Global Azacitidine Market

Market Size in USD Billion

CAGR :

%

USD

90.24 Billion

USD

165.79 Billion

2024

2032

USD

90.24 Billion

USD

165.79 Billion

2024

2032

| 2025 –2032 | |

| USD 90.24 Billion | |

| USD 165.79 Billion | |

|

|

|

|

Azacitidine Market Size

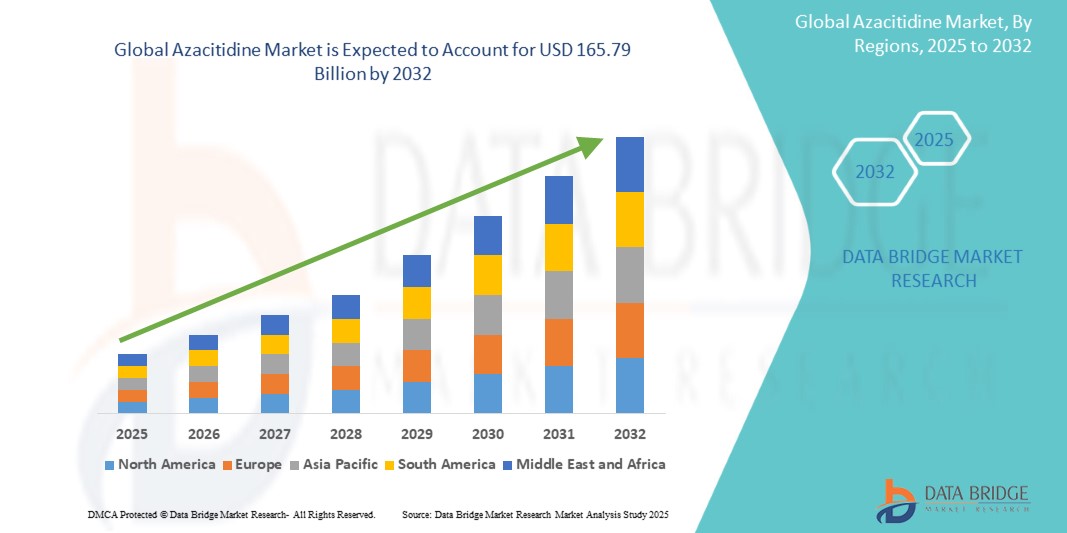

- The global azacitidine market was valued at USD 90.24 billion in 2024 and is expected to reach USD 165.79 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.90%, primarily driven by increasing geriatric population

- This growth is driven by factors such as higher disease incidence, longer life expectancy and less intensive treatment need

Azacitidine Market Analysis

- Azacitidine is a hypomethylating agent primarily used in the treatment of myelodysplastic syndromes (MDS), acute myeloid leukemia (AML), and chronic myelomonocytic leukemia (CMML). It plays a crucial role in inhibiting abnormal DNA methylation, thereby restoring normal gene function and slowing disease progression

- The market growth is driven by the rising prevalence of hematological malignancies, increasing adoption of hypomethylating agents (HMAs) in first-line treatment, and the expanding geriatric population, which is more susceptible to these disorders

- In addition, innovations in drug delivery methods, such as the development of oral azacitidine (Onureg), are transforming treatment approaches by enhancing patient compliance and reducing hospital visits

- For instance, the approval of Onureg (oral azacitidine) has provided an alternative to injectable formulations, allowing for greater flexibility in treatment administration

Report Scope and Azacitidine Market Segmentation

|

Attributes |

Azacitidine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Azacitidine Market Trends

“Growing Adoption of Oral Azacitidine Formulations”

- One prominent trend in the global azacitidine market is the growing adoption of oral azacitidine formulations

- This shift is driven by the demand for improved patient convenience, reduced hospital visits, and enhanced treatment adherence, encouraging pharmaceutical companies to develop advanced oral formulations for better disease management

- For instance, Bristol Myers Squibb introduced Onureg (oral azacitidine), which offers a more convenient administration route while maintaining therapeutic efficacy for patients with acute myeloid leukemia (AML) in remission

- As healthcare systems prioritize patient-friendly treatment options, the azacitidine market is evolving with innovations in drug formulation, extended-release mechanisms, and combination therapies, ensuring better treatment outcomes and wider accessibility

- This shift is expected to drive market expansion as oral hypomethylating agents (HMAs) gain traction in oncology treatment protocols

Azacitidine Market Dynamics

Driver

“Rising Prevalence of Hematological Disorders”

- The increasing prevalence of hematological disorders, particularly myelodysplastic syndromes (MDS), acute myeloid leukemia (AML), and chronic myelomonocytic leukemia (CMML), is a key driver of growth in the azacitidine market

- As the incidence of these disorders rises, the demand for effective hypomethylating agents (HMAs) such as azacitidine continues to grow, making it a crucial treatment option for managing these conditions

- This shift is particularly evident in North America, Europe, and Asia-Pacific, where aging populations, improved diagnostic capabilities, and greater access to advanced therapies are fueling market expansion. With a growing number of patients requiring long-term disease management, azacitidine is increasingly preferred for its ability to delay disease progression and improve survival outcomes

- With a growing number of patients requiring long-term disease management, azacitidine is increasingly preferred for its ability to delay disease progression and improve survival outcomes

- To meet this rising demand, pharmaceutical companies are investing in innovative formulations, combination therapies, and expanded treatment indications, ensuring broader access to effective hematological care

For instance,

- Takeda Pharmaceutical Company has been exploring combination therapies involving azacitidine and venetoclax for enhanced treatment efficacy in AML patients who cannot tolerate intensive chemotherapy

- Ongoing clinical research by Eisai Co., Ltd. and Daiichi Sankyo is evaluating azacitidine in combination with targeted agents to improve response rates in MDS and AML

- With increasing healthcare investments and ongoing research into next-generation HMAs, targeted therapies, and personalized treatment approaches, the azacitidine market is poised for sustained growth, offering improved therapeutic options and better survival rates for patients with hematological malignancies worldwide

Opportunity

“Rising Awareness About Myelodysplastic Syndrome (MDS)”

- The growing awareness of myelodysplastic syndrome (MDS) presents a significant opportunity for the Azacitidine market, as increased disease recognition leads to earlier diagnosis, higher treatment rates, and improved patient outcomes.

- Public health initiatives, medical conferences, and awareness campaigns are educating both healthcare professionals and patients, driving demand for effective treatment options such as azacitidine

- Pharmaceutical companies and healthcare organizations are investing in educational programs, patient advocacy groups, and research collaborations to enhance MDS awareness and encourage timely diagnosis and treatment

For instance,

- MDS Foundation and Leukemia & Lymphoma Society (LLS) have launched global initiatives to educate patients and clinicians on early symptoms, diagnostic approaches, and available treatment options, increasing azacitidine adoption

- Companies such as Bristol Myers Squibb and Takeda Pharmaceutical are actively engaging in awareness campaigns and collaborating with healthcare providers to expand access to azacitidine therapy

- As MDS awareness continues to rise, the demand for effective treatment solutions such as azacitidine will grow, creating new opportunities for market expansion. With increasing patient education, advancements in diagnostic technologies, and strong industry collaborations, the azacitidine market is well-positioned to benefit from this evolving landscape

Restraint/Challenge

“Late Approvals from Regulatory Organizations”

- Delays in regulatory approvals pose a significant challenge for the azacitidine market, as prolonged evaluation timelines can hinder new drug formulations, expanded indications, and combination therapies from reaching patients in a timely manner

- Regulatory agencies such as the U.S. FDA, EMA, and other national health authorities require extensive clinical data, leading to long approval cycles that slow market expansion

- Strict regulatory requirements and the need for comprehensive safety and efficacy trials often result in delayed drug launches and limited early access to new therapies. This challenge is particularly evident in regions with stringent approval processes, where pharmaceutical companies must navigate complex compliance frameworks before introducing updated formulations or label extensions

For instance,

- The approval process for oral azacitidine (Onureg) faced delays due to the need for additional clinical trial data on long-term efficacy and safety, slowing its market penetration in certain countries

- As regulatory requirements become more rigorous, pharmaceutical manufacturers must invest in extensive clinical trials, real-world evidence studies, and regulatory compliance strategies to accelerate approval timelines and ensure faster patient access to innovative azacitidine-based therapies

Azacitidine Market Scope

The market is segmented on the basis of type, product, application, route of administration, distribution channel, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Application |

|

|

By Route of Administration |

|

|

By Distribution Channel |

|

|

By End-User |

|

Azacitidine Market Regional Analysis

“North America is the Dominant Region in the Azacitidine Market”

- North America dominates the azacitidine market, driven by the high healthcare expenditures, a well-established healthcare infrastructure, and strong research and development investments. The region continues to lead in drug innovation, regulatory approvals, and early adoption of novel treatment approaches for hematological disorders

- The U.S. holds a significant share due to rising prevalence of myelodysplastic syndromes (MDS) and acute myeloid leukemia (AML), increasing geriatric population, and high adoption of hypomethylating agents (HMAs) such as azacitidine

- Leading pharmaceutical companies such as Bristol Myers Squibb, Pfizer, and Takeda Pharmaceutical are investing heavily in new drug formulations, clinical trials, and combination therapies to expand the therapeutic applications of azacitidine

- In addition, ongoing advancements in personalized medicine, biomarker-based treatment strategies, and AI-assisted drug development are accelerating North America’s leadership in the azacitidine market, ensuring improved treatment efficacy and patient outcomes

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the azacitidine market, driven by increasing consumption demand for active pharmaceutical ingredients (APIs), rising healthcare expenditures, and improving access to cancer treatments.

- Countries such as China, India, Japan, and South Korea are witnessing a surge in demand for hematological cancer therapies, supported by growing awareness of myelodysplastic syndromes (MDS), improving diagnostic capabilities, and government initiatives to enhance cancer care

- Global pharmaceutical companies are expanding their presence in the region through strategic partnerships with local drug manufacturers and healthcare institutions, enabling faster drug approvals and market penetration

- Furthermore, advancements in biopharmaceutical research, increased adoption of oral azacitidine formulations, and integration of AI-driven drug discovery are transforming the treatment landscape, positioning Asia-Pacific as the fastest-growing market for azacitidine-based therapies over the forecast period

Azacitidine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novartis AG (Switzerland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Johnson & Johnson Private Limited (U.S.)

- Abbott (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bausch Health Companies Inc. (Canada)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- H. Lundbeck A/S (Denmark)

- Takeda Pharmaceutical Company Limited (Japan)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Eisai Co., Ltd (Japan)

- Merz Pharma (Germany)

Latest Developments in Global Azacitidine Market

-

In September 2024, Intas Pharmaceuticals Ltd. announced the launch of Azadine-O, the first-ever oral Azacitidine therapy for Acute Myeloid Leukemia (AML) in the Indian market. This groundbreaking development marks a major milestone in the Azacitidine market, providing patients with a more convenient and patient-friendly alternative to traditional injectable formulations

- In May 2022, the U.S. Food and Drug Administration (FDA) granted approval for azacitidine (Vidaza, Celgene Corp.) for use in pediatric patients with newly diagnosed juvenile myelomonocytic leukemia (JMML). This approval marked a significant milestone in the Azacitidine market, expanding its therapeutic application beyond myelodysplastic syndromes (MDS) and acute myeloid leukemia (AML) to address a rare and aggressive form of childhood leukemia

- In September 2020, Hikma Pharmaceuticals PLC, a leading multinational pharmaceutical company, announced the launch of Azacitidine for Injection, 100mg, the generic version of Vidaza®, in the United States through its US affiliate, Hikma Pharmaceuticals USA Inc. This launch marked a significant development in the Azacitidine market, enhancing accessibility and affordability of the drug for patients suffering from myelodysplastic syndromes (MDS) and acute myeloid leukemia (AML). The introduction of a cost-effective generic alternative increased market competition, driving greater adoption of Azacitidine-based therapies across healthcare providers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AZACITIDINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AZACITIDINE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AZACITIDINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 EPIDEMIOLOGY

11.1 INCIDENCE OF ALL BY GENDER

11.2 TREATMENT RATE

11.3 MORTALITY RATE

11.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

11.5 PATIENT TREATMENT SUCCESS RATES

12 REGULATORY COMPLIANCE

12.1 REGULATORY AUTHORITIES

12.2 REGULATORY CLASSIFICATIONS

12.2.1 CLASS I

12.2.2 CLASS II

12.2.3 CLASS III

12.3 REGULATORY SUBMISSIONS

12.4 INTERNATIONAL HARMONIZATION

12.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

12.6 REGULATORY CHALLENGES AND STRATEGIES

13 PIPELINE ANALYSIS

13.1 CLINICAL TRIALS AND PHASE ANALYSIS

13.2 DRUG THERAPY PIPELINE

13.3 PHASE III CANDIDATES

13.4 PHASE II CANDIDATES

13.5 PHASE I CANDIDATES

13.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR AZACITIDINE MARKET

Company Name Product Name

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE FOR AZACITIDINE MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved but Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE FOR AZACITIDINE MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE FOR AZACITIDINE MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR AZACITIDINE MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

14 REIMBURSEMENT FRAMEWORK

15 OPPUTUNITY MAP ANALYSIS

16 VALUE CHAIN ANALYSIS

17 HEALTHCARE ECONOMY

17.1 HEALTHCARE EXPENDITURE

17.2 CAPITAL EXPENDITURE

17.3 CAPEX TRENDS

17.4 CAPEX ALLOCATION

17.5 FUNDING SOURCES

17.6 INDUSTRY BENCHMARKS

17.7 GDP RATION IN OVERALL GDP

17.8 HEALTHCARE SYSTEM STRUCTURE

17.9 GOVERNMENT POLICIES

18 GLOBAL AZACITIDINE MARKET, BY TYPES

18.1 OVERVIEW

18.2 0.995

18.3 <99.5%

18.4 OTHERS

19 GLOBAL AZACITIDINE MARKET, BY DOSAGE

19.1 OVERVIEW

19.2 STANDARD SYRINGES

19.3 PRE-FILLED SYRINGES

20 GLOBAL AZACITIDINE MARKET, BY STRENGTH

20.1 OVERVIEW

20.2 TABLET

20.2.1 200MG

20.2.2 300MG

20.2.3 OTHERS

20.3 INJECTION

20.3.1 25 MG/ML POWDER FOR INJECTION

20.3.2 100MG/SINGLE-DOSE VIAL INJECTION

20.3.3 OTHERS

21 GLOBAL AZACITIDINE MARKET, BY ROUTE OF ADMINISTRATION

21.1 OVERVIEW

21.2 ORAL

21.2.1 TABLETS

21.2.2 OTHERS

21.3 PARENTERAL

21.3.1 INTRAVENEOUS

21.3.2 SUBCUTANEOUS

21.3.3 OTHERS

21.4 OTHERS

22 GLOBAL AZACITIDINE MARKET, BY DRUG TYPE

22.1 OVERVIEW

22.2 BRANDED

22.2.1 VIDAZA

22.2.2 ONUREG

22.2.3 OTHERS

22.3 GENERICS

23 GLOBAL AZACITIDINE MARKET, BY AGE GROUP

23.1 OVERVIEW

23.2 PEDIATRIC

23.3 ADULT

23.4 GERIATRIC

24 GLOBAL AZACITIDINE MARKET, BY GEDNER

24.1 OVERVIEW

24.2 MALE

24.2.1 PEDIATRIC

24.2.2 ADULT

24.2.3 GERIATRIC

24.3 FEMALE

24.3.1 PEDIATRIC

24.3.2 ADULT

24.3.3 GERIATRIC

25 GLOBAL AZACITIDINE MARKET, BY APPLICATION

25.1 OVERVIEW

25.2 REFRACTORY ANEMIA (RA)

25.3 REFRACTORY ANEMIA WITH EXCESS BLASTS (RAEB)

25.4 MYELODYSPLASTIC SYNDROMES

25.5 CHRONIC MYELOMONOCYTIC LEUKEMIA (CMMOL)

25.6 ACUTE MYELOID LEUKEMIA

25.7 OTHERS

26 GLOBAL AZACITIDINE MARKET, BY END USER

26.1 OVERVIEW

26.2 HOSPITALS

26.2.1 BY TYPE

26.2.1.1. PUBLIC

26.2.1.2. PRIVATE

26.2.2 BY LEVEL

26.2.2.1. TIER 1

26.2.2.2. TIER 2

26.2.2.3. TIER 3

26.3 SPECIALTY CLINICS

26.3.1 PUBLIC

26.3.2 PRIVATE

26.4 ONCOLOGY CENTRES

26.5 HOME HEALTHCARE

26.6 ACADEMIC AND RESEARCH INSTITUTION

26.7 OTHERS

27 GLOBAL AZACITIDINE MARKET, BY DISTRIBUTION CHANNEL

27.1 OVERVIEW

27.2 DIRECT TENDER

27.3 RETAIL SALES

27.3.1 ONLINE

27.3.1.1. COMPANY WEBSITE

27.3.1.2. E-DRUG STORES

27.3.1.3. OTHERS

27.3.2 OFFLINE

27.3.2.1. HOSPITAL PHARMACY

27.3.2.2. MEDICINE STORES

27.3.2.3. OTHERS

27.4 OTHERS

28 GLOBAL AZACITIDINE MARKET, COMPANY LANDSCAPE

28.1 COMPANY SHARE ANALYSIS: GLOBAL

28.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

28.3 COMPANY SHARE ANALYSIS: EUROPE

28.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

28.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

28.6 COMPANY SHARE ANALYSIS: SOUTH AMERICA

28.7 MERGERS & ACQUISITIONS

28.8 NEW PRODUCT DEVELOPMENT & APPROVALS

28.9 EXPANSIONS

28.1 REGULATORY CHANGES

28.11 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

29 GLOBAL AZACITIDINE MARKET, BY REGION

29.1 GLOBAL AZACITIDINE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

29.1.1 NORTH AMERICA

29.1.1.1. U.S.

29.1.1.2. CANADA

29.1.1.3. MEXICO

29.1.2 EUROPE

29.1.2.1. GERMANY

29.1.2.2. FRANCE

29.1.2.3. U.K.

29.1.2.4. ITALY

29.1.2.5. SPAIN

29.1.2.6. RUSSIA

29.1.2.7. TURKEY

29.1.2.8. BELGIUM

29.1.2.9. NETHERLANDS

29.1.2.10. HUNGARY

29.1.2.11. LITHUANIA

29.1.2.12. AUSTRIA

29.1.2.13. IRELAND

29.1.2.14. NORWAY

29.1.2.15. POLAND

29.1.2.16. SWITZERLAND

29.1.2.17. REST OF EUROPE

29.1.3 ASIA-PACIFIC

29.1.3.1. JAPAN

29.1.3.2. CHINA

29.1.3.3. SOUTH KOREA

29.1.3.4. INDIA

29.1.3.5. AUSTRALIA

29.1.3.6. SINGAPORE

29.1.3.7. THAILAND

29.1.3.8. MALAYSIA

29.1.3.9. INDONESIA

29.1.3.10. VIETNAM

29.1.3.11. PHILIPPINES

29.1.3.12. REST OF ASIA-PACIFIC

29.1.4 SOUTH AMERICA

29.1.4.1. BRAZIL

29.1.4.2. ARGENTINA

29.1.4.3. PERU

29.1.4.4. REST OF SOUTH AMERICA

29.1.5 MIDDLE EAST AND AFRICA

29.1.5.1. SOUTH AFRICA

29.1.5.2. SAUDI ARABIA

29.1.5.3. UAE

29.1.5.4. EGYPT

29.1.5.5. KUWAIT

29.1.5.6. ISRAEL

29.1.5.7. REST OF MIDDLE EAST AND AFRICA

29.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

30 GLOBAL AZACITIDINE MARKET, SWOT AND DBMR ANALYSIS

31 GLOBAL AZACITIDINE MARKET, COMPANY PROFILE

31.1 VBSHILPA

31.1.1 COMPANY OVERVIEW

31.1.2 REVENUE ANALYSIS

31.1.3 GEOGRAPHIC PRESENCE

31.1.4 PRODUCT PORTFOLIO

31.1.5 RECENT DEVELOPEMENTS

31.2 BRISTOL-MYERS SQUIBB COMPANY

31.2.1 COMPANY OVERVIEW

31.2.2 REVENUE ANALYSIS

31.2.3 GEOGRAPHIC PRESENCE

31.2.4 PRODUCT PORTFOLIO

31.2.5 RECENT DEVELOPEMENTS

31.3 HIKMA PHARMACEUTICALS PLC

31.3.1 COMPANY OVERVIEW

31.3.2 REVENUE ANALYSIS

31.3.3 GEOGRAPHIC PRESENCE

31.3.4 PRODUCT PORTFOLIO

31.3.5 RECENT DEVELOPEMENTS

31.4 INTAS PHARMACEUTICALS LIMITED

31.4.1 COMPANY OVERVIEW

31.4.2 REVENUE ANALYSIS

31.4.3 GEOGRAPHIC PRESENCE

31.4.4 PRODUCT PORTFOLIO

31.4.5 RECENT DEVELOPEMENTS

31.5 ACCORD HEALTHCARE

31.5.1 COMPANY OVERVIEW

31.5.2 REVENUE ANALYSIS

31.5.3 GEOGRAPHIC PRESENCE

31.5.4 PRODUCT PORTFOLIO

31.5.5 RECENT DEVELOPEMENTS

31.6 ACTAVIS LLC

31.6.1 COMPANY OVERVIEW

31.6.2 REVENUE ANALYSIS

31.6.3 GEOGRAPHIC PRESENCE

31.6.4 PRODUCT PORTFOLIO

31.6.5 RECENT DEVELOPEMENTS

31.7 AMNEAL PHARMACEUTICALS LLC.

31.7.1 COMPANY OVERVIEW

31.7.2 REVENUE ANALYSIS

31.7.3 GEOGRAPHIC PRESENCE

31.7.4 PRODUCT PORTFOLIO

31.7.5 RECENT DEVELOPEMENTS

31.8 CIPLA

31.8.1 COMPANY OVERVIEW

31.8.2 REVENUE ANALYSIS

31.8.3 GEOGRAPHIC PRESENCE

31.8.4 PRODUCT PORTFOLIO

31.8.5 RECENT DEVELOPEMENTS

31.9 DR. REDDY’S LABORATORIES LIMITED

31.9.1 COMPANY OVERVIEW

31.9.2 REVENUE ANALYSIS

31.9.3 GEOGRAPHIC PRESENCE

31.9.4 PRODUCT PORTFOLIO

31.9.5 RECENT DEVELOPEMENTS

31.1 EUGIA US LLC

31.10.1 COMPANY OVERVIEW

31.10.2 REVENUE ANALYSIS

31.10.3 GEOGRAPHIC PRESENCE

31.10.4 PRODUCT PORTFOLIO

31.10.5 RECENT DEVELOPEMENTS

31.11 EUROHLTH INTL SARL

31.11.1 COMPANY OVERVIEW

31.11.2 REVENUE ANALYSIS

31.11.3 GEOGRAPHIC PRESENCE

31.11.4 PRODUCT PORTFOLIO

31.11.5 RECENT DEVELOPEMENTS

31.12 JIANGSU HANSOH PHARM

31.12.1 COMPANY OVERVIEW

31.12.2 REVENUE ANALYSIS

31.12.3 GEOGRAPHIC PRESENCE

31.12.4 PRODUCT PORTFOLIO

31.12.5 RECENT DEVELOPEMENTS

31.13 MEITHEAL

31.13.1 COMPANY OVERVIEW

31.13.2 REVENUE ANALYSIS

31.13.3 GEOGRAPHIC PRESENCE

31.13.4 PRODUCT PORTFOLIO

31.13.5 RECENT DEVELOPEMENTS

31.14 MSN LABS PVT LTD

31.14.1 COMPANY OVERVIEW

31.14.2 REVENUE ANALYSIS

31.14.3 GEOGRAPHIC PRESENCE

31.14.4 PRODUCT PORTFOLIO

31.14.5 RECENT DEVELOPEMENTS

31.15 NATCO PHARMA LTD

31.15.1 COMPANY OVERVIEW

31.15.2 REVENUE ANALYSIS

31.15.3 GEOGRAPHIC PRESENCE

31.15.4 PRODUCT PORTFOLIO

31.15.5 RECENT DEVELOPEMENTS

31.16 FLORENCIA HEALTHCARE

31.16.1 COMPANY OVERVIEW

31.16.2 REVENUE ANALYSIS

31.16.3 GEOGRAPHIC PRESENCE

31.16.4 PRODUCT PORTFOLIO

31.16.5 RECENT DEVELOPEMENTS

31.17 GETWELL PHARMA

31.17.1 COMPANY OVERVIEW

31.17.2 REVENUE ANALYSIS

31.17.3 GEOGRAPHIC PRESENCE

31.17.4 PRODUCT PORTFOLIO

31.17.5 RECENT DEVELOPEMENTS

31.18 TAJ PHARMA GROUP

31.18.1 COMPANY OVERVIEW

31.18.2 REVENUE ANALYSIS

31.18.3 GEOGRAPHIC PRESENCE

31.18.4 PRODUCT PORTFOLIO

31.18.5 RECENT DEVELOPEMENTS

31.19 HETERO HEALTHCARE LIMITED

31.19.1 COMPANY OVERVIEW

31.19.2 REVENUE ANALYSIS

31.19.3 GEOGRAPHIC PRESENCE

31.19.4 PRODUCT PORTFOLIO

31.19.5 RECENT DEVELOPEMENTS

31.2 ABBOTT

31.20.1 COMPANY OVERVIEW

31.20.2 REVENUE ANALYSIS

31.20.3 GEOGRAPHIC PRESENCE

31.20.4 PRODUCT PORTFOLIO

31.20.5 RECENT DEVELOPEMENTS

31.21 APIS LABOR GMBH (MARKETING AUTH.- MYLAN IRELAND LIMITED )

31.21.1 COMPANY OVERVIEW

31.21.2 REVENUE ANALYSIS

31.21.3 GEOGRAPHIC PRESENCE

31.21.4 PRODUCT PORTFOLIO

31.21.5 RECENT DEVELOPEMENTS

31.22 BRECKENRIDGE PHARMACEUTICAL, INC.

31.22.1 COMPANY OVERVIEW

31.22.2 REVENUE ANALYSIS

31.22.3 GEOGRAPHIC PRESENCE

31.22.4 PRODUCT PORTFOLIO

31.22.5 RECENT DEVELOPEMENTS

31.23 ARMAS PHARMACEUTICALS, INC.

31.23.1 COMPANY OVERVIEW

31.23.2 REVENUE ANALYSIS

31.23.3 GEOGRAPHIC PRESENCE

31.23.4 PRODUCT PORTFOLIO

31.23.5 RECENT DEVELOPEMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

32 RELATED REPORTS

33 CONCLUSION

34 QUESTIONNAIRE

35 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.