Global Aviation Test Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

15.08 Billion

2025

2033

USD

1.44 Billion

USD

15.08 Billion

2025

2033

| 2026 –2033 | |

| USD 1.44 Billion | |

| USD 15.08 Billion | |

|

|

|

|

Aviation Test Equipment Market Size

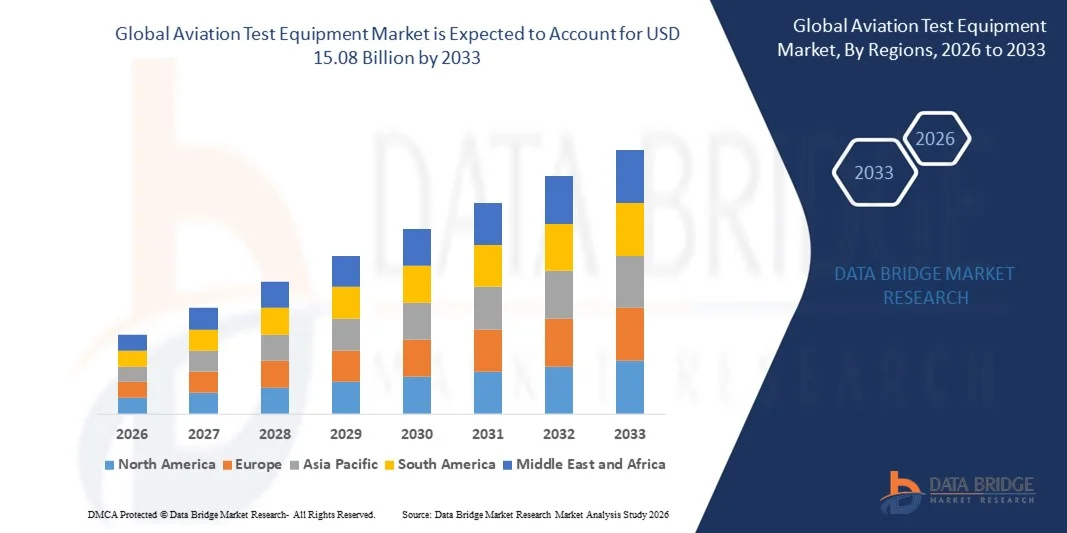

- The global aviation test equipment market size was valued at USD 1.44 billion in 2025 and is expected to reach USD 15.08 billion by 2033, at a CAGR of 5.80% during the forecast period

- The market growth is largely driven by increasing demand for advanced aircraft testing solutions across commercial, military, and defense aviation sectors, fueled by stringent safety regulations and the need for precise diagnostics and maintenance

- Furthermore, rising adoption of automated and digital testing systems, predictive maintenance solutions, and IoT-enabled equipment is enhancing operational efficiency and reliability, thereby accelerating the uptake of aviation test equipment and significantly boosting market expansion

Aviation Test Equipment Market Analysis

- Aviation test equipment comprises diagnostic, structural, propulsion, and avionics testing systems designed to evaluate, monitor, and ensure the performance, safety, and reliability of aircraft and associated components. These systems are used across MRO (maintenance, repair, and overhaul), manufacturing, and pilot training applications

- The escalating demand for aviation test equipment is primarily fueled by fleet expansion, modernization of aging aircraft, increased military and defense spending, and the growing adoption of automated, high-precision testing solutions to optimize maintenance operations and reduce operational downtime

- North America dominated the aviation test equipment market with a share of over 45% in 2025, due to the presence of a large aerospace manufacturing base, increasing defense budgets, and the growing need for advanced aircraft testing solutions

- Asia-Pacific is expected to be the fastest growing region in the aviation test equipment market during the forecast period due to rising airline fleets, increased aircraft manufacturing, and rapid urbanization in countries such as China, Japan, and India

- Manned aircraft segment dominated the market with a market share of 62.8% in 2025, due to the large global fleet of commercial and military aircraft requiring rigorous testing before deployment. Manned aircraft rely heavily on comprehensive system diagnostics to ensure pilot safety, regulatory compliance, and mission readiness, which sustains the demand for advanced test equipment. Manufacturers and MRO service providers prioritize robust testing solutions capable of handling complex avionics, electrical, hydraulic, and pneumatic systems, reinforcing market dominance

Report Scope and Aviation Test Equipment Market Segmentation

|

Attributes |

Aviation Test Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aviation Test Equipment Market Trends

Increasing Adoption of Automated and Digital Aircraft Testing Systems

- A prominent trend in the aviation test equipment market is the rising adoption of automated and digital testing solutions, driven by the growing need for faster, accurate, and reliable aircraft diagnostics across commercial and defense sectors. These systems are enhancing the efficiency of maintenance, repair, and overhaul (MRO) operations, while enabling precise data collection for predictive maintenance and safety compliance

- For instance, Honeywell and Rockwell Collins provide digital test benches and automated diagnostic platforms that allow aircraft manufacturers and airlines to perform comprehensive system checks efficiently. Such solutions are improving fault detection, reducing human error, and shortening aircraft turnaround times

- The integration of digital avionics testing systems is gaining traction as operators increasingly require real-time monitoring and performance assessment of complex aircraft systems. This trend is positioning automated test equipment as essential for modern aircraft development, certification, and operational reliability

- Maintenance, repair, and overhaul service providers are adopting advanced testing solutions for both legacy and next-generation aircraft platforms. Applications such as automated flight control system testing and engine diagnostics are driving innovation in multifunctional test equipment

- There is an increasing focus on reducing aircraft downtime and operational disruptions through rapid testing cycles supported by automated equipment. These solutions are facilitating continuous airworthiness and operational readiness, especially for airlines operating large fleets

- The demand for multifunctional, portable, and networked testing platforms is expanding as they allow seamless integration with aircraft systems and data management tools. This trend is reinforcing the shift toward digitalized, predictive, and connected aviation maintenance ecosystems

Aviation Test Equipment Market Dynamics

Driver

Rising Demand for Advanced Maintenance and Diagnostic Solutions

- The aviation industry is witnessing growing demand for sophisticated maintenance and diagnostic solutions that can provide detailed insights into aircraft health, system performance, and predictive maintenance requirements. These solutions enable operators to optimize maintenance schedules, reduce operational costs, and improve flight safety

- For instance, companies such as GE Aviation offer advanced diagnostic and health monitoring solutions that allow airlines to track engine performance and predict maintenance needs accurately. Such systems enhance fleet reliability, minimize unplanned downtime, and extend the service life of aircraft components

- The modernization of airline fleets and the increasing complexity of aircraft systems are driving adoption of integrated test solutions that combine hardware and software analytics. These platforms support more efficient troubleshooting, calibration, and system validation across multiple aircraft subsystems

- The defense sector is increasingly relying on automated and networked test equipment to meet stringent operational readiness and reliability requirements. Applications include avionics testing, radar system diagnostics, and electronic warfare equipment maintenance

- The emphasis on operational safety, regulatory compliance, and lifecycle management continues to strengthen this driver. Advanced test and diagnostic solutions are becoming indispensable for airlines, MRO providers, and OEMs aiming to improve efficiency, safety, and reliability

Restraint/Challenge

High Cost and Complexity of Sophisticated Test Equipment

- The aviation test equipment market faces significant challenges due to the high cost and technical complexity of sophisticated testing solutions, which often require specialized knowledge, calibration, and maintenance. These factors increase the total cost of ownership and may limit adoption among smaller operators and MRO providers

- For instance, companies such as Curtiss-Wright provide high-precision flight control and avionics test systems that involve intricate design, integration, and software configuration. Such complexity necessitates trained personnel and increases acquisition and operational expenses

- Developing multifunctional and automated test equipment demands advanced hardware, proprietary software, and rigorous compliance with aviation standards, which prolongs deployment timelines and elevates costs

- The reliance on rare components, high-grade materials, and specialized electronic assemblies introduces supply chain vulnerabilities and affects production scalability. This increases the financial and logistical challenges for manufacturers and operators alike

- Market growth is constrained by the difficulty of balancing performance, reliability, and cost-effectiveness while meeting stringent aviation regulatory requirements. These challenges collectively pressure manufacturers to innovate efficiently while ensuring safety and operational excellence

Aviation Test Equipment Market Scope

The market is segmented on the basis of system, type of aircraft, and application.

- By System

On the basis of system, the aviation test equipment market is segmented into power test equipment, pneumatic test equipment, hydraulic test equipment, electrical test equipment, and others. The electrical test equipment segment dominated the largest market revenue share in 2025, driven by its critical role in verifying aircraft electrical systems, avionics, and onboard electronics. Electrical test equipment is widely adopted due to its ability to ensure system reliability, compliance with aviation standards, and support for predictive maintenance practices. The market sees strong demand for this segment owing to the increasing complexity of aircraft electrical systems and the growing focus on safety and operational efficiency. Integration with advanced diagnostic software and automated testing solutions further enhances the appeal of electrical test equipment among aerospace manufacturers and MRO providers.

The pneumatic test equipment segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising adoption in both commercial and military aircraft testing. Pneumatic systems are essential for flight control, braking, and landing gear operations, and their precise testing ensures operational safety and efficiency. Advancements in compact and automated pneumatic test rigs allow aerospace engineers to conduct faster, more accurate testing, reducing downtime and maintenance costs. Increasing demand for unmanned aircraft with lightweight, reliable pneumatic components also contributes to market growth, while regulatory requirements for system validation reinforce the segment’s adoption.

- By Type of Aircraft

On the basis of type of aircraft, the aviation test equipment market is segmented into manned aircraft and unmanned aircraft. The manned aircraft segment dominated the market revenue share of 62.8% in 2025, driven by the large global fleet of commercial and military aircraft requiring rigorous testing before deployment. Manned aircraft rely heavily on comprehensive system diagnostics to ensure pilot safety, regulatory compliance, and mission readiness, which sustains the demand for advanced test equipment. Manufacturers and MRO service providers prioritize robust testing solutions capable of handling complex avionics, electrical, hydraulic, and pneumatic systems, reinforcing market dominance.

The unmanned aircraft segment is projected to witness the fastest growth from 2026 to 2033, fueled by the rapid proliferation of drones for surveillance, cargo delivery, and military operations. Increasing adoption of UAVs in commercial sectors, including logistics and agriculture, demands reliable, precise, and portable testing solutions. Innovations in miniaturized and automated test systems specifically designed for UAV components accelerate market growth, while regulatory standards for unmanned aircraft safety and performance further drive investment in this segment.

- By Application

On the basis of application, the aviation test equipment market is segmented into military and commercial. The military segment dominated the largest market revenue share in 2025, driven by stringent safety standards and the critical need for precise, mission-ready aircraft systems. Military aviation demands advanced testing of avionics, weapons integration, propulsion systems, and communication networks to ensure operational reliability under extreme conditions. Governments and defense contractors invest heavily in sophisticated test equipment capable of handling complex, high-performance aircraft, sustaining the segment’s dominance.

The commercial segment is expected to witness the fastest growth from 2026 to 2033, fueled by the expansion of passenger and cargo air transport, particularly in emerging markets. Increasing fleet modernization programs and rising demand for efficient maintenance, repair, and overhaul operations drive the adoption of advanced testing solutions. Commercial aviation operators seek test equipment that ensures safety, minimizes downtime, and supports predictive maintenance strategies, while technological integration with smart diagnostics and automated systems further accelerates market growth.

Aviation Test Equipment Market Regional Analysis

- North America dominated the aviation test equipment market with the largest revenue share of over 45% in 2025, driven by the presence of a large aerospace manufacturing base, increasing defense budgets, and the growing need for advanced aircraft testing solutions

- The region’s aerospace companies and MRO providers highly value the precision, reliability, and automation offered by advanced test equipment such as electrical and hydraulic test systems

- This widespread adoption is further supported by high government and private sector investments in aviation infrastructure, strong R&D capabilities, and the presence of major aerospace players, establishing North America as a leader in aviation test equipment solutions

U.S. Aviation Test Equipment Market Insight

The U.S. aviation test equipment market captured the largest revenue share in 2025 within North America, driven by extensive aerospace manufacturing and growing investments in aircraft maintenance and safety programs. The demand for advanced avionics testing, structural integrity assessments, and automated diagnostic systems is accelerating market growth. For instance, companies such as Honeywell Aerospace are expanding their test equipment portfolios to support commercial and defense aircraft testing requirements. In addition, increasing airline fleet expansions and retrofitting initiatives further fuel the market. The integration of IoT-enabled and data-driven test solutions enhances predictive maintenance and reduces operational downtime, supporting the market's expansion.

Europe Aviation Test Equipment Market Insight

The Europe aviation test equipment market is projected to grow at a steady CAGR throughout the forecast period, driven by stringent EU aviation safety regulations and the presence of major aircraft manufacturers. The region is witnessing increasing demand for advanced structural, propulsion, and avionics test equipment to maintain operational safety standards. For instance, Airbus has been leveraging innovative testing solutions to enhance aircraft reliability and reduce maintenance costs. Growing aerospace investments in countries such as France and Italy are promoting adoption across commercial and defense segments. Europe is also seeing rising incorporation of automated and digital test systems in both new aircraft production and MRO activities.

U.K. Aviation Test Equipment Market Insight

The U.K. aviation test equipment market is expected to expand at a notable CAGR during the forecast period, driven by the country’s strong aerospace sector and focus on aircraft safety and performance. The market benefits from high demand for avionics and structural testing equipment, particularly in London and the Midlands aerospace hubs. For instance, BAE Systems is adopting advanced test solutions to enhance aircraft maintenance and certification processes. The U.K.’s skilled workforce, robust R&D ecosystem, and emphasis on innovation are encouraging the use of sophisticated test instruments across commercial and defense applications. The growing need for compliance with safety standards and the adoption of digital testing technologies further support market growth.

Germany Aviation Test Equipment Market Insight

The Germany aviation test equipment market is anticipated to grow at a considerable CAGR during the forecast period, fueled by the country’s strong aerospace manufacturing base and emphasis on precision engineering. The adoption of automated, high-accuracy test equipment is increasing across commercial, business, and defense aircraft segments. For instance, Lufthansa Technik utilizes advanced diagnostic and structural testing tools to ensure aircraft reliability and safety. Germany’s well-established aerospace ecosystem, coupled with investments in digital testing and predictive maintenance technologies, drives demand. The integration of eco-efficient and next-generation test solutions aligns with local regulatory requirements and consumer expectations.

Asia-Pacific Aviation Test Equipment Market Insight

The Asia-Pacific aviation test equipment market is poised to grow at the fastest CAGR during 2026–2033, driven by rising airline fleets, increased aircraft manufacturing, and rapid urbanization in countries such as China, Japan, and India. The expansion of commercial and defense aviation in the region is creating significant demand for advanced test solutions, including avionics, propulsion, and structural testing equipment. For instance, China Eastern Airlines is investing in modern diagnostic and maintenance systems to optimize fleet operations. The growing adoption of digital and automated testing solutions, supported by government initiatives promoting aerospace modernization, further accelerates market growth. In addition, APAC’s emergence as a manufacturing hub for aviation components ensures cost-effective access to test equipment.

Japan Aviation Test Equipment Market Insight

The Japan aviation test equipment market is witnessing steady growth due to the country’s advanced aerospace technologies, focus on aircraft safety, and aging fleet modernization programs. Japanese airlines and MRO providers prioritize precision testing and predictive maintenance solutions to enhance operational efficiency. For instance, Mitsubishi Heavy Industries is deploying automated avionics and structural testing systems for next-generation aircraft. The integration of IoT and AI-driven diagnostic tools is facilitating proactive maintenance, reducing downtime, and improving safety. Japan’s emphasis on technological innovation and high-quality aerospace standards continues to drive market adoption.

China Aviation Test Equipment Market Insight

The China aviation test equipment market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid expansion of commercial and defense aviation, government initiatives, and rising domestic airline fleets. Advanced testing solutions are increasingly adopted for avionics, propulsion, and structural assessments to meet safety regulations. For instance, COMAC (Commercial Aircraft Corporation of China) is investing in state-of-the-art test equipment to support its C919 and ARJ21 aircraft programs. The push towards smart manufacturing, digitalized MRO operations, and locally produced test systems is further propelling market growth. China’s growing aerospace industry and increasing focus on predictive maintenance and operational reliability remain key growth factors.

Aviation Test Equipment Market Share

The aviation test equipment industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Airbus (Netherlands)

- Collins Aerospace (U.S.)

- 3M (U.S.)

- Boeing (U.S.)

- Teradyne Inc. (U.S.)

- Rolls-Royce Plc (U.K.)

- Moog, Inc. (U.S.)

- General Electric Company (U.S.)

- CapitalWorks LLC (U.S.)

- General Electric Aviation (U.S.)

- Testek Solutions (U.S.)

- SPHEREA (France)

- DAC International, Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- Ideal Aerosmith (U.S.)

- DMA (U.S.)

- International Aero Engineering (U.S.)

- TESSCORN SYSTEMS INDIA PVT. LTD (India)

Latest Developments in Global Aviation Test Equipment Market

- In October 2025, the U.S. Department of Defense awarded Consolidated Contractors Company (CCC) a contract to supply pressure test adapters manufactured by Nav-Aids. This development is expected to bolster the aviation test equipment market by increasing demand for specialized ground support testing tools. The adapters will be used by U.S. Army maintenance teams to service Black Hawk helicopters, highlighting the growing requirement for precision testing equipment in military aviation maintenance and supporting operational readiness initiatives. The contract underscores the strategic role of advanced testing solutions in defense aviation operations, driving both market adoption and technological upgrades in ground support equipment

- In September 2025, Singapore Airlines partnered with Pratt & Whitney Canada in a 15-year maintenance contract for 34 APS5000 auxiliary power units (APUs) servicing the airline's Boeing 787 Dreamliner fleet. This long-term agreement is projected to positively influence the aviation test equipment market by increasing the utilization of diagnostic and maintenance tools for APUs. The contract reflects the rising emphasis on predictive maintenance and reliable testing systems in commercial aviation, encouraging airlines and MRO providers to invest in advanced test equipment to ensure operational efficiency and reduce downtime

- In September 2025, a USD 980 billion contract was awarded to 33 companies to support U.S. Air Force initiatives for development, procurement, and sustainment through automation test systems (ATS). This significant investment is poised to expand the aviation test equipment market, particularly for electronic system diagnostics and automated testing solutions. ATS provides computer-controlled testing of military aircraft and weapon systems, highlighting the growing trend toward automation in maintenance and testing. The deal is expected to drive innovation in precision testing technologies, enhance reliability of defense aircraft systems, and accelerate adoption of next-generation automated test equipment

- In June 2025, Borsight Inc. secured a USD 2.18 billion contract from the U.S. Air Force to modernize avionics across the entire T-6A Texan II training fleet under the Joint Primary Pilot Training (JPPT) program. This contract is anticipated to stimulate growth in the aviation test equipment market, particularly in avionics diagnostics and simulation-based testing tools. The modernization covers aircraft and simulator upgrades for pilot training, emphasizing the increasing demand for advanced test systems in training environments. The initiative reflects a broader market trend of integrating digital and automated test solutions to enhance safety, efficiency, and operational readiness in military aviation

- In November 2023, Lufthansa Technik signed a Base Maintenance Services (BMS) contract with Emirates for Airbus A380 aircraft at the Dubai Airshow. The agreement tasks Lufthansa Technik Philippines with performing C-checks on 23 additional A380s by October 2026, creating heightened demand for aviation test equipment in commercial MRO operations. The contract demonstrates the market’s reliance on sophisticated testing and diagnostic tools to maintain large, complex aircraft efficiently. It also highlights the growing trend of outsourcing advanced maintenance services to specialized providers, driving adoption of automated and precision testing solutions across the commercial aviation sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.