Global Autonomous Trains Technology Market

Market Size in USD Billion

CAGR :

%

USD

7.88 Billion

USD

11.46 Billion

2025

2033

USD

7.88 Billion

USD

11.46 Billion

2025

2033

| 2026 –2033 | |

| USD 7.88 Billion | |

| USD 11.46 Billion | |

|

|

|

|

What is the Global Autonomous Trains Technology Market Size and Growth Rate?

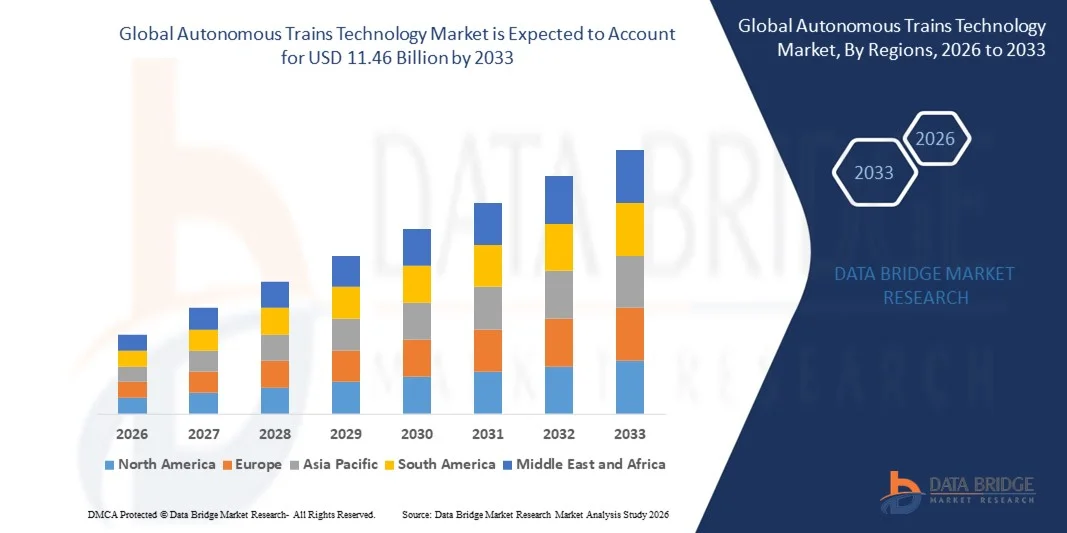

- The global autonomous trains technology market size was valued at USD 7.88 billion in 2025 and is expected to reach USD 11.46 billion by 2033, at a CAGR of4.80% during the forecast period

- The adoption of autonomous transportation due to the continuous advancement in transportation technology, the positive impact of the technology on all the modes of transportation such as trains and growing demand for safety, security and efficient transport are the major factors driving the autonomous trains technology market

- The technological advancement in the rails, the employment of the advanced technology such as high-powered cameras, advanced navigation systems, sensors and onboard computer systems and the popularity of these types of trains owning to the less time they take when compared to regular trains accelerate the autonomous trains technology market growth

What are the Major Takeaways of Autonomous Trains Technology Market?

- The implementation of autonomous technology in trains with the purpose of reducing the number of accidents and pollution and decreasing the load on fossil fuels and an increase in efficiency and the high use these trains as they are known to have connected server assisting them in measuring the exact distance between the trains are factors influencing the autonomous trains technology market

- In addition, the high safety and service benefits for onboard passengers and surge in the budget allocations for the development of railways positively affect the autonomous trains technology market. Furthermore, development in autonomous freight trains and low energy consumption and operational costs of autonomous trains extend profitable opportunities to the autonomous trains technology market players

- Asia-Pacific dominated the autonomous trains technology market with a 44.12% revenue share in 2025, driven by rapid urbanization, expansion of metro rail networks, and accelerated adoption of autonomous and driverless train technologies across China, Japan, South Korea, and India

- North America is projected to register the fastest CAGR of 12.23% from 2026 to 2033, supported by rapid modernization of rail infrastructure, strong adoption of advanced signaling systems, and growing demand for automated and remotely operated train solutions

- The Camera segment dominated the market with a 31.6% share in 2025, driven by the growing integration of high-resolution vision systems for obstacle detection, platform monitoring, track inspection, and autonomous decision-making

Report Scope and Autonomous Trains Technology Market Segmentation

|

Attributes |

Autonomous Trains Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Autonomous Trains Technology Market?

Increasing Shift Toward High-Speed, Smart, and Fully-Integrated Autonomous Rail Systems

- The autonomous trains technology market is witnessing rapid adoption of AI-enabled, sensor-rich, and real-time decision-making systems that improve safety, automation precision, and operational efficiency

- Manufacturers are introducing advanced onboard control units, driverless train software, predictive maintenance tools, and multi-sensor fusion platforms integrating LiDAR, radar, cameras, and V2X communication

- Growing demand for energy-efficient, semi-autonomous and fully-autonomous train solutions is accelerating deployment across metro networks, high-speed railways, and freight corridors

- For instance, companies such as Alstom, Siemens, Hitachi Rail, and CRRC are upgrading automation platforms with improved localization, enhanced obstacle detection, and cloud-connected command systems

- Increasing need for faster transit, reduced human error, and automated traffic management is strengthening the transition toward higher automation grades (GoA 2–4)

- As rail networks expand and urbanization accelerates, Autonomous Trains Technology will remain essential for safe, high-capacity, and sustainable rail mobility worldwide

What are the Key Drivers of Autonomous Trains Technology Market?

- Rising demand for safe, efficient, and driverless rail operations to reduce accidents, enhance punctuality, and optimize rail traffic flow

- For instance, in 2025, global players such as Alstom, Thales, and Siemens Mobility strengthened their autonomous train portfolios with upgraded signaling, collision-avoidance systems, and digital train control solutions

- Growing adoption of smart mobility, urban rail expansion, and high-speed rail modernization across the U.S., Europe, and Asia-Pacific is boosting automation investment

- Advancements in CBTC, ETCS Level 3, AI-based surveillance, real-time monitoring, and IoT-enabled maintenance are improving system reliability and operational performance

- Rising use of connected sensors, automation software, and intelligent communication networks is driving demand for next-generation autonomous railway solutions

- Supported by strong government spending, digital rail transformation programs, and sustainability commitments, the Autonomous Trains Technology market is expected to witness robust long-term growth

Which Factor is Challenging the Growth of the Autonomous Trains Technology Market?

- High upfront costs associated with advanced signaling, autonomous control systems, and multi-sensor safety technologies limit adoption, especially in developing regions

- For instance, during 2024–2025, rising costs of electronics, specialized chipset shortages, and longer deployment timelines increased system integration expenses for several global rail manufacturers

- Complexity in implementing AI-based decision systems, mixed traffic management, and GoA 4-level automation increases the need for highly skilled engineers and advanced training programs

- Limited awareness and slow technology adoption in emerging markets hinder large-scale deployment of autonomous rail systems

- Competition from semi-autonomous rail technologies, conventional signaling upgrades, and manual rail operations creates pricing pressure and delays full automation transitions

- To address these issues, companies are focusing on cost-optimized automation architecture, predictive maintenance, cloud-based monitoring, and modular automation solutions to increase global adoption of autonomous trains technology

How is the Autonomous Trains Technology Market Segmented?

The market is segmented on the basis of component, technology, train type, and automation.

- By Component

On the basis of component, the autonomous trains technology market is segmented into Tachometer, Doppler, Accelerometer, Camera, Antenna, and Radio Set. The Camera segment dominated the market with a 31.6% share in 2025, driven by the growing integration of high-resolution vision systems for obstacle detection, platform monitoring, track inspection, and autonomous decision-making. Cameras support AI-based analytics, real-time video processing, and behavioral prediction—making them essential for safety automation across metros, light rail, and high-speed trains. Their role in enabling situational awareness and computer-vision-assisted driving strengthens widespread deployment.

The Antenna segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of V2X communication, satellite-based positioning, CBTC upgrades, and connected train ecosystems. Increasing dependency on wireless communication, precise localization, and uninterrupted data exchange is accelerating demand for advanced antenna systems across global autonomous rail projects.

- By Technology

On the basis of technology, the market is segmented into CBTC, ERTMS, PTC, and ATC. The CBTC (Communication-Based Train Control) segment dominated the market with a 42.3% share in 2025, supported by large-scale metro modernization, shorter headways, improved traffic management, and higher automation levels adopted across Europe, Asia-Pacific, and the Middle East. CBTC systems deliver superior accuracy, continuous communication, and flexibility for GoA2–GoA4 operations, making them the global standard for driverless metros.

The ERTMS (European Rail Traffic Management System) segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by expanding high-speed rail networks, cross-border interoperability programs, and government-backed digital rail transformation. Increasing adoption of ETCS Level-2 and Level-3 for enhanced safety, higher capacity, and advanced automatic train protection is pushing demand for ERTMS across Europe, Asia, and emerging markets.

- By Train Type

On the basis of train type, the autonomous trains technology market is segmented into Metro/Monorail, Light Rail, and High-Speed Rail/Bullet Train. The Metro/Monorail segment dominated the market with a 49.1% share in 2025, driven by rapid urbanization, congestion management initiatives, and widespread deployment of automated metro networks across China, India, Europe, and the Gulf region. Metro systems utilize advanced automation for improved punctuality, reduced operational costs, and enhanced passenger safety, making them the primary application area for autonomous technologies.

The High-Speed Rail/Bullet Train segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by national high-speed rail expansion, government investments in long-distance autonomous corridors, and demand for predictive maintenance, automated inspection, and real-time traffic control. Increasing global focus on fast, sustainable intercity transportation is accelerating deployment of autonomy-enabled high-speed rail technologies.

- By Automation Level

On the basis of automation, the market is segmented into GOA1, GOA2, GOA3, and GOA4. The GOA2 (Semi-Automatic Train Operation) segment dominated the market with a 38.7% share in 2025, as it represents the most widely implemented automation level across global metro systems. GOA2 offers improved efficiency, reduced human error, and partial automation while maintaining operator supervision—making it ideal for transitioning networks.

The GOA4 (Fully Driverless, Unattended Train Operation) segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising adoption of fully autonomous metros, labor optimization, enhanced safety features, and cost-efficient operations. Increasing reliance on advanced CBTC, AI-based monitoring, remote operations centers, and predictive maintenance is positioning GOA4 as the future standard for global autonomous rail infrastructure.

Which Region Holds the Largest Share of the Autonomous Trains Technology Market?

- Asia-Pacific dominated the autonomous trains technology market with a 44.12% revenue share in 2025, driven by rapid urbanization, expansion of metro rail networks, and accelerated adoption of autonomous and driverless train technologies across China, Japan, South Korea, and India. Strong investments in high-speed rail, large-scale infrastructure projects, and next-generation signaling systems strengthen regional leadership

- Governments and rail authorities across Asia-Pacific are increasingly adopting CBTC, ERTMS-compatible systems, AI-based monitoring, and advanced communication architectures, boosting large-scale deployment of automation technologies

- Strong manufacturing ecosystems, expanding R&D activities, and rapid adoption of digital rail transformation further reinforce the region’s dominance in autonomous railway innovation

China Autonomous Trains Technology Market Insight

China is the leading contributor due to massive metro expansion, advanced high-speed rail networks, and government-led initiatives promoting smart transportation and fully automated transit systems. Rapid deployment of GoA3 and GoA4 metro lines, along with indigenous signaling technologies, accelerates adoption of next-generation autonomous train solutions.

Japan Autonomous Trains Technology Market Insight

Japan maintains steady growth supported by advanced railway standards, precision engineering, and increasing adoption of automation in metro, suburban, and high-speed networks. Strong emphasis on safety, reliability, and predictive maintenance drives demand for sophisticated autonomous control systems throughout the country.

India Autonomous Trains Technology Market Insight

India is emerging as a fast-growing market due to large-scale metro development, modernization of regional rail networks, and strong government focus on smart mobility. Increasing adoption of CBTC-based metro lines, driver-assist systems, and automated operations centers fuels market penetration across major cities.

North America Autonomous Trains Technology Market Insight

North America is projected to register the fastest CAGR of 12.23% from 2026 to 2033, supported by rapid modernization of rail infrastructure, strong adoption of advanced signaling systems, and growing demand for automated and remotely operated train solutions. The region’s investments in predictive maintenance, IoT-enabled rolling stock, and smart transportation networks continue to accelerate technological upgrades across freight and passenger rail systems.

U.S. Autonomous Trains Technology Market Insight

The U.S. is the largest contributor in North America, driven by strong deployment of autonomous freight systems, high-speed rail proposals, and advanced PTC adoption across national railroads. Increasing investments in AI-powered monitoring, digital twins, and real-time fleet management tools enhance operational efficiency and safety. Strong involvement of technology leaders, expansion of robotics-based maintenance platforms, and modernization initiatives in metropolitan transit systems further fuel demand for autonomous train technologies.

Canada Autonomous Trains Technology Market Insight

Canada contributes significantly to regional growth owing to ongoing upgrades in commuter rail, metro systems, and long-distance rail networks. Rising adoption of smart signaling systems, automated braking, and driver-assist technologies strengthens market expansion. Government-backed innovation programs, strong academic research, and modernization of freight corridors support accelerated integration of autonomous features across the Canadian railway ecosystem.

Which are the Top Companies in Autonomous Trains Technology Market?

The autonomous trains technology industry is primarily led by well-established companies, including:

- Alstom (France)

- Siemens (Germany)

- Bombardier (Canada)

- Hitachi, Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- General Electric (U.S.)

- Thales Group (France)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- CRRC Corporation Limited (China)

- ABB (Switzerland)

- Charities Aid Foundation (U.K.)

- CalAmp (U.S.)

- Bharat Forge (India)

- Tech Mahindra Limited (India)

- HollySys Asia Pacific Pte Ltd. (Singapore)

- Deutsche Bahn (Germany)

- DEUTA-WERKE GmbH (Germany)

- Belden Inc. (U.S.)

- American Equipment Company (U.S.)

- Ingeteam (Spain)

- Wabtec Corporation (U.S.)

What are the Recent Developments in Global Autonomous Trains Technology Market?

- In August 2025, Alstom secured a contract to supply 234 Metropolis metro cars along with an advanced Communications-Based Train Control (CBTC) signalling system and five years of maintenance services for Mumbai Metro Line 4, strengthening the region’s metro automation capabilities and improving operational efficiency across the corridor

- In January 2025, Siemens Mobility secured contracts worth EUR 670 million for HS2, covering Automatic Train Operation (ATO) over ETCS Level 2, high-voltage power systems, and telecommunications along a 225-kilometer stretch, marking a significant step forward in high-speed rail modernization and network automation

- In January 2025, the Federal Railroad Administration authorized Parallel Systems’ crewless battery-electric rail vehicle pilot on the Georgia Central Railway, marking the first autonomous freight operation in the U.S. and demonstrating the growing adoption of sustainable, driverless rail technologies

- In July 2024, The Bengaluru Metro Rail Corporation Limited (BMRCL) initiated dynamic signaling tests for the first driverless train on the Namma Metro Yellow Line, covering a 19-kilometer stretch from Electronics City and R V Road to Bommasandra, expected to revolutionize public transportation with trains operating at 20-minute intervals

- In November 2022, Alstom SA, in collaboration with Lineas and ProRail, demonstrated the highest level of automation, GoA4, on a shunting locomotive in the Netherlands, enabling fully autonomous starting, driving, stopping, and handling of unexpected events without on-board personnel, showcasing the future of fully autonomous rail operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.