Global Auxin Market

Market Size in USD Million

CAGR :

%

USD

681.12 Million

USD

1,438.94 Million

2024

2032

USD

681.12 Million

USD

1,438.94 Million

2024

2032

| 2025 –2032 | |

| USD 681.12 Million | |

| USD 1,438.94 Million | |

|

|

|

|

Auxin Market Size

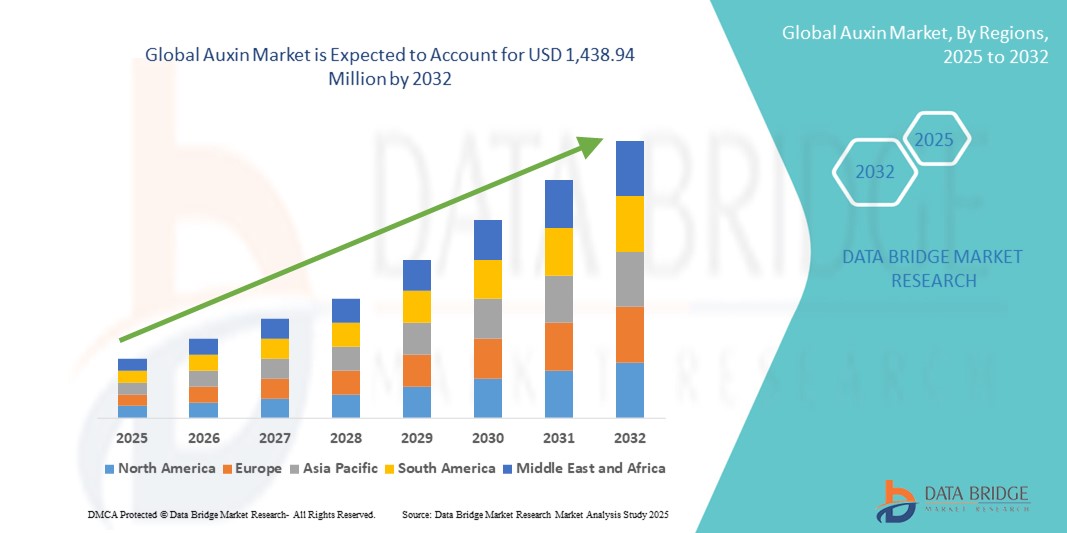

- The global auxin market size was valued at USD 681.12 million in 2024 and is expected to reach USD 1,438.94 million by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for plant growth regulators in modern agriculture, rising global food production needs, and the widespread adoption of sustainable farming practices

- The expansion of organic farming and rising awareness regarding crop quality and productivity enhancement are also contributing significantly to the growing use of auxins across diverse agricultural sectors

Auxin Market Analysis

- The auxin market is witnessing steady expansion due to its critical role in enhancing root initiation, cell elongation, and overall plant growth, making it essential in horticulture and field crop applications

- Technological advancements in agrochemicals, growing emphasis on high-yield crops, and the rising adoption of biostimulants are further propelling demand for auxins among farmers and agronomists worldwide

- North America dominates the global auxin market, accounting for the largest revenue share of 41.2% in 2024, driven by extensive use of crop protection and enhancement technologies across large-scale farming operations in the U.S. and Canada

- Asia-Pacific region is expected to witness the highest growth rate in the global auxin market, driven by a large agrarian economy, rapid population growth, expanding agricultural sector, and favorable government policies encouraging the use of plant growth regulators across major crop types

- The synthesised segment held the largest market revenue share in 2024, driven by its consistent quality, scalability, and widespread use in commercial agricultural applications. Synthetic auxins such as Indole-3-butyric acid (IBA) and 2,4-Dichlorophenoxyacetic acid (2,4-D) are extensively utilized in crop enhancement, tissue culture, and weed control programs due to their reliability and cost-efficiency. Their ability to be tailored for specific crops and growing conditions supports broad adoption across geographies and farming systems

Report Scope and Auxin Market Segmentation

|

Attributes |

Auxin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption of Organic Farming Practices Across Developing Regions • Increasing Demand for High-Yield and Stress-Resistant Crops Through Plant Growth Regulators |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Auxin Market Trends

“Rising Integration of Auxins in Micropropagation and Tissue Culture Techniques”

- Commercial tissue culture laboratories are increasingly incorporating auxins such as IAA and NAA into propagation protocols for crops including banana, sugarcane, and ginger, owing to their effectiveness in promoting callus formation, root initiation, and uniform plantlet development, which enhances productivity and quality consistency in high-demand horticultural markets

- The floriculture and ornamental plant industries are utilizing auxins to accelerate rooting and optimize shoot elongation in plantlets propagated via in-vitro techniques, particularly for premium flowers such as roses, orchids, and anthuriums, resulting in faster nursery cycles and improved commercial turnover for growers

- Continuous innovation in synthetic auxin formulations is driving the availability of stable, crop-specific blends that offer higher bioavailability and ease of absorption, enabling more efficient application in both commercial labs and agricultural R&D, thereby improving the scalability of tissue culture systems across regions

- For instance, leading horticulture producers in the Netherlands are deploying auxin-supported micropropagation for tulips and orchids, allowing large-scale production with minimal genetic variability, which supports their strong export presence in global floral markets

- These advancements are accelerating the adoption of auxins in controlled plant propagation environments, reinforcing their role in scalable and sustainable agricultural production systems that meet modern market demands for uniformity, volume, and efficiency

Auxin Market Dynamics

Driver

“Expanding Application of Auxins in Modern Agricultural Practices”

• Auxins play a central role in regulating plant physiology including apical dominance, root elongation, and fruit set, and are being increasingly applied through foliar sprays and seed treatments to enhance crop vigor and yield stability, especially under climate-induced stress conditions such as drought and heat

• Major cereal and horticultural crops such as rice, wheat, apples, and tomatoes are seeing increased use of auxins during critical growth stages, helping farmers improve pollination, reduce flower drop, and synchronize fruit development, which directly translates into higher marketable yield and lower wastage

• Synthetic auxins such as 2,4-D are also being utilized in integrated weed management programs for selective herbicidal action in crops such as maize and soybeans, delivering both weed control and crop growth stimulation, which improves cost-efficiency and field productivity in large-scale operations

• For instance, soybean farmers in Brazil are leveraging 2,4-D to manage broadleaf weeds while also promoting vegetative growth, resulting in significant yield improvements and streamlined field operations across high-acreage plantations in key agricultural zones

• These applications position auxins as multifunctional inputs that align with modern precision farming needs, contributing to a more resilient, productive, and economically viable global agricultural landscape driven by efficiency and output maximization

Restraint/Challenge

“Environmental and Health Concerns Related to Synthetic Auxins”

• Excessive or misregulated use of synthetic auxins poses ecological risks including groundwater contamination, soil degradation, and toxicity buildup, especially in areas with high application rates and limited regulatory enforcement, raising sustainability concerns among environmental agencies and policymakers

• Certain synthetic auxins such as 2,4-D and MCPA have been linked to health hazards for humans and animals when improperly handled or applied, leading to increased demand for personal protective equipment, stricter labeling requirements, and resistance from organic farming communities and health-conscious consumers

• Growing pressure from regulatory authorities and environmental watchdogs is prompting a shift toward bio-based and naturally derived plant growth regulators, compelling manufacturers to invest in research and reformulation, which increases production costs and could limit short-term scalability in price-sensitive regions

• For instance, the European Union has implemented strict residue limits and environmental assessments for 2,4-D-based products, forcing agrochemical companies to reformulate or withdraw certain products from the market, thereby slowing adoption rates in compliance-heavy regions despite existing demand

• These challenges are reshaping the competitive landscape by elevating the importance of sustainability and regulatory compliance, pushing the auxin market toward innovation in safer alternatives that can meet environmental standards without compromising agricultural efficacy or market access

Auxin Market Scope

The market is segmented on the basis of type, function, formulation, and application.

- By Type

On the basis of type, the auxin market is segmented into natural, synthesised, and others. The synthesised segment held the largest market revenue share in 2024, driven by its consistent quality, scalability, and widespread use in commercial agricultural applications. Synthetic auxins such as Indole-3-butyric acid (IBA) and 2,4-Dichlorophenoxyacetic acid (2,4-D) are extensively utilized in crop enhancement, tissue culture, and weed control programs due to their reliability and cost-efficiency. Their ability to be tailored for specific crops and growing conditions supports broad adoption across geographies and farming systems.

The natural segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for organic farming inputs and sustainable agricultural practices. Natural auxins derived from plant or microbial sources are gaining traction among environmentally conscious growers seeking eco-friendly solutions. This growth is also driven by regulatory support and the rising popularity of residue-free produce among consumers.

- By Function

On the basis of function, the market is segmented into plant growth promoters and plant growth inhibitors. The plant growth promoters segment dominated the market in 2024, owing to the critical role of auxins in stimulating root initiation, apical dominance, and cell elongation during early crop development stages. Farmers widely rely on auxin-based products to enhance crop establishment and vegetative growth under varied environmental conditions. These promoters are especially prevalent in horticulture and nursery operations for achieving faster, uniform growth.

The plant growth inhibitors segment is expected to witness the fastest growth rate from 2025 to 2032, due to expanding research into auxin analogs that restrict unwanted shoot growth or induce abscission in fruit-bearing crops. These inhibitors are being increasingly integrated into crop management strategies where controlling growth patterns is essential for productivity and harvest efficiency.

- By Formulation

On the basis of formulation, the market is segmented into water-dispersible & water-soluble granules, solutions, and wettable powders. The solutions segment accounted for the largest market share in 2024, driven by ease of application and superior absorption by plants. Liquid auxin formulations are favored in both foliar and soil-based delivery systems, particularly in horticulture and field crops requiring targeted nutrient uptake. The segment’s dominance is further supported by compatibility with precision agriculture tools and fertigation methods.

The wettable powders segment is expected to witness the fastest growth rate from 2025 to 2032, due to their long shelf life, ease of transport, and cost-effectiveness in large-scale farming. These powders allow for flexible concentration adjustment and are often chosen for bulk procurement by distributors serving smallholder farmers across emerging markets.

- By Application

On the basis of application, the auxin market is segmented into cereals and grains, fruits and vegetables, oilseed and pulses, plantation crops, grasslands, and others. The fruits and vegetables segment held the largest revenue share in 2024, fueled by high-value crop cultivation where auxins are used extensively to enhance fruit set, minimize flower drop, and improve produce quality. Auxin applications in tomatoes, apples, bananas, and citrus fruits are particularly prominent for achieving export-grade consistency and yield.

The plantation crops segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing use of auxins in crops such as tea, coffee, and rubber for promoting uniform sprouting, leaf expansion, and tapping efficiency. Plantation growers are adopting auxin-based formulations to optimize crop cycles and meet rising global demand for premium commodity crops.

Auxin Market Regional Analysis

• North America dominates the global auxin market, accounting for the largest revenue share of 41.2% in 2024, driven by extensive use of crop protection and enhancement technologies across large-scale farming operations in the U.S. and Canada

• Farmers in the region are increasingly turning to auxin-based solutions to optimize yields, regulate plant development, and improve crop uniformity, especially in corn, soybean, and wheat production

• This growth is supported by advanced agricultural infrastructure, high adoption of biotechnology, and strong regulatory frameworks that encourage the use of efficient plant growth regulators

U.S. Auxin Market Insight

The U.S. auxin market captured the largest revenue share in the North America region in 2024, attributed to its highly mechanized farming sector and the growing emphasis on maximizing productivity per acre. The country is witnessing significant use of synthetic and bio-based auxins in precision agriculture, supported by investments in agri-tech innovation, sustainable practices, and increasing demand for quality crop output.

Asia-Pacific Auxin Market Insight

The Asia-Pacific auxin market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rapid population growth, rising food demand, and government initiatives promoting modern agricultural inputs. Countries such as China, India, and Indonesia are increasingly relying on plant growth regulators to improve productivity, manage plant stress, and enhance crop quality. The widespread use of auxins in rice, maize, and horticultural crops is a key contributor to regional market expansion.

China Auxin Market Insight

The China auxin market held the highest revenue share within the Asia-Pacific region in 2024, driven by large-scale farming practices and state-supported efforts to enhance agricultural efficiency. Domestic manufacturers are actively involved in developing advanced formulations, while farmers use auxins to improve plant vigor and resistance to adverse conditions. The push toward sustainable farming and reduced chemical dependency is also influencing adoption patterns.

Japan Auxin Market Insight

The Japan auxin market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's focus on high-value horticultural crops and advanced farming techniques. Japanese growers are adopting auxins to enhance fruit development, regulate plant growth, and extend shelf life in crops such as apples, tomatoes, and strawberries. In addition, the country's emphasis on research-driven agriculture and sustainable practices is supporting the gradual rise in auxin usage across indoor and outdoor farming systems.

Europe Auxin Market Insight

The Europe auxin market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption of organic farming and environmentally responsible agricultural practices. Countries such as Germany, France, and Italy are focusing on sustainable crop enhancement techniques, including auxin usage, to comply with stringent environmental regulations and meet growing consumer demand for eco-friendly food production.

Germany Auxin Market Insight

The Germany auxin market is expected to witness the fastest growth rate from 2025 to 2032, supported by advanced agricultural practices and robust demand for high-yield, high-quality crops. German farmers are incorporating both natural and synthesized auxins into precision agriculture systems, while continuous research and innovation in plant physiology are enhancing product performance and application efficiency.

U.K. Auxin Market Insight

The U.K. auxin market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising popularity of organic farming and the need for environmentally sound plant growth solutions. Farmers are using auxin-based products to boost rooting, stem elongation, and fruit setting in vegetables, soft fruits, and ornamental plants. The implementation of government-led sustainability targets, along with a well-developed distribution network for agro-inputs, is further encouraging the adoption of both natural and synthetic auxins in the country.

Auxin Market Share

The Auxin industry is primarily led by well-established companies, including:

- Nufarm (Australia)

- Dow (U.S.)

- ADAMA (Israel)

- BASF (Germany)

- FMC Corporation (U.S.)

- NIPPON SODA CO., LTD. (Japan)

- Valent BioSciences LLC (U.S.)

- Arysta LifeScience Corporation (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- Bayer AG (Germany)

Latest Developments in Global Auxin Market

- In April 2020, Sumitomo Chemical Co., Ltd. completed the acquisition of the South American subsidiaries of Nufarm Ltd., marking a strategic expansion move. This development is intended to strengthen Sumitomo’s sales and development network across key agricultural markets in Brazil, Argentina, Chile, and Colombia. By leveraging these local subsidiaries, the company aims to enhance the distribution and reach of its plant growth regulator products. This acquisition is expected to improve market penetration, increase customer engagement, and support long-term growth in the Latin American crop protection and plant growth segment. The move significantly boosts Sumitomo’s competitive positioning in the region’s growing agriculture sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.