Global Bacillus Firmus Bionematicides Market

Market Size in USD Billion

CAGR :

%

USD

1.36 Billion

USD

3.49 Billion

2025

2033

USD

1.36 Billion

USD

3.49 Billion

2025

2033

| 2026 –2033 | |

| USD 1.36 Billion | |

| USD 3.49 Billion | |

|

|

|

|

Bacillus Firmus Bionematicides Market Size

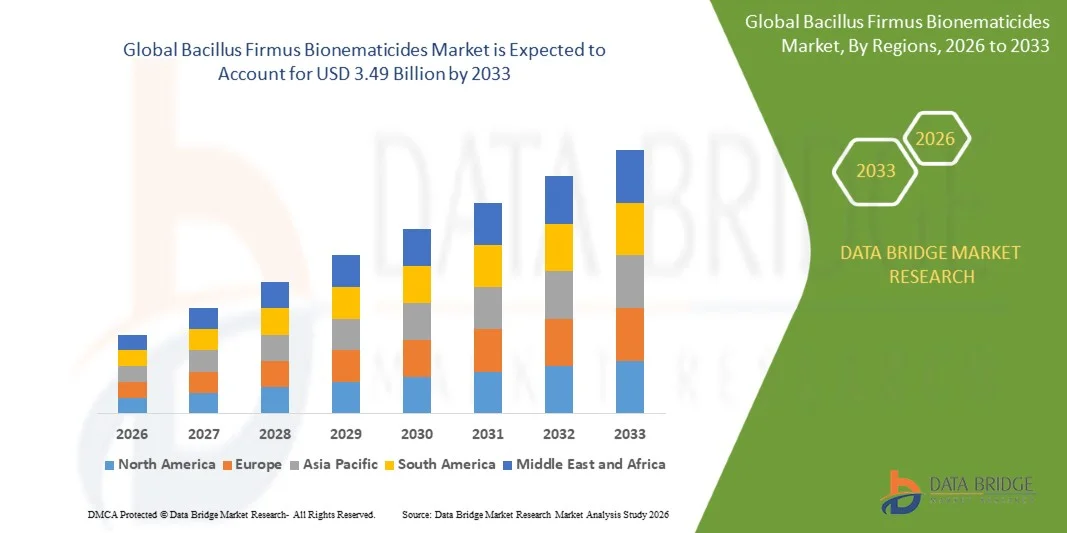

- The global bacillus firmus bionematicides market size was valued at USD 1.36 billion in 2025 and is expected to reach USD 3.49 billion by 2033, at a CAGR of 12.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of sustainable and bio-based crop protection solutions, along with rising awareness of nematode management among farmers, leading to greater implementation of integrated pest management practices in both large-scale and smallholder farms

- Furthermore, growing demand for residue-free, high-quality crops and government initiatives promoting eco-friendly agricultural practices are establishing Bacillus Firmus bionematicides as a preferred solution for nematode control. These converging factors are accelerating the adoption of biological nematicides, thereby significantly boosting the market’s growth

Bacillus Firmus Bionematicides Market Analysis

- Bacillus Firmus bionematicides, offering biological control of nematodes in soils and crops, are increasingly vital for maintaining crop health, improving yields, and reducing reliance on chemical nematicides across cereals, pulses, vegetables, and horticultural crops

- The escalating demand for these bionematicides is primarily fueled by rising adoption of sustainable farming practices, increasing regulatory restrictions on chemical nematicides, and growing farmer awareness regarding the benefits of microbial solutions for nematode management and soil fertility enhancement

- North America dominated the bacillus firmus bionematicides market with a share of around 35% in 2025, due to increasing adoption of sustainable and organic farming practices, as well as heightened awareness of nematode management in high-value crops

- Asia-Pacific is expected to be the fastest growing region in the bacillus firmus bionematicides market during the forecast period due to increasing cultivation of high-value crops, rising awareness of sustainable agriculture, and growing adoption of bio-based crop protection in countries such as China, India, and Japan

- Dry segment dominated the market with a market share of 55.8% in 2025, due to its ease of storage, long shelf life, and suitability for large-scale agricultural application. Dry formulations are preferred by farmers for seed coating and soil application, ensuring uniform distribution of the active microbe. Their stability under varying climatic conditions and compatibility with standard farm equipment enhances adoption. Dry bionematicides are often incorporated into integrated pest management programs to maintain soil health and improve crop productivity. In addition, cost-effectiveness and simplified transportation logistics make dry forms a popular choice in emerging economies. The segment benefits from established usage patterns among cereal and grain farmers globally

Report Scope and Bacillus Firmus Bionematicides Market Segmentation

|

Attributes |

Bacillus Firmus Bionematicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bacillus Firmus Bionematicides Market Trends

“Rising Adoption of Sustainable and Bio-Based Crop Protection Solutions”

- A significant trend in the Bacillus Firmus bionematicides market is the growing adoption of bio‑based nematicides as farmers and agribusinesses seek sustainable alternatives to chemical nematicides that pose environmental and health concerns. This trend is driven by increasing emphasis on eco‑friendly agriculture and the need to manage nematode infestations without degrading soil health or leaving harmful residues in crops

- For instance, BASF’s Votivo Prime, containing Bacillus firmus strain I‑1582, has been introduced as a biological nematicide solution that aligns with sustainable crop protection strategies and reduces dependency on synthetic pesticides, enhancing acceptance among growers focused on sustainable practices

- The trend is further supported by stringent regulatory frameworks in regions such as the European Union, where restrictions on chemical nematicides encourage growers to adopt microbial alternatives for root‑knot and cyst nematode control

- Increasing consumer demand for residue‑free produce in markets such as North America is reinforcing adoption of Bacillus Firmus bionematicides, as these solutions help maintain crop quality while addressing pest challenges

- Agritech companies and distributors are expanding their portfolios to include Bacillus Firmus–based products, indicating a broader industry shift toward biological crop protection technologies

- The integration of Bacillus Firmus solutions into integrated pest management (IPM) programs is enhancing farmer confidence in bionematicides as reliable tools for nematode management across diverse crops and agriculture systems, reinforcing this trend in the global market

Bacillus Firmus Bionematicides Market Dynamics

Driver

“Growing Awareness of Nematode Management and Crop Health”

- The growing awareness among farmers, agronomists, and agricultural stakeholders about the impact of nematodes on crop health and yields is a key driver for the Bacillus Firmus bionematicides market, encouraging adoption of biological solutions that target nematode infestations effectively. These soil pests significantly reduce productivity in cereals, vegetables, and high‑value horticultural crops, prompting demand for effective biological control

- For instance, Marrone Bio Innovations has actively promoted its bionematicide products by highlighting crop health benefits and yield improvements in field demonstrations and grower engagement programs, increasing market interest in biological nematicides

- Agricultural extension services and research institutions in countries such as India and Brazil are conducting awareness campaigns and training sessions on nematode management, further educating growers about the benefits of microbial nematicides for sustainable crop protection

- The increased emphasis on crop health monitoring and soil fertility preservation is encouraging farmers to incorporate Bacillus Firmus bionematicides into their crop protection regimens as proactive solutions, rather than relying solely on curative chemical treatments

- Partnerships between biocontrol companies and agricultural cooperatives to promote Bacillus Firmus products are reinforcing this driver by facilitating technology transfer and increasing accessibility for growers

Restraint/Challenge

“Regulatory Restrictions and Limited Awareness in Emerging Markets”

- The Bacillus Firmus bionematicides market faces challenges due to regulatory restrictions on biological product approvals and limited awareness of biological nematicides, particularly in emerging markets where chemical nematicides remain dominant. These challenges can slow market expansion as growers may be hesitant to switch to newer biological alternatives without clear regulatory pathways and education on use practices

- For instance, obtaining registration for biological bionematicides in regions such as Latin America and parts of Asia often involves complex regulatory evaluations that delay product launch timelines and restrict market entry for innovators such as Koppert Biological Systems

- In many emerging agricultural regions, farmers continue to rely on traditional chemical nematicides due to longstanding familiarity and insufficient exposure to biological alternatives, creating a market barrier for Bacillus Firmus–based products

- Limited demonstration of field performance under diverse agronomic conditions can also affect grower confidence, making widespread adoption more challenging for companies promoting biological nematicides

- These regulatory and awareness constraints collectively slow the pace at which Bacillus Firmus bionematicides can scale in markets that could benefit from sustainable nematode management solutions

Bacillus Firmus Bionematicides Market Scope

The market is segmented on the basis of crop type, form, mode of application, and infestation.

• By Crop Type

On the basis of crop type, the Bacillus Firmus bionematicides market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and the rest of the crops. The cereals and grains segment dominated the market with the largest revenue share in 2025, driven by the extensive cultivation of staple crops such as wheat, rice, and maize, which are highly susceptible to nematode infestations. Farmers prioritize bionematicides for cereals and grains due to their ability to improve crop health and enhance yield while reducing reliance on chemical nematicides. The compatibility of Bacillus Firmus with large-scale cereal farming practices and soil health management further reinforces its adoption. In addition, government programs promoting sustainable agriculture in major cereal-producing regions support market penetration. The increasing demand for high-quality, nematode-free cereals also propels the segment’s dominance.

The fruits and vegetables segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer demand for high-quality, residue-free produce. For instance, companies such as Bayer have introduced Bacillus Firmus-based solutions tailored for horticultural crops to control root-knot and lesion nematodes effectively. The segment benefits from higher-value crops requiring targeted nematode management and sustainable crop protection solutions. Smallholder and commercial growers increasingly adopt bionematicides for fruits and vegetables to maintain soil fertility and minimize chemical residues. Growing export-oriented cultivation of fruits and vegetables further drives the adoption of biocontrol solutions. In addition, awareness campaigns on eco-friendly pest management in horticulture strengthen the growth prospects of this segment.

• By Form

On the basis of form, the Bacillus Firmus bionematicides market is segmented into dry and liquid formulations. The dry form segment dominated the market with the largest revenue share of 55.8% in 2025, driven by its ease of storage, long shelf life, and suitability for large-scale agricultural application. Dry formulations are preferred by farmers for seed coating and soil application, ensuring uniform distribution of the active microbe. Their stability under varying climatic conditions and compatibility with standard farm equipment enhances adoption. Dry bionematicides are often incorporated into integrated pest management programs to maintain soil health and improve crop productivity. In addition, cost-effectiveness and simplified transportation logistics make dry forms a popular choice in emerging economies. The segment benefits from established usage patterns among cereal and grain farmers globally.

The liquid form segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by ease of application through foliar spray or fertigation systems. For instance, Novozymes has developed liquid Bacillus Firmus formulations that enable precise dosing and rapid soil penetration, improving nematode control in high-value crops. Liquid formulations are increasingly preferred in horticulture and intensive vegetable farming due to higher efficacy and faster microbial colonization. Ease of mixing with other fertilizers or biostimulants enhances convenience for farmers. The flexibility of liquid formulations for different modes of application further supports their growing adoption. In addition, regulatory approvals and farmer awareness programs emphasizing efficient bionematicide use bolster market growth for liquid products.

• By Mode of Application

On the basis of mode of application, the Bacillus Firmus bionematicides market is segmented into seed treatment, soil treatment, foliar spray, and others. The soil treatment segment dominated the market with the largest revenue share in 2025, driven by its effectiveness in directly targeting nematodes in the root zone. Farmers prefer soil treatment applications for cereals and grains to reduce root damage and improve nutrient uptake. Bacillus Firmus establishes itself in the rhizosphere, providing long-lasting protection against multiple nematode species. The adoption is further supported by integration with conventional fertilization practices, allowing simultaneous application. Soil treatment ensures uniform microbial distribution and consistent efficacy across different soil types. In addition, large-scale field trials demonstrating yield improvement reinforce the segment’s dominance in commercial agriculture.

Seed treatment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by its targeted protection at the earliest stages of plant growth. For instance, Syngenta has introduced Bacillus Firmus-based seed coatings that control nematode infestations from germination to early vegetative stages. Seed treatment applications reduce chemical usage, enhance germination rates, and improve seedling vigor. The practice is gaining traction among farmers cultivating high-value crops where early-stage protection is critical. Growing adoption of precision agriculture technologies complements the use of microbial seed treatments. In addition, awareness campaigns and demonstration programs on sustainable nematode management further drive growth for this mode of application.

• By Infestation

On the basis of infestation, the Bacillus Firmus bionematicides market is segmented into root-knot nematodes, cyst nematodes, lesion nematodes, and others. The root-knot nematodes segment dominated the market with the largest revenue share in 2025, driven by the widespread prevalence of Meloidogyne species affecting cereals, vegetables, and horticultural crops. Bacillus Firmus provides effective biological control by colonizing the rhizosphere and suppressing nematode populations, improving root development and nutrient absorption. Farmers prioritize this segment due to the significant crop losses caused by root-knot nematodes and the rising restrictions on chemical nematicides. The adoption is further supported by field studies validating consistent efficacy across diverse soil types. In addition, compatibility with integrated pest management practices enhances its application in commercial and small-scale farming. Regulatory support for biocontrol solutions targeting root-knot nematodes reinforces market leadership.

The cyst nematodes segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by its increasing incidence in pulse crops and high-value horticultural plants. For instance, BASF has developed Bacillus Firmus formulations specifically targeting Heterodera species in legumes, providing sustainable nematode suppression. Growing adoption of crop rotation and organic farming practices boosts demand for bionematicides against cyst nematodes. The segment benefits from rising awareness of the environmental impact of chemical nematicides. Precision application techniques ensure targeted control, increasing farmer confidence in efficacy. In addition, government incentives and extension services promoting sustainable nematode management further accelerate market growth in this infestation category.

Bacillus Firmus Bionematicides Market Regional Analysis

- North America dominated the bacillus firmus bionematicides market with the largest revenue share of around 35% in 2025, driven by increasing adoption of sustainable and organic farming practices, as well as heightened awareness of nematode management in high-value crops

- Farmers in the region prioritize eco-friendly biocontrol solutions to reduce chemical pesticide usage and maintain soil health, with Bacillus Firmus offering an effective alternative for controlling root-knot and cyst nematodes

- This widespread adoption is further supported by advanced agricultural research, government incentives promoting bio-based crop protection, and high awareness of integrated pest management strategies, establishing bionematicides as a preferred solution in both large-scale and smallholder farms

U.S. Bacillus Firmus Bionematicides Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by the increasing implementation of sustainable farming practices and the growing demand for residue-free crops. Farmers are increasingly adopting Bacillus Firmus for cereals, pulses, and vegetables due to its proven efficacy against root-knot nematodes. The presence of advanced biocontrol research institutions, coupled with government support programs for eco-friendly crop protection, further strengthens market growth. In addition, integration of Bacillus Firmus in seed treatment and soil application practices ensures consistent crop yield and soil health improvement.

Europe Bacillus Firmus Bionematicides Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by strict regulations limiting chemical nematicides and rising adoption of sustainable agricultural practices. Countries such as Germany, France, and the U.K. are witnessing increased demand for bio-based nematode management solutions. European farmers are focusing on soil conservation and crop safety, promoting Bacillus Firmus adoption in cereals, vegetables, and pulses. The integration of biocontrol solutions in organic farming and precision agriculture programs further supports growth.

U.K. Bacillus Firmus Bionematicides Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government initiatives encouraging bio-based crop protection and the rising demand for high-quality, nematode-free produce. Farmers are increasingly adopting Bacillus Firmus for horticultural and cereal crops due to its environmental benefits and efficacy against root-knot nematodes. The country’s strong agricultural research infrastructure and awareness campaigns on sustainable pest management reinforce market growth.

Germany Bacillus Firmus Bionematicides Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of sustainable farming and strict regulations on chemical nematicides. German farmers prioritize the use of biocontrol agents such as Bacillus Firmus in cereals and vegetables to enhance soil fertility and control nematode infestations. Advanced agri-tech solutions, government incentives, and extensive adoption of integrated pest management strategies promote market adoption.

Asia-Pacific Bacillus Firmus Bionematicides Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during 2026 to 2033, driven by increasing cultivation of high-value crops, rising awareness of sustainable agriculture, and growing adoption of bio-based crop protection in countries such as China, India, and Japan. Government programs supporting organic farming and nematode control, coupled with rapid urbanization and technological adoption in agriculture, boost the market. In addition, APAC serves as a key production hub for biocontrol products, improving affordability and availability of Bacillus Firmus solutions.

Japan Bacillus Firmus Bionematicides Market Insight

The Japan market is gaining momentum due to the country’s advanced agricultural technology adoption, emphasis on high-value crop protection, and growing concern for soil health. Farmers increasingly use Bacillus Firmus to control root-knot and lesion nematodes in vegetables and horticultural crops. Integration with precision farming practices and sustainable soil management programs fuels growth.

China Bacillus Firmus Bionematicides Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, driven by expanding cultivation of cereals, vegetables, and pulses, along with strong government initiatives promoting bio-based crop protection. China’s rapidly growing middle-class and demand for residue-free produce support market expansion. Domestic biocontrol manufacturers and wide accessibility of Bacillus Firmus products further propel adoption across both large-scale and smallholder farms.

Bacillus Firmus Bionematicides Market Share

The bacillus firmus bionematicides industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- Cargill, Incorporated (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- BioWorks Inc. (U.S.)

- Marrone Bio Innovations (U.S.)

- Hebei Weiyuan Biochemical Co., Ltd. (China)

- Koppert Biological Systems (Netherlands)

- STAR BIO SCIENCE (India)

- Andermatt Biocontrol AG (Switzerland)

- Dow (U.S.)

- Varsha Bioscience and Technology India Pvt Ltd. (India)

- Monsanto Company (U.S.)

- T. Stanes and Company Limited (India)

- SEIPASA, S.A. (Spain)

Latest Developments in Global Bacillus Firmus Bionematicides Market

- In March 2025, FMC Corporation expanded its biological crop protection platform in Canada by collaborating with Novonesis (formerly Novozymes), reinforcing its position in biocontrol nematicides and plant biosolutions. The collaboration strengthens research and development capabilities, accelerates delivery of advanced biological nematicide products to growers, and supports sustainable agriculture practices by offering effective, environmentally friendly alternatives for nematode control

- In February 2025, BASF pre‑launched Votivo Prime, a biological contact nematicide containing Bacillus firmus strain I‑1582 at the EnBio event, marking a major step toward sustainable seed treatment solutions. This development expands the availability of effective biological nematode control products for broad‑acre farming, strengthens the company’s biological crop protection portfolio, and enables growers to better manage nematode pressure in crops such as soybean and wheat, reflecting the increasing industry focus on bio-based alternatives to chemical nematicides

- In January 2025, American Vanguard Corporation, through its AMVAC unit, entered a regional distribution agreement with DPH Biologicals to broaden its GreenSolutions portfolio, which includes nematicidal biocontrol products. This partnership enhances market access for biological nematicides across wider geographies, improves distribution networks, and promotes adoption of integrated pest management strategies that reduce dependence on synthetic chemical nematicides

- In December 2024, UPL Corp introduced Nimaxxa, a novel triple-strain bionematicide seed treatment designed to protect soybeans and corn from nematode damage. The launch diversifies the biological nematicide product landscape, provides enhanced root protection and resilience for key crops, and reflects the increasing demand for multi-strain microbial solutions that improve crop health, yield, and sustainability

- In December 2023, Syngenta launched Certano, a microbiological bionematicide specifically designed for sugarcane cultivation, providing growers with improved nematode management and crop growth benefits. The product introduction broadens the application of biological nematicides in specialty crops, enhances crop productivity with minimal environmental impact, and demonstrates growing industry investment in sustainable solutions across diverse agricultural segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.