Global Automotive Textiles Market

Market Size in USD Billion

CAGR :

%

USD

32.20 Billion

USD

43.74 Billion

2024

2032

USD

32.20 Billion

USD

43.74 Billion

2024

2032

| 2025 –2032 | |

| USD 32.20 Billion | |

| USD 43.74 Billion | |

|

|

|

|

What is the Global Automotive Textiles Market Size and Growth Rate?

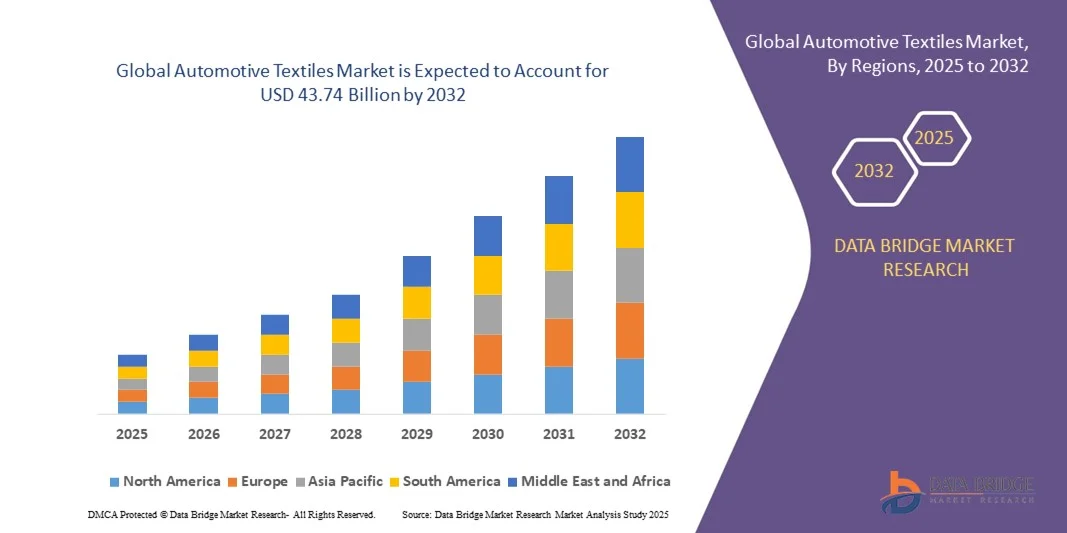

- The global automotive textiles market size was valued at USD 32.20 billion in 2024 and is expected to reach USD 43.74 billion by 2032, at a CAGR of 3.9% during the forecast period

- Factors such as prevailing demand for safety devices in vehicles such as airbags and seat belts and growing disposable income of consumers and living standards are the root cause fueling up the automotive textiles market growth rate

- In addition, the consumer’s lifestyle is improving day by day which is resulting into higher demand of personal vehicles will also directly and positively impact the growth rate of the automotive textiles market

What are the Major Takeaways of Automotive Textiles Market?

- Surge in raw material such as synthetic leather, natural leather and PVC and high cost of production of this textile derail growth of the automotive textiles market

- Research and development initiatives in developing novel and superior quality textile product pose as a major challenge to the growth of the automotive textiles market. Safety related standards pose as challenge for the market’s growth

- Asia-Pacific dominated the automotive textiles market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and growing adoption of smart vehicles and connected automotive systems

- The North America automotive textiles market is poised to grow at the fastest CAGR of 9.25% during the forecast period of 2025 to 2032, driven by increasing demand for premium vehicles, adoption of EVs, and rising focus on interior comfort and safety

- In 2024, polyester dominated the market with the largest revenue share of 38.6%, owing to its high durability, cost-effectiveness, and versatility across various automotive applications such as seat covers, carpets, and door trims

Report Scope and Automotive Textiles Market Segmentation

|

Attributes |

Automotive Textiles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Textiles Market?

Smart and Sustainable Materials Integration

- A major emerging trend in the global automotive textiles market is the integration of smart and sustainable materials into vehicle interiors. Automotive manufacturers are increasingly using fabrics embedded with sensors, temperature regulation technology, and eco-friendly fibers to enhance passenger comfort and sustainability

- For instance, Toyota’s latest concept vehicles feature seats made from recycled PET fabrics combined with embedded temperature and posture sensors, allowing adaptive comfort adjustments. Similarly, BMW’s iNext series uses leather alternatives and plant-based textiles to reduce environmental impact while maintaining luxury appeal

- Smart Automotive Textiles can monitor cabin conditions, detect occupancy, and adjust heating or cooling for individual passengers. Some materials also offer antimicrobial properties and self-cleaning features, improving hygiene and durability over time

- The integration of these textiles with vehicle electronics enables centralized control via infotainment systems, allowing drivers to customize seat comfort, lighting, and temperature settings through a single interface

- Automotive manufacturers such as Ford and Mercedes-Benz are developing textile solutions that combine sustainability, safety, and comfort, offering products such as airbag-integrated fabrics and recyclable interior panels

- The increasing consumer preference for vehicles that provide a comfortable, eco-friendly, and technologically advanced experience is accelerating the adoption of smart and sustainable Automotive Textiles across both luxury and mainstream segments

What are the Key Drivers of Automotive Textiles Market?

- Rising consumer demand for comfort, safety, and sustainability in vehicles is a significant driver for the adoption of advanced automotive textiles

- For instance, in March 2024, Lear Corporation (U.S.) unveiled a new line of eco-conscious seat fabrics that combine recycled fibers with enhanced durability and ergonomic support, catering to growing environmental awareness

- Automotive Textiles offer benefits such as temperature regulation, antimicrobial properties, and lightweight designs, improving vehicle efficiency and passenger well-being

- The growth of electric vehicles (EVs) and autonomous vehicles is driving innovation in interiors, with manufacturers seeking materials that enhance energy efficiency, passenger comfort, and cabin air quality

- Consumer preference for personalized and premium interiors, coupled with technological advancements such as smart fabrics with embedded sensors, is further propelling market growth

Which Factor is Challenging the Growth of the Automotive Textiles Market?

- The high cost of advanced and sustainable materials poses a barrier to widespread adoption, particularly in budget vehicle segments. Premium fabrics with embedded sensors or eco-friendly components can significantly increase production costs

- For instance, luxury EV manufacturers using smart textile seating or bio-based fabrics often face higher unit costs, limiting their integration into mid-range or mass-market vehicles

- Technical challenges related to durability, sensor integration, and maintenance of smart textiles may also hinder market growth. Ensuring that fabrics maintain their functional properties over the vehicle’s lifespan requires ongoing R&D investment

- While the adoption of sustainable and smart automotive textiles is growing, balancing cost, performance, and environmental benefits remains critical for broader market penetration. Manufacturers such as Adient and Schoeller Textil emphasize durability testing, recyclable components, and cost-effective material sourcing to overcome these barriers

How is the Automotive Textiles Market Segmented?

The automotive textiles market is segmented on the basis of raw materials, product type, vehicle type, and application.

- By Raw Materials

On the basis of raw materials, the automotive textiles market is segmented into polyamide, polyester, acrylic, polyethylene, and others. In 2024, polyester dominated the market with the largest revenue share of 38.6%, owing to its high durability, cost-effectiveness, and versatility across various automotive applications such as seat covers, carpets, and door trims. Polyester offers resistance to wear and tear, ease of cleaning, and compatibility with advanced coatings and finishes, making it a preferred choice among OEMs and aftermarket suppliers.

The polyamide segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for lightweight, high-strength, and heat-resistant materials in safety-critical components such as airbags, reinforced seats, and protective panels. Growing adoption of electric vehicles and performance-oriented vehicles is further boosting the demand for polyamide, as manufacturers seek materials that reduce vehicle weight while maintaining structural integrity and safety standards.

- By Product Type

On the basis of product type, the automotive textiles market is segmented into woven, non-woven, and composites. In 2024, the woven segment held the largest market share of 41.3%, driven by its widespread use in seat upholstery, door panels, and headliners due to its strength, durability, and aesthetic appeal. Woven textiles are compatible with advanced treatments such as stain resistance, flame retardancy, and antimicrobial finishes, making them a versatile option for both passenger and commercial vehicles.

The composites segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for lightweight, high-performance materials in automotive structural components, including dashboards, floor panels, and load-bearing elements. Composites offer superior mechanical properties while reducing overall vehicle weight, which aligns with growing fuel efficiency regulations, the rise of EVs, and the industry’s push toward sustainable and energy-efficient vehicle designs.

- By Vehicle Type

On the basis of vehicle type, the automotive textiles market is segmented into passenger cars, low commercial vehicles (LCVs), heavy trucks, buses, and coaches. In 2024, passenger cars dominated the market with a revenue share of 46.7%, due to the high production volume and growing consumer demand for comfortable, stylish, and functional interiors. Automakers are increasingly integrating advanced textiles, such as smart fabrics, temperature-regulating materials, and eco-friendly alternatives, to enhance the passenger experience.

The buses and coaches segment is expected to witness the fastest CAGR from 2025 to 2032, driven by modernization of public transportation, luxury coach upgrades, and increasing investments in fleet interiors. Demand for durable, fire-retardant, and easy-to-maintain textiles in buses and coaches is fueling adoption, as operators seek long-lasting materials that comply with strict safety and regulatory standards while improving passenger comfort.

- By Application

On the basis of application, the automotive textiles market is segmented into upholstery, floor covering, tires, airbags, and others. In 2024, upholstery held the largest market share of 44.5%, driven by the growing focus on interior comfort, design aesthetics, and technological integration in seats, door panels, and headliners. Innovations such as temperature-regulating fabrics, antimicrobial coatings, and leather alternatives are enhancing user experience, durability, and sustainability.

The airbags segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by strict vehicle safety regulations, rising vehicle production, and advancements in high-strength textile engineering. Airbag textiles require extreme durability, heat resistance, and reliable performance under high-pressure deployment conditions, which is driving the adoption of polyamide, woven, and composite fabrics specially designed for safety-critical applications in passenger cars, commercial vehicles, and heavy trucks.

Which Region Holds the Largest Share of the Automotive Textiles Market?

- Asia-Pacific dominated the automotive textiles market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, rising disposable incomes, and growing adoption of smart vehicles and connected automotive systems

- Consumers in the region are increasingly prioritizing vehicle interior comfort, sustainability, and advanced safety features, leading to higher demand for innovative Automotive Textiles in passenger cars, commercial vehicles, and buses

- This widespread adoption is further supported by government initiatives promoting EVs and smart mobility solutions, the presence of major textile manufacturers, and the affordability of high-quality automotive fabrics, positioning Asia-Pacific as the largest market for Automotive Textiles globally

China Automotive Textiles Market Insight

The China automotive textiles market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by strong vehicle production, an expanding middle class, and rising consumer interest in high-quality, durable, and eco-friendly vehicle interiors. Demand is particularly high for textiles used in seats, floor coverings, airbags, and upholstery, supported by the country’s push towards EV adoption and smart mobility solutions.

Japan Automotive Textiles Market Insight

The Japan automotive textiles market is growing steadily due to the country’s high-tech automotive industry, rising focus on passenger comfort, and demand for advanced, lightweight materials. Japanese consumers favor sustainable fabrics and multifunctional interiors, particularly in electric and hybrid vehicles. The integration of smart textiles into automotive seats and airbags, coupled with government safety regulations, is further accelerating adoption.

Which Region is the Fastest-Growing Region in the Automotive Textiles Market?

The North America automotive textiles market is poised to grow at the fastest CAGR of 9.25% during the forecast period of 2025 to 2032, driven by increasing demand for premium vehicles, adoption of EVs, and rising focus on interior comfort and safety. Consumers in the U.S. and Canada increasingly prefer high-quality, smart, and sustainable automotive fabrics, boosting demand for innovative textiles in both OEM and aftermarket segments.

U.S. Automotive Textiles Market Insight

The U.S. automotive textiles market captured the largest revenue share within North America in 2024, propelled by rising awareness of vehicle safety, sustainable materials, and smart interior solutions. Advanced fabrics for seat upholstery, airbags, floor mats, and composites are gaining traction due to the integration of connected vehicle technologies, including sensor-embedded seats and high-performance airbags.

Canada Automotive Textiles Market Insight

The Canada automotive textiles market is expanding steadily, supported by rising EV adoption, urbanization, and growing consumer preference for durable and eco-friendly automotive interiors. The demand for non-woven fabrics, polyamide-based composites, and lightweight materials in commercial and passenger vehicles is increasing, making Canada a key growth contributor in North America.

Which are the Top Companies in Automotive Textiles Market?

The automotive textiles industry is primarily led by well-established companies, including:

- Trevira GmbH (Germany)

- DuPont (U.S.)

- Sage Automotive Interiors (U.S.)

- Baltex (U.K.)

- Reliance Industries Limited (India)

- Auto Textile S.A (Greece)

- SMS Auto Fabrics (U.S.)

- Autoliv Inc. (Sweden)

- Lear Corporation (U.S.)

- Johnson Controls (U.S.)

- ACME (U.S.)

- AUNDE FAZE THREE Autofab Limited (India)

- Borgers SE & Co. KGaA (Germany)

- TOYOTA BOSHOKU CORPORATION (Japan)

- Elevate Textiles, Inc. (U.S.)

- Autotech Nonwovens Pvt Ltd. (India)

- Suminoe Textile Co. Ltd (Japan)

- CMI Enterprises (U.S.)

What are the Recent Developments in Global Automotive Textiles Market?

- In December 2024, Autoneum diversified its portfolio by introducing a 100% recyclable polyester trunk side trim, reflecting the industry’s move towards sustainable, green mono-material parts that can be easily recycled at the end of a vehicle’s life, reinforcing Autoneum’s commitment to eco-friendly innovations

- In December 2024, Asahi Kasei launched Lastan, a fireproof and highly flexible nonwoven fabric designed to enhance the safety of electric vehicle (EV) batteries, providing improved electrical insulation and fire resistance, marking a significant step in advancing safer EV technologies

- In June 2022, Supima partnered with TextileGenesis™ to create a new industry benchmark for traceability, establishing a reliable platform to authenticate American-grown Pima cotton, promoting transparency and sustainability in textile sourcing

- In May 2022, Toyota Boshoku, Aisin, and Shiroki agreed that Toyota Boshoku would acquire Shiroki’s commercial rights for automotive seat frame mechanism parts used in Suzuki Motor Corporation, Daihatsu Motor Co. Ltd., and Mazda Motor Corporation, strengthening Toyota Boshoku’s global competitiveness in the automotive seat business

- In January 2023, Autoneum announced the acquisition of Borgers Automotive, integrating Borgers’ product lines including wheelhouse outer liners, trunk trims, and sustainable automotive textiles into its portfolio, thereby reinforcing Autoneum’s market position and product diversity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.