Global Ayurvedic Personal Products Market

Market Size in USD Billion

CAGR :

%

USD

5.92 Billion

USD

19.53 Billion

2025

2033

USD

5.92 Billion

USD

19.53 Billion

2025

2033

| 2026 –2033 | |

| USD 5.92 Billion | |

| USD 19.53 Billion | |

|

|

|

|

Ayurvedic Personal Products Market Size

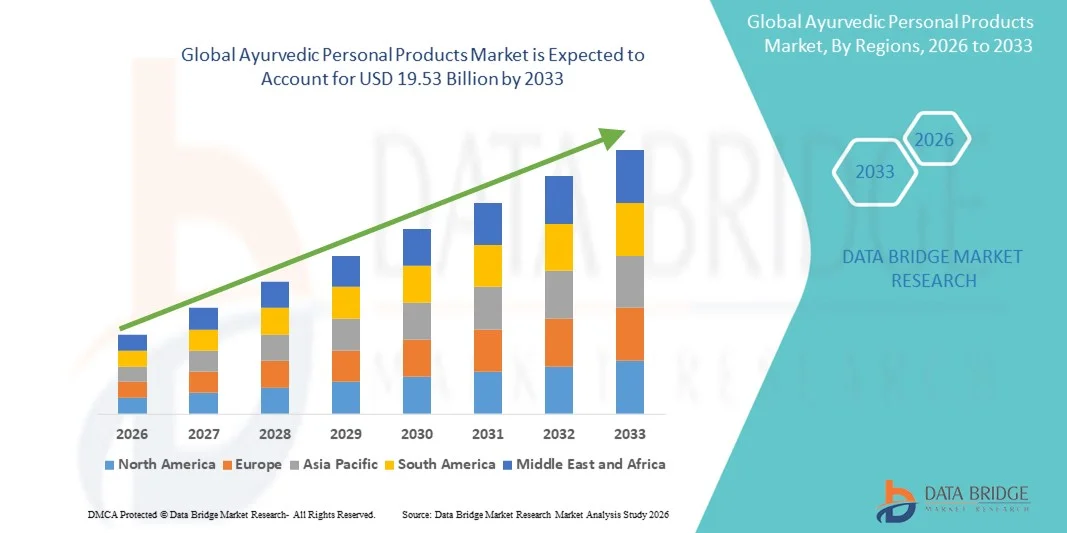

- The global ayurvedic personal products market size was valued at USD 5.92 billion in 2025 and is expected to reach USD 19.53 billion by 2033, at a CAGR of 16.09% during the forecast period

- The market growth is largely fuelled by rising consumer preference for natural and chemical-free formulations, increasing awareness of the long-term side effects of synthetic personal care products, and growing trust in traditional wellness systems such as Ayurveda

- In addition, expanding availability of ayurvedic products across organised retail and digital platforms, along with continuous product innovation in skincare, haircare, and oral care, is supporting sustained market expansion

Ayurvedic Personal Products Market Analysis

- The market is witnessing strong momentum due to a shift toward holistic self-care and preventive health, where ayurvedic personal products are perceived as safer and more sustainable alternatives to conventional offerings

- Increasing influence of clean-label trends, brand-led education initiatives, and higher spending on premium herbal formulations is strengthening market competitiveness and encouraging new product launches

- North America dominated the ayurvedic personal products market with the largest revenue share in 2025, driven by rising consumer demand for natural, organic, and chemical-free personal care solutions. Increasing awareness regarding the adverse effects of synthetic ingredients and strong inclination toward holistic wellness are supporting market dominance

- Asia-Pacific region is expected to witness the highest growth rate in the global ayurvedic personal products market, driven by rising disposable incomes, rapid urbanization, and growing consumer preference for natural and herbal personal care solutions

- The personal care products segment held the largest market revenue share in 2025, driven by high daily usage of ayurvedic soaps, shampoos, creams, and oils, along with growing consumer trust in herbal formulations for routine hygiene and wellness. Strong brand presence and wide product availability further supported segment dominance.

Report Scope and Ayurvedic Personal Products Market Segmentation

|

Attributes |

Ayurvedic Personal Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ayurvedic Personal Products Market Trends

Rise of Natural And Herbal-Based Personal Care Solutions

- The growing shift toward natural and herbal-based personal care products is transforming the ayurvedic personal products landscape by offering plant-derived formulations that align with consumer demand for safety and long-term wellness. These products leverage traditional ayurvedic ingredients to address skin, hair, and oral care needs without harsh chemicals, improving consumer trust and product adoption. In addition, increasing concerns around skin sensitivity and long-term health impacts are reinforcing the preference for nature-based solutions

- The rising preference for clean-label and toxin-free products among urban and semi-urban consumers is accelerating the adoption of ayurvedic personal care solutions. These products are increasingly favoured by health-conscious individuals seeking transparency, sustainability, and holistic benefits, particularly where concerns over synthetic ingredients are growing. Social media awareness, influencer marketing, and wellness-led branding are further amplifying this demand

- The improved availability and formulation stability of ayurvedic products are making them suitable for daily use across diverse consumer groups. Manufacturers are focusing on enhanced efficacy, pleasant sensory profiles, and standardized ingredients, enabling wider acceptance and repeat purchases. Technological advancements in extraction and preservation are also improving product shelf life and consistency

- For instance, in 2023, several leading ayurvedic brands reported increased demand for herbal shampoos and skincare products after introducing formulations free from parabens and sulfates, resulting in higher brand loyalty and expanded consumer reach. These launches also helped brands penetrate premium retail shelves and digital platforms more effectively

- While natural formulations are driving strong market interest, sustained growth depends on continuous innovation, quality standardization, and consumer education. Companies must balance traditional ayurvedic principles with modern product expectations to fully leverage this trend while ensuring efficacy, safety, and regulatory compliance

Ayurvedic Personal Products Market Dynamics

Driver

Increasing Consumer Awareness Of Chemical-Free And Preventive Personal Care

- Rising awareness of the potential side effects associated with synthetic personal care products is encouraging consumers to shift toward ayurvedic alternatives. Ingredients such as neem, aloe vera, turmeric, and amla are increasingly associated with preventive care and long-term skin and hair health, strengthening demand for ayurvedic offerings. This shift is particularly evident among young consumers adopting wellness-focused lifestyles

- Consumers are becoming more informed about ingredient labels and are actively seeking products that align with wellness-focused lifestyles. This awareness is driving consistent usage of ayurvedic personal products across daily routines, supported by growing influence from wellness campaigns and digital health content. Online reviews and educational content are also shaping informed purchasing decisions

- Support from government bodies and industry associations promoting traditional medicine systems has further enhanced market credibility. Certification frameworks, quality guidelines, and promotional initiatives are reinforcing consumer confidence and encouraging market expansion. These efforts are also helping formalize the ayurvedic personal care industry

- For instance, in 2022, national wellness programs in several countries promoted ayurvedic personal care products as part of holistic health initiatives, leading to increased retail visibility and higher product uptake. Such initiatives also encouraged collaborations between traditional practitioners and modern manufacturers

- While awareness and institutional support are propelling the market, ongoing efforts are required to combat misinformation, ensure product authenticity, and maintain consistent quality to sustain long-term consumer trust. Transparent labeling and consumer education remain critical to long-term adoption

Restraint/Challenge

Lack Of Standardization And Higher Price Sensitivity Among Consumers

- The absence of uniform global standards for ayurvedic personal care formulations poses challenges in ensuring consistent quality and efficacy. Variations in ingredient sourcing, processing methods, and formulations can create consumer skepticism and hinder widespread adoption. This lack of consistency also complicates international market expansion

- Higher price points compared to mass-market synthetic products limit accessibility, particularly among price-sensitive consumers. Premium positioning of many ayurvedic products can restrict penetration in lower-income segments despite growing interest in natural alternatives. Cost pressures are further intensified by fluctuating raw material availability

- Limited consumer understanding of authentic ayurvedic formulations versus herbal or pseudo-natural products also impacts market clarity. This confusion can reduce brand differentiation and slow purchasing decisions. Inconsistent claims and marketing practices further contribute to trust gaps

- For instance, in 2023, consumer surveys indicated that a significant portion of buyers found it difficult to distinguish certified ayurvedic personal care products from generic herbal offerings, affecting purchase confidence. This uncertainty often results in delayed adoption or preference for established brands

- While demand for ayurvedic personal products continues to rise, addressing standardization, affordability, and clear communication remains essential. Market players must focus on certification, scalable sourcing, and value-driven pricing strategies to overcome these challenges and support sustained growth

Ayurvedic Personal Products Market Scope

The market is segmented on the basis of product type, end-user, and distribution channel

- By Product Type

On the basis of product type, the global ayurvedic personal products market is segmented into healthcare products, personal care products, skin care, hair care, and oral care. The personal care products segment held the largest market revenue share in 2025, driven by high daily usage of ayurvedic soaps, shampoos, creams, and oils, along with growing consumer trust in herbal formulations for routine hygiene and wellness. Strong brand presence and wide product availability further supported segment dominance.

The skin care segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing concerns related to skin sensitivity, pollution exposure, and aging. Rising demand for chemical-free creams, lotions, and anti-acne solutions formulated with traditional ayurvedic ingredients is accelerating adoption across both premium and mass-market categories.

- By End-User

On the basis of end-user, the market is segmented into women, men, and children. The women segment accounted for the largest market share in 2025, supported by higher spending on skin care, hair care, and wellness-focused personal care products. Greater awareness of ingredient safety and preventive care has encouraged consistent usage of ayurvedic products among female consumers.

The men segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising grooming awareness and expanding product lines specifically designed for men, such as ayurvedic beard oils, face washes, and hair care solutions. Increasing acceptance of herbal grooming products is strengthening segment growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarkets, department stores, drug stores, beauty salons, specialty stores, direct selling, and internet retailing. Supermarkets and drug stores held the largest share in 2025 due to strong retail penetration, easy product accessibility, and consumer preference for in-store purchases of trusted ayurvedic brands.

Internet retailing is expected to register the highest growth rate from 2026 to 2033, driven by increasing online shopping adoption, wider product assortment, and attractive discounts. Brand-owned websites and e-commerce platforms are enabling direct consumer engagement, supporting rapid growth of digital sales channels.

Ayurvedic Personal Products Market Regional Analysis

- North America dominated the ayurvedic personal products market with the largest revenue share in 2025, driven by rising consumer demand for natural, organic, and chemical-free personal care solutions. Increasing awareness regarding the adverse effects of synthetic ingredients and strong inclination toward holistic wellness are supporting market dominance

- Consumers in the region highly value product safety, ingredient transparency, and preventive care benefits offered by ayurvedic personal products, particularly across skin care, hair care, and oral care categories

- This widespread adoption is further supported by high disposable incomes, strong presence of premium wellness brands, and well-established retail and e-commerce infrastructure, positioning ayurvedic personal products as a preferred alternative to conventional personal care offerings

U.S. Ayurvedic Personal Products Market Insight

The U.S. ayurvedic personal products market captured the largest revenue share in 2025 within North America, fueled by the growing clean beauty movement and increasing consumer focus on plant-based and herbal formulations. Consumers are actively shifting toward ayurvedic personal care products for long-term skin and hair health, supported by strong digital marketing, influencer-driven awareness, and wide product availability across online and specialty retail channels.

Europe Ayurvedic Personal Products Market Insight

The Europe ayurvedic personal products market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing preference for organic, vegan, and sustainably sourced personal care products. Rising regulatory scrutiny on chemical ingredients and heightened awareness of natural wellness solutions are accelerating the adoption of ayurvedic formulations across multiple personal care categories.

U.K. Ayurvedic Personal Products Market Insight

The U.K. ayurvedic personal products market is expected to witness the fastest growth rate from 2026 to 2033, driven by growing consumer interest in herbal beauty and wellness trends. Increasing demand for cruelty-free, clean-label, and ethically sourced products, combined with strong e-commerce penetration, is supporting the rapid expansion of ayurvedic personal care brands.

Germany Ayurvedic Personal Products Market Insight

The Germany ayurvedic personal products market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong consumer preference for certified natural and organic personal care products. Germany’s emphasis on product quality, safety standards, and sustainability aligns closely with ayurvedic principles, encouraging wider adoption across premium skin care and hair care segments.

Asia-Pacific Ayurvedic Personal Products Market Insight

The Asia-Pacific ayurvedic personal products market is expected to witness strong growth from 2026 to 2033, driven by rising disposable incomes, increasing urbanization, and deep-rooted cultural acceptance of herbal and traditional personal care practices. Expanding retail networks and growing e-commerce adoption are improving product accessibility across both urban and semi-urban markets.

China Ayurvedic Personal Products Market Insight

The China ayurvedic personal products market is expected to witness rapid growth from 2026 to 2033, driven by increasing consumer interest in herbal and alternative wellness solutions. Rising urbanization, expanding middle-class population, and strong e-commerce penetration are enabling wider adoption of ayurvedic personal products, particularly across skin care and hair care applications.

Japan Ayurvedic Personal Products Market Insight

The Japan ayurvedic personal products market is expected to witness steady growth from 2026 to 2033, driven by increasing consumer preference for natural, plant-based, and preventive personal care solutions. Japanese consumers place strong emphasis on product safety, efficacy, and minimalistic formulations, which aligns well with ayurvedic principles. In addition, growing interest in holistic wellness and the integration of herbal ingredients into established beauty and personal care routines are supporting the gradual adoption of ayurvedic personal products across the country

Ayurvedic Personal Products Market Share

The Ayurvedic Personal Products industry is primarily led by well-established companies, including:

• Maharishi Ayurveda (India)

• Dabur (India)

• The Himalaya Drug Company (India)

• Sadhu Laxmi Ayurveda (India)

• Biobaxy (India)

• Planet Ayurveda (India)

• Arvincare (India)

• Natreon Inc (U.S.)

• Basic Ayurveda (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.