Global Automotive Piston Pin Market

Market Size in USD Billion

CAGR :

%

USD

2.79 Billion

USD

3.06 Billion

2024

2032

USD

2.79 Billion

USD

3.06 Billion

2024

2032

| 2025 –2032 | |

| USD 2.79 Billion | |

| USD 3.06 Billion | |

|

|

|

|

Automotive Piston Market Size

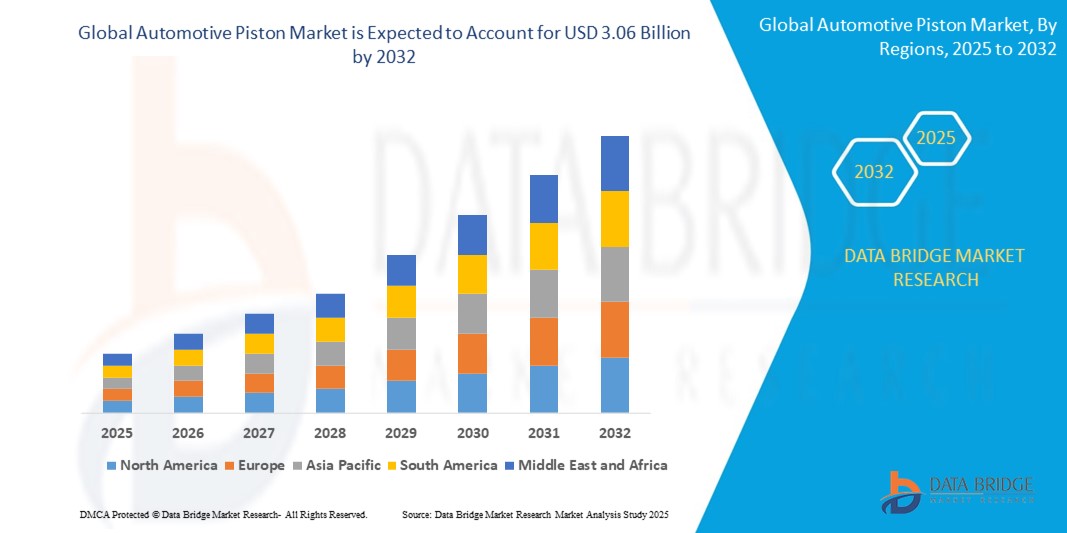

- The global automotive piston market size was valued at USD 2.79 billion in 2024 and is expected to reach USD 3.06 billion by 2032, at a CAGR of 1.20% during the forecast period

- The market growth is largely fueled by increasing vehicle production across emerging economies and sustained demand for internal combustion engine vehicles, especially in regions where EV penetration remains limited

- Furthermore, advancements in piston materials and coating technologies, combined with stringent emission regulations and rising emphasis on fuel efficiency, are accelerating the adoption of high-performance, lightweight pistons, thereby significantly boosting the industry's growth

Automotive Piston Market Analysis

- Automotive pistons, essential components of internal combustion engines, play a critical role in converting fuel energy into mechanical motion, making them indispensable across both passenger and commercial vehicle segments due to their impact on engine efficiency, performance, and durability

- The escalating demand for automotive pistons is primarily fueled by increasing global vehicle production, growing emphasis on fuel efficiency and emission control, and ongoing advancements in piston coatings and lightweight materials aimed at enhancing engine performance and meeting stringent regulatory standards

- Asia-Pacific dominated the automotive piston market with a share of over 50% in 2024, due to rapid industrialization, increasing vehicle production, and growing demand for fuel-efficient engines across emerging economies

- North America is expected to be the fastest growing region in the automotive piston market during the forecast period due to increasing production of fuel-efficient vehicles and adoption of advanced engine technologies

- Passenger car segment dominated the market with a market share of 62.5% in 2024, due to the rapid growth in personal vehicle ownership worldwide and the increasing emphasis on fuel efficiency and emission control technologies. Innovations in lightweight pistons and advanced coatings cater primarily to passenger cars, where efficiency, noise reduction, and performance are critical selling points

Report Scope and Automotive Piston Market Segmentation

|

Attributes |

Automotive Piston Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Automotive Piston Market Trends

“Increasing Demand for Fuel-Efficient Vehicles”

- A significant and accelerating trend in the global automotive piston market is the rising demand for fuel-efficient vehicles, driven by tightening emission norms and increasing fuel prices across major markets. This shift is compelling automakers to adopt lightweight, high-performance piston designs that enhance engine thermal efficiency and reduce friction losses

- For instance, Mahle GmbH has developed lightweight pistons with advanced graphite coatings aimed at reducing weight and improving combustion efficiency in gasoline engines. Similarly, Federal-Mogul LLC (now part of Tenneco Inc.) offers Duron coated piston rings that reduce friction and improve fuel economy across various vehicle types

- Coating technologies such as oil-shedding and thermal barrier coatings are being rapidly adopted to improve piston durability under high-pressure conditions and optimize fuel combustion. Rheinmetall AG is advancing dry film lubricating coatings that improve performance in turbocharged and downsized engines, which are widely used in modern fuel-efficient vehicles

- The use of aluminum alloys and composite materials in piston manufacturing is also gaining prominence due to their lightweight properties and heat resistance. Companies such as Hitachi Astemo, Ltd. are investing in advanced material science to produce pistons that reduce engine load while maintaining structural integrity under high RPM conditions

- This trend toward fuel-efficient engine components is fundamentally reshaping design and material standards for pistons. Consequently, leading manufacturers are prioritizing R&D investments in low-friction, high-durability piston systems to meet evolving efficiency standards and consumer expectations

- The demand for advanced, fuel-efficient piston solutions is growing rapidly across both OEM and aftermarket channels, particularly in regions such as Asia-Pacific and Europe where fuel economy regulations are becoming increasingly stringent

Automotive Piston Market Dynamics

Driver

“Rising Development of Advanced Piston Technologies”

- The rising development of advanced piston technologies is a significant driver for the growing demand in the automotive piston market, as manufacturers seek to enhance engine performance, fuel efficiency, and emission control to meet evolving regulatory standards

- For instance, in February 2024, MAHLE GmbH unveiled its next-generation aluminum pistons with integrated cooling galleries and friction-reducing coatings, specifically designed for turbocharged gasoline engines. These innovations are aimed at improving thermal stability and extending engine life, thereby enhancing vehicle efficiency

- As OEMs and tier-one suppliers increasingly focus on optimizing powertrain performance, advanced piston designs featuring thermal barrier coatings, dry film lubricants, and precision-engineered geometries are gaining momentum across high-performance and fuel-efficient vehicle segments

- The shift toward downsized engines with higher power output per liter is accelerating the need for pistons that can withstand higher thermal and mechanical stress, positioning advanced piston technologies as essential components in modern engine platforms

- The growing preference for cleaner, more efficient vehicles globally is compelling automakers to adopt innovative piston solutions, further contributing to the strong growth trajectory of the automotive piston market across both OEM and aftermarket channels

Restraint/Challenge

“Ensuring Lightweight Design while Maintaining Strength”

- Ensuring lightweight design while maintaining strength presents a significant challenge in the automotive piston market, as manufacturers strive to meet fuel efficiency targets without compromising engine performance or durability

- For instance, while aluminum pistons are widely adopted for their lightweight properties, they must be carefully engineered to endure high thermal and mechanical stress in modern turbocharged and high-compression engines

- Achieving this balance demands advanced metallurgical techniques and innovative geometries. Companies such as Rheinmetall AG and MAHLE GmbH are investing heavily in material research, including the use of reinforced aluminum alloys and complex internal cooling structures, to maintain mechanical integrity while minimizing piston weight

- However, these advanced manufacturing processes often lead to increased production complexity and cost, which can pose scalability issues for mass-market applications

- Overcoming this challenge will require continued innovation in materials science, precision engineering, and close collaboration between OEMs and suppliers to ensure pistons meet the increasingly demanding performance, efficiency, and cost criteria of the evolving automotive industry

Automotive Piston Market Scope

The market is segmented on the basis of component type, coating type, and vehicle type.

- By Component Type

On the basis of component type, the automotive piston market is segmented into pistons, piston rings, and piston pins. The piston segment dominated the market with the largest revenue share in 2024, driven by its critical role in the engine’s combustion process and ongoing innovations in lightweight and high-strength materials. Pistons designed with advanced alloys and optimized geometries help improve fuel efficiency and reduce emissions, which has increased demand especially from passenger vehicle manufacturers aiming to meet stringent regulatory standards.

The piston rings segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by advancements in sealing technology and materials that enhance engine performance and durability. Piston rings are essential for maintaining compression and minimizing oil consumption, which makes them a focus area for automotive OEMs seeking higher engine efficiency and lower maintenance costs. The piston pin segment maintains steady demand due to its crucial function in connecting the piston to the connecting rod, with innovations focusing on reducing friction and wear to extend engine life.

- By Coating Type

On the basis of coating type, the market is segmented into oil shedding, dry film lubricating, and thermal barrier coatings. The oil shedding coating segment held the largest revenue share in 2024, driven by its ability to reduce friction between moving parts, thereby improving engine efficiency and reducing wear. These coatings help in maintaining optimal lubrication under varied engine operating conditions, which is especially valued in passenger car engines where fuel efficiency is paramount.

The thermal barrier coating segment is anticipated to witness the fastest CAGR from 2025 to 2032, as manufacturers increasingly adopt these coatings to enhance engine thermal efficiency by protecting pistons from extreme combustion temperatures. Thermal barrier coatings contribute to reduced heat loss and improved power output, making them attractive for high-performance and commercial vehicle engines that operate under strenuous conditions. Dry film lubricating coatings also hold significant demand for their ability to provide solid lubrication in scenarios where liquid lubricants might be insufficient.

- By Vehicle Type

On the basis of vehicle type, the automotive piston market is segmented into passenger cars and commercial vehicles. The passenger car segment accounted for the largest market revenue share of 62.5% in 2024, supported by the rapid growth in personal vehicle ownership worldwide and the increasing emphasis on fuel efficiency and emission control technologies. Innovations in lightweight pistons and advanced coatings cater primarily to passenger cars, where efficiency, noise reduction, and performance are critical selling points.

The commercial vehicle segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for heavy-duty vehicles in logistics, construction, and transportation sectors. Commercial vehicles require durable pistons and components capable of withstanding higher loads and longer operating hours, which has accelerated the adoption of enhanced materials and coating technologies tailored to these requirements.

Automotive Piston Market Regional Analysis

- Asia-Pacific dominated the automotive piston market with the largest revenue share of over 50% in 2024, driven by rapid industrialization, increasing vehicle production, and growing demand for fuel-efficient engines across emerging economies

- The region’s expanding automotive manufacturing base, rising disposable incomes, and government incentives for emission reduction technologies are key contributors to market growth

- In addition, advancements in lightweight materials and coating technologies, along with strong presence of major automotive OEMs and suppliers, are accelerating adoption of advanced pistons in both passenger and commercial vehicles

Japan Automotive Piston Market Insight

Japan market is expanding due to a strong focus on automotive innovation and stringent emission regulations. Japanese manufacturers prioritize the development of high-performance pistons with thermal barrier coatings to improve engine efficiency. Growing consumer demand for compact and hybrid vehicles supports steady market growth. Investments in R&D and collaborations with coating technology providers further drive the sector.

China Automotive Piston Market Insight

China automotive piston market held the largest share in Asia-Pacific in 2024, supported by being the world’s largest vehicle producer and consumer. Government policies promoting cleaner engines and electric vehicles are pushing manufacturers to adopt advanced piston materials and coatings. Increasing demand from commercial vehicles and passenger cars fuels market expansion. Chinese suppliers are increasingly focusing on sustainable and high-durability piston components.

Europe Automotive Piston Market Insight

Europe automotive piston market is projected to grow at a significant CAGR, driven by strict emission norms and growing consumer preference for fuel-efficient vehicles. The region’s leadership in automotive technology and emphasis on sustainability promote adoption of thermal barrier coatings and lightweight pistons. High demand from premium vehicle manufacturers and growing focus on hybrid and electric powertrains support market growth.

U.K. Automotive Piston Market Insight

The U.K. market is anticipated to grow steadily during the forecast period, driven by rising investments in automotive manufacturing and adoption of advanced engine components. Increasing production of commercial vehicles and hybrid passenger cars boosts demand for pistons with enhanced coating technologies. Government incentives supporting cleaner vehicles and reduced emissions further stimulate market development.

Germany Automotive Piston Market Insight

The Germany automotive piston market is expected to witness considerable growth, underpinned by the country’s robust automotive industry and technological innovation. German manufacturers focus on high-performance piston solutions to meet stringent environmental regulations and performance standards. The demand for lightweight and durable piston components in luxury and commercial vehicles further strengthens the market outlook.

North America Automotive Piston Market Insight

North America market is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing production of fuel-efficient vehicles and adoption of advanced engine technologies. Rising investments in research for thermal barrier coatings and lightweight materials enhance piston performance. The region’s strong automotive aftermarket and preference for durable, high-performance pistons support rapid market expansion.

U.S. Automotive Piston Market Insight

U.S. automotive piston market captured the largest revenue share in 2024 within North America, supported by high vehicle production volumes and demand for performance-enhancing piston technologies. The rise in electric and hybrid vehicles fuels the adoption of innovative piston materials and coatings. In addition, stringent fuel economy and emission regulations accelerate demand for pistons that improve engine efficiency and durability.

Automotive Piston Market Share

The automotive piston industry is primarily led by well-established companies, including:

- Mahle GmbH (Germany)

- Tenneco Inc. (U.S.)

- Aisin Corporation (Japan)

- Kolbenschmidt Pistons (Germany)

- Shriram Pistons & Rings Limited (Japan)

- Dongsuh Federal-Mogul Co., Ltd. (South Korea)

- NPR RIKEN Corporation (Japan)

- India Pistons Limited (India)

- Hitachi Astemo, Ltd. (Japan)

- HIRSCHVOGEL GROUP (Germany)

What are the Recent Developments in Global Automotive Piston Market?

- In July 2021, Rheinmetall further enhanced its market presence by securing a contract to develop and produce customized LiteKS aluminum pistons for a new four-cylinder petrol engine in the North American market. This development underscored the company's leadership in lightweight piston technology and reinforced its strategic role in meeting the region’s growing demand for fuel-efficient and high-performance engine components

- In April 2021, Rheinmetall Group's subsidiary KS Kolbenschmidt GmbH, together with ZYNP Corporation of China and Riken Corporation of Japan, opened a dedicated tech center in Nanjing, China, aimed at developing advanced steel pistons. This move significantly strengthened the company’s technological capabilities in high-performance piston materials and expanded its influence in the rapidly evolving Asian automotive market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Piston Pin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Piston Pin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Piston Pin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.