Global Automotive Performance Tuning And Engine Remapping Services Market

Market Size in USD Million

CAGR :

%

USD

571.19 Million

USD

887.30 Million

2024

2032

USD

571.19 Million

USD

887.30 Million

2024

2032

| 2025 –2032 | |

| USD 571.19 Million | |

| USD 887.30 Million | |

|

|

|

|

Automotive Performance Tuning and Engine Remapping Services Market Size

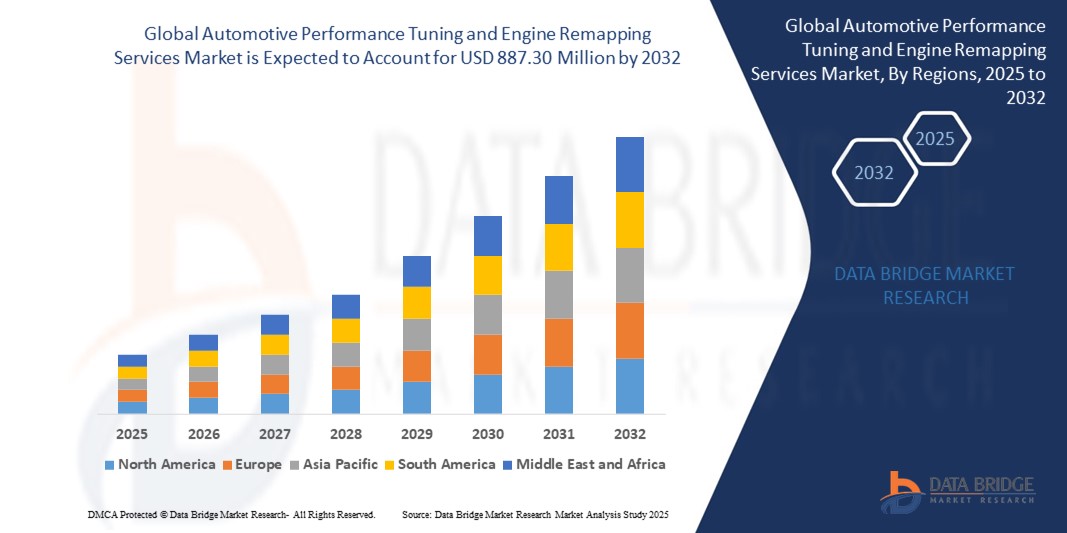

- The global automotive performance tuning and engine remapping services market size was valued at USD 571.19 million in 2024 and is expected to reach USD 887.30 million by 2032, at a CAGR of 5.66% during the forecast period

- The market growth is largely fueled by the increasing demand for vehicle personalization, performance enhancement, and fuel efficiency optimization, supported by advancements in ECU technology and growing availability of aftermarket tuning solutions

- Furthermore, the rising popularity of motorsports, expanding car enthusiast communities, and the integration of digital tuning tools are accelerating the adoption of engine remapping services across both consumer and commercial segments, thereby significantly boosting the industry's growth

Automotive Performance Tuning and Engine Remapping Services Market Analysis

- Automotive performance tuning and engine remapping involve modifying the software parameters of a vehicle's engine control unit (ECU) to enhance power output, torque, throttle response, and fuel efficiency. These services are applied to a range of vehicles including passenger cars, SUVs, and commercial fleets

- The growing demand for tuning and remapping is driven by increasing consumer interest in customized driving experiences, rising fuel costs, and the need for cost-effective performance upgrades, along with the growing accessibility of tuning through OBD-based and mobile-enabled solutions

- North America dominated the automotive performance tuning and engine remapping services market with a share of 31.73% in 2024, due to strong consumer interest in vehicle personalization, high disposable income, and the popularity of motorsports and car culture

- Asia-Pacific is expected to be the fastest growing region in the automotive performance tuning and engine remapping services market during the forecast period due to increasing vehicle ownership, expanding middle-class incomes, and a rising appetite for vehicle personalization among younger consumers

- OBD ports segment dominated the market with a market share of 70% in 2024, due to its non-invasive nature and compatibility with a wide range of modern vehicles. This method allows for efficient ECU access without the need for physical disassembly, appealing to both service providers and vehicle owners for its speed, convenience, and safety

Report Scope and Automotive Performance Tuning and Engine Remapping Services Market Segmentation

|

Attributes |

Automotive Performance Tuning and Engine Remapping Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Performance Tuning and Engine Remapping Services Market Trends

“Rising Demand for Personalized Vehicle Enhancements”

- There is robust growth in consumer interest for customized and performance-optimized vehicles, with car owners seeking individualized tuning to enhance driving dynamics, power output, fuel efficiency, and aesthetics. This has fueled demand across both the sports/performance car segment and among mainstream vehicle owners looking to differentiate their vehicles

- For instance, global tuning specialists such as APR LLC have launched platforms such as Ultralink, which enables cloud-based, real-time ECU tuning and diagnostics for premium European brands such as Audi, Volkswagen, and Porsche, reflecting the push towards accessible, personalized, and remote tuning solutions

- The popularity of car enthusiast culture, motorsport events, and aftermarket modifications showcased online and in media contributes to rising interest—especially among younger drivers and high-performance car owners

- Demand is supported by the proliferation of turbocharged and supercharged engines, which are notably responsive to tuning and remapping, further driving uptake in the market

- Social media, influencer marketing, and online communities play a significant role in spreading awareness and techniques for vehicle enhancements, broadening the customer base

- The sector is seeing dynamic growth in emerging markets as economic growth and a rising middle class translate to greater discretionary spending on vehicle upgrades

Automotive Performance Tuning and Engine Remapping Services Market Dynamics

Driver

“Advancements in Automotive Technology”

- The increasing integration of sophisticated electronic systems and ECUs (engine control units) in vehicles has made tuning more precise, safe, and effective—enabling real-time adjustment of fuel, air, and ignition parameters for optimized performance

- For instance, HP Tuners introduced CORE ECU and VCM Live platforms at the 2023 SEMA Show, providing enhanced support for encrypted control modules and ensuring tuners can safely access, monitor, and calibrate modern engines without breaching OEM cybersecurity protocols

- Cloud-based and remote tuning solutions are gaining traction, making services more accessible and offering tuners new ways to service a global clientele

- Enhanced compatibility and flexibility in tuning now cover a wider range of vehicles—including hybrid and electric models—boosted by ongoing software and hardware innovation. OEMs and third-party tuning service providers collaborate more frequently, sometimes even endorsing “official” upgrade packages for select models

- Cost reductions in tuning hardware and advancements in automotive cybersecurity help make professional-grade engine remapping attainable for broader segments of consumers and shops

Restraint/Challenge

“Security and Cybersecurity Risks”

- As vehicles become increasingly connected and reliant on digital control systems, security and cybersecurity vulnerabilities are a growing concern for both service providers and consumers

- For instance, companies such as HP Tuners have responded to stricter OEM encryption protocols by engineering tuning platforms that work within manufacturer security constraints to minimize the risk of unauthorized access or accidental system breaches during calibration and remapping

- Unauthorized or poorly executed tuning can inadvertently expose critical vehicle systems to cyber threats, malware, and manipulation, jeopardizing both safety and compliance. Regulatory scrutiny is increasing—especially in Europe and North America—requiring tuners and workshops to adhere to stringent data protection, access authorization, and software validation standards

- High complexity in engine and vehicle software means that a lack of specialist expertise can result in safety issues, compromised engine reliability, or warranty voidance—further complicating the regulatory and consumer risk landscape

- The prevalence of remote and cloud-based tuning amplifies the need for robust authentication and secure data transfer protocols to protect both user and vehicle integrity

Automotive Performance Tuning and Engine Remapping Services Market Scope

The market is segmented on the basis of vehicle type, fuel type, tuning stage, tuning method, and application.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment dominated the largest market revenue share in 2024, primarily due to the high volume of personal vehicle ownership and the increasing enthusiasm among car owners for enhancing engine responsiveness, horsepower, and fuel efficiency. Growing consumer awareness around customization, along with the availability of tuning packages tailored for various car brands and models, has accelerated adoption in this segment. Moreover, the integration of advanced ECU technologies in modern passenger vehicles enables smoother and safer remapping processes, further supporting market dominance.

The light commercial vehicles segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand among fleet operators and logistics firms seeking performance optimization and fuel cost savings. These vehicles benefit from tuning enhancements that improve torque and engine longevity, making remapping an attractive option for businesses aiming to improve operational efficiency.

- By Fuel Type

On the basis of fuel type, the market is segmented into petrol and diesel. The diesel segment held the largest market revenue share in 2024, owing to the high torque characteristics of diesel engines and their responsiveness to ECU remapping. Diesel engines typically offer more headroom for performance improvements, and remapping can significantly enhance fuel economy and power output, making it particularly appealing for commercial and long-distance drivers.

The petrol segment is projected to register the fastest CAGR from 2025 to 2032, supported by the growing number of petrol vehicles in urban areas and increasing demand from enthusiasts aiming to maximize acceleration and drivability. As turbocharged petrol engines become more prevalent, particularly in high-performance and premium models, tuning services for this category are gaining substantial traction.

- By Tuning Stage

On the basis of tuning stage, the market is segmented into Stage 1, Stage 2, and Stage 3. Stage 1 tuning dominated the market in 2024, as it involves minimal hardware modifications and is widely accessible to everyday users seeking a balanced improvement in performance and efficiency without compromising vehicle warranty or emissions compliance. The cost-effectiveness and ease of implementation make Stage 1 tuning a preferred entry point for many users.

Stage 2 tuning is expected to grow at the fastest rate from 2025 to 2032, driven by a rising niche of performance-focused drivers and automotive hobbyists. This stage often includes upgraded components such as exhaust systems or intercoolers, delivering more aggressive performance gains. The increasing availability of aftermarket parts and the rising popularity of car culture in emerging markets are boosting the appeal of Stage 2 tuning.

- By Tuning Method

On the basis of tuning method, the market is segmented into OBD ports and bench tuning. The OBD ports segment accounted for the largest revenue share of 70% in 2024, owing to its non-invasive nature and compatibility with a wide range of modern vehicles. This method allows for efficient ECU access without the need for physical disassembly, appealing to both service providers and vehicle owners for its speed, convenience, and safety.

Bench tuning is anticipated to witness the fastest growth from 2025 to 2032, particularly among high-performance vehicle owners and in scenarios where OBD access is restricted due to manufacturer encryption. Bench tuning allows technicians to directly access the ECU via specialized hardware, providing deeper control and enabling more advanced customization, especially for older vehicles or heavily modified engines.

- By Application

On the basis of application, the market is segmented into racing, fuel economizing, and performance tuning. Performance tuning held the largest market share in 2024, underpinned by a broad customer base seeking enhanced engine responsiveness, smoother gear shifts, and increased horsepower. As performance tuning can be tailored to both everyday driving and spirited driving styles, it serves as the primary use case across various vehicle segments.

The fuel economizing segment is expected to record the fastest CAGR from 2025 to 2032, driven by heightened consumer sensitivity to fuel prices and increasing environmental concerns. ECU remapping to optimize fuel consumption without sacrificing drivability is becoming popular among both individuals and fleet operators, especially in regions with strict emissions regulations and fluctuating fuel costs.

Automotive Performance Tuning and Engine Remapping Services Market Regional Analysis

- North America dominated the automotive performance tuning and engine remapping services market with the largest revenue share of 31.73% in 2024, driven by strong consumer interest in vehicle personalization, high disposable income, and the popularity of motorsports and car culture

- The region benefits from a well-established aftermarket ecosystem and a high penetration of performance vehicles, encouraging demand for tuning services

- Advancements in ECU technologies and widespread availability of tuning specialists across the U.S. and Canada further reinforce the market’s growth, particularly for performance optimization and emissions-compliant remapping

U.S. Automotive Performance Tuning and Engine Remapping Services Market Insight

The U.S. automotive performance tuning and engine remapping services market captured the largest revenue share within North America in 2024. This growth is driven by the widespread popularity of vehicle personalization, a high volume of pickup trucks and muscle cars, and an expanding base of performance enthusiasts. The rise of OBD-based remapping and mobile-integrated tuning tools has made access to tuning services easier for both DIY users and professional tuners. In addition, favorable regulatory environments in several states and a strong aftermarket supply chain support the widespread adoption of remapping services across both consumer and commercial applications.

Europe Automotive Performance Tuning and Engine Remapping Services Market

The Europe automotive performance tuning and engine remapping services market is projected to witness substantial growth throughout the forecast period. The region's strong focus on emission reduction and vehicle efficiency is driving demand for tuning services that comply with environmental regulations while optimizing performance. Stricter Euro 6 and upcoming Euro 7 standards have pushed tuning providers to innovate solutions that boost power output without increasing emissions. Europe’s mature automotive industry and long-standing tradition in performance vehicle engineering also support a stable environment for ECU remapping services, particularly in countries with high-performance vehicle density.

U.K. Automotive Performance Tuning and Engine Remapping Services Market Insight

The U.K. automotive performance tuning and engine remapping services market is expected to grow at a notable CAGR during the forecast period. Growing interest in vehicle fuel efficiency and customization, combined with rising fuel prices, is encouraging more drivers to opt for ECU remapping. The country’s strong aftermarket service network and enthusiast-driven car culture contribute to demand, especially among younger drivers. In addition, tuning for fleet efficiency is gaining traction among commercial operators seeking long-term cost savings and reduced emissions.

Germany Automotive Performance Tuning and Engine Remapping Services Market Insight

The Germany automotive performance tuning and engine remapping services market is expected to expand at a considerable CAGR, supported by the country’s reputation for engineering excellence and its leadership in the automotive sector. German consumers and garages adhere to rigorous technical standards such as TUV certification, ensuring tuning services remain safe, legal, and effective. Performance tuning for brands such as BMW, Audi, and Mercedes-Benz remains popular, particularly for Stage 1 and Stage 2 upgrades. Increasing integration of tuning with digital diagnostics and connected car platforms is further elevating the quality and scope of tuning services in Germany.

Asia-Pacific Automotive Performance Tuning and Engine Remapping Services Market

The Asia-Pacific automotive performance tuning and engine remapping services market is poised to grow at the fastest CAGR from 2025 to 2032. This rapid growth is fueled by increasing vehicle ownership, expanding middle-class incomes, and a rising appetite for vehicle personalization among younger consumers. Countries such as China, Japan, and India are experiencing a surge in demand for tuning solutions that improve fuel efficiency, acceleration, and engine responsiveness. As the region becomes a major hub for automotive manufacturing and aftermarket components, tuning services are becoming more affordable and accessible. Government initiatives aimed at promoting digital vehicle technologies and cleaner emissions are also encouraging compliant ECU remapping services.

Japan Automotive Performance Tuning and Engine Remapping Services Market Insight

The Japan automotive performance tuning and engine remapping services market is gaining momentum due to the country’s advanced automotive technologies and longstanding car modification culture. Japanese consumers favor precise, software-driven tuning that improves responsiveness while maintaining safety and efficiency. With a growing number of connected and hybrid vehicles, tuning solutions tailored to modern ECUs are seeing increased demand. The rise in urban mobility and a focus on driving convenience are also influencing demand for remapping services among both individual drivers and vehicle owners seeking smoother engine performance.

China Automotive Performance Tuning and Engine Remapping Services Market Insight

The China automotive performance tuning and engine remapping services market accounted for the largest revenue share in Asia-Pacific in 2024. This growth is driven by rapid urbanization, rising disposable income, and strong interest in vehicle personalization. China’s large vehicle population and increasing popularity of car culture among younger generations have created a fertile market for tuning and remapping services. Domestic firms offering cost-effective tuning solutions and the government’s push toward smart mobility and digital vehicle ecosystems are further enhancing market prospects. Demand spans both performance upgrades and fuel optimization, making China a central player in the regional market’s development.

Automotive Performance Tuning and Engine Remapping Services Market Share

The automotive performance tuning and engine remapping services industry is primarily led by well-established companies, including:

- Tuning Works Inc (U.S.)

- Turbo Dynamics (Canada)

- EcuTek (U.K.)

- Quantum Tuning (U.K.)

- Shift Performance (U.S.)

- Emaps (Italy)

- ZF Friedrichshafen AG (Germany)

- Valeo (France)

- Continental AG (Germany)

- Hitachi, Ltd (Japan)

- Robert Bosch GmbH (Germany)

- Honeywell International Inc (U.S.)

- BorgWarner Inc (U.S.)

- MITSUBISHI HEAVY INDUSTRIES, LTD (Japan)

- DENSO CORPORATION (Japan)

- VIEZU (U.K.)

- ABT Sportsline (Germany)

- Roo Systems (Australia)

Latest Developments in Global Automotive Performance Tuning and Engine Remapping Services Market

- In April 2024, ABT Sportsline launched a high-performance engine upgrade for select Audi and Lamborghini models equipped with the 4.0-liter twin-turbo V8 engine. This development highlights the increasing demand for precision tuning solutions tailored to premium and super-luxury vehicles. By offering factory-compliant performance enhancements for such high-end brands, ABT reinforces consumer trust in aftermarket tuning as a safe and reliable performance upgrade option. This boosts the credibility of professional tuning services and also expands market opportunities within the luxury and performance segments

- In May 2023, ABT Sportsline unveiled the limited-edition RS6 Legacy Edition (LE), restricted to just 200 units. This release served as a strategic showcase of ABT's engineering capabilities, blending supercar-level performance with daily drivability. The exclusive nature of the LE model, coupled with its advanced remapping and tuning, underlines growing consumer interest in bespoke, limited-run vehicles. It also highlights how tuning companies are shifting toward brand collaborations and limited-edition offerings to drive premium value in the performance aftermarket sector, enhancing both brand recognition and consumer aspiration

- In March 2022, ABT Sportsline achieved a significant milestone by extracting 450 horsepower from the iconic five-cylinder engine in the CUPRA Formentor SUV coupé. This accomplishment reflects the technological advancements in tuning techniques for compact performance SUVs, a segment gaining popularity among younger buyers. The successful enhancement of a relatively new brand such as CUPRA signifies the widening scope of tuning applications beyond traditional performance models, encouraging broader market participation. It also emphasizes the market shift toward power enhancement in crossover and lifestyle-oriented vehicles without compromising on design or functionality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.