Global Baby Bottle Market

Market Size in USD Billion

CAGR :

%

USD

4.06 Billion

USD

6.09 Billion

2025

2033

USD

4.06 Billion

USD

6.09 Billion

2025

2033

| 2026 –2033 | |

| USD 4.06 Billion | |

| USD 6.09 Billion | |

|

|

|

|

Baby Bottle Market Size

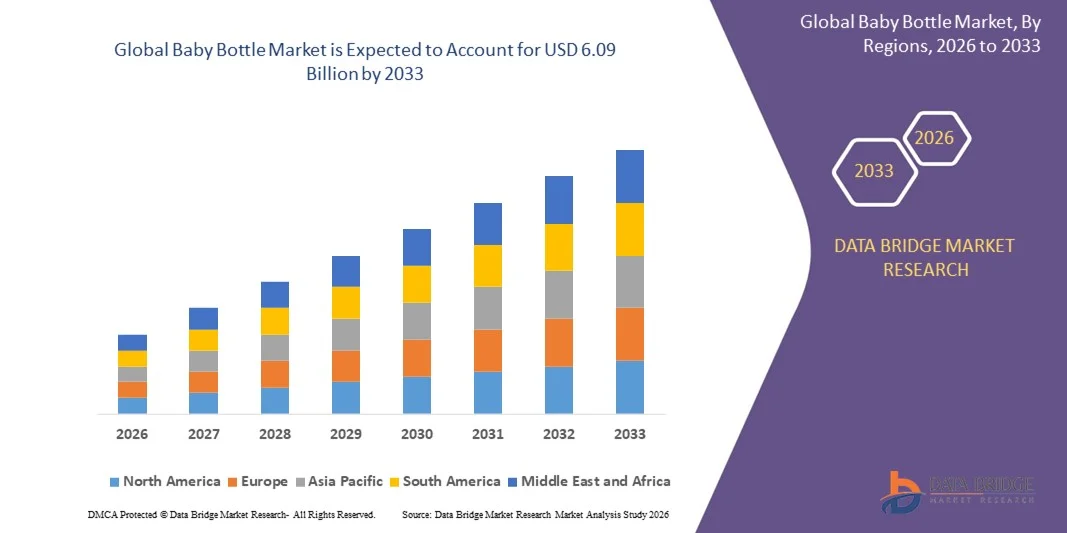

- The global baby bottle market size was valued at USD 4.06 billion in 2025 and is expected to reach USD 6.09 billion by 2033, at a CAGR of 5.20% during the forecast period

- The market growth is largely fuelled by the rising awareness among parents regarding infant nutrition and hygiene, as well as increasing adoption of safe and innovative feeding solutions

- Growing preference for BPA-free, eco-friendly, and ergonomic baby bottles is driving product demand across both developed and emerging regions

Baby Bottle Market Analysis

- Increasing parental focus on infant health and safe feeding practices is shaping market trends, with emphasis on hygienic, spill-proof, and easy-to-clean bottles

- Technological advancements and product innovations, such as anti-colic designs, temperature-indicating bottles, and multifunctional feeding sets, are enhancing consumer adoption and satisfaction

- North America dominated the baby bottle market with the largest revenue share of 38.50% in 2025, driven by rising awareness of infant nutrition, safety, and the growing preference for premium and certified feeding solutions

- Asia-Pacific region is expected to witness the highest growth rate in the global baby bottle market, driven by rapid population growth, rising middle-class consumers, increasing working parents, and government initiatives promoting child health and nutrition

- The Plastic Baby Bottles segment held the largest market revenue share in 2025, driven by their lightweight design, affordability, and widespread availability. Plastic bottles are particularly popular among parents for daily use, ease of handling, and compatibility with various feeding accessories

Report Scope and Baby Bottle Market Segmentation

|

Attributes |

Baby Bottle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Baby Bottle Market Trends

Rise of Innovative and Safe Feeding Solutions

- The growing shift toward advanced and safe baby bottles is transforming the infant feeding landscape by enabling hygienic, spill-proof, and ergonomic feeding solutions. Features such as anti-colic designs, temperature indicators, and easy-to-clean materials allow parents to ensure optimal feeding safety and infant comfort, resulting in higher adoption rates and improved infant health outcomes. In addition, product innovations focusing on eco-friendly materials and modular designs are further increasing consumer preference and loyalty

- Rising demand for innovative baby bottles in emerging and underdeveloped regions is accelerating the adoption of multifunctional feeding products. These bottles are particularly valuable where access to professional pediatric guidance is limited, helping reduce feeding issues and ensuring proper nutrition. The trend is supported by growing retail penetration, promotional campaigns, and collaborations between brands and healthcare providers

- The affordability and convenience of modern baby bottles are making them attractive for daily infant feeding. Parents benefit from products that are durable, easy to sterilize, and compatible with pumps and accessories, reducing preparation time and improving overall feeding efficiency. Increasing availability of starter kits and bundled solutions also encourages first-time parents to adopt these products

- For instance, in 2023, several baby care retailers in India and Southeast Asia reported increased sales of BPA-free, anti-colic bottles after awareness drives highlighted their benefits in reducing infant digestive discomfort and ensuring safe feeding. Similar trends were observed in Latin America and Middle East markets where pediatric endorsements boosted consumer confidence

- While innovation in baby bottles is driving adoption, sustained growth depends on continued R&D, quality assurance, and accessibility. Manufacturers must focus on localized product designs, cost-effective solutions, and education initiatives to fully capitalize on this expanding demand. Expanding collaborations with e-commerce platforms and childcare organizations can further accelerate market penetration

Baby Bottle Market Dynamics

Driver

Growing Awareness of Infant Nutrition and Hygiene

- Rising awareness among parents regarding infant health and safe feeding practices is pushing governments, pediatricians, and caregivers to prioritize the use of safe and high-quality baby bottles. The focus on proper nutrition and hygienic feeding has accelerated product adoption globally. Parents increasingly rely on expert recommendations and product certifications to ensure infant safety

- Parents are increasingly conscious of the risks associated with poor feeding practices, including choking, colic, and infections. This awareness has led to higher demand for anti-colic, spill-proof, and BPA-free bottles, even among first-time parents and urban households. Social media campaigns and parenting forums are amplifying knowledge and driving informed purchase decisions

- Public sector initiatives, pediatric recommendations, and NGO awareness programs have strengthened trust in certified baby feeding products. Subsidized awareness campaigns and health education programs are encouraging the adoption of innovative and safe baby bottles. Regional government programs promoting child health have further incentivized manufacturers to expand availability and affordability

- For instance, in 2022, pediatric councils across North America and Europe recommended the use of BPA-free, ergonomic bottles for infants, boosting sales of certified products and raising parental awareness. These endorsements also encouraged retailers to highlight certified and safe product lines prominently

- While awareness and institutional support are driving the market, there is still a need to improve affordability, product availability, and education on proper usage to ensure sustained adoption. Investments in local distribution networks, community outreach, and targeted campaigns can further enhance market penetration

Restraint/Challenge

High Cost of Premium Bottles and Limited Access in Emerging Regions

- Premium and technologically advanced baby bottles, such as anti-colic or self-sterilizing bottles, carry higher price points, making them less accessible for middle- and low-income households. This limits penetration in cost-sensitive markets. Consumers in rural regions often prioritize price over advanced features, slowing adoption rates

- In several emerging regions, limited retail and e-commerce infrastructure restricts the availability of certified and branded feeding products. Parents may rely on locally made alternatives that may not meet safety and hygiene standards. Logistical hurdles and high shipping costs further exacerbate the issue, reducing product reliability and trust

- Supply chain and distribution challenges further hinder consistent product availability, particularly in rural and semi-urban areas, affecting both trust and adoption of certified baby bottles. Seasonal shortages, import restrictions, and dependency on international suppliers can result in delayed product delivery and fluctuating prices

- For instance, in 2023, surveys in Sub-Saharan Africa and South Asia revealed that over 65% of parents had limited access to high-quality, BPA-free bottles, citing high costs and limited retail presence as primary barriers. Limited awareness about certified products in these regions also contributed to reliance on informal alternatives

- While innovation and increasing brand presence are improving accessibility, addressing affordability, distribution, and awareness challenges remains essential for unlocking long-term growth and market potential. Expanding local manufacturing, government incentives, and targeted marketing initiatives can help overcome these constraints and boost adoption

Baby Bottle Market Scope

The market is segmented on the basis of material type, size, age group, and distribution channel

- By Material Type

On the basis of material type, the baby bottle market is segmented into Plastic Baby Bottles, Glass Baby Bottles, Silicone Baby Bottles, and Stainless-Steel Baby Bottles. The Plastic Baby Bottles segment held the largest market revenue share in 2025, driven by their lightweight design, affordability, and widespread availability. Plastic bottles are particularly popular among parents for daily use, ease of handling, and compatibility with various feeding accessories.

The Glass Baby Bottles segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer preference for chemical-free and eco-friendly materials. Glass bottles are valued for their durability, non-toxicity, and resistance to odor or staining, making them a preferred choice for health-conscious parents and premium product segments.

- By Size

On the basis of size, the baby bottle market is segmented into Less than 3 Ounces, 3-6 Ounces, 6-9 Ounces, and More than 9 Ounces. The 3-6 Ounces segment held the largest revenue share in 2025, as it is suitable for newborns and young infants and widely recommended by pediatricians for controlled feeding.

The 6-9 Ounces segment is expected to register the fastest growth from 2026 to 2033, owing to rising demand for bottles that accommodate growing infants’ increasing feeding needs. Parents prefer mid-sized bottles for flexibility, longer usage duration, and compatibility with various nipples and accessories.

- By Age Group

On the basis of age group, the market is segmented into 0-6 Months, 6-18 Months, and Above 18 Months. The 0-6 Months segment accounted for the largest revenue share in 2025, driven by the high demand for feeding solutions among newborns and early infancy, where proper nutrition and hygiene are critical.

The 6-18 Months segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing parental adoption of transition bottles and multifunctional feeding systems. These bottles support gradual weaning and adapt to changing feeding behaviors in infants.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Modern Trade, Online, Specialty Stores, and Others. The Modern Trade segment held the largest market share in 2025, driven by the availability of diverse product ranges, promotional offers, and in-store guidance for parents.

The Online segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing e-commerce penetration, convenient home delivery, and access to a wider variety of brands and premium baby bottles. Online channels are particularly popular among tech-savvy parents and in regions with limited physical retail presence.

Baby Bottle Market Regional Analysis

- North America dominated the baby bottle market with the largest revenue share of 38.50% in 2025, driven by rising awareness of infant nutrition, safety, and the growing preference for premium and certified feeding solutions

- Parents and caregivers in the region highly value convenience, hygienic designs, anti-colic features, and durable materials in baby bottles, supporting widespread adoption across households

- This widespread adoption is further supported by high disposable incomes, technologically inclined consumers, and increasing e-commerce penetration, establishing baby bottles as a staple infant feeding solution in both urban and suburban regions

U.S. Baby Bottle Market Insight

The U.S. baby bottle market captured the largest revenue share in 2025 within North America, fueled by growing parental focus on infant health, hygiene, and safe feeding practices. Consumers are increasingly prioritizing BPA-free, spill-proof, and ergonomic bottles that enhance feeding efficiency and safety. The growing preference for online shopping, subscription-based baby care products, and multifunctional bottles further propels the market. In addition, recommendations by pediatric associations and widespread awareness campaigns are significantly contributing to market expansion

Europe Baby Bottle Market Insight

The Europe baby bottle market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent safety regulations, increasing urbanization, and rising disposable incomes. Parents are seeking certified, chemical-free, and multifunctional bottles that ensure infant safety and hygiene. The region is witnessing significant growth across modern retail channels, online platforms, and specialty baby care stores, with bottles being integrated into both newborn essentials and transitional feeding solutions.

U.K. Baby Bottle Market Insight

The U.K. baby bottle market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising trends in home-based infant care and increasing awareness of premium and safe feeding products. Concerns regarding hygiene, digestive health, and proper nutrition are encouraging parents to adopt advanced and ergonomically designed bottles. The U.K.’s strong retail infrastructure, growing e-commerce adoption, and influence of parenting communities are expected to further stimulate market growth.

Germany Baby Bottle Market Insight

The Germany baby bottle market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of infant health, safety, and eco-conscious parenting. Germany’s well-developed retail and e-commerce infrastructure, combined with a focus on high-quality, durable, and certified bottles, promotes adoption. The preference for BPA-free, glass, and silicone bottles integrated with ergonomic and anti-colic designs is also becoming increasingly prevalent, aligning with local consumer expectations.

Asia-Pacific Baby Bottle Market Insight

The Asia-Pacific baby bottle market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising urbanization, growing disposable incomes, and technological advancements in countries such as China, Japan, and India. Increasing awareness regarding infant health and hygiene, supported by government initiatives and pediatric campaigns, is driving adoption. Furthermore, as APAC emerges as a manufacturing hub for safe and innovative baby bottles, affordability, accessibility, and availability are expanding to a broader consumer base.

Japan Baby Bottle Market Insight

The Japan baby bottle market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high-tech culture, rapid urbanization, and strong emphasis on infant safety. Japanese parents prioritize ergonomic designs, anti-colic features, and hygienic feeding solutions. The integration of baby bottles with multifunctional feeding systems and the increasing number of nuclear households is fueling growth. Moreover, Japan’s aging population is likely to spur demand for easy-to-use, safe, and efficient feeding solutions in both residential and daycare settings.

China Baby Bottle Market Insight

The China baby bottle market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s expanding middle class, urbanization, and growing awareness of infant safety and hygiene. China stands as one of the largest markets for premium and innovative baby bottles, with parents increasingly adopting BPA-free, anti-colic, and ergonomic feeding solutions. The rise of e-commerce, government-supported childcare initiatives, and strong domestic manufacturers are key factors propelling the market in China.

Baby Bottle Market Share

The Baby Bottle industry is primarily led by well-established companies, including:

- Babisil International Ltd. (India)

- Mayborn Group Limited (U.K.)

- Pigeon India (India)

- Munchkin, Inc. (U.S.)

- Edgewell Personal Care (U.S.)

- Medela AG (Switzerland)

- Nürnberg Gummi Babyartikel GmbH & Co. KG (Germany)

- Richell Corporation (Japan)

- Nykaa E-Retail Pvt. Ltd. (India)

- Koninklijke Philips N.V. (Netherlands)

- Paul Manufacturing (India)

- Chemco (India)

- Dolphin Baby Product (India)

- Bonny Products Private Limited (India)

- Narang Plastics Private Limited (India)

- Ambica Tech (India)

- Linco Baby Merchandise Works Co., Ltd (China)

- ALPHA BABY CARE CO., LTD. (China)

- Summer Infant (USA), Inc. (U.S.)

- Novatex (Brazil)

Latest Developments in Global Baby Bottle Market

- In April 2025, Momtech Inc. expanded its mōmi baby-bottle portfolio by launching new formats, including 4-ounce standard bottles, 9-ounce borosilicate glass variants, and 10-ounce BPA-free plastic bottles, all featuring the proprietary babypace nipple technology. The development aimed to replicate natural breastfeeding behavior, supporting the suck-swallow-breathe rhythm, and enhancing feeding comfort for infants. This launch strengthened Momtech’s presence in the premium biomimetic feeding segment, appealing to parents seeking a seamless transition between breast and bottle feeding, and boosted the brand’s market positioning

- In 2024, Munchkin introduced the Bond silicone-coated glass baby bottle, combining a borosilicate glass interior with a silicone exterior shell. The innovation featured an all-silicone anti-colic valve designed to reduce digestive discomfort, while offering durability, impact resistance, and improved grip. This development reinforced Munchkin’s focus on hybrid-material innovation, providing safe, chemical-free feeding solutions and enhancing the brand’s competitive edge in the infant feeding market

- In 2024, Philips Avent launched a glass-based iteration of its Natural Response baby bottle series, featuring a wide-neck borosilicate glass design and a Natural Response nipple that releases milk only when drawn by the infant. The bottle also incorporated anti-colic venting to reduce gastrointestinal stress. This launch emphasized Philips Avent’s commitment to premium, safe-material solutions and addressed the growing consumer demand for clinically aligned, non-plastic feeding products, strengthening its market share in the high-end baby bottle segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.