Global Avian Influenza Drug Market

Market Size in USD Million

CAGR :

%

USD

774.85 Million

USD

1.25 Million

2024

2032

USD

774.85 Million

USD

1.25 Million

2024

2032

| 2025 –2032 | |

| USD 774.85 Million | |

| USD 1.25 Million | |

|

|

|

|

Avian Influenza Drug Market Size

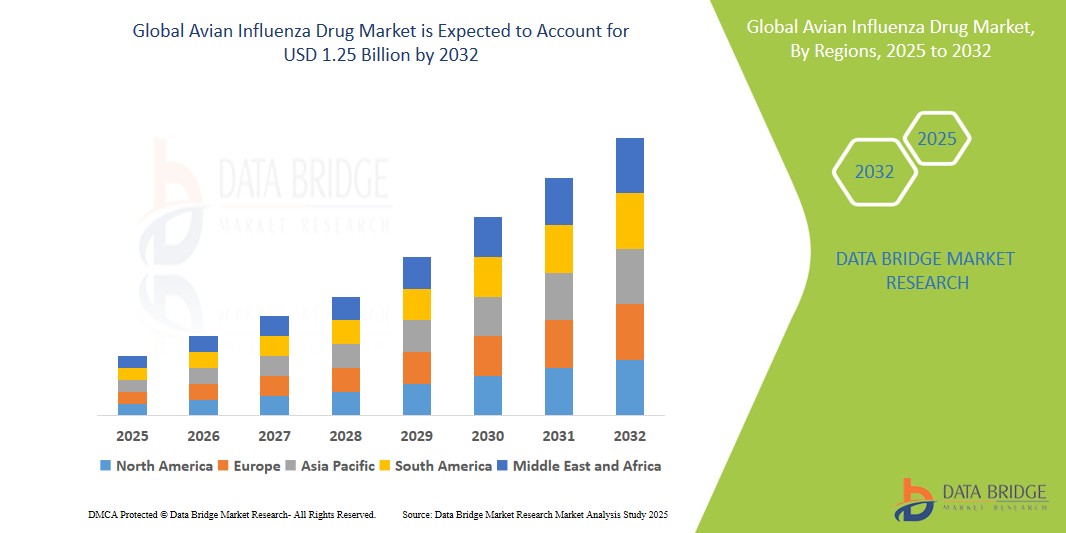

- The global avian influenza vaccines market was valued at USD 774.85 Million in 2024 and is expected to reach USD 1.25 Billion by 2032, registering a CAGR of 7.07% during the forecast period

- This growth is driven by factors such as the rising prevalence of avian influenza outbreaks, increasing awareness about poultry health, and advancements in vaccine technologies

Avian Influenza Drug Market Analysis

- Avian influenza vaccines are crucial in controlling and preventing outbreaks of avian flu, which can significantly affect poultry populations and human health. These vaccines are designed to protect poultry from various strains of the virus, including H5, H7, and H9.

- The demand for these vaccines is primarily driven by the increased incidence of avian influenza outbreaks and the growing need for biosecurity in poultry farming to protect both animal and public health.

- The Asia-Pacific region is expected to dominate the avian influenza vaccines market due to its large poultry farming industry and frequent outbreaks of avian influenza.

- North America and Europe are expected to witness moderate growth, with an increasing focus on vaccination programs to control the spread of avian influenza and prevent economic losses in the poultry industry.

- The H5 strain vaccine segment is expected to hold the largest market share, accounting for 46.9% of the total market, due to the frequent outbreaks of this strain in poultry farms. This leads to increased vaccination demand, as controlling H5 avian influenza is critical for maintaining poultry health and preventing widespread outbreaks.

Report Scope and Avian Influenza Drug Market Segmentation

|

Attributes |

Avian Influenza Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Avian Influenza Drug Market Trends

“Emergence of Novel Vaccine Technologies for Enhanced Protection”

- A significant trend in the avian influenza vaccines market is the emergence of novel vaccine technologies, including recombinant vector vaccines and DNA-based vaccines

- These advanced technologies offer enhanced immunity, longer protection duration, and improved safety profiles, reducing the need for frequent booster doses

- For instance, recent developments in live recombinant vaccines have shown improved efficacy in targeting multiple avian influenza virus strains simultaneously, especially in high-risk poultry regions.

- These innovations are reshaping preventive strategies in poultry farming, improving disease control, and accelerating the adoption of next-generation avian influenza vaccines across global markets.

Avian Influenza Drug Market Dynamics

Driver

“Increasing Frequency of Avian Influenza Outbreaks”

- The growing frequency of avian influenza outbreaks globally is a key factor driving the demand for avian influenza vaccines. Outbreaks have severe consequences for poultry industries, leading to mass culling, trade restrictions, and economic losses.

- Countries with large poultry farming industries are ramping up vaccination programs to prevent viral spread and safeguard food security.

- The global push toward preventive healthcare in animals is also contributing to sustained vaccine demand.

For instance,

- In March 2023, the World Organization for Animal Health (WOAH) reported a surge in H5N1 avian influenza outbreaks across Europe and Asia, prompting mass vaccination efforts to contain the virus.

- As outbreaks become more frequent and widespread, the demand for effective and rapid-response avian influenza vaccines continues to rise, fueling market growth

Opportunity

“Expansion of Government and International Vaccination Programs”

- Global and regional governments, along with organizations like the FAO and WHO, are increasingly supporting avian influenza vaccination as part of biosecurity measures to ensure food supply and prevent zoonotic transmission

- These initiatives provide funding and logistic support for widespread immunization in poultry populations, especially in developing regions with limited access to veterinary services

- The strategic stockpiling of vaccines by governments is also creating opportunities for vaccine manufacturers

For instance,

- In September 2024, the FAO launched a coordinated vaccination campaign across Southeast Asia, targeting high-risk zones with a focus on controlling the spread of H5 and H9 strains through subsidized vaccines and veterinary infrastructure

- Such initiatives not only mitigate the risk of outbreaks but also open new markets for vaccine manufacturers seeking government and institutional contracts.

Restraint/Challenge

“Strain Variability and Vaccine Efficacy Concerns”

- One of the major challenges in the avian influenza vaccines market is the high mutation rate of the virus, leading to strain variability and reduced vaccine efficacy over time

- Constant monitoring and reformulation of vaccines are required to address new and evolving strains, which increases production costs and delays vaccine deployment

- Additionally, incomplete or improperly implemented vaccination campaigns can contribute to viral persistence and mutations

For instance,

- According to a 2022 study published in the journal Veterinary Microbiology, mismatches between circulating H7 strains and available vaccines in certain regions resulted in limited protection, underlining the need for more adaptable vaccine platforms

- These challenges hinder the consistent effectiveness of vaccines, posing a barrier to sustained immunity and potentially limiting market penetration in regions with diverse viral profiles

Avian Influenza Drug Market Scope

The market is segmented on the basis vaccine type, application, and strain.

|

Segmentation |

Sub-Segmentation |

|

By Vaccine Type |

|

|

By Application |

|

|

By Strain |

|

In 2025, the H5 strain vaccine is projected to dominate the market with the largest share in the strain segment

The H5 strain vaccine segment is expected to dominate the global avian influenza vaccines market with the largest share of 47.6% in 2025 due to the high frequency and severity of H5 strain outbreaks in poultry farms worldwide. As one of the most contagious and economically damaging strains, targeted vaccination against H5 is critical for outbreak prevention. Growing government vaccination initiatives and international efforts to curb H5N1 transmission further reinforce the demand, contributing significantly to this segment’s market dominance.

The inactivated vaccines segment is expected to account for the largest share during the forecast period in the vaccine type market

In 2025, the inactivated vaccines segment is projected to lead the avian influenza vaccines market with the largest market share of 53.8%, owing to its proven safety profile and effectiveness in providing strong immune protection. These vaccines are widely used in commercial poultry due to their stability, ease of storage, and minimal risk of reversion to virulence. The increasing implementation of preventive vaccination programs and regulatory approvals for inactivated vaccines across high-risk regions drive the continued growth and dominance of this segment.

Avian Influenza Drug Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Avian Influenza Vaccines Market”

- Asia-Pacific dominates the global avian influenza vaccines market, primarily due to the high concentration of poultry farming in countries like China, India, Indonesia, and Vietnam, which are frequently affected by avian influenza outbreaks

- China holds a significant share owing to its massive poultry population and proactive government vaccination campaigns aimed at controlling recurring H5 and H9 strain infections

- The region’s dominance is further driven by supportive regulatory frameworks, increasing awareness among poultry farmers, and government-backed mass immunization programs

- High poultry consumption rates, economic dependence on the poultry industry, and rising investment in preventive animal healthcare continue to reinforce the region’s leadership in the market.

“Latin America is Projected to Register the Highest CAGR in the Avian Influenza Vaccines Market”

- Latin America is expected to witness the highest growth rate in the avian influenza vaccines market during the forecast period, fueled by growing poultry production and export activities, especially in countries like Brazil, Argentina, and Mexico

- Brazil, as one of the world’s leading poultry exporters, is increasingly focusing on biosecurity and vaccination strategies to meet international trade requirements and prevent disease outbreaks

- Rising concerns over zoonotic disease transmission and government mandates for avian influenza prevention are encouraging wider vaccine adoption across commercial poultry farms

- Increased investment in animal health infrastructure, growing awareness about disease control, and expanding access to veterinary healthcare in rural and peri-urban regions are expected to further accelerate market growth in this region.

Avian Influenza Drug Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Sanofi (France)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Mallinckrodt (US)

- Elanco (US)

- Boehringer Ingelheim International GmbH. (Germany)

- GlaxoSmithKline plc (UK)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Eli Lilly and Company (US)

- Merck & Co., Inc. (US)

- AstraZeneca (UK)

- Johnson & Johnson Private Limited (US)

- Virbac (France)

- Vetoquinol (France)

- Zoetis (US)

- Ceva (France)

- Bimeda, Inc. (US)

- Phibro Animal Health Corporation (US)

- HIPRA (Spain)

- Medion (Germany)

- YEBIO BIOENGINEERING CO., LTD OF QINGDAO (China)

Latest Developments in Global Avian Influenza Drug Market

- In December 2022, Hester Biosciences Ltd., an India-based animal and poultry vaccine manufacturing company, acquired the technology from the Indian Council of Agricultural Research and the National Institute of High-Security Animal Diseases (ICAR-NIHSAD) for an undisclosed amount. With this technology acquisition, the aim of Hester Biosciences acquiring the technology to develop an inactivated H9N2 avian influenza vaccine for poultry is to provide a solution to the significant economic losses faced by Indian poultry farmers due to periodic outbreaks of the disease. The Indian Council of Agricultural Research, National Institute of High Security Animal Diseases (ICAR-NIHSAD), is an India-based research institute that offers technology for aviation flu vaccines and diagnostic tests for avian influenza.

- In February 2024, Zoetis Inc. announced the launch of a new recombinant avian influenza vaccine targeting emerging H5N1 variants. In June 2024, Ceva Santé Animale introduced its Vectormune AI H9 vaccine across Asia-Pacific markets to help manage rising H9N2 outbreaks. Both launches aim to enhance protection against evolving strains and improve poultry health outcomes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AVIAN INFLUENZA DRUG MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AVIAN INFLUENZA DRUG MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AVIAN INFLUENZA DRUG MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 REGULATORY SCENARIO

6 PREMIUM INSIGHTS

6.1 PESTLE ANALYSIS

6.2 PORTER’S FIVE FORCES

7 INDUSTRY INSIGHTS

8 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

8.1 PRICE IMPACT

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC DECISION FOR MANUFACTURER/SERVICE PROVIDER

8.5 CONCLUSION

9 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY TREATMENT

9.1 OVERVIEW

9.2 DRUGS

9.2.1 OSELTAMIVIR (TAMIFLU)

9.2.2 ZANAMIVIR (RELENZA)

9.2.3 RIMANTADINE

9.2.4 OTHERS

9.3 VACCINES

9.3.1 NON-ADJUVANTED

9.3.2 ADJUVANTED

9.3.2.1. SUBVIRION VACCINES

9.3.2.1.1. ALUMINIUM

9.3.2.1.2. AS03

9.3.2.1.3. MF59

9.3.2.1.4. OTHERS

9.3.2.2. WHOLE-VIRION VACCINES

9.3.2.3. VIROSOMAL VACCINE

9.3.3 MODIFIED VACCINIA VIRUS VECTOR VACCINE

9.3.4 LIVE ATTENUATED VACCINE

9.3.5 OTHERS

9.4 OTHERS

10 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY STRAIN TYPE

10.1 OVERVIEW

10.2 H5N1

10.3 H5N6

10.4 H6N1

10.5 H7N4

10.6 H7N9

10.7 H9N2

10.8 H10N8

10.9 OTHERS

11 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY ROUTE OF ADMINISTRATION

11.1 OVERVIEW

11.2 ORAL

11.3 INJECTABLE

12 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY TYPE

12.1 OVERVIEW

12.2 CHICKEN

12.2.1 HIGHLY PATHOGENIC AVIAN INFLUENZA (HPAI)

12.2.2 LOW PATHOGENIC AVIAN INFLUENZA (LPAI)

12.3 TURKEY

12.4 GOOSE

12.5 DUCK

12.6 OTHERS

13 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS & CLINICS

13.3 HOME CARE SETTING

13.4 ACADEMIC AND RESEARCH INSTITUTES

13.5 OTHERS

14 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT TENDER

14.3 RETAIL SALES

14.4 ONLINE PHARMACY

14.5 OTHERS

15 GLOBAL AVIAN INFLUENZA DRUG MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.2 COMPANY SHARE ANALYSIS: EUROPE

15.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.4 MERGERS & ACQUISITIONS

15.5 NEW PRODUCT DEVELOPMENT & APPROVALS

15.6 EXPANSIONS

15.7 REGULATORY CHANGES

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL AVIAN INFLUENZA DRUG MARKET, BY REGION

16.1 GLOBAL AVIAN INFLUENZA DRUG MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1.1 NORTH AMERICA

16.1.1.1. U.S.

16.1.1.2. CANADA

16.1.1.3. MEXICO

16.1.2 EUROPE

16.1.2.1. GERMANY

16.1.2.2. FRANCE

16.1.2.3. U.K.

16.1.2.4. ITALY

16.1.2.5. SPAIN

16.1.2.6. RUSSIA

16.1.2.7. TURKEY

16.1.2.8. BELGIUM

16.1.2.9. NETHERLANDS

16.1.2.10. SWITZERLAND

16.1.2.11. REST OF EUROPE

16.1.3 ASIA-PACIFIC

16.1.3.1. JAPAN

16.1.3.2. CHINA

16.1.3.3. SOUTH KOREA

16.1.3.4. INDIA

16.1.3.5. AUSTRALIA

16.1.3.6. SINGAPORE

16.1.3.7. THAILAND

16.1.3.8. MALAYSIA

16.1.3.9. INDONESIA

16.1.3.10. PHILIPPINES

16.1.3.11. REST OF ASIA-PACIFIC

16.1.4 SOUTH AMERICA

16.1.4.1. BRAZIL

16.1.4.2. ARGENTINA

16.1.4.3. REST OF SOUTH AMERICA

16.1.5 MIDDLE EAST AND AFRICA

16.1.5.1. SOUTH AFRICA

16.1.5.2. SAUDI ARABIA

16.1.5.3. UAE

16.1.5.4. EGYPT

16.1.5.5. ISRAEL

16.1.5.6. REST OF MIDDLE EAST AND AFRICA

16.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL AVIAN INFLUENZA DRUG MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL AVIAN INFLUENZA DRUG MARKET, COMPANY PROFILE

18.1 GLAXOSMITHKLINE PLC

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPEMENTS

18.2 F. HOFFMANN-LA ROCHE LTD

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPEMENTS

18.3 ALLERGAN

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPEMENTS

18.4 NOVARTIS AG

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPEMENTS

18.5 BAXTER

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPEMENTS

18.6 BIOCRYST PHARMACEUTICALS, INC.

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPEMENTS

18.7 UNM PHARMA INC.

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPEMENTS

18.8 CSL LIMITED

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPEMENTS

18.9 EMERGENT BIOSOLUTIONS INC.

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPEMENTS

18.1 NOVAVAX, INC.

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPEMENTS

18.11 MEDIGEN BIOTECHNOLOGY CORP

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPEMENTS

18.12 BIONDVAX PHARMACEUTICALS LTD.

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPEMENTS

18.13 INOVIO PHARMACEUTICALS

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPEMENTS

18.14 VAXART, INC.

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPEMENTS

18.15 JOHNSON & JOHNSON SERVICES, INC.

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPEMENTS

18.16 SINOVAC

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPEMENTS

18.17 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPEMENTS

18.18 CEVA

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPEMENTS

18.19 ZOETIS

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPEMENTS

18.2 QIANYUANHAO BIOLOGICAL CO., LTD.

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPEMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

19 RELATED REPORTS

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.