Global Badminton Apparel Market

Market Size in USD Billion

CAGR :

%

USD

29.34 Billion

USD

41.72 Billion

2024

2032

USD

29.34 Billion

USD

41.72 Billion

2024

2032

| 2025 –2032 | |

| USD 29.34 Billion | |

| USD 41.72 Billion | |

|

|

|

|

Badminton Apparel Market Size

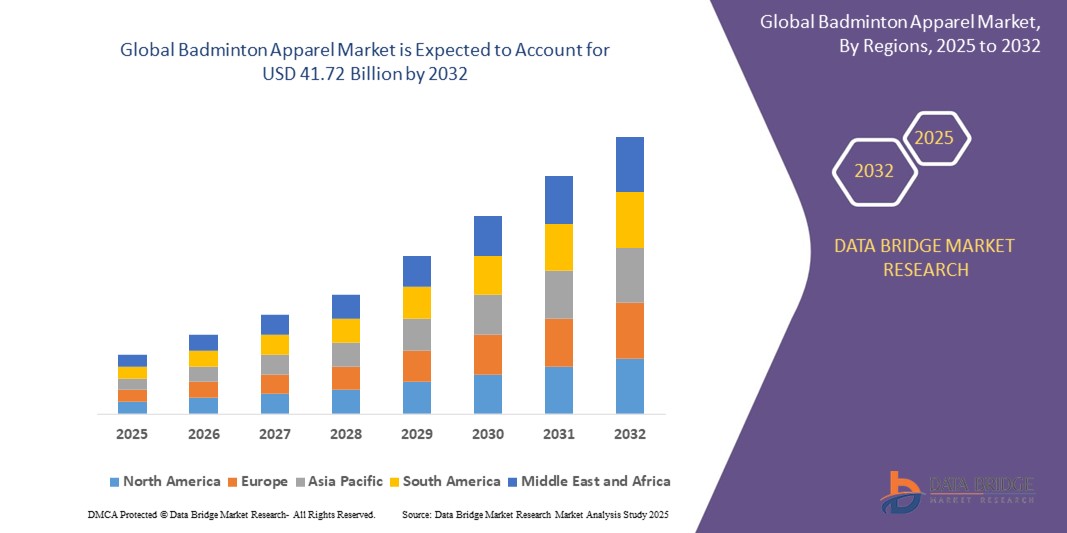

- The global badminton apparel market size was valued at USD 29.34 billion in 2024 and is expected to reach USD 41.72 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the increasing popularity of badminton as both a professional and recreational sport, growing health consciousness, and rising participation rates across Asia-Pacific, Europe, and North America

- Expanding sports infrastructure, endorsements by professional athletes, and innovations in lightweight, sweat-absorbent, and breathable fabric technologies are further supporting market expansion

Badminton Apparel Market Analysis

- Rising demand for high-performance sportswear that enhances agility and comfort is driving the adoption of premium badminton apparel among both amateurs and professionals

- Countries such as China, India, Indonesia, and Malaysia are contributing significantly due to government support for grassroots-level training programs and national-level tournaments

- North America dominated the badminton apparel market with the largest revenue share of 39.28% in 2024, driven by growing participation in badminton at the school, collegiate, and recreational levels, alongside rising consumer interest in fitness and indoor sports

- Asia-Pacific region is expected to witness the highest growth rate in the global badminton apparel market, driven by the sport’s deep cultural roots, expanding middle-class population, and the increasing availability of affordable performance wear through both offline and online channels

- The top wear segment dominated the market with the largest market revenue share in 2024, driven by its essential role in both practice and competition, and consistent demand from both amateur and professional players. Branded jerseys and performance-enhancing t-shirts made with sweat-absorbent and breathable fabrics have gained traction among players seeking comfort and mobility

Report Scope and Badminton Apparel Market Segmentation

|

Attributes |

Badminton Apparel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Sustainable and Eco-Friendly Badminton Apparel • Expansion of E-Commerce Channels in Emerging Markets |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Badminton Apparel Market Trends

“Incorporation of Advanced Fabric Technologies Enhancing Performance and Comfort”

- The incorporation of advanced fabric technologies such as moisture-wicking, anti-odor, and heat-regulating materials is transforming the functionality of badminton apparel, enhancing player performance and comfort during high-intensity matches, training sessions, and long tournaments where temperature regulation is critical to endurance and focus

- Brands are investing in research and development to create lightweight, stretchable, and breathable apparel that can adapt to body movements and improve athletic agility without compromising durability or design aesthetics

- Leading manufacturers such as Yonex and Victor are launching collections with integrated fabric technologies, such as “VeryCool Dry” and air-circulation mesh panels, to reduce sweat retention and skin irritation, which are key concerns for professional and recreational players alike

- For instance, Yonex’s use of Xylitol cooling material in select apparel lines helps lower body temperature by up to 3°C, while Victor’s functional wear features eco-conscious, sweat-reducing technology aimed at younger athletes and climate-conscious buyers

- These innovations are setting new standards in badminton apparel and shifting consumer expectations toward value-added performance wear, encouraging broader adoption among enthusiasts, club players, and national-level athletes globally

Badminton Apparel Market Dynamics

Driver

“Growing Participation in Recreational and Competitive Badminton”

• Growing participation in badminton as a recreational and competitive sport is significantly driving demand for specialized apparel that offers durability, comfort, and performance-enhancing features for training and tournament play, particularly in emerging economies where grassroots initiatives and local leagues are expanding rapidly

• National federations and sports ministries in countries such as India, Indonesia, and Malaysia are promoting badminton through talent identification programs, school-level championships, and public infrastructure development, which is increasing demand for sport-specific clothing across age groups and skill levels

• The rise of international tournaments, Olympic success stories, and professional leagues is boosting aspirational interest among younger demographics, who are now seeking branded, athlete-endorsed apparel that mimics professional standards and aligns with athletic identity and peer perception

• For instance, the Badminton Association of India’s partnership with apparel brands to support junior players and Japan’s strategic investments in nationwide badminton coaching centers are enabling a more apparel-conscious sports culture

• These factors are encouraging major brands to launch region-specific product lines, sponsor academies, and partner with elite athletes to reinforce their visibility and cater to the rising demand for performance-oriented apparel in both urban and semi-urban markets

Restraint/Challenge

“High Price Sensitivity in Developing Markets”

• High price sensitivity among consumers in developing markets is limiting the penetration of technologically advanced or premium badminton apparel, as most users still prioritize affordability over specialized features such as thermoregulation, UV protection, or antimicrobial finishes

• International brands offering high-end apparel face a competitive disadvantage in rural or lower-income areas where locally produced or generic sportswear is widely available at lower prices, despite lacking the performance attributes essential for serious training and gameplay

• Retailers and distributors struggle to strike a balance between product pricing and profitability, particularly in areas with inconsistent sales volumes, low brand awareness, or restricted access to modern retail infrastructure such as specialty sports stores or e-commerce logistics

• For instance, while brands such as Adidas and Yonex are present in India and Southeast Asia, their reach is limited in tier-2 and tier-3 cities due to high price points, import duties, and inadequate promotional spending, making it difficult to compete with unbranded domestic alternatives

• These cost-related challenges are creating a market divide, hindering inclusive growth, and emphasizing the need for budget-friendly product innovations, localized sourcing, and pricing strategies that cater to mass-market adoption without compromising on quality or basic performance standards

Badminton Apparel Market Scope

The market is segmented on the basis of product type, price point, material, and distribution channel.

- By Product Type

On the basis of product type, the badminton apparel market is segmented into top wear badminton apparel, bottom wear badminton apparel, badminton footwear, badminton accessories, and others. The top wear segment dominated the market with the largest market revenue share in 2024, driven by its essential role in both practice and competition, and consistent demand from both amateur and professional players. Branded jerseys and performance-enhancing t-shirts made with sweat-absorbent and breathable fabrics have gained traction among players seeking comfort and mobility.

The badminton footwear segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing awareness of foot support, agility, and injury prevention during gameplay. High-traction soles, shock-absorbing midsoles, and lightweight design features are boosting the adoption of badminton-specific shoes, especially among competitive players and enthusiasts upgrading from generic sports footwear.

- By Price Point

On the basis of price point, the badminton apparel market is segmented into premium, medium, and economy. The medium segment accounted for the largest market share in 2024 due to its balance between performance and affordability, appealing to a broad consumer base including club-level players and semi-professionals. These products often incorporate key features such as ventilation and stretchability while maintaining price accessibility.

The premium segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand from elite athletes and performance-focused users who value innovation in fabric, fit, and durability. Premium lines often include sponsor-endorsed apparel and advanced technology integrations, such as anti-odor treatments and thermoregulation.

- By Material

On the basis of material, the market is segmented into natural fabric, synthetic fabric, and others. The synthetic fabric segment held the largest market revenue share in 2024 owing to its moisture-wicking capabilities, lightweight construction, and enhanced durability, making it the preferred choice for activewear in high-performance settings. Polyester, nylon, and blended textiles are extensively used to ensure comfort during fast-paced movements.

The natural fabric segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing consumer preference for eco-friendly, breathable materials such as organic cotton and bamboo. Sustainable apparel initiatives and environmentally conscious consumer behavior are pushing brands to explore natural alternatives without compromising on comfort and performance.

- By Distribution Channel

On the basis of distribution channel, the badminton apparel market is segmented into B2B, B2C, and online. The B2C segment dominated the market in 2024 due to strong brand retail presence, exclusive brand outlets, and growing consumer interest in direct product experience and personalized fitting. Offline purchases remain dominant in urban regions where consumers seek assurance on fabric quality and size before buying.

The online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising popularity of e-commerce platforms, expanding reach of global brands, and digital-first product launches. Online channels offer convenience, product variety, seasonal discounts, and doorstep delivery, attracting a younger and tech-savvy demographic.

Badminton Apparel Market Regional Analysis

• North America dominated the badminton apparel market with the largest revenue share of 39.28% in 2024, driven by growing participation in badminton at the school, collegiate, and recreational levels, alongside rising consumer interest in fitness and indoor sports

• The region benefits from a well-established sports retail infrastructure, high disposable income, and the increasing influence of multicultural communities where badminton enjoys traditional popularity, particularly among Asian-American populations

• Expanding online channels, coupled with the demand for performance-based, stylish, and durable apparel, is contributing to increased sales across both amateur and competitive badminton segments

U.S. Badminton Apparel Market Insight

The U.S. badminton apparel market accounted for the largest revenue share in North America in 2024, supported by a surge in community-level clubs, school programs, and university tournaments. Growing health awareness and interest in racket sports are contributing to greater consumer demand for sport-specific clothing. The presence of international brands and a well-developed e-commerce ecosystem further enhances market access and product variety, fueling continued adoption across fitness enthusiasts and athletes.

Europe Badminton Apparel Market Insight

The Europe badminton apparel market is anticipated to witness stable growth throughout the forecast period, supported by strong institutional support, competitive club systems, and rising fitness culture in countries such as Germany, Denmark, and France. Consumers in the region increasingly seek sustainable, high-quality apparel designed for agility and comfort, which is encouraging innovation and expansion in eco-conscious sportswear lines.

Germany Badminton Apparel Market Insight

The Germany badminton apparel market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s structured sports club ecosystem and rising interest in indoor fitness activities. Germany’s focus on athletic performance, quality standards, and sustainability is prompting demand for badminton apparel made from breathable, durable, and eco-friendly materials. The presence of specialized sports retailers, along with increasing consumer interest in functional and stylish activewear, is contributing to broader market adoption among both recreational and competitive players.

U.K. Badminton Apparel Market Insight

The U.K. badminton apparel market is expected to witness the fastest growth rate from 2025 to 2032, fueled by government-led fitness initiatives, recreational badminton clubs, and increasing school-level sports integration. British consumers prefer breathable, flexible apparel that supports ease of movement while maintaining a stylish appearance, creating opportunities for both domestic and international brands to launch modern collections that appeal to youth and adult players alike.

Asia-Pacific Badminton Apparel Market Insight

The Asia-Pacific badminton apparel market is expected to witness the fastest growth rate from 2025 to 2032, led by the region’s strong badminton heritage, extensive player base, and government investments in sports development programs. Countries such as China, India, Indonesia, and Malaysia are driving consumption due to their global competitive presence and rapidly growing urban populations with rising fitness consciousness. Expanding retail networks and digital sales channels are further accelerating the market's growth.

China Badminton Apparel Market Insight

The China badminton apparel market held the largest revenue share in Asia-Pacific in 2024, driven by the country's long-standing dominance in international badminton and the widespread cultural popularity of the sport. Robust government-backed youth development programs, coupled with a massive domestic manufacturing base, allow for rapid product innovation and accessibility. Local and global brands continue to launch performance-driven collections catering to both elite athletes and mass consumers.

Japan Badminton Apparel Market Insight

The Japan badminton apparel market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s strong tradition in badminton and a high level of interest across schools, universities, and corporate leagues. Japanese consumers place high value on product quality, comfort, and technological innovation, which supports the adoption of advanced performance apparel. In addition, the popularity of local and international tournaments, combined with the availability of lightweight and design-focused clothing, is encouraging both youth and adults to invest in sport-specific attire tailored for speed, agility, and endurance.

Badminton Apparel Market Share

The badminton apparel industry is primarily led by well-established companies, including:

- Under Armour, Inc. (U.S.)

- ASICS Asia Pte. Ltd. (Japan)

- adidas America Inc. (Germany)

- Nike, Inc. (U.S.)

- New Balance (U.S.)

- PUMA SE (Germany)

- Mizuno USA (Japan)

- SKECHERS (U.S.)

- Fila Inc. (South Korea)

- Amer Sports (Finland)

- YONEX Co., Ltd. (Japan)

- Apacs Sports (M) Sdn Bhd. (Malaysia)

- Karakal (Worldwide) Ltd. (U.K.)

Latest Developments in Global Badminton Apparel Market

- In April 2021, Yonex entered into a strategic sponsorship agreement with the Badminton Association of Malaysia (BAM), becoming the official sponsor of the Malaysia National Badminton Team. Through this partnership, Yonex will provide high-performance apparel, footwear, and equipment to support national athletes in international competitions. This development is expected to strengthen Yonex’s brand visibility in Southeast Asia and reinforce its position as a leading badminton apparel provider. The collaboration is also likely to enhance player performance and inspire greater youth participation, positively impacting the regional badminton apparel market growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.