Global Automotive Water Separation System Market

Market Size in USD Billion

CAGR :

%

USD

10.32 Billion

USD

14.02 Billion

2025

2033

USD

10.32 Billion

USD

14.02 Billion

2025

2033

| 2026 –2033 | |

| USD 10.32 Billion | |

| USD 14.02 Billion | |

|

|

|

|

Automotive Water Separation System Market Size

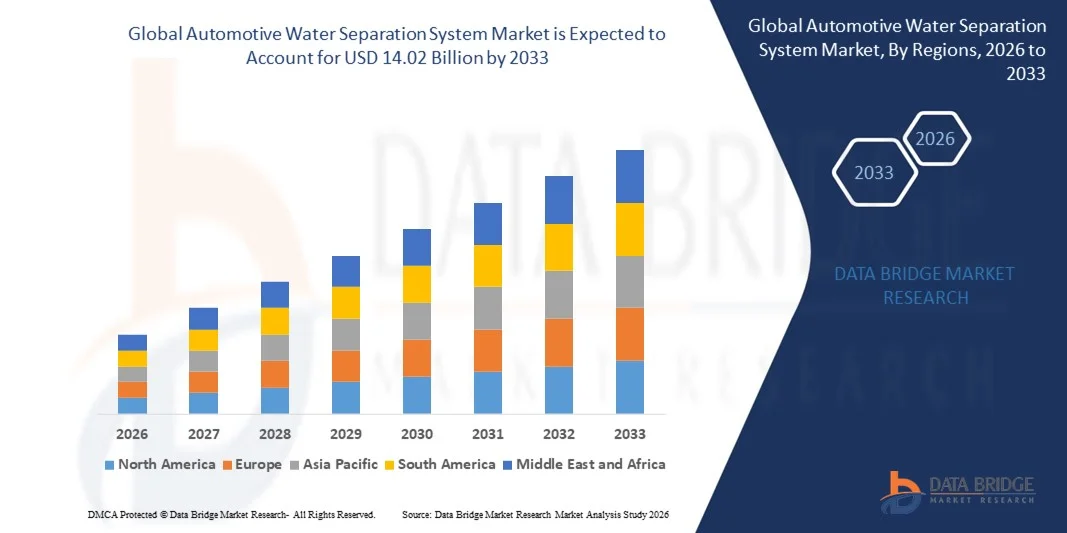

- The global automotive water separation system market size was valued at USD 10.32 billion in 2025 and is expected to reach USD 14.02 billion by 2033, at a CAGR of 3.90% during the forecast period

- The market growth is largely fuelled by the increasing adoption of advanced filtration systems in vehicles to enhance fuel efficiency, reduce engine wear, and improve overall performance

- Rising demand for commercial and passenger vehicles, coupled with stricter emission regulations, is further driving the implementation of water separation systems in automotive applications

Automotive Water Separation System Market Analysis

- The market is witnessing technological advancements in water separation systems, including improved filter materials, compact designs, and enhanced separation efficiency, which are increasing their appeal among automakers

- The rise of electric and hybrid vehicles is also influencing the market, as manufacturers seek optimized fluid management solutions to ensure system reliability and performance across diverse powertrain architectures

- North America dominated the automotive water separation system market with the largest revenue share of 35.47% in 2025, driven by increasing adoption of commercial vehicles, growing fleet modernization initiatives, and stringent emission regulations that emphasize fuel system protection

- Asia-Pacific region is expected to witness the highest growth rate in the global automotive water separation system market, driven by increasing vehicle sales, growing commercial fleet operations, rising disposable incomes, and the adoption of advanced engine protection technologies in emerging economies such as China, India, and Japan

- The OEM segment held the largest market revenue share in 2025, driven by the increasing integration of water separation systems during vehicle production to enhance engine protection and fuel efficiency. OEM-installed systems offer reliability, compliance with emission standards, and long-term durability, making them the preferred choice for commercial and passenger vehicles

Report Scope and Automotive Water Separation System Market Segmentation

|

Attributes |

Automotive Water Separation System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• MAHLE GmbH (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Water Separation System Market Trends

Increasing Adoption of Advanced Water Separation Systems in Vehicles

- The growing emphasis on fuel efficiency and engine performance is driving the adoption of automotive water separation systems, which prevent water contamination in fuel lines and enhance overall vehicle reliability. These systems are particularly critical for diesel engines in commercial and heavy-duty vehicles, reducing maintenance costs and improving operational efficiency. In addition, the increasing complexity of modern engines and stricter emission regulations are further compelling OEMs to integrate advanced water separation solutions

- Rising awareness about engine longevity and regulatory standards for emission control is accelerating the integration of water separation systems in both passenger and commercial vehicles. These systems help maintain optimal combustion, reduce particulate emissions, and ensure compliance with environmental regulations. Moreover, growing demand for eco-friendly vehicles and extended engine life is driving fleet operators and automotive manufacturers to adopt these systems across diverse vehicle segments

- The ease of integration and reliability of modern water separation systems are making them attractive for OEM installations and aftermarket upgrades. Vehicle owners and fleet operators benefit from reduced downtime, lower repair costs, and improved engine safety. The modular design of contemporary water separators also allows compatibility with multiple fuel types, further enhancing their utility across different vehicle platforms

- For instance, in 2023, several logistics companies in North America reported enhanced fleet performance and reduced engine failure incidents after installing advanced water separation systems in their diesel trucks. This deployment also resulted in decreased maintenance intervals, longer fuel filter life, and better fuel efficiency, showcasing the practical benefits of adoption at scale

- While adoption is increasing, the market’s growth depends on continued innovation in filtration efficiency, compact designs, and compatibility with emerging engine technologies. Manufacturers must focus on cost-effective and durable solutions to fully capitalize on this trend. In addition, advancements in sensor-enabled and automated water separation systems are expected to further boost market growth by providing real-time monitoring and predictive maintenance capabilities

Automotive Water Separation System Market Dynamics

Driver

Growing Demand for Fuel Efficiency and Engine Protection

- The increasing need to improve fuel efficiency and minimize engine wear is pushing OEMs and fleet operators to implement automotive water separation systems as a key solution for protecting fuel systems and optimizing performance. Enhanced engine reliability directly contributes to lower operational costs, making these systems attractive for large-scale fleet operations. Rising awareness about the financial and environmental impact of engine failure further reinforces market adoption

- Fleet operators and commercial vehicle owners are increasingly aware of the operational and financial benefits offered by water separation systems, including reduced engine downtime, lower maintenance costs, and extended component lifespan. Companies are recognizing that proactive fuel system protection can improve fleet availability, reduce repair expenses, and enhance overall service quality, encouraging broader deployment

- Regulatory frameworks and emission standards emphasizing engine protection and environmental safety are further supporting market growth. Incentives for adopting efficient filtration systems encourage widespread implementation across vehicle fleets. In addition, governments are promoting stricter maintenance compliance in commercial fleets, which indirectly boosts demand for advanced water separation solutions

- For instance, in 2022, several European transport companies upgraded their commercial trucks with advanced water separation systems to comply with stringent emission standards and enhance engine reliability. The integration of these systems also supported improved fuel economy and lower particulate matter emissions, highlighting the regulatory and operational benefits of adoption

- While demand is rising, ensuring high filtration efficiency, compatibility with diverse fuel types, and minimal maintenance remains critical to sustain market growth and long-term adoption of water separation systems. Future growth is expected to be propelled by innovative designs, improved materials, and integration with smart monitoring technologies

Restraint/Challenge

High Costs of Advanced Systems and Limited Awareness in Small Fleets

- The upfront cost of high-quality automotive water separation systems can be a barrier for small fleet operators and individual vehicle owners, limiting widespread adoption. Budget constraints often delay system implementation despite long-term operational benefits. In addition, smaller operators may prioritize short-term savings over preventive maintenance investments, further slowing adoption rates

- Many small operators and service centers lack awareness of the importance of water separation for engine performance and fuel system protection. The absence of technical knowledge can lead to underutilization and inefficient maintenance. Limited access to training and technical support further exacerbates the challenge, preventing optimal system performance and reduced operational risks

- Market penetration is also restricted by the need for specialized installation and regular maintenance. Improper setup or neglect can reduce system efficiency, increasing the risk of engine damage and fuel contamination. Furthermore, the lack of standardized installation guidelines in some regions creates additional uncertainty for fleet operators and service providers

- For instance, in 2023, surveys in Asia-Pacific revealed that over 60% of small commercial vehicle operators had not adopted water separation systems due to cost concerns and limited technical knowledge. This gap underscores the need for awareness campaigns, incentives, and affordable solutions to encourage adoption across smaller fleets

- While technology continues to evolve with improved separation efficiency and lower maintenance designs, addressing cost, awareness, and installation challenges remains crucial. Stakeholders must focus on user-friendly, affordable, and reliable solutions to unlock the long-term potential of the automotive water separation system market. Advanced monitoring systems and modular designs are expected to mitigate these challenges and accelerate market adoption

Automotive Water Separation System Market Scope

The global automotive water separation system market is segmented into two notable segments based on sales channel and vehicle type.

- By Sales Channel

On the basis of sales channel, the automotive water separation system market is segmented into Original Equipment Manufacturers (OEM), Original Equipment Supplier (OES), and Independent Aftermarket (IAM). The OEM segment held the largest market revenue share in 2025, driven by the increasing integration of water separation systems during vehicle production to enhance engine protection and fuel efficiency. OEM-installed systems offer reliability, compliance with emission standards, and long-term durability, making them the preferred choice for commercial and passenger vehicles.

The Independent Aftermarket (IAM) segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for replacement and retrofit water separation systems among fleet operators and individual vehicle owners. IAM solutions provide cost-effective, easy-to-install options for improving engine performance and extending fuel system life, making them attractive for both passenger and commercial vehicles.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Passenger Car Automotive Water Separation Systems, LCV Automotive Water Separation Systems, and HCV Automotive Water Separation Systems. The HCV segment held the largest market revenue share in 2025, owing to the critical need for water separation in diesel engines used in heavy-duty vehicles, which are more susceptible to fuel contamination and downtime. HCV water separation systems improve engine reliability, reduce maintenance costs, and enhance fleet operational efficiency.

The Passenger Car segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of water separation systems in private vehicles to protect fuel injectors and optimize engine performance. Growing consumer awareness about engine longevity, combined with stricter emission norms and aftermarket retrofit options, is fueling the expansion of this segment globally.

Automotive Water Separation System Market Regional Analysis

- North America dominated the automotive water separation system market with the largest revenue share of 35.47% in 2025, driven by increasing adoption of commercial vehicles, growing fleet modernization initiatives, and stringent emission regulations that emphasize fuel system protection

- Fleet operators and vehicle owners in the region highly value the reliability, maintenance cost savings, and enhanced engine performance offered by advanced water separation systems in diesel and gasoline engines

- This widespread adoption is further supported by well-established automotive manufacturing infrastructure, high vehicle penetration, and increasing awareness about engine longevity and fuel efficiency, establishing water separation systems as a standard in both passenger and commercial vehicles

U.S. Automotive Water Separation System Market Insight

The U.S. automotive water separation system market captured the largest revenue share in 2025 within North America, fueled by the rapid expansion of commercial and heavy-duty vehicle fleets and increasing demand for engine protection technologies. Fleet operators are prioritizing the integration of advanced water separation systems to reduce fuel contamination, prevent downtime, and enhance vehicle performance. Government initiatives for emission compliance and incentives for adopting fuel protection systems are further boosting market adoption. Moreover, the growing use of diesel engines in logistics, construction, and transportation sectors is significantly contributing to market growth.

Europe Automotive Water Separation System Market Insight

The Europe automotive water separation system market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent emission standards, increasing adoption of commercial and heavy-duty vehicles, and technological advancements in filtration systems. Rising awareness about engine durability and operational efficiency is encouraging OEMs and fleet operators to implement advanced water separation solutions. The market is seeing growth across passenger vehicles, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs), with systems being incorporated in both new vehicles and retrofits.

U.K. Automotive Water Separation System Market Insight

The U.K. automotive water separation system market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing number of diesel-powered vehicles and the need for improved engine protection and fuel efficiency. Concerns about engine failures, maintenance costs, and regulatory compliance are prompting both fleet operators and individual vehicle owners to adopt water separation systems. The country’s advanced automotive service and maintenance infrastructure, along with strong aftermarket support, is expected to sustain market growth.

Germany Automotive Water Separation System Market Insight

The Germany automotive water separation system market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of engine protection, rising commercial vehicle registrations, and technological advancements in separation efficiency. Germany’s strong automotive manufacturing sector, emphasis on sustainability, and stringent fuel system regulations are driving OEM and aftermarket adoption. The integration of compact and efficient water separation systems in diesel and gasoline engines is becoming increasingly prevalent, aligning with local regulatory and consumer expectations.

Asia-Pacific Automotive Water Separation System Market Insight

The Asia-Pacific automotive water separation system market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising vehicle sales, and increasing fleet modernization in countries such as China, Japan, and India. The region’s growing logistics and transportation sector, supported by government regulations promoting fuel efficiency and engine safety, is accelerating adoption. In addition, APAC emerging as a key manufacturing hub for water separation system components is improving affordability and accessibility, enabling wider adoption across passenger and commercial vehicles.

Japan Automotive Water Separation System Market Insight

The Japan automotive water separation system market is expected to witness the fastest growth rate from 2026 to 2033, fueled by technological advancements, high vehicle safety standards, and the country’s strong focus on engine efficiency. Japanese fleet operators and vehicle owners are increasingly integrating advanced water separation systems to reduce maintenance costs, prevent fuel contamination, and ensure long-term engine reliability. The growing emphasis on diesel engines in commercial and industrial sectors further supports market expansion.

China Automotive Water Separation System Market Insight

The China automotive water separation system market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding automotive production, rapid fleet expansion, and high adoption of diesel-powered commercial vehicles. The push towards fuel-efficient and reliable engine technologies, coupled with government initiatives for emission control, is driving the adoption of advanced water separation systems. Availability of cost-effective solutions and strong domestic manufacturers are key factors supporting market growth in China across passenger, LCV, and HCV segments.

Automotive Water Separation System Market Share

The Automotive Water Separation System industry is primarily led by well-established companies, including:

• MAHLE GmbH (Germany)

• Stuttgart (Germany)

• Hollingsworth & Vose Company (U.S.)

• Donaldson Company, Inc (U.S.)

• MANN+HUMMEL (Germany)

• Filtration Group (U.S.)

• Bosch Limited (U.K.)

• PARKER HANNIFIN CORP (U.S.)

• Elofic Industries Limited (U.K.)

• UFI Filters (Italy)

• Kohler Co. (U.S.)

• Caterpillar (U.S.)

• DENSO CORPORATION (Japan)

• HYDAC (Germany)

• Cummins Filtration (U.S.)

• Separ of the Americas, LLC (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.