Global Automotive Ultrasonic Sensors Market

Market Size in USD Billion

CAGR :

%

USD

4.93 Billion

USD

7.91 Billion

2025

2033

USD

4.93 Billion

USD

7.91 Billion

2025

2033

| 2026 –2033 | |

| USD 4.93 Billion | |

| USD 7.91 Billion | |

|

|

|

|

Automotive Ultrasonic Sensors Market Size

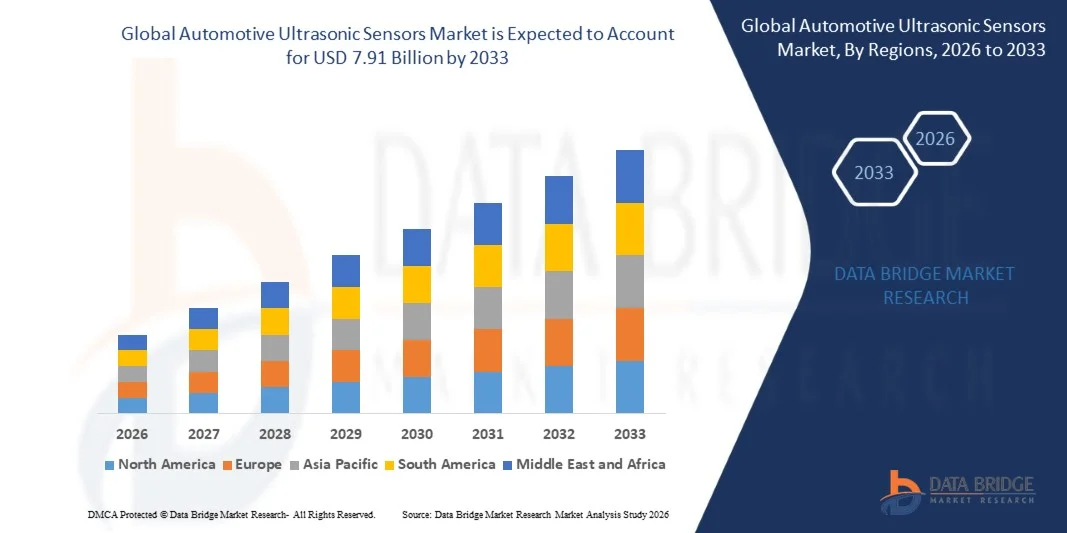

- The global automotive ultrasonic sensors market size was valued at USD 4.93 billion in 2025 and is expected to reach USD 7.91 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by increasing adoption of advanced driver assistance systems and rising demand for enhanced vehicle safety and parking assistance features

- Growing integration of ultrasonic sensors in passenger and commercial vehicles to support functions such as park assist, obstacle detection, and low-speed collision avoidance

Automotive Ultrasonic Sensors Market Analysis

- The market is driven by continuous advancements in sensor technology, including improved accuracy, compact design, and cost efficiency, enabling wider adoption across mass-market vehicles

- In addition, stringent vehicle safety regulations and increasing consumer preference for convenience-oriented automotive features are accelerating the incorporation of ultrasonic sensors into modern vehicle architectures

- North America dominated the automotive ultrasonic sensors market with the largest revenue share in 2025, driven by the increasing adoption of advanced driver assistance systems (ADAS) and rising focus on vehicle safety and parking convenience

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive ultrasonic sensors market, driven by increasing vehicle production, expanding automotive manufacturing base, rapid urbanization, and growing demand for advanced safety and driver-assistance technologies

- The Proximity Detection segment held the largest market revenue share in 2025, driven by its widespread use in parking assistance and low-speed obstacle detection systems. Proximity detection sensors offer accurate short-range measurement, enhancing vehicle safety and convenience for both drivers and passengers

Report Scope and Automotive Ultrasonic Sensors Market Segmentation

|

Attributes |

Automotive Ultrasonic Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Ultrasonic Sensors Market Trends

“Rising Integration Of Ultrasonic Sensors In Advanced Driver Assistance Systems”

• The increasing integration of ultrasonic sensors in advanced driver assistance systems is reshaping the automotive ultrasonic sensors market by enabling accurate short-range object detection. These sensors support key functions such as parking assistance, blind spot alerts, and low-speed collision avoidance. Their ability to operate reliably at close range enhances overall vehicle safety and everyday driving convenience

• Growing demand for automated and semi-autonomous driving features is accelerating the adoption of ultrasonic sensors across passenger and commercial vehicles. These sensors perform effectively in low-speed and confined environments where precision is critical. Their reliability in urban traffic conditions makes them an essential component of modern vehicle architectures

• Automakers are increasingly deploying multiple ultrasonic sensors around vehicle perimeters to improve spatial awareness and maneuverability. This approach enhances vehicle control during parking and tight turns. The trend is particularly prominent in densely populated urban areas with limited parking space

• For instance, in 2023, several automotive manufacturers expanded the use of ultrasonic sensor arrays in mid-range vehicle models to support advanced park-assist and surround-view systems. These enhancements improved feature differentiation and customer appeal. The move also helped bridge the gap between premium and mass-market vehicle offerings

• While ultrasonic sensors play a vital role in vehicle safety systems, their continued impact depends on improvements in sensor accuracy and durability. Cost optimization and efficient integration with cameras and radar systems are also critical. These factors will determine long-term scalability and adoption across vehicle segments

Automotive Ultrasonic Sensors Market Dynamics

Driver

“Stringent Vehicle Safety Regulations And Growing Focus On Driver Convenience”

• Increasingly stringent vehicle safety regulations are compelling automakers to integrate ultrasonic sensors as standard safety components. Mandates focused on pedestrian protection and collision prevention are driving consistent demand. Compliance requirements are accelerating sensor deployment even in entry-level vehicles

• Consumers are placing greater emphasis on driving comfort and ease of operation, increasing demand for features such as automated parking and proximity warnings. Ultrasonic sensors enable these functions through real-time distance measurement. Their accuracy enhances driver confidence and reduces stress during low-speed maneuvers

• The rising production of passenger vehicles equipped with safety and convenience features is further supporting market growth. Automakers are using ultrasonic sensors to strengthen value propositions and differentiate models. This trend is evident across both conventional and electric vehicles

• For instance, in 2024, updated safety compliance standards in multiple countries encouraged the inclusion of parking assist technologies as standard features. This led to higher installation rates of ultrasonic sensors in compact and mid-sized vehicles. The change significantly boosted overall sensor demand

• While regulatory and consumer trends strongly support market expansion, maintaining consistent sensor performance is essential. Cost efficiency and long-term reliability remain key considerations for manufacturers. Addressing these factors will support sustained adoption

Restraint/Challenge

“Performance Limitations And Competition From Alternative Sensor Technologies”

• Ultrasonic sensors face performance limitations under certain environmental conditions such as heavy rain, snow, and uneven road surfaces. These factors can interfere with signal reflection and accuracy. As a result, detection reliability may decline in challenging weather scenarios

• The growing adoption of alternative sensing technologies such as radar and camera-based systems presents strong competition. These technologies offer longer detection ranges and support multiple driving functions. Their versatility reduces dependence on ultrasonic sensors in advanced applications

• Integration complexity and calibration requirements can increase development time and system costs for automakers. This challenge is more pronounced when combining ultrasonic sensors with multi-sensor platforms. Higher costs may limit adoption in budget-sensitive vehicle segments

• For instance, in 2023, several automakers prioritized camera and radar systems for higher-level driver assistance and automated driving functions. Ultrasonic sensors were increasingly restricted to parking and close-range detection roles. This shift affected overall sensor deployment strategies

• While ultrasonic sensors remain essential for short-range detection, addressing performance gaps is critical. Enhancing compatibility with other sensing technologies will improve system reliability. These improvements are necessary to sustain long-term market growth

Automotive Ultrasonic Sensors Market Scope

The market is segmented on the basis of type, vehicle autonomy, vehicle type, and application.

• By Type

On the basis of type, the automotive ultrasonic sensors market is segmented into Proximity Detection and Range Measurement. The Proximity Detection segment held the largest market revenue share in 2025, driven by its widespread use in parking assistance and low-speed obstacle detection systems. Proximity detection sensors offer accurate short-range measurement, enhancing vehicle safety and convenience for both drivers and passengers.

The Range Measurement segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing adoption in semi-autonomous and fully-autonomous vehicles. These sensors provide precise distance measurement over longer ranges, enabling advanced safety features and integration with other ADAS technologies.

• By Vehicle Autonomy

On the basis of vehicle autonomy, the market is segmented into Semi-Autonomous Vehicle and Fully-Autonomous Vehicle. The Semi-Autonomous Vehicle segment accounted for the largest market share in 2025, owing to the rising integration of ultrasonic sensors in driver-assist features such as park assist, blind spot monitoring, and collision avoidance.

The Fully-Autonomous Vehicle segment is expected to grow at the fastest pace during the forecast period, as ultrasonic sensors play a crucial role in multi-sensor fusion systems for self-driving vehicles, supporting precise navigation and environment perception in complex driving scenarios.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into Passenger Cars and Commercial Vehicles. The Passenger Cars segment dominated the market in 2025, fueled by the growing incorporation of ultrasonic sensors in mid-range and premium passenger vehicles for enhanced safety and convenience features.

The Commercial Vehicles segment is projected to grow at a faster rate from 2026 to 2033, driven by increasing demand for safety and automated driving features in logistics, delivery, and public transport vehicles.

• By Application

On the basis of application, the market is segmented into Park Assist, Self-Parking, and Blind Spot Detection. The Park Assist segment held the largest revenue share in 2025 due to its widespread use in urban areas and increasing consumer preference for convenient parking solutions.

The Self-Parking segment is expected to witness the fastest growth from 2026 to 2033, driven by advancements in ADAS technologies and the rising adoption of semi- and fully-autonomous vehicle systems.

Automotive Ultrasonic Sensors Market Regional Analysis

• North America dominated the automotive ultrasonic sensors market with the largest revenue share in 2025, driven by the increasing adoption of advanced driver assistance systems (ADAS) and rising focus on vehicle safety and parking convenience

• Consumers in the region highly value the enhanced safety, ease of parking, and low-speed collision prevention offered by vehicles equipped with ultrasonic sensors. The integration of these sensors in passenger cars and commercial vehicles is increasing overall vehicle appeal

• This widespread adoption is further supported by high vehicle production rates, well-developed automotive infrastructure, and the presence of leading automotive manufacturers, establishing ultrasonic sensors as a standard feature in modern vehicles

U.S. Automotive Ultrasonic Sensors Market Insight

The U.S. automotive ultrasonic sensors market captured the largest revenue share in 2025 within North America, fueled by the rapid deployment of ADAS features and increasing consumer preference for vehicles with enhanced safety systems. The growing incorporation of ultrasonic sensors in mid-range and premium passenger vehicles for park assist, blind spot detection, and self-parking functions is further propelling market growth. In addition, advancements in sensor technology and integration with semi-autonomous vehicle systems are significantly contributing to market expansion.

Europe Automotive Ultrasonic Sensors Market Insight

The Europe automotive ultrasonic sensors market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict vehicle safety regulations and rising demand for collision prevention systems. Increasing urbanization and growing adoption of connected vehicles are fostering ultrasonic sensor integration. The market is experiencing significant growth across passenger and commercial vehicles, with sensors being incorporated in both new models and retrofitted systems.

U.K. Automotive Ultrasonic Sensors Market Insight

The U.K. automotive ultrasonic sensors market is expected to witness notable growth from 2026 to 2033, driven by stringent safety norms and rising consumer awareness regarding vehicle safety and convenience. Concerns regarding urban parking challenges and low-speed collisions are encouraging vehicle owners and fleet operators to adopt sensor-equipped vehicles. The U.K.’s mature automotive industry and strong after-sales infrastructure are further supporting market growth.

Germany Automotive Ultrasonic Sensors Market Insight

The Germany automotive ultrasonic sensors market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of ADAS technologies and demand for technologically advanced and reliable vehicle safety solutions. Germany’s strong automotive manufacturing base, emphasis on innovation, and regulatory focus on road safety are promoting the adoption of ultrasonic sensors in passenger cars and commercial vehicles. Integration with autonomous driving technologies is also becoming increasingly prevalent.

Asia-Pacific Automotive Ultrasonic Sensors Market Insight

The Asia-Pacific automotive ultrasonic sensors market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising vehicle production, rapid urbanization, and increasing consumer focus on safety and convenience in countries such as China, Japan, and India. The region’s growing automotive industry, government support for vehicle safety standards, and increasing adoption of semi-autonomous vehicles are boosting sensor deployment. Furthermore, the presence of domestic sensor manufacturers is making these solutions more affordable and accessible.

Japan Automotive Ultrasonic Sensors Market Insight

The Japan automotive ultrasonic sensors market is expected to witness significant growth from 2026 to 2033 due to the country’s advanced automotive technology adoption, high urban density, and growing demand for safety and convenience features. The integration of ultrasonic sensors in passenger cars and commercial vehicles supports automated parking, blind spot monitoring, and other ADAS functions. Moreover, Japan’s aging population is likely to drive demand for driver-assist technologies that enhance safety and ease of use.

China Automotive Ultrasonic Sensors Market Insight

The China automotive ultrasonic sensors market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid vehicle production, high adoption of ADAS features, and increasing focus on vehicle safety. China is one of the largest markets for passenger and commercial vehicles, and ultrasonic sensors are becoming standard for parking assistance and collision avoidance. Government initiatives supporting smart and safe transportation, along with competitive local manufacturers, are key factors driving market growth in China.

Automotive Ultrasonic Sensors Market Share

The Automotive Ultrasonic Sensors industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- DENSO CORPORATION (Japan)

- TE Connectivity (Switzerland)

- BorgWarner Inc. (U.S.)

- Raytheon Company (U.S.)

- Trimble Inc. (U.S.)

- Allegro MicroSystems, LLC (U.S.)

- Elmos Semiconductor SE (Germany)

- Infineon Technologies AG (Germany)

- ZF Friedrichshafen AG (Germany)

- Sensirion AG (Switzerland)

- VALEO (France)

- Hitachi Automotive Systems, Ltd. (Japan)

- Sensata Technologies, Inc. (U.S.)

- Thor Industries (U.S.)

- Autoliv Inc. (Sweden)

- NXP Semiconductors (Netherlands)

- STMicroelectronics (Switzerland)

- Analog Devices, Inc. (U.S.)

- Parker Hannifin Corp (U.S.)

Latest Developments in Global Automotive Ultrasonic Sensors Market

- In March 2025, Continental AG introduced an over-the-air updatable ultrasonic sensor platform for automotive OEMs. The platform allows post-deployment software updates to enhance sensor performance, add new features, and extend vehicle safety capabilities, positioning Continental at the forefront of smart sensor innovation

- In February 2025, Valeo opened a new R&D center in Seoul, South Korea, focused on developing next-generation ultrasonic sensors for the Asian automotive market. The center aims to accelerate innovation, enhance sensor performance for regional OEMs, and support Valeo’s expansion in the rapidly growing Asia-Pacific automotive sector

- In February 2025, Bosch unveiled an AI-powered ultrasonic sensor suite for Level 3 and Level 4 autonomous vehicles. The sensors leverage AI-based signal processing for improved object detection and classification, enhancing vehicle safety and advancing Bosch’s technology leadership in autonomous driving solutions

- In January 2025, Infineon Technologies launched a compact ultrasonic sensor chip designed for electric vehicles. The chip enables efficient integration into tight vehicle architectures, supports improved parking assistance, and contributes to the development of advanced EV safety systems

- In January 2025, Continental AG secured a major multi-year contract with Hyundai to supply ultrasonic parking sensors for new vehicle platforms. This deal strengthens Continental’s market footprint, ensures broader adoption of its sensors, and supports enhanced parking assistance features across Hyundai’s upcoming models

- In December 2024, Magna International secured a contract to supply ultrasonic parking and proximity sensors for Ford’s next-generation SUV lineup. The agreement boosts Magna’s market presence, ensures widespread adoption of its sensors, and enhances vehicle safety and driver convenience

- In March 2024, Aptiv acquired U.S.-based SensComp, a specialist in ultrasonic sensor modules for automotive applications. The acquisition expands Aptiv’s ADAS product portfolio, improves technological capabilities, and strengthens its position in the growing automotive sensor market

- In March 2024, Murata Manufacturing announced a strategic partnership with Tesla to supply advanced ultrasonic sensors for upcoming Tesla vehicle models. This collaboration enables enhanced driver-assistance features, boosts Murata’s market presence, and supports Tesla’s push toward safer and more autonomous vehicles

- In February 2024, Denso invested USD 100 million to expand its U.S. R&D center in Michigan, focusing on next-generation automotive sensors, including ultrasonic technologies. This investment is expected to accelerate innovation, improve sensor performance, and meet the increasing global demand for ADAS-enabled vehicles

- In February 2024, Valeo launched its next-generation ultrasonic parking sensor platform for electric and hybrid vehicles. The new sensors offer improved range, precision, and reliability for parking assistance, helping EV manufacturers enhance vehicle safety and user convenience while supporting Valeo’s leadership in ADAS solutions

- In February 2024, Bosch opened a new state-of-the-art automotive sensor manufacturing facility in Dresden, Germany, dedicated to producing advanced ultrasonic sensors for ADAS and autonomous vehicles. The facility aims to enhance production capacity, improve sensor accuracy, and support the growing demand for safety and autonomous driving features, strengthening Bosch’s market position in automotive sensing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.