Global Automotive Polyurea Greases Market

Market Size in USD Million

CAGR :

%

USD

307.65 Million

USD

595.69 Million

2025

2033

USD

307.65 Million

USD

595.69 Million

2025

2033

| 2026 –2033 | |

| USD 307.65 Million | |

| USD 595.69 Million | |

|

|

|

|

Global Automotive Polyurea Greases Market Size

- The global Automotive Polyurea Greases Market size was valued at USD 307.65 million in 2025 and is expected to reach USD 595.69 million by 2033, registering a CAGR of 8.61% during the forecast period.

- The market growth is primarily driven by the increasing demand for high-performance lubricants in the automotive sector, as manufacturers focus on enhancing vehicle efficiency, durability, and sustainability.

- Additionally, technological advancements in grease formulations, along with the rising production of electric and hybrid vehicles, are fueling the adoption of polyurea greases. These factors collectively strengthen market expansion, positioning polyurea greases as a critical solution for modern automotive applications.

Global Automotive Polyurea Greases Market Analysis

- Automotive polyurea greases, known for their exceptional thermal stability, water resistance, and long-lasting lubrication, are becoming essential components in modern vehicles for applications in wheel bearings, electric motors, and chassis systems, due to their superior performance under extreme operating conditions.

- The growing demand for high-performance lubricants in the automotive sector is primarily driven by the increasing production of electric and hybrid vehicles, the need for extended maintenance intervals, and the rising emphasis on improving energy efficiency and component durability.

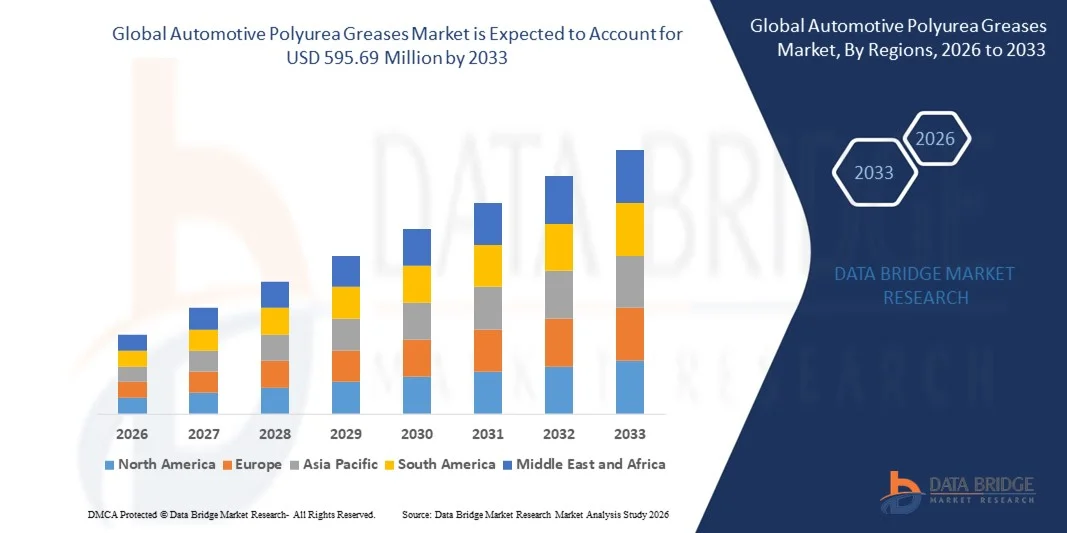

- Asia-Pacific dominated the Global Automotive Polyurea Greases Market with the largest revenue share of 32.2% in 2025, attributed to advanced automotive manufacturing capabilities, strong R&D activities, and the presence of major lubricant producers. The U.S. leads the regional market, supported by growing EV adoption and technological innovations in grease formulations tailored for next-generation vehicles.

- North America is expected to be the fastest-growing region in the Global Automotive Polyurea Greases Market during the forecast period, driven by rapid industrialization, increasing vehicle production in China, India, and Japan, and rising consumer demand for efficient, low-maintenance automotive solutions.

- The Ball Bearings segment dominated the market with the largest revenue share of 42.8% in 2025, driven by the widespread use of ball bearings in automobiles, particularly in wheel hubs, steering systems, and transmission assemblies.

Report Scope and Global Automotive Polyurea Greases Market Segmentation

|

Attributes |

Automotive Polyurea Greases Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Automotive Polyurea Greases Market Trends

Technological Advancements Driving High-Performance Efficiency

- A significant and accelerating trend in the Global Automotive Polyurea Greases Market is the increasing adoption of advanced formulation technologies and automation in grease manufacturing. This technological evolution is enhancing product consistency, temperature resistance, and lubrication efficiency across diverse automotive applications.

- For instance, leading manufacturers such as Shell and Chevron are investing in next-generation additive technologies to develop polyurea greases that offer superior oxidation stability, extended service life, and improved compatibility with modern vehicle components, including electric drivetrains and precision bearings.

- The integration of nanotechnology and performance-enhancing polymers is also transforming grease formulations, enabling reduced friction, lower wear, and enhanced energy efficiency. Some companies are leveraging AI-driven formulation analysis to optimize grease properties based on vehicle type, load conditions, and operating temperatures, ensuring tailored solutions for both conventional and electric vehicles.

- Furthermore, advancements in automated grease application systems and smart monitoring sensors are streamlining maintenance in automotive manufacturing and fleet operations. These technologies enable real-time tracking of lubricant performance, predictive maintenance, and reduced downtime, thereby improving overall operational efficiency.

- This ongoing shift toward technologically advanced, data-optimized, and sustainable grease solutions is reshaping industry standards and customer expectations. Major players such as Fuchs Petrolub SE and Klüber Lubrication are introducing eco-friendly polyurea formulations with enhanced biodegradability and reduced environmental impact.

- The demand for high-performance, technologically advanced polyurea greases is rapidly growing across both OEM and aftermarket segments, as automakers and suppliers increasingly prioritize reliability, energy efficiency, and sustainability in line with global automotive innovation trends.

Global Automotive Polyurea Greases Market Dynamics

Driver

Growing Need Due to Expanding Automotive Production and Technological Advancements

- The rising global automotive production, coupled with the growing shift toward high-performance and energy-efficient lubricants, is a key factor driving the demand for automotive polyurea greases. As vehicles become more advanced, manufacturers are seeking lubricants that can withstand extreme temperatures, heavy loads, and extended maintenance intervals.

- For instance, in March 2025, ExxonMobil Corporation announced advancements in its polyurea grease formulations designed for electric and hybrid vehicles, offering enhanced thermal stability and longer component life. Such product innovations are expected to propel market growth in the forecast period.

- As the automotive industry transitions toward electric and hybrid vehicles, the need for specialized greases that ensure reduced friction, noise control, and energy efficiency is increasing. Polyurea greases, known for their exceptional oxidation stability and water resistance, offer significant advantages over conventional lithium-based greases.

- Furthermore, the growing emphasis on sustainable manufacturing and low-maintenance lubrication solutions is making polyurea greases an essential component in both passenger and commercial vehicles. Their ability to perform reliably in high-speed bearings, motors, and chassis applications is driving adoption across global markets.

- The convenience of extended re-lubrication intervals, compatibility with various automotive components, and the reduction in overall maintenance costs are key factors propelling the market forward. Additionally, the trend toward automated and predictive maintenance systems in modern vehicles supports the increased use of smart lubricant solutions like polyurea greases.

Restraint/Challenge

High Production Costs and Limited Material Availability

- Despite strong demand, high production costs and limited availability of specialized raw materials pose significant challenges to the widespread adoption of polyurea greases. The complex synthesis process and the need for high-quality polyurea thickeners contribute to their higher price compared to conventional greases.

- For instance, fluctuations in the prices of base oils and additives, along with supply chain disruptions, can significantly impact manufacturing costs and profitability for grease producers.

- Addressing these challenges through process optimization, strategic raw material sourcing, and advancements in cost-effective formulations is crucial for market scalability. Leading companies such as Fuchs Petrolub SE and TotalEnergies SE are actively investing in research to develop more sustainable and economical production methods.

- Additionally, the relatively higher price point of polyurea greases compared to lithium-based alternatives can deter adoption in price-sensitive markets, particularly in developing regions. Many small-scale manufacturers and fleet operators still rely on conventional greases due to cost considerations.

- While technological progress and economies of scale are gradually reducing production costs, ensuring affordable availability and consistent supply will be vital for sustaining long-term market growth and ensuring competitiveness across all automotive segments.

Global Automotive Polyurea Greases Market Scope

Automotive polyurea greases market is segmented on the basis of application and end-users.

- By Application

On the basis of application, the Global Automotive Polyurea Greases Market is segmented into Ball Bearings, Sealed-For-Life Bearings, Electric Motor Bearings, and Constant Velocity (CV) Joints. The Ball Bearings segment dominated the market with the largest revenue share of 42.8% in 2025, driven by the widespread use of ball bearings in automobiles, particularly in wheel hubs, steering systems, and transmission assemblies. Polyurea greases are highly preferred in these applications due to their superior thermal stability, resistance to water washout, and long lubrication intervals, which enhance bearing life and reduce maintenance costs.

The Electric Motor Bearings segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rapid growth of electric and hybrid vehicles worldwide. The need for high-performance lubricants that can withstand higher operating temperatures and electrical conductivity challenges is boosting the demand for polyurea greases in electric motor applications.

- By End Users

On the basis of end users, the Global Automotive Polyurea Greases Market is segmented into Automotive, Manufacturing, Construction, Steel, Mining, Agriculture, and Others. The Automotive segment dominated the market with the largest revenue share of 46.3% in 2025, primarily due to the increasing demand for advanced lubrication solutions in modern vehicles, including electric and hybrid models. Automakers are adopting polyurea greases to improve energy efficiency, enhance durability, and reduce maintenance frequency across various vehicle components.

The Manufacturing segment is anticipated to record the fastest CAGR from 2026 to 2033, driven by the growing use of automated machinery and robotics in industrial operations. The superior performance of polyurea greases in high-load, high-temperature environments makes them ideal for extending equipment life and minimizing downtime. This growing industrial automation trend is expected to significantly boost the adoption of polyurea greases in the manufacturing sector during the forecast period.

Global Automotive Polyurea Greases Market Regional Analysis

- Asia-Pacific dominated the Global Automotive Polyurea Greases Market with the largest revenue share of 32.2% in 2025, driven by the strong presence of major automotive manufacturers, increasing adoption of high-performance lubricants, and advanced research and development activities in the region.

- Consumers and industries across North America highly value the durability, thermal stability, and extended service life offered by polyurea greases, making them ideal for a wide range of automotive applications, including bearings, chassis, and electric motor components.

- This widespread adoption is further supported by the rapid growth of electric and hybrid vehicle production, high consumer spending capacity, and stringent regulations promoting energy efficiency and reduced maintenance requirements. These factors collectively position polyurea greases as a preferred lubrication solution for both original equipment manufacturers (OEMs) and the automotive aftermarket across the region.

U.S. Automotive Polyurea Greases Market Insight

The U.S. automotive polyurea greases market captured the largest revenue share of 78% in 2025 within North America, driven by the country’s strong automotive manufacturing base, growing electric vehicle (EV) production, and increasing demand for advanced lubrication solutions. U.S. automakers are focusing on enhancing vehicle durability, performance, and energy efficiency, which is accelerating the adoption of polyurea greases due to their superior oxidation stability and long service life. Additionally, ongoing research and innovation in high-temperature and environmentally friendly grease formulations are further strengthening the market. The robust presence of key players such as ExxonMobil, Chevron, and Valvoline contributes significantly to the U.S. market expansion.

Europe Automotive Polyurea Greases Market Insight

The Europe automotive polyurea greases market is projected to grow at a substantial CAGR during the forecast period, driven by stringent environmental regulations and the region’s strong focus on sustainable automotive technologies. The shift toward electric mobility, coupled with the demand for energy-efficient and long-lasting lubricants, is fostering the adoption of polyurea greases. European consumers and manufacturers emphasize low-maintenance and high-performance solutions, particularly in automotive and industrial sectors. The region is witnessing growing usage in wheel bearings, electric motors, and driveline components, supported by advancements in automotive R&D and government policies promoting eco-friendly lubricants.

U.K. Automotive Polyurea Greases Market Insight

The U.K. automotive polyurea greases market is anticipated to grow at a notable CAGR during the forecast period, propelled by the expanding electric vehicle fleet and the country’s emphasis on sustainability and efficiency in automotive operations. Increasing demand for high-performance lubricants in both passenger and commercial vehicles, along with government initiatives encouraging cleaner technologies, is driving market growth. Furthermore, the rising adoption of automation in manufacturing and maintenance processes is enhancing the use of polyurea greases for their ability to extend service intervals and reduce friction-related energy losses.

Germany Automotive Polyurea Greases Market Insight

The Germany automotive polyurea greases market is expected to expand at a considerable CAGR during the forecast period, supported by the nation’s position as a global hub for automotive engineering and innovation. German automakers’ focus on precision engineering, coupled with their commitment to reducing emissions and improving performance, is boosting the demand for premium lubricants. The integration of polyurea greases in electric drivetrains, bearings, and gear assemblies is rising, driven by their superior thermal stability and long service life. Additionally, Germany’s focus on research, development, and sustainable manufacturing practices continues to promote the growth of advanced grease formulations.

Asia-Pacific Automotive Polyurea Greases Market Insight

The Asia-Pacific automotive polyurea greases market is poised to grow at the fastest CAGR of 22.5% during 2026–2033, fueled by rapid industrialization, expanding automotive production, and increasing adoption of electric and hybrid vehicles in China, Japan, and India. Rising disposable incomes and the growing need for reliable, long-lasting lubricants are accelerating market expansion. Moreover, government initiatives promoting industrial modernization and cleaner manufacturing processes are supporting the transition to high-performance greases. The region’s strong manufacturing capabilities and the presence of major lubricant producers are making Asia-Pacific a vital hub for production and consumption.

Japan Automotive Polyurea Greases Market Insight

The Japan automotive polyurea greases market is gaining traction due to the country’s focus on technological advancement, precision engineering, and energy efficiency. Japanese automakers are integrating polyurea greases in various vehicle components, including electric motors and sealed bearings, to improve performance and reliability. The growing adoption of electric and hybrid vehicles, coupled with Japan’s emphasis on environmentally sustainable manufacturing, is further boosting demand. Moreover, advancements in smart maintenance systems and automated lubrication are driving continuous innovation in grease technology within the country.

China Automotive Polyurea Greases Market Insight

The China automotive polyurea greases market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s booming automotive manufacturing industry, large-scale electric vehicle production, and rising demand for high-performance lubricants. China’s rapid industrial growth and government-backed initiatives to enhance energy efficiency are major drivers of market expansion. The country’s strong domestic base of lubricant manufacturers, coupled with cost-effective production capabilities, is fostering the development of innovative polyurea grease solutions. Increasing focus on sustainability, extended service life, and low maintenance requirements continues to position China as a dominant player in the global automotive polyurea greases market.

Global Automotive Polyurea Greases Market Share

The Automotive Polyurea Greases industry is primarily led by well-established companies, including:

• ExxonMobil Corporation (U.S.)

• Shell plc (U.K.)

• Fuchs Petrolub SE (Germany)

• Chevron Corporation (U.S.)

• TotalEnergies SE (France)

• Klüber Lubrication (Germany)

• Mobil Industrial Lubricants (U.S.)

• Lubrizol Corporation (U.S.)

• BASF SE (Germany)

• CASTROL (U.K.)

• Petro-Canada Lubricants Inc. (Canada)

• Valvoline Inc. (U.S.)

• ENOC (U.A.E)

• Pennzoil (U.S.)

• Aral AG (Germany)

• Havoline (U.S.)

• NP Lubricants (China)

• Toros Lubricants (Turkey)

• Lukoil (Russia)

• Repsol (Spain)

What are the Recent Developments in Global Automotive Polyurea Greases Market?

- In April 2024, ExxonMobil Corporation, a global leader in lubricants and energy solutions, announced the launch of its next-generation Mobil Polyrex™ Ultra series of polyurea greases. These greases are specifically designed for electric and hybrid vehicle components, offering superior oxidation stability, low noise performance, and extended bearing life. This initiative reflects ExxonMobil’s commitment to advancing sustainable lubrication technologies while addressing the evolving needs of the modern automotive industry. The launch further strengthens the company’s global presence in the automotive polyurea greases market.

- In March 2024, Fuchs Petrolub SE introduced its newly developed Renolit PU-Flex line of polyurea greases, engineered for high-speed bearings and long-life automotive applications. The new formulation offers exceptional resistance to thermal degradation and mechanical stress, ensuring reliability under extreme conditions. This product expansion underscores Fuchs’ strategic focus on innovation and its dedication to supporting the automotive sector’s transition toward high-efficiency, low-maintenance lubrication solutions.

- In March 2024, Shell plc announced a major technological partnership with leading EV manufacturers in Europe and Asia to supply specialized polyurea-based greases for electric motor and drivetrain applications. The collaboration aims to optimize lubricant performance in high-voltage systems, ensuring improved thermal control and longer component life. This strategic move demonstrates Shell’s commitment to advancing lubricant technology in alignment with the growing demand for electric mobility solutions worldwide.

- In February 2024, TotalEnergies SE unveiled its EcoGrease PU Series, a new range of environmentally friendly polyurea greases designed for use in both conventional and electric vehicles. These greases are formulated with low-toxicity additives and biodegradable base oils, reflecting TotalEnergies’ dedication to sustainability and circular economy principles. The introduction of this product line positions the company as a key contributor to the development of greener, high-performance lubricants in the global automotive sector.

- In January 2024, Chevron Corporation launched its Delo® Polyurea EP2 Advanced Grease, targeted at heavy-duty automotive and industrial applications. The new grease features improved water resistance, superior load-carrying capacity, and enhanced performance in extreme temperature conditions. Chevron’s new product highlights its ongoing investment in R&D and commitment to delivering innovative lubrication solutions that extend equipment life, reduce downtime, and meet the evolving performance standards of modern automotive systems.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.