Global Automotive Upholstery Market

Market Size in USD Billion

CAGR :

%

USD

7.46 Billion

USD

11.15 Billion

2024

2032

USD

7.46 Billion

USD

11.15 Billion

2024

2032

| 2025 –2032 | |

| USD 7.46 Billion | |

| USD 11.15 Billion | |

|

|

|

|

Automotive Upholstery Market Size

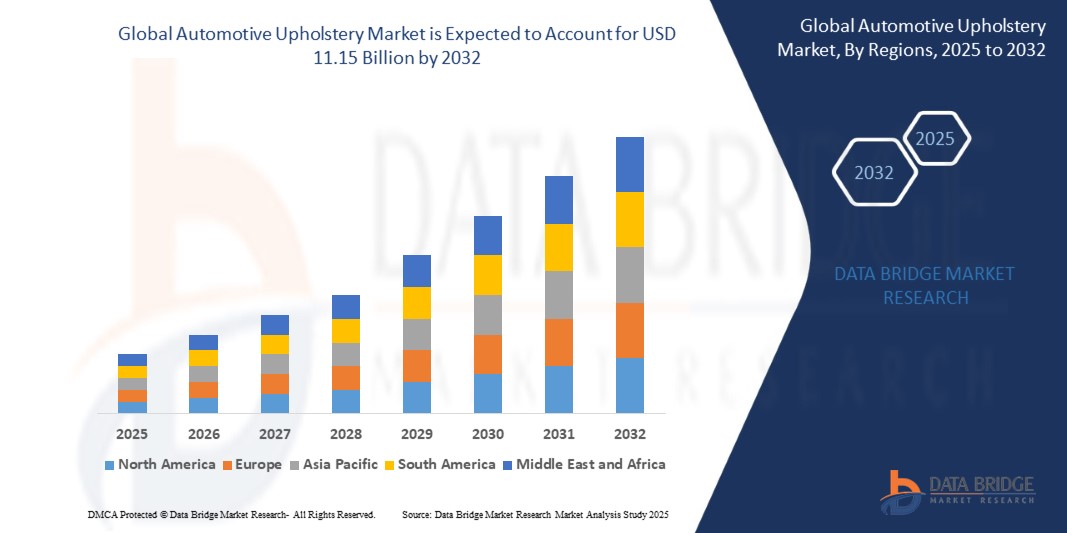

- The global automotive upholstery market was valued at USD 7.46 billion in 2024 and is projected to reach USD 11.15 billion by 2032, growing at a robust CAGR of 5.90% during the forecast period.

- Market growth is fueled by the rising demand for enhanced in-vehicle comfort, the growing preference for premium interiors, and the increasing production of electric and autonomous vehicles, which are driving innovation in sustainable, lightweight, and smart upholstery materials..

Automotive Upholstery Market Analysis

- Automotive upholstery refers to the materials and fabrics used to cover vehicle interiors, including seats, door panels, headliners, carpets, and dashboards, offering both functional support and aesthetic appeal.

- As consumers increasingly prioritize comfort, premium design, and customization, automotive upholstery is becoming a key differentiator in passenger vehicles, electric vehicles, and luxury models.

- Manufacturers are adopting advanced materials like synthetic leather, performance fabrics, and recycled composites to meet evolving regulations and sustainability goals without compromising durability or design.

- The shift toward electric and autonomous vehicles is driving demand for lightweight, noise-insulating, and smart textiles that enhance cabin acoustics, temperature control, and user interaction.

- Technological innovations in 3D knitting, antimicrobial coatings, and bio-based materials are reshaping the upholstery landscape—supporting circular economy goals while delivering enhanced in-vehicle experiences.

Report Scope and Automotive Upholstery Market Segmentation

|

Attributes |

Automotive Upholstery Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import-export analysis, automotive upholstery production landscape, production and consumption patterns by material and vehicle type, price trend analysis of key upholstery materials (leather, vinyl, synthetic fibers, etc.), climate impact and sustainable material adoption outlook, supply chain and distribution channel analysis, value chain assessment from raw material sourcing to OEM delivery, raw material and consumables overview, vendor qualification and selection parameters, PESTLE Analysis, Porter’s Five Forces Analysis, and regulatory framework analysis focusing on automotive interior safety and sustainability standards. |

Automotive Upholstery Market Trends

Customization, Sustainability, and Technological Innovation Reshaping Automotive Interiors

- Surge in Demand for Sustainable Upholstery Materials: OEMs and suppliers are increasingly adopting eco-friendly materials such as recycled polyester, plant-based leather alternatives, and water-based adhesives to meet environmental regulations and consumer preferences for sustainable vehicles.

- Premiumization and Interior Personalization: As vehicle interiors become a focal point for user experience, there's growing demand for customizable upholstery options ranging from luxury leather to bespoke fabric textures especially in mid- to high-end vehicle segments.

- Integration of Smart and Temperature-Regulating Fabrics: Advancements in fabric technology are enabling the development of smart upholstery with features like seat heating, cooling, and embedded sensors, enhancing comfort and safety for occupants.

- Uptake of Synthetic Leather and Performance Fabrics: Due to their durability, ease of cleaning, and cost-efficiency, synthetic materials such as PU and PVC leather are seeing strong adoption, particularly in commercial and economy vehicle categories.

- Influence of EV and Autonomous Vehicle Design: The transition toward electric and self-driving vehicles is driving innovation in upholstery layouts, with flat-floor cabins and lounge-style seating demanding new forms of modular, breathable, and lightweight fabrics..

Automotive Upholstery Market Dynamics

Driver

Demand for Lightweight, Flexible, and Cost-Effective Electronics for Emerging Applications

- The growing need for conformable electronics in wearables, packaging, and automotive interiors is driving rapid adoption of printed components, which offer mechanical flexibility and reduced production costs.

- Applications such as e-paper displays, smart bandages, touch-sensitive surfaces, and interactive posters are increasing in volume, enabled by low-cost, scalable printed technology.

- Consumer electronics brands are integrating printed displays and sensors into curved screens, bendable devices, and compact form factors, encouraging continued R&D and material innovation.

- Governments and corporates are investing in bio-compatible printed sensors for healthcare and PV-integrated infrastructure, contributing to industry-wide expansion.

Restraint/Challenge

Rising Demand for Premium, Durable, and Sustainable Upholstery in Next-Generation Vehicles

- The shift in consumer preference toward enhanced in-cabin comfort, tactile experience, and aesthetics is driving automakers to invest in high-quality upholstery materials, including leather, suede, and advanced textiles.

- Electric vehicles (EVs) and luxury car segments are increasingly focusing on sophisticated and customizable interiors, prompting OEMs to differentiate through sustainable and ergonomic upholstery solutions.

- The adoption of vegan leather, recycled fabrics, and low-emission adhesives is accelerating, as automakers aim to meet global sustainability targets and appeal to environmentally conscious buyers.

- Smart fabrics that regulate temperature, resist stains, or integrate sensors are gaining traction in both high-end and mid-range vehicles, enhancing user experience and enabling integration with smart vehicle systems.

- Stringent automotive interior safety and environmental standards in regions like Europe and North America are pushing manufacturers to adopt flame-retardant, low-VOC, and hypoallergenic materials, expanding demand for advanced upholstery solutions.

Automotive Upholstery Market Scope

The market is segmented by material, fabric type, vehicle type, and sales channel, reflecting its integral role across diverse vehicle categories and production models.

- By Material

Includes Leather, Vinyl, Nylon, Polyester, PVC, and Others. Leather upholstery leads the market in 2025 due to its premium feel, durability, and association with luxury vehicles. However, synthetic materials like vinyl and polyester are gaining traction for their cost-efficiency, ease of maintenance, and growing demand in mid-range and electric vehicles. Sustainable and recycled materials are also emerging, especially among environmentally-conscious OEMs..

- By Fabric Type

Includes Woven and Non-Woven fabrics. Woven fabrics dominate the segment in 2025 due to their superior strength, aesthetic appeal, and use in both seating and interior trims. Non-woven fabrics, on the other hand, are witnessing faster growth owing to their lightweight nature, cost advantages, and increasing application in headliners, door panels, and trunk liners..

- By Vehicle Type

Includes Passenger Cars, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). Passenger cars account for the largest share in 2025, driven by higher production volumes, consumer preferences for comfort, and rising demand for customizable interiors. Meanwhile, LCVs and HCVs are experiencing steady growth due to fleet expansions, especially in logistics and public transport, where durable and easy-to-clean upholstery is prioritized.

- By Sales Channel

Includes OEM and Aftermarket. OEMs dominate the market in 2025 as upholstery is primarily installed during vehicle manufacturing. However, the aftermarket segment is growing robustly, fueled by customization trends, refurbishment of older vehicles, and the popularity of luxury seat covers, especially in emerging economies and among ride-sharing fleets..

Automotive Upholstery Market Regional Analysis

- North America leads the global automotive upholstery market in 2025 due to strong demand for premium vehicles, advanced safety features, and comfort-focused interiors. The U.S. dominates regional growth, driven by rising consumer preference for leather-trimmed seating, growing electric vehicle (EV) adoption, and technological integration like climate-controlled seating and memory foams in upholstery.

- Europe follows closely, supported by high-end vehicle production, particularly in Germany, France, and the U.K. Automakers in this region emphasize sustainability and are increasingly incorporating eco-friendly materials such as recycled polyester, synthetic leather alternatives, and vegan interiors. The strong presence of luxury car brands further boosts demand for high-quality, customized upholstery solutions.

- Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. The region’s expansion is fueled by surging automotive production, expanding middle-class income groups, and shifting preferences toward aesthetic vehicle interiors. China leads in volume, while Japan and South Korea focus on material innovation—such as antibacterial and lightweight fabrics—backed by strong OEM networks.

- Middle East & Africa (MEA) is witnessing moderate growth, driven by increasing demand for SUVs and luxury vehicles, especially in UAE and Saudi Arabia. The region's hot climate also spurs demand for heat-resistant and ventilated upholstery solutions. Emerging manufacturing setups and aftermarket growth contribute to gradual market development.

- South America, led by Brazil and Argentina, is seeing growth in mid-range and utility vehicle segments, where fabric-based and synthetic leather upholstery are gaining traction due to affordability. Automotive OEMs and tier suppliers are expanding production and localization efforts to serve growing domestic markets.

United States

The U.S. leads regional growth with a strong focus on comfort and safety. Demand is high for advanced seating systems, leather upholstery, and customization in both ICE and electric vehicle segments. OEM partnerships with upholstery suppliers are driving product innovation and volume deployment.

Germany

Germany’s automotive upholstery market thrives on premium vehicle production, with manufacturers prioritizing high-performance, sustainable materials. Innovations in heated/cooled seating and integration of upholstery with ambient lighting and acoustic comfort systems align with Industry 4.0 standards.

China

China dominates in vehicle production volume and is rapidly shifting toward premium interiors, even in mass-market vehicles. Domestic OEMs are incorporating synthetic leather and modern fabric designs at scale, supported by rising urban demand and local material production capabilities..

India

India is emerging as a key market for cost-effective upholstery in hatchbacks, compact SUVs, and two-wheelers. The shift from basic fabric seats to improved synthetic leather in entry-level vehicles is driven by consumer aspirations and rapid OEM model launches across segments.

South Korea

South Korea continues to focus on material innovation, driven by major OEMs like Hyundai and Kia. The country is adopting smart and eco-friendly upholstery with antimicrobial, anti-odor, and sustainable fabric technologies aligned with global EV trends and green manufacturing practices.

Automotive Upholstery Market Share

The automotive upholstery industry is primarily led by well-established companies, including:

- ear Corporation,

- TOYOTA BOSHOKU CORPORATION,

- Faurecia,

- Borgers SE & Co. KGaA,

- The Haartz Corporation,

- MARTUR,

- Sage Automotive Interiors,

- SEIREN Co., LTD,

- MarvelVinyls, Rabe Auto Upholstery,

- Katzkin Leather, Inc.,

- Auto textile S.A.

- Moorestown Auto & Boat Upholstery Inc.,

- SMS Auto Fabrics,

- PD,

- TMI Products Automotive.,

- Gruppo Mastrotto spa,

- Morbern, Simi Auto Upholstery,

- Gilbreath Upholstery Supply

Latest Developments in Global Automotive Upholstery Market

- In April 2025, a leading Russian custom auto shop made headlines by upholstering a Ford F‑250 using grizzly bear fur, showcasing ultra-luxury materials though such customization sparked ethical and legal debates within the EU and North America.

- March 2025, Car Design News teamed with Ultrafabrics to launch the CMF Trend Survey 2025, highlighting growing designer interest in sustainable microfiber upholstery for vehicle interiors.

- February 2025, automotive suppliers widely adopted Ultrasuede microfiber fabric, engineered to meet automotive flammability and durability standards; its polyester/polyurethane structure continues to replace traditional suede in high-end and mass-market interiors.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AUTOMOTIVE UPHOLSTERY MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AUTOMOTIVE UPHOLSTERY MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RECENT TRENDS FOR AUTOMOTIVE UPHOLSTERY MARKET (QUALITATTIVE )

5.1.1 PASSENGER CAR

5.1.2 LIGHT COMMERCIAL VEHICLE

5.1.3 HEAVY COMMERCIAL VEHICLE

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 GENUINE LEATHER

7.2.1 BY VEHICLE TYPE

7.2.1.1. PASSENGER CAR

7.2.1.2. LIGHT COMMERCIAL VEHICLE

7.2.1.3. HEAVY COMMERCIAL VEHICLE

7.2.1.4. ELECTRIC VEHICLE

7.3 SYNTHETIC LEATHER

7.3.1 BY TYPE

7.3.1.1. PU-BASED

7.3.1.2. PVC BASED

7.3.1.3. BIO-BASED

7.4 AUTOMOTIVE TEXTILES

7.4.1 BY VEHICLE TYPE

7.4.1.1. PASSENGER CAR

7.4.1.2. LIGHT COMMERCIAL VEHICLE

7.4.1.3. HEAVY COMMERCIAL VEHICLE

7.4.1.4. ELECTRIC VEHICLE

7.5 PLASTICS

7.5.1 BY VEHICLE TYPE

7.5.1.1. PASSENGER CAR

7.5.1.2. LIGHT COMMERCIAL VEHICLE

7.5.1.3. HEAVY COMMERCIAL VEHICLE

7.5.1.4. ELECTRIC VEHICLE

7.6 SMART FABRICS

7.6.1 BY TYPE

7.6.1.1. NONWOVENS FABRICS

7.6.1.2. COMPOSITE FABRICS

7.6.1.3. COATING FABRICS

7.6.1.4. FOAM FABRICS

7.6.1.5. UPHOLSTERY , TRIMMING FABRICS

7.6.1.6. FILTER FABRIC

7.6.1.7. BELT FABRIC

7.6.2 BY VEHICLE TYPE

7.6.2.1. PASSENGER CAR

7.6.2.2. LIGHT COMMERCIAL VEHICLE

7.6.2.3. HEAVY COMMERCIAL VEHICLE

7.6.2.4. ELECTRIC VEHICLE

7.7 THERMOPLASTIC POLYMERS

7.7.1 BY VEHICLE TYPE

7.7.1.1. PASSENGER CAR

7.7.1.2. LIGHT COMMERCIAL VEHICLE

7.7.1.3. HEAVY COMMERCIAL VEHICLE

7.7.1.4. ELECTRIC VEHICLE

8 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTO FLOOR MATS

8.3 AUTOMOTIVE CARPETING

8.4 AUTOMOTIVE SEATING

8.5 SEAT BELTS

8.6 AIR BAGS

8.7 STEERING WHEEL COVERS

8.8 AUTOMOTIVE HEADLINERS

8.9 AUTO TRIM/SUPPORTED PVC

8.1 AUTO TRIM/ LEATHER

8.11 CAR COVERS

8.12 CARPETS

8.12.1 DASHBOARDS

8.13 ROOF LINERS

8.14 SEAT COVERS

8.15 SUN VISORS

8.16 TRUNK LINERS

8.17 OTHERS

9 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY INTEGRATED TECHNOLOGY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 SMART SEATS

9.4 VENTILATED

10 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY PROPULSION TYPE

10.1 OVERVIEW

10.2 DIESEL

10.3 PETROL

10.4 ELECTRIC VEHICLE

10.5 OTHERS

11 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY HIDE SIZE

11.1 OVERVIEW

11.2 18 TO 20 SQ FT

11.3 20 TO 50 SQ FT

11.4 50 TO 55 SQ FT

11.5 MORE THAN 55 SQ FT

12 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY FABRIC TYPE

12.1 OVERVIEW

12.2 NON-WOVEN

12.3 WOVEN

13 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY FINISH TYPE

13.1 OVERVIEW

13.2 SEMI-ANILINE

13.3 SUEDE

13.4 PIGMENTED

13.5 ANILINE PLUS

13.6 OTHERS

14 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY SALES CHANNEL

14.1 OVERVIEW

14.2 OEM

14.3 AFTER-MARKET

15 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY COLORS

15.1 OVERVIEW

15.2 DARK COLOR

15.3 SEMI-DARK COLOR

15.4 NUDE COLOURS

15.5 LIGHT COLOR

16 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY VEHICLE TYPE

16.1 OVERVIEW

16.2 PASSENGER CARS

16.2.1 BY VEHICLE TYPE

16.2.1.1. HATCHBACK

16.2.1.2. SEDAN

16.2.1.3. MPV

16.2.1.4. SUV

16.2.1.5. CROSSOVER

16.2.1.6. COUPE

16.2.1.7. CONVERTIBLE

16.2.1.8. OTHERS

16.3 LCV

16.3.1.1. VANS

16.3.1.1.1. PASSENGER VANS

16.3.1.1.2. CARGO VANS

16.3.1.2. PICK UP TRUCKS

16.3.1.3. MINI BUS

16.3.1.4. COACHES

16.3.1.5. OTHERS

16.4 HCV

16.4.1.1. TRUCKS

16.4.1.1.1. DUMP TRUCK

16.4.1.1.2. TOW TRUCKS

16.4.1.1.3. CEMENT TRUCKS

16.4.1.2. BUSES

16.5 ELECTRIC VEHICLE

16.5.1 PHEV

16.5.2 HEV

16.5.3 BEV

17 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY GEOGRAPHY

18 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, BY REGION

18.1 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

18.1.1 NORTH AMERICA

18.1.1.1. U.S.

18.1.1.2. CANADA

18.1.1.3. MEXICO

18.1.2 EUROPE

18.1.2.1. GERMANY

18.1.2.2. U.K.

18.1.2.3. FRANCE

18.1.2.4. ITALY

18.1.2.5. SPAIN

18.1.2.6. THE NETHERLANDS

18.1.2.7. SWITZERLAND

18.1.2.8. TURKEY

18.1.2.9. BELGIUM

18.1.2.10. RUSSIA

18.1.2.11. REST OF EUROPE

18.1.3 ASIA-PACIFIC

18.1.3.1. CHINA

18.1.3.2. JAPAN

18.1.3.3. SOUTH KOREA

18.1.3.4. INDIA

18.1.3.5. SINGAPORE

18.1.3.6. AUSTRALIA

18.1.3.7. MALAYSIA

18.1.3.8. PHILIPPINES

18.1.3.9. THAILAND

18.1.3.10. INDONESIA

18.1.3.11. REST OF ASIA-PACIFIC

18.1.4 SOUTH AMERICA

18.1.4.1. BRAZIL

18.1.4.2. ARGENTINA

18.1.4.3. REST OF SOUTH AMERICA

18.1.5 MIDDLE EAST AND AFRICA

18.1.5.1. SOUTH AFRICA

18.1.5.2. EGYPT

18.1.5.3. SAUDI ARABIA

18.1.5.4. U.A.E

18.1.5.5. ISRAEL

18.1.5.6. REST OF MIDDLE EAST AND AFRICA

18.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

19 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT & APPROVALS

19.7 EXPANSIONS

19.8 REGULATORY CHANGES

19.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

20 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, SWOT AND DBMR ANALYSIS

21 GLOBAL AUTOMOTIVE UPHOLSTERY MARKET, COMPANY PROFILE

21.1 KYOWA LEATHER CLOTH CO. LTD.

21.1.1 COMPANY SNAPSHOT

21.1.2 REVENUE ANALYSIS

21.1.3 GEOGRAPHIC PRESENCE

21.1.4 PRODUCT PORTFOLIO

21.1.5 RECENT DEVELOPMENTS

21.2 BOXMARK

21.2.1 COMPANY SNAPSHOT

21.2.2 REVENUE ANALYSIS

21.2.3 GEOGRAPHIC PRESENCE

21.2.4 PRODUCT PORTFOLIO

21.2.5 RECENT DEVELOPMENTS

21.3 STAHL AUTOMOTIVE SOLUTIONS

21.3.1 COMPANY SNAPSHOT

21.3.2 REVENUE ANALYSIS

21.3.3 GEOGRAPHIC PRESENCE

21.3.4 PRODUCT PORTFOLIO

21.3.5 RECENT DEVELOPMENTS

21.4 SADDLES INDIA PVT. LTD.

21.4.1 COMPANY SNAPSHOT

21.4.2 REVENUE ANALYSIS

21.4.3 GEOGRAPHIC PRESENCE

21.4.4 PRODUCT PORTFOLIO

21.4.5 RECENT DEVELOPMENTS

21.5 NATROYAL GROUP

21.5.1 COMPANY SNAPSHOT

21.5.2 REVENUE ANALYSIS

21.5.3 GEOGRAPHIC PRESENCE

21.5.4 PRODUCT PORTFOLIO

21.5.5 RECENT DEVELOPMENTS

21.6 LEAR CORPORATION

21.6.1 COMPANY SNAPSHOT

21.6.2 REVENUE ANALYSIS

21.6.3 GEOGRAPHIC PRESENCE

21.6.4 PRODUCT PORTFOLIO

21.6.5 RECENT DEVELOPMENTS

21.7 GRUPO ANTOLIN IRAUSA, S.A.

21.7.1 COMPANY SNAPSHOT

21.7.2 REVENUE ANALYSIS

21.7.3 GEOGRAPHIC PRESENCE

21.7.4 PRODUCT PORTFOLIO

21.7.5 RECENT DEVELOPMENTS

21.8 SEIREN CO., LTD.

21.8.1 COMPANY SNAPSHOT

21.8.2 REVENUE ANALYSIS

21.8.3 GEOGRAPHIC PRESENCE

21.8.4 PRODUCT PORTFOLIO

21.8.5 RECENT DEVELOPMENTS

21.9 SAGE AUTOMOTIVE INTERIORS

21.9.1 COMPANY SNAPSHOT

21.9.2 REVENUE ANALYSIS

21.9.3 GEOGRAPHIC PRESENCE

21.9.4 PRODUCT PORTFOLIO

21.9.5 RECENT DEVELOPMENTS

21.1 ACME MILLS COMPANY

21.10.1 COMPANY SNAPSHOT

21.10.2 REVENUE ANALYSIS

21.10.3 GEOGRAPHIC PRESENCE

21.10.4 PRODUCT PORTFOLIO

21.10.5 RECENT DEVELOPMENTS

21.11 MARTUR AUTOMOTIVE SEATING SYSTEMS

21.11.1 COMPANY SNAPSHOT

21.11.2 REVENUE ANALYSIS

21.11.3 GEOGRAPHIC PRESENCE

21.11.4 PRODUCT PORTFOLIO

21.11.5 RECENT DEVELOPMENTS

21.12 HAARTZ CORPORATION

21.12.1 COMPANY SNAPSHOT

21.12.2 REVENUE ANALYSIS

21.12.3 GEOGRAPHIC PRESENCE

21.12.4 PRODUCT PORTFOLIO

21.12.5 RECENT DEVELOPMENTS

21.13 BORGERS SE & CO. KGAA

21.13.1 COMPANY SNAPSHOT

21.13.2 REVENUE ANALYSIS

21.13.3 GEOGRAPHIC PRESENCE

21.13.4 PRODUCT PORTFOLIO

21.13.5 RECENT DEVELOPMENTS

21.14 TOYOTA BOSHOKU CORPORATION

21.14.1 COMPANY SNAPSHOT

21.14.2 REVENUE ANALYSIS

21.14.3 GEOGRAPHIC PRESENCE

21.14.4 PRODUCT PORTFOLIO

21.14.5 RECENT DEVELOPMENTS

21.15 FAURECIA S.A.

21.15.1 COMPANY SNAPSHOT

21.15.2 REVENUE ANALYSIS

21.15.3 GEOGRAPHIC PRESENCE

21.15.4 PRODUCT PORTFOLIO

21.15.5 RECENT DEVELOPMENTS

21.16 GRAMMER AG

21.16.1 COMPANY SNAPSHOT

21.16.2 REVENUE ANALYSIS

21.16.3 GEOGRAPHIC PRESENCE

21.16.4 PRODUCT PORTFOLIO

21.16.5 RECENT DEVELOPMENTS

21.17 ADIENT PLC

21.17.1 COMPANY SNAPSHOT

21.17.2 REVENUE ANALYSIS

21.17.3 GEOGRAPHIC PRESENCE

21.17.4 PRODUCT PORTFOLIO

21.17.5 RECENT DEVELOPMENTS

21.18 DELPHI AUTOMOTIVE PLC

21.18.1 COMPANY SNAPSHOT

21.18.2 REVENUE ANALYSIS

21.18.3 GEOGRAPHIC PRESENCE

21.18.4 PRODUCT PORTFOLIO

21.18.5 RECENT DEVELOPMENTS

21.19 VISTEON S.A.

21.19.1 COMPANY SNAPSHOT

21.19.2 REVENUE ANALYSIS

21.19.3 GEOGRAPHIC PRESENCE

21.19.4 PRODUCT PORTFOLIO

21.19.5 RECENT DEVELOPMENTS

21.2 JOHNSON CONTROLS

21.20.1 COMPANY SNAPSHOT

21.20.2 REVENUE ANALYSIS

21.20.3 GEOGRAPHIC PRESENCE

21.20.4 PRODUCT PORTFOLIO

21.20.5 RECENT DEVELOPMENTS

21.21 LEAR CORPORATION

21.21.1 COMPANY SNAPSHOT

21.21.2 REVENUE ANALYSIS

21.21.3 GEOGRAPHIC PRESENCE

21.21.4 PRODUCT PORTFOLIO

21.21.5 RECENT DEVELOPMENTS

21.22 MAGNA INTERNATIONAL INC.

21.22.1 COMPANY SNAPSHOT

21.22.2 REVENUE ANALYSIS

21.22.3 GEOGRAPHIC PRESENCE

21.22.4 PRODUCT PORTFOLIO

21.22.5 RECENT DEVELOPMENTS

21.23 SEIREN CO. LTD.

21.23.1 COMPANY SNAPSHOT

21.23.2 REVENUE ANALYSIS

21.23.3 GEOGRAPHIC PRESENCE

21.23.4 PRODUCT PORTFOLIO

21.23.5 RECENT DEVELOPMENTS

21.24 CMI ENTERPRISES

21.24.1 COMPANY SNAPSHOT

21.24.2 REVENUE ANALYSIS

21.24.3 GEOGRAPHIC PRESENCE

21.24.4 PRODUCT PORTFOLIO

21.24.5 RECENT DEVELOPMENTS

21.25 KATZKIN LEATHERS

21.25.1 COMPANY SNAPSHOT

21.25.2 REVENUE ANALYSIS

21.25.3 GEOGRAPHIC PRESENCE

21.25.4 PRODUCT PORTFOLIO

21.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 CONCLUSION

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.