Global Bag In Box Market

Market Size in USD Billion

CAGR :

%

USD

1.99 Billion

USD

2.68 Billion

2025

2033

USD

1.99 Billion

USD

2.68 Billion

2025

2033

| 2026 –2033 | |

| USD 1.99 Billion | |

| USD 2.68 Billion | |

|

|

|

|

What is the Global Bag-in-Box Market Size and Growth Rate?

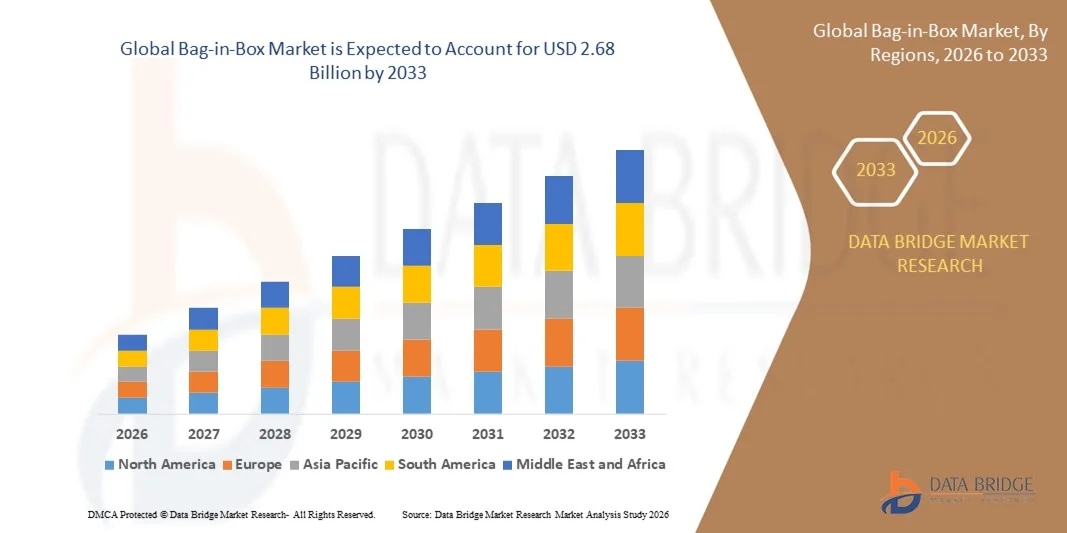

- The global bag-in-box market size was valued at USD 1.99 billion in 2025 and is expected to reach USD 2.68 billion by 2033, at a CAGR of 3.80% during the forecast period

- The growing demand for packaged foods and beverages, increasing need for environmentally safer and sustainable packaging, rising consumer awareness regarding hygiene and health, rising levels of disposable income of the people along with rising preferences of the consumer towards the consumption of premium products, increasing development of effective as well as cost-effective solutions for liquid product packaging are some of the major as well as vital factors which will such asly to augment the growth of the bag-in-box market

What are the Major Takeaways of Bag-in-Box Market?

- Increasing penetration of packaged food products, increasing growth of the E-commerce retail packaging along with development of new and innovative materials which will further contribute by generating massive opportunities for the growth of the bag-in-box market in the above mentioned projected timeframe

- Increasing availability of product substitute along with stringent government regulations which will such asly to act as market restraints factor for the growth of the bag-in-box

- Asia-Pacific dominated the Bag-in-Box market with the largest revenue share of 39.5% in 2025, driven by rapid urbanization, rising food and beverage production, and increasing adoption of convenient and bulk packaging solutions across emerging economies such as China, India, Japan, and South Korea

- North America is projected to witness the fastest growth rate of 9.7% during 2026–2033, driven by high demand from the beverage, dairy, and liquid food industries

- The 3–5 liters segment dominated the market with the largest revenue share of 42.6% in 2025, driven by its suitability for retail beverages, small-scale commercial use, and home consumption

Report Scope and Bag-in-Box Market Segmentation

|

Attributes |

Bag-in-Box Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Bag-in-Box Market?

Rising Demand for Convenient, Sustainable, and Extended-Shelf-Life Packaging Solutions

- The bag-in-box market is witnessing a significant shift toward convenient, eco-friendly, and long-lasting packaging solutions, driven by increasing demand from food and beverage manufacturers, retailers, and consumers seeking portability and waste reduction. Producers are focusing on innovative bag and box materials that enhance product shelf life and maintain quality

- For instance, Smurfit Kappa and Amcor have introduced lightweight, recyclable Bag-in-Box systems with improved barrier properties for beverages and liquid foods, meeting both environmental and functional requirements

- Growing interest in sustainable and recyclable packaging is pushing the adoption of bio-based films, carton composites, and easy-to-use dispensing systems

- The surge in on-the-go consumption and home-based entertaining is driving innovation in user-friendly, resealable Bag-in-Box solutions

- Manufacturers are also investing in premium designs, printed graphics, and smart packaging technologies to differentiate offerings and improve brand appeal

- As sustainability, convenience, and product protection become critical, bag-in-box solutions are emerging as the preferred packaging format across global food and beverage sectors

What are the Key Drivers of Bag-in-Box Market?

- Increasing demand for convenient and portable packaging is driving the popularity of Bag-in-Box solutions across retail, catering, and e-commerce channels

- For instance, in 2025, DS Smith launched eco-friendly Bag-in-Box packaging for wines and juices in Europe, enhancing supply chain efficiency while reducing packaging waste

- Rising consumer preference for sustainable, recyclable, and easy-to-store packaging is influencing product development and design

- Expanding home consumption, foodservice adoption, and premium beverage offerings are supporting market growth, particularly in Asia-Pacific and North America

- Digital marketing and e-commerce adoption are boosting brand visibility and allowing manufacturers to reach eco-conscious consumers directly

- With ongoing innovations in barrier films, resealable systems, and recyclable carton technology, the Bag-in-Box market is expected to witness sustained global growth and product diversification

Which Factor is Challenging the Growth of the Bag-in-Box Market?

- Fluctuating raw material costs for plastics, films, and carton boards are posing challenges for manufacturers, affecting production expenses and pricing stability

- For instance, in 2024–2025, volatility in polymer and paperboard prices impacted production costs for leading packaging suppliers

- Intense competition among local and international packaging companies increases pricing pressure, making product differentiation difficult

- Strict environmental regulations in regions such as the U.S. and Europe regarding recyclability, carbon footprint, and packaging waste compliance require continuous innovation and reformulation

- Shifts in consumer preference toward alternative packaging formats such as cans, pouches, and glass bottles may reduce Bag-in-Box adoption in some segments

- To mitigate these challenges, key players are investing in sustainable material sourcing, modular production processes, and innovative design, ensuring long-term market resilience and profitability

How is the Bag-in-Box Market Segmented?

The market is segmented on the basis of capacity, component, material state, tap, material, type, and end user.

- By Capacity

On the basis of capacity, the bag-in-box market is segmented into <1 liter, 3–5 liters, 5–10 liters, 10–20 liters, and >20 liters. The 3–5 liters segment dominated the market with the largest revenue share of 42.6% in 2025, driven by its suitability for retail beverages, small-scale commercial use, and home consumption. This size offers a balance between portability, storage convenience, and product volume, making it highly preferred by consumers and manufacturers asuch as.

The >20 liters segment is expected to register the fastest CAGR from 2026 to 2033, fueled by increasing adoption in industrial, institutional, and bulk beverage applications. Large-scale operations prefer high-capacity Bag-in-Box solutions for cost efficiency, reduced packaging waste, and simplified logistics, supporting robust growth in the industrial and commercial beverage sectors.

- By Component

On the basis of component, the bag-in-box market is segmented into Boxes, Bags/Films, Fitments, Bulk Containers, Filling Machines/Systems, and Equipment. The Bags/Films segment dominated the market with the largest revenue share of 46.1% in 2025, attributed to its critical role in maintaining product quality, extending shelf life, and ensuring leak-proof storage.

The Filling Machines/Systems and Equipment segment is projected to witness the fastest CAGR from 2026 to 2033, driven by rising demand for automated and high-efficiency production lines in beverage and food industries. Investment in advanced filling technologies is enabling manufacturers to enhance production speed, reduce contamination risks, and maintain consistent product standards, fueling adoption globally.

- By Material State

On the basis of material state, the bag-in-box market is segmented into Semi-liquid and Liquid. The Liquid segment dominated the market with the largest revenue share of 55.3% in 2025, reflecting its extensive use in beverages such as juices, wines, dairy, and ready-to-drink products. Liquids require effective barrier and sealing solutions to prevent oxidation and leakage, making Bag-in-Box packaging highly suitable.

The Semi-liquid segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing demand for sauces, purees, and concentrated products. The versatility of Bag-in-Box packaging in maintaining consistency, enhancing shelf life, and reducing spillage is boosting its adoption for semi-liquid applications across foodservice and retail.

- By Tap

On the basis of tap, the bag-in-box market is segmented into Without Tap and With Tap. The With Tap segment dominated the market with the largest revenue share of 58.7% in 2025, fueled by convenience, ease of use, and controlled dispensing, particularly in wine, juice, and dairy applications. Taps allow for portion control, reduce wastage, and maintain product freshness, making this segment highly preferred across both consumer and commercial segments.

The Without Tap segment is projected to register the fastest CAGR from 2026 to 2033, supported by growing adoption in bulk liquid transport, industrial food production, and low-cost packaging applications. Increasing demand for cost-effective packaging solutions in emerging markets is further driving growth.

- By Material

On the basis of material, the bag-in-box market is segmented into Ethylene Vinyl Acetate (EVA), Low-Density Polyethylene (LDPE), and Ethylene Vinyl Alcohol (EVOH). The LDPE segment dominated the market with the largest revenue share of 50.4% in 2025, owing to its flexibility, durability, cost-effectiveness, and wide acceptance in beverage and food packaging.

The EVOH segment is expected to register the fastest CAGR from 2026 to 2033, driven by its superior barrier properties, ability to protect against oxygen and moisture, and suitability for premium liquid and semi-liquid products. The use of advanced barrier materials is supporting long-term product stability and increasing consumer trust in packaged beverages.

- By Type

On the basis of type, the bag-in-box market is segmented into Barrier and Non-Barrier. The Barrier segment dominated the market with the largest revenue share of 54.1% in 2025, driven by growing demand for extended shelf-life solutions, especially for beverages prone to oxidation, such as wine, juices, and dairy drinks.

The Non-Barrier segment is projected to exhibit the fastest CAGR from 2026 to 2033, supported by cost-sensitive applications in bulk beverages, sauces, and industrial food products. Rising awareness of eco-friendly, recyclable packaging is further promoting non-barrier options globally.

- By End User

On the basis of end user, the bag-in-box market is segmented into Industrial, Food, Beverage, and Other End-Users. The Beverage segment dominated the market with the largest revenue share of 47.8% in 2025, attributed to widespread adoption in juices, wines, dairy, and RTD beverages.

The Industrial segment is expected to register the fastest CAGR from 2026 to 2033, fueled by the need for bulk liquid transport, processed ingredients, and cost-efficient packaging in manufacturing and institutional operations. Increasing automation, sustainable packaging trends, and growing industrial demand are supporting adoption across this segment globally.

Which Region Holds the Largest Share of the Bag-in-Box Market?

- Asia-Pacific dominated the bag-in-box market with the largest revenue share of 39.5% in 2025, driven by rapid urbanization, rising food and beverage production, and increasing adoption of convenient and bulk packaging solutions across emerging economies such as China, India, Japan, and South Korea. The expansion of retail chains, growth of foodservice and catering industries, and rising demand for packaged beverages are key growth drivers.

- Local and international manufacturers are heavily investing in innovative packaging designs, sustainable materials, and advanced filling technologies to meet diverse industry requirements

- The growth of e-commerce platforms, distribution networks, and the influence of global packaging standards are further consolidating Asia-Pacific’s dominance in the bag-in-box market

China Bag-in-Box Market Insight

China is the largest contributor in Asia-Pacific, supported by increasing demand for packaged beverages, dairy, wine, and liquid foods. Manufacturers are adopting bag-in-box solutions for extended shelf-life, reduced transportation costs, and convenient storage. Expansion of modern retail chains, beverage companies, and foodservice industries, along with government support for packaging innovations, is driving China’s leadership in the regional market.

India Bag-in-Box Market Insight

India is witnessing strong growth due to rising packaged beverage consumption, rapid expansion of the foodservice sector, and increasing demand from dairy and liquid food producers. Government initiatives promoting modern food processing, investments in packaging infrastructure, and growth of retail and e-commerce channels are further accelerating bag-in-box adoption in the country.

North America Bag-in-Box Market Insight

North America is projected to witness the fastest growth rate of 9.7% during 2026–2033, driven by high demand from the beverage, dairy, and liquid food industries. The region benefits from advanced packaging technologies, increasing adoption of sustainable and convenient packaging solutions, and strong presence of global packaging manufacturers. Expansion in wineries, breweries, and ready-to-drink beverage sectors is further accelerating growth.

U.S. Bag-in-Box Market Insight

The U.S. leads North America’s market, fueled by growing use of bag-in-box in wine, dairy, and liquid food segments. Rising demand for cost-efficient bulk packaging, sustainability initiatives, and on-the-go beverage consumption are driving adoption. Key players are focusing on innovation in bag materials, fitments, and filling systems to meet evolving customer requirements.

Canada Bag-in-Box Market Insight

Canada contributes steadily, supported by increasing consumption of wine, fruit juice, and dairy products in packaged formats. Adoption of eco-friendly materials, reusable fitments, and advanced filling equipment is enhancing market penetration. Growth in retail, foodservice, and catering channels is driving further bag-in-box adoption.

Europe Bag-in-Box Market Insight

Europe is witnessing stable growth, led by strong consumption of wine, liquid dairy, and ready-to-drink beverages in bag-in-box formats. Countries such as Germany, France, and the U.K. are investing in sustainable packaging solutions, innovative fitments, and improved shelf-life technologies. Stringent environmental regulations and increasing consumer preference for convenient packaging are driving market expansion.

Germany Bag-in-Box Market Insight

Germany leads Europe’s bag-in-box market, driven by high demand in wine, fruit juice, and liquid food packaging. Manufacturers are adopting barrier bags, fitment innovations, and recyclable materials to meet regulatory and consumer expectations. Investments in automation and filling systems are further strengthening Germany’s position in Europe.

U.K. Bag-in-Box Market Insight

The U.K. market is expanding steadily, fueled by growing demand for convenience packaging in wine, dairy, and beverage sectors. Rising adoption of eco-friendly materials, reusable fitments, and innovative bag-in-box systems is boosting market growth. Retail and foodservice channels are increasingly supporting large-scale Bag-in-Box deployment.

Which are the Top Companies in Bag-in-Box Market?

The bag-in-box industry is primarily led by well-established companies, including:

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

- Amcor plc (Australia)

- Liquibox (U.S.)

- Scholle IPN (U.S.)

- CDF Corporation (U.S.)

- Aran Group (Ireland)

- FUJIMORI KOGYO CO., LTD. (Japan)

- Goglio SpA (Italy)

- WUXI SLF INDUSTRY AND TRADE CO., LTD. (China)

- Optopack Ltd. (U.K.)

- TPS Rental Systems Ltd IBC Containers (U.K.)

- Arlington Packaging (Rental) Limited (U.K.)

- BERNHARDT Packaging & Process (Germany)

- Vine Valley Ventures LLC (U.S.)

- LGR Packaging (U.S.)

- Hearthside Food Solutions LLC (U.S.)

- Armando Alvarez Group (Spain)

- WestRock Company (U.S.)

- Polsinelli Enologia Srl (Italy)

What are the Recent Developments in Global Bag-in-Box Market?

- In February 2024, Smurfit Kappa announced a USD 59 million investment in a bag-in-box plant in Alicante, Spain, aimed at enhancing the sustainability of the plant’s operations and expanding the company’s eco-friendly product portfolio, reflecting a commitment to greener packaging solutions

- In February 2024, Aran Group announced the completion of the acquisition of a majority stake in IBA Germany from the previous owner, Liquid Concept GmbH (LC), strengthening its footprint in the European bag-in-box and flexible packaging market and supporting strategic growth initiatives

- In January 2024, WestRock Company revealed plans to construct a new corrugated box plant in Pleasant Prairie, Wisconsin, at an estimated cost of USD 140 million, intended to meet rising customer demand in the Great Lakes region and expand regional production capacity efficiently

- In December 2023, LIQUI MOLY introduced bag-in-box packaging for six of its motor oils, offering benefits such as reduced plastic use due to recyclable cardboard and more storage space with stackable dimensions, showcasing innovation in sustainable and convenient packaging solutions

- In November 2023, Smurfit Kappa developed a recyclable film with nylon-such as strength, designed for bag-in-box applications in the U.S., providing durability while remaining fully recyclable, and highlighting the company’s focus on sustainable material innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Bag In Box Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Bag In Box Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Bag In Box Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.