Global Automotive Rubber Seals Market

Market Size in USD Billion

CAGR :

%

USD

8.57 Billion

USD

11.67 Billion

2025

2033

USD

8.57 Billion

USD

11.67 Billion

2025

2033

| 2026 –2033 | |

| USD 8.57 Billion | |

| USD 11.67 Billion | |

|

|

|

|

Automotive Rubber Seals Market Size

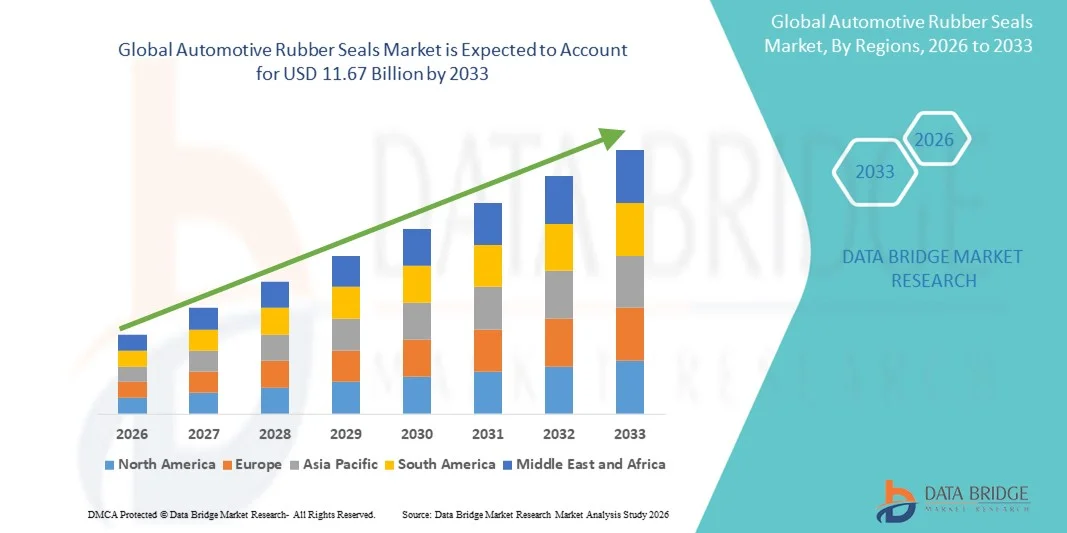

- The global automotive rubber seals market size was valued at USD 8.57 billion in 2025 and is expected to reach USD 11.67 billion by 2033, at a CAGR of 3.93% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced sealing solutions across automotive applications such as doors, windows, engines, and chassis components

- Increasing vehicle production, particularly in emerging economies, is further strengthening market expansion by supporting continuous demand for reliable and durable sealing systems

Automotive Rubber Seals Market Analysis

- The market is witnessing steady growth due to the increasing adoption of high-performance rubber materials designed to enhance vehicle efficiency, reduce noise, and improve protection against dust, moisture, and vibration

- In addition, manufacturers are investing in innovative manufacturing technologies such as precision molding and advanced elastomer formulations to meet rising quality requirements from OEMs and regulatory bodies

- North America dominated the automotive rubber seals market with the largest revenue share in 2025, driven by high vehicle production, growing demand for durable sealing solutions, and increasing adoption of premium vehicle models

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive rubber seals market, driven by increasing vehicle production, rapid urbanization, rising disposable incomes, and growing demand for electric and hybrid vehicles

- The door seals segment held the largest market revenue share in 2025, driven by the need for enhanced cabin insulation, NVH (Noise, Vibration, and Harshness) reduction, and improved water and dust resistance. Door seals are critical in ensuring passenger comfort, protecting internal components, and supporting vehicle safety across various climatic conditions

Report Scope and Automotive Rubber Seals Market Segmentation

|

Attributes |

Automotive Rubber Seals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Rubber Seals Market Trends

Rise of Advanced Material Integration In Automotive Rubber Seals

- The growing adoption of advanced elastomers and composite rubber materials is transforming the automotive rubber seals landscape by improving durability, heat resistance, and vibration control. These materials ensure stable performance under extreme conditions, which enhances vehicle reliability over long operational cycles. As a result, manufacturers are prioritizing material upgrades to meet evolving automotive engineering standards

- The rising demand for lightweight materials in vehicle manufacturing is accelerating the integration of high-performance rubber compounds. These compounds help reduce overall vehicle weight while improving sealing efficiency and structural integrity across key systems. The trend aligns with automakers’ goals of achieving better fuel economy and complying with stringent global emission norms

- The increasing use of specialized rubber seals in modern vehicle architectures is supporting broader adoption across conventional, hybrid, and electric vehicles. These multifunctional seals offer enhanced protection for electronic components, battery housings, and thermal management systems. Their versatility enables automakers to optimize long-term performance in diverse vehicle platforms

- For instance, in 2023, several automotive manufacturers in Europe reported notable improvements in NVH (Noise, Vibration, and Harshness) control after adopting next-generation EPDM and silicone-based sealing systems in high-temperature engine applications. These systems helped reduce cabin vibration levels while maintaining optimal sealing performance. Such advancements are now being explored for next-generation EV platforms

- While advanced material adoption is improving sealing efficiency, long-term success depends on robust R&D, cost-effective manufacturing, and compatibility with next-generation vehicle platforms. Manufacturers must also address environmental sustainability by integrating recyclable materials and greener production processes. Continuous innovation will remain essential for meeting tightening regulatory and performance requirements

Automotive Rubber Seals Market Dynamics

Driver

Growing Vehicle Production and Increasing Demand For High-Performance Sealing Solutions

- The continuous rise in global vehicle production is driving the demand for durable, weather-resistant, and high-performance rubber sealing systems. These seals play a critical role in protecting vehicle interiors from environmental impacts such as dust, moisture, and temperature variations. Their contribution to improving vehicle safety and minimizing component wear is expanding their importance across automotive applications

- Increasing consumer awareness about vehicle quality, cabin insulation, and long-term reliability is encouraging automakers to integrate premium sealing materials. High-efficiency sealing systems significantly reduce external noise, enhance climate control, and improve overall cabin comfort. As buyers prioritize comfort and refinement, sealing quality has become a key differentiator in new vehicle models

- OEMs and Tier-1 suppliers are investing heavily in the development of advanced sealing technologies to comply with stringent safety and emission norms. Innovations in elastomers, precision molding, and material engineering are enabling seals to withstand greater mechanical stress and environmental exposure. This technological progress supports fleet durability and performance across global markets

- For instance, in 2022, several automakers in the U.S. upgraded their door and window sealing architectures to meet enhanced safety regulations and energy-efficiency standards, boosting demand for advanced rubber seals. These upgrades were also aimed at improving EV performance, where airtight sealing helps regulate battery temperatures. The development aligns with broader sustainability and efficiency initiatives in the industry

- While rising vehicle manufacturing is accelerating market growth, continued investment in material innovations, testing standards, and sustainability practices is crucial to support long-term market expansion. Companies must address performance consistency, cost competitiveness, and compliance with evolving regional regulations. This will ensure reliable adoption across all vehicle categories

Restraint/Challenge

Volatile Raw Material Prices and High Manufacturing Costs

- The fluctuating prices of key raw materials such as synthetic rubber, natural rubber, and specialized elastomers pose significant challenges for manufacturers. Variability in global supply chains and commodity markets directly affects production planning and pricing stability. This volatility makes it difficult for producers to maintain consistent margins, particularly in highly competitive markets

- The manufacturing of high-precision automotive rubber seals requires sophisticated machinery, skilled labor, and rigorous quality-control systems. Many developing regions lack access to advanced production infrastructure, limiting their ability to meet OEM performance and certification requirements. This constraint restricts market expansion and increases reliance on established suppliers

- Supply chain disruptions, logistics constraints, and dependence on imported raw materials further complicate market operations, especially for small and mid-sized suppliers. Transportation delays, geopolitical tensions, and global shortages often affect material availability and lead times. These issues can result in inconsistent supply delivery to OEMs and reduced production efficiency

- For instance, in 2023, several Asian suppliers reported difficulties in managing production timelines due to rising rubber prices and transportation constraints, adversely impacting supply availability for OEMs. This led to increased procurement costs and operational delays for automotive manufacturers. Many suppliers had to revise contracts and adjust sourcing strategies to mitigate risks

- While technological advancements are helping optimize production, addressing cost instability, strengthening supply chain resilience, and enhancing material sourcing strategies remain essential for long-term market stability. Manufacturers must also explore alternative elastomers and recycling methods to reduce raw material dependency. These efforts will play a key role in maintaining competitiveness globally

Automotive Rubber Seals Market Scope

The automotive rubber seals market is segmented on the basis of component, material, and vehicle type.

- By Component

On the basis of component, the market is segmented into glass run channels, roof ditch molding, door, front windshield, hood & trunk seals, and glass. The door seals segment held the largest market revenue share in 2025, driven by the need for enhanced cabin insulation, NVH (Noise, Vibration, and Harshness) reduction, and improved water and dust resistance. Door seals are critical in ensuring passenger comfort, protecting internal components, and supporting vehicle safety across various climatic conditions.

The front windshield and hood & trunk seals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of advanced elastomeric materials and precision molding techniques. These components are vital for structural integrity, aerodynamic efficiency, and prevention of leakage, especially in high-end and electric vehicles.

- By Material

On the basis of material, the market is segmented into TPE, PVC, silicone, and EPDM rubber. The EPDM rubber segment held the largest market revenue share in 2025, owing to its excellent weather resistance, durability, and ability to maintain flexibility across extreme temperature ranges. EPDM seals are widely used in doors, windows, and trunk applications, providing long-term performance and reducing maintenance requirements.

The silicone segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its superior heat resistance, aging stability, and suitability for electric vehicles and hybrid platforms. Silicone seals are increasingly preferred in high-temperature engine and battery compartments, offering enhanced reliability and lifecycle performance.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into internal combustion engine (ICE) and electric vehicles. The ICE segment held the largest market revenue share in 2025, due to the continued dominance of conventional vehicles and the high demand for robust sealing solutions to maintain engine performance, reduce noise, and ensure component protection.

The electric vehicle segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising production of EVs, the adoption of lightweight and efficient sealing materials, and the need for specialized seals to protect battery packs, motors, and electronic systems. EV seals are increasingly engineered for durability, thermal management, and water/dust resistance to ensure optimal vehicle performance.

Automotive Rubber Seals Market Regional Analysis

- North America dominated the automotive rubber seals market with the largest revenue share in 2025, driven by high vehicle production, growing demand for durable sealing solutions, and increasing adoption of premium vehicle models

- Consumers and OEMs in the region highly value enhanced sealing performance, noise and vibration reduction, and weather resistance offered by advanced rubber seals across doors, windows, and engine compartments

- This widespread adoption is further supported by technological innovation, high disposable incomes, and stringent safety and emission standards, establishing automotive rubber seals as essential components across ICE and EV vehicles

U.S. Automotive Rubber Seals Market Insight

The U.S. automotive rubber seals market captured the largest revenue share in North America in 2025, fueled by rising vehicle production and growing emphasis on vehicle safety, NVH (Noise, Vibration, and Harshness) control, and thermal insulation. OEMs are increasingly integrating high-performance sealing materials such as EPDM, TPE, and silicone to enhance vehicle durability and passenger comfort. Moreover, initiatives to improve fuel efficiency and comply with stringent emission norms are further driving the adoption of advanced sealing solutions.

Europe Automotive Rubber Seals Market Insight

The Europe automotive rubber seals market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising adoption of electric and hybrid vehicles, stringent safety regulations, and the focus on lightweight and sustainable materials. Increasing urbanization and the demand for premium vehicles with improved NVH performance are encouraging OEMs to incorporate advanced sealing technologies. The region is also witnessing significant growth across passenger cars, commercial vehicles, and high-end automotive segments.

U.K. Automotive Rubber Seals Market Insight

The U.K. automotive rubber seals market is expected to grow rapidly from 2026 to 2033, driven by the adoption of electric vehicles, growing demand for energy-efficient vehicles, and emphasis on vehicle safety and cabin comfort. In addition, government regulations regarding emission reduction and sustainability are pushing automakers to integrate high-quality sealing systems. The presence of strong automotive manufacturing infrastructure and continuous R&D investments are expected to support long-term market expansion.

Germany Automotive Rubber Seals Market Insight

The Germany automotive rubber seals market is expected to witness substantial growth from 2026 to 2033, fueled by increasing awareness of vehicle safety, advanced automotive technology adoption, and demand for eco-conscious and lightweight sealing solutions. Germany’s established automotive industry, coupled with its focus on innovation, promotes the integration of multifunctional rubber seals in passenger and commercial vehicles. The adoption of advanced materials such as silicone and EPDM is becoming prevalent to meet performance and regulatory requirements.

Asia-Pacific Automotive Rubber Seals Market Insight

The Asia-Pacific automotive rubber seals market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising vehicle production, urbanization, and growing adoption of electric vehicles in countries such as China, Japan, and India. Government initiatives promoting EV adoption and increasing infrastructure investments are boosting the demand for advanced sealing solutions. Furthermore, APAC’s emergence as a major automotive manufacturing hub is enhancing the availability and affordability of high-performance rubber seals.

Japan Automotive Rubber Seals Market Insight

The Japan automotive rubber seals market is expected to witness strong growth from 2026 to 2033 due to the country’s high emphasis on vehicle safety, technological innovation, and growing EV penetration. The market is supported by the adoption of advanced sealing materials that improve noise insulation, thermal management, and vehicle efficiency. Moreover, Japan’s aging population and preference for high-comfort vehicles are encouraging the integration of reliable, easy-to-maintain sealing solutions in both passenger and commercial vehicles.

China Automotive Rubber Seals Market Insight

The China automotive rubber seals market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly expanding automotive industry, high vehicle production volumes, and increasing adoption of EVs and hybrid vehicles. The push toward smart and energy-efficient vehicles, coupled with strong domestic automotive manufacturing capabilities, is driving demand for advanced rubber seals. The availability of cost-effective materials and large-scale production is further propelling market growth across passenger cars, commercial vehicles, and electric vehicle segments.

Automotive Rubber Seals Market Share

The Automotive Rubber Seals industry is primarily led by well-established companies, including:

- COOPER STANDARD (U.S.)

- HUTCHINSON SA (France)

- MAGNA INTERNATIONAL INC. (Canada)

- TOYODA GOSEI CO. LTD (Japan)

- SAARGUMMI AUTOMOTIVE (Germany)

- MINTH GROUP CO LTD (China)

- PPAP AUTOMOTIVE (Japan)

- STANDARD PROFIL (Turkey)

- HWASEUNG R&A CO., LTD. (South Korea)

Latest Developments in Global Automotive Rubber Seals Market

- In July 2025, Cooper Standard announced a strategic collaboration with Renault Group on the Renault Emblème project, an eco-conscious family demo car. The initiative introduced the FlexiCore thermoplastic body seal and FlushSeal system, offering lightweight, recyclable sealing solutions and improved aerodynamic efficiency. This development strengthens Cooper Standard’s position in sustainable, high-performance automotive sealing and supports OEMs in meeting CO2 reduction targets

- In February 2025, Cooper Standard showcased its Fortrex material technology at leading automotive events in North America and Europe. Fortrex, a lightweight elastomer combining thermoplastic processability with EPDM durability, enhances vehicle sealing performance and longevity. The technology highlights innovation in material science, driving market adoption in next-generation automotive applications

- In November 2024, Cooper Standard participated in the China International Import Expo (CIIE), presenting advanced sealing technologies for electric vehicles. Key innovations included lightweight door and glass run channel systems and NVH solutions that reduce wind and road noise. This move reinforces Cooper Standard’s market presence in EV-focused sealing solutions and demonstrates commitment to mass reduction and improved vehicle comfort

- In September 2024, Toyoda Gosei developed a simulation system enabling automakers to evaluate interior cabin acoustics using different sealing components. The system assists OEMs in selecting seals that optimize NVH performance, particularly in electric vehicles, enhancing passenger comfort and vehicle quality

- In May 2024, Toyoda Gosei expanded its rubber recycling capacity in Japan by doubling processing facilities. This supports sustainability objectives by converting production scrap into new automotive rubber components, reducing waste and dependence on virgin materials, and strengthening the company’s eco-friendly manufacturing reputation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.