Global Autonomous Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

89.36 Billion

USD

397.75 Billion

2024

2032

USD

89.36 Billion

USD

397.75 Billion

2024

2032

| 2025 –2032 | |

| USD 89.36 Billion | |

| USD 397.75 Billion | |

|

|

|

|

Autonomous Vehicle Market Size

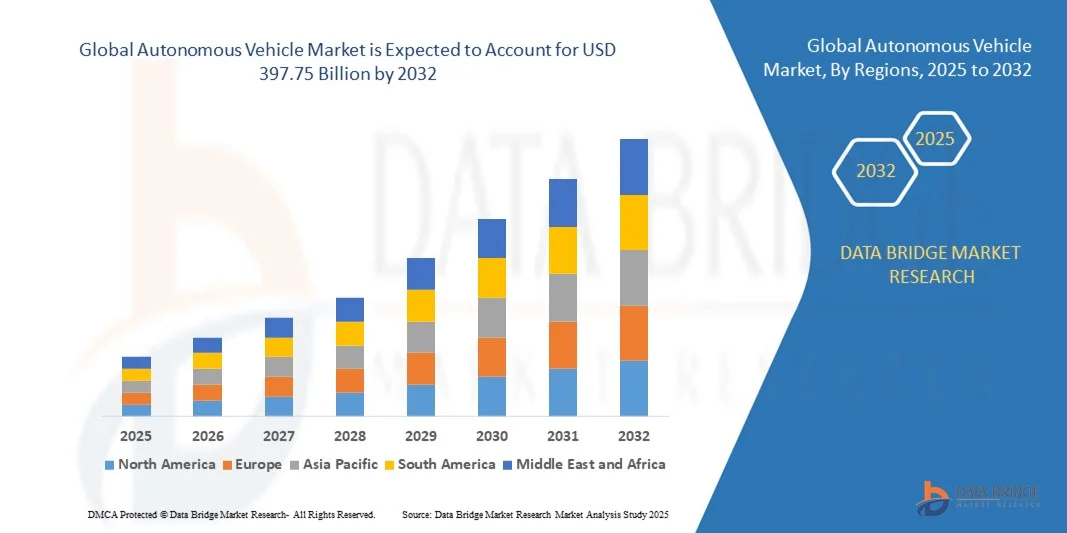

- The global autonomous vehicle market size was valued at USD 89.36 billion in 2024 and is expected to reach USD 397.75 billion by 2032, at a CAGR of 20.52% during the forecast period

- The market growth is largely fueled by the increasing adoption of connected vehicle technologies and advancements in AI, sensors, and autonomous driving software, leading to enhanced vehicle intelligence and safety across both personal and commercial transportation sectors

- Furthermore, rising demand for safer, efficient, and cost-effective mobility solutions is driving investments in autonomous vehicle development. These factors are accelerating the integration of semi-autonomous and fully autonomous vehicles into urban transport, logistics, and ride-hailing services, thereby significantly boosting the market's growth

Autonomous Vehicle Market Analysis

- Autonomous vehicles utilize advanced sensors, cameras, radar, LIDAR, and AI-powered software to navigate and operate without human intervention. These vehicles enhance safety, reduce traffic congestion, and improve operational efficiency in passenger transport, logistics, and commercial applications

- The escalating demand for autonomous vehicles is primarily driven by growing urbanization, increasing consumer preference for hands-free driving experiences, government support for smart mobility initiatives, and technological progress in AI, sensor fusion, and vehicle-to-everything (V2X) communication systems

- North America dominated the autonomous vehicle market with a share of 38% in 2024, due to significant investments in advanced automotive technologies, supportive regulatory frameworks, and early adoption of connected and autonomous vehicles

- Asia-Pacific is expected to be the fastest growing region in the autonomous vehicle market during the forecast period due to rising urban populations, rapid technological advancements, and increased investments in smart transportation systems across countries such as China, Japan, and India

- Semi-autonomous vehicles segment dominated the market with a market share of 62.5% in 2024, due to their earlier adoption and compatibility with existing road infrastructure. These vehicles offer partial automation features such as lane-keeping, adaptive cruise control, and automated braking, which appeal to consumers seeking enhanced safety without fully relinquishing control. The segment benefits from ongoing advancements in driver-assistance systems, regulatory support in select regions, and rising consumer trust in hybrid automation technologies

Report Scope and Autonomous Vehicle Market Segmentation

|

Attributes |

Autonomous Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Autonomous Vehicle Market Trends

Increasing Use of AI and Advanced Driver-Assistance Systems (ADAS)

- The integration of artificial intelligence and advanced driver-assistance systems (ADAS) is a defining trend in the autonomous vehicle market. These technologies enable vehicles to perceive their environment, make intelligent decisions, and perform driving tasks with reduced human intervention, marking a significant step toward fully autonomous driving

- For instance, Tesla has advanced its Autopilot and Full Self-Driving beta systems using AI-powered neural networks to improve lane-keeping, adaptive cruise control, and automated navigation. This demonstrates how global leaders are leveraging AI and ADAS to accelerate progress toward safe and reliable autonomous driving features

- ADAS features such as lane departure warning, adaptive braking, blind-spot detection, and traffic sign recognition are now being deployed widely in both passenger and commercial vehicles. Their growing adoption enhances driver convenience and also builds trust in semi-autonomous functions that pave the way for higher autonomy levels

- AI-driven perception systems are improving accuracy in real-time object detection and decision-making. With developments in LiDAR, radar, and camera fusion, vehicles are better able to respond to dynamic environments, ensuring greater precision and safety in complex traffic conditions

- The trend is also shaping shared mobility and logistics sectors, where AI-enabled autonomous systems are reducing operational costs and increasing efficiency. Fleets incorporating ADAS provide safer services while gathering critical data for enhancing future autonomous capabilities

- In conclusion, the growing integration of AI and ADAS is accelerating the shift toward fully autonomous driving. This trend signifies a critical evolution in mobility, ensuring that future vehicles become safer, smarter, and more accessible to people and businesses globally

Autonomous Vehicle Market Dynamics

Driver

Rising Demand for Safer and More Efficient Mobility

- The increasing demand for safer and more efficient mobility is a major driver of autonomous vehicle adoption. Road safety concerns and the rising number of accidents due to human error are compelling consumers and regulators to push for automation in driving systems

- For instance, Waymo, a subsidiary of Alphabet, has deployed autonomous ride-hailing services in Phoenix, USA, demonstrating how autonomy can offer safer and more efficient solutions compared to conventional vehicles. This practical application shows how the market is directly benefiting from the growing demand for advanced mobility services

- Autonomous driving technology is designed to reduce accidents by removing human limitations such as fatigue, distraction, or impaired judgment. Incorporating automation into vehicles thereby contributes to lowering accident rates and creating safer road environments

- In addition, the efficiency benefits of autonomous vehicles, such as optimal route planning, reduced congestion, and lower fuel consumption, make them attractive to both private users and fleet operators. This efficiency also supports global sustainability goals through reduced emissions and energy optimization

- Together, these factors are pushing consumers, businesses, and governments toward the adoption of autonomous technologies. The strong demand for reliability, safety, and efficiency ensures that the autonomous vehicle market will continue its upward growth trajectory across both passenger and commercial applications

Restraint/Challenge

Regional Regulatory and Safety Compliance

- Differences in regional regulations and safety compliance standards present one of the biggest challenges to widespread deployment of autonomous vehicles. The lack of harmonized global guidelines has slowed down the commercialization of higher-level autonomy due to varying approval processes and testing requirements

- For instance, Uber had to suspend its autonomous vehicle trials in Arizona after a high-profile safety incident due to non-compliance with regional protocols. This highlights the complexities companies face in adapting autonomous systems to diverse regulatory frameworks across regions

- Strict safety regulations mandate extensive testing and validation to ensure reliability, which raises both cost and time-to-market for manufacturers. Regional regulators also differ in their approach to liability and insurance frameworks, creating uncertainty for businesses seeking to scale operations across borders

- The variation in infrastructure readiness, such as availability of smart roads and 5G connectivity, further compounds regulatory challenges. While some regions support autonomous trials, others still lack the legal and technological foundation to facilitate adoption

- In conclusion, regulatory and compliance frameworks remain critical barriers to faster deployment of autonomous vehicles. Standardization of rules, cross-border cooperation, and technological infrastructure development will be necessary steps toward overcoming these hurdles and enabling autonomous mobility at scale

Autonomous Vehicle Market Scope

The market is segmented on the basis of type, sensors, hardware and software, application, and level of automation.

- By Type

On the basis of type, the autonomous vehicle market is segmented into semi-autonomous vehicles and fully autonomous vehicles. The semi-autonomous vehicles segment dominated the market in 2024, capturing the largest revenue share of 62.5% due to their earlier adoption and compatibility with existing road infrastructure. These vehicles offer partial automation features such as lane-keeping, adaptive cruise control, and automated braking, which appeal to consumers seeking enhanced safety without fully relinquishing control. The segment benefits from ongoing advancements in driver-assistance systems, regulatory support in select regions, and rising consumer trust in hybrid automation technologies.

The fully autonomous vehicles segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing investments from tech companies and automotive manufacturers. Fully autonomous vehicles promise complete hands-free operation, appealing to logistics and ride-hailing companies looking to reduce operational costs. Advancements in AI, machine learning algorithms, and vehicle-to-everything (V2X) connectivity are accelerating adoption. Urbanization trends and smart city initiatives further support growth by facilitating infrastructure integration for high-level autonomy.

- By Sensors

On the basis of sensors, the market is segmented into ultrasonic, radar, LIDAR, image sensors, and others. The radar segment dominated the largest revenue share in 2024, attributed to its proven reliability under various weather conditions and effectiveness in detecting distant objects. Radar sensors are widely integrated into semi-autonomous vehicles for adaptive cruise control and collision avoidance systems, providing critical real-time data for vehicle safety. Their relatively low cost, ease of integration, and strong performance in diverse environments make them the preferred choice for both consumer and commercial vehicles.

The LIDAR segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its high-precision mapping and object detection capabilities. LIDAR systems are essential for fully autonomous vehicles, enabling detailed 3D environmental perception and supporting advanced navigation. Continuous advancements in solid-state LIDAR and miniaturization have made the technology more affordable and scalable, encouraging adoption in new autonomous vehicle models.

- By Hardware and Software

On the basis of hardware and software, the autonomous vehicle market is segmented into cameras, GPS systems, and communication systems. The cameras segment dominated the market in 2024, driven by their role in providing real-time visual data for lane detection, object recognition, and traffic sign identification. High-resolution cameras are increasingly paired with AI-powered software to enhance decision-making algorithms, improving safety and navigation accuracy. Widespread adoption is also supported by declining sensor costs and ease of integration into both semi- and fully autonomous vehicles.

Communication systems are projected to witness the fastest growth rate from 2025 to 2032, driven by the rising importance of vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) connectivity. These systems enable real-time data exchange for traffic management, collision avoidance, and fleet coordination. Growing focus on connected vehicle ecosystems, 5G deployment, and smart city initiatives are fueling demand for advanced communication modules in autonomous vehicles.

- By Application

On the basis of application, the autonomous vehicle market is segmented into transportation, logistics, and military & defense. The transportation segment dominated the largest revenue share in 2024, attributed to the increasing adoption of autonomous passenger vehicles in urban areas. Rising demand for safer, efficient, and convenient commuting options is driving growth, along with the integration of semi-autonomous features into commercial ride-hailing services. Government incentives and infrastructure investments in smart mobility solutions further strengthen market dominance.

The logistics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for cost-efficient, round-the-clock operations in goods delivery. Autonomous trucks and last-mile delivery robots are being rapidly deployed to optimize supply chains and reduce dependency on human drivers. Technological advancements in sensors, AI navigation, and fleet management software are accelerating adoption across e-commerce and freight transportation sectors.

- By Level of Automation

On the basis of level of automation, the market is segmented into Level 3, Level 4, and Level 5 vehicles. Level 3 autonomous vehicles dominated the largest revenue share in 2024 due to their widespread implementation and regulatory approvals in multiple regions. These vehicles allow conditional automation where the driver can take control when necessary, offering a balance of safety, comfort, and early exposure to autonomous technology. The maturity of sensor and software ecosystems has enabled faster deployment at a commercial scale.

Level 4 autonomous vehicles are expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing pilot projects and smart city initiatives that support fully driverless operations in defined areas. These vehicles operate without human intervention in most scenarios, making them ideal for ride-hailing services, urban transit, and restricted logistics zones. Continued innovation in AI decision-making, sensor fusion, and high-definition mapping is propelling market expansion for higher levels of automation.

Autonomous Vehicle Market Regional Analysis

- North America dominated the autonomous vehicle market with the largest revenue share of 38% in 2024, driven by significant investments in advanced automotive technologies, supportive regulatory frameworks, and early adoption of connected and autonomous vehicles

- Consumers and commercial operators in the region are increasingly focused on safety, convenience, and efficiency, boosting demand for both semi-autonomous and fully autonomous vehicles

- The presence of major OEMs, technology companies, and robust R&D infrastructure further accelerates market growth. Moreover, rising adoption of smart transportation systems and pilot programs for autonomous mobility services establishes North America as a key hub for autonomous vehicle development

U.S. Autonomous Vehicle Market Insight

The U.S. autonomous vehicle market captured the largest revenue share in North America in 2024, fueled by advanced research in autonomous technologies, AI-enabled driving systems, and widespread testing on public roads. The increasing push from ride-hailing companies, logistics providers, and tech startups for autonomous mobility solutions is driving demand. In addition, government incentives for autonomous vehicle testing, infrastructure modernization, and integration with smart city initiatives further support market expansion. The growing focus on reducing traffic congestion, enhancing road safety, and implementing connected vehicle systems continues to propel the U.S. market.

Europe Autonomous Vehicle Market Insight

The Europe autonomous vehicle market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent safety regulations, emission reduction targets, and growing urban mobility challenges. European countries are investing heavily in autonomous vehicle pilot projects, smart roads, and vehicle-to-infrastructure connectivity, fostering adoption. The market is also supported by rising consumer interest in sustainable, energy-efficient transportation solutions and technologically advanced vehicles. Countries such as Germany, France, and the Netherlands are witnessing growth across passenger transport, logistics, and smart city mobility applications, positioning Europe as a key market for autonomous vehicle deployment.

U.K. Autonomous Vehicle Market Insight

The U.K. autonomous vehicle market is expected to grow at a noteworthy CAGR during the forecast period, driven by strong government initiatives supporting autonomous mobility and a focus on reducing road accidents. The country’s advanced transport infrastructure, robust automotive industry, and adoption of connected vehicle technologies stimulate market expansion. In addition, ride-hailing and fleet operators are increasingly testing semi-autonomous and fully autonomous solutions to enhance operational efficiency. Rising consumer acceptance and urban mobility challenges further contribute to the market’s growth trajectory.

Germany Autonomous Vehicle Market Insight

The Germany autonomous vehicle market is poised to expand significantly, fueled by the country’s strong automotive engineering heritage, technological innovations, and government support for autonomous vehicle testing and deployment. Germany’s focus on smart transportation, AI-enabled vehicles, and Industry 4.0 integration drives adoption across passenger and commercial segments. Moreover, increasing urbanization and the push for sustainable mobility solutions encourage the integration of autonomous vehicles into transportation networks, making Germany a strategic market in Europe.

Asia-Pacific Autonomous Vehicle Market Insight

The Asia-Pacific autonomous vehicle market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising urban populations, rapid technological advancements, and increased investments in smart transportation systems across countries such as China, Japan, and India. The region is witnessing significant government support for autonomous vehicle pilot projects, smart city development, and mobility-as-a-service (MaaS) initiatives. In addition, growing consumer interest in technologically advanced, efficient, and safer transport solutions is accelerating adoption. Manufacturing hubs in the region are also contributing to the development and affordability of autonomous vehicle components, expanding market reach.

Japan Autonomous Vehicle Market Insight

The Japan autonomous vehicle market is gaining momentum due to the country’s technological sophistication, early adoption of connected vehicles, and supportive urban mobility policies. Japan places high importance on safety, convenience, and operational efficiency, driving the adoption of semi-autonomous and fully autonomous vehicles in urban and logistics applications. Integration with IoT-based transport management systems and smart city projects further propels market growth. Moreover, Japan’s aging population is encouraging demand for autonomous mobility solutions that enhance accessibility and reduce reliance on human drivers.

China Autonomous Vehicle Market Insight

The China autonomous vehicle market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, strong government backing, and widespread technological adoption. China is emerging as a global leader in autonomous vehicle testing, smart mobility solutions, and AI-enabled vehicle technologies. High demand from ride-hailing services, logistics providers, and public transportation operators is supporting market expansion. In addition, the development of smart city infrastructure and domestic manufacturing of autonomous vehicle components contributes to the growing availability and adoption of autonomous mobility solutions.

Autonomous Vehicle Market Share

The autonomous vehicle industry is primarily led by well-established companies, including:

- ZF Friedrichshafen AG (Germany)

- Volkswagen AG (Germany)

- Daimler AG (Germany)

- Texas Instruments Incorporated (U.S.)

- DENSO CORPORATION (Japan)

- BYD Company Ltd. (China)

- Robert Bosch GmbH (Germany)

- AB Volvo (Sweden)

- Nissan (Japan)

- BorgWarner Inc. (U.S.)

- Visteon Corporation (U.S.)

- Continental AG (Germany)

- NXP Semiconductors (Netherlands)

- BMW AG (Germany)

- Magna International Inc. (Canada)

- Infineon Technologies AG (Germany)

- Renesas Electronics Corporation (Japan)

- Intel Corporation (U.S.)

- Tesla (U.S.)

- Valeo (France)

Latest Developments in Global Autonomous Vehicle Market

- In October 2023, Uber partnered with Waymo, the autonomous vehicle division of Alphabet, to introduce Waymo’s self-driving cars in Phoenix. This collaboration allows Uber to offer autonomous rides at pricing consistent with traditional services, significantly enhancing Uber’s position in the autonomous ride-hailing market. The partnership demonstrates a growing trend of technology integration between ride-hailing platforms and autonomous vehicle developers, accelerating consumer adoption of driverless mobility solutions

- In August 2023, Baidu expanded its autonomous ride-hailing platform, Apollo Go, to Wuhan Tianhe International Airport. This expansion strengthens Baidu’s presence in the Chinese autonomous mobility market by increasing accessibility and convenience for passengers. It underscores the role of strategic location deployments in accelerating the adoption of autonomous ride services and showcases China’s leadership in large-scale autonomous transportation integration

- In May 2023, Valeo and DiDi Autonomous Driving entered a strategic investment and collaboration agreement. Valeo’s investment and the joint focus on intelligent safety solutions for L4 robotaxis bolster the development of high-level autonomous vehicles in the ride-hailing sector. This partnership is expected to advance market-ready solutions for fully autonomous urban mobility, strengthening the competitive landscape for next-generation autonomous vehicle technology

- In December 2022, Apple announced a one-year delay in the launch of its self-driving electric vehicle, shifting the target date to 2026. This adjustment reflects Apple’s cautious approach to ensuring safety, compliance, and technological readiness. The delay impacts market expectations by temporarily slowing the anticipated entry of Apple into the autonomous vehicle market, while reinforcing its focus on high-quality, fully integrated self-driving solutions

- In October 2022, Ford chose to internally develop lower-level automated driving technology rather than partnering with Argo, whose L4 technology lacked traditional controls such as steering wheels and pedals. This decision emphasizes Ford’s strategic focus on controllable, scalable autonomous solutions while cautiously approaching higher-level automation. It highlights a broader industry trend where established automakers prioritize incremental autonomous advancements over radical deployments to ensure safety, regulatory compliance, and consumer trust

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.