Global Automotive Supercharger Market

Market Size in USD Billion

CAGR :

%

USD

8.20 Billion

USD

12.00 Billion

2024

2032

USD

8.20 Billion

USD

12.00 Billion

2024

2032

| 2025 –2032 | |

| USD 8.20 Billion | |

| USD 12.00 Billion | |

|

|

|

|

Automotive Supercharger Market Size

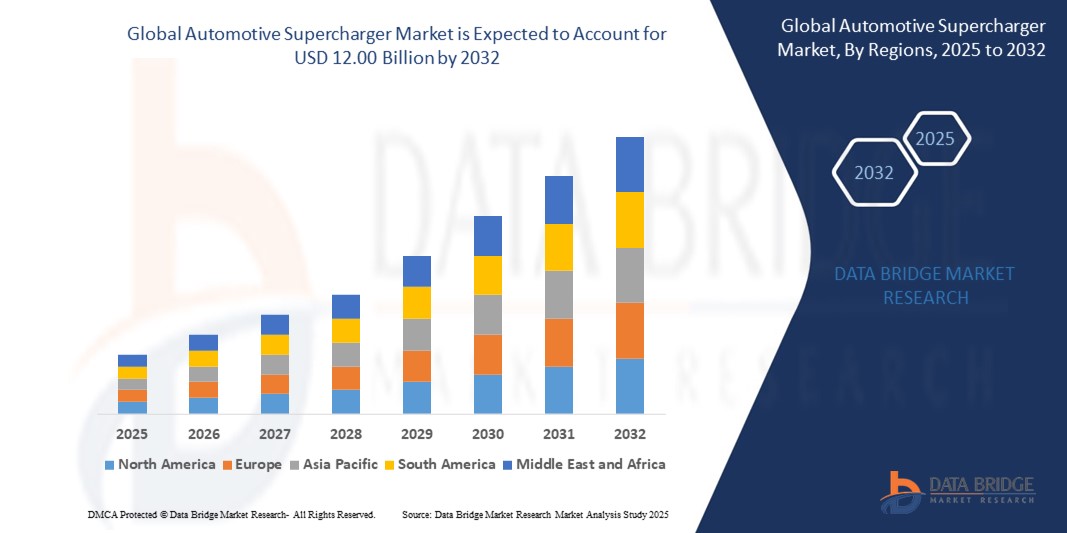

- The global automotive supercharger market size was valued at USD 8.20 billion in 2024 and is expected to reach USD 12.00 billion by 2032, at a CAGR of 4.88% during the forecast period

- The market growth is largely fuelled by the increasing demand for enhanced engine performance and fuel efficiency, alongside stricter emission regulations driving the adoption of advanced forced induction technologies

- The growing popularity of electric and hybrid vehicles incorporating supercharged engines for improved power output and the rising trend of vehicle customization in the aftermarket sector are also contributing to market expansion

Automotive Supercharger Market Analysis

- The automotive supercharger market is witnessing steady growth as manufacturers focus on enhancing vehicle performance through compact, high-efficiency engine components that support both power and responsiveness

- Increasing collaboration between key players and aftermarket specialists is shaping product innovation, leading to wider adoption of superchargers in both passenger and performance vehicles across various segments

- Asia Pacific leads the automotive supercharger market with the largest revenue share of 39.2% in 2024, driven by rapid industrial growth, rising vehicle production, and increasing demand for fuel-efficient, high-performance engines in countries such as China, Japan, and India

- North America region is expected to witness the highest growth rate in the global automotive supercharger market, driven by strong consumer demand for high-performance vehicles, a well-established aftermarket culture, and rapid adoption of advanced supercharger technologies

- The compressor segment holds the largest market revenue share in 2024, attributed to its core role in boosting engine performance by increasing air intake. Compressors are essential in achieving the primary function of a supercharger system and are widely used across vehicle types due to their reliability and impact on power output

Report Scope and Automotive Supercharger Market Segmentation

|

Attributes |

Automotive Supercharger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Supercharger Market Trends

“Integration of Superchargers in Hybrid and Performance Vehicles”

- A prominent trend in the automotive supercharger market is the growing integration of superchargers in hybrid and high-performance vehicles, driven by the demand for enhanced power without compromising efficiency

- Automakers are increasingly using superchargers to improve throttle response and acceleration in hybrid drivetrains, as seen in models such as the Volvo T8 Twin Engine and the Land Rover Range Rover Sport PHEV

- In performance cars, superchargers continue to play a key role in delivering high horsepower outputs with minimal turbo lag, supported by instance such as the Dodge Challenger Hellcat and Jaguar F-Type R

- This trend aligns with the industry's push toward downsized engines that maintain or exceed traditional performance benchmarks through forced induction

- As hybrid and sports car markets expand, the use of superchargers is expected to rise, reflecting a shift toward powertrain technologies that balance speed, efficiency, and environmental considerations

Automotive Supercharger Market Dynamics

Driver

“Rising Demand for Performance and Fuel Efficiency”

- One of the key drivers of the automotive supercharger market is the increasing demand for improved vehicle performance combined with better fuel efficiency, particularly in sports, luxury, and high-performance vehicles

- Consumers prefer vehicles that offer faster acceleration and higher torque, which superchargers enable by forcing more air into the combustion chamber to increase engine output

- Unlike turbochargers that rely on exhaust gases and often experience lag, superchargers deliver instant throttle response, making them ideal for performance-focused applications

- Environmental regulations are pushing automakers to develop smaller, more efficient engines, and superchargers help maintain or exceed traditional performance while meeting these regulatory requirements

- For instance, Jaguar has incorporated superchargers in its F-Type models to balance emission standards with the high-performance expectations of luxury sports car buyers

Restraint/Challenge

“High Cost and Mechanical Complexity”

- Despite their advantages, superchargers present challenges such as high costs and mechanical complexity, which can limit their appeal in the broader automotive market

- Integration of superchargers often requires extra components such as intercoolers, reinforced engine parts, and upgraded fuel systems, resulting in increased production and maintenance expenses

- These added costs typically restrict supercharger use to premium or high-performance vehicles, making them less viable for mass-market models

- Superchargers are driven directly by the engine crankshaft, which can create parasitic power loss and reduce fuel efficiency if not carefully optimized

- For instance, in cost-sensitive segments such as compact or economy cars, manufacturers often choose turbochargers or hybrid systems instead, due to their better balance of affordability and efficiency

Automotive Supercharger Market Scope

The market is segmented on the basis of component, power source, technology, fuel type, vehicle type, and sales

- By Component

On the basis of component, the automotive supercharger market is segmented into harmonic balancers, pulleys/belts, compressors, intercoolers, blowers, tensioners, valves, and head units. The compressor segment holds the largest market revenue share in 2024, attributed to its core role in boosting engine performance by increasing air intake. Compressors are essential in achieving the primary function of a supercharger system and are widely used across vehicle types due to their reliability and impact on power output.

The intercooler segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising need for thermal efficiency and engine cooling. Intercoolers enhance performance by reducing the temperature of compressed air, minimizing engine knock, and supporting consistent horsepower delivery in both OEM and aftermarket applications.

- By Power Source

On the basis of power source, the automotive supercharger market is segmented into engine driven and electric motor driven. The engine driven segment accounts for the largest market revenue share in 2024, as it remains the most common configuration in traditional supercharger systems. This type delivers immediate boost by drawing power directly from the engine’s crankshaft, making it ideal for performance vehicles where throttle response is critical.

The electric motor driven segment is expected to witness the fastest growth rate from 2025 to 2032, supported by advancements in hybrid powertrains and growing emphasis on efficiency. Electric superchargers reduce lag and enable better power management, making them suitable for next-generation engines in both performance and eco-friendly vehicles.

- By Technology

Based on technology, the automotive supercharger market is segmented into centrifugal supercharger, roots supercharger, and twin-screw supercharger. The roots supercharger segment leads with the largest revenue share in 2024 due to its simple design, robust construction, and strong low-end torque delivery. It is widely used in muscle cars and trucks where immediate power output is a key requirement.

The centrifugal supercharger segment is expected to witness the fastest growth rate from 2025 to 2032, as it offers better high-end performance, higher efficiency, and compact size. Its rising adoption in sports cars and aftermarket upgrades reflects the demand for scalable and space-saving performance solutions.

- By Fuel Type

By fuel type, the automotive supercharger market is segmented into gasoline and diesel. The gasoline segment dominates the largest revenue share in 2024, driven by the widespread use of gasoline-powered performance vehicles and the growing preference for forced induction in downsized engines. Gasoline engines benefit significantly from superchargers in terms of responsiveness and horsepower enhancement.

The diesel segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing use in commercial vehicles and off-road applications. Superchargers help diesel engines improve power density and emissions control, particularly in markets emphasizing environmental compliance.

- By Vehicle Type

On the basis of vehicle type, the automotive supercharger market is segmented into passenger cars, commercial vehicles, and motorcycles. The passenger cars segment captured the largest market revenue share in 2024, driven by rising demand for compact and luxury cars with enhanced engine performance. Superchargers are favored for their instant power delivery and integration into existing engine layouts.

The commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the need for higher torque and power in logistics and heavy-duty operations. Superchargers support load-bearing efficiency and are gaining traction in trucks and vans used in demanding environments.

- By Sales

On the basis of sales channel, the automotive supercharger market is segmented into original equipment manufacturers (OEM) and aftermarket. The OEM segment holds the largest market revenue share in 2024, as major automakers integrate factory-installed superchargers in performance and specialty vehicles. OEM solutions ensure compatibility, warranty coverage, and optimized performance.

The aftermarket segment is expected to witness the fastest growth rate from 2025 to 2032, driven by customization trends and increasing interest in upgrading existing vehicles. Enthusiasts and performance-focused drivers are turning to aftermarket superchargers for affordable power enhancements and personalization.

Automotive Supercharger Market Regional Analysis

- Asia Pacific leads the automotive supercharger market with the largest revenue share of 39.2% in 2024, driven by rapid industrial growth, rising vehicle production, and increasing demand for fuel-efficient, high-performance engines in countries such as China, Japan, and India

- Government initiatives supporting clean technologies and advanced powertrain adoption accelerate market growth. The region benefits from a strong automotive manufacturing base and expanding aftermarket performance tuning

- Growing urbanization and rising disposable incomes further encourage consumer interest in supercharged vehicles, particularly in passenger cars and commercial vehicles

China Automotive Supercharger Market Insight

The China holds the largest share within the Asia Pacific supercharger market, propelled by its massive automotive manufacturing sector and surging demand for performance-enhanced vehicles. Increased focus on emission norms and fuel efficiency supports the integration of superchargers in both gasoline and diesel engines. Domestic OEMs and aftermarket providers are actively adopting advanced supercharger technologies. The country’s rapid urbanization and expanding middle class boost sales in passenger and commercial vehicle segments. In addition, China’s push for electric and hybrid vehicles opens new avenues for electric motor-driven superchargers.

Japan Automotive Supercharger Market Insight

The Japan’s automotive supercharger market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s emphasis on technological innovation and environmental regulations. The preference for compact, efficient vehicles with enhanced power output supports supercharger adoption, especially in passenger cars. Japanese automakers invest heavily in hybrid powertrains, where electric superchargers complement performance and fuel efficiency. Aging populations and urban density increase demand for smooth, responsive engines in both commercial and private vehicles, fostering market growth.

North America Automotive Supercharger Market Insight

The North America is expected to witness the fastest growth rate from 2025 to 2032. Strong consumer demand for high-performance vehicles, including sports cars and trucks, drives this trend. The region’s well-developed aftermarket and customization culture supports growing supercharger sales. OEMs are incorporating advanced supercharger systems to meet stringent emission regulations while enhancing power. Innovations in electric motor-driven superchargers and hybrid integration further boost market opportunities. High disposable income and automotive enthusiasm are key growth factors.

U.S. Automotive Supercharger Market Insight

The U.S. market dominates North America’s automotive supercharger segment, led by a robust sports and luxury vehicle market and widespread aftermarket interest. The country’s consumers seek performance enhancements without compromising fuel efficiency, fuelling supercharger adoption. OEM partnerships with performance brands and growing demand for electric superchargers support market expansion. In addition, strong automotive culture and motorsports activities increase awareness and acceptance of superchargers in passenger and commercial vehicles.

Europe Automotive Supercharger Market Insight

The Europe’s automotive supercharger market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict emission standards and increasing demand for efficient, high-performance engines. Countries such as Germany, the U.K., and France focus on integrating superchargers to meet environmental regulations without sacrificing power. The rise of electric motor-driven superchargers in hybrid vehicles fuels innovation. Consumers in Europe prefer premium and luxury vehicles, driving adoption in the passenger car segment. Growing urbanization and government incentives for clean automotive technologies also support market growth.

U.K. Automotive Supercharger Market Insight

The U.K. automotive supercharger market is expected to witness the fastest growth rate from 2025 to 2032, due to rising consumer interest in vehicle performance and efficiency. Increasing adoption of hybrid powertrains and stricter emission laws encourage supercharger integration. The aftermarket sector benefits from a growing number of car enthusiasts seeking power upgrades. OEMs focus on developing supercharger solutions compatible with new energy vehicles. The U.K.’s strong automotive heritage and increasing government focus on sustainability help drive market demand.

Germany Automotive Supercharger Market Insight

The Germany holds a significant share of the European automotive supercharger market, driven by its well-established automotive industry and innovation focus. German manufacturers are investing in advanced supercharger technologies that improve engine efficiency and reduce emissions. The country’s stringent environmental policies accelerate the adoption of electric motor-driven superchargers in hybrid and performance vehicles. Consumer preference for premium and luxury cars further supports market growth. Integration with smart engine management systems is increasingly common in Germany’s automotive sector.

Automotive Supercharger Market Share

The Automotive Supercharger industry is primarily led by well-established companies, including:

- Eaton (Ireland)

- Edelbrock Group (U.S.)

- Rotrex A/S (Denmark)

- Vortech Superchargers (U.S.)

- RIPP Modifications (U.S.)

- Accelerated Machine LLC. (U.S.)

- MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan)

- Honeywell International Inc (U.S.)

- VALEO (France)

- Tenneco Inc. (U.S.)

- A&A Corvette Performance, Ltd. (U.S.)

- Aeristech Ltd (U.K.)

- Duryea Technologies (U.S.)

- IHI Corporation (Japan)

- Mercedes-Benz Group AG (Germany)

- Ford Motor Company (U.S.)

- Automobili Lamborghini S.p.A (Italy)

- Ferrari N.V (Italy)

Latest Developments in Global Automotive Supercharger Market

- In October 2023, HySE, a Japanese research association including Honda, Toyota, and Yamaha, announced the debut of the hydrogen ICE-powered side-by-side X1 at Dakar 2024. The X1 features a 1.0-liter four-stroke inline-four hydrogen engine with a supercharger, enhancing power efficiency and promoting sustainable off-road vehicle technology. This development marks a significant step toward integrating hydrogen engines in competitive motorsports

- In June 2023, Late Model Engines (LME) introduced Whipple’s Gen 5 3.0L supercharger for its Gen V L8T engine, capable of delivering up to 1,400 horsepower with suitable fuel such as race gas or ethanol. This versatile engine supports both passenger and sports car applications, expanding performance options for automotive enthusiasts and the racing market

- In November 2022, Eaton Corporation launched the Twin Vortices Series X3100 supercharger designed for aftermarket use, focusing on increased airflow within a compact engine package. Available exclusively through Eaton’s partners such as Magnuson Products and Edelbrock, the X3100 addresses customer demand for enhanced engine performance, benefiting the aftermarket tuning and customization sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.