Global Automotive Wiring Harness Market

Market Size in USD Billion

CAGR :

%

USD

57.12 Billion

USD

57.12 Billion

2024

2032

USD

57.12 Billion

USD

57.12 Billion

2024

2032

| 2025 –2032 | |

| USD 57.12 Billion | |

| USD 57.12 Billion | |

|

|

|

|

Automotive Wiring Harness Market Size

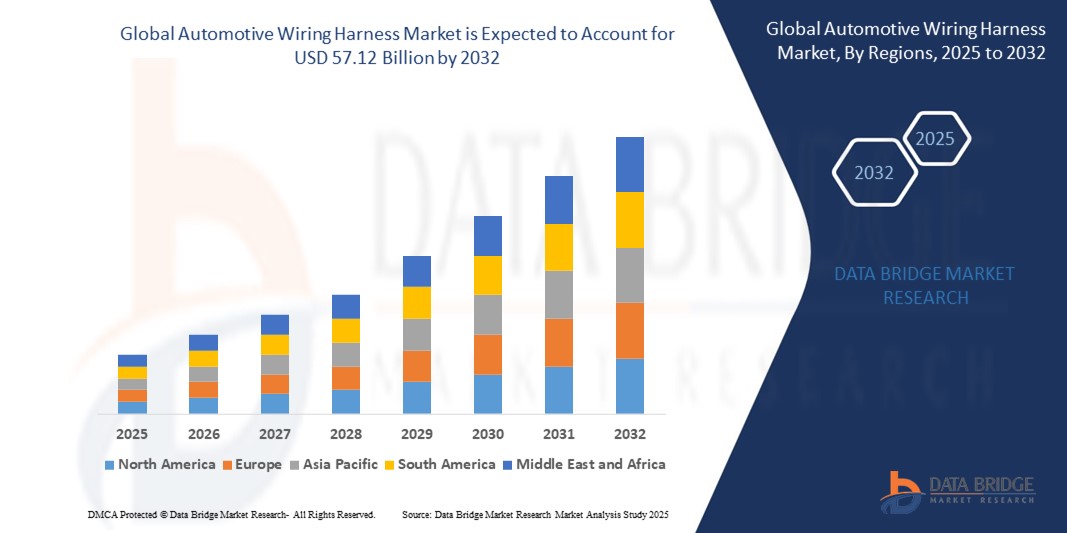

- The global automotive wiring harness market size was valued at USD 57.12 billion in 2024 and is expected to reach USD 57.12 billion by 2032, at a CAGR of 4.57% during the forecast period

- The market growth is largely fuelled by the rising demand for advanced vehicle electronics, increasing adoption of electric vehicles, and the growing focus on vehicle safety and performance optimization

- In addition, rising vehicle production volumes globally, particularly in developing economies, are contributing significantly to the growing demand for robust and efficient wiring harness systems

Automotive Wiring Harness Market Analysis

- The global automotive wiring harness market is witnessing robust expansion as automotive manufacturers integrate more electronic components into vehicles for connectivity, automation, and safety features. Wiring harnesses serve as essential components that bundle and secure cables and wires, facilitating efficient power and signal transmission

- Growing preference for lightweight and energy-efficient wiring systems is encouraging innovations in material and design. Furthermore, government regulations regarding vehicle safety and emission reduction are compelling automakers to adopt modern wiring harness solutions

- Asia-Pacific dominated the automotive wiring harness market with the largest revenue share of 46.5% in 2024, driven by the surge in automobile production and the rapid adoption of electric vehicles across emerging economies

- North America region is expected to witness the highest growth rate in the global automotive wiring harness market, driven by strong innovation in vehicle electrification, rising demand for connected vehicles, and supportive government initiatives aimed at decarbonizing the transportation sector

- The electric wires segment dominated the market with the largest revenue share in 2024, primarily due to the critical role these wires play in transmitting power and signals throughout the vehicle. The growing integration of electronic systems in modern vehicles, including infotainment, driver-assistance, and lighting systems, is driving the demand for high-performance electric wires that ensure reliable conductivity and durability under harsh automotive conditions

Report Scope and Automotive Wiring Harness Market Segmentation

|

Attributes |

Automotive Wiring Harness Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• China Auto Electronics Group Limited (THB Group) (China) |

|

Market Opportunities |

• Integration of Wiring Harness with Advanced Driver Assistance Systems (ADAS) |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Wiring Harness Market Trends

Integration of Advanced Driver-Assistance Systems (ADAS) Driving Harness Innovation

- The growing adoption of Advanced Driver-Assistance Systems (ADAS) is significantly influencing the design and complexity of automotive wiring harnesses. As vehicles become more automated, the demand for specialized harnesses capable of managing data transmission from multiple sensors, cameras, radar systems, and control units has risen. Automakers are increasingly investing in high-speed data cables and shielded harnesses to ensure optimal signal integrity and system performance

- This trend is particularly evident in premium and electric vehicles, where ADAS features such as lane departure warning, automatic emergency braking, and adaptive cruise control are becoming standard. These systems require robust and flexible wiring infrastructure to handle both power and signal needs reliably

- Manufacturers are shifting from traditional copper-based harnesses to lightweight materials such as aluminum and optical fiber to reduce vehicle weight and support fuel efficiency targets. Modular harness designs are also gaining traction, allowing easier upgrades and maintenance for complex ADAS systems

- For instance, in 2023, Yazaki Corporation introduced a new modular wiring harness tailored for Level 3 autonomous vehicles, enabling high-speed communication while reducing harness weight by 20% compared to traditional systems

- While ADAS-driven harness innovation is reshaping the market, it requires continuous adaptation of standards, collaboration across OEMs and Tier 1 suppliers, and investment in new production technologies to meet the evolving electrical and data requirements of next-generation vehicles

Automotive Wiring Harness Market Dynamics

Driver

Surge in Electric Vehicle Production and Electrification of Vehicle Architecture

• The global shift toward electrification is accelerating demand for advanced automotive wiring harnesses capable of supporting complex battery systems, power electronics, and high-voltage applications. As electric vehicles (EVs) incorporate a larger number of electrical components than internal combustion engine (ICE) vehicles, the volume and complexity of wiring harnesses have increased significantly

• Wiring harnesses in EVs are essential for connecting battery packs to electric motors, inverters, onboard chargers, and thermal management systems. This has prompted automakers to adopt specialized high-voltage harnesses with enhanced insulation, safety features, and lightweight design to meet performance and safety standards

• The rapid growth of the EV market, supported by favorable government policies, emission regulations, and rising fuel prices, is creating robust opportunities for wiring harness manufacturers. Companies are establishing dedicated product lines for EV-specific harnesses, often incorporating aluminum conductors to reduce weight and cost

• For instance, in 2024, Sumitomo Electric Industries announced the development of a next-generation aluminum harness for EVs, which reduces total vehicle weight by 8 kilograms while maintaining thermal and electrical performance

• While electrification is driving harness demand, it also introduces technical challenges such as electromagnetic interference, thermal management, and voltage drop mitigation. Manufacturers are investing in R&D to address these issues and support the transition to fully electric and hybrid vehicle platforms

Restraint/Challenge

Complex Manufacturing Processes and Supply Chain Disruptions

• The production of automotive wiring harnesses is highly labor-intensive and involves meticulous routing, bundling, and labeling of wires for specific vehicle models. Customization needs and increasing system complexity, especially in EVs and connected cars, often lead to longer production cycles and higher costs. This complexity poses a challenge for scalability and efficient mass production

• The dependence on manual labor makes the harness industry vulnerable to workforce shortages, quality variability, and manufacturing delays, particularly in developing countries where much of the harness assembly is outsourced. Automated solutions are still limited due to the complexity and flexibility required in harness design

• In recent years, global supply chain disruptions—caused by geopolitical tensions, semiconductor shortages, and material procurement delays—have affected the timely availability of key inputs such as copper wires, connectors, and insulation materials. This has led to bottlenecks in automotive production and delayed vehicle deliveries

• For instance, in 2023, multiple European automakers faced output slowdowns after their wiring harness suppliers in Ukraine were unable to operate during regional conflicts, underscoring the risks of geographically concentrated production

• Addressing these challenges requires enhanced supply chain resilience, investment in semi-automated production systems, and nearshoring strategies to reduce overreliance on labor-intensive, offshore assembly operations and mitigate potential disruptions

Automotive Wiring Harness Market Scope

The market is segmented on the basis of component type, application, electric vehicle type, and vehicle type.

- By Component Type

On the basis of component type, the automotive wiring harness market is segmented into electric wires, connectors, terminals, and others. The electric wires segment dominated the market with the largest revenue share in 2024, primarily due to the critical role these wires play in transmitting power and signals throughout the vehicle. The growing integration of electronic systems in modern vehicles, including infotainment, driver-assistance, and lighting systems, is driving the demand for high-performance electric wires that ensure reliable conductivity and durability under harsh automotive conditions.

The connectors segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing complexity in vehicle electronics and the growing need for modular and secure connections. As vehicles incorporate more sensors, control units, and communication systems, high-quality connectors that ensure signal integrity and resistance to vibration and corrosion are becoming essential in both combustion and electric powertrains.

- By Application

On the basis of application, the market is segmented into body harness, chassis harness, engine harness, HVAC harness, and sensors harness. The body harness segment held the largest revenue share in 2024, driven by its extensive use across lighting systems, door electronics, infotainment, and interior features. Rising consumer expectations for comfort and convenience features are boosting the demand for comprehensive body harness solutions that can handle higher electrical loads and connectivity requirements.

The sensors harness segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increased deployment of advanced sensors in modern vehicles for safety, performance monitoring, and emissions control. As technologies such as ADAS and vehicle-to-everything (V2X) communication become more prevalent, manufacturers are prioritizing the development of dedicated sensor harnesses for precise and uninterrupted signal transmission.

- By Electric Vehicle Type

On the basis of electric vehicle type, the automotive wiring harness market is segmented into battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). The battery electric vehicles (BEV) segment dominated the market with the largest share in 2024, supported by the global push for zero-emission mobility and the rising production of fully electric vehicles. BEVs require specialized high-voltage harnesses to support battery packs, power control units, and inverters, which significantly expands the harness scope and complexity.

The plug-in hybrid electric vehicles (PHEV) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer demand for vehicles that offer both electric driving range and combustion engine reliability. PHEVs typically feature dual systems, requiring intricate harness architecture to manage transitions between electric and hybrid modes efficiently, thus boosting the need for advanced wiring harness solutions.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into light vehicles and heavy vehicles. The light vehicles segment held the largest market share in 2024, driven by the high production volumes of passenger cars and light commercial vehicles globally. The growing demand for advanced safety, infotainment, and comfort features in light vehicles is increasing the complexity and density of wiring harnesses, supporting segment growth.

The heavy vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the electrification and automation of trucks, buses, and commercial fleets. Heavy-duty applications require durable and high-capacity harnesses to support power-hungry systems and ensure reliable operation under demanding conditions, prompting investments in robust harness designs tailored for heavy vehicle platforms.

Automotive Wiring Harness Market Regional Analysis

• Asia-Pacific dominated the automotive wiring harness market with the largest revenue share of 46.5% in 2024, driven by the surge in automobile production and the rapid adoption of electric vehicles across emerging economies

• The region benefits from a strong manufacturing ecosystem, cost-effective labor, and supportive government policies that promote automotive component exports

• Increasing demand for connected and fuel-efficient vehicles, especially in countries such as China, India, and Japan, along with rapid urbanization and infrastructure development, continues to boost market expansion

China Automotive Wiring Harness Market Insight

The China automotive wiring harness market accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to the country’s dominance in vehicle manufacturing and electric mobility initiatives. Government support for new energy vehicles, combined with strong investments in automotive research and development, is encouraging the adoption of advanced wiring systems. In addition, the presence of key domestic and international players, coupled with high local demand for fuel-efficient and smart vehicles, is driving sustained growth in the market.

Japan Automotive Wiring Harness Market Insight

The Japan automotive wiring harness market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s advanced automotive technology landscape and early adoption of electric and hybrid vehicles. Japan’s strong emphasis on vehicle safety, fuel efficiency, and automation drives the demand for high-quality, compact, and heat-resistant wiring harnesses. Moreover, the increasing development of autonomous driving systems and integration of in-vehicle electronics further supports the market's expansion, particularly among key domestic automakers.

North America Automotive Wiring Harness Market Insight

The North America automotive wiring harness market is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s technological advancements in autonomous and electric vehicles. Growing investment in automotive innovation, especially around safety and infotainment systems, is accelerating the adoption of high-performance wiring harnesses. In addition, consumer interest in high-end vehicles and the expansion of electric vehicle infrastructure are key contributors to market growth across the U.S. and Canada.

U.S. Automotive Wiring Harness Market Insight

The U.S. automotive wiring harness market is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing integration of smart features and connectivity modules in modern vehicles. With a strong focus on sustainability, the U.S. is witnessing a shift toward electrification and autonomous technologies, boosting demand for complex and durable wiring systems. The country’s well-established automobile sector, combined with regulatory emphasis on vehicle safety, continues to foster steady market development.

Europe Automotive Wiring Harness Market Insight

The Europe automotive wiring harness market is expected to witness the fastest growth rate from 2025 to 2032, backed by the region’s robust automotive manufacturing industry and a clear shift towards electric mobility. Stringent regulations surrounding emissions and vehicle safety are encouraging the use of advanced, lightweight harnesses in both traditional and electric vehicles. Rising demand for luxury and hybrid vehicles across Germany, France, and the United Kingdom is further influencing market trends.

Germany Automotive Wiring Harness Market Insight

The Germany automotive wiring harness market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s automotive engineering excellence and a strong presence of major OEMs. Germany’s focus on premium vehicles and innovation in electric and hybrid vehicle technology is enhancing demand for high-voltage wiring systems. Furthermore, growing initiatives toward digitalization and the deployment of connected cars are likely to accelerate the integration of smart wiring harness solutions in upcoming vehicle models.

U.K. Automotive Wiring Harness Market Insight

The U.K. automotive wiring harness market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s ongoing shift toward electric vehicles and regulatory push for carbon-neutral transportation. The U.K.'s commitment to phasing out internal combustion engine vehicles, along with growing demand for technologically advanced and lightweight automotive components, is stimulating interest in innovative wiring harness solutions. Investments in EV production facilities and the presence of high-end car manufacturers also contribute to the sector’s positive trajectory.

Automotive Wiring Harness Market Share

The Automotive Wiring Harness industry is primarily led by well-established companies, including:

• China Auto Electronics Group Limited (THB Group) (China)

• Delphi Technologies PLC (Aptiv PLC) (U.K.)

• Furukawa Electric Co., Ltd. (Japan)

• Kromberg & Schubert GmbH Cable & Wire (Germany)

• Lear Corporation (U.S.)

• LEONI AG (Germany)

• PKC Group (Finland)

• Spark Minda, Ashok Minda Group (India)

• Sumitomo Electric Industries, Ltd. (Japan)

• Yazaki Corporation (Japan)

Latest Developments in Global Automotive Wiring Harness Market

- In April 2024, AVR Global Technologies, Inc. merged with Conner Industrial to form AVR Conner Industrial Ltda. The merger combines expertise in Surface Mount Technology (SMT), electronics box assembly, and custom wire harness manufacturing, aiming to enhance production efficiency for OEMs and contract manufacturers across the automotive electronics sector

- In May 2023, Sumitomo Electric Industries, Ltd. initiated the development of an automotive optical harness, with sample availability targeted for 2026. This innovation, rooted in the company’s experience in wire harness and optical communication, is expected to support high-speed, high-capacity data transmission, propelling the advancement of CASE (Connected, Autonomous, Shared & Services, and Electric) mobility

- In April 2023, Sumitomo Corporation secured approval to build an electric vehicle wiring harness manufacturing plant in Egypt, with an investment of approximately USD 100 million. The facility, set in a 150,000 square meter free zone, is projected to create about 10,000 jobs and supply major European and Middle Eastern carmakers, boosting regional and global production capabilities

- In February 2023, Hero Electric partnered with Dhoot Transmission to source wiring harnesses for its electric two-wheelers. The collaboration aims to ensure efficient and durable power transmission from battery to wheel, enhancing vehicle performance and long-term reliability in the electric mobility market

- In May 2022, Yazaki North America entered a supply and engineering partnership with Aptera Motors to provide production parts for high-voltage and low-voltage electrical harnesses. The deal supports Aptera’s electric vehicle development by delivering essential components such as wiring, charge ports, and connectivity systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.