Global Automotive Stainless Steel Tube Market

Market Size in USD Billion

CAGR :

%

USD

4.95 Billion

USD

12.97 Billion

2024

2032

USD

4.95 Billion

USD

12.97 Billion

2024

2032

| 2025 –2032 | |

| USD 4.95 Billion | |

| USD 12.97 Billion | |

|

|

|

|

Automotive Stainless Steel Tube Market Size

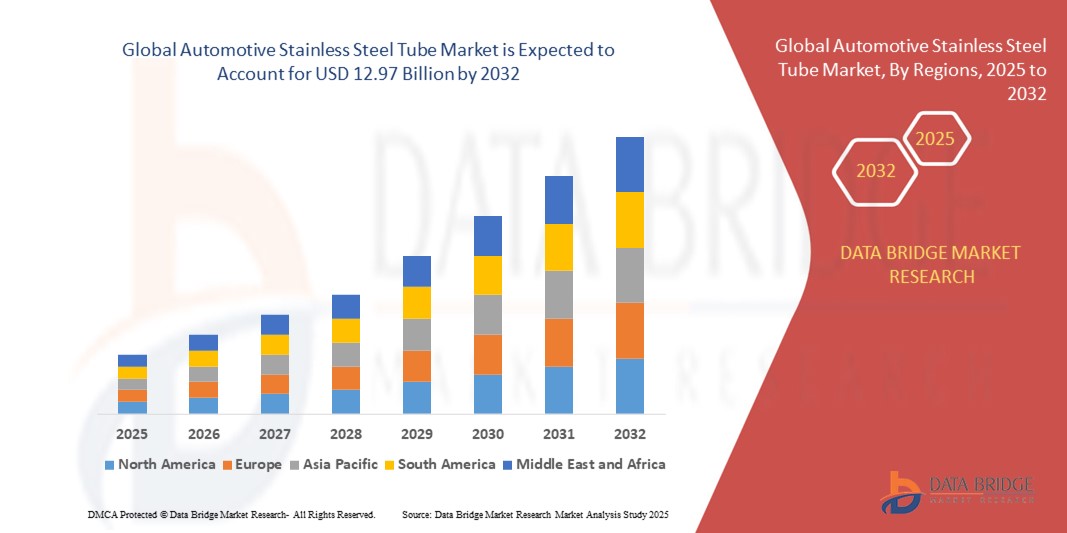

- The global automotive stainless steel tube market size was valued at USD 4.95 billion in 2024 and is expected to reach USD 12.97 billion by 2032, at a CAGR of 12.80% during the forecast period

- The market growth is largely driven by the increasing demand for lightweight, durable, and corrosion-resistant materials in vehicle manufacturing, especially in exhaust systems, fuel lines, and structural components

- Furthermore, stricter global emission regulations, rising vehicle production—particularly in emerging economies—and the growing shift toward electric and hybrid vehicles are reinforcing the demand for high-performance stainless steel tubes, significantly propelling market expansion

Automotive Stainless Steel Tube Market Analysis

- Automotive stainless steel tubes are precision-engineered components used in critical vehicle systems including exhaust, braking, fuel injection, and thermal management. These tubes offer superior strength, corrosion resistance, and longevity under high pressure and temperature conditions

- The growing adoption of emission-compliant technologies, demand for longer-lasting vehicle components, and increasing focus on vehicle efficiency and lightweighting—especially in EVs—are key factors driving the usage of stainless steel tubes across both passenger and commercial vehicle segments

- Asia-Pacific dominated the automotive stainless steel tube market with a share of 52.5% in 2024, due to rapid vehicle production growth, urbanization, and increasing infrastructure development across emerging economies

- North America is expected to be the fastest growing region in the automotive stainless steel tube market during the forecast period due to emission regulations, EV adoption, and demand for durable, lightweight materials

- Welded tube segment dominated the market with a market share of 93.8% in 2024, due to its cost-effectiveness and ease of mass production. Welded tubes are widely preferred in automotive applications such as exhaust systems, structural frameworks, and fluid transfer lines due to their consistent wall thickness and availability in various sizes. Advancements in welding techniques have significantly enhanced the strength and durability of these tubes, making them a reliable choice for OEMs. Moreover, the high yield and low material wastage during fabrication contribute to their strong adoption among automotive manufacturers looking to optimize production efficiency

Report Scope and Automotive Stainless Steel Tube Market Segmentation

|

Attributes |

Automotive Stainless Steel Tube Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Stainless Steel Tube Market Trends

Rising Demand for Electric Vehicles

- Accelerating global adoption of electric vehicles is intensifying demand for stainless steel tubes, as manufacturers utilize them for essential functions including battery cooling, power electronics enclosures, structural supports, and high-voltage electrical lines, ensuring thermal stability, safety, and weight reduction for modern automotive platforms

- For instance, leading players such as IMARC Group and Future Market Insights report strong utilization of stainless steel tubes in the battery protection and chassis components of EVs, with OEMs in China, Europe, and the United States expanding production to meet regulatory and consumer requirements for emission reduction and advanced crash safety

- The integration of stainless steel tubing within hybrid and autonomous vehicles continues to grow, serving new applications in exhaust systems, turbocharger pipes, and adaptive braking, as platforms transition toward cleaner, more connected technologies

- Innovations in composite materials and advanced manufacturing techniques are enabling lighter, stronger, and more corrosion-resistant tubes, supporting both legacy internal combustion and next-generation EV models, while facilitating compliance with stringent emission and durability standards

- Regional incentives and government mandates aimed at promoting electric vehicle production are driving rapid infrastructure expansion in Asia-Pacific, reshaping global supply chains for tubing materials and downstream distribution

- The emergence of circular economy practices and recycling initiatives among leading automotive manufacturers is further enhancing sustainability within stainless steel tube product lines, reducing lifecycle environmental impact and supporting long-term market growth

Automotive Stainless Steel Tube Market Dynamics

Driver

Growing Automotive Industry

- The steady acceleration of global vehicle manufacturing across passenger and commercial segments is a key driver for stainless steel tube demand, as expanding automotive facilities require robust tubing solutions for brake lines, cooling systems, instrumentation, and HVAC

- For instance, Asia-Pacific leads production volumes with top automotive hubs in China and India ramping their capacity, leveraging stainless steel tubes for long-lasting resistance against harsh environments, improved safety, and optimized vehicle performance

- Regulatory emphasis on safety and emissions continues to reinforce adoption in exhaust, fuel, and hydraulic systems, while rapid urbanization and economic growth in developing regions increase consumer and industrial vehicle purchases

- Advances in automation, digitalization, and smart manufacturing have enhanced tube quality, precision, and manufacturing efficiency, fueling the broad integration of these components in new vehicle models

- OEM collaborations with material science innovators are expanding the spectrum of specialized tube grades and custom geometries, further propelling market development and differentiation

Restraint/Challenge

Fluctuating Raw Material Prices

- Volatility in the global prices of essential raw materials—such as nickel, chromium, and stainless steel alloys—significantly impacts production costs and long-term profitability for tube manufacturers and automotive OEMs

- For instance, IMARC Group and The Business Research Company highlight how price swings driven by geopolitical tensions, supply chain disruptions, and regulatory tariffs have prompted leading automotive stainless steel tube producers to adjust procurement strategies, manage inventories, and hedge against cost inflation

- Supply dependencies on specialized alloys can restrict production flexibility while increasing exposure to international market risks, creating operational challenges for both regional and global manufacturers

- Price sensitivity across end-use industries constrains the ability to fully transfer cost increases to buyers, especially in price-competitive automotive sectors and emerging markets

- Shifts toward recycled and secondary raw materials are being adopted as mitigation strategies, but technical barriers and quality control concerns remain, requiring ongoing investment in innovation and process optimization

Automotive Stainless Steel Tube Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the automotive stainless steel tube market is segmented into welded tube and seamless tube. The welded tube segment dominated the largest market revenue share of 93.8% in 2024, driven by its cost-effectiveness and ease of mass production. Welded tubes are widely preferred in automotive applications such as exhaust systems, structural frameworks, and fluid transfer lines due to their consistent wall thickness and availability in various sizes. Advancements in welding techniques have significantly enhanced the strength and durability of these tubes, making them a reliable choice for OEMs. Moreover, the high yield and low material wastage during fabrication contribute to their strong adoption among automotive manufacturers looking to optimize production efficiency.

The seamless tube segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its superior mechanical strength and resistance to high pressure and temperature. Seamless stainless steel tubes are increasingly being used in high-performance vehicle applications such as turbochargers, fuel injection systems, and braking circuits where structural integrity is critical. Their uniformity and lack of welded joints make them ideal for critical automotive components requiring high precision and durability. Growing demand for high-performance and luxury vehicles globally is driving OEMs to adopt seamless tubing for enhanced safety, performance, and reliability. Their corrosion resistance and longevity further make them suitable for long-term automotive applications, especially in challenging environments.

- By Application

On the basis of application, the automotive stainless steel tube market is segmented into passenger cars, commercial vehicles, and others. The passenger cars segment held the largest market revenue share in 2024, supported by the rising global vehicle production and consumer demand for corrosion-resistant, lightweight components. Stainless steel tubes are extensively used in exhaust systems, fuel lines, and structural parts of passenger vehicles to ensure durability, weight reduction, and safety. The segment benefits from increasing regulatory pressure on emission control and vehicle efficiency, driving demand for high-grade stainless steel tubing. The shift toward electric and hybrid vehicles is also accelerating the need for specialized tubing systems that offer thermal stability and long-term reliability.

The commercial vehicles segment is anticipated to register the fastest growth from 2025 to 2032, spurred by growing logistics demand and infrastructure expansion across emerging economies. Stainless steel tubes in commercial vehicles are essential for applications such as hydraulic lines, chassis reinforcement, and exhaust systems that operate under higher mechanical stress and heavier loads. The robustness and corrosion resistance of stainless steel make it a preferred choice in trucks, buses, and utility vehicles that face harsh operating environments. Increasing emphasis on fleet reliability, safety, and total cost of ownership is pushing manufacturers to integrate longer-lasting components such as stainless steel tubes. In addition, stricter emission norms and adoption of CNG and electric commercial fleets are creating new demand for advanced tubing solutions with high temperature and pressure resistance.

Automotive Stainless Steel Tube Market Regional Analysis

- Asia-Pacific dominated the automotive stainless steel tube market with the largest revenue share of 52.5% in 2024, driven by rapid vehicle production growth, urbanization, and increasing infrastructure development across emerging economies

- Expanding automotive manufacturing hubs, rising demand for fuel-efficient vehicles, and supportive government policies for industrial expansion are propelling tube consumption in both passenger and commercial segments

- Availability of cost-effective labor and raw materials, along with strong supply chain networks, is attracting major OEMs and component suppliers to establish regional operations

China Automotive Stainless Steel Tube Market Insight

China held the largest share in the Asia-Pacific market in 2024, supported by its global leadership in automotive manufacturing and continued investment in electric mobility. Stainless steel tubes are in strong demand for use in exhaust systems, fuel lines, and structural parts. With advanced production capabilities and policy-driven innovation, China is driving both domestic consumption and export growth in high-performance tubing.

India Automotive Stainless Steel Tube Market Insight

India is the fastest-growing market in Asia-Pacific, driven by expanding vehicle production, stricter emission norms, and rising infrastructure needs. “Make in India” and BS-VI policies are encouraging stainless steel use in exhaust and engine components. Growing demand from both passenger and commercial vehicles, combined with a shift toward localization and EV development, is fueling market momentum.

Europe Automotive Stainless Steel Tube Market Insight

Europe is a key market due to stringent emission laws, advanced vehicle technologies, and strong demand for lightweight and durable materials. Stainless steel tubes are widely used in safety systems, fuel delivery, and EV platforms. A mature manufacturing ecosystem, innovation in material science, and high sustainability standards are reinforcing regional market growth.

Germany Automotive Stainless Steel Tube Market Insight

Germany leads the European market with its strong automotive base, advanced R&D, and strict quality requirements. OEMs increasingly use stainless steel tubes in high-performance and EV applications, such as battery cooling and structural support. Collaboration between manufacturers and steel producers ensures continued innovation and export strength.

U.K. Automotive Stainless Steel Tube Market Insight

The U.K. market is supported by EV growth, sustainability focus, and increasing domestic manufacturing. Demand is rising for lightweight, corrosion-resistant tubing across thermal, structural, and fuel applications. Post-Brexit localization efforts, R&D incentives, and growing demand from luxury and performance vehicle segments are strengthening the country’s market position.

North America Automotive Stainless Steel Tube Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by emission regulations, EV adoption, and demand for durable, lightweight materials. The region’s strong manufacturing base and focus on fuel economy are increasing stainless steel use in exhausts, crash structures, and EV thermal systems.

U.S. Automotive Stainless Steel Tube Market Insight

The U.S. held the largest share in the North America market in 2024, driven by high vehicle production, innovation in mobility technologies, and demand for high-specification tubing. Stainless steel is widely used across vehicle segments for its strength, corrosion resistance, and regulatory compliance, particularly in light trucks, EVs, and commercial fleets.

Automotive Stainless Steel Tube Market Share

The automotive stainless steel tube industry is primarily led by well-established companies, including:

- Sandvik AB (Sweden)

- NIPPON STEEL CORPORATION (Japan)

- ArcelorMittal (Luxembourg)

- thyssenkrupp AG (Germany)

- TUBACEX S.A. (Spain)

- Handytube Corporation (U.S.)

- Plymouth Tube Company (U.S.)

- fischer Group of Companies (Germany)

- Maxim Tubes Company Pvt. Ltd. (India)

- JFE Steel Corporation (Japan)

- ChelPipe (Russia)

- Penn Stainless (U.S.)

- Bri-Steel Manufacturing (Canada)

- Centravis (Ukraine)

Latest Developments in Global Automotive Stainless Steel Tube Market

- In May 2023, JFE Steel Corporation announced plans to install a new electric-arc furnace at its No. 4 steelmaking shop in the Chiba District Facility, with completion targeted for the second half of the fiscal year starting April 2025. This strategic investment, exceeding USD 100 million, is aimed at enhancing sustainable steel production by incorporating large volumes of scrap to reduce CO₂ emissions. The move is expected to strengthen JFE’s position in the stainless steel market by aligning with global decarbonization trends, supporting automotive manufacturers increasingly seeking low-carbon, high-strength materials for environmentally compliant vehicle production

- In February 2023, NIPPON STEEL CORPORATION entered a strategic agreement with Teck Resources Limited to acquire royalty interests and equity in Elk Valley Resources Ltd. This initiative is designed to secure a long-term supply of high-quality steel-making coal—a critical input for stainless steel production—supporting Nippon Steel’s roadmap toward carbon neutrality. By investing in stable, high-grade raw materials, the company aims to reinforce its raw material security and improve supply chain resilience, which directly impacts the quality and reliability of stainless steel products used across demanding sectors, including automotive tubing

- In January 2023, MARCEGAGLIA STEEL S.p.A made its first entry into upstream steel manufacturing by acquiring a stainless steel electric furnace facility in Sheffield, U.K. This strategic acquisition marks a significant shift toward partial value chain integration, aimed at reducing dependency on external suppliers and stabilizing raw material availability. The move enhances Marcegaglia’s ability to control product quality and lead times, which is critical for automotive-grade stainless steel tube production where supply chain consistency and high mechanical performance are essential

- In January 2023, Jindal Stainless announced its contribution of stainless steel materials to the Mumbai Metro project, providing a wide array of components such as roofs, underframes, structural parts, car bodies, and interiors. This large-scale supply underscores the company’s technical capability and production scale, strengthening its brand reputation in infrastructure and transportation sectors. The project’s success reinforces Jindal’s role as a major supplier of high-performance stainless steel, indirectly boosting its credibility and market reach in the automotive stainless steel tube segment where similar structural and aesthetic properties are valued

- In April 2021, Sandvik AB, in collaboration with its subsidiary BEAMIT Group, introduced super-duplex stainless steel components produced through advanced 3D printing technology. This development marks a significant innovation in additive manufacturing, enabling the production of stainless steel parts with superior mechanical strength and corrosion resistance. For the automotive stainless steel tube market, such advancements represent future potential for custom, lightweight, and high-durability components—especially in EVs and performance vehicles where design flexibility and material efficiency are critical

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Stainless Steel Tube Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Stainless Steel Tube Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Stainless Steel Tube Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.