Global Automotive Sun Visor Market

Market Size in USD Billion

CAGR :

%

USD

6.27 Billion

USD

8.65 Billion

2024

2032

USD

6.27 Billion

USD

8.65 Billion

2024

2032

| 2025 –2032 | |

| USD 6.27 Billion | |

| USD 8.65 Billion | |

|

|

|

|

Automotive Sun Visor Market Size

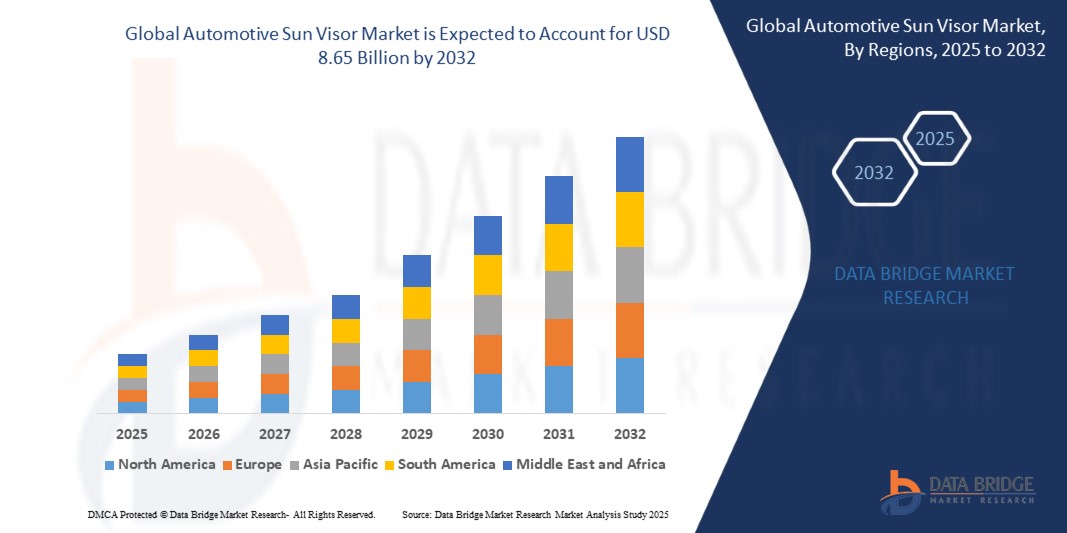

- The global automotive sun visor market was valued at USD 6.27 billion in 2024 and is expected to reach USD 8.65 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.10%, primarily driven by increasing vehicle production

- This growth is driven by rising demand for premium interiors and growing adoption of smart sun visors for enhanced driver safety

Automotive Sun Visor Market Analysis

- Automotive sun visors are gaining traction due to the rising demand for enhanced driver comfort, increasing adoption in electric and hybrid vehicles, and advancements in smart sun visor technologies. Modern innovations, such as LCD sun visors and adaptive glare control, have improved visibility and safety, making them a preferred choice for passenger and commercial vehicles

- The demand for automotive sun visors is significantly driven by stringent road safety regulations, increasing production of luxury and premium vehicles, and the growing shift toward energy-efficient automotive components to enhance fuel efficiency

- For instance, in 2023, Grupo Antolin introduced a next-generation smart sun visor with an integrated electrochromic dimming system, enhancing glare reduction and driver visibility

- Globally, the automotive sun visor market is witnessing rapid advancements, with innovations such as lightweight materials, AI-powered glare detection, and personalized sunshade solutions driving industry growth

Report Scope and Automotive Sun Visor Market Segmentation

|

Attributes |

Automotive Sun Visor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Automotive Sun Visor Market Trends

“Advancements in Smart and Adaptive Automotive Sun Visors”

- One of the key trends in the global automotive sun visor market is the increasing adoption of smart sunshade technologies, driven by the rising demand for luxury vehicles and enhanced driver comfort

- These innovations include LCD sun visors and electrochromic dimming, which improve glare reduction, enhance visibility, and optimize driving safety, while reducing eye strain and power consumption

For instance,

- Leading automotive manufacturers are integrating AI-powered sun visors that automatically adjust shading levels based on ambient light conditions, ensuring optimal glare protection and driver visibility

- Manufacturers are also incorporating lightweight composite materials and touchscreen-integrated visors, enabling real-time adjustments and enhancing aesthetic appeal

- This trend is transforming automotive interiors, making automotive sun visors more intelligent, efficient, and essential for next-generation vehicle designs

Automotive Sun Visor Market Dynamics

Driver

“Growing Demand for Smart and Functional Automotive Sun Visors”

- The automotive sun visor market is driven by the increasing demand for enhanced driver safety and improved in-cabin comfort, as automakers focus on reducing glare and enhancing visibility

- The adoption of electric and autonomous vehicles has accelerated the need for advanced sun visors, including LCD and electrochromic visors, which provide adaptive shading and reduce eye strain for drivers

- Consumers are increasingly prioritizing ergonomic and aesthetic interior designs, pushing manufacturers to develop lightweight, customizable, and multifunctional sun visors to align with modern vehicle interiors

For instance,

In March 2024, TOYOTA BOSHOKU CORPORATION unveiled a next-generation smart sun visor with automatic tint adjustment, offering optimized glare reduction while maintaining clear road visibility

- As automakers continue innovating vehicle interiors, the automotive sun visor market is expected to expand with technologically advanced and user-friendly solutions catering to both traditional and electric vehicles

Opportunity

“Rising Demand for Advanced Safety Features”

- Increasing adoption of illuminated mirrors, vanity mirrors, and LCD screens in sun visors to enhance driver convenience

- Development of electrochromic and LCD-based sun visors that adjust tint automatically based on sunlight exposure

- Advanced Driver Assistance Systems (ADAS) are being incorporated into sun visors for augmented reality (AR) navigation and improved driver safety

For Instance,

- In 2023, Bosch introduced a Virtual Visor that uses AI and an LCD panel to block only the sun’s glare, improving visibility while driving

- As automakers focus on driver safety and comfort, demand for smart sun visors is expected to grow, driving innovation in the market

Restraint/Challenge

“High Production Costs”

- The automotive sun visor market faces challenges due to the high production costs associated with advanced materials, smart technologies, and electronic integration in next-generation sun visors

- Despite the benefits of electrochromic and LCD sun visors, their high price points and complex manufacturing processes make them less accessible for budget and mid-range vehicle segments

For Instance,

- In 2023, Toyota Boshoku Corporation highlighted the cost constraints of integrating AI-powered sun visors, emphasizing the need for scalable production methods to drive widespread adoption

- Addressing these challenges will require cost optimization, increased consumer education, and strategic collaborations between automakers and technology providers to enhance affordability and adoption rates

Automotive Sun Visor Market Scope

The market is segmented on the basis of surface material, type, vehicle type, propulsion, and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Surface Material |

|

|

By Type |

|

|

By Vehicle Type |

|

|

By Propulsion |

|

|

By Sales Channel |

|

Automotive Sun Visor Market Regional Analysis

“North America is the Dominant Region in the Automotive Sun Visor Market”

- North America holds the largest market share in the global automotive sun visor market, driven by increasing vehicle production, rising demand for luxury interiors, and expanding electric vehicle (EV) adoption

- The U.S. leads the region due to strong government support for automotive innovation, the presence of major automobile OEMs, and increasing investments in premium vehicle components

- The availability of advanced sun visor technologies, including LCD sun visors and smart dimming systems, has further accelerated market expansion

- In addition, growing demand for lightweight materials, increasing partnerships between automakers and component suppliers, and rising adoption of customized sun visors in high-end and electric vehicles contribute to the growth of the automotive sun visor market across North America

“Europe is projected to register the Highest Growth Rate”

- Europe is projected to witness the highest CAGR in the global automotive sun visor market, driven by increasing demand for luxury vehicles, rising investments in automotive interiors, and a growing shift toward smart sun visor technologies

- Countries such as Germany and France are leading the market due to strong government incentives for sustainable mobility, expanding automotive R&D, and the presence of key automobile manufacturers investing in premium vehicle components

- The rapid adoption of electric vehicles (EVs), coupled with continuous advancements in LCD sun visors and adaptive glare control, is further accelerating market expansion

- In addition, government regulations promoting road safety, increasing collaborations between OEMs and component suppliers, and rising demand for lightweight materials in vehicle interiors are contributing to the rapid development of the automotive sun visor market across Europe

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- PISTON GROUP (U.S.)

- GUMOTEX (Czech Republic)

- Grios s. r. o. (Slovakia)

- Antolin (Spain)

- Atlas Holdings (U.S.)

- KASAI KOGYO CO., LTD. (Japan)

- BURSA OTOTRIM PANEL SANAYİ VE TİCARET A.Ş. (Turkey)

- Martur Fompak International (Turkey)

- KYOWA SANGYO CO., LTD. (Japan)

- HAYASHI TELEMPU CORPORATION (Japan)

- TOYOTA BOSHOKU CORPORATION (Japan)

- Continental AG (Germany)

- Magna International Inc. (Canada)

- ACME Specialty Manufacturing Company (U.S.)

- Rosco, Inc. (U.S.)

- American Stitchco Inc. (U.S.)

- Mirror Lite Company, Inc. (U.S.)

- Feurer Group GmbH (Germany)

- Hansen International, Inc. (U.S.)

Latest Developments in Global Automotive Sun Visor Market

- In November 2024, Nissan Motor Co., Ltd. announced the completion of its investment in Kasai Kogyo Co., Ltd., a leading supplier of automotive parts in Japan. The investment includes the acquisition of newly issued Class A preferred shares, strengthening Nissan's position in the automotive components sector

- In October 2024, Atlas Holdings signed an agreement with Guardian Industries to acquire SRG Global. This acquisition expands Atlas Holdings’ portfolio in the automotive sector, adding to its existing investments and enhancing its presence in vehicle component manufacturing

- In September 2024, Visto Visors, a leading manufacturer of sun protection accessories, launched a new line of wide-brim visors designed for consumers seeking enhanced UV protection and 360-degree visibility

- In September 2024, Hyundai introduced the Alcazar, an SUV designed to compete with rivals such as the Mahindra XUV700, Tata Safari, and MG Hector Plus. The Alcazar features 1.5-liter turbo-petrol and diesel engines, along with six-speed torque converter automatic, six-speed manual, and seven-speed DCT transmission options

- In July 2024, Grupo Antolin and Mit Adt University collaborated on automotive interior design projects. This partnership provided students with hands-on experience, working alongside Antolin experts to develop innovative design solutions, including automotive sun visors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.