Global Baby Cereal Market

Market Size in USD Billion

CAGR :

%

USD

20.89 Billion

USD

30.62 Billion

2024

2032

USD

20.89 Billion

USD

30.62 Billion

2024

2032

| 2025 –2032 | |

| USD 20.89 Billion | |

| USD 30.62 Billion | |

|

|

|

|

What is the Global Baby Cereal Market Size and Growth Rate?

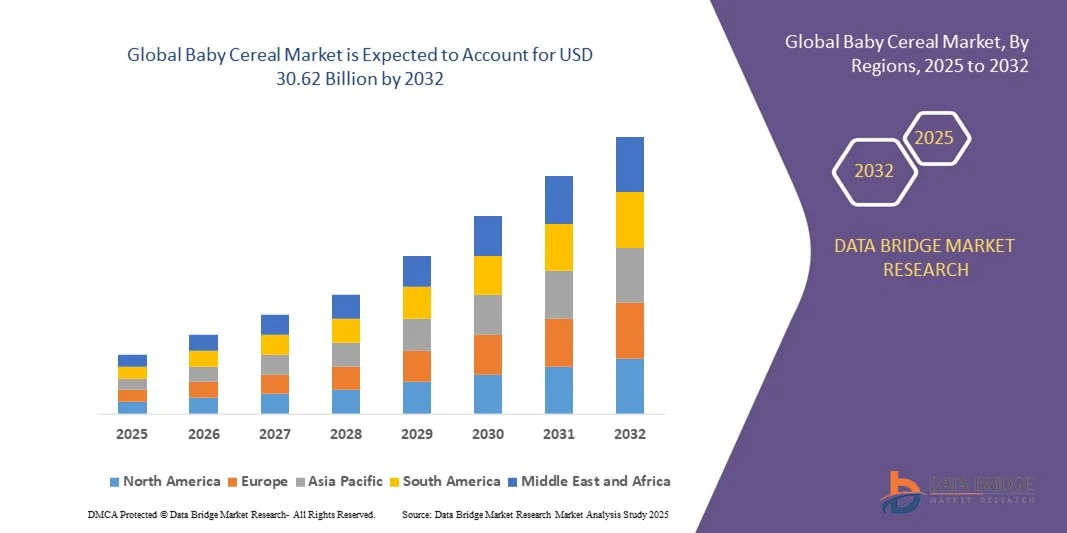

- The global baby cereal market size was valued at USD 20.89 billion in 2024 and is expected to reach USD 30.62 billion by 2032, at a CAGR of 4.90% during the forecast period

- Increasing preferences towards the consumption of the organic baby food, improved economic conditions along with increased expenditure by the parents, rapid urbanization along with increasing working population especially women, increasing growth of food and beverages industry, increasing retail penetration and awareness about the products, along with an increasing purchasing power are some of the major as well as important factors which will likely to accelerate the growth

What are the Major Takeaways of Baby Cereal Market?

- Increase in organic ingredients used in baby food production, rising infant population along with availability of organized retail sector which will further contribute by generating immense opportunities that will led to the growth of the baby cereal market in the above mentioned projected timeframe

- High cost of product along with stringent government regulations and quality standards governing baby food industry which will likely to act as market restraints factor for the growth of the baby cereal

- North America dominated the baby cereal market with the largest revenue share of 39.41% in 2024, driven by rising awareness of infant nutrition, growing health-consciousness among parents, and the strong presence of major baby cereal manufacturers

- The Asia-Pacific baby cereal market is poised to grow at the fastest CAGR of 7.98% during the forecast period 2025–2032, driven by rising urbanization, growing disposable incomes, and heightened awareness of infant nutrition in countries such as China, Japan, and India

- The immune system segment dominated the market with the largest revenue share of 32% in 2024, driven by rising parental awareness of the importance of boosting infants’ immunity and reducing susceptibility to common infections

Report Scope and Baby Cereal Market Segmentation

|

Attributes |

Baby Cereal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Baby Cereal Market?

Rising Demand for Nutrient-Rich and Convenient Baby Cereal

- A prominent and accelerating trend in the global baby cereal market is the growing preference for nutrient-dense, organic, and fortified formulations that cater to busy parents seeking convenient feeding solutions. This trend is significantly enhancing consumer convenience and fostering brand loyalty

- For instance, companies such as Nestlé and Abbott have launched fortified instant cereals and ready-to-eat porridges enriched with essential vitamins and minerals, making mealtime easier and healthier for infants and toddlers. Similarly, HiPP and Bellamy’s Organic are expanding their organic cereal offerings, emphasizing natural and chemical-free ingredients

- Nutritional personalization in baby cereals is also gaining traction, with products tailored for age-specific dietary needs, digestive health, and immunity support. Brands are increasingly leveraging research-backed formulations to enhance the functional benefits of cereals

- The integration of convenience-oriented packaging such as single-serve sachets, resealable pouches, and ready-to-eat packs is facilitating easier storage, preparation, and portability, especially for working parents

- This trend towards nutrient-rich, convenient, and easy-to-use products is reshaping expectations for infant nutrition, prompting leading companies to innovate continuously and expand product portfolios to meet parental demand for health-conscious and time-saving solutions

- The market demand for baby cereals that combine nutrition, convenience, and innovation is steadily growing across both developed and emerging regions, driven by evolving lifestyles, increasing health awareness, and rising disposable incomes

What are the Key Drivers of Baby Cereal Market?

- The increasing awareness among parents about the importance of balanced nutrition during early childhood, coupled with the rising adoption of organic and fortified food products, is a key driver for the heightened demand for baby cereals

- For instance, in 2024, Nestlé introduced a line of nutrient-fortified cereals enriched with iron, calcium, and DHA to support infant growth and cognitive development, reflecting the emphasis on scientific-backed nutrition

- As parents prioritize immunity, digestive health, and overall wellness, Baby Cereals offer enhanced formulations with probiotics, prebiotics, and essential vitamins, providing a compelling alternative to traditional cereal offerings

- In addition, the demand for convenient, ready-to-eat, and age-specific cereals aligns with busy lifestyles, increasing dual-income households, and on-the-go feeding requirements

- Packaging innovations such as resealable pouches, single-serve cups, and instant mixes further support convenience, making Baby Cereals a preferred choice for both at-home and travel feeding

- The growing trend of premiumization, coupled with increasing disposable incomes and rising awareness of early childhood nutrition, continues to propel the adoption of Baby Cereals globally

Which Factor is Challenging the Growth of the Baby Cereal Market?

- Rising concerns regarding product safety, contamination, and stringent regulatory standards pose a challenge to the Baby Cereal market. Consumers are increasingly cautious about sourcing, ingredient quality, and potential allergens

- For instance, past recalls of contaminated or adulterated cereals have created hesitancy among parents to adopt new brands without stringent quality assurances

- Companies are addressing these challenges through enhanced quality control, transparent labeling, third-party certifications, and adherence to international food safety standards to build consumer trust

- In addition, the relatively higher price of organic and fortified Baby Cereals compared to conventional options can limit adoption, particularly in price-sensitive or developing markets. While some brands offer more affordable options, premium variants with specialized nutrients or organic certification often come with a higher price tag

- Despite gradual price reductions and increased accessibility, the perceived premium cost of high-quality Baby Cereals remains a potential barrier to broader market penetration

- Overcoming these challenges through robust safety measures, consumer education, and the development of cost-effective, nutrient-rich products will be crucial for sustained growth in the Baby Cereal market

How is the Baby Cereal Market Segmented?

The market is segmented on the basis of health benefits, sales channel, ingredients, and category.

- By Health Benefits

On the basis of health benefits, the baby cereal market is segmented into immune system, brain and eye development, muscular growth, bones and teeth development, blood enhancement, nervous system, vascular system, body energy, and other benefits. The immune system segment dominated the market with the largest revenue share of 32% in 2024, driven by rising parental awareness of the importance of boosting infants’ immunity and reducing susceptibility to common infections. Baby Cereals fortified with vitamins, minerals, and probiotics for immunity enhancement are highly preferred, especially in developed regions with a growing focus on preventive nutrition.

The brain and eye development segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, fueled by the increasing demand for cereals enriched with DHA, omega-3 fatty acids, and other neuro-supportive nutrients. Growing awareness about early childhood cognitive development is prompting manufacturers to innovate and offer functional cereals targeting mental growth, visual acuity, and overall neurological health.

- By Sales Channel

On the basis of sales channel, the baby cereal market is segmented into modern trade, specialty stores, drug stores, online retailers, and other sales channels. The modern trade segment dominated the market with a 38% revenue share in 2024, primarily due to the wide availability of various Baby Cereal brands, promotional offers, and organized retail infrastructure. Supermarkets and hypermarkets offer parents a convenient, one-stop platform to compare products and purchase in bulk, enhancing sales.

The online retail segment is anticipated to register the fastest CAGR of 22% during 2025–2032, driven by the rising e-commerce adoption, home delivery convenience, and the increasing use of mobile apps for grocery shopping. The COVID-19 pandemic accelerated online penetration, and parents now prefer digital platforms for doorstep delivery, subscription models, and product variety. The trend is further supported by targeted marketing, subscription services, and user reviews boosting consumer confidence in online purchases.

- By Ingredients

On the basis of ingredients, the baby cereal market is segmented into oatmeal, rice, barley, and mixed. The rice-based segment dominated the market with the largest revenue share of 35% in 2024, owing to its hypoallergenic properties, easy digestibility, and suitability for infant nutrition. Rice cereals remain a staple first food for babies in both developed and emerging regions, offering high nutrient absorption and gentle digestion.

The mixed-ingredient segment is projected to witness the fastest CAGR of 21% from 2025 to 2032, driven by growing consumer demand for multi-nutrient formulations combining oats, barley, and rice. These cereals offer enhanced nutritional profiles, such as fiber, protein, vitamins, and minerals, in a single serving. Manufacturers are focusing on blended recipes that provide comprehensive benefits such as immunity support, energy boost, and cognitive development, aligning with parental expectations for holistic infant nutrition.

- By Category

On the basis of category, the baby cereal market is segmented into organic and conventional. The conventional segment dominated the market with a 55% revenue share in 2024, supported by large-scale production, wider availability, and cost-effectiveness. Conventional Baby Cereals offer fortified nutrients and functional benefits, making them the preferred choice for middle-income families seeking reliable and accessible options.

The organic segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, driven by the rising awareness of chemical-free, pesticide-free, and additive-free nutrition for infants. Increasing health consciousness among parents, coupled with premiumization trends, is boosting demand for certified organic cereals that emphasize natural ingredients, clean labels, and sustainable sourcing. This segment is witnessing strong growth in both developed and emerging markets, with retailers and e-commerce platforms actively promoting organic options to capture health-driven consumers.

Which Region Holds the Largest Share of the Baby Cereal Market?

- North America dominated the baby cereal market with the largest revenue share of 39.41% in 2024, driven by rising awareness of infant nutrition, growing health-consciousness among parents, and the strong presence of major Baby Cereal manufacturers

- Consumers in the region highly value fortified cereals with functional benefits such as immunity support, brain development, and digestive health. The convenience of ready-to-eat formulations and a wide product variety is further encouraging adoption

- This widespread adoption is reinforced by high disposable incomes, increasing awareness of early childhood nutrition, and robust retail infrastructure, positioning Baby Cereals as a preferred choice for both parents and caregivers across North America

U.S. Baby Cereal Market Insight

The U.S. baby cereal market captured the largest revenue share of 75% in 2024 within North America, fueled by the growing preference for fortified cereals targeting immunity, cognitive development, and overall health. Consumers increasingly seek convenient, nutrient-rich options, including organic and mixed-ingredient formulations. Strong distribution channels across modern trade, online platforms, and specialty stores further drive market growth. In addition, increasing marketing initiatives and product innovations by leading brands significantly contribute to the market’s expansion.

Europe Baby Cereal Market Insight

The Europe baby cereal market is projected to expand at a substantial CAGR throughout the forecast period, supported by rising awareness of infant nutrition, the adoption of fortified cereals, and stringent regulations on product quality and safety. Countries such as Germany, France, and the U.K. are witnessing growing demand for organic and health-focused Baby Cereals. The region’s preference for convenience, clean-label products, and fortified formulations across residential and childcare institutions is driving growth.

U.K. Baby Cereal Market Insight

The U.K. baby cereal market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by parental preference for high-nutrient, fortified cereals. The demand for organic, fortified, and easy-to-prepare options, combined with well-established retail networks and e-commerce penetration, continues to fuel market adoption. Rising awareness about infant health and wellness is further encouraging product uptake across households and daycare centers.

Germany Baby Cereal Market Insight

The Germany baby cereal market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing health-consciousness, stringent product safety regulations, and the demand for organic and nutrient-rich formulations. Strong retail infrastructure, increasing product innovations, and focus on functional cereals targeting immunity, growth, and cognitive development are supporting market growth. Germany’s emphasis on quality and sustainability is driving preference for high-standard Baby Cereals, particularly in residential and childcare applications.

Which Region is the Fastest Growing Region in the Baby Cereal Market?

The Asia-Pacific baby cereal market is poised to grow at the fastest CAGR of 7.98% during the forecast period 2025–2032, driven by rising urbanization, growing disposable incomes, and heightened awareness of infant nutrition in countries such as China, Japan, and India. The increasing penetration of e-commerce, modern trade, and innovative fortified cereals is encouraging adoption among a growing middle-class population.

Japan Baby Cereal Market Insight

The Japan baby cereal market is gaining momentum due to the country’s health-conscious culture, high awareness of functional nutrition, and demand for convenience. Cereals enriched with DHA, probiotics, and vitamins are increasingly popular among parents, with online and retail availability facilitating widespread adoption. The focus on cognitive development, immunity, and digestive health is further boosting demand in residential and childcare segments.

China Baby Cereal Market Insight

The China baby cereal market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and increasing health awareness among parents. The market is driven by fortified cereals, organic options, and mixed-ingredient products designed for infant growth and development. The growth of modern retail, online platforms, and domestic manufacturers offering affordable options is accelerating adoption across urban and semi-urban areas.

Which are the Top Companies in Baby Cereal Market?

The baby cereal industry is primarily led by well-established companies, including:

- Nestlé S.A. (Switzerland)

- Meiji Holdings Co., Ltd. (Japan)

- Danone (France)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline Consumer Healthcare Ltd. (U.K.)

- Ella’s Kitchen (Brands) Limited (U.K.)

- FrieslandCampina (Netherlands)

- Bellamy’s Organic (Australia)

- Kraft Heinz Canada ULC. (Canada)

- DMK GROUP (Germany)

- Hain Celestial (U.S.)

- DSM (Netherlands)

- Bristol Myers Squibb Company (U.S.)

- Hero Group (Switzerland)

- Mead Johnson & Company, LLC. (U.S.)

- Perrigo Company plc (Ireland)

- Beech Nut (U.S.)

- Abbott. (U.S.)

- HiPP (Germany)

- CSC BRANDS, L.P. (U.S.)

- Wyeth (U.S.)

- Arla Foods Ingredients Group P/S (Denmark)

What are the Recent Developments in Global Baby Cereal Market?

- In June 2023, Nature’s Path Organic Foods, a privately held family-owned producer of certified organic foods, acquired Love Child Organics, a Canadian-based organic baby food and children’s snack brand, enabling the company to expand Love Child Organics’ baby food products in the U.S. market and strengthen its presence in North America

- In December 2022, Mother Nurture launched a new range of around 12 parent-tasted, baby-approved infant foods, including products such as Baby King Kong’s Pudding and Jumping Jack Rabbit Only Carrots, which are highly nutritious, preservative-free, and proven wholesome for infants, supporting its objective to cater to health-conscious parents

- In November 2022, Hero Group, a Switzerland-based baby food manufacturer, invested approximately USD 16.5 million to establish a new 6,000 square meter factory in Alcantarilla, Murcia, Spain, on Hero’s existing premises, aiming to enhance production capacity and meet growing demand for baby food in the European market

- In July 2022, Gerber expanded its product portfolio by introducing its first-ever infant puree line, offering nutrient-dense flavors such as Corn and Mango, made from fruits and vegetables to ensure satiety and proper nutrition for babies, marking a strategic move toward broader product offerings

- In June 2022, Abbott Laboratories, a leading U.S.-based company, announced the restart of Similac infant formula production at its Sturgis manufacturing plant in Michigan, aiming to address the nationwide infant formula shortage and meet the urgent needs of American parents

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Baby Cereal Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Baby Cereal Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Baby Cereal Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.