Global Automotive Throttle Position Sensor Market

Market Size in USD Billion

CAGR :

%

USD

40.35 Billion

USD

89.69 Billion

2025

2033

USD

40.35 Billion

USD

89.69 Billion

2025

2033

| 2026 –2033 | |

| USD 40.35 Billion | |

| USD 89.69 Billion | |

|

|

|

|

Automotive Throttle Position Sensor Market Size

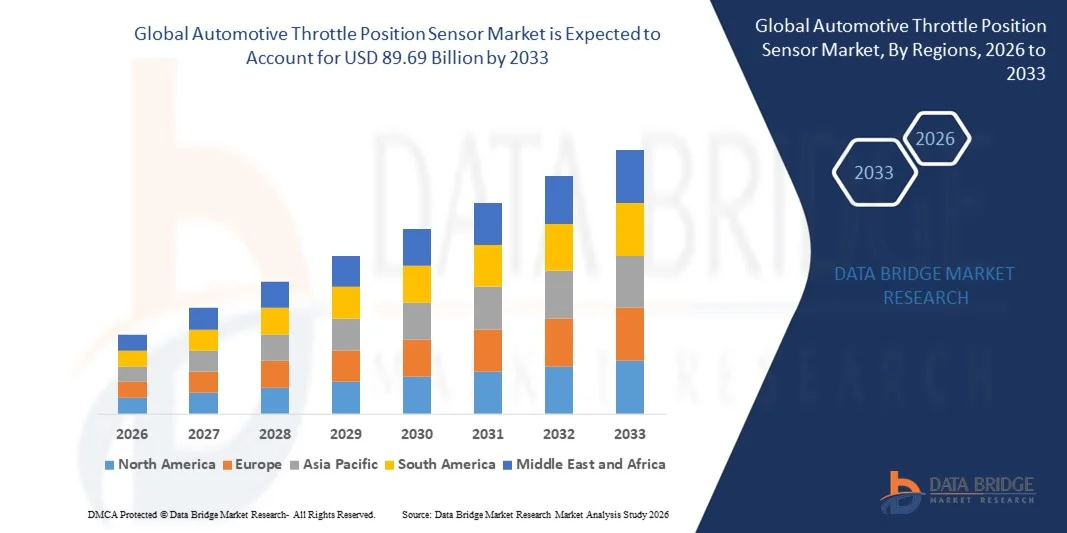

- The global automotive throttle position sensor market size was valued at USD 40.35 billion in 2025 and is expected to reach USD 89.69 billion by 2033, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of electronic throttle control systems in passenger cars, commercial vehicles, and electric vehicles, driven by rising focus on fuel efficiency, emission reduction, and engine performance optimization

- Furthermore, advancements in sensor technology, including higher precision, durability, and integration with vehicle electronic control units, are encouraging automakers to deploy advanced throttle position sensors across new vehicle platforms. These factors are accelerating TPS adoption, thereby significantly boosting the market's expansion

Automotive Throttle Position Sensor Market Analysis

- Automotive throttle position sensors are electronic devices that monitor the position of the throttle valve and relay this information to the engine control unit to optimize air-fuel mixture, engine efficiency, and vehicle performance. These sensors are integral to both conventional internal combustion engines and modern hybrid/electric powertrains

- The growing demand for TPS is primarily fueled by stricter emission regulations, increasing production of passenger and commercial vehicles with electronic throttle control, and rising consumer expectations for better vehicle performance, reliability, and fuel efficiency

- Asia-Pacific dominated the automotive throttle position sensor market with a share of 42.78% in 2025, due to rapid growth in automotive manufacturing, increasing adoption of electronic throttle control systems, and the presence of major vehicle production hubs

- North America is expected to be the fastest growing region in the automotive throttle position sensor market during the forecast period due to high demand for passenger cars and commercial vehicles equipped with electronic throttle control systems

- Passenger car segment dominated the market with a market share of 73.96% in 2025, due to high production volumes, strong consumer demand for fuel efficiency, and increased adoption of electronic throttle control systems in modern passenger vehicles. OEMs prioritize passenger car TPS for their accuracy, longevity, and compatibility with multiple engine configurations, supporting smooth acceleration and improved drivability

Report Scope and Automotive Throttle Position Sensor Market Segmentation

|

Attributes |

Automotive Throttle Position Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Throttle Position Sensor Market Trends

Growing Use of Electronic Throttle Control in Vehicles

- A significant trend in the automotive throttle position sensor (TPS) market is the increasing deployment of electronic throttle control systems across passenger cars, commercial vehicles, and electric and hybrid vehicles. These systems enhance engine efficiency, fuel management, and emission compliance, positioning TPS as a critical component in modern automotive powertrains

- For instance, Bosch and Denso have been actively supplying high-precision electronic throttle position sensors that enable real-time engine monitoring and enhanced fuel efficiency. Their TPS solutions are incorporated in both conventional internal combustion engines and hybrid/electric vehicles, demonstrating industry-wide reliance on these sensors for performance optimization

- Automakers are increasingly incorporating TPS into advanced driver-assistance systems (ADAS) and intelligent powertrain controls, where sensors ensure smooth acceleration, precise throttle response, and overall engine reliability. The shift toward electrification and hybridization of vehicles is further expanding the role of TPS as an essential enabler of sustainable and efficient mobility

- The market is witnessing strong growth in aftermarket TPS as vehicle owners and service providers replace aging components with sensors offering better accuracy, reliability, and compatibility with modern vehicle electronics. This trend is accelerating adoption and creating a broader demand ecosystem beyond OEM installations

- Continuous innovation in sensor materials, miniaturization, and integration with vehicle control units is enhancing TPS functionality, contributing to increased deployment across new vehicle platforms. These advancements are helping manufacturers meet stringent emission norms while improving fuel economy

- The TPS market’s trajectory is shaped by a combination of regulatory compliance, rising vehicle production, and increasing consumer expectations for performance, positioning electronic throttle sensors as indispensable in modern automotive systems

Automotive Throttle Position Sensor Market Dynamics

Driver

Focus on Fuel Efficiency and Emission Reduction

- The growing emphasis on reducing vehicular emissions and improving fuel efficiency is a primary driver for the TPS market, as precise throttle monitoring directly influences engine combustion, air-fuel mixture optimization, and energy efficiency. Governments worldwide are enforcing stricter emission standards, prompting OEMs to integrate high-accuracy TPS in new vehicles to comply with regulations

- For instance, Delphi Technologies provides advanced throttle position sensors designed to optimize fuel injection and engine performance, supporting global emission norms while enhancing fuel economy. These sensors help maintain optimal engine output under varying load and driving conditions, reinforcing their importance in modern powertrains

- Increasing consumer awareness of vehicle performance, sustainability, and operating costs is further encouraging the adoption of reliable TPS across both passenger and commercial vehicles. The growing prevalence of hybrid and electric vehicles, which rely on precise electronic throttle control, amplifies market demand

- Automotive manufacturers are also leveraging TPS data to enable predictive maintenance and engine diagnostics, improving vehicle lifecycle management and reducing operational costs. Such integration highlights TPS as a critical enabler of efficient and compliant automotive systems

- The sustained drive for environmentally friendly and fuel-efficient vehicles continues to underpin TPS market growth, as automakers seek reliable solutions to meet regulatory and performance targets across global markets

Restraint/Challenge

Maintaining Sensor Accuracy and Durability

- The automotive TPS market faces challenges due to the need for sensors to deliver consistent accuracy and durability under harsh operating conditions, including extreme temperatures, vibrations, and fluctuating electrical loads. Ensuring reliability over the vehicle’s lifetime is critical to engine performance and compliance with emission regulations

- For instance, STMicroelectronics and Allegro MicroSystems design TPS with advanced materials and robust housing to withstand mechanical and thermal stress, but these measures increase production complexity and cost. Manufacturers must balance precision, longevity, and economic feasibility while meeting rigorous automotive standards

- Production variability and sensor calibration intricacies can affect throttle response, fuel efficiency, and engine stability, creating additional pressure on OEMs and component suppliers

- The increasing integration of TPS with electronic control units and vehicle diagnostics systems requires high reliability, as failures can lead to vehicle performance issues or safety risks. These technical demands present constraints in scaling production without compromising quality

- The challenge of maintaining high-accuracy TPS in diverse vehicle platforms and powertrain types continues to influence design, manufacturing, and adoption strategies, shaping competitive dynamics within the market

Automotive Throttle Position Sensor Market Scope

The market is segmented on the basis of product type, vehicle type, and sales channel.

- By Product Type

On the basis of product type, the Automotive Throttle Position Sensor market is segmented into potentiometer, socket, and comprehensive sensors. The potentiometer segment dominated the largest market revenue share in 2025, driven by its established reliability, cost-effectiveness, and widespread compatibility with conventional internal combustion engines. Automotive manufacturers often prefer potentiometer-based TPS due to their proven performance, ease of calibration, and straightforward integration into existing engine control units. The market also sees strong demand for potentiometer TPS due to their durability under varied driving conditions and availability across multiple vehicle models.

The comprehensive segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in modern vehicles equipped with advanced electronic throttle control systems. Comprehensive TPS offer enhanced precision, adaptability to hybrid and electric vehicles, and the ability to provide real-time data to engine management systems for optimal performance. The integration of advanced sensing technologies and diagnostic capabilities in comprehensive TPS further drives their popularity among automakers focusing on emission compliance and fuel efficiency.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars and commercial vehicles. The passenger car segment held the largest market revenue share of 73.96% in 2025 due to high production volumes, strong consumer demand for fuel efficiency, and increased adoption of electronic throttle control systems in modern passenger vehicles. OEMs prioritize passenger car TPS for their accuracy, longevity, and compatibility with multiple engine configurations, supporting smooth acceleration and improved drivability.

The commercial vehicle segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for heavy-duty vehicles with precise throttle control for better load management and emission compliance. Advanced TPS in commercial vehicles enhance engine performance under variable driving conditions and reduce operational costs, encouraging fleet operators to adopt these sensors in new vehicles. Growing regulations for commercial vehicle emissions and the adoption of hybrid propulsion systems further support the segment’s rapid growth.

- By Sales Channel

On the basis of sales channel, the market is segmented into OEM and aftermarket. The OEM segment dominated the largest market revenue share in 2025, fueled by original equipment manufacturers’ preference for high-quality TPS directly installed in new vehicles for superior performance and warranty compliance. OEM-supplied sensors are often preferred by automakers due to their adherence to stringent quality standards, integration with vehicle electronics, and reliability over the vehicle’s lifespan.

The aftermarket segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the rising need for replacement sensors in aging vehicle fleets and the increasing availability of cost-effective aftermarket TPS options. Aftermarket TPS provide vehicle owners and service centers with accessible alternatives for maintenance and repair, ensuring continued engine efficiency. In addition, growing awareness among vehicle owners regarding performance optimization and fuel efficiency contributes to the rapid adoption of aftermarket sensors.

Automotive Throttle Position Sensor Market Regional Analysis

- Asia-Pacific dominated the automotive throttle position sensor market with the largest revenue share of 42.78% in 2025, driven by rapid growth in automotive manufacturing, increasing adoption of electronic throttle control systems, and the presence of major vehicle production hubs

- The region’s cost-effective manufacturing landscape, rising investments in automotive electronics, and growing exports of vehicles and auto components are accelerating market expansion

- The availability of skilled labor, favorable government policies supporting automotive innovation, and rapid industrialization across developing economies are contributing to increased adoption of advanced throttle position sensors

China Automotive Throttle Position Sensor Market Insight

China held the largest share in the Asia-Pacific Automotive Throttle Position Sensor market in 2025, owing to its position as a global leader in automotive production and electronic component manufacturing. The country's strong industrial base, government incentives for EVs and smart vehicle technologies, and extensive exports of passenger and commercial vehicles are major growth drivers. Demand is also supported by investments in automotive electronics R&D and the localization of sensor production for both domestic and international markets.

India Automotive Throttle Position Sensor Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising passenger vehicle production, increasing adoption of electronic throttle control systems, and expanding commercial vehicle sales. Government initiatives promoting Make in India, EV adoption, and localization of auto components are strengthening TPS demand. In addition, increasing focus on emission standards and fuel efficiency in vehicles is driving the adoption of precise and reliable throttle position sensors.

Europe Automotive Throttle Position Sensor Market Insight

The Europe automotive throttle position sensor market is expanding steadily, supported by strict emission regulations, high adoption of advanced vehicle electronics, and growing investments in electric and hybrid vehicle production. The region emphasizes safety, fuel efficiency, and performance optimization, particularly in passenger cars and commercial fleets. Increasing use of TPS in EVs and advanced driver assistance systems is further enhancing market growth.

Germany Automotive Throttle Position Sensor Market Insight

Germany’s automotive throttle position sensor market is driven by its leadership in high-precision automotive manufacturing, strong electronic component industry, and focus on vehicle innovation. The country has well-established R&D networks and collaborations between automotive OEMs and suppliers, fostering continuous innovation in sensor technologies. Demand is particularly strong for high-performance passenger cars, commercial vehicles, and EVs requiring advanced throttle control systems.

U.K. Automotive Throttle Position Sensor Market Insight

The U.K. market is supported by a mature automotive sector, growing focus on hybrid and electric vehicles, and increasing adoption of advanced vehicle electronics. With rising investments in R&D, local manufacturing of automotive components, and government policies encouraging green mobility, the demand for reliable TPS continues to grow. In addition, integration with smart vehicle management systems strengthens market expansion.

North America Automotive Throttle Position Sensor Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by high demand for passenger cars and commercial vehicles equipped with electronic throttle control systems. Advancements in engine efficiency, emission reduction technologies, and electric and hybrid vehicle adoption are boosting TPS demand. In addition, strong presence of OEMs, automotive electronics manufacturers, and supplier collaborations are supporting market expansion.

U.S. Automotive Throttle Position Sensor Market Insight

The U.S. accounted for the largest share in the North America automotive throttle position sensor market in 2025, underpinned by its expansive automotive industry, focus on advanced electronics in vehicles, and significant investment in EV and hybrid technology. The country’s emphasis on fuel efficiency, emission compliance, and vehicle performance optimization is encouraging widespread adoption of advanced throttle position sensors. Presence of key OEMs and sensor manufacturers further solidify the U.S.'s leading position in the region.

Automotive Throttle Position Sensor Market Share

The automotive throttle position sensor industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- SICK AG (Germany)

- TE Connectivity (Switzerland)

- ams AG (Austria)

- Vishay Intertechnology (U.S.)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Bourns, Inc. (U.S.)

- Allegro MicroSystems, LLC (U.S.)

- Renishaw plc (U.K.)

- HEIDENHAIN (Germany)

- Hans Turck GmbH & Co. KG (Germany)

- Novotechnik U.S. Inc. (U.S.)

- PIHER SENSORS AND CONTROLS SA (Spain)

- General Electric (U.S.)

- ifm electronic (Germany)

Latest Developments in Global Automotive Throttle Position Sensor Market

- In March 2024, Bosch unveiled a range of advanced technologies at the Bosch Mobility Experience, focusing on solutions tailored for electric vehicles (EVs). The company highlighted a holistic approach combining advanced hardware and software integration, aimed at enhancing throttle control performance, vehicle efficiency, and overall electronic powertrain management. This development is expected to strengthen Bosch’s leadership in EV sensor systems and drive adoption of next-generation TPS in emerging electric mobility platforms

- In January 2024, TDK and Goodyear announced a strategic collaboration to develop next-generation tyre intelligence systems that integrate TDK's sensor hardware and software with Goodyear's tyre expertise. The initiative focuses on creating real-time road-to-tire-to-vehicle intelligence, which has significant implications for enhanced sensor integration, predictive performance analytics, and improved engine response. This partnership is likely to accelerate the deployment of TPS systems with advanced connectivity in smart and autonomous vehicles

- In October 2023, Denso (Japan) entered into a strategic partnership with a leading automotive manufacturer to co-develop next-generation throttle position sensors leveraging artificial intelligence (AI). This collaboration aims to improve sensor accuracy, responsiveness, and reliability, setting new benchmarks for intelligent throttle control. The development underscores Denso’s emphasis on integrating AI and advanced analytics into TPS products, positioning the company to capture growing demand in high-performance and connected vehicle segments

- In September 2023, Delphi Technologies (U.K.) completed the acquisition of a specialized sensor technology firm, expanding its capabilities in throttle position sensor solutions. The acquisition enables Delphi to diversify its TPS offerings, incorporate innovative technologies, and strengthen its competitive positioning in both passenger and commercial vehicle markets. This strategic move reflects the industry trend of consolidation and technological expansion to meet increasing market demand for precise and reliable sensor systems

- In August 2023, Continental (Germany) launched an advanced electronic throttle position sensor designed for hybrid and electric vehicles, featuring improved durability, higher precision, and enhanced data communication capabilities. This development allows automakers to optimize engine performance, improve fuel efficiency, and integrate TPS with advanced driver-assistance systems. Continental’s innovation is expected to influence adoption trends, especially in the EV and hybrid vehicle segments, by setting new standards for sensor reliability and functionality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.