Global Automotive Targeting Pods Market

Market Size in USD Billion

CAGR :

%

USD

1.65 Billion

USD

2.75 Billion

2024

2032

USD

1.65 Billion

USD

2.75 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 2.75 Billion | |

|

|

|

|

Automotive Targeting Pods Market Size

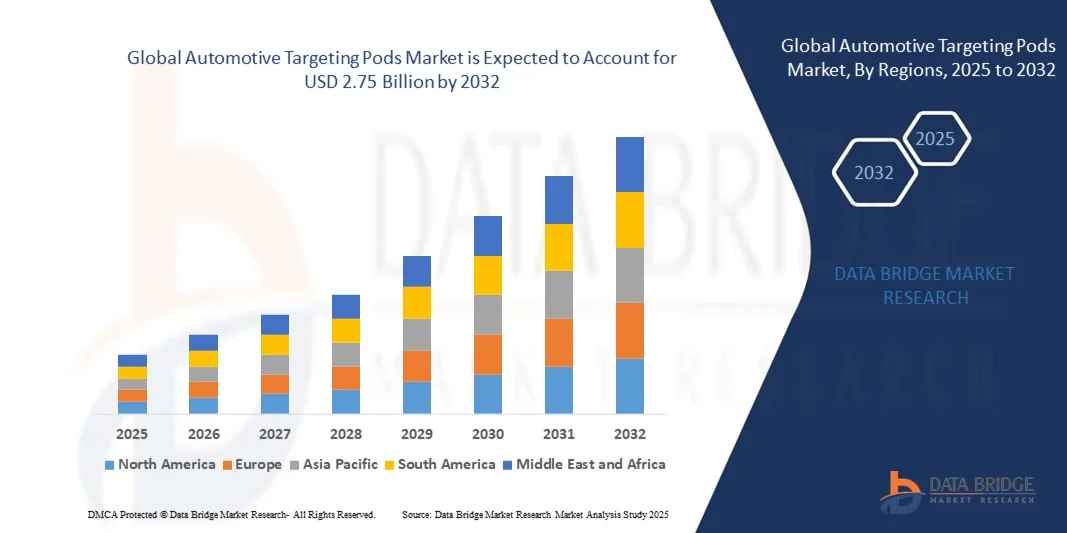

- The global automotive targeting pods market size was valued at USD 1.65 billion in 2024 and is expected to reach USD 2.75 billion by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by the increasing defense modernization programs and rapid technological advancements in electro-optical systems, leading to enhanced precision strike and surveillance capabilities across various air platforms. The growing integration of advanced targeting solutions in combat aircraft and UAVs is driving significant investment from defense agencies worldwide

- Furthermore, rising demand for improved situational awareness, real-time data processing, and multi-sensor fusion technologies is establishing targeting pods as a critical component in modern aerial warfare. These converging factors are accelerating adoption across global air forces, thereby substantially boosting the automotive targeting pods market growth

Automotive Targeting Pods Market Analysis

- Automotive targeting pods are precision systems mounted on military aircraft designed to enhance target detection, identification, and engagement accuracy through advanced electro-optical and infrared imaging technologies. They integrate sensors, lasers, and data links to enable real-time targeting, surveillance, and reconnaissance under diverse combat conditions

- The growing demand for targeting pods is primarily driven by the rising focus on precision-guided weaponry, modernization of existing aircraft fleets, and expanding utilization of UAVs for intelligence and strike missions. Continuous innovation in sensor technology and miniaturization further strengthens their adoption across global defense platforms

- North America dominated the automotive targeting pods market with a share of 33.3% in 2024, due to increasing defense modernization programs and the strong presence of major aerospace and defense contractors

- Asia-Pacific is expected to be the fastest growing region in the automotive targeting pods market during the forecast period due to increasing defense investments, territorial security concerns, and rapid military modernization in countries such as China, India, and Japan

- OEM fit segment dominated the market with a market share of 65.6% in 2024, due to the rising integration of advanced targeting pods into newly manufactured combat and reconnaissance aircraft. Defense OEMs are increasingly collaborating with targeting pod manufacturers to ensure seamless integration, enhanced mission readiness, and improved system interoperability. The surge in defense modernization programs and the procurement of next-generation aircraft across major economies has reinforced this segment’s dominance

Report Scope and Automotive Targeting Pods Market Segmentation

|

Attributes |

Automotive Targeting Pods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Targeting Pods Market Trends

Adoption of AI-Based Targeting and Sensor Fusion

- A significant trend in the automotive targeting pods market is the growing adoption of artificial intelligence (AI) and sensor fusion technologies, enhancing target detection accuracy, situational awareness, and decision-making capabilities during defense and tactical operations. AI-driven targeting systems enable faster data processing, real-time image recognition, and predictive tracking for improved mission efficiency

- For instance, Lockheed Martin has introduced advanced AI-enabled capabilities in its Sniper ATP (Advanced Targeting Pod) to enhance threat recognition accuracy and automated target cueing. Similarly, L3Harris Technologies is incorporating multi-sensor fusion in its WESCAM MX series for improved surveillance and tracking applications, reflecting the expanding integration of AI algorithms in next-generation targeting pods

- The combination of electro-optical, infrared, laser designation, and radar sensors within a single pod is transforming operational efficiency on both manned and unmanned platforms. Sensor fusion allows for cohesive data interpretation from multiple sources, improving target confirmation accuracy, even in challenging environments such as low visibility or electronic interference

- AI integration assists in real-time image processing and also supports autonomous threat prioritization, allowing operators to focus on mission-critical decisions. This transition to intelligent automation reduces human error and operational delay, thereby increasing overall combat readiness and effectiveness

- The ongoing miniaturization and power optimization of AI hardware components are also broadening their applicability across different vehicle platforms, from ground-equipped systems to advanced airborne defense vehicles. In addition, advancements in machine learning are enabling predictive diagnostics for pod maintenance and calibration, further contributing to system reliability

- The adoption of AI-based targeting and sensor fusion represents a fundamental advancement in defense technologies, ensuring higher situational awareness, precision, and coordination across military operations. As nations adopt modern surveillance and reconnaissance systems, the integration of AI continues to drive performance standards and technological evolution in the targeting pods sector

Automotive Targeting Pods Market Dynamics

Driver

Rising Defense Modernization Programs

- Increasing investments in defense modernization and next-generation warfare capabilities are major drivers of the global automotive targeting pods market. Governments worldwide are prioritizing precision engagement, threat identification, and advanced surveillance systems to strengthen tactical efficiency and national security frameworks

- For instance, the U.S. Department of Defense continues to allocate significant budgets toward upgrading surveillance and targeting systems, including procurement of next-generation ATPs from Lockheed Martin and Raytheon Technologies. Similar modernization efforts are visible in European, Asian, and Middle Eastern defense programs, underlining global momentum toward advanced target acquisition technology integration

- The demand for multi-role combat and reconnaissance vehicles has increased, requiring advanced targeting systems capable of operating in geospatially complex and rapidly changing environments. Modern targeting pods offer enhanced range, image clarity, and real-time data integration, enabling forces to maintain superior defensive awareness and operational readiness

- Emerging defense strategies emphasize interoperability between air, land, and naval platforms, which has increased the need for targeting pods that can share data seamlessly across multiple domains. Such integrated defense frameworks strengthen joint operations and improve mission coordination capabilities

- As national defense forces focus on upgrading orbital, aerial, and ground tactical networks, the inclusion of AI-enabled targeting pods is expected to remain a core aspect of modernization programs. This steady rise in military procurement ensures consistent growth and high technological relevance for the global targeting pods market over the forecast period

Restraint/Challenge

High Production and Maintenance Costs

- One of the primary challenges limiting widespread adoption of advanced targeting pods is the high cost of production, integration, and maintenance. These systems require sophisticated optical, laser, and electronic components, all of which demand precise manufacturing tolerances and rigorous testing to ensure combat readiness and operational reliability

- For instance, major defense contractors such as Raytheon Technologies and Northrop Grumman face high production expenditures due to advanced sensor calibration, cooling systems, and digital imaging technologies. These complexities increase procurement costs for defense agencies and also raise maintenance and lifecycle management expenses over time

- The extensive use of specialized materials such as reinforced composites, precision lenses, and AI processors further elevates production costs. In addition, the integration of new software modules for data fusion and analytics typically requires frequent upgrades, driving higher operational expenditure across the equipment lifespan

- Maintenance and servicing remain resource-intensive due to the need for trained technical personnel and high-end diagnostic systems. Downtime for calibration, system replacement, or software verification can reduce operational availability during critical missions, making cost planning and logistical support essential for operators

- To mitigate these challenges, industry stakeholders are emphasizing modular design, standardization of components, and remote maintenance capabilities to optimize lifecycle cost efficiency. However, the high expenses associated with production and upkeep remain a major limiting factor, particularly for smaller defense budgets, thereby impacting adoption rates in emerging economies

Automotive Targeting Pods Market Scope

The market is segmented on the basis of type, fit, component, and platform.

- By Type

On the basis of type, the automotive targeting pods market is segmented into FLIR & Laser Designator Pods, Laser Designator Pods, FLIR Pods, and Laser Spot Tracker. The FLIR & Laser Designator Pods segment dominated the market in 2024 with the largest revenue share, attributed to their dual-function capability that combines thermal imaging and precision laser targeting. These pods provide superior situational awareness, target identification, and engagement capabilities for both day and night missions. Their integration into next-generation aircraft fleets by defense forces globally and high reliability in adverse environments have strengthened their adoption in modern combat systems.

The Laser Designator Pods segment is projected to witness the fastest growth from 2025 to 2032, fueled by their expanding use in precision-guided munitions and advanced surveillance applications. The increasing need for accurate target illumination and reduced collateral damage during combat operations is boosting demand for these pods. Moreover, advancements in miniaturization and power efficiency are making them suitable for smaller aircraft and UAV platforms, enhancing their market potential across multiple defense sectors.

- By Fit

On the basis of fit, the market is bifurcated into OEM Fit and Upgradation. The OEM Fit segment held the largest market revenue share of 65.6% in 2024, driven by the rising integration of advanced targeting pods into newly manufactured combat and reconnaissance aircraft. Defense OEMs are increasingly collaborating with targeting pod manufacturers to ensure seamless integration, enhanced mission readiness, and improved system interoperability. The surge in defense modernization programs and the procurement of next-generation aircraft across major economies has reinforced this segment’s dominance.

The Upgradation segment is expected to register the fastest CAGR during 2025–2032, driven by the ongoing retrofitting of legacy aircraft with advanced targeting pod systems to enhance mission precision and extend fleet lifecycles. Governments are emphasizing cost-effective modernization over new procurement, leading to higher adoption of upgrade kits that offer real-time imaging, laser designation, and data-link integration. This trend is particularly strong in developing nations upgrading existing aerial platforms for multirole operations.

- By Component

On the basis of component, the automotive targeting pods market is divided into FLIR Sensor, Charge Coupled Device Camera, Environmental Control Unit, Moving Map System Digital Data Recorder, Processor, Video Data Link, and High Definition TV. The FLIR Sensor segment dominated the market in 2024, owing to its critical role in providing high-resolution thermal imagery for surveillance and targeting in all weather and lighting conditions. The demand for enhanced battlefield visibility and long-range detection has propelled investments in next-generation FLIR sensors featuring improved resolution and reduced power consumption.

The Processor segment is anticipated to grow at the fastest rate during the forecast period, driven by increasing adoption of AI-enabled and real-time image processing technologies. The integration of high-speed processors allows for rapid target recognition, automatic tracking, and improved accuracy in dynamic environments. As targeting systems evolve toward data-centric and network-enabled architectures, the demand for powerful processors capable of handling complex data fusion and analytics continues to surge.

- By Platform

On the basis of platform, the market is segmented into Combat Aircraft, Unmanned Aerial Vehicles, Attack Helicopters, and Bombers. The Combat Aircraft segment accounted for the largest revenue share in 2024, supported by its widespread use in precision strike, reconnaissance, and surveillance missions. The demand is primarily fueled by global fleet modernization and increased procurement of advanced fighter jets equipped with integrated targeting pods. The ability of these pods to enhance mission effectiveness, night-vision capabilities, and precision engagement has solidified their importance in air force operations worldwide.

The Unmanned Aerial Vehicles (UAV) segment is projected to witness the fastest growth from 2025 to 2032, attributed to the growing adoption of UAVs for intelligence, surveillance, and reconnaissance (ISR) applications. Integration of lightweight and power-efficient targeting pods enables UAVs to conduct long-endurance missions with enhanced accuracy. Increasing defense investments in tactical drones for border surveillance and counter-insurgency missions are further driving the demand for advanced targeting pod systems in this segment.

Automotive Targeting Pods Market Regional Analysis

- North America dominated the automotive targeting pods market with the largest revenue share of 33.3% in 2024, driven by increasing defense modernization programs and the strong presence of major aerospace and defense contractors

- The region’s focus on enhancing air-to-ground precision strike capabilities and expanding investments in next-generation combat aircraft programs significantly contributes to market growth

- High adoption of advanced electro-optical targeting systems for surveillance and reconnaissance missions further boosts demand. The modernization of existing fleets with upgraded targeting pods reinforces the region’s leading position in the global market

U.S. Automotive Targeting Pods Market Insight

The U.S. automotive targeting pods market accounted for the largest share within North America in 2024, supported by extensive procurement of advanced fighter jets and UAVs by the U.S. Department of Defense. The country’s continuous investment in advanced laser targeting, FLIR, and data-link technologies enhances mission effectiveness and precision. The presence of leading manufacturers such as Lockheed Martin and Northrop Grumman ensures steady technological innovation and export opportunities. The growing emphasis on multi-role and network-enabled warfare continues to drive U.S. market expansion.

Europe Automotive Targeting Pods Market Insight

Europe is projected to witness substantial growth in the automotive targeting pods market throughout the forecast period, primarily driven by increasing defense budgets and modernization initiatives across major nations. The rising adoption of precision-guided weapon systems and surveillance platforms in NATO member states is fueling market expansion. European defense programs, including collaborative aircraft development and retrofitting initiatives, are strengthening the demand for advanced targeting pods. In addition, regional emphasis on interoperability and situational awareness is propelling adoption across air and unmanned platforms.

U.K. Automotive Targeting Pods Market Insight

The U.K. automotive targeting pods market is anticipated to grow steadily during the forecast period, driven by the country’s participation in multinational defense programs and upgrades of its Typhoon and F-35 fleets. The increasing focus on precision strike capabilities and intelligence-driven missions is fostering the integration of advanced targeting systems. The government’s commitment to defense innovation, alongside partnerships with key aerospace players, continues to support the market’s development and export growth.

Germany Automotive Targeting Pods Market Insight

The Germany automotive targeting pods market is expected to expand considerably, fueled by the nation’s growing defense spending and emphasis on enhancing air combat readiness. Germany’s ongoing procurement of new-generation aircraft and retrofit initiatives for legacy fleets contribute to rising demand. The integration of advanced targeting pods supporting multi-spectral imaging and real-time data transfer aligns with Germany’s focus on networked defense operations. The country’s robust industrial base also supports local manufacturing and technology development in targeting systems.

Asia-Pacific Automotive Targeting Pods Market Insight

The Asia-Pacific automotive targeting pods market is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing defense investments, territorial security concerns, and rapid military modernization in countries such as China, India, and Japan. Rising procurement of fighter aircraft and UAVs equipped with precision-guided weaponry is accelerating regional adoption. Governments are prioritizing indigenous production and joint ventures to strengthen self-reliance in defense technology, contributing to market expansion.

China Automotive Targeting Pods Market Insight

The China automotive targeting pods market captured the largest share in Asia-Pacific in 2024, supported by the country’s robust defense spending and focus on modernizing its air force. Ongoing programs to develop advanced combat and reconnaissance aircraft have driven the integration of domestic targeting pod systems with enhanced FLIR and laser designation capabilities. China’s investments in electronic warfare and precision attack systems, along with strong domestic manufacturing capacity, further reinforce its market leadership in the region.

India Automotive Targeting Pods Market Insight

The India automotive targeting pods market is expected to witness the fastest growth in Asia-Pacific, propelled by the country’s defense modernization initiatives and increasing procurement of multirole combat aircraft. India’s “Make in India” program and defense partnerships are encouraging domestic production and technology transfer in advanced targeting solutions. The growing focus on improving precision strike and ISR (intelligence, surveillance, and reconnaissance) capabilities across the air force and naval aviation sectors is strengthening demand for targeting pods.

Automotive Targeting Pods Market Share

The automotive targeting pods industry is primarily led by well-established companies, including:

- Lockheed Martin Corporation. (U.S.)

- ASELSAN A.S. (Turkey)

- Thales Group (France)

- Raytheon Technologies Corporation (U.S.)

- Northrop Grumman Corporation. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Ultra. (U.K.)

- IAI (Israel)

- Moog Inc. (U.S.)

- FLIR (U.S.)

- Rafael Advanced Defense Systems Ltd. (Israel)

- Excelitas Technologies Corp. (U.S.)

- Elbit Systems Ltd. (Israel)

- Leonardo DRS (U.S.)

- BAE Systems. (U.S.)

- Rheinmetall AG (Germany)

- Collins Aerospace (U.S.)

- Saab (Sweden)

- Textron Inc. (U.S.)

Latest Developments in Global Automotive Targeting Pods Market

- In August 2025, the German parliament authorized the procurement of 90 Litening 5 targeting pods for its Eurofighter Typhoon fleet, significantly strengthening Germany’s precision strike and reconnaissance capabilities. This strategic acquisition underlines the Bundeswehr’s commitment to enhancing situational awareness and interoperability within NATO operations. The move reinforces Rafael’s presence in the European defense market and sets a benchmark for integrating multi-wavelength sensor technologies and stand-off targeting systems across advanced combat platforms

- In June 2025, Lockheed Martin announced the successful completion of advanced flight trials for its Sniper ATP-SE (Advanced Targeting Pod – Sensor Enhancement) system in the U.S., demonstrating improved image resolution and real-time data-link transmission. This milestone marks a major leap in targeting efficiency, offering enhanced detection, recognition, and tracking accuracy in complex mission environments. The achievement is expected to accelerate adoption across U.S. and allied air forces, strengthening Lockheed Martin’s competitive position in the global targeting pods market

- In May 2025, Pod, one of the U.K.’s leading electric vehicle (EV) charging providers, launched its new all-inclusive home charging service under the Pod Drive subscription, transforming EV charging accessibility across the region. By reducing installation costs and incentivizing smart charging behavior, the initiative promotes broader EV adoption and supports sustainability goals. This expansion of the Pod brand reinforces the U.K.’s leadership in clean mobility infrastructure and consumer-centric energy solutions

- In June 2024, Zen Mobility, an Indian electric vehicle OEM, launched its latest Micro Pod variants—ThermoFlex and LoadMax—priced at ₹2.25 lakh each, to address the evolving needs of temperature-sensitive and bulk cargo transport. These models are designed to meet the growing requirements of e-commerce and quick commerce logistics, strengthening India’s light mobility ecosystem. The innovation positions Zen Mobility as a key player in the compact EV logistics space, promoting efficiency and sustainability in last-mile delivery

- In March 2024, India’s Hindustan Aeronautics Limited (HAL) partnered with Bharat Electronics Limited (BEL) to co-develop an indigenous advanced targeting pod system for integration into Tejas and Su-30MKI aircraft. The collaboration aims to reduce dependency on foreign suppliers while fostering technological self-reliance under the “Make in India” defense initiative. This development enhances India’s defense manufacturing capabilities and supports the growth of domestic expertise in electro-optical and laser designation technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.