Global Autonomous Data Platform Market

Market Size in USD Billion

CAGR :

%

USD

2.44 Billion

USD

13.21 Billion

2024

2032

USD

2.44 Billion

USD

13.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.44 Billion | |

| USD 13.21 Billion | |

|

|

|

|

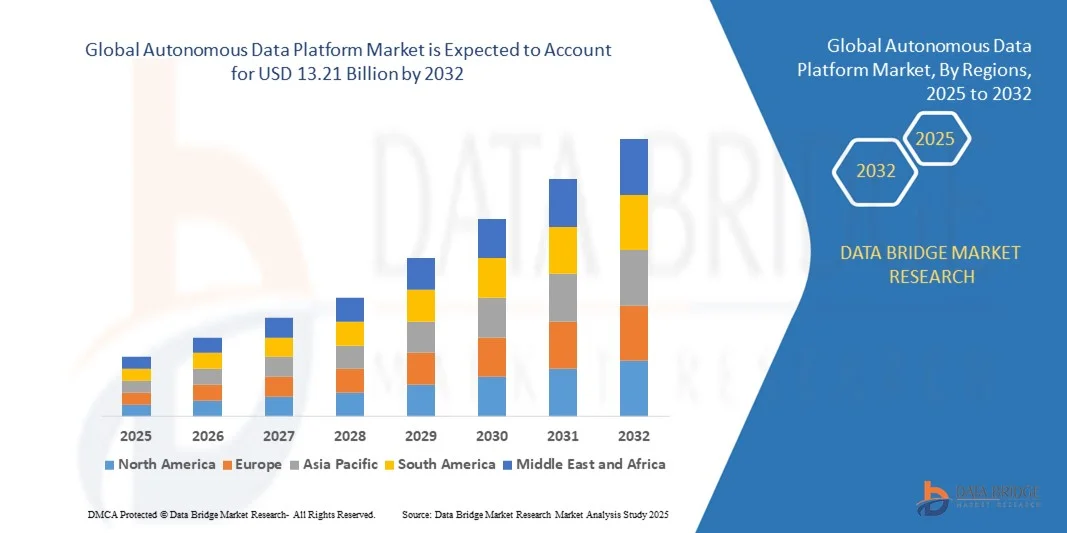

What is the Global Autonomous Data Platform Market Size and Growth Rate?

- The global autonomous data platform market size was valued at USD 2.44 billion in 2024 and is expected to reach USD 13.21 billion by 2032, at a CAGR of 23.50% during the forecast period

- Rising amount of complex data is a crucial factor accelerating the market growth, also rise in the volume of unstructured data due to the phenomenal growth of interconnected devices and social media and rise in the demand for omnichannel experience from retailer are the major factors among others boosting the autonomous data platform market

- Moreover, rise in the research and development activities in the market will further create new opportunities for laser technology market in the forecast period mentioned above

What are the Major Takeaways of Autonomous Data Platform Market?

- Rise in the adoption of cognitive computing technology and advanced analytics is an essential factor driving the autonomous data platform market.

- Autonomous data tool helps in analysing a specific customer's big data infrastructure to address crucial company problems and ensure optimal database usage. This helps the businesses to improve and increase their data management abilities

- North America dominated the autonomous data platform market with the largest revenue share of 34.15% in 2024, driven by high adoption of cloud computing, data analytics, and AI-powered automation among enterprises

- The Asia-Pacific market is poised to grow at the fastest CAGR of 5.69% from 2025 to 2032, driven by rapid digitalization, rising cloud adoption, and increasing investment in AI-driven enterprise solutions across countries such as China, Japan, and India

- The Platform segment dominated the market with the largest revenue share of 62.5% in 2024, driven by enterprises’ increasing reliance on self-managing data platforms that offer automation, AI-driven insights, and advanced analytics capabilities

Report Scope and Autonomous Data Platform Market Segmentation

|

Attributes |

Autonomous Data Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Autonomous Data Platform Market?

AI-Driven Automation and Seamless Cloud Integration

- A key and accelerating trend in the global autonomous data platform market is the deep integration of artificial intelligence (AI) and cloud-based automation, enabling platforms to self-manage workloads, optimize performance, and reduce manual interventions. This trend is significantly enhancing operational efficiency and data reliability for enterprises

- For instance, platforms such as Oracle Autonomous Database and IBM Db2 Autonomous Database use AI to automatically tune performance, manage updates, and detect anomalies without human intervention, delivering seamless data management

- AI-powered autonomous data platforms enable predictive analytics, automated query optimization, and self-healing mechanisms, reducing downtime and enhancing business insights. Features such as anomaly detection, automated schema adjustments, and intelligent resource allocation are increasingly standard

- The seamless integration of autonomous data platforms with existing enterprise ecosystems, including cloud storage, SaaS applications, and data lakes, facilitates centralized control over complex IT environments. Users can manage diverse workloads, monitor KPIs, and perform analytics through a single interface, increasing agility

- This movement toward intelligent, self-managing data platforms is reshaping enterprise expectations, emphasizing reliability, speed, and minimal manual intervention. Companies such as Oracle, IBM, and Teradata are developing AI-driven solutions that enhance productivity while reducing operational complexity

- The demand for Autonomous Data Platforms with advanced AI automation is growing across industries such as BFSI, healthcare, retail, and IT services, as businesses prioritize faster decision-making, operational efficiency, and reduced human dependency

What are the Key Drivers of Autonomous Data Platform Market?

- The rising demand for automated data management, combined with increasing enterprise adoption of cloud and AI technologies, is driving market growth. Organizations aim to minimize manual IT operations and focus on core business tasks

- For instance, in April 2024, Oracle expanded its autonomous database services with AI-driven automation to streamline transaction processing, analytics, and cybersecurity, reflecting industry-wide adoption of self-managing data solutions

- Enterprises increasingly prioritize real-time insights, high data availability, and error-free management, which autonomous data platforms provide through predictive maintenance, anomaly detection, and auto-optimization features

- The adoption of hybrid cloud and multi-cloud strategies further boosts the need for intelligent platforms that can automatically manage data across diverse environments without compromising performance or security

- Features such as auto-scaling, automated backup, self-tuning, and integrated analytics accelerate adoption in enterprises seeking agility, efficiency, and cost reduction, while user-friendly interfaces support deployment across IT and business teams

Which Factor is Challenging the Growth of the Autonomous Data Platform Market?

- Cybersecurity concerns and regulatory compliance present significant challenges. Autonomous Data Platforms rely heavily on cloud connectivity and automated processes, making them susceptible to data breaches, unauthorized access, and compliance risks

- Reports of security vulnerabilities in AI-powered databases have made some organizations cautious in adopting fully autonomous solutions without robust safeguards

- Addressing these challenges requires advanced encryption, secure access protocols, continuous monitoring, and regular compliance audits. In addition, high upfront costs of premium autonomous solutions may deter small and medium enterprises, even though cost savings are realized long-term

- While subscription-based models and cloud deployment are reducing entry barriers, perceptions of complexity and limited customization options can still restrict adoption in certain sectors

- Overcoming these challenges through enhanced security, regulatory alignment, and cost-effective deployment models will be essential for sustained market growth, ensuring businesses benefit from AI-driven data automation while maintaining trust and compliance

How is the Autonomous Data Platform Market Segmented?

The market is segmented on the basis of component, organization size, deployment, and vertical.

- By Component

On the basis of component, the autonomous data platform market is segmented into Platform and Services. The Platform segment dominated the market with the largest revenue share of 62.5% in 2024, driven by enterprises’ increasing reliance on self-managing data platforms that offer automation, AI-driven insights, and advanced analytics capabilities. Organizations are prioritizing platforms that integrate data management, performance optimization, and security features into a single solution, reducing manual intervention and operational costs.

The Services segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, fueled by growing demand for consulting, integration, and managed services to support autonomous platform deployment, customization, and ongoing optimization. Services offerings such as migration, implementation, and AI model tuning are becoming critical for enterprises with complex IT environments, ensuring seamless adoption and enhanced platform efficiency. The overall trend indicates a balanced demand for both core platforms and associated services to maximize business value.

- By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and Small & Medium-Sized Enterprises (SMEs). The Large Enterprise segment dominated the market with a revenue share of 68% in 2024, driven by the need to manage vast volumes of structured and unstructured data, ensure high availability, and achieve operational efficiency through automation. Large enterprises, particularly in BFSI, healthcare, and retail, are leveraging AI-driven platforms to reduce manual workloads, optimize queries, and gain real-time business insights.

Conversely, the SME segment is projected to witness the fastest CAGR of 25% from 2025 to 2032, supported by the increasing availability of cost-effective, cloud-based autonomous platforms. SMEs are adopting these platforms to streamline operations, gain competitive intelligence, and scale efficiently, without heavy investments in IT infrastructure or personnel, reflecting a growing trend of democratization of autonomous data technologies.

- By Deployment Type

On the basis of deployment type, the autonomous data platform market is segmented into On-Premises and Cloud. The Cloud segment dominated the market with the largest revenue share of 59% in 2024, attributed to its scalability, reduced infrastructure costs, and ease of integration with existing enterprise applications. Cloud-based autonomous platforms offer automated updates, AI-driven resource allocation, and real-time analytics, enabling organizations to handle dynamic workloads efficiently.

The On-Premises segment is anticipated to witness the fastest CAGR of 22% from 2025 to 2032, driven by industries such as BFSI, government, and healthcare, where regulatory compliance, data sovereignty, and high security requirements necessitate localized deployments. The trend toward hybrid architectures is also emerging, with organizations combining cloud agility with on-premises control to optimize performance, security, and cost-effectiveness in data management strategies.

- By Vertical

On the basis of vertical, the autonomous data platform market is segmented into BFSI, Healthcare & Life Sciences, Retail, Manufacturing, Telecommunication & Media, Government, and Others. The BFSI vertical dominated the market with a revenue share of 32% in 2024, fueled by high-volume transaction data, compliance requirements, and the demand for real-time analytics in banking, insurance, and financial services.

The Healthcare & Life Sciences segment is expected to witness the fastest CAGR of 24% from 2025 to 2032, driven by the need for automated patient data management, genomic analytics, and clinical research optimization. Adoption across other sectors, such as retail and manufacturing, is also growing rapidly as autonomous platforms help optimize inventory, production planning, and customer insights. The trend indicates cross-industry deployment, with organizations increasingly relying on AI-driven automation to improve operational efficiency and accelerate data-driven decision-making.

Which Region Holds the Largest Share of the Autonomous Data Platform Market?

- North America dominated the autonomous data platform market with the largest revenue share of 34.15% in 2024, driven by high adoption of cloud computing, data analytics, and AI-powered automation among enterprises

- Organizations in the region prioritize enhanced operational efficiency, data security, and seamless integration across enterprise applications, fueling the demand for autonomous platforms

- The region’s technological maturity, robust IT infrastructure, and high investments in digital transformation further support widespread adoption of Autonomous Data Platforms across various industries

U.S. Autonomous Data Platform Market Insight

The U.S. autonomous data platform market captured the largest revenue share of 81% in 2024 within North America, driven by early adoption of AI-powered analytics, self-managing databases, and cloud-based enterprise solutions. Enterprises are increasingly leveraging autonomous platforms to reduce manual workloads, improve operational efficiency, and derive actionable insights in real-time. The growing preference for hybrid and multi-cloud deployments, coupled with strong integration of enterprise applications and AI/ML workflows, is propelling market growth. In addition, technology-driven sectors such as BFSI, healthcare, and retail are contributing significantly to the market expansion, making the U.S. a central hub for autonomous data adoption.

Europe Autonomous Data Platform Market Insight

The Europe autonomous data platform market is projected to grow steadily, supported by stringent data regulations, digital transformation initiatives, and increasing adoption of cloud technologies. Enterprises across BFSI, healthcare, and manufacturing are investing in autonomous data platforms to streamline data processing, reduce operational costs, and enhance security. Urbanization, increased data generation, and demand for real-time insights are driving adoption, while governments are promoting AI-driven automation in public services. In addition, European enterprises are emphasizing energy-efficient, compliant, and secure data management solutions, which further stimulates the deployment of autonomous platforms across new and existing IT infrastructures.

U.K. Autonomous Data Platform Market Insight

The U.K. market is expected to witness steady growth driven by digital transformation in both public and private sectors. Enterprises are adopting autonomous platforms to manage large datasets, enhance analytics capabilities, and reduce human intervention in data operations. Concerns regarding regulatory compliance, data security, and operational efficiency are driving adoption among BFSI, healthcare, and retail sectors. In addition, strong cloud infrastructure, a technology-savvy workforce, and robust IT services ecosystem support widespread deployment. The increasing trend of hybrid work and digital workflows further accelerates demand for autonomous data platforms, enabling seamless management of distributed data and cloud environments.

Germany Autonomous Data Platform Market Insight

Germany’s autonomous data platform market is anticipated to expand due to rising demand for intelligent data management solutions in manufacturing, BFSI, and healthcare industries. Enterprises are increasingly focused on AI-enabled analytics, automated ETL processes, and compliance with GDPR and local regulations. Advanced infrastructure, innovation in enterprise IT, and emphasis on security and privacy make Germany a strategic market for autonomous platforms. Adoption is further encouraged by digitalization initiatives and smart manufacturing trends under Industry 4.0, where autonomous data platforms help optimize production, reduce operational overheads, and enable real-time decision-making across complex business processes.

Which Region is the Fastest Growing Region in the Autonomous Data Platform Market?

The Asia-Pacific market is poised to grow at the fastest CAGR of 5.69% from 2025 to 2032, driven by rapid digitalization, rising cloud adoption, and increasing investment in AI-driven enterprise solutions across countries such as China, Japan, and India. Growing demand for real-time analytics, big data processing, and automation in BFSI, healthcare, retail, and manufacturing sectors is driving adoption. Moreover, government initiatives promoting smart cities and Industry 4.0, along with increasing IT infrastructure investments, are making autonomous data platforms more accessible and affordable, supporting wider enterprise adoption.

Japan Autonomous Data Platform Market Insight

The Japan market is expanding due to its high-tech ecosystem, increasing AI adoption, and emphasis on operational efficiency. Enterprises leverage autonomous data platforms to optimize data workflows, improve analytics, and enhance decision-making. Aging population trends are also pushing adoption in healthcare and retail sectors, requiring automated, real-time data insights. The integration of autonomous platforms with cloud and AI technologies enables Japanese organizations to manage complex datasets efficiently, while stringent data security regulations drive the adoption of compliant, automated solutions.

China Autonomous Data Platform Market Insight

The China autonomous data platform market accounted for the largest share in Asia-Pacific in 2024, supported by rapid urbanization, industrial digitization, and a booming technology sector. Enterprises across BFSI, retail, and manufacturing are adopting autonomous platforms for automated data processing, AI-powered analytics, and cloud integration. Government initiatives to promote smart cities and Industry 4.0, combined with cost-effective domestic solutions, further accelerate market penetration. High data volumes, rising investment in enterprise IT infrastructure, and growing demand for real-time insights continue to drive market expansion, making China a key hub for autonomous data platform deployment in the region.

Which are the Top Companies in Autonomous Data Platform Market?

The autonomous data platform industry is primarily led by well-established companies, including:

- Oracle Corporation (U.S.)

- Qubole, Inc. (U.S.)

- IBM Corporation (U.S.)

- MapR Technologies, Inc. (U.S.)

- Cloudera, Inc. (U.S.)

- Ataccama (Canada)

- Gemini Data Inc. (U.S.)

- Denodo Technologies (U.S.)

- Datrium, Inc. (U.S.)

- DvSum (U.S.)

- Alteryx, Inc. (U.S.)

- Zaloni (U.S.)

- Paxata, Inc. (U.S.)

- The Linux Foundation (U.S.)

- Teradata (U.S.)

- DXC Technology Company (U.S.)

- Intellias Ltd. (Ukraine)

What are the Recent Developments in Global Autonomous Data Platform Market?

- In September 2024, Salesforce and IBM Corporation announced a strategic partnership to meet the rising demand for AI-driven sales and service transformations, targeting enterprises and regulated industries. The collaboration focuses on leveraging untapped enterprise data to automate processes within autonomous data platforms. Together, both companies will provide pre-built AI agents and tools, enabling organizations to seamlessly integrate AI into their IT environments while maintaining full control over data and systems. This partnership is expected to drive significant innovation and operational efficiency across multiple sectors

- In June 2024, Oracle expanded its collaboration with Microsoft to enhance the Oracle Database Azure offering by integrating it with Oracle Cloud Infrastructure (OCI). The integration simplifies cloud migration for businesses and improves access to Oracle database services within the Azure ecosystem. Customers can now run Oracle databases on OCI hardware deployed in Azure data centers, ensuring high performance, scalability, security, and compliance. This initiative is poised to accelerate enterprise adoption of hybrid cloud solutions

- In May 2024, Syncari launched its Autonomous Data Management (ADM) platform, transforming how organizations manage master data across systems. This AI-driven platform unifies and automates the entire data lifecycle, addressing challenges related to fragmented and inconsistent data. By enabling a seamless, automated approach to data management, Syncari aims to enhance operational efficiency and support data-driven decision-making across enterprises

- In August 2023, Accenture and NVIDIA strengthened their partnership by forming a new NVIDIA Business Group, designed to help enterprises scale AI adoption. Leveraging Accenture’s AI Refinery and NVIDIA’s complete AI stack, the collaboration focuses on process reinvention, AI-powered simulations, and sovereign AI solutions. With an investment of USD 3 billion in generative AI, the initiative aims to advance autonomous data platforms while laying the foundation for next-generation AI functionality

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.