Global Automotive Throttle Cables Market

Market Size in USD Billion

CAGR :

%

USD

3.16 Billion

USD

5.90 Billion

2024

2032

USD

3.16 Billion

USD

5.90 Billion

2024

2032

| 2025 –2032 | |

| USD 3.16 Billion | |

| USD 5.90 Billion | |

|

|

|

|

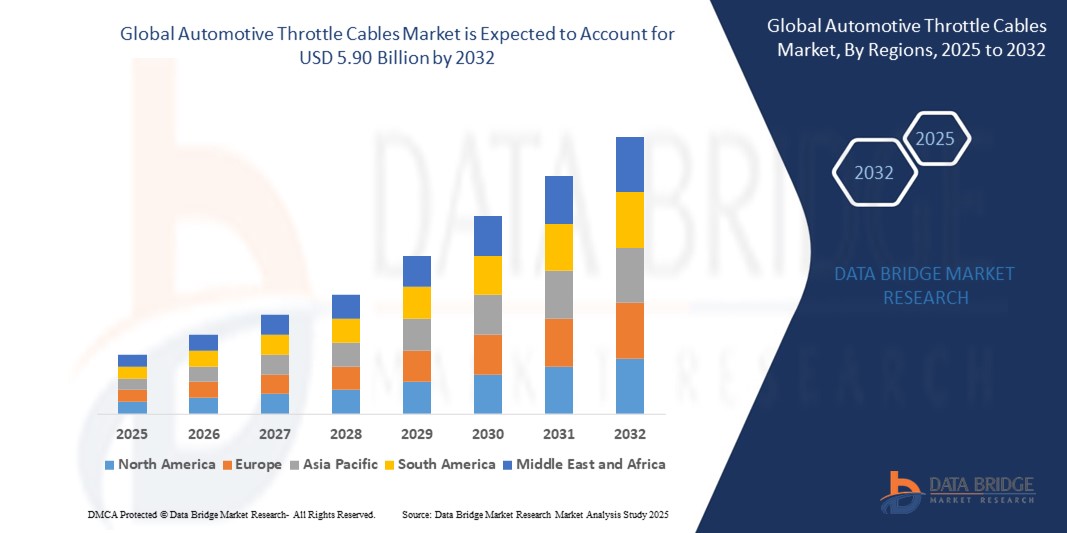

What is the Global Automotive Throttle Cables Market Size and Growth Rate?

- The global automotive throttle cables market size was valued at USD 3.16 billion in 2024 and is expected to reach USD 5.90 billion by 2032, at a CAGR of 8.10% during the forecast period

- The automotive throttle cables market is evolving due to advancements in materials and manufacturing technologies. One notable development is the shift towards high-tensile steel and polymer-coated cables, enhancing durability, flexibility, and corrosion resistance. These advancements reduce maintenance needs and prolong the lifespan of throttle cables, especially in harsh environments

- The introduction of electronic throttle control (ETC) systems is another key technology impacting the market. While electronic systems are increasingly popular in modern vehicles, throttle cables remain essential in various vehicle segments, especially commercial vehicles and motorcycles. Manufacturers are improving cable designs to complement ETC systems, ensuring precise throttle response and driver control

What are the Major Takeaways of Automotive Throttle Cables Market?

- Automated manufacturing processes, such as robotic cable assembly and precision testing, are boosting production efficiency, reducing errors, and lowering costs, which drives the market growth. As automotive production rises, particularly in emerging markets, demand for reliable throttle cables is increasing

- The market is poised to expand with the growing need for fuel-efficient vehicles and the continuous evolution of hybrid and electric cars that still rely on throttle cables for specific applications

- Asia-Pacific dominated the automotive throttle cables market with the largest revenue share of 39.27% in 2024, driven by the rapid expansion of the automotive sector, rising vehicle production, and increasing adoption of advanced mechanical components across China, India, Japan, and South Korea

- North America automotive throttle cables market is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, propelled by rising demand for high-performance vehicles and increasing interest in electric and hybrid models that require precise throttle control systems

- The Single-Core Cables segment dominated the automotive throttle cables market with the largest market revenue share of 58.6% in 2024, owing to its widespread use in traditional throttle systems due to cost-effectiveness, ease of installation, and suitability for standard engine configurations

Report Scope and Automotive Throttle Cables Market Segmentation

|

Attributes |

Automotive Throttle Cables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Automotive Throttle Cables Market?

“Transition toward Drive-by-Wire and Electrification Technologies”

- A key and rapidly emerging trend in the automotive throttle cables market is the shift toward electronic throttle control (ETC) or drive-by-wire systems, replacing traditional mechanical cable-based throttle systems. This evolution is driven by the broader transition to electric vehicles (EVs), improved fuel efficiency targets, and the need for precision control in modern powertrains

- ETC systems eliminate the need for physical cables by using sensors and actuators, improving throttle responsiveness and enabling advanced features such as adaptive cruise control and automatic idle speed regulation. Automakers are increasingly integrating ETC in new models across both ICE and EV platforms

- In addition, with stricter emission standards being adopted globally, automotive OEMs are opting for electronic throttle systems that allow for better engine mapping, smoother acceleration, and reduced environmental impact. For instance, Tesla and BMW use throttle-by-wire systems in their electric and hybrid vehicles to support seamless torque delivery and driver assistance features

- This trend is also leading to hybrid integration, where traditional throttle cables are used in conjunction with electronic modules for improved transition in mid-range vehicles. Manufacturers such as Denso and Hitachi Astemo are offering modular cable systems adaptable for EVs and plug-in hybrids

- As software-defined vehicles become mainstream, the role of mechanical throttle cables is evolving from being a critical component in power transmission to serving niche applications in off-road vehicles and entry-level models. Companies are also innovating with high-performance, corrosion-resistant cable materials to support durability in harsh environments

- The ongoing electrification wave is reshaping the throttle cable segment, requiring manufacturers to rethink product portfolios, integrate sensor technologies, and develop flexible, cost-effective throttle solutions that align with the future of connected and electric mobility

What are the Key Drivers of Automotive Throttle Cables Market?

- The rising production of passenger and commercial vehicles, especially in developing nations, is a major driver of demand for mechanical throttle cables, which remain widely used in low-cost and entry-level vehicles due to their simplicity and cost-effectiveness

- In April 2024, Leoni AG announced a new line of lightweight throttle cable assemblies targeting compact vehicle platforms in Southeast Asia and Latin America, where price sensitivity and fuel efficiency are key purchase factors

- Moreover, the growth of aftermarket sales is fueling demand for replacement throttle cables in aging vehicle fleets, particularly in countries with slower EV adoption. Increased maintenance cycles, especially in commercial fleets, boost the replacement rate for throttle control components

- The increasing trend of customization and performance tuning in automotive enthusiast circles is also supporting cable demand, as enthusiasts opt for performance throttle cables for enhanced responsiveness and engine control

- In addition, rising demand for two-wheelers and utility vehicles, especially in rural and semi-urban areas across Asia and Africa, where mechanical throttle systems are preferred due to lower complexity, continues to support market growth

Which Factor is challenging the Growth of the Automotive Throttle Cables Market?

- The rising shift toward electronic throttle control systems in modern vehicles is the most significant challenge facing the traditional mechanical throttle cable market. As OEMs transition to software-controlled systems, the need for physical cables is being phased out

- For instance, in 2023, Volkswagen Group confirmed the complete elimination of throttle cables in its next-generation electric models under the ID. series, aiming for complete software-based acceleration and torque modulation

- Another challenge is the growing pressure on OEMs to improve fuel efficiency and reduce emissions, which favors electronic solutions offering precision control over traditional cables that are prone to slack, wear, and calibration issues

- Moreover, increased automation and self-driving capabilities in vehicles necessitate electronic interfaces that mechanical systems cannot support. Autonomous driving systems require seamless integration with throttle functions that rely on sensor-based digital inputs

- The fluctuation in raw material costs, particularly steel and composite polymers used in cable housings and liners, can impact manufacturing margins and limit scalability. In response, companies are exploring alternative materials and modular assemblies, but these efforts often involve higher R&D costs

- Addressing these challenges will require diversification of applications, innovation in hybrid cable-electronic systems, and a stronger focus on aftermarket and specialty vehicle segments to sustain growth in the evolving automotive landscape

How is the Automotive Throttle Cables Market Segmented?

The market is segmented on the basis of type, coating material, application, and sales channel.

- By Type

On the basis of type, the automotive throttle cables market is segmented into Single-Core Cables and Multi-Core Cables. The Single-Core Cables segment dominated the automotive throttle cables market with the largest market revenue share of 58.6% in 2024, owing to its widespread use in traditional throttle systems due to cost-effectiveness, ease of installation, and suitability for standard engine configurations. These cables are preferred in low-cost passenger vehicles and two-wheelers where basic mechanical linkages are sufficient for throttle control.

The Multi-Core Cables segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising demand for complex and high-performance cable assemblies in modern vehicles. Multi-core cables enable better control, durability, and flexibility, particularly in commercial vehicles and performance-oriented passenger cars.

- By Coating Material

On the basis of coating material, the automotive throttle cables market is segmented into PVC Cables, Polyethylene, and Others. The PVC Cables segment held the largest market revenue share in 2024, due to its cost-efficiency, abrasion resistance, and widespread availability. PVC-coated throttle cables are commonly used in most vehicles due to their balance of durability and flexibility.

The Polyethylene segment is anticipated to grow at the fastest CAGR during the forecast period, supported by its enhanced chemical resistance and weatherproofing properties, making it ideal for vehicles exposed to harsh environments, including off-road and commercial vehicles.

- By Application

On the basis of application, the market is segmented into Passenger Cars and Commercial Vehicles. The Passenger Cars segment accounted for the largest market revenue share of 65.3% in 2024, driven by the high global production volume of passenger vehicles, especially in emerging economies. Throttle cables continue to be used widely in entry-level and mid-range models for their mechanical simplicity.

The Commercial Vehicles segment is projected to witness the fastest growth rate from 2025 to 2032, propelled by the increasing demand for durable, heavy-duty throttle cable systems that can endure prolonged usage and harsh operating conditions. Fleet operators also drive aftermarket demand for high-performance throttle replacements.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and Aftermarket. The OEM segment dominated the automotive throttle cables market with the largest revenue share in 2024, owing to the consistent demand from automotive manufacturers for factory-installed throttle cables in newly produced vehicles.

The Aftermarket segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the aging vehicle fleet and increasing consumer preference for performance-enhancing or replacement throttle cable systems. In addition, the growth of e-commerce platforms and availability of vehicle-specific cable kits further support aftermarket expansion.

Which Region Holds the Largest Share of the Automotive Throttle Cables Market?

- Asia-Pacific dominated the automotive throttle cables market with the largest revenue share of 39.27% in 2024, driven by the rapid expansion of the automotive sector, rising vehicle production, and increasing adoption of advanced mechanical components across China, India, Japan, and South Korea

- The region benefits from a strong manufacturing ecosystem, cost-effective labor, and the presence of key cable and automotive component manufacturers, contributing to mass-scale production and exports

- In addition, favorable government policies supporting automotive R&D and electric vehicle adoption are accelerating innovation and integration of high-performance throttle cables across both passenger and commercial vehicles

China Automotive Throttle Cables Market Insight

The China automotive throttle cables market held the largest market revenue share within Asia-Pacific in 2024, driven by its robust auto production base and increasing domestic demand. China’s focus on expanding its electric and hybrid vehicle lineup is spurring demand for precise throttle control systems. Moreover, the rise in aftermarket sales and technological localization by domestic players is fueling sustained market growth.

Japan Automotive Throttle Cables Market Insight

The Japan automotive throttle cables market is expanding steadily due to the country’s automotive innovation, emphasis on fuel efficiency, and precision engineering. Japanese automakers are integrating advanced multi-core throttle cables to improve driving responsiveness and safety in compact and hybrid vehicles. Japan’s automotive exports and R&D investments further support market advancement.

India Automotive Throttle Cables Market Insight

India’s market is poised for strong growth, driven by increasing vehicle ownership, rapid urbanization, and a shift toward advanced vehicle components. The government’s Make in India initiative and rising investments in automotive manufacturing hubs are creating opportunities for throttle cable suppliers. Entry-level passenger cars and two-wheelers continue to drive volume demand.

Which Region is the Fastest Growing Region in the Automotive Throttle Cables Market?

North America automotive throttle cables market is projected to grow at the fastest CAGR of 7.2% from 2025 to 2032, propelled by rising demand for high-performance vehicles and increasing interest in electric and hybrid models that require precise throttle control systems. The shift toward vehicle electrification and advanced driver assistance systems (ADAS) is encouraging the use of customized and reliable throttle cable assemblies across OEMs and aftermarket channels. The U.S. and Canada are also seeing growing investments in vehicle diagnostics, performance tuning, and replacement parts, which is boosting demand for throttle cables across passenger and commercial vehicles.

U.S. Automotive Throttle Cables Market Insight

The U.S. market leads the North American region with high adoption of performance-based aftermarket upgrades and robust OEM activity. Innovation in automotive electronics, combined with increasing preference for lightweight and durable materials in cable design, supports market acceleration. Strong consumer demand for off-road vehicles, trucks, and SUVs continues to bolster market expansion.

Canada Automotive Throttle Cables Market Insight

Canada’s automotive throttle cables market is growing gradually, driven by a steady rise in vehicle sales and maintenance services. The cold climate drives demand for durable and weather-resistant cables, while the country’s well-established supply chain network supports consistent component availability and imports.

Which are the Top Companies in Automotive Throttle Cables Market?

The automotive throttle cables industry is primarily led by well-established companies, including:

- Continental (Germany)

- Denso (Japan)

- Magneti Marelli (Italy)

- Hitachi Ltd. (Japan)

- Delphi Technologies (U.K.)

- SKF (Sweden)

- Curtiss-Wright (U.S.)

- Hella (Germany)

- Johnson Controls (U.S.)

- Visteon (U.S.)

- Sumitomo (Japan)

- SAB Bröckskes GmbH & Co. KG (Germany)

- Allied Wire & Cable, Inc. (U.S.)

- Cable Manufacturing & Assembly Co. (U.S.)

- Tyler Madison, Inc. (U.S.)

- Jersey Strand and Cable, Inc. (U.S.)

- Lexco Cable Mfg. (U.S.)

- Cable-Tec (U.S.)

- Leoni AG (Germany)

- Guangzhou ZhuJiang Cable Co., Ltd. (China)

- Alpha Wire (U.S.)

- CHUHATSU (Japan)

- Dura Automotive Systems (U.S.)

- HI-LEX (Japan)

- Küster Holding (Germany)

- Tata AutoComp Systems (India)

- WR Controls (U.S.)

What are the Recent Developments in Global Automotive Throttle Cables Market?

- In April 2023, Minda Corporation Limited focused on executing comprehensive procedures to gather audit evidence concerning the accuracy of amounts and disclosures within their financial statements. These procedures, influenced by the auditor's professional judgment, include evaluating the risks of material misstatement, whether arising from fraudulent activities or errors. This meticulous process underscores the company's commitment to financial integrity and transparency in reporting

- In October 2022, Venhill expanded its Featherlight Cable fitment list by designing control cables specifically for Indian motorcycles. These new cables feature marine-grade stainless steel inner wires combined with a PTFE (Teflon) liner, ensuring reduced friction for smoother operation. This development demonstrates Venhill's commitment to quality and performance, providing Indian motorcycle riders with enhanced durability and efficiency in their control systems

- In June 2022, Buell Motorcycle announced a strategic partnership with Venhill, aiming to upgrade the clutch and throttle cables used in their motorcycles. The collaboration resulted in the replacement of Buell's existing throttle cables with Venhill's innovative Featherlight Cables, which provide improved functionality and performance. This partnership enhances the riding experience for consumers and facilitates easier aftermarket access to high-quality replacement parts

- In October 2020, Remsons Industries, a prominent manufacturer and supplier of automotive cables, announced a significant acquisition of a UK-based control cable manufacturer for approximately USD 52.8 million. This strategic acquisition aims to broaden Remsons' product portfolio and strengthen its presence within the UK market. By expanding its capabilities, Remsons intends to enhance its customer base and improve service delivery in the competitive automotive sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.