Global Automotive Torque Actuator Motor Market

Market Size in USD Billion

CAGR :

%

USD

2.68 Billion

USD

5.31 Billion

2024

2032

USD

2.68 Billion

USD

5.31 Billion

2024

2032

| 2025 –2032 | |

| USD 2.68 Billion | |

| USD 5.31 Billion | |

|

|

|

|

Automotive Torque Actuator Motor Market Size

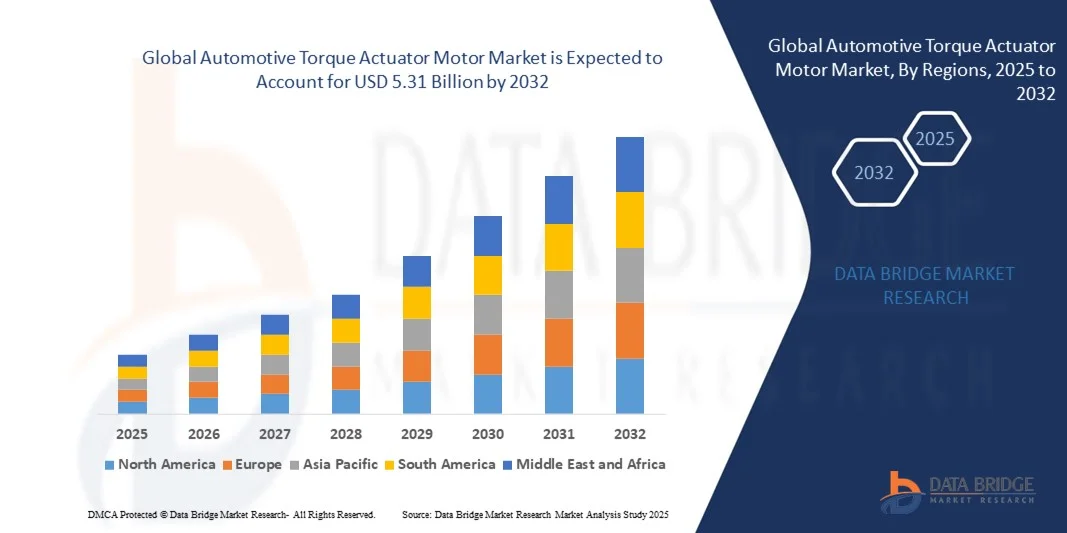

- The global automotive torque actuator motor market size was valued at USD 2.68 billion in 2024 and is expected to reach USD 5.31 billion by 2032, at a CAGR of 8.91% during the forecast period

- The market growth is largely fuelled by the rising adoption of electric and hybrid vehicles, increasing demand for advanced driver-assistance systems (ADAS), and the growing need for precision control in automotive systems

- The integration of torque actuator motors in systems such as transmission control, braking, and steering is enhancing vehicle performance, safety, and fuel efficiency, thereby supporting market expansion

Automotive Torque Actuator Motor Market Analysis

- The global automotive torque actuator motor market is experiencing robust growth owing to the rising emphasis on vehicle electrification and automation. Torque actuator motors are crucial in achieving precise motion control and efficient torque management, contributing to smoother vehicle operations

- The growing trend toward lightweight, energy-efficient components in vehicles is increasing the adoption of smart actuator systems. Manufacturers are investing heavily in research and development to enhance torque density and reliability while reducing maintenance costs

- North America dominated the automotive torque actuator motor market with the largest revenue share of 39.62% in 2024, driven by the growing adoption of advanced vehicle technologies and the increasing penetration of electric and hybrid vehicles across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive torque actuator motor market, driven by accelerating industrialization, strong EV adoption in countries such as China and Japan, and increasing investment in advanced automotive components

- The rotary segment held the largest market revenue share in 2024 owing to its extensive use in applications such as transmission systems, throttle control, and braking systems. Rotary torque actuator motors are preferred for their compact design, efficient torque transfer, and smooth rotational movement that enhance vehicle performance and control accuracy

Report Scope and Automotive Torque Actuator Motor Market Segmentation

|

Attributes |

Automotive Torque Actuator Motor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• CTS Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Torque Actuator Motor Market Trends

Integration Of Torque Actuator Motors In Electric And Hybrid Vehicles

- The growing integration of torque actuator motors in electric and hybrid vehicles is transforming automotive performance by enhancing power efficiency and control precision. These motors play a vital role in managing torque distribution, improving vehicle stability, and optimizing overall driving dynamics, especially in high-performance EV models. Their ability to provide instantaneous torque response also contributes to smoother acceleration and improved traction control across varying road conditions

- The increasing demand for energy-efficient mobility solutions and advancements in powertrain electrification are driving widespread adoption of torque actuator motors across both passenger and commercial vehicle segments. Their capability to reduce mechanical losses and enhance acceleration responsiveness is contributing significantly to vehicle efficiency. Furthermore, government policies promoting sustainable transportation and stringent emission norms are accelerating their deployment in hybrid and fully electric vehicles

- Automotive manufacturers are increasingly investing in intelligent actuator systems that combine electric control and feedback mechanisms to ensure smoother torque transition and improved fuel economy. The evolution of next-generation electric drivetrains is further expanding the use of torque actuator motors across hybrid and battery-electric platforms. The integration of AI and sensor-based systems is enabling predictive torque control, improving safety, and enhancing the overall driving experience

- For instance, in 2024, Bosch introduced a new generation of high-precision torque actuator motors designed for electric powertrains, enabling improved torque modulation and regenerative braking efficiency across premium vehicle models in Europe and Asia. These innovations are expected to set new benchmarks for performance and reliability, encouraging more automakers to incorporate similar systems into next-generation EVs. Bosch’s continued focus on miniaturization and thermal optimization also supports long-term scalability for mass-market adoption

- While integration into electric vehicles offers significant growth potential, it also demands continuous innovation in motor design, thermal management, and material optimization. Market players focusing on compact, lightweight, and high-torque solutions are expected to gain a competitive advantage in the evolving mobility landscape. The ability to achieve cost-effective scalability while maintaining performance standards will define the competitive dynamics in the coming years

Automotive Torque Actuator Motor Market Dynamics

Driver

Growing Demand For Advanced Vehicle Control Systems And Electrification

- The rising demand for advanced vehicle control systems and electrified powertrains is one of the key drivers of the automotive torque actuator motor market. These motors enable precise control of torque distribution between axles and wheels, enhancing vehicle performance, stability, and energy efficiency. The growing complexity of vehicle architectures has made precise torque management essential for ensuring smooth transitions, dynamic performance, and improved handling in both passenger and commercial vehicles

- With the increasing penetration of electric and hybrid vehicles, automakers are focusing on improving drivetrain response and power control to meet efficiency standards and emission regulations. Torque actuator motors are being adopted to achieve better synchronization between engine, transmission, and braking systems. In addition, the push for zero-emission vehicles has created new opportunities for the integration of torque actuators in regenerative braking and torque vectoring systems

- Continuous developments in automotive electronics and integration of digital control architectures are propelling the adoption of torque actuator motors in electric steering, transmission, and braking systems. The demand is particularly strong in performance cars, SUVs, and EVs requiring dynamic torque adjustments. This shift toward electronically controlled powertrains is also enabling the development of autonomous driving technologies that rely on real-time torque modulation for precise vehicle control

- For instance, in 2023, Continental AG unveiled a new electric torque actuator system for hybrid drivetrains, enhancing torque delivery accuracy and improving regenerative braking control across multiple vehicle categories. The company’s system allows real-time feedback and dynamic response adjustments, ensuring smooth power transfer and reducing mechanical stress on components. This innovation highlights the growing convergence between mechatronics and digital control systems in modern automotive design

- While the trend toward electrification is accelerating market expansion, maintaining compact design and thermal stability under high load remains a challenge. Continuous innovation in sensor-based feedback systems and actuator materials will be essential to ensure long-term performance and reliability. Moreover, addressing issues related to electromagnetic interference, system noise, and efficiency loss will be key to supporting the next generation of high-performance vehicles

Restraint/Challenge

High Manufacturing Costs And Integration Complexity

- The high manufacturing costs associated with precision-engineered torque actuator motors and complex integration processes are key challenges limiting market penetration. Advanced materials, high-speed control systems, and precision calibration increase production expenses, particularly in mass-market vehicles. In addition, the need for tight tolerance levels and extensive testing protocols adds to the cost burden, especially in electric and hybrid powertrains

- Integration challenges arise from compatibility issues with existing vehicle architectures, requiring significant customization and software tuning to achieve optimal performance. This complexity often leads to higher development time and cost, restricting adoption in low- and mid-range models. OEMs are also required to adapt their manufacturing lines and control systems, increasing capital expenditure and extending time-to-market for new models

- The lack of standardization across actuator motor designs and control algorithms adds further challenges for OEMs and Tier-1 suppliers, increasing the complexity of component interoperability within multi-motor systems. Differences in communication protocols and power distribution architectures can create inconsistencies in torque response, requiring extensive reprogramming for different vehicle models

- For instance, in 2023, several automakers in the U.S. and Europe reported delays in integrating torque actuator systems into hybrid vehicle models due to cost constraints and system calibration challenges associated with electric powertrains. These delays also impacted production schedules and highlighted the need for unified software interfaces and scalable actuator solutions. The rising cost of raw materials further compounded these integration challenges

- While manufacturing and integration complexities persist, advancements in modular actuator designs, cost-effective production techniques, and software-defined torque management systems are expected to gradually overcome these barriers, paving the way for broader market adoption. Industry collaborations and joint R&D initiatives between automotive OEMs and component manufacturers are likely to accelerate innovation and reduce overall production costs

Automotive Torque Actuator Motor Market Scope

The market is segmented on the basis of type, motion output, and application.

- By Type

On the basis of type, the automotive torque actuator motor market is segmented into pneumatic, electric, and mechanical. The electric segment held the largest market revenue share in 2024 driven by the rapid electrification of powertrains and increasing integration of electronically controlled systems in vehicles. Electric torque actuator motors provide high precision, faster response time, and better efficiency compared to pneumatic and mechanical types, making them ideal for modern hybrid and electric vehicles.

The pneumatic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its robust performance, reliability, and suitability for heavy-duty applications. Pneumatic torque actuator motors are widely adopted in commercial vehicles and high-load systems where rapid torque actuation and durability are essential. Their cost-effectiveness and ease of integration also contribute to their growing adoption across industrial-grade automotive systems.

- By Motion Output

On the basis of motion output, the automotive torque actuator motor market is segmented into linear, rotary, and electric. The rotary segment held the largest market revenue share in 2024 owing to its extensive use in applications such as transmission systems, throttle control, and braking systems. Rotary torque actuator motors are preferred for their compact design, efficient torque transfer, and smooth rotational movement that enhance vehicle performance and control accuracy.

The linear segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its increasing adoption in precise torque modulation applications. Linear torque actuator motors are gaining traction in advanced automotive systems such as electronic throttle control and turbocharger actuations due to their ability to deliver accurate linear displacement and consistent power output.

- By Application

On the basis of application, the automotive torque actuator motor market is segmented into electronic throttle control (ETC), turbocharger, and exhaust gas circulation (EGC). The electronic throttle control (ETC) segment dominated the market in 2024, driven by the widespread adoption of drive-by-wire technologies in passenger and commercial vehicles. ETC systems rely on torque actuator motors to regulate airflow precisely, improving engine response, fuel efficiency, and emissions performance.

The turbocharger segment is expected to witness the fastest growth rate from 2025 to 2032 owing to increasing demand for high-performance and fuel-efficient engines. Torque actuator motors used in turbocharger applications enhance boost pressure management and responsiveness, supporting better acceleration and reduced turbo lag. The growing shift toward smaller displacement engines with higher output is further boosting demand for advanced actuator motor systems in this segment.

Automotive Torque Actuator Motor Market Regional Analysis

- North America dominated the automotive torque actuator motor market with the largest revenue share of 39.62% in 2024, driven by the growing adoption of advanced vehicle technologies and the increasing penetration of electric and hybrid vehicles across the region

- The region’s automotive industry is characterized by high R&D investments, robust manufacturing infrastructure, and strong regulatory support for vehicle electrification. The demand for precise torque control systems in performance and commercial vehicles is further accelerating market growth

- Moreover, the presence of major OEMs and Tier-1 suppliers, along with rising consumer preference for enhanced driving dynamics and fuel efficiency, continues to reinforce North America’s leadership in the global market

U.S. Automotive Torque Actuator Motor Market Insight

The U.S. automotive torque actuator motor market captured the largest revenue share in 2024 within North America, driven by rapid advancements in vehicle electrification and the increasing integration of intelligent control systems. The rising production of electric vehicles, coupled with the adoption of electronically controlled torque management systems, is fuelling growth. In addition, the U.S. automotive industry’s focus on high-performance vehicles and stringent emission norms is driving the adoption of actuator motors that optimize torque delivery and energy efficiency.

Europe Automotive Torque Actuator Motor Market Insight

The Europe automotive torque actuator motor market is expected to witness the fastest growth rate from 2025 to 2032, propelled by strict emission regulations and the widespread adoption of hybrid and electric vehicles. European automakers are increasingly deploying advanced actuator technologies to improve energy efficiency and meet CO₂ reduction targets. The region’s emphasis on sustainable mobility solutions and growing investments in EV production are creating significant opportunities for torque actuator motor suppliers across the continent.

U.K. Automotive Torque Actuator Motor Market Insight

The U.K. automotive torque actuator motor market is expected to witness the fastest growth rate from 2025 to 2032, supported by strong government initiatives toward vehicle electrification and innovation in automotive engineering. The country’s transition to zero-emission vehicles, coupled with growing demand for high-efficiency powertrain components, is driving adoption. Furthermore, the expansion of domestic EV manufacturing capabilities and the focus on intelligent control systems are enhancing market potential in the U.K.

Germany Automotive Torque Actuator Motor Market Insight

The Germany automotive torque actuator motor market is expected to witness the fastest growth rate from 2025 to 2032, driven by the nation’s strong automotive engineering base and focus on precision control technologies. German OEMs are integrating advanced torque actuator motors into electric and hybrid drivetrains to optimize torque distribution and improve performance. The country’s leadership in automotive innovation, combined with the rapid development of EV infrastructure, is significantly boosting market expansion.

Asia-Pacific Automotive Torque Actuator Motor Market Insight

The Asia-Pacific automotive torque actuator motor market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising production of vehicles, rapid urbanization, and growing consumer demand for fuel-efficient and connected mobility solutions. Countries such as China, Japan, and India are leading regional growth through technological advancements and government support for EV adoption. The region’s robust manufacturing ecosystem and cost-effective production capabilities further position APAC as a key hub for torque actuator motor development.

Japan Automotive Torque Actuator Motor Market Insight

The Japan automotive torque actuator motor market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the country’s technological leadership and focus on innovation in electric and hybrid vehicle systems. Japanese automakers are investing heavily in actuator technologies to enhance performance, improve torque precision, and support autonomous driving functions. Furthermore, the integration of torque actuator motors into advanced powertrains aligns with Japan’s broader goal of achieving carbon neutrality in the automotive sector.

China Automotive Torque Actuator Motor Market Insight

The China automotive torque actuator motor market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s booming electric vehicle industry and strong focus on automotive electrification. China’s large-scale EV production, coupled with government subsidies and extensive domestic manufacturing capabilities, is accelerating adoption. In addition, local suppliers are investing in compact, high-efficiency actuator systems to support the rapidly growing demand for intelligent powertrain solutions across passenger and commercial vehicles.

Automotive Torque Actuator Motor Market Share

The Automotive Torque Actuator Motor industry is primarily led by well-established companies, including:

• CTS Corporation (U.S.)

• Johnson Electric Holdings Limited (Hong Kong)

• Mitsuba Corp. (Japan)

• Rheinmetall Automotive AG (Germany)

• Bray International (U.S.)

• NSK Ltd. (Japan)

• ElectroCraft, Inc. (U.S.)

• SIKO GmbH (Germany)

• Val-Matic Valve & Mfg. Corporation (U.S.)

• Hiwin Corporation (Taiwan)

• IGARASHI MOTORS INDIA LTD. (India)

• Tolomatic, Inc. (U.S.)

• DUFF NORTON AUSTRALIA (Australia)

• Emerson Electric Co. (U.S.)

• Flowserve Corporation (U.S.)

• Pentair (U.K.)

• ATI. (U.S.)

• Crane Co. (U.S.)

• Eaton (U.S.)

• Honeywell International Inc. (U.S.)

• Moog Inc. (U.S.)

• Rockwell Automation, Inc. (U.S.)

• SMC Corporation (Japan)

• Woodward, Inc. (U.S.)

• Curtiss-Wright (U.S.)

Latest Developments in Global Automotive Torque Actuator Motor Market

- In September 2025, Nidec announced the expansion of its Arkansas facility to enhance automotive actuator motor production capacity. The development includes the creation of 35 new jobs and aims to strengthen regional supply chain resilience. This expansion is expected to boost Nidec’s manufacturing efficiency and support growing demand from electric and hybrid vehicle manufacturers, positively influencing the global automotive torque actuator motor market

- In September 2025, Ampere achieved a major milestone by producing its one-millionth electric motor at the Cléon plant in France. This development reinforces the company’s large-scale manufacturing capability for integrated actuator motors across Europe. The milestone highlights Ampere’s growing influence in the EV component market and strengthens Europe’s self-sufficiency in electric powertrain systems

- In February 2024, Schaeffler announced an investment of USD 230 million to expand its Dover facility for electric axle production. The project will create approximately 650 jobs and integrate advanced precision actuation technologies into its manufacturing line. This initiative enhances Schaeffler’s vertical integration strategy and positions the company as a key supplier in the transition toward electrified mobility solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.