Global Automotive Torque Vectoring Market

Market Size in USD Billion

CAGR :

%

USD

10.52 Billion

USD

26.80 Billion

2024

2032

USD

10.52 Billion

USD

26.80 Billion

2024

2032

| 2025 –2032 | |

| USD 10.52 Billion | |

| USD 26.80 Billion | |

|

|

|

|

Automotive Torque Vectoring Market Size

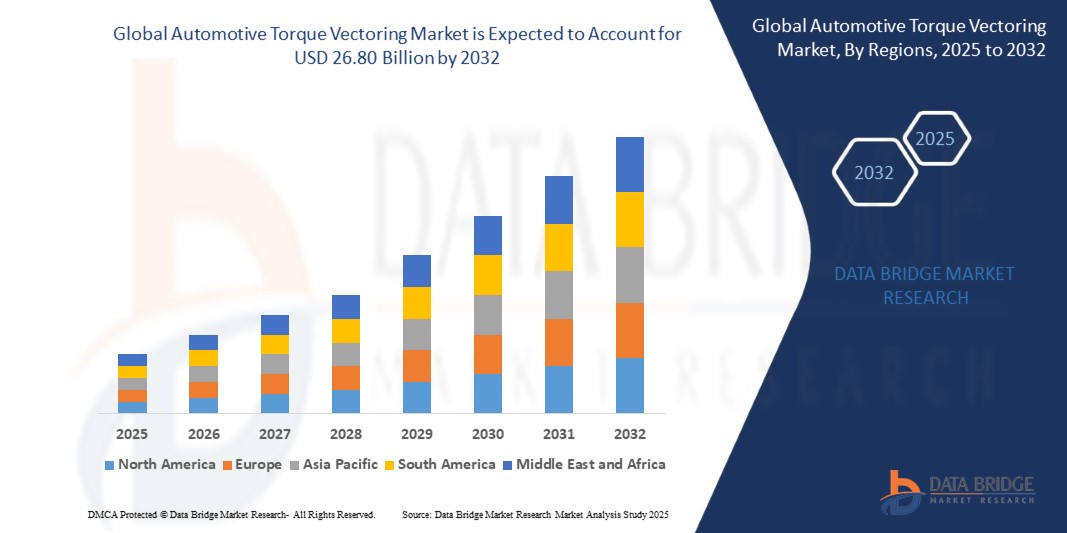

- The global automotive torque vectoring market size was valued at USD 10.52 billion in 2024 and is expected to reach USD 26.80 billion by 2032, at a CAGR of 12.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for enhanced vehicle handling, safety, and performance in both high-performance and utility vehicles, along with the rising integration of advanced driver-assistance systems (ADAS) in modern automobiles

- Continuous innovation in drivetrain technologies and the growing adoption of all-wheel drive (AWD) and four-wheel drive (4WD) systems across various vehicle classes are also contributing significantly to market expansion

Automotive Torque Vectoring Market Analysis

- The torque vectoring technology is witnessing rapid adoption across luxury and electric vehicle segments, with original equipment manufacturers (OEMs) increasingly focusing on offering precise traction control, cornering stability, and acceleration performance

- The shift towards electrification is further boosting the market, as electric drivetrains enable more efficient torque distribution across wheels, improving both energy efficiency and driving dynamics in electric vehicles (EVs) and hybrid vehicles

- North America dominated the automotive torque vectoring market with the largest revenue share of 36.4% in 2024, driven by a growing preference for high-performance vehicles and increasing demand for advanced driver-assistance systems (ADAS)

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive torque vectoring market, driven by rapid industrialization, rising disposable income, and strong government support for hybrid and electric vehicle production in countries such as China, Japan, and South Korea

- The passenger vehicle segment held the largest market revenue share of 61.3% in 2024, driven by the rising demand for enhanced stability, traction, and cornering control in mid-size and premium vehicles. Increasing adoption of luxury sedans and sports utility vehicles (SUVs), especially in urban areas, is contributing to the dominance of this segment. In addition, automakers are incorporating advanced torque vectoring systems in their premium models to differentiate offerings and improve driving dynamics

Report Scope and Automotive Torque Vectoring Market Segmentation

|

Attributes |

Automotive Torque Vectoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Integration of Torque Vectoring in Electric Vehicles |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Torque Vectoring Market Trends

“Increased Integration of Torque Vectoring in Electric and Hybrid Vehicles”

- Torque vectoring is increasingly being integrated into electric and hybrid vehicles to improve traction, control, and efficiency

- Electric drivetrains allow for more precise and responsive torque distribution compared to traditional mechanical systems

- Dual-motor and multi-motor configurations in EVs enable advanced torque vectoring through software

- Automakers are prioritizing vehicle dynamics and performance in EV models, driving adoption of torque vectoring

- For instance, Audi’s e-tron and Tesla’s dual-motor Model 3 utilize torque vectoring to enhance cornering stability and handling

Automotive Torque Vectoring Market Dynamics

Driver

“Increasing Demand for Enhanced Vehicle Safety and Stability”

- Modern consumers are prioritizing safety and stability features in vehicles, leading to higher demand for technologies such as torque vectoring that improve control under all driving conditions

- Torque vectoring ensures optimal torque distribution to each wheel, enhancing maneuverability and traction during sharp turns, wet conditions, or uneven terrain

- Government regulations and safety rating agencies are encouraging the adoption of stability-enhancing systems to reduce accident rates and improve road safety

- The system also complements other advanced driver-assistance systems (ADAS), creating a more cohesive and responsive safety package in modern vehicles

- For instance, BMW's xDrive system integrates torque vectoring with dynamic stability control to enhance road grip and reduce skidding, especially in premium sedan and SUV segments

Restraint/Challenge

“High System Cost and Complexity”

- Torque vectoring systems require precise calibration and high-end components, including sensors, electronic control units, and actuators, which significantly increase vehicle production costs

- The engineering complexity involved in integrating these systems into existing drivetrains limits their use to premium or performance vehicle segments

- Maintenance and repair of torque vectoring systems involve advanced diagnostics and specialized tools, leading to higher aftersales costs and dependency on authorized service centers

- The higher upfront investment and complexity make it challenging for mass-market manufacturers to adopt torque vectoring across entry-level or economy models

- For instance, Compact hatchbacks and low-cost sedans in emerging markets often exclude torque vectoring systems due to cost constraints and limited consumer awareness of the technology.

Automotive Torque Vectoring Market Scope

The market is segmented on the basis of vehicle type, propulsion, clutch actuation type, electric vehicle (EV) type, and technology.

• By Vehicle Type

On the basis of vehicle type, the automotive torque vectoring market is segmented into passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The passenger vehicle segment held the largest market revenue share of 61.3% in 2024, driven by the rising demand for enhanced stability, traction, and cornering control in mid-size and premium vehicles. Increasing adoption of luxury sedans and sports utility vehicles (SUVs), especially in urban areas, is contributing to the dominance of this segment. In addition, automakers are incorporating advanced torque vectoring systems in their premium models to differentiate offerings and improve driving dynamics.

The light commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the demand for improved load management and vehicle control across logistics and last-mile delivery services. As fleet operators seek reliable solutions for vehicle handling and safety under varying loads and terrains, torque vectoring systems are becoming increasingly attractive.

• By Propulsion

On the basis of propulsion, the market is segmented into front-wheel drive, rear-wheel drive, and all-wheel/four-wheel drive. The all-wheel/four-wheel drive segment dominated the market in 2024, owing to the system’s compatibility with high-performance and off-road vehicles that require precise torque distribution to all wheels. Enhanced grip and control in diverse road conditions are key advantages driving adoption.

The front-wheel drive segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing implementation in compact and affordable vehicles. With software-based torque vectoring technologies, front-wheel drive vehicles are now achieving improved maneuverability without the complexity of traditional AWD systems.

• By Clutch Actuation Type

On the basis of clutch actuation type, the market is divided into hydraulic and electronic systems. The hydraulic segment led the market in terms of revenue share in 2024 due to its long-standing presence, durability, and cost-effectiveness in traditional drivetrains. It remains a preferred option in internal combustion engine vehicles across multiple price segments.

The electronic clutch actuation segment is expected to witness the fastest growth rate from 2025 to 2032, supported by advancements in electrification and demand for precise, real-time torque modulation. This segment is gaining traction in premium electric vehicles and performance cars that rely on advanced electronic control units for seamless power delivery.

• By EV Type

Based on EV type, the market is segmented into battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs). The BEV segment accounted for the largest market share in 2024, driven by growing EV adoption globally and the inherent compatibility of electric drivetrains with software-controlled torque vectoring. Leading EV manufacturers are focusing on performance and handling, making torque vectoring a core feature.

The HEV segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising demand for fuel efficiency and improved handling in hybrid powertrains. Automakers are integrating compact and efficient torque vectoring solutions to enhance hybrid vehicle performance.

• By Technology

On the basis of technology, the automotive torque vectoring market is categorized into active torque vectoring systems and passive torque vectoring systems. The active torque vectoring segment dominated the market in 2024, as it enables real-time torque distribution based on driving conditions and user inputs, thereby enhancing vehicle dynamics significantly. This system is widely used in high-performance and luxury vehicles that prioritize responsiveness and driver control.

The passive torque vectoring segment is expected to witness the fastest growth rate from 2025 to 2032, as it offers a cost-effective alternative with fewer components and lower complexity. It is increasingly being integrated into mass-market vehicles where affordability and basic performance enhancement are key priorities.

Automotive Torque Vectoring Market Regional Analysis

- North America dominated the automotive torque vectoring market with the largest revenue share of 36.4% in 2024, driven by a growing preference for high-performance vehicles and increasing demand for advanced driver-assistance systems (ADAS)

- Consumers in the region prioritize enhanced vehicle safety, traction control, and superior handling—attributes strongly associated with torque vectoring technology

- The widespread adoption is further supported by a high concentration of automotive innovation hubs, growing investments in electric vehicle platforms, and regulatory emphasis on vehicle efficiency and safety standards, positioning North America as a leading market for torque vectoring solutions

U.S. Automotive Torque Vectoring Market Insight

The U.S. automotive torque vectoring market accounted for the highest share within North America in 2024, largely due to the country’s expanding production of electric and performance vehicles. Major automakers such as Tesla, General Motors, and Ford are increasingly incorporating torque vectoring systems into electric and all-wheel-drive platforms to enhance handling and acceleration. Moreover, consumer expectations for vehicle control and dynamic performance, particularly in SUVs and luxury sedans, are significantly boosting the demand for torque vectoring technologies.

Europe Automotive Torque Vectoring Market Insight

The Europe automotive torque vectoring market is expected to witness the fastest growth rate from 2025 to 2032, supported by the presence of top-tier automotive manufacturers and ongoing investments in vehicle performance enhancements. Countries such as Germany, the U.K., and France are actively innovating in driveline technologies to comply with safety norms and sustainability goals. European consumers also show strong interest in performance-oriented electric and hybrid vehicles, which increasingly rely on torque vectoring systems to achieve optimal energy distribution and maneuverability.

Germany Automotive Torque Vectoring Market Insight

The Germany automotive torque vectoring market captured the largest revenue share in Europe in 2024, bolstered by its legacy as a global leader in automotive engineering. German manufacturers such as BMW, Audi, and Mercedes-Benz have integrated torque vectoring across several high-end and electric models to improve vehicle balance and responsiveness. The country’s emphasis on quality engineering, continuous R&D, and consumer demand for driving precision contribute to Germany's leadership in torque vectoring deployment.

U.K. Automotive Torque Vectoring Market Insight

The U.K. automotive torque vectoring market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's strong automotive engineering sector and rising demand for advanced vehicle safety technologies. The increasing consumer preference for high-performance and luxury vehicles, especially all-wheel-drive and hybrid electric vehicles, is contributing significantly to market expansion. In addition, regulatory pressures to reduce emissions are accelerating the integration of torque vectoring systems to enhance fuel efficiency and vehicle stability. The presence of leading automotive manufacturers and research institutions in the U.K. supports ongoing innovation and adoption. Furthermore, the growth of electric mobility and supportive government incentives for electric and hybrid vehicles are expected to further boost the demand for electronic torque vectoring systems across both the passenger and commercial vehicle segments.

Asia-Pacific Automotive Torque Vectoring Market Insight

The Asia-Pacific automotive torque vectoring market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing penetration of electric and hybrid vehicles. Countries such as China, Japan, and South Korea are advancing their EV infrastructure, and torque vectoring is emerging as a preferred technology to enhance vehicle performance and safety. The growing interest in premium and performance vehicles across emerging economies is further accelerating market adoption.

Japan Automotive Torque Vectoring Market Insight

The Japan automotive torque vectoring market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s automotive innovation ecosystem and high consumer awareness regarding safety and performance. Leading Japanese automakers such as Toyota, Honda, and Nissan are integrating torque vectoring into their hybrid and electric vehicle lineups to provide improved cornering control and energy efficiency. Additionally, Japan’s regulatory focus on sustainable mobility solutions and advanced driver-assistance systems continues to encourage the adoption of torque vectoring technology.

China Automotive Torque Vectoring Market Insight

The China automotive torque vectoring market accounted for the largest revenue share in Asia-Pacific in 2024, fuelled by its large automotive base, accelerating EV adoption, and government support for intelligent mobility solutions. Chinese automakers are equipping new energy vehicles with torque vectoring to enhance traction, especially in complex road conditions. The presence of multiple domestic electric vehicle manufacturers and the country’s strategic push toward smart and connected vehicles are major drivers supporting market expansion in China.

Automotive Torque Vectoring Market Share

The Automotive Torque Vectoring industry is primarily led by well-established companies, including:

- GKN Automotive Limited (U.K.)

- Eaton (Ireland)

- American Axle & Manufacturing, Inc. (U.S.)

- Dana Limited. (U.S.)

- BorgWarner Inc. (U.S.)

- Schaeffler AG (Germany)

- ZF Friedrichshafen AG (Germany)

- JTEKT Corporation. (Japan)

- Continental AG (Germany)

- Auburn Gear, LLC. (U.S.)

- Neapco Holdings (U.S.)

- Magna International Inc. (Canada)

- Drexler Automotive GmbH (Germany)

- RT Quaife Engineering Ltd. (U.K.)

- Xtrac Ltd (U.K.)

- NSK Ltd. (Japan)

- Bharat Gears Ltd. (India)

- CUSCO Japan co.,ltd. (Japan)

Latest Developments in Global Automotive Torque Vectoring Market

- In May 2024, BorgWarner introduced its cutting-edge electric Torque Vectoring and Disconnect (eTVD) system for battery electric vehicles (BEVs), first featured in the Polestar. This groundbreaking technology is set to be integrated into additional European car models later in the year, enhancing performance and efficiency

- In February 2023, American Axle & Manufacturing Holdings, Inc. formed partnerships with NIO and Mercedes to develop high-performance hybrid-electric systems. Their P3 system layout, featuring an electric motor on the rear axle, improves weight distribution and increases total output torque compared to the traditional transmission-mounted P2 hybrid configuration

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.