Global Autonomous Farm Equipment Market

Market Size in USD Billion

CAGR :

%

USD

125.24 Billion

USD

383.12 Billion

2025

2033

USD

125.24 Billion

USD

383.12 Billion

2025

2033

| 2026 –2033 | |

| USD 125.24 Billion | |

| USD 383.12 Billion | |

|

|

|

|

What is the Global Autonomous Farm Equipment Market Size and Growth Rate?

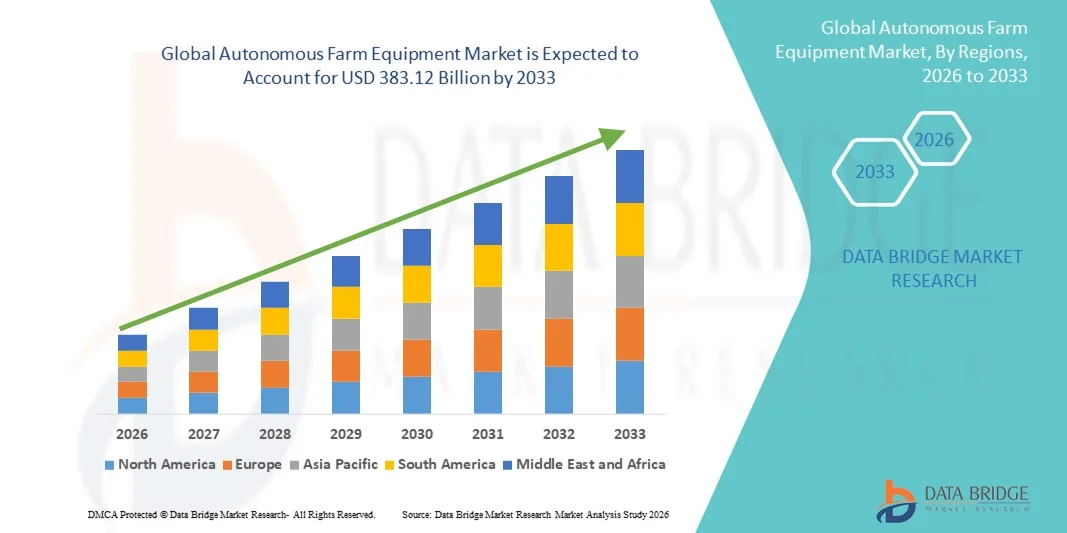

- The global autonomous farm equipment market size was valued at USD 125.24 billion in 2025 and is expected to reach USD 383.12 billion by 2033, at a CAGR of15.0% during the forecast period

- Major factors that are expected to boost the growth of the autonomous farm equipment market in the forecast period are the rise in the application of the drones in the agricultural implementations and the growing of the precision farming

What are the Major Takeaways of Autonomous Farm Equipment Market?

- The attention on the improvising of the productivity and rise in the labor cost is further anticipated to propel the growth of the autonomous farm equipment market. Also, the upsurge in the agricultural commodity exports is further estimated to cushion the growth of the autonomous farm equipment market

- On the other hand, the high-priced expenses and the automation pushes the unemployment which are further projected to impede the growth of the autonomous farm equipment market in timeline period

- North America dominated the autonomous farm equipment market with an estimated 43.3% revenue share in 2025, driven by early adoption of precision agriculture, large-scale commercial farming, and strong investments in agri-technology across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of around 11.32% from 2026 to 2033, driven by rising food demand, labor shortages in rural areas, and rapid modernization of agriculture across China, Japan, India, South Korea, and Southeast Asia

- The Partially Autonomous segment dominated the market with a 62.4% share in 2025, as it offers a balanced combination of automation and human control

Report Scope and Autonomous Farm Equipment Market Segmentation

|

Attributes |

Autonomous Farm Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Autonomous Farm Equipment Market?

Increasing Shift Toward AI-Enabled, Sensor-Integrated, and Fully Autonomous Farming Solutions

- The autonomous farm equipment market is witnessing rapid adoption of AI-driven, GPS-guided, and sensor-integrated machines designed to support precision agriculture, autonomous navigation, and real-time field decision-making

- Manufacturers are introducing self-driving tractors, autonomous harvesters, robotic sprayers, and driverless implements equipped with LiDAR, computer vision, machine learning algorithms, and cloud connectivity

- Growing demand for labor-efficient, fuel-optimized, and data-driven farming operations is accelerating deployment across large-scale farms and commercial agriculture

- For instance, companies such as Deere & Company, CNH Industrial, AGCO, Kubota, and Autonomous Tractor Corporation are advancing autonomous platforms with improved safety systems, remote monitoring, and predictive maintenance features

- Increasing need for round-the-clock operations, precise input application, and yield optimization is accelerating the shift toward semi- and fully autonomous farm equipment

- As agriculture becomes more data-intensive and sustainability-focused, Autonomous Farm Equipment will play a critical role in modern, high-efficiency farming ecosystems

What are the Key Drivers of Autonomous Farm Equipment Market?

- Rising demand for labor cost reduction and workforce shortage mitigation in agriculture is driving adoption of autonomous machines

- For instance, in 2024–2025, leading OEMs such as John Deere, CNH Industrial, and AGCO expanded their autonomous equipment portfolios with AI-enabled navigation and remote fleet management

- Growing adoption of precision farming, smart agriculture, and IoT-enabled equipment across North America, Europe, and Asia-Pacific is boosting market demand

- Advancements in AI, machine vision, GPS accuracy, edge computing, and cloud-based farm analytics have significantly improved operational reliability and efficiency

- Rising focus on sustainable farming, optimized input usage, and higher crop productivity is increasing investment in autonomous technologies

- Supported by strong investments in agritech innovation, government subsidies, and digital agriculture initiatives, the Autonomous Farm Equipment market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Autonomous Farm Equipment Market?

- High costs associated with advanced sensors, AI software, autonomous control systems, and safety technologies limit adoption among small and medium-sized farms

- For instance, during 2024–2025, supply chain disruptions and rising semiconductor prices increased manufacturing costs for autonomous agricultural machinery

- Complexity in system integration, maintenance, and real-time decision-making algorithms increases dependency on skilled technicians and operator training

- Limited digital infrastructure and low awareness of autonomous farming benefits in emerging economies slow market penetration

- Regulatory uncertainty related to autonomous vehicle operation, safety standards, and liability creates adoption challenges

- To overcome these barriers, companies are focusing on cost-effective autonomous solutions, scalable platforms, farmer training programs, and stronger software-hardware integration to expand global adoption of autonomous farm equipment

How is the Autonomous Farm Equipment Market Segmented?

The market is segmented on the basis of operation, products, and technology.

- By Operation

On the basis of operation, the autonomous farm equipment market is segmented into Fully Autonomous and Partially Autonomous systems. The Partially Autonomous segment dominated the market with a 62.4% share in 2025, as it offers a balanced combination of automation and human control. These systems support assisted steering, automated planting, harvesting assistance, and precision spraying while allowing operators to intervene when required. Lower upfront costs, easier integration with existing machinery, and reduced regulatory constraints drive strong adoption among small- and mid-sized farms.

The Fully Autonomous segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by labor shortages, rising farm sizes, and advancements in AI, GPS, and sensor technologies. Increasing acceptance of driverless operations, especially in large commercial farms, is accelerating demand for fully autonomous solutions.

- By Products

On the basis of products, the market is segmented into Tractors, Harvesters, and UAVs. The Tractors segment dominated the market with a 48.7% share in 2025, supported by their wide usage across plowing, planting, tilling, and hauling operations. Autonomous tractors deliver higher fuel efficiency, precise field coverage, and reduced labor dependency, making them the backbone of smart farming practices.

The UAV segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use in crop monitoring, aerial mapping, yield estimation, and precision spraying. Advancements in drone autonomy, imaging sensors, and AI-based analytics are significantly expanding UAV adoption in precision agriculture.

- By Technology

On the basis of technology, the autonomous farm equipment market is segmented into Software and Hardware. The Hardware segment dominated the market with a 55.9% share in 2025, driven by strong demand for sensors, cameras, LiDAR, GPS modules, and autonomous control units. These components form the physical backbone of autonomous systems and are essential for navigation, obstacle detection, and real-time field operations.

The Software segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid advancements in AI algorithms, machine learning, computer vision, and cloud-based farm management platforms. Increasing focus on data-driven decision-making, predictive analytics, and remote fleet management is accelerating software adoption across autonomous farming ecosystems.

Which Region Holds the Largest Share of the Autonomous Farm Equipment Market?

- North America dominated the autonomous farm equipment market with an estimated 43.3% revenue share in 2025, driven by early adoption of precision agriculture, large-scale commercial farming, and strong investments in agri-technology across the U.S. and Canada. High labor costs, farm consolidation, and increasing focus on productivity optimization have accelerated adoption of autonomous tractors, harvesters, and robotic field equipment

- Leading manufacturers and agri-tech companies in North America are actively deploying AI-enabled guidance systems, GPS-based navigation, machine vision, and telematics platforms, strengthening the region’s technological leadership

- Strong availability of skilled workforce, supportive regulatory pilots, and continuous investments in smart farming infrastructure further reinforce North America’s dominance

U.S. Autonomous Farm Equipment Market Insight

The U.S. is the largest contributor within North America, supported by large farm sizes, acute labor shortages, and rapid adoption of precision farming technologies. Increasing use of autonomous tractors, robotic harvesters, and UAVs for planting, spraying, and yield monitoring is driving market growth. Strong presence of global OEMs, agri-startups, and advanced R&D ecosystems further accelerates adoption.

Canada Autonomous Farm Equipment Market Insight

Canada contributes significantly, driven by mechanized farming practices, growing adoption of smart agriculture, and government support for agri-innovation. Autonomous equipment is increasingly used to improve efficiency in large grain and oilseed farms, supporting steady market expansion.

Asia-Pacific Autonomous Farm Equipment Market

Asia-Pacific is projected to register the fastest CAGR of around 11.32% from 2026 to 2033, driven by rising food demand, labor shortages in rural areas, and rapid modernization of agriculture across China, Japan, India, South Korea, and Southeast Asia. Increasing adoption of smart farming, government subsidies for mechanization, and growing use of AI- and IoT-enabled agricultural equipment are accelerating regional growth

China Autonomous Farm Equipment Market Insight

China leads the region due to strong government support for agricultural modernization, rapid deployment of smart tractors and drones, and large-scale investments in agri-robotics. China’s growth is supported by advanced robotics capabilities, smart farming programs, and strong integration of AI and automation technologies

Japan Autonomous Farm Equipment Market Insight

Japan shows steady growth, supported by aging farmer demographics and strong demand for fully autonomous and robotic farming solutions.

Which are the Top Companies in Autonomous Farm Equipment Market?

The autonomous farm equipment industry is primarily led by well-established companies, including:

- Deere & Company (U.S.)

- CNH Industrial N.V. (Netherlands)

- KUBOTA Corporation (Japan)

- AGCO Corporation (U.S.)

- JCB (U.K.)

- Trringo (India)

- Escorts Limited (India)

- Tractors and Farm Equipment Limited (India)

- The Papé Group, Inc. (U.S.)

- Premier Equipment Limited (Canada)

- Flaman (Canada)

- Pacific Ag Rentals (Canada)

- Pacific Tractor & Implement (U.S.)

- Farmease (India)

- KWIPPED, Inc. (U.S.)

- Cedar Street (U.S.)

- EM3 Agri Services (India)

- Princeville (U.S.)

- Friesen Sales & Rentals (Canada)

- Messick's (U.S.)

- Autonomous Tractor Corporation (U.S.)

What are the Recent Developments in Global Autonomous Farm Equipment Market?

- In November 2025, Claas showcased its advanced TORION Autonomy Connect system at Agritechnica, featuring an autonomous wheel loader powered by LiDAR sensors and AI-based pile analysis for GPS-independent silage handling, alongside the launch of the Weed Detector system for real-time weed mapping and the Dynamic Field Scout combining RTK positioning with AI imaging for accurate field boundary detection, highlighting Claas’s focus on precision, efficiency, and next-generation autonomous farming solutions

- In May 2025, Case IH revealed a concept autonomous tractor incorporating advanced AI algorithms, radar-based obstacle detection, and remote operation functionality, designed to perform essential tasks such as tillage and planting with high efficiency, underscoring the company’s vision for the future of precision-driven and intelligent agriculture

- In January 2025, at CES, John Deere introduced its next-generation autonomous machinery portfolio led by the autonomous 9RX tractor, engineered for large-scale tillage and equipped with 360-degree perception using 12 stereo cameras, LiDAR sensors, and AI-powered obstacle detection, reinforcing John Deere’s leadership in large-farm automation and smart equipment innovation

- In January 2025, Kubota made a strong presence at CES by unveiling multiple autonomous innovations, including the Agri Concept 2.0 electric tractor with GPS guidance and remote mission planning, a smart autonomous sprayer with AI-based spot treatment, a multifunctional robotic cart, and robotic orchard pruners, demonstrating Kubota’s comprehensive approach to advancing sustainable, automated, and technology-driven agriculture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.