Global Automotive Steer By Wire System Market

Market Size in admin@databridgemarketresearch.com

CAGR :

%

4.19 admin@databridgemarketresearch.com

16.51 admin@databridgemarketresearch.com

2024

2032

4.19 admin@databridgemarketresearch.com

16.51 admin@databridgemarketresearch.com

2024

2032

| 2025 –2032 | |

| USD 4.19 admin@databridgemarketresearch.com | |

| USD 16.51 admin@databridgemarketresearch.com | |

|

|

|

|

Automotive Steer-by-Wire System Market Size

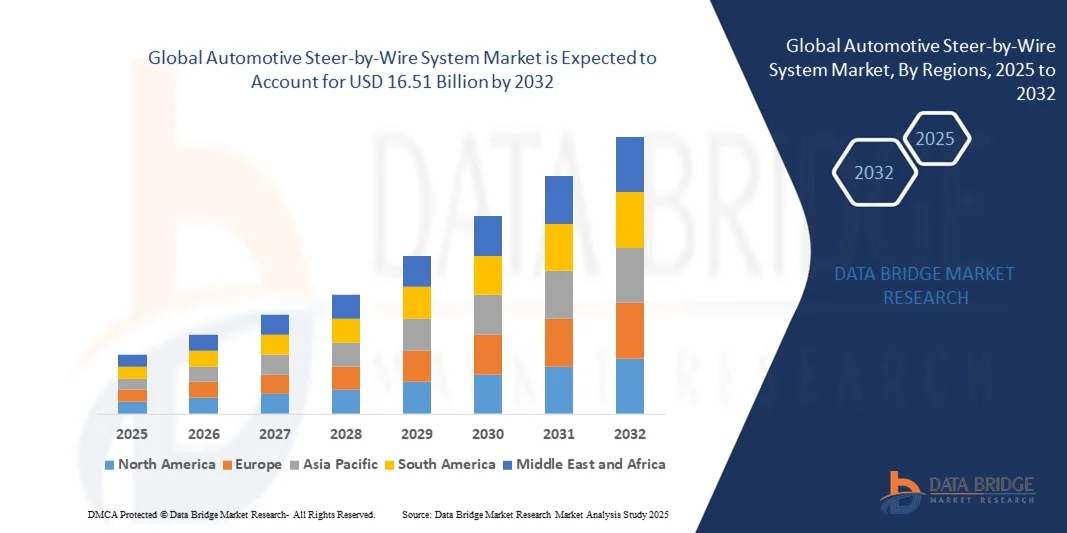

- The global automotive steer-by-wire system market size was valued at USD 4.19 billion in 2024 and is expected to reach USD 16.51 billion by 2032, at a CAGR of 18.70% during the forecast period

- The market growth is largely fuelled by the increasing adoption of electric vehicles (EVs), rising demand for advanced driver assistance systems (ADAS), and stringent safety regulations promoting electronic steering solutions

- Growing consumer preference for enhanced driving comfort, customizable steering feel, and reduced mechanical complexity is further driving the adoption of steer-by-wire systems

Automotive Steer-by-Wire System Market Analysis

- The integration of steer-by-wire technology with autonomous driving and connected car platforms is transforming the automotive steering landscape by enabling precise control, enhanced safety, and improved vehicle dynamics

- Rising R&D investments by automotive OEMs and tier-1 suppliers are accelerating innovation in lightweight, high-reliability, and cost-efficient steer-by-wire systems for passenger and commercial vehicles

- North America dominated the automotive steer-by-wire (SbW) system market with the largest revenue share of 38.5% in 2024, driven by a growing adoption of advanced driver assistance systems (ADAS) and electric vehicles, as well as increased focus on vehicle safety and fuel efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive steer-by-wire system market, driven by growing adoption of electric and autonomous vehicles, expanding automotive manufacturing hubs, and rising consumer awareness of advanced vehicle safety and convenience technologies

- The hardware segment held the largest market revenue share in 2024, driven by the critical role of high-quality mechanical and electronic components in ensuring precise, safe, and reliable steering performance. Advanced hardware enables better integration with driver assistance systems and improves overall vehicle handling

Report Scope and Automotive Steer-by-Wire System Market Segmentation

|

Attributes |

Automotive Steer-by-Wire System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Steer-by-Wire System Market Trends

Rise of Steer-by-Wire Technology in Advanced Vehicles

- The growing adoption of steer-by-wire (SbW) systems is transforming the automotive steering landscape by enabling electronic control of vehicle steering without mechanical linkages. These systems provide precise handling, improved safety features, and flexibility in vehicle design, particularly in electric and autonomous vehicles. SbW technology also reduces mechanical wear, enhances system responsiveness, and allows manufacturers to implement innovative driver-assistance functions

- Increasing demand for lightweight, fuel-efficient, and compact vehicle architectures is accelerating the integration of SbW systems in passenger and commercial vehicles. The elimination of mechanical steering components reduces weight, enhances energy efficiency, and allows more innovative cabin and chassis designs. In addition, SbW systems support modular vehicle platforms, enabling OEMs to streamline production and reduce assembly costs

- The scalability, modularity, and compatibility of modern SbW systems are making them attractive for both new vehicle platforms and retrofitting existing models. Automakers can implement these advanced systems without major redesigns, supporting cost-effective innovation. Integration with other electronic systems, such as lane assist and parking guidance, further enhances vehicle safety and operational efficiency

- For instance, in 2023, several EV manufacturers in Europe and North America integrated SbW systems into electric SUVs and autonomous shuttles, improving maneuverability, reducing mechanical complexity, and enhancing driver assistance capabilities. This integration also facilitated improved vehicle stability, energy-efficient steering, and seamless adaptation to autonomous driving scenarios

- While SbW technology is gaining traction, its impact depends on continued sensor innovation, cybersecurity, and integration with ADAS and autonomous driving platforms. Manufacturers must focus on reliability, redundancy, and standardization to fully capitalize on growing market demand. Furthermore, ongoing regulatory approvals and consumer confidence in electronic steering are critical for market penetration

Automotive Steer-by-Wire System Market Dynamics

Driver

Increasing Demand for Advanced Vehicle Safety and Autonomous Driving Technologies

- The rising emphasis on advanced driver assistance systems (ADAS) and autonomous vehicles is driving the adoption of SbW systems. These systems enable precise, electronically controlled steering that integrates seamlessly with lane-keeping, parking, and adaptive cruise control features. SbW solutions also allow faster response times and adaptive feedback for improved safety and driver comfort

- Automotive manufacturers are increasingly prioritizing weight reduction and fuel efficiency, which steer-by-wire systems support by removing mechanical linkages and reducing vehicle mass. This also allows for more flexible chassis and cabin layouts. Lightweight SbW systems further contribute to reduced emissions and enhanced energy efficiency in electric and hybrid vehicles

- The proliferation of electric vehicles is further accelerating demand, as SbW systems complement the electronic architecture of EVs and enable smoother integration with electric powertrains. These systems also facilitate innovative vehicle designs, compact packaging, and optimized steering torque distribution for high-performance EVs

- For instance, in 2022, several leading EV manufacturers integrated SbW systems into high-end sedans and SUVs, resulting in improved steering precision, enhanced safety, and better integration with automated driving systems. This adoption also enabled advanced driver-assistance features, reduced maintenance requirements, and enhanced vehicle ergonomics

- While advanced vehicle safety and autonomous features drive market growth, adoption depends on cost-effectiveness, regulatory approvals, and consumer trust in electronic steering reliability. OEMs must address cybersecurity concerns, system redundancy, and long-term reliability to ensure widespread adoption and market confidence

Restraint/Challenge

High Cost of Technology and Limited Infrastructure for Widespread Adoption

- The high price of advanced SbW systems, including redundant actuators, sensors, and electronic control units, limits adoption in mass-market vehicles. Cost remains a key barrier for widespread deployment, particularly in price-sensitive regions. In addition, complex calibration and integration processes further increase upfront implementation expenses

- In many regions, insufficient manufacturing infrastructure, testing facilities, and skilled personnel for SbW technology restrict production and integration capabilities. This can delay adoption and slow market expansion. Limited access to specialized testing equipment and simulation tools also hinders product development and compliance verification

- Supply chain volatility for critical electronic components, such as sensors, actuators, and control modules, can impact production timelines and vehicle delivery schedules. Any disruptions may affect OEM rollout plans. Regional shortages of high-grade electronics and raw materials further exacerbate delays in deployment and increase manufacturing costs

- For instance, in 2023, several commercial vehicle manufacturers in Asia faced delays in implementing SbW systems due to component shortages, affecting new model launches and fleet deliveries. These delays also impacted aftersales support, warranty management, and overall customer satisfaction in emerging markets

- While technology continues to advance, addressing cost, infrastructure, and supply chain challenges is essential for broader adoption and long-term growth in the automotive steer-by-wire system market. Strategic partnerships, localized production, and investment in training and testing facilities are crucial to overcoming these restraints and ensuring sustainable market expansion

Automotive Steer-by-Wire System Market Scope

The market is segmented on the basis of component, product type, vehicle type, and propulsion type.

- By Component

On the basis of component, the automotive steer-by-wire (SbW) system market is segmented into hardware, feedback motor, angular sensors, steering actuator, and software. The hardware segment held the largest market revenue share in 2024, driven by the critical role of high-quality mechanical and electronic components in ensuring precise, safe, and reliable steering performance. Advanced hardware enables better integration with driver assistance systems and improves overall vehicle handling.

The angular sensors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its importance in providing accurate real-time steering position and torque feedback. Angular sensors enhance SbW system responsiveness and safety, making them essential for autonomous vehicles and modern electric mobility solutions.

- By Product Type

On the basis of product type, the market is segmented into pure electronic and backup mechanical systems. The pure electronic segment held the largest revenue share in 2024 due to its capability to offer fully electronic steering without mechanical linkages, enabling weight reduction and flexibility in vehicle design. Pure electronic SbW systems are particularly attractive for electric and autonomous vehicles where electronic integration is key.

The backup mechanical segment is expected to witness the fastest growth from 2025 to 2032, driven by the growing demand for fail-safe and redundant systems that ensure safety in case of electronic failures. These systems are increasingly being adopted in commercial and autonomous vehicle platforms to meet stringent safety regulations.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). The passenger car segment held the largest market revenue share in 2024, fueled by the growing adoption of SbW technology in electric vehicles (EVs) and high-end sedans for improved handling, reduced weight, and enhanced integration with ADAS features.

The LCV segment is expected to witness the fastest growth rate from 2025 to 2032, driven by fleet electrification and the adoption of autonomous delivery and shuttle vehicles. SbW systems provide better maneuverability, reduced mechanical complexity, and easier integration with lightweight vehicle architectures in commercial fleets.

- By Propulsion Type

On the basis of propulsion type, the market is segmented into internal combustion engine (ICE) vehicles and electric vehicles (EVs). The EV segment held the largest revenue share in 2024, due to the inherent compatibility of electronic steering systems with electric powertrains and the increasing production of EVs across passenger and commercial segments.

The ICE vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by retrofitting and integration of SbW systems in hybrid and next-generation ICE vehicles for improved steering precision, reduced mechanical wear, and enhanced driver comfort.

Automotive Steer-by-Wire System Market Regional Analysis

- North America dominated the automotive steer-by-wire (SbW) system market with the largest revenue share of 38.5% in 2024, driven by a growing adoption of advanced driver assistance systems (ADAS) and electric vehicles, as well as increased focus on vehicle safety and fuel efficiency

- Consumers and manufacturers in the region highly value the precision, flexibility, and reduced mechanical complexity offered by SbW systems, enabling innovative vehicle architectures and enhanced driving experiences

- This widespread adoption is further supported by strong automotive R&D infrastructure, high disposable incomes, and regulatory incentives for advanced vehicle safety technologies, establishing SbW systems as a preferred solution for passenger and commercial vehicles

U.S. Automotive Steer-by-Wire System Market Insight

The U.S. SbW system market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of electric and autonomous vehicles. Manufacturers are increasingly prioritizing electronically controlled steering systems for improved vehicle performance, safety, and design flexibility. The growing integration of SbW with ADAS features, such as lane-keeping assist, adaptive cruise control, and parking automation, further drives market expansion. In addition, government incentives and R&D investments in advanced automotive electronics are significantly contributing to market growth.

Europe Automotive Steer-by-Wire System Market Insight

The Europe SbW system market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent vehicle safety regulations and the rising adoption of electric and autonomous vehicles. Growing urbanization and the need for lightweight, efficient vehicle designs are fostering the integration of SbW systems. European manufacturers are increasingly incorporating these systems into both passenger cars and commercial vehicles, aiming for improved handling, energy efficiency, and compliance with safety standards.

U.K. Automotive Steer-by-Wire System Market Insight

The U.K. SbW system market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for advanced vehicle safety, connected car technologies, and electric vehicles. Concerns regarding road safety, emission reduction, and vehicle efficiency are encouraging OEMs to implement SbW solutions. The U.K.’s automotive sector, combined with strong R&D capabilities and adoption of connected mobility solutions, is expected to continue stimulating market growth.

Germany Automotive Steer-by-Wire System Market Insight

The Germany SbW system market is expected to witness the fastest growth rate from 2025 to 2032, fueled by growing awareness of automotive innovation, sustainability, and digital mobility solutions. Germany’s robust automotive manufacturing base, coupled with a focus on autonomous and electric vehicles, is promoting SbW adoption in both passenger and commercial segments. Integration of SbW with advanced ADAS and in-vehicle electronics is also becoming increasingly prevalent, aligning with consumer expectations for safety, precision, and comfort.

Asia-Pacific Automotive Steer-by-Wire System Market Insight

The Asia-Pacific SbW system market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising vehicle production, urbanization, and adoption of EVs and autonomous driving technologies in countries such as China, Japan, and India. Government initiatives supporting smart mobility, electrification, and automotive safety are accelerating the deployment of SbW systems. Furthermore, APAC’s emergence as a manufacturing hub for automotive electronics is enhancing affordability and accessibility, expanding the market across passenger and commercial vehicles.

Japan Automotive Steer-by-Wire System Market Insight

The Japan SbW system market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced automotive industry, focus on autonomous vehicles, and demand for high-tech vehicle features. Japanese consumers and manufacturers are emphasizing safety, precision, and efficiency, which is boosting SbW adoption in electric and hybrid vehicles. Integration with ADAS, automated driving solutions, and connected vehicle technologies is fueling growth, while the aging population also drives demand for easier-to-use, electronically controlled steering systems.

China Automotive Steer-by-Wire System Market Insight

The China SbW system market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid vehicle electrification, technological adoption, and government support for smart mobility initiatives. China is becoming a key market for advanced steering technologies in passenger cars, commercial vehicles, and EV platforms. Rising domestic production capabilities, coupled with cost-effective SbW solutions, are driving widespread adoption across multiple vehicle segments, further propelling market growth.

Automotive Steer-by-Wire System Market Share

The Automotive Steer-by-Wire System industry is primarily led by well-established companies, including:

- Nissan Motor Co., LTD. (Japan)

- ZF Friedrichshafen AG (Germany)

- JTEKT Corporation (Japan)

- thyssenkrupp AG (Germany)

- PARAVAN GmbH (Germany)

- Nexteer Automotive Corporation (U.S.)

- Danfoss A/S (Denmark)

- SKF Evolution (Sweden)

- Parker Hannifin Corp (U.S.)

- Eaton (U.S.)

- KYB Corporation (Japan)

- NSK Ltd. (Japan)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- Curtiss-Wright (U.S.)

- Hitachi Automotive Systems Americas, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Schaeffler AG (Germany)

- Stoneridge, Inc. (U.S.)

- WABCO (Belgium)

Latest Developments in Global Automotive Steer-by-Wire System Market

- In October 2024, Parker Hannifin introduced the LORD Force Feedback Device (FFD), marking a significant advancement in steer-by-wire (SbW) feedback technology. The integrated system, comprising a steering sensor, magnetically controllable variable brake, and electric motor, enhances steering texture and operator feedback. This development is designed for new vehicle platforms, improving driving precision and safety. The innovation is expected to strengthen market adoption of SbW systems by offering superior control and a more realistic steering experience, boosting consumer and OEM confidence in electronic steering technologies

- In July 2024, Vector Informatik, in collaboration with MdynamiX, launched new test benches for steer-by-wire and traditional steering systems. The compact, modular tabletop system combines Vector’s real-time simulation capabilities with MdynamiX hardware components, optimizing the testing process for engineers. This advancement enhances development efficiency, reduces prototyping time, and supports faster innovation cycles in the SbW market, positively impacting OEMs and technology adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.