Global Autonomous Underwater Vehicle Auv Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

5.54 Billion

2024

2032

USD

1.30 Billion

USD

5.54 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 5.54 Billion | |

|

|

|

|

What is the Global Autonomous Underwater Vehicle (AUV) Market Size and Growth Rate?

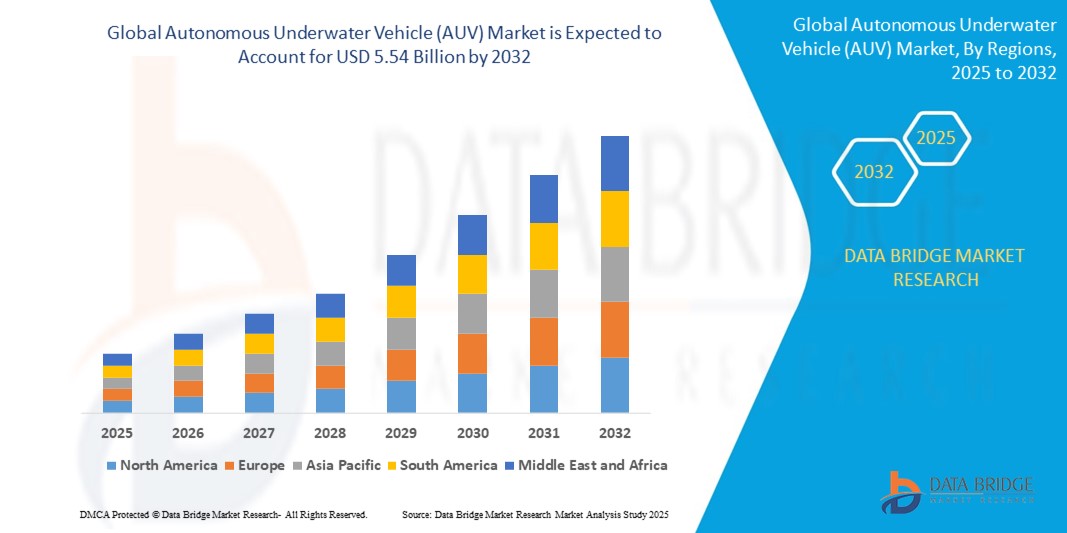

- The global autonomous underwater vehicle (AUV) market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 5.54 billion by 2032, at a CAGR of 19.80% during the forecast period

- The autonomous underwater vehicle market is experiencing significant growth, driven by advancements in underwater technology, increased investments in maritime research, and the rising need for efficient underwater exploration and surveillance. According to the French National Institute for Ocean Science (Ifremer), Xblue's subsea technologies have been chosen to be integrated into a new 6000-meter autonomous underwater vehicle (AUV) named CORAL (Constructive Offshore Robotics ALliance)

- The CORAL AUV is set to feature iXblue's SAMS-150 synthetic aperture sonar (SAS), Phins C7 inertial navigation system (INS), and Echoes 5000 sub-bottom profiler. It will utilize iXblue's Delph Software suite for SAS and navigation post-processing

What are the Major Takeaways of Autonomous Underwater Vehicle (AUV) Market?

- AUVs provide a versatile and effective solution for monitoring underwater environments, detecting potential threats, and ensuring safe navigation routes for naval and commercial vessels

- The capability of autonomous underwater vehicle control system to operate autonomously over long durations and in challenging conditions makes it invaluable for military applications. As maritime security becomes a top priority due to geopolitical tensions and the increasing risk of underwater terrorism, the adoption of autonomous underwater vehicle technology is expected to continue growing

- North America dominated the autonomous underwater vehicle (AUV) market with the largest revenue share of 42.8% in 2024, characterized by early smart home adoption, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in autonomous underwater vehicle (AUV) installations, particularly in new smart homes and multi-dwelling units, driven by innovations from both established tech companies and startups focusing on AI and voice-activated features.

- Asia-Pacific (APAC) region is forecasted to grow at the fastest CAGR of 14.65% from 2025 to 2032, driven by increasing investment in naval modernization, maritime surveillance, and oceanographic research

- The Medium AUVs segment dominated the autonomous underwater vehicle market with the largest market revenue share of 48.6% in 2024, driven by their versatile usage across both commercial and defense applications, and suitability for deep inspection tasks without the high cost of large AUVs

Report Scope and Autonomous Underwater Vehicle (AUV) Market Segmentation

|

Attributes |

Autonomous Underwater Vehicle (AUV) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Autonomous Underwater Vehicle (AUV) Market?

- A dominant trend reshaping the global autonomous underwater vehicle market is the integration of Artificial Intelligence (AI) and machine learning (ML) to enhance autonomous navigation, adaptive mission planning, and real-time data analysis. These technologies are significantly improving autonomous underwater vehicle efficiency in dynamic underwater environments

- AI enables AUVs to autonomously recognize and respond to obstacles, terrain changes, or environmental anomalies without human intervention. This reduces the need for continuous surface-level control and extends mission durations in complex scenarios such as deep-sea surveys or mine countermeasures

- For instance, in September 2023, Kongsberg Maritime unveiled new AUV software that leverages AI algorithms to optimize route planning and seabed imaging accuracy, reducing energy consumption and improving mission outcomes

- In addition, AI-driven AUVs can autonomously classify marine species, map the seafloor, detect oil leaks, or inspect underwater infrastructure, offering enormous value across defense, oil & gas, environmental monitoring, and scientific research applications

- The demand for smart AUVs capable of adaptive, multi-role operations is growing rapidly, driven by the need for cost-effective, long-range, and unmanned subsea missions. Companies are increasingly focusing on embedding edge AI processors within AUV systems to support onboard decision-making without reliance on surface communication

- Overall, AI integration is transforming AUVs from passive data collectors into intelligent underwater agents, capable of executing complex tasks with minimal human oversight

What are the Key Drivers of Autonomous Underwater Vehicle (AUV) Market?

- Rising demand for ocean exploration and resource mapping is a major market driver. As commercial and scientific interest in ocean floors increases, autonomous underwater vehicles are essential for mapping, inspection, and sampling in inaccessible or hazardous underwater zones

- For instance, in February 2024, Fugro announced a large-scale deployment of AUVs for deep-sea mineral exploration in the Pacific Ocean, using its new Blue Essence autonomous underwater vehicle series for extended operations

- The growing military and defense spending across countries is boosting demand for AUVs in applications like surveillance, anti-submarine warfare, and mine detection. Governments are prioritizing unmanned systems for strategic underwater operations

- In addition, AUVs play a vital role in the oil & gas and offshore energy sectors, supporting pipeline inspection, seafloor monitoring, and environmental surveys. Their ability to operate autonomously reduces human risk and operational costs

- The technological advancement in battery life, sensor fusion, and underwater communication systems further enhances the range, accuracy, and reliability of AUVs, accelerating market adoption across diverse end-use industries

Which Factor is challenging the Growth of the Autonomous Underwater Vehicle (AUV) Market?

- A key challenge facing the autonomous underwater vehicle market is the high initial investment and operational costs associated with autonomous underwater vehicle development, deployment, and maintenance. These costs can deter small-scale users and research institutions from adoption

- AUVs also face technical limitations in terms of underwater navigation, obstacle avoidance in cluttered environments, and reliable real-time data transmission in deep-sea conditions, where GPS and radio signals are ineffective

- For instance, complex missions in the Arctic or deep-sea oil fields require robust vehicle design, thermal shielding, and precise control mechanisms, all of which increase costs and complexity

- Another challenge is the limited standardization of underwater communication protocols and interoperability, which hinders multi-vendor system integration and collaborative missions

- Furthermore, there are regulatory and safety concerns about the operation of unmanned vehicles in shared maritime environments, particularly in coastal regions and naval zones

- Overcoming these challenges requires continued investment in R&D, improvements in underwater navigation algorithms, and collaboration between governments, academia, and private sector players to standardize systems and reduce total cost of ownership

How is the Autonomous Underwater Vehicle (AUV) Market Segmented?

The market is segmented on the basis of type, technology, payload type, application, and shape.

• By Type

On the basis of type, the autonomous underwater vehicle market is segmented into Shallow AUVs (Up to 100 Meters), Medium AUVs (Up to 1,000 Meters), and Large AUVs (More Than 1,000 Meters). The Medium AUVs segment dominated the AUV market with the largest market revenue share of 48.6% in 2024, driven by their versatile usage across both commercial and defense applications, and suitability for deep inspection tasks without the high cost of large AUVs. Medium-depth AUVs are commonly deployed in offshore oil & gas exploration, marine research, and underwater mine countermeasure missions.

The Large AUVs segment is expected to witness the fastest CAGR from 2025 to 2032, as demand surges for high-endurance vehicles capable of operating in ultra-deep sea environments for military surveillance, long-duration mapping missions, and subsea cable inspection.

• By Technology

On the basis of technology, the autonomous underwater vehicle market is segmented into Collision Avoidance, Communication, Navigation, Propulsion, and Imaging. The Navigation segment held the largest market revenue share in 2024, supported by increasing advancements in inertial navigation systems (INS), Doppler velocity logs (DVL), and GPS-denied positioning techniques. Accurate navigation is essential for deep-sea missions and pipeline inspection, where surface communication is limited.

The Collision Avoidance segment is anticipated to register the fastest growth rate from 2025 to 2032, driven by the increasing emphasis on autonomous safety and mission reliability, especially in cluttered or reef-laden underwater environments.

• By Payload Type

On the basis of payload type, the market is segmented into Cameras, Sensors, Synthetic Aperture Sonars, Echo Sounders, Acoustic Doppler Current Profilers (ADCP), and Others. The Sensors segment dominated the AUV market in 2024 with the largest revenue share, owing to their broad application in oceanography, marine life monitoring, and pipeline inspection. These include temperature, salinity, and pressure sensors, as well as chemical and biological sensing tools.

The Synthetic Aperture Sonars segment is projected to grow at the fastest CAGR from 2025 to 2032 due to rising adoption in military and geological surveys for high-resolution seabed imaging.

• By Application

On the basis of application, the market is segmented into Military and Defence, Oil and Gas, Environmental Protection and Monitoring, Oceanography, Archaeology and Exploration, and Search and Salvage Operations. The Military and Defence segment captured the largest market share of 41.3% in 2024, fueled by increasing investments in underwater surveillance, intelligence gathering, and mine countermeasures. Defense forces are increasingly relying on AUVs for unmanned and covert maritime missions.

The Oil and Gas segment is expected to experience the fastest CAGR from 2025 to 2032, driven by the growing need for efficient, unmanned pipeline inspection, seabed monitoring, and offshore rig surveys to reduce operational risk and cost.

• By Shape

On the basis of shape, the autonomous underwater vehicle market is segmented into Torpedo, Laminar Flow Body, Streamlined Rectangular Style, and Multi-Hull Vehicle. The Torpedo segment held the highest market share in 2024, due to its hydrodynamic efficiency, enabling higher speeds and lower drag in long-range missions. It is widely adopted in military, oceanography, and commercial applications.

The Multi-Hull Vehicle segment is projected to grow at the fastest CAGR, as it allows greater stability, larger payload accommodation, and adaptability for modular design, making it ideal for research and survey missions.

Which Region Holds the Largest Share of the Autonomous Underwater Vehicle (AUV) Market?

- North America dominated the autonomous underwater vehicle (AUV) market with the largest revenue share of 42.8% in 2024, primarily driven by significant defense spending, extensive offshore oil & gas exploration activities, and growing investment in oceanographic research and unmanned marine systems

- The region’s well-established defense infrastructure, including organizations like the U.S. Navy and DARPA, has been actively investing in AUVs for mine countermeasures, surveillance, and seabed mapping

- The presence of leading autonomous underwater vehicle manufacturers and technology providers, coupled with robust R&D funding and favorable government policies, has made North America the central hub for AUV innovations and deployments

U.S. Autonomous Underwater Vehicle (AUV) Market Insight

U.S. autonomous underwater vehicle (AUV) market accounted for the largest share in the North American region in 2024. Growth is driven by the U.S. Navy’s emphasis on unmanned underwater operations, including ISR (intelligence, surveillance, and reconnaissance) missions and anti-submarine warfare. Initiatives like the unmanned maritime systems Program are accelerating the procurement and fielding of AUVs. In addition, the oil & gas sector and academic institutions are investing heavily in subsea survey and monitoring applications, further contributing to market demand.

Europe Autonomous Underwater Vehicle (AUV) Market Insight

Europe autonomous underwater vehicle market is expected to expand at a strong CAGR through 2032, supported by increasing maritime security concerns, environmental monitoring mandates, and technological collaborations across the continent. The European Union’s Blue Economy initiatives and deep-sea exploration missions have spurred demand for advanced AUVs across defense, research, and commercial domains. Countries like Norway, France, and the U.K. are key contributors, investing in ocean science, undersea resource assessments, and subsea infrastructure inspection.

U.K. Autonomous Underwater Vehicle (AUV) Market Insight

U.K. autonomous underwater vehicle market is poised for significant growth, driven by a blend of defense modernization programs and commercial deepwater exploration projects. The Royal Navy’s push towards autonomous marine systems and growing offshore wind energy infrastructure are key growth enablers. In addition, collaborative efforts between academia and private manufacturers are fostering innovation, while the U.K.’s strategic maritime positioning enhances AUV adoption for security and logistics purposes.

Germany Autonomous Underwater Vehicle (AUV) Market Insight

Germany autonomous underwater vehicle market is anticipated to grow at a considerable CAGR, fueled by increased focus on marine biodiversity studies, subsea asset inspection, and naval modernization. Germany’s emphasis on sustainable ocean practices and precision technologies is leading to rising adoption of sensor-equipped AUVs in scientific, industrial, and governmental sectors. The country’s leadership in engineering excellence is reflected in the rapid advancement of compact and energy-efficient AUV platforms.

Which Region is the Fastest Growing in the Autonomous Underwater Vehicle (AUV) Market?

Asia-Pacific (APAC) region is forecasted to grow at the fastest CAGR of 14.65% from 2025 to 2032, driven by increasing investment in naval modernization, maritime surveillance, and oceanographic research. Countries such as China, Japan, South Korea, and India are actively investing in AUVs to secure maritime borders, assess undersea resources, and monitor environmental changes. Rising maritime trade, infrastructure development, and government support for innovation further support regional market expansion.

Japan Autonomous Underwater Vehicle (AUV) Market Insight

The Japan autonomous underwater vehicle market is gaining traction due to the country’s strong focus on technological innovation, disaster management, and marine sustainability. Japan is leveraging AUVs for earthquake and tsunami-related seabed monitoring, submarine cable inspection, and academic exploration missions. With a legacy in robotics and precision engineering, Japan is also enhancing AUV capabilities in autonomy, miniaturization, and deep-sea operation reliability.

China Autonomous Underwater Vehicle (AUV) Market Insight

The China autonomous underwater vehicle market held the largest share within APAC in 2024, propelled by massive investments in military naval operations, marine resource exploration, and smart port infrastructure. Government-led initiatives like “Made in China 2025” emphasize advancements in robotics and autonomous systems. The country is also expanding its role in the global AUV supply chain, with local companies increasingly developing low-cost, high-performance underwater systems tailored for domestic and international applications.

Which are the Top Companies in Autonomous Underwater Vehicle (AUV) Market?

The autonomous underwater vehicle (AUV) industry is primarily led by well-established companies, including:

- Kongsberg Maritime (Norway)

- Teledyne Marine (U.S.)

- Bluebird Marine Systems Ltd. (U.K.)

- ECA GROUP (France)

- Saab AB (Sweden)

- Lockheed Martin Corporation (U.S.)

- Fugro (Netherlands)

- ATLAS ELEKTRONIK GmbH (Germany)

- Boston Engineering (U.S.)

- International Submarine Engineering Limited (Canada)

- Graal Group (France)

- BAE Systems (U.K.)

- Boeing (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Hydromea (Switzerland)

- General Dynamics Mission Systems, Inc. (U.S.)

- SUBSEA 7 (U.K.)

- Autonomous Undersea Vehicle Applications Center (U.S.)

- Stone Aerospace, Inc. (U.S.)

- Tiburon Subsea Inc. (U.S.)

What are the Recent Developments in Global Autonomous Underwater Vehicle (AUV) Market?

- In March 2024, Metron Inc. partnered with Cellula Robotics Inc. to enhance the capabilities of autonomous underwater vehicles (AUVs) for advanced operations in dynamic maritime environments. This partnership aims to strengthen mission planning and navigation systems for next-generation underwater missions

- In November 2023, Adelaide-based Nova Systems announced a strategic collaboration with the Australian Maritime College to deliver the Advanced Test and Practitioner Evaluation course focused on AUV operations. The initiative is designed to equip professionals with hands-on experience and technical skills in underwater autonomy

- In July 2023, L3Harris Technologies, along with its industry partners, successfully launched and recovered an autonomous underwater vehicle (AUV) from a submarine in motion using a newly developed Torpedo Tube Launch and Recovery (TTL&R) homing and docking solution. This marks a significant breakthrough in undersea warfare and AUV deployment from submerged platforms

- In July 2023, India introduced Neerakshi, a mine-detecting autonomous underwater vehicle (AUV) developed through a collaboration between Garden Reach Shipbuilders and Engineers (GRSE) Limited and the MSME firm AEPL. The AUV strengthens India’s naval mine detection capabilities and supports indigenous defense manufacturing

- In February 2021, Kongsberg Maritime launched the HUGIN Endurance, the latest addition to its advanced HUGIN AUV series. The new model offers an operational autonomy of up to 15 days, allowing it to conduct long-range survey missions far from shore. This innovation significantly enhances underwater endurance and expands deep-sea exploration potentia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Autonomous Underwater Vehicle Auv Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Autonomous Underwater Vehicle Auv Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Autonomous Underwater Vehicle Auv Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.