Global Autonomous Networks Market

Market Size in USD Billion

CAGR :

%

USD

7.82 Billion

USD

33.33 Billion

2024

2032

USD

7.82 Billion

USD

33.33 Billion

2024

2032

| 2025 –2032 | |

| USD 7.82 Billion | |

| USD 33.33 Billion | |

|

|

|

|

Autonomous Networks Market Size

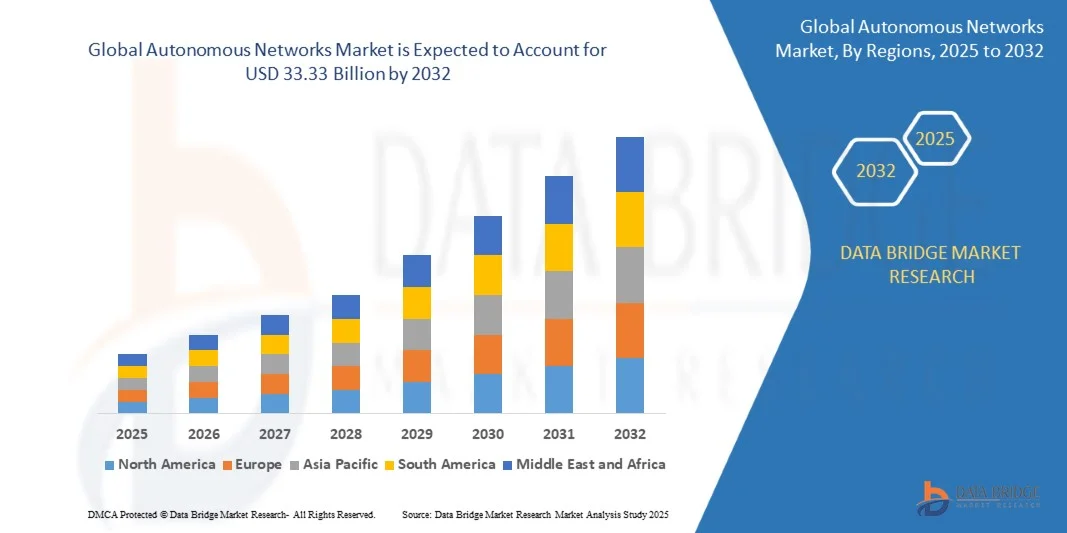

- The global autonomous networks market size was valued at USD 7.82 billion in 2024 and is expected to reach USD 33.33 billion by 2032, at a CAGR of 19.87% during the forecast period

- The market growth is largely fueled by the rapid adoption of artificial intelligence (AI), machine learning (ML), and automation technologies across telecom and enterprise networks, enabling self-managing, self-optimizing, and self-healing network infrastructures that minimize human intervention and operational costs

- Furthermore, increasing demand for efficient traffic management, predictive maintenance, and enhanced service reliability is driving organizations to integrate autonomous networking systems. These advancements are transforming traditional network operations into intelligent, adaptive ecosystems, thereby accelerating overall market expansion

Autonomous Networks Market Analysis

- Autonomous networks leverage AI, analytics, and automation to create intelligent, self-operating systems capable of dynamically optimizing performance and responding to real-time network conditions. These networks are becoming critical to managing the rising complexity of 5G, IoT, and cloud-based environments across industries such as IT, telecom, and manufacturing

- The growing emphasis on digital transformation, coupled with the need for low-latency, scalable, and resilient network infrastructure, is propelling market demand. The ability of autonomous networks to reduce downtime, enhance security, and improve operational efficiency positions them as a cornerstone of next-generation connectivity solutions

- North America dominated the autonomous networks market with a share of 43.5% in 2024, due to the early adoption of AI, machine learning, and automation technologies across major telecom and IT sectors

- Asia-Pacific is expected to be the fastest growing region in the autonomous networks market during the forecast period due to rapid urbanization, increasing 5G deployments, and growing investment in digital ecosystems

- Large enterprises segment dominated the market with a market share of 68.6% in 2024, due to the extensive network infrastructures and higher investments in AI-driven network automation. Large organizations in telecom, finance, and manufacturing are adopting autonomous systems to enhance network reliability, optimize bandwidth utilization, and ensure predictive maintenance. The growing focus on efficiency, data-driven decision-making, and operational resilience continues to fuel adoption among large corporations

Report Scope and Autonomous Networks Market Segmentation

|

Attributes |

Autonomous Networks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Autonomous Networks Market Trends

“AI-Driven Real-Time Network Automation”

- The autonomous networks market is expanding rapidly as AI-driven real-time automation technologies transform how networks are managed, optimized, and secured. These systems leverage machine learning algorithms, predictive analytics, and closed-loop automation to make autonomous operational decisions without human intervention, delivering faster responses and higher reliability

- For instance, Nokia has implemented AI-enabled automation capabilities in its Autonomous Operations framework, allowing real-time network optimization and fault rectification for telecom operators. Similarly, Ericsson’s Intelligent Automation Platform uses AI and data-driven policies to enhance service delivery and improve customer experience in complex multi-domain networks

- AI-driven network automation supports continuous performance monitoring, anomaly detection, and adaptive resource allocation, ensuring optimal functioning under varying traffic loads and environmental conditions. This proactive approach reduces downtime, improves service quality, and enhances operational efficiency for large-scale networks

- The deployment of AI-enhanced automation tools in autonomous networks aligns with the growing demand for zero-touch operations in modern telecom ecosystems. This enables network operators to dynamically configure systems, prioritize workloads, and resolve issues before they impact users

- Integration with intelligent orchestration platforms allows autonomous networks to facilitate end-to-end service lifecycle management in real time. This capability benefits telecom, enterprise, and cloud service providers by ensuring consistent performance and compliance while minimizing manual interventions

- The rise of AI-driven real-time automation represents a fundamental shift in network operations, enabling highly responsive, self-optimizing infrastructure. As digital transformation accelerates, autonomous networks are set to become a cornerstone for next-generation communications and service delivery

Autonomous Networks Market Dynamics

Driver

“Growing 5G and IoT Adoption”

- The accelerating global rollout of 5G and expanding deployment of IoT ecosystems are key drivers fueling the adoption of autonomous networks. These technologies place unprecedented demands on network scalability, latency, and reliability, creating the need for intelligent automation to manage complex traffic patterns and connected devices

- For instance, Huawei Technologies integrates autonomous networking capabilities into its 5G core solutions, enabling real-time optimization for dense IoT deployments in industries such as manufacturing and logistics. This supports consistent performance for high-throughput and ultra-low-latency applications

- 5G networks require adaptive resource allocation to manage diverse service slices, ranging from industrial automation to consumer streaming services. Autonomous networks enable such optimization with self-adjusting algorithms that maintain service-level agreements without manual oversight

- IoT deployments often span massive device networks, generating continuous streams of varied data. Autonomous systems monitor and prioritize workloads, manage congestion, and ensure security across connected devices, making them vital for industrial IoT and smart city infrastructure

- With the growth of cross-industry applications such as autonomous vehicles, smart manufacturing, and remote healthcare, the need for self-optimizing network architectures is becoming increasingly critical. Autonomous networks meet this demand by providing resilience and flexibility to complex, high-performance connectivity environments

Restraint/Challenge

“High Costs and Complexity with Legacy Networks”

- The high cost of implementing autonomous networking capabilities and the complexity of integrating them with legacy infrastructure present significant challenges to market expansion. Advanced automation systems require substantial investment in AI platforms, multi-domain orchestration tools, and scalable compute resources

- For instance, operators transitioning from traditional network management systems to autonomous architectures often face compatibility issues with legacy hardware from multiple vendors. This integration complexity increases engineering costs and extends deployment timelines, as seen in multi-regional telecom upgrade projects

- Legacy networks may lack the programmability and API-based openness necessary to support real-time autonomous features, requiring extensive modernization before integration. This adds financial and technical barriers to adoption, especially for operators in markets with older infrastructure

- The need for skilled personnel to manage migration projects, configure interoperability, and maintain hybrid infrastructures further escalates costs and operational risk. Smaller service providers can find these requirements prohibitive compared to larger operators with broader financial resources

- Mitigating these challenges will involve standardizing protocols, adopting modular automation frameworks, and implementing phased migration strategies. Enhancing compatibility between new autonomous systems and existing legacy environments will be essential to accelerate market adoption while controlling costs and operational complexity

Autonomous Networks Market Scope

The market is segmented on the basis of component, deployment, enterprise type, and end-user.

- By Component

On the basis of component, the autonomous networks market is segmented into solution and services. The solution segment dominated the market with the largest revenue share of 65% in 2024, driven by increasing deployment of automation, AI-driven analytics, and orchestration platforms for managing complex network infrastructures. Enterprises are increasingly adopting autonomous network solutions to minimize human intervention, improve scalability, and ensure faster fault detection and correction. The need to manage high data volumes from IoT, 5G, and edge networks has further accelerated the adoption of integrated automation solutions that optimize performance and reduce downtime.

The services segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for consulting, integration, and managed services to support the deployment and maintenance of autonomous systems. Organizations are seeking expert support to implement AI-based automation frameworks and ensure seamless interoperability across legacy and modern network environments. The growing reliance on service providers for ongoing monitoring, analytics, and software upgrades is expected to sustain this segment’s momentum over the forecast period.

- By Deployment

On the basis of deployment, the autonomous networks market is segmented into on-premises and cloud-based. The on-premises segment held the largest market share in 2024, driven by large enterprises’ preference for maintaining control over data security and compliance within their private infrastructure. Industries such as BFSI and government prioritize on-premises deployment to safeguard sensitive data and ensure regulatory adherence. The ability to customize automation systems according to internal policies and integrate with existing IT frameworks also supports the dominance of this segment.

The cloud-based segment is expected to grow at the fastest CAGR from 2025 to 2032 due to its scalability, cost efficiency, and ease of remote management. Cloud-based autonomous networks enable faster deployment of automation tools, real-time analytics, and AI capabilities across distributed environments. The increasing shift toward hybrid work models, digital transformation, and the proliferation of SaaS-based network management platforms are key factors driving the rapid adoption of cloud-based deployment models.

- By Enterprise Type

On the basis of enterprise type, the market is segmented into large enterprises and SMEs. The large enterprises segment dominated the market with a share of 68.6% in 2024, primarily due to the extensive network infrastructures and higher investments in AI-driven network automation. Large organizations in telecom, finance, and manufacturing are adopting autonomous systems to enhance network reliability, optimize bandwidth utilization, and ensure predictive maintenance. The growing focus on efficiency, data-driven decision-making, and operational resilience continues to fuel adoption among large corporations.

The SMEs segment is anticipated to witness the fastest growth from 2025 to 2032, supported by the increasing affordability and accessibility of cloud-based automation tools. SMEs are leveraging autonomous network solutions to reduce operational costs, simplify management, and enhance network visibility without requiring extensive in-house IT expertise. The rise of subscription-based and modular deployment models has made it easier for SMEs to adopt these technologies incrementally, driving segment expansion.

- By End-user

On the basis of end-user, the market is segmented into IT & telecom, BFSI, transportation, government, healthcare, retail, manufacturing, education, and others. The IT & telecom segment dominated the market in 2024, driven by the rapid rollout of 5G networks, high data traffic, and the need for self-optimizing and self-healing network capabilities. Telecom operators are investing heavily in AI-driven automation to improve service delivery, manage complex network topologies, and minimize latency. The adoption of autonomous networks enables them to efficiently handle dynamic traffic loads and ensure superior customer experience.

The healthcare segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the increasing digitalization of healthcare infrastructure and the growing reliance on real-time data connectivity. Autonomous networks enable seamless operation of connected medical devices, telemedicine platforms, and patient monitoring systems with enhanced security and reliability. The need for uninterrupted data flow and minimal downtime in critical healthcare environments is a major factor driving rapid adoption in this sector.

Autonomous Networks Market Regional Analysis

- North America dominated the autonomous networks market with the largest revenue share of 43.5% in 2024, driven by the early adoption of AI, machine learning, and automation technologies across major telecom and IT sectors

- The region benefits from a strong presence of leading network operators and technology innovators investing in self-optimizing and self-healing network systems

- The demand for efficient traffic management, reduced operational costs, and enhanced service reliability is fueling widespread adoption across industries. Robust 5G rollout and increasing deployment of edge computing further strengthen North America’s leadership in autonomous network development

U.S. Autonomous Networks Market Insight

The U.S. autonomous networks market accounted for the largest share within North America in 2024, supported by rapid digital transformation and high investments in AI-driven network management solutions. Major telecom operators and cloud service providers are prioritizing automation to improve service quality and operational efficiency. The increasing adoption of 5G networks, IoT, and data-intensive applications necessitates advanced autonomous systems capable of dynamic resource allocation and predictive maintenance. Moreover, supportive government initiatives promoting digital infrastructure modernization continue to drive market growth in the U.S.

Europe Autonomous Networks Market Insight

The Europe autonomous networks market is projected to grow at a notable CAGR during the forecast period, propelled by strong regulatory support for digital transformation and smart connectivity. European nations are increasingly investing in AI-based network solutions to enhance cross-border data communication and cybersecurity resilience. The rising need for automation in telecommunications and enterprise networks is boosting adoption, particularly in industrial and governmental sectors. The region’s emphasis on sustainability and energy-efficient systems is also encouraging the deployment of intelligent, self-managing network technologies.

U.K. Autonomous Networks Market Insight

The U.K. autonomous networks market is expected to grow at a significant CAGR during the forecast period, driven by the rapid expansion of 5G infrastructure and increasing reliance on cloud-based and AI-integrated communication networks. Businesses are adopting automation to enhance operational agility and reduce latency in data transmission. The growing digital economy, combined with strong initiatives toward smart city projects and advanced network orchestration, supports market expansion. The U.K.’s focus on cybersecurity and innovation in telecom automation is likely to maintain its competitive edge in Europe.

Germany Autonomous Networks Market Insight

The Germany autonomous networks market is anticipated to expand considerably during the forecast period, fueled by the nation’s strong industrial base and focus on Industry 4.0 adoption. German enterprises are integrating AI and machine learning for automated network optimization, particularly in manufacturing and automotive sectors. The government’s emphasis on digital transformation and 5G connectivity is driving innovation in network automation. In addition, the presence of advanced IT infrastructure and a strong commitment to data privacy are key factors contributing to Germany’s market growth.

Asia-Pacific Autonomous Networks Market Insight

The Asia-Pacific autonomous networks market is projected to register the fastest CAGR from 2025 to 2032, driven by rapid urbanization, increasing 5G deployments, and growing investment in digital ecosystems. Countries such as China, Japan, and India are leading the adoption of AI-based automation for telecom and enterprise network management. The region’s expanding data traffic, coupled with the need for intelligent network monitoring and fault management, is propelling demand. Government-backed initiatives promoting digitalization and smart infrastructure are further enhancing the market outlook.

China Autonomous Networks Market Insight

China held the largest market share in the Asia-Pacific region in 2024, driven by its aggressive 5G rollout and massive investment in AI and automation. The country’s telecom giants are at the forefront of developing self-optimizing and predictive network systems to support its expanding IoT and smart city frameworks. Domestic innovation, strong manufacturing capabilities, and government support for digital transformation are accelerating adoption. In addition, the growing enterprise demand for high-speed, automated networks ensures China’s continued dominance in the region.

Japan Autonomous Networks Market Insight

The Japan autonomous networks market is witnessing strong growth, underpinned by the country’s emphasis on technological innovation and advanced connectivity. Japan’s telecom and IT operators are integrating AI-driven automation to enhance service reliability and optimize network performance. The rise of smart cities, autonomous vehicles, and IoT ecosystems is fueling the need for self-managing networks. Furthermore, Japan’s focus on efficiency, precision, and minimal downtime aligns with the core objectives of autonomous network implementation, positioning it as a key growth market in Asia-Pacific.

Autonomous Networks Market Share

The autonomous networks industry is primarily led by well-established companies, including:

- Arista Networks, Inc. (U.S.)

- Ciena Corporation (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Juniper Networks, Inc. (U.S.)

- NEC Corporation (Japan)

- Nokia Corporation (Finland)

- Broadcom (U.S.)

- Cisco Systems, Inc. (U.S.)

- Ericsson (Sweden)

- Extreme Networks, Inc. (U.S.)

- Hewlett-Packard Enterprise (U.S.)

- IBM Corporation (U.S.)

- ZTE Corporation (China)

- Versa Networks (U.S.)

- Arrcus, Inc. (U.S.)

Latest Developments in Autonomous Networks Market

- In August 2025, Cisco Systems launched its Autonomous Network Cloud Suite, a comprehensive platform that merges AI-driven analytics, intent-based networking, and predictive automation. This advancement significantly enhances Cisco’s ability to deliver fully self-managing network ecosystems capable of real-time optimization and fault detection. By enabling enterprises to deploy adaptive networks that intelligently respond to traffic fluctuations and security threats, the solution reduces downtime and operational costs. This strategic launch fortifies Cisco’s market leadership and also accelerates global adoption of autonomous network architectures across enterprise and telecom sectors

- In June 2025, Nokia Corporation entered a strategic partnership with Microsoft Azure to co-develop next-generation cloud-native autonomous networking solutions. The collaboration focuses on integrating AI, machine learning, and advanced orchestration tools to optimize 5G network performance and automate lifecycle management. This initiative allows telecom operators to achieve higher agility, scalability, and energy efficiency within their network infrastructure. The alliance positions Nokia as a key innovator in the convergence of cloud and autonomous networking, driving digital transformation and improving service reliability across global telecommunications

- In April 2025, Huawei Technologies unveiled its Autonomous Driving Network (ADN) 3.0 platform, featuring advanced AI orchestration, closed-loop automation, and predictive maintenance capabilities. The platform aims to deliver intelligent, self-optimizing, and self-healing network operations across large-scale telecom environments. By enabling operators to achieve faster service provisioning and enhanced fault management, Huawei strengthens its foothold in the AI-based network automation domain. This development also supports the industry’s shift toward greener, more efficient networks that meet the demands of growing 5G and IoT deployments

- In March 2025, Arista Networks introduced a series of AI networking projects centered around Ethernet-based infrastructures to meet the escalating bandwidth requirements of AI and machine learning server clusters. The initiative focuses on enhancing scalability, automation, and performance efficiency across high-density data centers. By aligning its networking solutions with the evolving demands of AI-driven computing environments, Arista reinforces its leadership in delivering high-performance autonomous network solutions, ensuring reliable data flow and minimal latency for AI workloads

- In February 2025, Redwire Corporation finalized the acquisition of Edge Autonomy for $925 million, marking a strategic move to expand its footprint in automation and autonomous systems integration. This acquisition broadens Redwire’s capabilities in leveraging uncrewed aerial systems alongside intelligent autonomous networking technologies. The merger enhances its innovation potential in defense, aerospace, and industrial automation applications, solidifying its presence in the autonomous networks market and paving the way for advanced AI-powered network management systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.