation

For instance,

- According to a Deloitte report on the automotive industry, manufacturers face challenges in balancing the cost of advanced packaging solutions with the need for sustainability. It highlights that the shift to biodegradable packaging and RFID-based solutions could add 10-20% to packaging costs, posing a significant financial hurdle for companies aiming to modernize their supply chains while staying cost-competitive

- The high cost of advanced packaging solutions remains a significant restraint for the automotive parts packaging market. While these solutions offer long-term benefits in terms of efficiency, sustainability, and tracking, the initial investment and higher costs for advanced materials and technologies can be a barrier, particularly for smaller players in the market

Automotive Parts Packaging Market Scope

The market is segmented on the basis application, product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Packaging Type |

|

|

By Component |

|

Automotive Parts Packaging Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Automotive Parts Packaging Market”

- The Asia-Pacific region, particularly China, Japan, and India, has seen a surge in automotive manufacturing and vehicle production, driving high demand for automotive parts packaging solutions. China alone is the world’s largest vehicle producer, contributing significantly to packaging needs for automotive components

- The growing number of vehicles on the road in Asia-Pacific countries results in increased demand for aftermarket automotive parts. The region's vast and diverse vehicle fleet fuels the need for secure and cost-effective packaging solutions for spare parts and accessories

- Asia-Pacific is a major manufacturing hub for both vehicle production and packaging solutions. The availability of affordable raw materials and low labor costs in countries like China, India, and Vietnam make it an attractive region for producing automotive parts packaging at scale

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific, especially China and India, is witnessing rapid growth in automotive production, with China being the world’s largest car manufacturer. This surge in production drives a corresponding increase in the need for packaging solutions for both original equipment and replacement parts

- The rise in disposable income, urbanization, and increasing vehicle ownership in emerging markets such as India and Southeast Asia is expanding the demand for automotive parts. This growing vehicle fleet is fueling the need for efficient and protective packaging for aftermarket parts

- With the boom in e-commerce platforms across the region, especially in China and India, the demand for packaging solutions that can facilitate direct-to-consumer shipping of automotive parts is growing rapidly. Consumers are increasingly turning to online platforms for purchasing replacement parts, prompting the need for optimized packaging

- The Asia-Pacific region benefits from a cost-effective manufacturing base, enabling competitive pricing for packaging solutions. Additionally, ongoing innovations in materials and packaging technologies are driving the rapid growth of the automotive parts packaging market in the region

Automotive Parts Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Automotive Parts Packaging Are:

- Mondi (U.K.)

- Sealed Air (U.S.)

- Sonoco Products Company (U.S.)

- DS Smith (U.K.)

- Deufol (Germany)

- Encase (U.K.)

- Sunbelt Paper & Packaging Inc. (U.S.)

- Primex Design & Fabrication (U.S.)

- CMTP (France)

- LOSCAM (Australia)

- Pratt Industries, Inc. (U.S.)

- JIT Packaging (U.S.)

- Smurfit Kappa (Ireland)

- NEFAB GROUP (Sweden)

- Signode India (India)

- WestRock Company (U.S.)

- Monoflo International (U.S.)

- Pacific Packaging Products, Inc. (U.S.)

- Schoeller Allibert (Netherlands)

- Knauf Industries (Germany)

Latest Developments in Global Automotive Parts Packaging Market

- In November 2024, Twinplast expanded its operations into the automotive sector by launching custom packaging solutions made from dense polypropylene. These solutions are specifically designed to protect vehicle components during transport. The environmentally friendly packaging is reusable, contributing to sustainability efforts by reducing carbon footprints. This expansion highlights Twinplast's commitment to providing durable, cost-effective, and eco-conscious packaging solutions for the automotive industry

- In October 2024, One World Products introduced hemp-based molded containers for Flex-N-Gate, providing a renewable material alternative for automotive packaging. This innovative solution is designed to reduce carbon emissions and promote sustainability within the automotive sector

- In November 2024, Michelin and Schaeffler revealed plans to close multiple factories and cut nearly 6,000 jobs across Europe. This decision stems from challenges in the automotive sector, such as the shift to electric vehicles and intensifying global competition. Michelin's closures include two plants in France, while Schaeffler's restructuring impacts several sites across Europe, aiming to address market pressures and improve operational efficiency

- In August 2023, Nefab AB, a Sweden-based industrial packaging and logistics services provider, leased 11,000m² of industrial and warehouse space in Gdańsk, Poland. This expansion aims to increase the company’s production capacity and enhance its brand presence in the global market. The new manufacturing facility and branch are expected to open in early 2024, helping Nefab meet growing demand for packaging solutions in various sectors, including automotive

- In February 2022, Smurfit Kappa Group, a leading provider of paper-based packaging solutions worldwide, invested in its new Design2Market Factory. This initiative positions the company to address two of the biggest trends in the packaging industry: sustainability and e-commerce. By utilizing customer data, cutting-edge machinery, and its extensive expertise, Smurfit Kappa aims to enhance its customers' competitive advantage and drive innovation in packaging solutions that align with environmental goals and the growing demand for e-commerce packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Parts Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Parts Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Parts Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.