Global Automotive Safety System Market

Market Size in USD Billion

CAGR :

%

USD

67.45 Billion

USD

192.00 Billion

2024

2032

USD

67.45 Billion

USD

192.00 Billion

2024

2032

| 2025 –2032 | |

| USD 67.45 Billion | |

| USD 192.00 Billion | |

|

|

|

|

Automotive Safety System Market Size

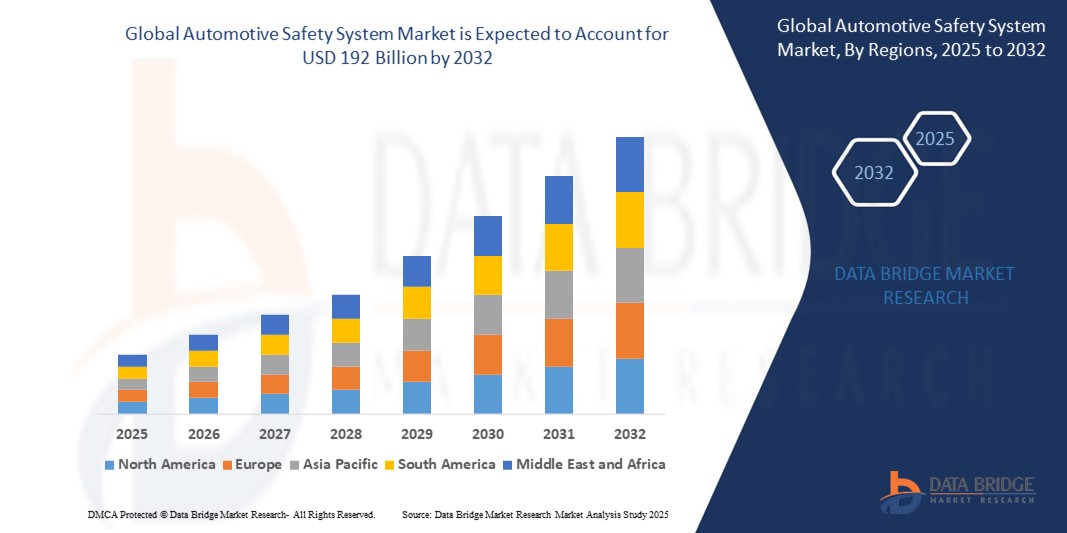

- The global Automotive Safety System market size was valued at USD 67.45 billion in 2024 and is expected to reach USD 192 billion by 2032, at a CAGR of 13.97% during the forecast period

- The market growth is largely fueled by the rising consumer awareness around vehicle safety and increasing government regulations mandating safety features

- Furthermore, the surge in electric and autonomous vehicles is also pushing automakers to integrate advanced safety systems. OEMs are investing heavily in R&D to meet evolving safety standards and consumer expectations. Insurance incentives and crash-test ratings are influencing buyers toward safer cars. Emerging economies are now enforcing stricter vehicle safety norms, boosting market expansion. Additionally, smart sensor integration and AI-driven solutions are transforming how safety systems operate in real time.

Automotive Safety System Market Analysis

- The vehicle safety systems are the vehicle technology supporting in the preventing and lessening of the collision injury. The safety systems contain seatbelts and headrest that supports to hold the occupant in place during collision and minimize the chances of injury.

- North America dominates the Automotive Safety System market with the largest revenue share of 55.73% in 2025, characterized by growing of the population and along with one of the world’s best road infrastructure induces the automakers to produce high powered vehicles which will further boost the growth of the automotive safety system market in the region during the forecast period

- Asia-Pacific is expected to be the fastest growing region in the Automotive Safety System market during the forecast period due to rising economy and the growing of the disposable income in the advancing countries is further anticipated to propel the growth of the automotive safety system market in the region in the coming years.

- Active Safety System segment is expected to dominate the Automotive Safety System market with a market share of 48.27% in 2025, driven by its increasing adoption of advanced driver-assistance technologies enhancing accident prevention.

Report Scope and Automotive Safety System Market Segmentation

|

Attributes |

Automotive Safety System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Safety System Market Trends

“Integration of Artificial Intelligence (AI) and Machine Learning in Safety Systems”

- A major trend in the automotive safety system market is the growing integration of artificial intelligence (AI) and machine learning technologies into vehicle safety features. These smart systems can analyze real-time data from sensors and cameras to predict and prevent potential accidents more effectively than traditional systems.

- AI enables adaptive learning, where the system improves its performance by continuously learning from driving patterns and environmental conditions. This enhances functions like collision avoidance, lane-keeping, and pedestrian detection with higher accuracy. Additionally, AI-powered systems support over-the-air updates, allowing vehicles to receive new safety features and improvements without physical recalls. Automakers are increasingly investing in these technologies to provide safer and smarter vehicles, meeting consumer demand for enhanced safety and convenience.

- AI integration also supports the advancement of semi-autonomous and fully autonomous driving, which relies heavily on precise safety systems. This trend not only increases safety but also pushes innovation and competitive differentiation within the market. As a result, AI-driven safety solutions are becoming a key selling point for new vehicles globally.

- For instance, In April 2025, Bosch announced the launch of its new AI-powered advanced driver-assistance system (ADAS) that improves hazard detection and braking response time using machine learning algorithms. This system marks a significant advancement in vehicle safety technology.

Automotive Safety System Market Dynamics

Driver

“Increasing Government Regulations on Vehicle Safety”

- One of the strongest drivers pushing the automotive safety system market is the rise in strict government regulations worldwide. Authorities are enforcing higher safety standards to reduce road accidents and fatalities. These regulations often require manufacturers to equip vehicles with advanced safety features like airbags, electronic stability control, and automatic emergency braking. Governments are also promoting adoption of active safety systems to prevent crashes before they happen.

- As a result, automakers are compelled to innovate and integrate more sophisticated safety technologies into their vehicles. This regulatory pressure ensures consistent demand for safety systems globally, especially in developed and emerging markets. Additionally, compliance with safety standards boosts consumer confidence and vehicle resale value. Regulations also drive investments in research and development focused on enhancing system reliability and effectiveness.

- Consequently, the market experiences steady growth as safety compliance becomes mandatory rather than optional. This driver benefits both consumers and the automotive industry by improving road safety and reducing insurance costs.

- For instance, In January 2025, the European Union introduced updated vehicle safety regulations mandating all new cars to have advanced driver-assistance systems (ADAS) by 2026, accelerating safety system adoption across Europe.

Restraint/Challenge

“High Cost of Advanced Safety Systems”

- A significant challenge restricting the growth of the automotive safety system market is the high cost of advanced safety technologies. Systems such as adaptive cruise control, lane-keeping assist, and collision avoidance require expensive sensors, cameras, and processing units. These costs increase the overall price of vehicles, making them less affordable, especially in price-sensitive markets or for budget car segments.

- Many consumers and manufacturers hesitate to adopt these technologies due to the added expense, slowing down market penetration.

- Additionally, the maintenance and repair of these complex systems can also be costly, further discouraging buyers. Small and mid-size automakers might find it difficult to integrate such expensive systems without affecting profit margins. This financial barrier creates a gap between high-end luxury vehicles and more affordable models, limiting widespread adoption. Consequently, despite the clear safety benefits, cost remains a critical restraint on market growth.

- For instance, In February 2025, a report highlighted how rising costs of LiDAR sensors slowed their adoption among mid-range car manufacturers, impacting the speed of advanced safety system integration.

Automotive Safety System Market Scope

The market is segmented on the basis technology, on-highway vehicle, off-highway vehicle, electric vehicle and offering

- By technology

Based on the technology, the automotive safety system market is segmented into active safety system and passive safety system. The Active Safety System segment is expected to dominate the Automotive Safety System market with a market share of 48.27% in 2025, driven by its increasing adoption of advanced driver-assistance technologies enhancing accident prevention.

The passive safety system segment is anticipated to witness the fastest growth rate of 24.17% from 2025 to 2032, fueled by increasing regulatory mandates for enhanced occupant protection features. Rising consumer awareness about vehicle safety and advancements in airbag technologies and crash-resistant structures also drive demand. Additionally, automakers are focusing on integrating sophisticated passive safety systems to meet stringent global safety standards.

- By on-highway vehicle

Based on the on-highway vehicle, the automotive safety system market is segmented into passenger cars, light commercial vehicle (LCV), buses, trucks. The passenger cars held the largest market revenue share in 2025 of, driven by the growing demand for safer and more technologically advanced vehicles. Increasing consumer preference for enhanced safety features and stricter government safety regulations globally boost this segment. Additionally, rising production of passenger cars equipped with advanced safety systems fuels market growth.

The light commercial vehicle segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its increased demand for efficient and safer transportation solutions in logistics and delivery sectors. Growing adoption of advanced safety technologies and rising fleet modernization efforts also contribute to this growth. Additionally, government regulations promoting vehicle safety standards in commercial vehicles further propel the segment’s expansion.

- By off-highway vehicle

Based on the off-highway vehicle, the automotive safety system market is segmented into agriculture vehicle, construction vehicle. The agriculture vehicle held the largest market revenue share in 2025, driven by the increasing mechanization of farming practices worldwide. Rising demand for higher crop yields and efficient field operations encourages the adoption of advanced safety systems in these vehicles. Additionally, government initiatives promoting agricultural modernization support this segment's growth.

The construction vehicle segment held a significant market share in 2025, favored for its critical role in hazardous and high-risk work environments. Demand for robust safety systems to protect operators and enhance site safety boosted adoption. Increased infrastructure development and strict safety regulations further supported growth in this segment.

- By electric vehicle

Based on the electric vehicle, the automotive safety system market is segmented into battery electric vehicle (BEV), hybrid electric vehicle (HEV), plug-in hybrid electric vehicle (PHEV), fuel cell electric vehicle (FCEV). The battery electric vehicle (BEV) segment accounted for the largest market revenue share in 2024, driven by the global shift toward sustainable transportation and strict emission regulations. Growing consumer demand for eco-friendly vehicles and advancements in battery technology have accelerated BEV adoption. Government incentives and investments in EV infrastructure further boosted the segment’s dominance.

The hybrid electric vehicle (HEV) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising fuel efficiency concerns and growing consumer demand for low-emission vehicles. HEVs offer a practical balance between conventional and electric powertrains, making them attractive in markets with developing EV infrastructure. Supportive government policies and advancements in hybrid technologies are further accelerating their adoption.

- By offering

Based on the offering, the automotive safety system market is segmented into hardware, software. The hardware segment accounted for the largest market revenue share in 2024, driven by the essential role of components like sensors, cameras, and control units in automotive safety systems. Increasing vehicle production and the integration of advanced safety features across all vehicle classes boosted hardware demand. Additionally, continuous innovation in safety-related hardware technologies supported this segment’s strong growth.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing need for real-time data processing, system integration, and advanced driver-assistance functionalities. As vehicles become more connected and autonomous, software plays a critical role in managing safety systems. Continuous updates, AI integration, and cybersecurity advancements are also fueling this segment’s rapid growth.

Automotive Safety System Market Regional Analysis

- North America dominates the Automotive Safety System market with the largest revenue share of 55.73% in 2025, characterized by growing of the population and along with one of the world’s best road infrastructure induces the automakers to produce high powered vehicles which will further boost the growth of the automotive safety system market in the region during the forecast period

- Major factors that are expected to boost the growth of the automotive safety system market in the forecast period are the government guidelines that are related to the vehicle safety, the upsurge in the demand for a safe, effective, and suitable driving experience and the rising need for luxury cars.

- On the other hand, the complex and luxurious features and the software failures in the applications are few of the factors anticipated to further impede the growth of the automotive safety system market in the timeline period.

U.S. Automotive Safety System Market Insight

The U.S. automotive safety system market is growing, influenced by technological advancements and increasing consumer demand for enhanced safety features. The adoption of advanced driver-assistance systems (ADAS) is on the rise, driven by the need for improved road safety. Regulatory initiatives and safety standards are encouraging automakers to integrate advanced safety technologies into their vehicles. The increasing production of electric and autonomous vehicles is further propelling market growth. Collaborations between U.S. automakers and technology companies are accelerating the development of innovative safety systems.

Europe Automotive Safety System Market Insight

Europe's automotive safety system market is expanding due to the enforcement of stringent road safety regulations and the growing adoption of advanced safety technologies. The European Union's General Safety Regulation mandates the installation of safety equipment in all vehicles, driving market growth. Technological advancements, such as the integration of AI and machine learning in safety systems, are enhancing vehicle safety. The increasing production of electric vehicles in Europe is also contributing to the demand for advanced safety systems. Collaborations between European automakers and technology providers are fostering innovation in the automotive safety sector.

U.K. Automotive Safety System Market Insight

The U.K. automotive safety system market is experiencing growth, driven by stringent safety regulations and increasing consumer demand for advanced safety features. Technological advancements in active and passive safety systems are contributing to this trend. The government's commitment to enhancing road safety further supports market expansion. Collaborations between automakers and technology providers are fostering innovation in safety technologies. The market is also influenced by the rising adoption of electric vehicles, which often come equipped with advanced safety systems.

Germany Automotive Safety System Market Insight

Germany remains a leader in automotive safety system development, with a strong emphasis on integrating cutting-edge technologies such as autonomous driving and AI-based safety features. The country's robust automotive industry and stringent safety standards drive continuous innovation. Collaborations between German automakers and tech companies are accelerating the deployment of advanced safety systems. The increasing demand for electric and autonomous vehicles is further propelling market growth. Germany's commitment to road safety and technological advancement positions it as a key player in the global automotive safety system market.

Asia-Pacific Automotive Safety System Market Insight

The Asia-Pacific automotive safety system market is experiencing significant growth, driven by the increasing adoption of advanced safety technologies and rising consumer awareness about vehicle safety. Countries like China and Japan are leading in the integration of active safety systems, such as lane-keeping assist and automatic emergency braking. The growing production of electric vehicles in the region is contributing to the demand for advanced safety systems. Government initiatives and regulatory measures are encouraging the adoption of safety technologies. Collaborations between automakers and technology providers are fostering innovation in the automotive safety sector.

India Automotive Safety System Market Insight

India's automotive safety system market is expanding, influenced by the government's initiatives to enhance road safety and the increasing adoption of advanced safety technologies. The implementation of the Bharat New Car Assessment Program (NCAP) is encouraging automakers to improve vehicle safety standards. The rising production of electric vehicles in India is contributing to the demand for advanced safety systems. Consumer awareness about vehicle safety is on the rise, driving the adoption of safety features. Collaborations between Indian automakers and technology providers are accelerating the development of innovative safety systems.

China Automotive Safety System Market Insight

China's automotive safety system market is growing rapidly, driven by advancements in autonomous driving technologies and the increasing adoption of electric vehicles. Companies like BYD and Baidu are leading the development of autonomous driving systems, integrating advanced safety features into their vehicles. The government's support for the development of autonomous vehicles and electric vehicles is fueling market growth. Regulatory measures are encouraging the adoption of advanced safety technologies. Collaborations between Chinese automakers and technology providers are fostering innovation in the automotive safety sector.

Automotive Safety System Market Share

The Automotive Safety System industry is primarily led by well-established companies, including:

- Robert Bosch GmbH,

- DENSO CORPORATION,

- STMicroelectronics,

- Infineon Technologies AG,

- ZF Friedrichshafen AG,

- Continental AG,

- Valeo,

- Magna International Inc.,

- Johnson Electric Holdings Limited,

- Autoliv Inc.,

- Mobileye.,

- HYUNDAI MOBIS.,

- ANAND Group,

- Knorr-Bremse AG,

- Takata Corporation,

- HARMAN International.,

- BMW AG,

- Joyson Safety Systems,

- TOYODO GOSEI Co., Ltd.,

- HELLA GmbH & Co. KGaA,

- Lear,

- Groupe PSA,

- BorgWarner Inc.,

- Ficosa Internacional SA

Latest Developments in Global Automotive Safety System Market

- In March 2025, Bosch introduced a new generation of radar sensors designed to enhance driver assistance systems. These sensors offer improved detection capabilities, enabling more accurate and reliable vehicle speed and distance adjustments. The new radar sensors are expected to be integrated into various vehicle models starting in the second half of 2025, aiming to improve overall driving safety and comfort.

- In February 2025, DENSO announced the development of an advanced driver assistance system (ADAS) that integrates artificial intelligence (AI) to predict and respond to potential hazards. The system utilizes AI algorithms to analyze real-time data from sensors and cameras, allowing for proactive safety measures. DENSO plans to begin production of this system in mid-2025, with implementation in select vehicle models by the end of the year.

- In January 2025, STMicroelectronics launched a new microcontroller unit (MCU) designed specifically for automotive safety applications. This MCU offers enhanced processing power and reliability, making it suitable for critical safety functions such as airbag deployment and electronic stability control. The MCU is expected to be adopted by several automakers in 2025, contributing to improved vehicle safety standards.

- In March 2025, Infineon Technologies announced a partnership with Ather Energy, an Indian electric two-wheeler manufacturer, to advance semiconductor technologies for light electric vehicles (LEVs). The collaboration aims to enhance the performance and safety of LEVs, focusing on improving charging infrastructure and integrating advanced safety features. This partnership marks a significant step in supporting the growth and technological sophistication of the electric mobility ecosystem.

- In April 2025, ZF Friedrichshafen unveiled a new suite of driver assistance systems designed to enhance vehicle safety and automation. These systems include advanced radar and camera technologies that enable features such as automatic emergency braking and lane-keeping assistance. ZF plans to integrate these systems into a range of vehicle models starting in late 2025.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ACTIVE SAFETY SYSTEM

7.2.1 ANTI-LOCK BRAKING SYSTEMS (ABS)

7.2.1.1. BY SUB-SYSTEMS TYPE

7.2.1.1.1. SENSORS

7.2.1.1.2. ELECTRONIC CONTROL UNIT

7.2.1.1.3. HYDRAULLIC UNIT

7.2.2 AUTOMATIC EMERGENCY BREAKING (AEB)

7.2.2.1. BY TECHNOLOGY

7.2.2.1.1. CAMERA

7.2.2.1.2. FUSION

7.2.2.1.3. LIDAR

7.2.2.1.4. RADAR

7.2.2.2. BY TECHNOLOGY

7.2.2.2.1. HIGH SPEED-INTER URBAN AEB SYSTEMS

7.2.2.2.2. LOW SPEED-CITY AEB SYSTEMS

7.2.2.2.3. PEDESTRIAN-VRU (VULNERABLE ROAD USERS) AEB SYSTEMS

7.2.2.3. BY COMPONENTS

7.2.2.3.1. ACTUATORS

7.2.2.3.2. AUDIBLE BUZZERS

7.2.2.3.3. CONTROLLERS

7.2.2.3.4. SENSORS

7.2.2.3.5. VISUAL INDICATORS

7.2.3 BLIND SPOT DETECTION (BSD)

7.2.3.1. BY COMPONENT TYPE

7.2.3.1.1. UTRASONIC

7.2.3.1.2. RADAR

7.2.3.1.3. CAMERA

7.2.4 ELECTRONIC BRAKE FORCE DISTRIBUTION (EBD)

7.2.4.1. BY COMPONENTS

7.2.4.1.1. SPEED SENSORS

7.2.4.1.2. BRAKE FORCE MODULATORS

7.2.4.1.3. ELECTRONIC CONTROL UNITS

7.2.4.1.4. OTHERS

7.2.5 ELECTRONIC STABILITY CONTROL (ESC)

7.2.6 LANE DEPARTURE WARNING SYSTEMS (LDW)

7.2.6.1. BY FUNCTION TYPE

7.2.6.1.1. LANE DEPARTURE

7.2.6.1.2. LANE KEEPING

7.2.6.2. BY SENSOR TYPE

7.2.6.2.1. VIDEO SENSORS

7.2.6.2.2. LASER SENSORS

7.2.6.2.3. INFRARED SENSORS

7.2.7 TIRE PRESSURE MONITORING SYSTEM (TPMS)

7.2.7.1. BY TYPE

7.2.7.1.1. DIRECT TPMS

7.2.7.1.2. INDIRECT TPMS

7.2.7.2. BY TECHNOLOGY

7.2.7.2.1. INTELLIGENT TPMS

7.2.7.2.2. CONVENTIONAL TPMS

7.2.8 TRACTION CONTROL SYSTEM (TCS)

7.2.9 FORWARD-COLLISION WARNING (FCW)

7.3 PASSIVE SAFETY SYSTEM

7.3.1 SEATBELTS

7.3.1.1. BY TYPE

7.3.1.1.1. TWO POINT

7.3.1.1.2. THREE POINTS

7.3.1.1.3. OTHERS

7.3.2 AIRBAGS

7.3.2.1. BY APPLICATION

7.3.2.1.1. KNEE

7.3.2.1.2. SIDE

7.3.2.1.3. FRONT

7.3.2.1.4. CURTAIN

7.3.3 ACTIVE HOOD LIFTERS

7.3.4 PEDESTRIAN PROTECTION AIRBAGS

7.3.5 WHIPLASH PROTECTION SYSTEM

7.3.5.1. BY SYSTEMS TYPE

7.3.5.1.1. REACTIVE HEAD RESTRAINT

7.3.5.1.2. PRO-ACTIVE HEAD RESTRAINT

7.3.5.1.3. OTHERS

8 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 HARDWARE

8.3 SOFTWARE

9 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY PROPULSION

9.1 OVERVIEW

9.2 DIESEL

9.3 PETROL

9.4 ELECTRIC

10 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY DRIVE TYPE

10.1 OVERVIEW

10.2 FRONT WHEEL DRIVE

10.3 REAR WHEEL DRIVE

10.4 ALL WHEEL DRIVE

11 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 OEM

11.3 AFTERMARKET

12 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY VEHICLE TYPE

12.1 OVERVIEW

12.2 PASSENGER CARS

12.2.1 BY VEHICLE TYPE

12.2.1.1. HATCHBACK

12.2.1.2. SEDAN

12.2.1.3. MPV

12.2.1.4. SUV

12.2.1.5. CROSSOVER

12.2.1.6. COUPE

12.2.1.7. CONVERTIBLE

12.2.1.8. OTHERS

12.2.2 LCV

12.2.2.1. VANS

12.2.2.1.1. PASSENGER VANS

12.2.2.1.2. CARGO VANS

12.2.2.2. PICK UP TRUCKS

12.2.2.3. MINI BUS

12.2.2.4. COACHES

12.2.2.5. OTHERS

12.2.3 HCV

12.2.3.1. TRUCKS

12.2.3.1.1. DUMP TRUCK

12.2.3.1.2. TOW TRUCKS

12.2.3.1.3. CEMENT TRUCKS

12.2.3.2. BUSES

12.3 ELECTRIC VEHICLES

12.3.1 BEV

12.3.2 PHEV

12.3.3 HYBRID VEHICLE

12.3.4 FCEV

13 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, BY GEOGRAPHY

GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. SWITZERLAND

13.1.2.11. REST OF EUROPE

13.1.3 ASIA PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. SINGAPORE

13.1.3.7. THAILAND

13.1.3.8. MALAYSIA

13.1.3.9. INDONESIA

13.1.3.10. PHILIPPINES

13.1.3.11. REST OF ASIA PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. EGYPT

13.1.5.3. SAUDI ARABIA

13.1.5.4. U.A.E

13.1.5.5. ISRAEL

13.1.5.6. REST OF MIDDLE EAST AND AFRICA

13.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET , SWOT & DBMR ANALYSIS

16 GLOBAL AUTOMOTIVE SAFETY SYSTEM MARKET, COMPANY PROFILE

16.1 ROBERT BOSCH GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 DENSO CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 DELPHI AUTOMOTIVE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 INFINEON AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 ZF FRIEDRICHSHAFEN

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 CONTINENTAL AG

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 VALEO S.A.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENTS

16.8 MAGNA

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENTS

16.9 AUTOLIV

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENTS

16.1 MOBILEEYE

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENTS

16.11 HYUNDAI MOBIS

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 HYUNDAI MOBIS

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENTS

16.13 TAKATA CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 KNORR-BREMSE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 FLIR SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENTS

16.16 INFINEON TECHNOLOGIES

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENTS

16.17 FICOSA INTERNATIONAL S.A.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENTS

16.18 GROUP PSA

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENTS

16.19 BOX WARNER INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 CAX SOFTWARE

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

16.21 TOYODA GOSIE

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

16.21.5 RECENT DEVELOPMENTS

16.22 WABCO-TVS INDIA LIMITED

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 GEOGRAPHIC PRESENCE

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENTS

16.23 DORMAN PRODUCTS INC.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 GEOGRAPHIC PRESENCE

16.23.4 PRODUCT PORTFOLIO

16.23.5 RECENT DEVELOPMENTS

16.24 ADVICS CO. LTD.

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 GEOGRAPHIC PRESENCE

16.24.4 PRODUCT PORTFOLIO

16.24.5 RECENT DEVELOPMENTS

16.25 NISSAN KOGYO CO. LTD.

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 GEOGRAPHIC PRESENCE

16.25.4 PRODUCT PORTFOLIO

16.25.5 RECENT DEVELOPMENTS

16.26 WABCO

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 GEOGRAPHIC PRESENCE

16.26.4 PRODUCT PORTFOLIO

16.26.5 RECENT DEVELOPMENTS

16.27 HYUNDAI MOBIS CO. LTD.

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 GEOGRAPHIC PRESENCE

16.27.4 PRODUCT PORTFOLIO

16.27.5 RECENT DEVELOPMENTS

16.28 MURATA MANUFACTURING CO. LTD.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 GEOGRAPHIC PRESENCE

16.28.4 PRODUCT PORTFOLIO

16.28.5 RECENT DEVELOPMENTS

16.29 MAN

16.29.1 COMPANY SNAPSHOT

16.29.2 REVENUE ANALYSIS

16.29.3 GEOGRAPHIC PRESENCE

16.29.4 PRODUCT PORTFOLIO

16.29.5 RECENT DEVELOPMENTS

16.3 HALDEX BRAKE PRODUCTS CORP.

16.30.1 COMPANY SNAPSHOT

16.30.2 REVENUE ANALYSIS

16.30.3 GEOGRAPHIC PRESENCE

16.30.4 PRODUCT PORTFOLIO

16.30.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 RELATED REPORTS

19 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.