Global Automotive Tie Rod Assembly Market

Market Size in USD Million

CAGR :

%

USD

882.81 Million

USD

1,255.45 Million

2024

2032

USD

882.81 Million

USD

1,255.45 Million

2024

2032

| 2025 –2032 | |

| USD 882.81 Million | |

| USD 1,255.45 Million | |

|

|

|

|

Automotive Tie Rod Assembly Market Size

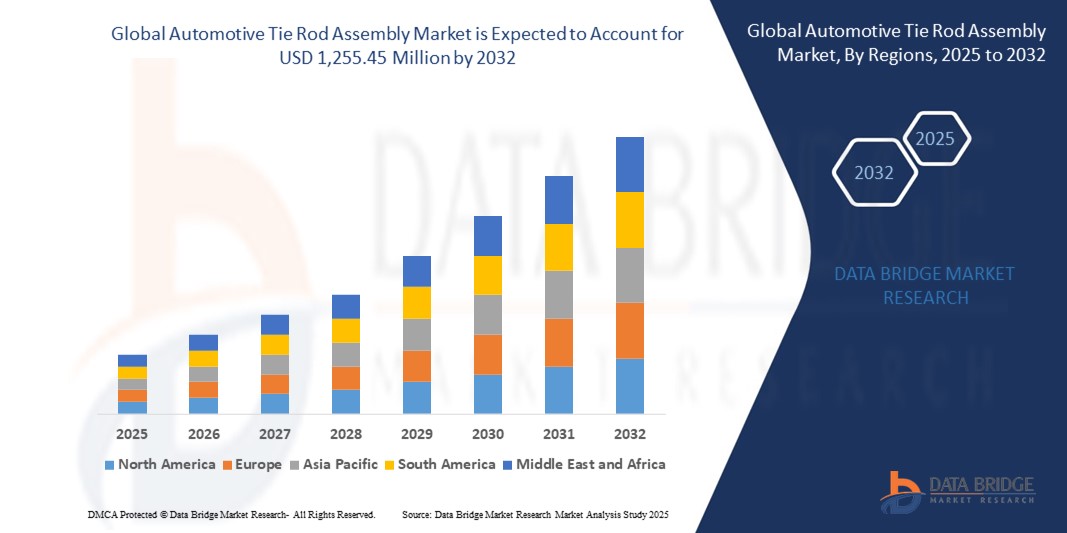

- The global automotive tie rod assembly market size was valued at USD 882.81 million in 2024 and is expected to reach USD 1,255.45 million by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing production of passenger and commercial vehicles, coupled with rising demand for enhanced steering performance and vehicle stability. Technological advancements in automotive suspension and steering systems, particularly in electric and autonomous vehicles, are driving innovation in tie rod assembly design and materials

- Furthermore, rising consumer expectations for safer, smoother, and more responsive driving experiences are establishing automotive tie rod assemblies as a critical component in modern vehicle dynamics. These converging factors are accelerating the uptake of advanced tie rod assembly solutions, including lightweight and corrosion-resistant variants, thereby significantly boosting the industry's growth across both OEM and aftermarket segments

Automotive Tie Rod Assembly Market Analysis

- Automotive tie rod assemblies, which are essential components of a vehicle's steering system, play a critical role in ensuring precise directional control and stability by connecting the steering rack to the steering knuckle in both passenger and commercial vehicles

- The growing emphasis on vehicle safety, along with the rising production of vehicles globally, is driving the demand for robust and durable tie rod assemblies. In addition, increased awareness of suspension and steering maintenance is contributing to the replacement market, especially in aging vehicle fleets

- North America dominated the automotive tie rod assembly market with the largest revenue share of 31.4% in 2024, fueled by the presence of major automobile manufacturers, a large base of on-road vehicles, and a growing demand for premium and off-road vehicles requiring advanced suspension systems. The U.S., in particular, is experiencing a steady rise in vehicle maintenance activities and aftermarket services

- Asia-Pacific is projected to be the fastest-growing region in the automotive tie rod assembly market during the forecast period, registering a CAGR of 8.4% from 2025 to 2032, owing to the rapid growth of the automotive industry in countries such as China, India, and Indonesia, as well as expanding infrastructure and urbanization

- The steering tie rod assembly segment dominated the automotive tie rod assembly market with a market revenue share of 59.4% in 2024, primarily due to its widespread use in front-wheel and four-wheel steering systems of both passenger and commercial vehicles. These assemblies are critical for transferring motion from the steering rack to the wheels, ensuring precise control and safety

Report Scope and Automotive Tie Rod Assembly Market Segmentation

|

Attributes |

Automotive Tie Rod Assembly Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Tie Rod Assembly Market Trends

Growing Importance of Steering Precision and Vehicle Safety Enhancements

- A significant and accelerating trend in the global automotive tie rod assembly market is the increasing demand for high-performance steering components that enhance vehicle handling, road safety, and ride comfort, especially in modern passenger and commercial vehicles

- Tie rod assemblies are essential parts of the steering linkage system, connecting the steering rack to the steering arm, and are now increasingly being designed to support electric power steering (EPS) and advanced driver-assistance systems (ADAS)

- Manufacturers are focusing on lightweight and corrosion-resistant materials such as aluminum and high-strength steel alloys to meet fuel efficiency regulations and durability requirements. For instance, ZF Friedrichshafen AG and Nexteer Automotive are investing in next-generation tie rod technologies that reduce vehicle weight while improving mechanical strength

- The growing adoption of electrified and autonomous vehicles is also influencing the evolution of tie rod assemblies, as precise and responsive steering mechanisms become critical in drive-by-wire and self-driving vehicle systems

- In the aftermarket, the increasing average age of vehicles globally—especially in regions such as North America and Europe—is boosting demand for replacement tie rod assemblies, often bundled with steering and suspension kits

- Leading market players are expanding their product portfolios and global distribution networks to meet rising demand across both OEM and aftermarket channels. Additionally, companies are investing in smart manufacturing practices, such as real-time quality monitoring and predictive maintenance analytics, to ensure consistent product performance and traceability

Automotive Tie Rod Assembly Market Dynamics

Driver

Growing Need Due to Rising Vehicle Safety Regulations and Suspension System Upgrades

- The increasing focus on vehicular safety, ride stability, and responsive steering control is significantly driving demand in the global automotive tie rod assembly market, especially in passenger and commercial vehicles. Tie rod assemblies are crucial in linking the steering system to the wheels, ensuring precise maneuverability and road feedback

- For instance, in April 2024, ZF Friedrichshafen AG announced a strategic enhancement of its electric power steering (EPS) components, including advanced tie rod assemblies designed for next-generation electric and autonomous vehicles. This move highlights how manufacturers are modernizing traditional steering systems to meet evolving mobility needs

- As consumers and regulators alike demand better handling, fuel efficiency, and occupant safety, automakers are increasingly incorporating lightweight materials such as forged aluminum and high-strength steel into steering and suspension components. This shift is also aligned with tightening global emissions standards

- Furthermore, the growing production and sales of electric vehicles (EVs) and ADAS-integrated platforms are accelerating the need for highly accurate, durable, and electronically compatible tie rod assemblies, especially in premium and high-performance models

- The rise in vehicle ownership, particularly in developing economies, is fueling aftermarket demand for replacement tie rod assemblies, particularly in regions where road conditions lead to quicker wear and tear of steering systems. In mature markets, the trend toward suspension and steering upgrades in off-road and performance vehicles is also contributing to aftermarket growth

Restraint/Challenge

Pricing Pressure and Product Lifecycle Complexity

- While the automotive tie rod assembly market is expanding, fluctuations in raw material costs (such as, steel, aluminum) and increasing cost pressure from OEMs pose challenges for component manufacturers. Companies must maintain performance and safety standards while keeping production costs low to remain competitive

- Moreover, the complex lifecycle testing and validation required for tie rod assemblies in safety-critical systems can delay product rollout and increase development costs. Compliance with stringent quality and durability standards, especially in Europe and North America, is a continuous operational hurdle

- Another challenge is the increasing vehicle model diversity, which demands a wide variety of customized tie rod configurations. This complicates inventory management and requires flexible manufacturing systems

- To address these challenges, leading suppliers such as Nexteer Automotive and Dana Incorporated are investing in modular product platforms and automated production lines, aiming to enhance scalability, cost-efficiency, and responsiveness to evolving OEM requirements

Automotive Tie Rod Assembly Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the automotive tie rod assembly market is segmented into steering tie rod assembly and straight tie rod assembly. The steering tie rod assembly segment dominated the largest market revenue share of 59.4% in 2024, primarily due to its widespread use in front-wheel and four-wheel steering systems of both passenger and commercial vehicles. These assemblies are critical for transferring motion from the steering rack to the wheels, ensuring precise control and safety.

The straight tie rod assembly segment is expected to witness the fastest growth rate of 19.3% from 2025 to 2032, driven by increasing demand from heavy commercial vehicle (HCV) applications and off-road utility vehicles. Their rugged construction and compatibility with high-load steering systems make them ideal for demanding environments.

- By Application

On the basis of application, the automotive tie rod assembly market is segmented into passenger cars, LCVs, and HCVs. The passenger cars segment accounted for the largest market share of 45% in 2024, owing to the growing global vehicle parc, increasing production of compact and mid-sized vehicles, and rising focus on driver safety and comfort.

The HCVs (heavy commercial vehicles) segment is projected to register the fastest CAGR from 2025 to 2032, driven by expanding logistics operations, infrastructure development, and the demand for robust steering systems capable of handling heavy payloads.

Automotive Tie Rod Assembly Market Regional Analysis

- North America dominated the automotive tie rod assembly market with the largest revenue share of 31.4% in 2024, driven by increasing demand for vehicle safety and handling performance, a strong presence of leading automobile manufacturers, and a rising trend in EV adoption requiring enhanced steering components

- The region’s robust automotive aftermarket and high consumer spending on vehicle maintenance also support the growing replacement demand for tie rod assemblies, especially in the U.S. and Canada

- Furthermore, the focus on advanced suspension systems in both commercial and passenger vehicles is fueling demand for technologically superior, corrosion-resistant tie rod assemblies

U.S. Automotive Tie Rod Assembly Market Insight

The U.S. automotive tie rod assembly market captured approximately 66% of the North American Automotive Tie Rod Assembly market revenue in 2024, owing to the high vehicle parc, growing production of light and heavy commercial vehicles, and rapid advancements in steering technologies. Major OEMs and Tier-1 suppliers in the U.S. are increasingly investing in precision-engineered tie rod assemblies for EVs, off-road vehicles, and performance cars. In addition, the increasing preference for ADAS-equipped steering systems and replacement of conventional components with lightweight aluminum-based tie rods is boosting market growth.

Europe Automotive Tie Rod Assembly Market Insight

The Europe automotive tie rod assembly market is anticipated to expand at a solid CAGR during the forecast period, driven by the region’s strict vehicle safety regulations (Euro NCAP), increasing demand for hybrid and electric vehicles, and the push for sustainability. Countries such as Germany, France, and the U.K. are witnessing strong demand for lightweight, high-durability tie rod assemblies used in advanced suspension architectures. The growth of the aftermarket in Eastern Europe is further contributing to the replacement and upgrade cycle of steering and suspension parts.

U.K. Automotive Tie Rod Assembly Market Insight

The U.K. Automotive Tie Rod Assembly market is projected to grow at a notable CAGR, supported by increasing demand for vehicle performance optimization and lightweight automotive components. Rising investments in electric mobility and autonomous vehicle platforms are creating opportunities for custom tie rod solutions that meet new safety and handling benchmarks. The aftermarket segment in the U.K. is also thriving, driven by a well-developed repair ecosystem and consumer preference for quality replacement parts.

Germany Automotive Tie Rod Assembly Market Insight

The Germany automotive tie rod assembly market, being the largest auto manufacturer in Europe, is expected to be a key contributor to the Automotive Tie Rod Assembly market. OEMs are focusing on integrating tie rods that can withstand higher steering loads, improve responsiveness, and align with the modular vehicle platforms for ICEs and EVs. Germany’s automotive engineering leadership ensures continuous innovation in materials and durability, enhancing its global export potential for steering system components.

Asia-Pacific Automotive Tie Rod Assembly Market Insight

The Asia-Pacific automotive tie rod assembly market is poised to grow at the fastest CAGR of 8.4% between 2025 and 2032, led by increased vehicle production, expanding road networks, and higher vehicle ownership across developing economies. China, India, and Japan are at the forefront, with strong demand from both OEMs and the replacement market. Government regulations mandating vehicle safety and increased consumer spending on vehicle maintenance are propelling the adoption of enhanced tie rod assemblies. Moreover, APAC's leadership in cost-efficient automotive component manufacturing boosts export potential and competitive pricing in domestic markets.

Japan Automotive Tie Rod Assembly Market Insight

The Japan automotive tie rod assembly market is benefiting from the country's focus on automotive innovation, including steer-by-wire systems and compact vehicle engineering. High consumer expectations around handling precision and safety, especially in urban EVs and hybrid vehicles, are increasing the demand for premium-quality tie rod assemblies. Tie rods integrated into electronic and sensor-based steering systems are gaining popularity, aligning with Japan’s push for connected and autonomous vehicle platforms.

China Automotive Tie Rod Assembly Market Insight

The China automotive tie rod assembly market held the largest revenue share in the Asia-Pacific market in 2024, thanks to its massive vehicle production base, government-backed EV incentives, and focus on domestic manufacturing. Leading Chinese OEMs are rapidly upgrading their steering systems to meet global quality benchmarks, spurring demand for precision tie rod assemblies. Aftermarket sales are thriving, especially due to harsh road conditions and growing awareness of routine vehicle maintenance, boosting product replacements and upgrades.

Automotive Tie Rod Assembly Market Share

The automotive tie rod assembly industry is primarily led by well-established companies, including:

- Ample Auto Tech Pvt. Ltd. (India)

- G.S. Autocomp Pvt. Ltd. (India)

- Ocap Chassis Parts Pvt. Ltd. (India)

- FAI Automotive (U.K.)

- Powers & Sons (U.S.)

- GDST (China)

- CCTY (China)

- ATEK (India)

- Teknorot (Türkiye)

- GKN Automotive Limited (U.K.)

- ZF Friedrichshafen AG (Germany)

- Nexteer Automotive Corporation (U.S.)

Latest Developments in Global Automotive Tie Rod Assembly Market

- In April 2023, Suprajit Engineering Ltd., a leading Indian auto component manufacturer, completed its acquisition of Kongsberg Automotive’s standard business unit. This strategic move enhances Suprajit’s global footprint in mechanical control cables and steering assemblies, including tie rod systems, strengthening its position in both OEM and aftermarket segments globally

- In March 2023, OCAP Group, a key European supplier of chassis parts, announced the expansion of its tie rod production facility in India to meet increasing demand from both passenger and commercial vehicle manufacturers. This development reflects the ongoing shift of global supply chains toward Asia-Pacific manufacturing hubs

- In February 2023, Powers & Sons LLC, a U.S.-based steering component supplier, unveiled its investment into advanced automation for tie rod assembly manufacturing at its Indiana plant. The aim is to enhance precision, reduce lead time, and meet the rising demand from electric vehicle manufacturers in North America

- In January 2023, FAI Automotive Plc, a leading aftermarket supplier based in the U.K., launched an expanded range of precision-engineered tie rod assemblies and steering parts to support the growing vehicle parc across Europe. The move targets increasing replacement part demand from aging vehicles

- In January 2023, China-based Patmax Union Corporation announced a strategic partnership with Southeast Asian OEMs to supply straight and steering tie rod assemblies for upcoming commercial vehicle platforms, reinforcing its commitment to expanding in the ASEAN automotive market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.