Global Autonomous Forklifts Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

4.20 Billion

2024

2032

USD

2.20 Billion

USD

4.20 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 4.20 Billion | |

|

|

|

|

Autonomous Forklifts Market Size

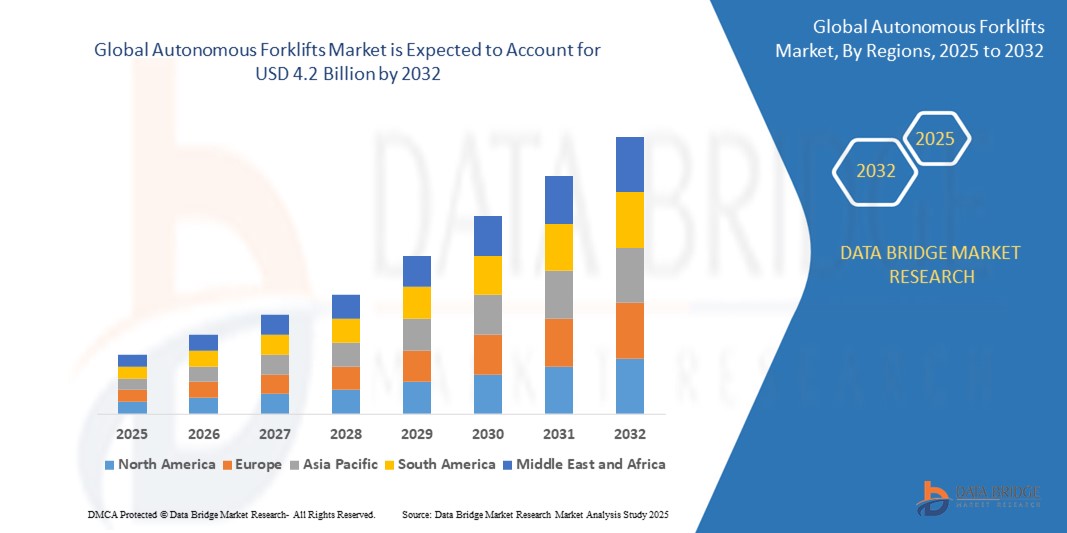

- The Global Autonomous Forklifts Market size was valued at USD 2.2 billion in 2024 and is expected to reach USD 4.2 billion by 2032, at a CAGR of 9.7% during the forecast period

- The rapid expansion of e-commerce is driving demand for faster and more efficient warehouse operations, which autonomous forklifts help enable by streamlining material handling and fulfilment processes.

- Labour shortages in warehousing and manufacturing, combined with increasing labor costs, are pushing companies to adopt autonomous forklifts to maintain productivity and control expenses.

Autonomous Forklifts Market Analysis

- Modern autonomous forklifts are integrating advanced technologies such as LiDAR, cameras, and ultrasonic sensors to enhance navigation and safety. Artificial intelligence and machine learning algorithms enable these machines to optimize operations and adapt to dynamic environments.

- The adoption of autonomous forklifts is partly motivated by safety concerns, as traditional forklifts are associated with a high number of workplace accidents. Autonomous models aim to reduce these incidents by minimizing human error and enhancing operational efficiency.

- Autonomous forklifts are increasingly utilized in sectors such as e-commerce, manufacturing, and logistics to streamline operations and reduce labor costs. Their ability to operate continuously and integrate with warehouse management systems makes them valuable assets in modern supply chains.

- Asia-Pacific dominates the Autonomous Forklifts Market with the largest revenue share of 44.01% in 2024, The rapid expansion of e-commerce is driving demand for faster and more efficient warehouse operations, which autonomous forklifts help enable by streamlining material handling and fulfilment processes.

- Asia-Pacific is expected to be the fastest growing region in the Autonomous Forklifts Market during the Businesses are increasingly seeking automation solutions like autonomous forklifts to improve operational efficiency, reduce downtime, and optimize workflow in distribution centres and warehouses.

- Electric Pallet Jacks segment dominates the Autonomous Forklifts Market with a market share of 31.2% in 2024, driven by Rising Labour Costs and Shortages.

Report Scope and Autonomous Forklifts Market Segmentation

|

Attributes |

Autonomous Forklifts Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Autonomous Forklifts Market Trends

“Enhanced Productivity and Safety Through AI and Autonomous Integration”

- A major and accelerating trend in the Global Autonomous Forklifts Market is the deepening integration of artificial intelligence (AI), advanced sensors, and autonomous navigation technologies. This fusion is dramatically improving warehouse productivity, safety, and operational efficiency by enabling forklifts to perform complex tasks—such as pallet handling, inventory movement, and route optimization—without human intervention.

- For instance, leading autonomous forklift solutions now feature real-time object detection, dynamic path planning, and obstacle avoidance, allowing them to operate safely alongside human workers and other vehicles. Integration with warehouse management systems (WMS) and enterprise resource planning (ERP) platforms further enables seamless coordination of logistics and inventory flows.

- This shift toward more intelligent, connected, and self-operating material handling systems is fundamentally reshaping expectations for warehouse and logistics operations. As a result, manufacturers are developing next-generation forklifts equipped with AI-powered analytics, remote diagnostics, and cloud-based fleet management, supporting predictive maintenance and continuous process optimization.

- The demand for autonomous forklifts offering robust AI integration, safety features, and interoperability with existing warehouse systems is growing rapidly across both industrial and commercial sectors, as organizations prioritize scalability, labor savings, and comprehensive automation capabilities.

- Asia Pacific is emerging as the fastest-growing region due to Businesses are increasingly seeking automation solutions like autonomous forklifts to improve operational efficiency, reduce downtime, and optimize workflow in distribution centers and warehouses.

Autonomous Forklifts Market Dynamics

Driver

“Rising Demand for Automation and Efficiency in Warehousing and Manufacturing”

- The rapid expansion of e-commerce, coupled with the need for efficient material handling, is driving the adoption of autonomous forklifts in warehouses, distribution centers, and manufacturing plants worldwide.

- For instance, in early 2025, Toyota Material Handling launched its next-generation autonomous forklift series featuring advanced AI-powered navigation and fleet management, enabling seamless operation in dynamic warehouse environments.

- Autonomous forklifts leverage technologies such as LiDAR, vision systems, and machine learning to navigate, detect obstacles, and optimize routes without human intervention.

- This has accelerated their adoption in logistics and retail sectors, where minimizing labor costs and maximizing throughput are critical for maintaining competitiveness.

Restraint/Challenge

“High Initial Investment and Integration Complexities”

- Autonomous forklifts require significant upfront investment in hardware, software, and infrastructure modifications (e.g., installation of sensors, network upgrades, and safety systems).

- For instance, in 2025, several mid-sized logistics firms in Europe reported delayed adoption of autonomous forklifts due to high capital expenditure and the need for extensive employee training and workflow redesign.

- The integration of autonomous forklifts with existing warehouse management systems (WMS) and legacy equipment can be complex and time-consuming, often requiring customized solutions.

- Additionally, operational challenges such as navigating cluttered or unstructured environments, handling mixed-traffic scenarios with human workers, and ensuring cybersecurity can limit the scalability and return on investment for some organizations.

Autonomous Forklifts Market Scope

The market is segmented on the basis of Type, Level of Automation, Tonnage, Component, Sales Channel, Function, End Users.

- By Type

On the basis of Type, the Autonomous Forklifts Market is segmented into Electric Motor Rider Forklifts, Electric Motor Narrow Aisle Forklifts, Electric Pallet Jacks, Stackers, and Tow Tractors, Internal Combustion Cushion Tire Forklifts, Internal Combustion Pneumatic Tire Forklifts, Electric/IC Engine Tow Tractors and Rough Terrain Forklift Trucks. The Electric Pallet Jacks segment dominates the largest market revenue share of 21.2% in 2024, driven by Need for Enhanced Warehouse Efficiency.

The Internal Combustion Cushion Tire Forklifts segment is anticipated to witness the fastest growth rate of 13.7% from 2025 to 2032, fueled by Focus on Workplace Safety and Regulatory Compliance.

- By Level of Automation

On the basis of Level of Automation, the Autonomous Forklifts Market is segmented into Level 1, Level 2, Level 3, Level 4 and Level 5. The Level 1 System segment held the largest market revenue share in 2024 driven by Technological Advancements in AI and Robotics.

The Level 2 segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Integration with Smart Warehousing and IoT.

- By Tonnage

On the basis of Tonnage, the Autonomous Forklifts Market is segmented into Below 5 Tons, 5-10 Tons and More Than 10 Tons. The Below 5 Tons segment held the largest market revenue share in 2024, driven by Demand for Scalability and Flexibility.

The 5-10 Tons is expected to witness the fastest CAGR from 2025 to 2032, driven by Autonomous forklifts offer dynamic flexibility and scalability, allowing businesses to quickly adapt to changing demand and warehouse layouts without significant reconfiguration.

- By Component

On the basis of Component, the Autonomous Forklifts Market is segmented into Hardware, Software and Service. The Software segment held the largest market revenue share in 2024 driven by Reduction in Product Damage and Operational Errors.

The Service segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Automation minimizes human error, reduces product damage during handling, and ensures consistent and precise operations, leading to cost savings and improved quality.

- By Sales Channel

On the basis of Sales Channel, the Autonomous Forklifts Market is segmented into In-House Purchase and Leasing. The In-House Purchase System segment held the largest market revenue share in 2024 driven by Sustainability and Eco-Friendly Operations.

The Leasing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Reduction in Product Damage and Operational Errors.

- By Function

On the basis of Function, the Autonomous Forklifts Market is segmented into Manufacturing, Warehousing, Material Handling, Logistics and Freight and Others. The Manufacturing segment held the largest market revenue share in 2024 driven by Increased Investments and R&D by Key Players.

The Warehousing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Reduction in Product Damage and Operational Errors.

- By End Users

On the basis of End Users, the Autonomous Forklifts Market is segmented into Transportation and Logistics, Manufacturing, Paper Industry, Wood Industry, Construction, Automotive, Food and Beverages, Retail and Others. The Transportation and Logistics segment held the largest market revenue share in 2024 driven by Infrastructure Development and Industry 4.0 Adoption.

The Warehousing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Rising investments in infrastructure and the adoption of Industry 4.0 practices are fueling demand for autonomous forklifts as part of broader digital transformation and automation strategies.

Autonomous Forklifts Market Regional Analysis

- Asia-Pacific dominates the Autonomous Forklifts Market with the largest revenue share of 42.01% in 2024, driven by Continuous innovations in artificial intelligence, machine learning, and robotics are enhancing the capabilities of autonomous forklifts, making them smarter, more adaptable, and easier to integrate with other warehouse systems.

- The adoption of autonomous forklifts is partly motivated by safety concerns, as traditional forklifts are associated with a high number of workplace accidents. Autonomous models aim to reduce these incidents by minimizing human error and enhancing operational efficiency.

- Autonomous forklifts are increasingly utilized in sectors such as e-commerce, manufacturing, and logistics to streamline operations and reduce labor costs. Their ability to operate continuously and integrate with warehouse management systems makes them valuable assets in modern supply chains.

China Autonomous Forklifts Market Insight

The China Autonomous Forklifts Market captured the largest revenue share of 58% in 2024 within Asia-Pacific, fueled by the Businesses are increasingly seeking automation solutions like autonomous forklifts to improve operational efficiency, reduce downtime, and optimize workflow in distribution centers and warehouses.

Europe Autonomous Forklifts Market Insight

Both OEM and aftermarket channels are expanding, with OEM solutions dominating the market due to Autonomous forklifts help reduce workplace accidents and comply with stringent safety regulations, such as OSHA and ANSI standards, making them attractive for companies prioritizing employee safety.

U.K. Autonomous Forklifts Market Insight

The U.K. Autonomous Forklifts Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by Continuous innovations in artificial intelligence, machine learning, and robotics are enhancing the capabilities of autonomous forklifts, making them smarter, more adaptable, and easier to integrate with other warehouse systems.

Germany Autonomous Forklifts Market Insight

The Germany Autonomous Forklifts Market is expected to expand at a considerable CAGR during the forecast period, fueled by the integration of autonomous forklifts with smart warehousing solutions and IoT platforms enables real-time tracking, predictive maintenance, and data-driven decision-making, further boosting their adoption.

Asia-Pacific Autonomous Forklifts Market Insight

The Asia-Pacific Autonomous Forklifts Market is poised to grow at the fastest CAGR of 14% during the forecast period of 2025 to 2032, driven by Autonomous forklifts offer dynamic flexibility and scalability, allowing businesses to quickly adapt to changing demand and warehouse layouts without significant reconfiguration.

Japan Autonomous Forklifts Market Insight

The Japan Autonomous Forklifts Market is gaining momentum due Automation minimizes human error, reduces product damage during handling, and ensures consistent and precise operations, leading to cost savings and improved quality.

U.S. Autonomous Forklifts Market Insight

The U.S. Autonomous Forklifts Market accounted for the largest market revenue share in Asia Pacific in 2024, driven by The industry’s shift toward sustainability is driving the adoption of energy-efficient and eco-friendly autonomous forklifts, which help reduce carbon footprints and support green logistics initiatives.

Autonomous Forklifts Market Share

The Autonomous Forklifts Market is primarily led by well-established companies, including:

- Caterpillar.

- Hangcha

- HYSTER

- Jungheinrich AG

- Linde Material Handling

- TOYOTA MOTOR CORPORATION.

- Komatsu Ltd.

- STILL GmbH

- Crown Equipment Corporation

- MITSUBISHI MOTORS CORPORATION.

- KAUP GmbH & Co. KG

- Doosan Corporation.

- Hyundai Construction Equipment Europe

- MLE B.V.

- NITCO, Anhui Heli Co., Ltd.

- Anhui Yufeng Equipment Co.,Ltd.

- BHS Corrugated Maschinen- und Anlagenbau GmbH

- AB Volvo

- Baylo

Latest Developments in Global Autonomous Forklifts Market

- In July 2024, Walmart planned a $200 million investment in autonomous forklifts from Fox Robotics to automate its warehouse operations. This initiative aimed to enhance efficiency and competitiveness against rivals like Amazon.

- In August 2024, ArcBest unveiled semi-autonomous AI-powered forklifts at its Fort Smith facility. These forklifts combine automation with human oversight, aiming to improve efficiency and safety in logistics operations.

- In March 2024, Seegrid launched the Palion Lift CR1, an autonomous lift truck designed for warehousing and logistics. It features a 15-foot lift height and a 4,000-pound payload capacity, utilizing proprietary navigation technology.

- In February 2020, Cyngn announced a pre-order agreement with Arauco to supply 100 autonomous electric DriveMod-enabled forklifts. This deal aims to enhance Arauco's material handling efficiency.

- In January 2024, Linde introduced a new counterbalance autonomous forklift with vision-guided navigation, capable of transporting loads between 2 to 3 tons, enhancing warehouse automation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.