Global Automotive Perimeter Lighting Systems Market

Market Size in USD Billion

CAGR :

%

USD

39.62 Billion

USD

91.10 Billion

2024

2032

USD

39.62 Billion

USD

91.10 Billion

2024

2032

| 2025 –2032 | |

| USD 39.62 Billion | |

| USD 91.10 Billion | |

|

|

|

|

Automotive Perimeter Lighting Systems Market Size

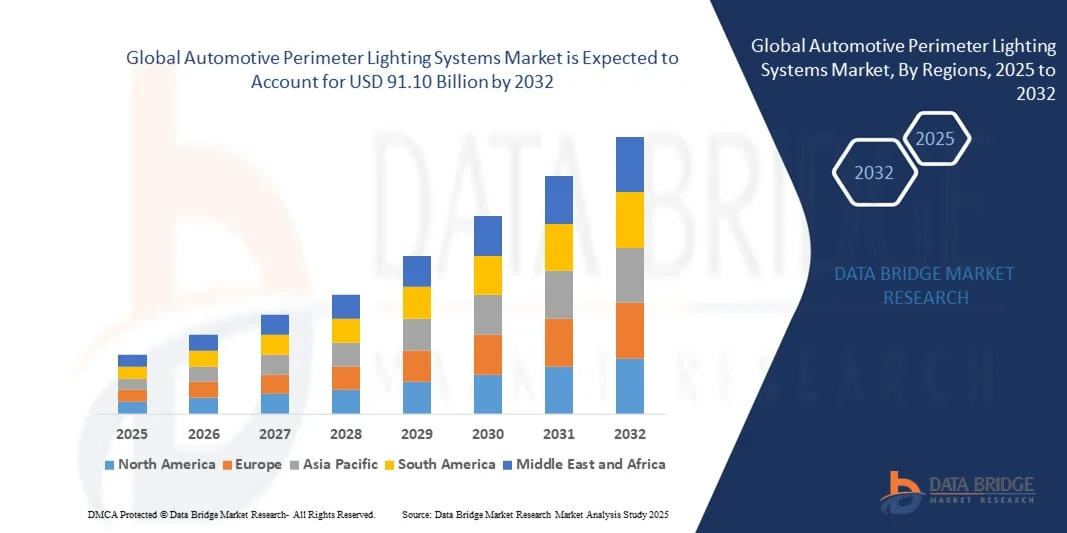

- The global automotive perimeter lighting systems market size was valued at USD 39.62 billion in 2024 and is expected to reach USD 91.10 billion by 2032, at a CAGR of 10.97% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced lighting technologies, such as LED and adaptive perimeter lighting systems, and increasing focus on vehicle aesthetics, safety, and energy efficiency across passenger and commercial vehicles

- Furthermore, rising consumer demand for visually appealing, customizable, and high-performance lighting solutions is establishing perimeter lighting systems as a key feature in modern vehicles. These converging factors are accelerating the uptake of advanced lighting solutions, thereby significantly boosting the industry's growth

Automotive Perimeter Lighting Systems Market Analysis

- Automotive perimeter lighting systems, including puddle lamps, door handle lamps, and halo rings, are increasingly vital components of modern vehicles due to their ability to enhance safety, visibility, and aesthetic appeal in both passenger and commercial vehicles

- The escalating demand for perimeter lighting systems is primarily fueled by rapid technological advancements in LED and adaptive lighting, increasing adoption of electric and autonomous vehicles, and growing consumer preference for stylish and energy-efficient lighting solutions

- Asia-Pacific dominated the automotive perimeter lighting systems market with a share of 38.26% in 2024, due to expanding automotive production, increasing adoption of LED and advanced lighting technologies, and a strong presence of automotive manufacturing hubs

- North America is expected to be the fastest growing region in the automotive perimeter lighting systems market during the forecast period due to robust demand for advanced perimeter lighting in passenger and commercial vehicles

- LED lights segment dominated the market with a market share of 45.5% in 2024, due to their energy efficiency, long lifespan, and superior illumination quality. Automakers increasingly prefer LED lighting for its ability to enhance vehicle aesthetics while improving visibility and safety. The flexibility of LEDs allows integration into various vehicle designs, including intricate lighting patterns for modern car exteriors, making them highly compatible with advanced automotive technologies

Report Scope and Automotive Perimeter Lighting Systems Market Segmentation

|

Attributes |

Automotive Perimeter Lighting Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Perimeter Lighting Systems Market Trends

Rising use of LED and Adaptive Lighting in Vehicles

- The automotive perimeter lighting systems market is witnessing significant growth as manufacturers increasingly incorporate LED and adaptive lighting technologies into vehicle designs. These advancements enhance visibility, safety, and aesthetics while improving energy efficiency compared to traditional lighting systems

- For instance, Hella GmbH & Co. KGaA and Valeo SA have developed perimeter lighting solutions integrating adaptive LED technology, enabling illumination patterns that adjust automatically based on driving conditions and surroundings. Such systems enhance safety during night driving, adverse weather, and off-road conditions while adding premium visual appeal

- LED-based perimeter lighting systems offer longer lifespans, lower power consumption, and consistent light output, making them highly suited for modern vehicle architectures. Adaptive lighting features further elevate functionality by directing light precisely where needed, reducing glare and improving driving comfort

- Manufacturers are integrating perimeter lighting into various zones such as door sills, underbody panels, and vehicle exteriors to boost both safety and style. These features provide enhanced visibility during ingress and egress while creating distinctive design signatures that strengthen brand identity

- The adoption of smart control modules and sensor integration enables responsive perimeter lighting that adjusts brightness and angle automatically. This integration supports advanced driver-assistance systems (ADAS), improving awareness of pedestrians, obstacles, and road conditions surrounding the vehicle perimeter

- The rising use of LED and adaptive lighting solutions is transforming perimeter lighting from functional safety components into key design and branding elements. This evolution highlights the growing convergence of technology, style, and efficiency in modern automotive lighting strategies

Automotive Perimeter Lighting Systems Market Dynamics

Driver

Growing Demand for Safer, Stylish, and Energy-Efficient Lighting

- Rising consumer expectations for safety, design innovation, and energy efficiency are key drivers in the automotive perimeter lighting systems market. Vehicle buyers are prioritizing lighting technologies that enhance visibility while contributing to vehicle aesthetics and sustainability goals

- For instance, BMW and Audi have incorporated advanced LED perimeter lighting designs in their premium models, providing distinctive illumination patterns that enhance safety during vehicle entry and exit while reinforcing brand identity. These applications showcase the appeal of stylish yet functional lighting solutions

- Energy-efficient lighting systems such as LEDs reduce strain on vehicle electrical systems, supporting extended battery life in electric and hybrid vehicles. Their reliability ensures consistent performance under varying conditions, making them a preferred choice for safety-conscious consumers

- Enhanced lighting aesthetics contribute significantly to the vehicle’s value perception. Perimeter lighting solutions offer design customization through programmable colors, patterns, and animations, creating unique visual experiences for owners and strengthening brand affinity in luxury and mid-range segments

- The convergence of sustainability, safety performance, and design innovation ensures continued demand for energy-efficient and aesthetically appealing perimeter lighting across both internal combustion and electric vehicles. Manufacturers investing in these technologies are aligning with changing consumer preferences and evolving automotive design trends

Restraint/Challenge

High Costs Limiting Adoption in Budget Vehicles

- The relatively high production and integration costs of advanced perimeter lighting systems are a challenge for widespread adoption in budget vehicle segments. Premium LED modules, adaptive lighting controls, and smart sensor integration increase manufacturing expenses compared to conventional solutions

- For instance, integrating adaptive multi-zone perimeter lighting from suppliers such as Valeo and Hella often involves expensive electronic control units, precision light modules, and custom housing components. This cost structure limits application in economy-class vehicles focused on price competitiveness

- Budget-conscious manufacturers face difficulty balancing affordability with advanced lighting features due to high initial costs and potential impact on profit margins. As a result, simpler halogen or basic LED solutions remain standard in lower-priced models despite reduced functionality and styling flexibility

- Maintenance and replacement costs for advanced perimeter lighting systems can also deter potential buyers in cost-sensitive markets, as these systems require specialized servicing and parts availability that may not be widespread outside premium automotive service networks

- Reducing costs through modular designs, scalable manufacturing, and simplified integration will be key to extending advanced perimeter lighting to broader market segments. Achieving affordability without compromising performance or design quality will determine the pace of adoption in budget vehicle categories

Automotive Perimeter Lighting Systems Market Scope

The market is segmented on the basis of type, product type, material, vehicle type, and distribution channel.

- By Type

On the basis of type, the automotive perimeter lighting systems market is segmented into LED lights, halo rings, fluorescent bulbs, and others. The LED lights segment dominated the market with the largest revenue share of 45.5% in 2024, driven by their energy efficiency, long lifespan, and superior illumination quality. Automakers increasingly prefer LED lighting for its ability to enhance vehicle aesthetics while improving visibility and safety. The flexibility of LEDs allows integration into various vehicle designs, including intricate lighting patterns for modern car exteriors, making them highly compatible with advanced automotive technologies.

The halo rings segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by their rising adoption in luxury and premium vehicles. Halo rings offer a visually striking appearance that enhances the overall vehicle design, while their compatibility with LED technology provides customizable lighting effects. Growing consumer demand for stylish and attention-grabbing lighting solutions further propels their market growth, particularly in passenger cars and high-end commercial vehicles.

- By Product Type

On the basis of product type, the market is segmented into puddle lamps, door handle lamps, door mirror lamps, and license plate lights. Puddle lamps dominated the market in 2024 due to their functional advantage of illuminating the area around the vehicle’s door, enhancing passenger safety during entry and exit. These lamps are widely used in both luxury and mid-range vehicles for their combination of practical utility and premium aesthetic appeal. Their integration with smart lighting control systems also adds convenience and a modern touch to vehicle exteriors.

Door mirror lamps are expected to witness the fastest growth from 2025 to 2032, driven by increasing adoption in passenger cars and commercial vehicles for improved visibility and vehicle awareness. These lamps enhance driver safety by illuminating blind spots and the vehicle’s immediate surroundings, while also serving as a styling element. The growing trend of incorporating advanced safety features and customizable lighting designs further accelerates demand for door mirror lamps.

- By Material

On the basis of material, the market is segmented into plastic, glass, fiber, and others. Plastic materials dominated the market in 2024 due to their lightweight nature, cost-effectiveness, and ease of integration into complex vehicle body designs. Plastic-based lighting systems allow manufacturers to reduce overall vehicle weight, thereby improving fuel efficiency and performance. They also provide design flexibility, durability, and resistance to environmental conditions, making them a preferred choice across passenger and commercial vehicles.

Glass-based lighting systems are expected to witness the fastest growth from 2025 to 2032, driven by their premium appearance, optical clarity, and enhanced light dispersion. Glass materials are increasingly used in luxury vehicles and high-end commercial models to deliver superior lighting aesthetics while maintaining durability. Consumer preference for visually appealing and high-quality lighting components is driving the rapid adoption of glass in perimeter lighting systems.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. Passenger cars dominated the market in 2024 with the largest revenue share, owing to the high demand for aesthetically enhanced, energy-efficient lighting solutions in personal vehicles. Manufacturers are increasingly integrating advanced lighting systems, such as LEDs and halo rings, into passenger cars to meet consumer expectations for safety, style, and technology. The adoption is further driven by rising urbanization and disposable income, leading to demand for premium and feature-rich lighting systems.

Commercial vehicles are expected to witness the fastest growth from 2025 to 2032, fueled by the need for improved safety, visibility, and brand visibility on the road. Advanced perimeter lighting systems in commercial vehicles enhance driver awareness, reduce accidents, and improve operational efficiency. The increasing adoption of smart lighting solutions in logistics, public transport, and specialty vehicles supports this rapid market growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into OEM and aftermarket. The OEM segment dominated the market in 2024 due to the integration of perimeter lighting systems during the manufacturing process, ensuring better quality control, durability, and seamless compatibility with vehicle designs. Automakers prefer OEM lighting solutions for both functional and branding purposes, as they allow customization and advanced technology integration at scale.

The aftermarket segment is expected to witness the fastest growth from 2025 to 2032, driven by rising consumer demand for retrofitting vehicles with advanced lighting systems. Vehicle owners increasingly seek customizable and upgraded lighting solutions to improve aesthetics, safety, and energy efficiency. Growing awareness about vehicle personalization and the availability of innovative perimeter lighting products in the aftermarket channel further boosts its adoption.

Automotive Perimeter Lighting Systems Market Regional Analysis

- Asia-Pacific dominated the automotive perimeter lighting systems market with the largest revenue share of 38.26% in 2024, driven by expanding automotive production, increasing adoption of LED and advanced lighting technologies, and a strong presence of automotive manufacturing hubs

- The region’s cost-effective manufacturing landscape, rising investments in automotive R&D, and growing exports of passenger and commercial vehicles are accelerating market expansion

- Availability of skilled labor, favorable government policies, and rapid urbanization across developing economies are contributing to increased adoption of advanced perimeter lighting systems

China Automotive Perimeter Lighting Systems Market Insight

China held the largest share in the Asia-Pacific market in 2024, owing to its status as a global automotive manufacturing leader and early adoption of advanced lighting technologies. Strong industrial infrastructure, favorable government incentives, and a focus on electric and smart vehicles are major growth drivers. Demand is further supported by extensive exports and domestic adoption of premium and energy-efficient lighting systems in passenger cars and commercial vehicles.

India Automotive Perimeter Lighting Systems Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion of the automotive sector, rising sales of passenger vehicles, and increasing adoption of energy-efficient lighting solutions. Government initiatives promoting domestic manufacturing and automotive technology adoption, along with growing R&D in electric vehicles and smart lighting systems, are strengthening demand. Rising consumer preference for aesthetically enhanced vehicles is further driving market expansion.

Europe Automotive Perimeter Lighting Systems Market Insight

The Europe market is expanding steadily, supported by stringent vehicle safety regulations, high demand for advanced and customizable lighting solutions, and growing investments in electric and luxury vehicles. The region emphasizes innovation, environmental compliance, and high-quality standards, particularly in premium passenger vehicles. Increasing integration of LED and halo ring systems in vehicle exteriors is further boosting market growth.

Germany Automotive Perimeter Lighting Systems Market Insight

Germany’s market is driven by its leadership in automotive manufacturing, strong focus on vehicle safety and design, and adoption of premium lighting technologies. The country’s extensive R&D networks, collaborations between automotive OEMs and lighting technology providers, and strong export orientation are fostering continuous innovation. Demand is particularly strong for high-end passenger cars and commercial vehicles incorporating advanced perimeter lighting systems.

U.K. Automotive Perimeter Lighting Systems Market Insight

The U.K. market is supported by a mature automotive industry, increasing adoption of smart and energy-efficient lighting systems, and efforts to localize automotive supply chains. Focus on R&D, collaborations between manufacturers and technology providers, and growing interest in electric and premium vehicles continue to drive adoption. Rising consumer preference for modern and customizable vehicle lighting solutions enhances market growth.

North America Automotive Perimeter Lighting Systems Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand for advanced perimeter lighting in passenger and commercial vehicles. Focus on vehicle safety, integration with smart and connected car technologies, and growing adoption of LED and halo ring systems are boosting demand. Increasing domestic vehicle production, technological innovations, and collaboration between OEMs and lighting solution providers are supporting market expansion.

U.S. Automotive Perimeter Lighting Systems Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive automotive industry, strong R&D capabilities, and early adoption of advanced lighting technologies. The country’s focus on vehicle safety, energy-efficient solutions, and premium vehicle aesthetics is encouraging the use of LED and halo ring perimeter lighting systems. Presence of key OEMs, aftermarket players, and a mature distribution network further solidify the U.S.'s leading position in the region.

Automotive Perimeter Lighting Systems Market Share

The automotive perimeter lighting systems industry is primarily led by well-established companies, including:

- GENTEX CORPORATION (U.S.)

- KOITO MANUFACTURING CO., LTD. (Japan)

- HELLA GmbH & Co. KGaA (Germany)

- Magna International Inc. (Canada)

- Marelli Holdings Co., Ltd. (Japan)

- Varroc Group (India)

- Valeo (France)

- STMicroelectronics (Switzerland)

- OSRAM GmbH (Germany)

- DENSO CORPORATION (Japan)

- Samvardha Motherson Group (India)

- Robert Bosch GmbH (Germany)

- ICHIKOH INDUSTRIES, LTD. (Japan)

- STANLEY ELECTRIC CO., LTD. (Japan)

- Keboda (China)

- Lear Corporation (U.S.)

- HYUNDAI MOBIS (South Korea)

- Wipro Lighting (India)

- Feniex Industries (U.S.)

- Setina Manufacturing Inc. (U.S.)

Latest Developments in Global Automotive Perimeter Lighting Systems Market

- In April 2025, Koito Manufacturing unveiled a next-generation adaptive perimeter lighting system with dynamic beam control and ambient illumination capabilities. This innovation enhances vehicle safety and visibility in varying conditions, reflecting the growing consumer and OEM demand for intelligent and aesthetically appealing lighting solutions

- In March 2025, Stanley Electric introduced perimeter lighting modules optimized for electric vehicles, emphasizing energy efficiency and seamless integration with autonomous driving systems. The launch highlights the market’s shift toward sustainable and smart lighting solutions, supporting the growth of advanced perimeter lighting technologies in the expanding EV sector

- In February 2022, Magna announced a joint venture with LAN Manufacturing, a minority-owned automotive supplier in Michigan, to form LM Manufacturing. The JV will assemble complete seats for various trucks and SUVs for Ford Motor Company from a 296,000-square-foot facility in Detroit. Magna’s 49% stake in the venture highlights its strategic expansion in automotive manufacturing, strengthening its presence in the North American vehicle component market

- In January 2022, Gentex Corporation partnered with eSight, a provider of vision enhancement technology, to develop and manufacture next-generation mobile electronic eyewear for people with visual impairments. This collaboration underscores Gentex’s commitment to innovation and its expansion into assistive technology, enhancing its product portfolio beyond traditional automotive electronics

- In January 2022, HELLA launched the Black Magic LED series in the European market, featuring dustproof and waterproof housing and robust construction designed for off-road applications. The introduction of this series demonstrates HELLA’s focus on durable, high-performance perimeter lighting solutions, catering to increasing demand for advanced vehicle lighting in challenging environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.