Global Automotive Radar Market

Market Size in USD Billion

CAGR :

%

USD

6.10 Billion

USD

25.79 Billion

2024

2032

USD

6.10 Billion

USD

25.79 Billion

2024

2032

| 2025 –2032 | |

| USD 6.10 Billion | |

| USD 25.79 Billion | |

|

|

|

|

Automotive Radar Market Size

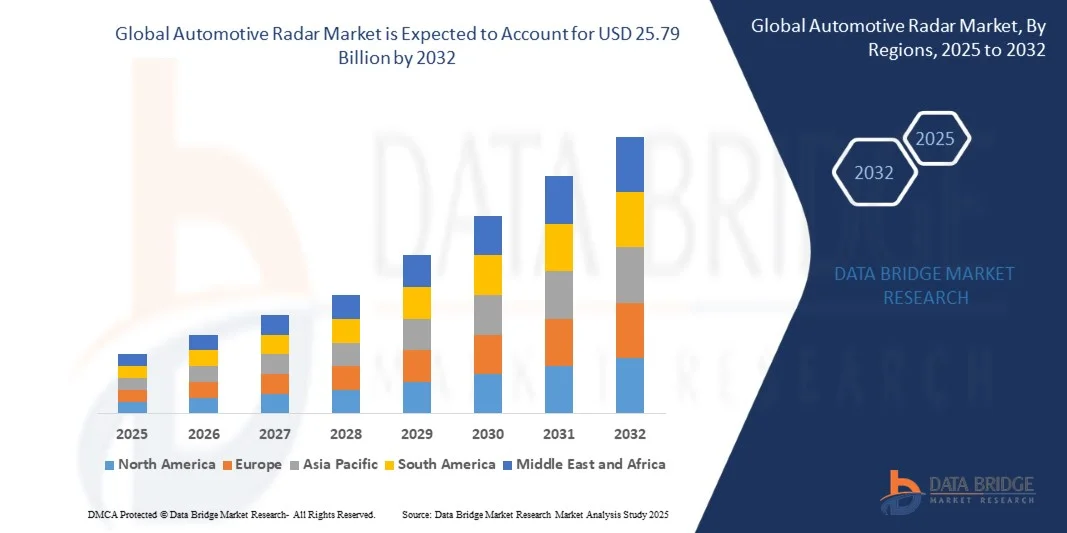

- The global automotive radar market size was valued at USD 6.10 billion in 2024 and is expected to reach USD 25.79 billion by 2032, at a CAGR of 19.75% during the forecast period

- The market growth is largely driven by the increasing integration of advanced driver-assistance systems (ADAS) and autonomous driving technologies in vehicles, supported by stringent safety regulations and growing awareness of road safety across global markets

- Furthermore, rising consumer demand for enhanced driving comfort, accident prevention, and intelligent vehicle functionalities is propelling automakers to adopt radar-based systems. These converging factors are significantly accelerating the deployment of radar sensors in both passenger and commercial vehicles, thereby fueling market expansion

Automotive Radar Market Analysis

- Automotive radar, a key sensing technology used for detecting object distance, speed, and direction, plays a critical role in enabling ADAS functions such as adaptive cruise control, blind spot detection, and autonomous emergency braking. Its reliability under diverse weather and lighting conditions makes it indispensable for vehicle safety and automation

- The growing emphasis on reducing collisions, coupled with rapid advancements in sensor fusion and radar accuracy, is driving the adoption of radar systems across vehicle segments. Increasing electrification, autonomous mobility trends, and regulatory mandates are further strengthening the market outlook for automotive radar globally

- Europe dominated the automotive radar market with a share of 36.52% in 2024, due to stringent vehicle safety regulations, rapid advancements in advanced driver-assistance systems (ADAS), and the strong presence of leading automobile manufacturers

- Asia-Pacific is expected to be the fastest growing region in the automotive radar market during the forecast period due to surging vehicle production, urbanization, and increasing demand for safer and more comfortable driving experiences in China, Japan, and South Korea

- Medium and short-range radar segment dominated the market with a market share of 55.4% in 2024, due to its critical role in close-proximity applications such as blind spot detection, lane change assistance, and cross-traffic alerts. Automakers are increasingly deploying these radars across multiple vehicle points to achieve full 360-degree sensing coverage. Their compact structure, cost-effectiveness, and high integration flexibility make them widely used in both premium and mid-segment vehicles

Report Scope and Automotive Radar Market Segmentation

|

Attributes |

Automotive Radar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Radar Market Trends

“Adoption of 4D Imaging Radar for Advanced Vehicle Perception”

- The automotive radar market is witnessing rapid advancement driven by the adoption of 4D imaging radar technology, which enables superior vehicle perception and environmental mapping. As the automotive industry moves toward fully autonomous systems, radar sensors offering enhanced resolution, depth, and velocity detection are becoming integral to next-generation driver assistance and safety architectures

- For instance, Arbe Robotics Ltd. has developed 4D imaging radar systems designed to generate ultra-high resolution data for real-time object classification and tracking in autonomous driving applications. This innovation reflects the growing emphasis on intelligent sensing platforms that complement camera and LiDAR systems in comprehensive situational awareness

- 4D radar enables vehicles to detect object size, shape, and motion across challenging weather and lighting conditions, outperforming traditional 2D or 3D radar systems in reliability and accuracy. Its advanced signal processing capabilities support features such as adaptive cruise control, blind spot detection, and collision avoidance under complex traffic scenarios

- In addition, integration of AI-driven radar perception algorithms is expanding radar’s role beyond safety systems into predictive control and spatial mapping for autonomous navigation. This convergence of radar imaging with machine learning is transforming how vehicles sense, interpret, and interact with surroundings

- The increasing focus on scalability and compact radar module design is also driving integration into mass-market vehicles, supporting affordable ADAS deployment without compromising detection capability. Industry players are collaborating with chip manufacturers to design cost-effective radar-on-chip solutions with high computational efficiency and minimal power consumption

- As vehicle automation accelerates, 4D imaging radar is emerging as a cornerstone technology enabling accurate environmental reconstruction, enhanced safety, and smoother decision-making in real-time. Its widespread adoption signifies a major leap toward fully autonomous mobility and next-level Automotive perception systems

Automotive Radar Market Dynamics

Driver

“Growing Deployment of ADAS in Mass-Market Vehicles”

- The increasing integration of advanced driver-assistance systems (ADAS) across mass-market vehicles is a key factor driving the automotive radar market. Manufacturers are embedding radar sensors to enable features such as lane-keeping, emergency braking, and adaptive cruise control that are now becoming standard across mid-range vehicle segments

- For instance, Continental AG and Robert Bosch GmbH have expanded their radar system portfolios for ADAS and autonomous applications, focusing on compact sensors that deliver high precision and range adaptability. These developments highlight the scaling of radar technology within mainstream automotive production to meet evolving safety and regulatory standards

- As governments worldwide implement stricter vehicle safety regulations and encourage adoption of collision prevention technologies, radar sensors have become essential for compliance and differentiation. Radar’s ability to function reliably in poor visibility and adverse weather conditions ensures its dominance among sensing technologies in safety-critical applications

- In addition, the transition to electric and connected vehicle platforms has increased the need for multifunctional radar systems that integrate seamlessly with other sensors and vehicle networks. Automakers are leveraging radar fusion with cameras and ultrasonic sensors to enhance detection coverage and overall system intelligence

- The proliferation of ADAS across diverse vehicle classes—from passenger cars to light commercial vehicles—ensures strong market growth for radar sensors globally. As safety technology becomes a fundamental expectation in mass-market models, radar-based ADAS systems will remain a primary enabler of vehicle automation and accident mitigation

Restraint/Challenge

“High Manufacturing and Calibration Costs”

- The high manufacturing and calibration cost associated with automotive radar systems presents a major challenge to market scalability, particularly in cost-sensitive vehicle categories. Production involves sophisticated semiconductor components, high-frequency antennas, and precise sensor alignment that drive up total system costs

- For instance, Valeo SA has indicated that the complexity of millimeter-wave radar calibration and electromagnetic compatibility testing significantly increases production expenses and time-to-market. These challenges often limit affordability and hinder widespread adoption in economy and mid-range vehicles

- Achieving optimal radar performance requires extensive calibration to minimize interference and ensure accurate detection across multiple vehicle sensor systems. The technical effort and equipment involved in this process contribute to increased overall assembly and maintenance costs for both automakers and tier-one suppliers

- In addition, sourcing high-performance semiconductor materials and achieving quality consistency for radar transceivers and signal processors remain expensive due to limited supplier availability. Small manufacturers face difficulties managing these expenses while adhering to regional automotive certification standards

- To mitigate these constraints, companies are investing in radar-on-chip architectures, automated calibration tools, and miniaturized antenna designs to reduce precision-related overheads. As economies of scale improve and production methods advance, radar system costs are expected to decline, facilitating broader integration of high-performance radar technologies in future vehicle generations

Automotive Radar Market Scope

The market is segmented on the basis of range, frequency, engine type, vehicle type, and application.

- By Range

On the basis of range, the automotive radar market is segmented into long-range radar and medium & short-range radar. The medium & short-range radar segment dominated the market in 2024, accounting for the largest revenue share of 55.4% due to its critical role in close-proximity applications such as blind spot detection, lane change assistance, and cross-traffic alerts. Automakers are increasingly deploying these radars across multiple vehicle points to achieve full 360-degree sensing coverage. Their compact structure, cost-effectiveness, and high integration flexibility make them widely used in both premium and mid-segment vehicles.

The long-range radar segment is projected to record the fastest growth from 2025 to 2032, propelled by increasing demand for advanced driver assistance features such as adaptive cruise control and highway autopilot. These radars enable precise object detection up to 250 meters, which is essential for safe high-speed autonomous driving. Growing development of long-range radar systems with enhanced accuracy and performance is further boosting their adoption across new-generation vehicles.

- By Frequency

On the basis of frequency, the market is categorized into 2X-GHz and 7X-GHz. The 7X-GHz segment held the largest market share in 2024, driven by its superior range resolution, reduced interference, and smaller antenna size. This frequency range is highly preferred for short- and mid-range applications, ensuring compact integration into vehicle architectures. Its ability to support multiple radar sensors within one system has made it a standard choice for passenger vehicles aiming for higher precision and safety.

The 2X-GHz segment is expected to witness the fastest growth rate from 2025 to 2032, supported by demand from cost-sensitive markets and older vehicle platforms. These systems, though offering lower resolution, remain highly economical for essential functions such as rear parking assistance and basic collision alerts. Continued usage in emerging economies is expected to sustain the demand for 2X-GHz radar technology throughout the forecast period.

- By Engine Type

On the basis of engine type, the market is segmented into internal combustion engine (ICE) and electric. The ICE segment led the market in 2024 due to the large operational fleet and ongoing production of traditional fuel-powered vehicles, especially across developing regions. OEMs continue integrating radar-based safety systems into ICE models to enhance vehicle safety and meet global regulatory requirements. This segment remains vital as many regions transition gradually toward electric mobility.

The electric segment is anticipated to register the fastest growth from 2025 to 2032, driven by rising EV adoption and the suitability of radar technology for sensor-rich architectures. EV manufacturers increasingly integrate radar systems for enhanced automation features, including autonomous emergency braking and self-parking. The growing shift toward connected and intelligent EV platforms is expected to accelerate radar deployment across upcoming electric vehicle models.

- By Vehicle Type

On the basis of vehicle type, the automotive radar market is divided into passenger cars and commercial vehicles. The passenger car segment dominated in 2024, capturing the largest revenue share due to high production volumes and rapid adoption of ADAS features in mainstream vehicles. Growing consumer demand for safer and more convenient driving experiences is prompting manufacturers to incorporate radar technology across a wider range of models.

The commercial vehicle segment is expected to grow at the fastest pace from 2025 to 2032, supported by the rising focus on driver assistance and safety technologies for heavy-duty fleets. Radar-based solutions are increasingly used in trucks, buses, and delivery vans to enhance road safety and minimize collision risks. These systems enable adaptive cruise control, blind spot monitoring, and forward collision alerts, helping fleet operators boost productivity and reduce accident-related costs.

- By Application

On the basis of application, the market is segmented into adaptive cruise control (ACC), autonomous emergency braking (AEB), blind spot detection (BSD), forward collision warning system, intelligent park assist, and other advanced driver-assistance systems (ADAS). The adaptive cruise control segment led the market in 2024, driven by growing consumer interest in semi-autonomous driving functions that offer improved comfort and safety. Increasing adoption of ACC in premium and mid-segment vehicles across North America and Europe has further supported market dominance.

The autonomous emergency braking segment is expected to witness the highest growth from 2025 to 2032, fueled by stringent safety mandates and regulatory requirements across major markets. Governments are increasingly making AEB a mandatory feature in new vehicles, driving radar demand for obstacle detection and collision prevention. In addition, applications such as BSD and intelligent park assist are expanding due to higher traffic congestion and consumer preference for driver-assist features.

Automotive Radar Market Regional Analysis

- Europe dominated the automotive radar market with the largest revenue share of 36.52% in 2024, driven by stringent vehicle safety regulations, rapid advancements in advanced driver-assistance systems (ADAS), and the strong presence of leading automobile manufacturers

- The region’s focus on reducing road accidents and improving vehicle safety has resulted in the widespread adoption of radar-based technologies across passenger and commercial vehicles

- Furthermore, continued investments in electric mobility and autonomous driving development are accelerating radar sensor demand, especially in countries such as Germany and the U.K.

Germany Automotive Radar Market Insight

The Germany automotive radar market accounted for the largest revenue share in Europe in 2024, supported by a mature automotive industry and strong R&D infrastructure. German automakers are increasingly incorporating radar-based ADAS technologies such as adaptive cruise control and blind spot detection to align with consumer expectations and evolving safety norms. The country’s growing focus on autonomous and connected vehicles is also propelling the integration of radar systems across multiple vehicle categories.

U.K. Automotive Radar Market Insight

The U.K. automotive radar market is projected to register the fastest growth from 2025 to 2032, driven by government-led safety mandates and rising consumer demand for advanced driving technologies. Local manufacturers are integrating radar sensors in both premium and budget vehicles to enhance safety and driver convenience. In addition, active initiatives in autonomous vehicle trials and intelligent traffic management are strengthening the country’s adoption of radar-based systems.

North America Automotive Radar Market Insight

The North America automotive radar market is projected to grow rapidly from 2025 to 2032, supported by heightened awareness of road safety, growing adoption of electric and autonomous vehicles, and the presence of major technology innovators. Automakers are increasingly equipping vehicles with radar-based ADAS to comply with safety regulations and fulfill consumer expectations for convenience and protection. The region also benefits from substantial investments in R&D and pilot programs related to autonomous vehicle technologies.

U.S. Automotive Radar Market Insight

The U.S. automotive radar market dominated North America in 2024, driven by high demand for driver-assistance technologies and growing consumer inclination toward tech-integrated vehicles. Regulatory frameworks such as the New Car Assessment Program (NCAP) are pushing manufacturers to adopt radar-based safety systems. Moreover, the U.S. leadership in autonomous vehicle testing and smart mobility infrastructure continues to enhance the adoption of advanced radar solutions across the automotive sector.

Asia-Pacific Automotive Radar Market Insight

The Asia-Pacific automotive radar market is expected to record the fastest growth rate from 2025 to 2032, driven by surging vehicle production, urbanization, and increasing demand for safer and more comfortable driving experiences in China, Japan, and South Korea. Supportive government policies promoting ADAS integration and road safety are fostering market expansion. Moreover, the availability of cost-efficient component manufacturers and growing adoption of electric and autonomous vehicles are amplifying radar deployment across the region.

China Automotive Radar Market Insight

The China automotive radar market held the largest revenue share in Asia-Pacific in 2024, propelled by the country’s rapidly growing electric vehicle market and government initiatives promoting intelligent transport systems. Domestic automakers are accelerating radar-based ADAS integration to meet regulatory standards and consumer safety expectations. China’s commitment to smart city projects and autonomous mobility development is further stimulating the adoption of radar technologies in both urban and intercity applications.

Japan Automotive Radar Market Insight

The Japan automotive radar market is expected to achieve the fastest growth from 2025 to 2032, driven by the nation’s strong innovation ecosystem and emphasis on safety and automation. Japanese automakers are pioneers in adopting radar-enabled ADAS across vehicle categories, from compact models to high-end cars. National programs aimed at achieving zero-accident transportation and advancing automated driving are propelling demand for high-frequency radar modules within the country’s automotive industry.

Automotive Radar Market Share

The automotive radar industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Valeo (France)

- ZF Friedrichshafen AG (Germany)

- HELLA GmbH & Co. KGaA (Germany)

- Autoliv Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors (Netherlands)

Latest Developments in Global Automotive Radar Market

- In September 2023, Mercedes-Benz launched its Drive Pilot system in the U.S. market, marking a major advancement in Level 3 autonomous driving technology. The system integrates cutting-edge safety components such as LiDAR, a rear camera, road wetness sensors, and microphones to detect emergency vehicles. This introduction significantly strengthens Mercedes-Benz’s position in next-generation mobility, enhancing consumer confidence in autonomous driving. The development is expected to accelerate market growth by setting new benchmarks for vehicle autonomy and safety integration in premium automotive segments

- In January 2023, Continental entered into a strategic partnership with Ambarella, Inc. to jointly develop scalable, AI-driven software and hardware solutions for automated driving. The collaboration focuses on high-performance edge AI systems capable of improving real-time decision-making and situational awareness in autonomous vehicles. This partnership reinforces Continental’s technological leadership in the ADAS and autonomous radar markets, promoting faster adoption of intelligent driving systems and expanding opportunities for AI-powered automotive innovation

- In October 2022, Veoneer partnered with Arbe to co-develop advanced automotive radar systems designed for high reliability, modularity, and cost efficiency. These radar sensors enhance redundancy and data accuracy, which are crucial for safety and autonomous driving applications. The collaboration strengthens Veoneer’s radar product portfolio and supports the industry’s transition toward safer, more intelligent driving technologies, boosting demand for radar-based ADAS solutions across vehicle categories

- In August 2022, Renesas Electronics announced the acquisition of Steradian Semiconductors Pvt. Ltd., a move aimed at expanding its radar technology portfolio and enhancing its sensor solution capabilities. The acquisition allows Renesas to strengthen its market presence in both automotive and industrial radar systems, facilitating the development of compact, high-performance radar solutions. This strategic move positions Renesas as a key player in meeting the growing global demand for radar-integrated ADAS and autonomous driving systems

- In July 2022, Bosch formed a partnership with Swedish technology company Gapwaves to develop high-definition radar antennas for automotive applications. Bosch contributes its radar sensor and autonomous driving expertise, while Gapwaves provides advanced antenna design knowledge. This collaboration enhances Bosch’s radar capabilities, enabling the creation of next-generation radar sensors with improved precision and performance. The partnership is expected to drive innovation in radar hardware, reinforcing Bosch’s competitive edge in the global automotive radar market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.