Global Automotive Turbocharger Market

Market Size in USD Billion

CAGR :

%

USD

14.94 Billion

USD

26.06 Billion

2024

2032

USD

14.94 Billion

USD

26.06 Billion

2024

2032

| 2025 –2032 | |

| USD 14.94 Billion | |

| USD 26.06 Billion | |

|

|

|

|

Automotive Turbocharger Market Size

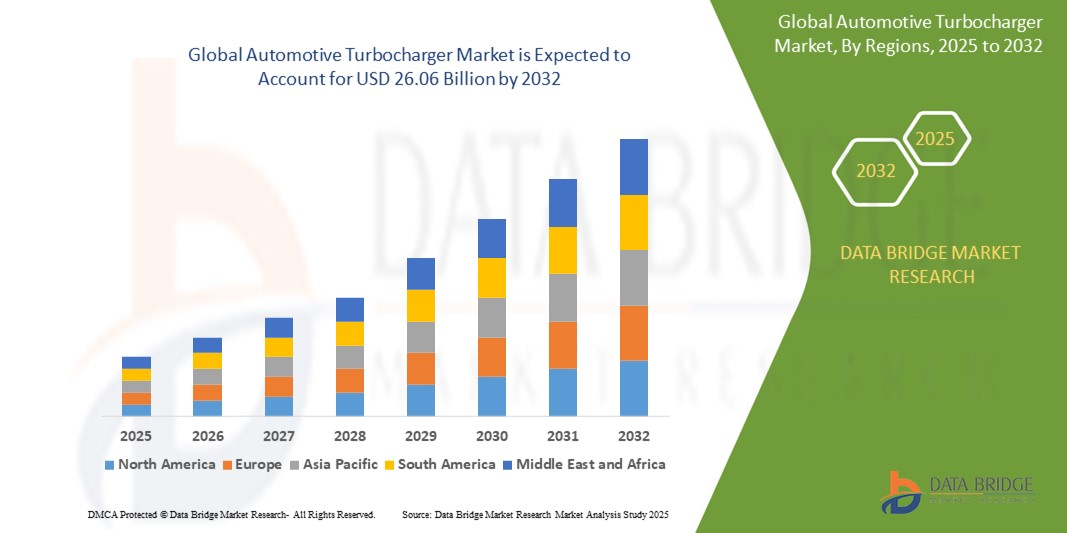

- The global automotive turbocharger market size was valued at USD 14.94 billion in 2024 and is expected to reach USD 26.06 billion by 2032, at a CAGR of 7.20% during the forecast period

- The market growth is primarily driven by increasing demand for fuel-efficient vehicles, stringent emission regulations, and advancements in turbocharging technologies, particularly in electric and hybrid vehicles

- Rising consumer preference for high-performance vehicles with improved power output and fuel economy is further propelling the adoption of turbochargers across various vehicle segments

Automotive Turbocharger Market Analysis

- Automotive turbochargers, which enhance engine power output by forcing extra air into the combustion chamber, are critical components in modern vehicles, improving fuel efficiency and reducing emissions

- The surge in demand for turbochargers is fueled by the global push for lower carbon emissions, the growing popularity of downsized engines, and the increasing adoption of turbocharged engines in passenger and commercial vehicles

- North America dominated the automotive turbocharger market with a revenue share of 38.5% in 2024, driven by stringent emission standards, high vehicle production rates, and the presence of leading automotive manufacturers and turbocharger suppliers in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing vehicle production, and rising disposable incomes in countries such as China, India, and Japan

- The diesel segment held the largest market revenue share of 59% in 2024, driven by its widespread use in heavy-duty vehicles, commercial trucks, and SUVs, where turbochargers enhance fuel efficiency and torque output

Report Scope and Automotive Turbocharger Market Segmentation

|

Attributes |

Automotive Turbocharger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Turbocharger Market Trends

“Integration of Advanced Technologies for Enhanced Efficiency”

- The global automotive turbocharger market is experiencing a significant trend toward the integration of advanced technologies such as electric turbochargers and variable geometry turbochargers (VGT)

- These technologies enhance engine efficiency, improve fuel economy, and reduce emissions by optimizing air intake and boost pressure across various engine speeds

- Electric turbochargers, for instance, eliminate turbo lag by using an electric motor to spool up the compressor instantly, providing immediate power delivery

- Companies such as BorgWarner and Garrett Motion are developing advanced turbocharging solutions, such as e-turbochargers, that integrate with hybrid and electric vehicle powertrains to improve performance

- This trend is increasing the appeal of turbochargers for both manufacturers and consumers, as it aligns with global demands for high-performance, fuel-efficient, and eco-friendly vehicles

- VGT systems are being adopted for their ability to dynamically adjust turbine geometry, offering precise control over boost levels and improved responsiveness across diverse driving conditions

Automotive Turbocharger Market Dynamics

Driver

“Growing Demand for Fuel-Efficient and High-Performance Vehicles”

- The rising consumer preference for vehicles that combine fuel efficiency with high performance is a key driver for the global automotive turbocharger market

- Turbochargers enable smaller engines to produce power comparable to larger, naturally aspirated engines, supporting engine downsizing trends while meeting stringent emission standards

- Government regulations, such as the EU’s CO2 emission targets (93.6 g/km by 2025) and the U.S. CAFE standards (54.5 mpg by 2025), are pushing automakers to adopt turbocharging technology to enhance fuel economy and reduce emissions

- The proliferation of turbocharged gasoline direct injection (TGDI) engines in passenger vehicles, particularly in North America and Asia-Pacific, is further driving market growth

- Automakers are increasingly integrating turbochargers as standard features in both gasoline and diesel vehicles to meet consumer expectations for performance and efficiency

Restraint/Challenge

“High Development Costs and Shift toward Electric Vehicles”

- The high initial costs associated with the development, manufacturing, and integration of advanced turbocharger systems, such as VGT and electric turbochargers, pose a significant barrier, particularly for smaller manufacturers and in cost-sensitive markets

- The complexity of retrofitting turbochargers into existing vehicle platforms adds to the overall cost, limiting adoption in some regions

- The growing popularity of electric vehicles (EVs), which do not rely on internal combustion engines, presents a challenge to the long-term growth of the turbocharger market

- Concerns about the durability and maintenance costs of turbocharged engines, particularly in high-performance applications, can deter potential buyers

- The transition to alternative powertrains, such as hydrogen fuel cells and fully electric systems, may reduce demand for traditional turbochargers in certain vehicle segments, particularly in passenger vehicles

Automotive Turbocharger market Scope

The market is segmented on the basis of fuel type, vehicle type, technology, and sales channel.

- By Fuel Type

On the basis of fuel type, the automotive turbocharger market is segmented into Gasoline, Diesel, CNG/LPG, and Hydrogen ICE. The diesel segment held the largest market revenue share of 59% in 2024, driven by its widespread use in heavy-duty vehicles, commercial trucks, and SUVs, where turbochargers enhance fuel efficiency and torque output. Diesel engines' inherent efficiency and higher energy density make them ideal for turbocharging applications.

The gasoline segment is expected to witness the fastest growth rate of 8.7% from 2025 to 2032, fueled by the rising adoption of turbocharged gasoline direct injection (TGDI) engines in passenger cars. Stricter emission norms and consumer preference for high-performance, fuel-efficient gasoline vehicles are accelerating this segment's growth.

- By Vehicle Type

On the basis of vehicle type, the automotive turbocharger market is segmented into Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles. The passenger vehicles segment dominated with a market revenue share of 75% in 2024, driven by high global production volumes and increasing consumer demand for fuel-efficient, high-performance cars equipped with turbochargers. OEMs are integrating turbocharging to meet regulatory standards and enhance vehicle performance.

The light commercial vehicles segment is anticipated to experience the fastest growth rate of 10.6% from 2025 to 2032. The rising demand for fuel-efficient and powerful light commercial vehicles in logistics and delivery services is driving the adoption of turbocharging technology to optimize performance and comply with emission regulations.

- By Technology

On the basis of technology, the automotive turbocharger market is segmented into Variable Geometry Turbocharger (VGT/VNT), Wastegate Turbocharger, and Electric Turbocharger. The variable geometry turbocharger segment held the largest market revenue share of 65.3% in 2024, owing to its ability to dynamically adjust exhaust gas flow, improving engine efficiency, reducing turbo lag, and enhancing performance across a wide range of engine speeds.

The electric turbocharger segment is expected to witness the fastest growth from 2025 to 2032, driven by advancements in electric boosting systems that eliminate turbo lag and enhance fuel efficiency. The increasing adoption of hybrid and electrified vehicles is further propelling demand for electric turbochargers.

- By Sales Channel

On the basis of sales channel, the automotive turbocharger market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM segment dominated with a market revenue share of 70% in 2024, driven by the pre-installation of turbochargers in vehicles during manufacturing. OEMs are increasingly adopting turbocharging to meet stringent emission standards and consumer demand for enhanced performance.

The aftermarket segment is anticipated to grow robustly from 2025 to 2032, fueled by the rising need for replacement turbochargers in aging vehicles and the growing popularity of performance upgrades in passenger and commercial vehicles. The aftermarket's growth is supported by increasing vehicle ownership rates and demand for fuel-efficient solutions.

Automotive Turbocharger Market Regional Analysis

- North America dominated the automotive turbocharger market with a revenue share of 38.5% in 2024, driven by stringent emission standards, high vehicle production rates, and the presence of leading automotive manufacturers and turbocharger suppliers in the U.S. and Canada

- Consumers prioritize turbochargers for enhancing engine efficiency, reducing emissions, and improving performance, particularly in regions with stringent emission regulations

- Growth is supported by advancements in turbocharger technology, including variable geometry turbochargers (VGT/VNT), wastegate turbochargers, and electric turbochargers, alongside rising adoption in both OEM and aftermarket segments

U.S. Automotive Turbocharger Market Insight

The U.S. smart lock market captured the largest revenue share of 78.5% in 2024 within North America, fueled by strong aftermarket demand and increasing consumer awareness of fuel efficiency and emission reduction benefits. The trend toward engine downsizing and the adoption of turbocharged gasoline direct injection (TGDI) engines further boost market expansion. Automakers’ growing integration of turbochargers in factory-installed vehicles complements aftermarket sales, creating a robust market ecosystem.

Europe Automotive Turbocharger Market Insight

The Europe automotive turbocharger market is expected to witness significant growth, supported by stringent emission regulations and a focus on fuel-efficient vehicles. Consumers seek turbochargers that enhance engine performance while meeting environmental standards. Growth is prominent in both OEM installations and aftermarket retrofits, with countries such as Germany and France showing significant uptake due to advanced automotive industries and urban traffic demands.

U.K. Automotive Turbocharger Market Insight

The U.K. market for automotive turbochargers is expected to witness rapid growth, driven by demand for high-performance and fuel-efficient vehicles in urban and suburban settings. Increased interest in vehicle customization and growing awareness of emission reduction benefits encourage adoption. Evolving emission and fuel efficiency regulations influence consumer choices, balancing performance with compliance.

Germany Automotive Turbocharger Market Insight

Germany is expected to witness rapid growth in automotive turbochargers, attributed to its advanced automotive manufacturing sector and high consumer focus on fuel efficiency and performance. German consumers prefer technologically advanced turbochargers, such as VGT and electric turbochargers, that optimize engine efficiency and contribute to lower fuel consumption. The integration of these turbochargers in premium vehicles and aftermarket options supports sustained market growth.

Asia-Pacific Automotive Turbocharger Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of fuel efficiency, emission reduction, and vehicle performance is boosting demand. Government initiatives promoting stricter emission norms and energy-efficient vehicles further encourage the use of advanced turbochargers.

Japan Automotive Turbocharger Market Insight

Japan’s automotive turbocharger market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced turbochargers that enhance driving performance and fuel efficiency. The presence of major automotive manufacturers and the integration of turbochargers in OEM vehicles accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Automotive Turbocharger Market Insight

China holds the largest share of the Asia-Pacific automotive turbocharger market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for fuel-efficient and high-performance solutions. The country’s growing middle class and focus on smart mobility support the adoption of advanced turbochargers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Automotive Turbocharger Market Share

The automotive turbocharger industry is primarily led by well-established companies, including:

- BorgWarner Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Mitsubishi Heavy Industries (Japan)

- Garrett Motion Inc. (Switzerland)

- IHI Corporation (Japan)

- Cummins Turbo Technologies (U.S.)

- Continental AG (Germany)

- Bosch Mahle Turbo Systems (Germany)

- Eaton Corporation (Ireland)

- Precision Turbo & Engine (U.S.)

- Turbonetics (U.S.)

- Rotomaster (Canada)

- Weichai Power (China)

- Hunan Tyen Machinery (China)

- Kangyue Technology (China)

What are the Recent Developments in Global Automotive Turbocharger Market?

- In April 2025, Cummins Inc. introduced a groundbreaking line of hydrogen internal combustion engine (H2-ICE) turbochargers tailored for heavy-duty commercial trucks in Europe. These turbochargers feature bespoke aerodynamics and advanced prognostics to optimize performance under the unique conditions of hydrogen combustion. The launch marks a major step in Cummins’ Destination Zero strategy, supporting the transition to low-emission transportation and aligning with upcoming Euro VII emission standards. By integrating these turbochargers into hydrogen-powered vehicles, Cummins reinforces its commitment to sustainable innovation and positions itself as a leader in alternative fuel technologies

- In April 2025, Garrett Motion unveiled a suite of electrification and turbocharging innovations at Auto Shanghai 2025, underscoring its commitment to sustainable mobility. The showcase featured the debut of its 3-in-1 E-Powertrain and E-Cooling Compressor, engineered to enhance zero-emission vehicle performance and energy efficiency. Garrett also introduced hybrid-optimized turbocharging solutions for plug-in hybrids and range-extended EVs, aimed at improving fuel economy and reducing emissions. These technologies reflect Garrett’s strategic focus on cleaner combustion and next-generation electrification, supporting the global transition to smarter, more efficient transportation

- In February 2025, Continental expanded its aftermarket turbocharger portfolio to include high-efficiency models for BMW, MINI, and several Volkswagen Group brands. These turbochargers are identical to the original equipment installed by manufacturers, ensuring uncompromised performance, durability, and emissions compliance. The expansion addresses rising demand for OEM-quality replacements and upgrades in the independent aftermarket, especially for gasoline engines. Continental’s offerings include lightweight, water-cooled aluminum turbine housings and advanced RAAX™ turbine technology, which enhance engine response and reduce emissions

- In September 2024, BorgWarner introduced the largest passenger car twin turbochargers ever developed, engineered exclusively for the General Motors Corvette ZR1. These high-performance turbos are paired with GM’s 5.5-liter flat-plane crankshaft V8 engine, enabling the ZR1 to deliver a staggering 1,064 horsepower and 828 lb-ft of torque. Each turbo features a 76mm forged milled compressor wheel, a 67mm turbine wheel, and a patented decoupled ball bearing system for faster response, reduced noise, and enhanced durability. The launch underscores BorgWarner’s commitment to cutting-edge propulsion technologies for specialized and performance-driven vehicle segments

- In March 2024, Cummins Inc. launched the HE400VGT, its 8th-generation Holset variable geometry turbocharger, engineered specifically for 10- to 15-liter heavy-duty truck engines. This advanced turbocharger delivers 5% improved efficiency over its predecessor, along with enhanced transient response and fuel economy. Key upgrades include a new bearing system, tighter compressor clearances, and a smart electric actuator with integrated speed sensor for better durability and control. The HE400VGT reflects Cummins’ commitment to innovation, helping OEMs meet stricter emission regulations while improving overall engine performance and reliability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Automotive Turbocharger Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Automotive Turbocharger Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Automotive Turbocharger Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.