Global Automotive Retread Tires Market

Market Size in USD Billion

CAGR :

%

USD

47.26 Billion

USD

61.75 Billion

2024

2032

USD

47.26 Billion

USD

61.75 Billion

2024

2032

| 2025 –2032 | |

| USD 47.26 Billion | |

| USD 61.75 Billion | |

|

|

|

|

Global Automotive Retread Tires Market Size

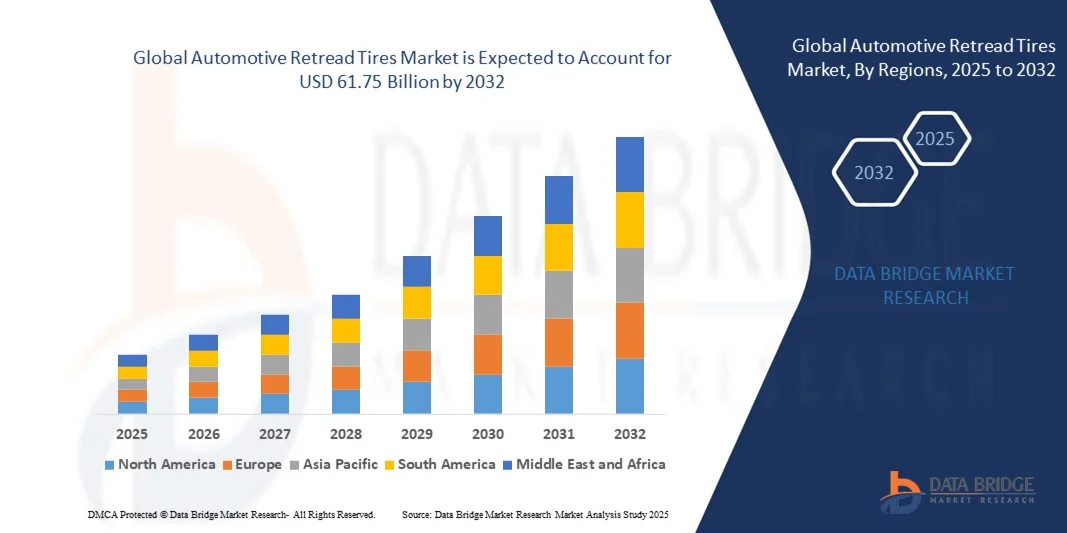

- The global Automotive Retread Tires Market size was valued at USD 47.26 billion in 2024 and is projected to reach USD 61.75 billion by 2032, growing at a CAGR of 3.40% during the forecast period.

- Market expansion is primarily driven by the increasing emphasis on sustainability, cost-efficiency, and eco-friendly practices across the transportation and logistics sectors, prompting a shift toward retreaded tire solutions.

- Additionally, advancements in retreading technologies and enhanced tire performance standards are encouraging widespread adoption among commercial fleet operators, accelerating demand and supporting robust industry growth.

Global Automotive Retread Tires Market Analysis

- Automotive retread tires, which involve the process of replacing the tread on worn tires to extend their usability, are becoming increasingly essential in commercial and industrial applications due to their cost-effectiveness, environmental benefits, and reliable performance in demanding conditions.

- The growing demand for automotive retread tires is primarily driven by the expansion of commercial transportation fleets, rising awareness about sustainable tire solutions, and the increasing cost of new tires.

- Asia-Pacific dominated the Global Automotive Retread Tires Market with the largest revenue share of 32.8% in 2024, attributed to the region's well-established logistics industry, stringent regulations promoting recycling, and the presence of major retread tire manufacturers and suppliers focused on technological advancements in retreading processes.

- Europe is expected to be the fastest growing region in the Global Automotive Retread Tires Market during the forecast period due to rapid industrialization, urbanization, and increasing demand for commercial vehicles across emerging economies.

- The pre-cure segment dominated the market with the largest revenue share of 55.4% in 2024, driven by its cost-effectiveness, faster turnaround times, and widespread use among commercial fleets.

Report Scope and Global Automotive Retread Tires Market Segmentation

|

Attributes |

Automotive Retread Tires Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Automotive Retread Tires Market Trends

Technological Advancements Driving Efficiency and Sustainability

- A significant and accelerating trend in the Global Automotive Retread Tires Market is the integration of advanced retreading technologies and automation, enhancing the precision, durability, and sustainability of retreaded tires across various vehicle segments. This shift is revolutionizing tire lifecycle management, especially in the commercial transportation sector.

- For instance, leading players such as Bridgestone and Michelin have developed proprietary retreading systems such as Bandag and Recamic, which utilize automated inspection, buffing, and curing processes to ensure consistent tread quality and performance, significantly reducing the rate of retread failure.

- The use of smart sensors and data analytics in retreading operations is also gaining traction. These technologies enable real-time monitoring of tire wear, pressure, and temperature, allowing fleet managers to identify optimal retreading intervals and extend overall tire life while minimizing operational downtime.

- Moreover, advancements in eco-friendly materials such as low-rolling-resistance compounds and recycled rubber blends are being integrated into retread tires, aligning with global sustainability goals and helping fleets lower their carbon footprint without compromising performance.

- This push for innovation is prompting manufacturers to invest in AI-powered inspection tools and automated tread application systems, improving quality control and reducing human error in the retreading process. Companies such as Goodyear are actively exploring automation and machine learning to streamline retread production and enhance tire reliability.

- As fleet operators and governments worldwide increase their focus on environmental regulations and cost-effective solutions, the demand for technologically advanced, eco-conscious retread tires is rapidly rising. This trend is expected to further accelerate the adoption of modern retreading solutions across logistics, public transport, and industrial sectors.

Global Automotive Retread Tires Market Dynamics

Driver

Growing Need Due to Rising Environmental Concerns and Cost Efficiency

-

The increasing focus on environmental sustainability, along with the need to reduce operational costs, is a significant driver for the growing demand for automotive retread tires. Fleet operators and commercial transport companies are increasingly adopting retread tires as a cost-effective and eco-friendly alternative to new tires.

- For instance, in 2024, leading tire manufacturers like Michelin and Bridgestone launched initiatives promoting the use of retread tires to reduce tire waste and carbon emissions, encouraging fleets to embrace sustainable tire management practices. Such efforts by key companies are expected to drive market growth during the forecast period.

- As regulatory bodies worldwide tighten environmental regulations and promote circular economy principles, retread tires offer an effective solution by extending tire life and reducing landfill waste, appealing to environmentally conscious businesses.

- Furthermore, the rising fuel efficiency standards and the growing adoption of electric commercial vehicles are increasing the demand for retread tires designed to meet specific performance criteria, further integrating retreads into modern transportation fleets.

- The cost savings from using retread tires—typically 30-50% cheaper than new tires—combined with advances in retreading technology that improve durability and safety, are key factors propelling adoption in both developed and emerging markets. Additionally, increasing awareness and training programs for fleet managers on the benefits and proper use of retread tires are helping to boost market penetration.

Restraint/Challenge

Concerns Regarding Performance Perception and Initial Investment

- Concerns about the performance and safety of retread tires compared to new tires pose a notable challenge to broader market acceptance. Some fleet operators and end-users remain hesitant due to misconceptions regarding retread reliability and durability.

- For instance, despite technological advancements, occasional reports of retread tire failures have made some operators cautious, affecting confidence in retread products.

- Addressing these concerns through stringent quality standards, certifications, and educating customers on modern retreading processes is crucial for increasing market trust. Companies such as Goodyear and Continental emphasize their rigorous testing and warranty programs to reassure buyers. Additionally, the upfront investment required for advanced retreading equipment and training can be a barrier for smaller operators or emerging markets, limiting adoption.

- Although retreading offers long-term cost savings, the initial costs associated with setting up or contracting high-quality retreading services may deter some potential users, especially in price-sensitive regions.

- Overcoming these challenges through enhanced industry standards, consumer education on the benefits and safety of retread tires, and the development of cost-effective retreading solutions will be vital for sustained market growth.

Global Automotive Retread Tires Market Scope

Automotive retread tires market is segmented on the basis of process, sales channel, tire position, production method and vehicle type.

- By Process Type

On the basis of process type, the Global Automotive Retread Tires Market is segmented into pre-cure and mold cure. The pre-cure segment dominated the market with the largest revenue share of 55.4% in 2024, driven by its cost-effectiveness, faster turnaround times, and widespread use among commercial fleets. Pre-cure retreading involves applying a pre-vulcanized tread to the buffed tire casing, making it a preferred choice for operators seeking affordable and reliable retread solutions. This process is especially popular in regions with high demand for quick tire replacements to minimize vehicle downtime.

The mold cure segment is expected to witness the fastest CAGR from 2025 to 2032, attributed to its superior tread bonding and longer lifespan compared to pre-cure methods. Mold cure retreading allows for customized tread patterns and better performance under heavy-duty conditions, making it attractive for heavy trucks and specialized applications where tire durability is critical.

- By Sales Channel

On the basis of sales channel, the Global Automotive Retread Tires Market is segmented into OEM (Original Equipment Manufacturer) and aftermarket. The aftermarket segment accounted for the largest market revenue share of 62.7% in 2024, fueled by the rising demand for tire replacements and retreading services across commercial fleets and independent vehicle operators. Aftermarket sales provide flexibility and cost savings, allowing fleet managers to optimize tire life cycles without investing in new tires.

The OEM segment is projected to register the fastest CAGR from 2025 to 2032 due to increasing collaborations between tire manufacturers and vehicle makers. OEMs are incorporating retread tires as part of vehicle maintenance packages, especially in commercial transport sectors focused on sustainability and operational efficiency. The OEM channel is gaining traction as manufacturers emphasize environmental regulations and promote retread adoption as a green alternative.

- By Tire Position

On the basis of tire position, the Global Automotive Retread Tires Market is segmented into drive axle and trailer axle. The drive axle segment dominated the market with a revenue share of 58.9% in 2024, primarily due to the higher load and wear experienced on drive tires, necessitating frequent replacement and retreading. Drive axle tires require enhanced durability and performance, making retreading a cost-effective solution to extend tire life while maintaining safety standards.

The trailer axle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of retread tires for trailer fleets in logistics and freight industries. The lower operational stress on trailer tires compared to drive tires allows for effective use of retreads, contributing to cost savings and sustainability goals across commercial transport operations.

- By Production Method

On the basis of production method, the Global Automotive Retread Tires Market is segmented into pre-cure and mold cure. The pre-cure method held the largest market revenue share of 55.4% in 2024, favored for its efficiency, lower production costs, and scalability in mass retreading operations. Pre-cure retreading involves applying a pre-vulcanized tread to a prepared tire casing, allowing quicker production cycles ideal for commercial fleets with high tire replacement frequency.

The mold cure method is anticipated to experience the fastest CAGR from 2025 to 2032, attributed to its ability to provide superior tread adhesion, enhanced performance, and custom tread designs. Mold cure retreading is preferred in high-demand applications such as heavy trucks and off-road vehicles where longer tire life and durability are critical factors.

- By Vehicle Type

On the basis of vehicle type, the Global Automotive Retread Tires Market is segmented into passenger cars, light commercial vehicles, heavy trucks & buses, off-road vehicles, and commercial aircraft. The heavy trucks & buses segment dominated the market with the largest revenue share of 47.8% in 2024, driven by the high volume of long-haul transportation and logistics operations requiring durable and cost-effective tire solutions. Retread tires help fleet operators significantly reduce operating costs while complying with stringent safety and environmental regulations.

The passenger cars segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing awareness among individual consumers about sustainability and tire maintenance costs. The growth of ride-sharing services and urban mobility solutions is also contributing to higher demand for retread tires in this segment, as fleet operators seek affordable tire management options.

Global Automotive Retread Tires Market Regional Analysis

- Asia-Pacific dominated the Global Automotive Retread Tires Market with the largest revenue share of 32.8% in 2024, driven by the presence of well-established commercial transportation networks and a strong focus on sustainability and cost-efficiency in fleet management.

- Fleet operators in the region prioritize retread tires due to their ability to reduce operational expenses and environmental impact, supported by stringent regulations promoting tire recycling and reuse.

- The market growth is further fueled by advanced retreading technologies, extensive infrastructure for tire maintenance, and high awareness among logistics and public transportation sectors, making North America a key hub for automotive retread tire adoption.

U.S. Automotive Retread Tires Market Insight

The U.S. automotive retread tires market captured the largest revenue share of 81% in North America in 2024, driven by the extensive commercial transportation and logistics sectors emphasizing cost savings and sustainability. Fleet operators increasingly prioritize retread tires for their ability to reduce operational costs while meeting stringent environmental regulations. The presence of advanced retreading facilities and widespread industry awareness further propel market growth. Additionally, government incentives promoting tire recycling and extended tire life encourage greater adoption of retread tires across freight, public transit, and delivery services.

Europe Automotive Retread Tires Market Insight

The Europe automotive retread tires market is projected to expand at a substantial CAGR during the forecast period, fueled by strict environmental policies and rising fuel efficiency standards. Growing urbanization and increasing demand for sustainable transport solutions are fostering the uptake of retread tires across commercial fleets and public transport systems. European operators are focusing on reducing tire waste and carbon emissions, which, combined with technological advancements in retreading processes, is driving market growth across passenger and commercial vehicle segments.

U.K. Automotive Retread Tires Market Insight

The U.K. automotive retread tires market is expected to grow at a notable CAGR during the forecast period, supported by the country’s push towards greener transportation and cost-efficient fleet operations. The growing emphasis on reducing landfill waste and the increasing cost pressures on logistics and commercial fleets are driving retread adoption. Moreover, the U.K.’s strong automotive manufacturing base and increasing investment in retreading infrastructure contribute to expanding market penetration.

Germany Automotive Retread Tires Market Insight

The Germany automotive retread tires market is anticipated to witness considerable growth during the forecast period, driven by the nation’s rigorous environmental regulations and commitment to sustainable manufacturing. Germany’s advanced automotive sector and high demand for eco-friendly commercial transport solutions fuel the retread tire market. Integration of smart tire management systems and innovation in retread materials and processes also promote adoption in both industrial and commercial fleets.

Asia-Pacific Automotive Retread Tires Market Insight

The Asia-Pacific automotive retread tires market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rapid urbanization, rising vehicle ownership, and increasing demand for cost-effective tire solutions. Countries such as China, India, and Japan are witnessing significant growth in logistics and public transportation, creating strong demand for retread tires. Government initiatives supporting circular economy practices and tire recycling programs further boost market expansion. The region’s manufacturing capabilities also contribute to making retread tires more affordable and accessible to a broader consumer base.

Japan Automotive Retread Tires Market Insight

The Japan automotive retread tires market is gaining momentum due to the country’s advanced automotive technology, high vehicle utilization rates, and emphasis on environmental sustainability. The demand for durable, fuel-efficient retread tires is rising among commercial fleet operators and public transit agencies. Japan’s focus on innovation and integration of smart tire monitoring systems enhances retread tire performance and market adoption. Additionally, government policies encouraging sustainable vehicle maintenance practices support growth.

China Automotive Retread Tires Market Insight

The China automotive retread tires market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid industrialization, expanding logistics networks, and increasing focus on cost-efficient fleet operations. The growing middle class and urbanization fuel demand for commercial transport, while government regulations promote retreading as part of tire waste reduction strategies. Strong domestic manufacturing capabilities and the presence of major retread tire companies further bolster market growth across passenger and commercial vehicle segments.

Global Automotive Retread Tires Market Share

The Automotive Retread Tires industry is primarily led by well-established companies, including:

• Bridgestone Corporation (Japan)

• Michelin (France)

• Continental AG (Germany)

• Goodyear Tire and Rubber Company (U.S.)

• Sumitomo Rubber Industries (Japan)

• Hankook (South Korea)

• Pirelli (Italy)

• Yokohama Rubber Company (Japan)

• Toyo Tires (Japan)

• Giti Tire (Singapore)

• Maxxis (Taiwan)

• ZC Rubber (China)

• MRF Tires (India)

• Apollo Tyres (India)

What are the Recent Developments in Global Automotive Retread Tires Market?

- In April 2023, Bridgestone Corporation, a global leader in tire manufacturing, announced the launch of a new advanced retreading technology in South Africa aimed at enhancing the durability and performance of commercial vehicle tires. This initiative reflects Bridgestone’s commitment to delivering sustainable and cost-effective tire solutions tailored to the specific needs of the regional transport industry. By leveraging its global expertise and innovative retreading processes, Bridgestone is strengthening its position in the rapidly expanding global Automotive Retread Tires Market.

- In March 2023, Michelin introduced a next-generation retread tire specifically designed for heavy-duty trucks and buses in North America. The new product offers improved fuel efficiency and extended tire life, supporting fleet operators in reducing operational costs while minimizing environmental impact. This development highlights Michelin’s dedication to innovation and sustainability, ensuring safer and more economical tire solutions for commercial transport.

- In March 2023, Continental AG successfully implemented a large-scale retread tire program for public transportation fleets in Bengaluru, India. The project, focused on improving urban transit efficiency and safety, underscores Continental’s commitment to smart tire management and sustainability. This initiative demonstrates the growing role of retread technologies in developing safer, greener, and more cost-effective transportation infrastructure.

- In February 2023, Goodyear Tire and Rubber Company announced a strategic partnership with major logistics companies in Europe to expand its retread tire services and products. This collaboration aims to enhance fleet efficiency and reduce tire waste through innovative retreading solutions, providing economic and environmental benefits for commercial transport operators. The partnership reinforces Goodyear’s leadership in driving growth and innovation within the automotive retread tires sector.

- In January 2023, Sumitomo Rubber Industries unveiled its latest mold cure retread tire at the Tokyo International Motor Show, featuring advanced rubber compounds for improved tread life and performance. Designed for passenger cars and light commercial vehicles, the new retread tire highlights Sumitomo’s focus on sustainable product development and technological advancement. The launch reinforces the company’s commitment to meeting evolving market demands while promoting tire recycling and environmental stewardship.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.