Global Baby Personal Care Products Market

Market Size in USD Billion

CAGR :

%

USD

106.12 Billion

USD

185.09 Billion

2025

2033

USD

106.12 Billion

USD

185.09 Billion

2025

2033

| 2026 –2033 | |

| USD 106.12 Billion | |

| USD 185.09 Billion | |

|

|

|

|

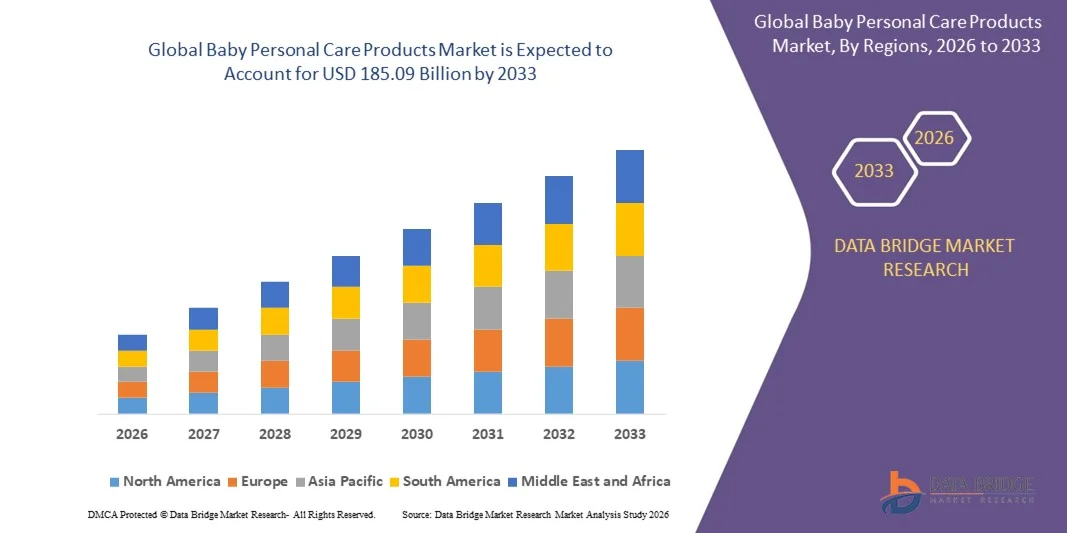

What is the Global Baby Personal Care Products Market Size and Growth Rate?

- The global baby personal care products market size was valued at USD 106.12 billion in 2025 and is expected to reach USD 185.09 billion by 2033, at a CAGR of7.20% during the forecast period

- The increase in awareness regarding child health and hygiene among people around the world is one of the major factors anticipated to drive the baby personal care products market growth rate

- Moreover, the rise in disposable income and increase in number of working women populations are also expected to fuel the growth of the baby personal care products market

What are the Major Takeaways of Baby Personal Care Products Market?

- Increase in awareness concerning health and new brands supporting health for babies are also expected to highly impact the growth of the baby personal care products market

- While, the rise in the economic stability of parents and rise in regular use of baby care products for children among consumers are also amongst the major factors expected to fuel the growth of the baby personal care products market in the above mentioned forecast period

- North America dominated the baby personal care products market with an estimated 41.8% revenue share in 2025, driven by high consumer awareness regarding infant hygiene, strong preference for premium and dermatologist-tested products, and high per-capita spending on baby care across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.32% from 2026 to 2033, driven by high birth rates, rapid urbanization, rising disposable incomes, and increasing awareness of infant hygiene across China, India, Southeast Asia, and other developing markets

- The Toiletries segment dominated the market with a 48.6% share in 2025, driven by daily and frequent usage of products such as baby soaps, shampoos, body washes, wipes, and diapers-related hygiene items

Report Scope and Baby Personal Care Products Market Segmentation

|

Attributes |

Baby Personal Care Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Baby Personal Care Products Market?

Increasing Shift Toward Natural, Organic, and Dermatologically Tested Baby Personal Care Products

- The baby personal care products market is witnessing strong adoption of natural, organic, and plant-based formulations designed to minimize skin irritation and ensure safety for infants and toddlers

- Manufacturers are increasingly introducing dermatologically tested, hypoallergenic, and chemical-free products, avoiding parabens, sulfates, synthetic fragrances, and harsh preservatives

- Growing parental awareness regarding infant skin sensitivity, long-term health impacts, and ingredient transparency is driving demand for premium and clean-label baby care products

- For instance, companies such as Johnson & Johnson, Procter & Gamble, Unilever, Weleda, and Himalaya have expanded their baby care portfolios with organic oils, gentle cleansers, and toxin-free skincare solutions

- Rising preference for eco-friendly packaging, cruelty-free production, and sustainable sourcing is accelerating the shift toward responsible baby personal care brands

- As consumer focus on safety and wellness intensifies, Baby Personal Care Products will remain essential for nurturing infant health and supporting premium market growth

What are the Key Drivers of Baby Personal Care Products Market?

- Rising birth rates in emerging economies and increasing expenditure on infant hygiene, skincare, and wellness products

- For instance, in 2024–2025, leading brands such as Unilever, Beiersdorf, and Johnson & Johnson introduced baby-specific ranges emphasizing mild formulations and pediatric safety standards

- Growing awareness of baby skin disorders, allergies, and sensitivity issues is increasing demand for specialized lotions, creams, shampoos, and wipes

- Expansion of e-commerce platforms, organized retail, and pharmacy chains has improved product accessibility and brand visibility globally

- Increasing influence of pediatric recommendations, parenting communities, and digital marketing is shaping purchasing decisions

- Supported by rising disposable incomes, urbanization, and focus on infant care, the Baby Personal Care Products market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Baby Personal Care Products Market?

- High prices of premium, organic, and dermatologically tested baby care products limit adoption among price-sensitive consumers

- For instance, during 2024–2025, rising costs of natural raw materials and sustainable packaging increased production expenses for several global brands

- Strict regulatory requirements related to product safety, ingredient approval, and labeling compliance increase time-to-market and operational complexity

- Limited consumer awareness in developing regions regarding product differentiation and ingredient safety restrains market penetration

- Intense competition from private-label brands and low-cost local manufacturers creates pricing pressure and reduces brand margins

- To address these challenges, companies are focusing on cost-efficient formulations, localized production, consumer education, and wider distribution networks to expand adoption of Baby Personal Care Products globally

How is the Baby Personal Care Products Market Segmented?

The market is segmented on the basis of product type, price, and distribution channel.

- By Product Type

On the basis of product type, the baby personal care products market is segmented into Toiletries, Cosmetics, and Others. The Toiletries segment dominated the market with a 48.6% share in 2025, driven by daily and frequent usage of products such as baby soaps, shampoos, body washes, wipes, and diapers-related hygiene items. High consumption frequency, essential nature of these products, and strong demand across both developed and emerging economies support segment dominance. Parents prioritize hygiene-focused products to prevent infections, rashes, and skin irritation, further strengthening demand.

The Cosmetics segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for baby lotions, creams, oils, and moisturizers formulated with natural and organic ingredients. Increasing awareness of infant skincare, preference for dermatologically tested products, and premiumization trends are driving faster growth in this segment globally.

- By Price

On the basis of price, the baby personal care products market is segmented into Premium Baby Care Products and Mass Baby Care Products. The Mass Baby Care Products segment dominated the market with a 62.3% share in 2025, owing to its affordability, wide availability, and strong penetration in price-sensitive markets. Large population bases, especially in Asia-Pacific, Latin America, and parts of Africa, rely heavily on mass-market baby care products for daily hygiene needs. Established brands and local manufacturers offer cost-effective solutions through supermarkets, pharmacies, and convenience stores, supporting sustained demand.

The Premium Baby Care Products segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing disposable incomes, urbanization, and growing parental preference for organic, chemical-free, and dermatologist-recommended products. Premiumization, clean-label trends, and heightened focus on baby skin health continue to accelerate growth of this segment.

- By Distribution Channel

On the basis of distribution channel, the baby personal care products market is segmented into Hypermarkets and Supermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Retail, and Others. The Hypermarkets and Supermarkets segment dominated the market with a 39.8% share in 2025, supported by wide product assortments, strong brand visibility, competitive pricing, and one-stop shopping convenience. Parents prefer these channels for regular purchases of baby care essentials due to trust, accessibility, and promotional offers.

The Online Retail segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing internet penetration, smartphone usage, and preference for doorstep delivery. Availability of detailed product information, subscription models, discounts, and growing influence of digital parenting communities are significantly boosting online sales of baby personal care products worldwide.

Which Region Holds the Largest Share of the Baby Personal Care Products Market?

- North America dominated the baby personal care products market with an estimated 41.8% revenue share in 2025, driven by high consumer awareness regarding infant hygiene, strong preference for premium and dermatologist-tested products, and high per-capita spending on baby care across the U.S. and Canada. Widespread adoption of organic, hypoallergenic, and pediatric-recommended products continues to support strong demand

- Leading companies in North America are expanding portfolios focused on clean-label, fragrance-free, and clinically tested baby care solutions, strengthening brand trust and consumer loyalty. Continuous product innovation and strong retail penetration support long-term market growth

- High disposable incomes, advanced healthcare infrastructure, and strong influence of pediatric guidance further reinforce North America’s market leadership

U.S. Baby Personal Care Products Market Insight

The U.S. is the largest contributor in North America, supported by high birth-related spending, strong demand for premium baby skincare, and widespread availability through supermarkets, pharmacies, and online channels. Increasing preference for organic, sustainable, and cruelty-free baby care products, along with strong brand presence and marketing, continues to drive market expansion.

Canada Baby Personal Care Products Market Insight

Canada contributes significantly to regional growth, driven by rising awareness of baby skin health, growing demand for natural formulations, and steady expansion of organized retail. Parents increasingly prefer mild, eco-friendly, and dermatologist-approved products, supporting consistent demand for baby toiletries, skincare, and wellness products.

Asia-Pacific Baby Personal Care Products Market

Asia-Pacific is projected to register the fastest CAGR of 9.32% from 2026 to 2033, driven by high birth rates, rapid urbanization, rising disposable incomes, and increasing awareness of infant hygiene across China, India, Southeast Asia, and other developing markets. Expansion of e-commerce and growing penetration of branded baby care products are accelerating market growth.

China Baby Personal Care Products Market Insight

China is the largest contributor to Asia-Pacific, supported by a large infant population, growing middle class, and strong demand for premium and imported baby care products. Rising focus on product safety, ingredient transparency, and quality assurance is driving rapid adoption of branded baby personal care products.

Japan Baby Personal Care Products Market Insight

Japan shows steady growth supported by strong preference for high-quality, gentle, and clinically tested baby care products. Advanced retail infrastructure, aging parents’ cautious purchasing behavior, and emphasis on product safety and innovation contribute to sustained market demand.

India Baby Personal Care Products Market Insight

India is emerging as a major growth hub, driven by high birth rates, improving living standards, and increasing penetration of branded baby care products. Rapid growth of online retail, expanding middle-class population, and rising awareness of baby hygiene and skincare are accelerating market adoption.

South Korea Baby Personal Care Products Market Insight

South Korea contributes steadily due to strong demand for premium, natural, and dermatologically tested baby care products. High consumer awareness, influence of clean beauty trends, and preference for innovative formulations support continued growth in the baby personal care products market.

Which are the Top Companies in Baby Personal Care Products Market?

The baby personal care products industry is primarily led by well-established companies, including:

- KCWW (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Procter & Gamble (U.S.)

- Unilever (U.K.)

- AVON Beauty Products India Pvt Ltd. (U.S.)

- Beiersdorf AG (Germany)

- KAO Corporation (Japan)

- Burt’s Bees (U.S.)

- Chicco (Italy)

- Earth Mama Organics (U.S.)

- The Himalaya Drug Company (India)

- PREMCO (U.S.)

- Weleda (Switzerland)

- Galderma Laboratories, L.P. (Switzerland)

- Colgate-Palmolive Company (India) Limited (U.S.)

- The Estée Lauder Companies Inc. (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Natura International Inc. (Brazil)

- Lion Corporation (Japan)

- Reckitt Benckiser (U.K.)

What are the Recent Developments in Global Baby Personal Care Products Market?

- In February 2023, Walmart announced the launch of an exclusive soft and organic baby apparel line, M + A by Monica + Andy, made from 100% organic cotton and designed for babies from newborn to 24 months, with availability online and across more than 1,100 Walmart stores in the U.S., reinforcing Walmart’s focus on expanding sustainable and premium baby product offerings

- In October 2022, Nature’s One expanded its Baby’s Only Formula portfolio by introducing Baby’s Only Organic Premium Infant Formula, formulated to meet all FDA nutritional requirements and suitable as a complete source of nourishment or breastfeeding supplement, highlighting the company’s emphasis on certified organic and nutritionally complete infant nutrition solutions

- In July 2022, Danone launched Aptamil, a new baby formula combining dairy and plant-based ingredients such as soy proteins, vegetable oils, and chicory-root fibers, reflecting the company’s strategy to address evolving consumer demand for plant-forward and balanced infant nutrition

- In April 2022, Gerber, a Nestlé brand, introduced its first plant-based baby food range, Plant-Tastic, offering organic toddler foods made from nutrient-dense beans, whole grains, and vegetables, strengthening its position in the fast-growing plant-based baby nutrition segment

- In September 2021, Johnson & Johnson launched its Cottontouch baby care range in India, including lotion, oil, wash, and cream, distributed through offline retail and major e-commerce platforms, underscoring the company’s focus on meeting rising demand for gentle baby skincare products in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.